74116c9d451e91fa740d7eb597e31175.ppt

- Количество слайдов: 20

First Industrial Realty Trust November 20, 2008 Brian Bird Ryan Foelske

Overview • • Company Overview Industry Overview Macroeconomic Financials Valuation RCMP Portfolio Recommendation

Company Overview • Headquartered in Chicago, Illinois • First Industrial Realty-Trust (FR), founded in 1994, is an established REIT and owner of industrial real estate serving customers worldwide. • FR engages in the buying, selling, leasing, development and management of industrial real estate solutions for every stage of the industrial supply chain. • Their mission is to create industrial real estate solutions that mutually benefit their customers and their investors.

Description of a REIT • A Real Estate Investment Trust (REIT) is a company that owns and operates income-producing real estates. • REITs’ shares are traded publicly on major stock exchanges, giving anyone the ability to invest in largescale real estate. • REITs are required to distribute 90% of their taxable income annually in the form of dividends, giving high yields to its investors • Diversification advantage of REIT • Give individual investors opportunity to access real estate market • Typically, relatively low correlation between REITs and other stocks and bonds

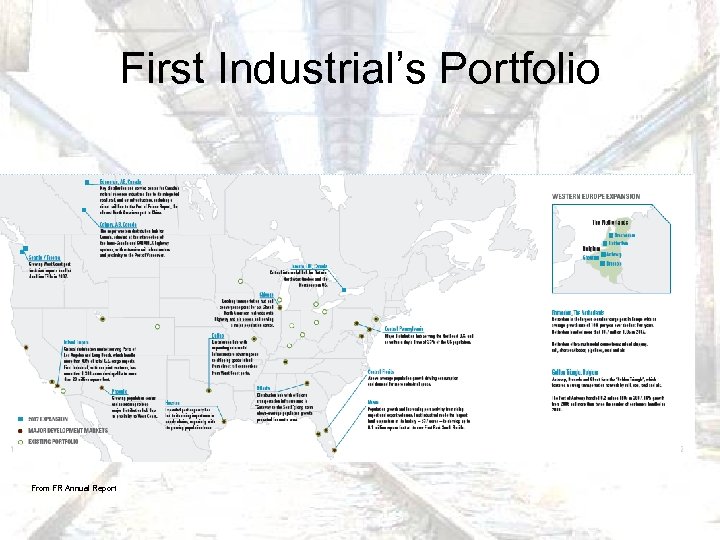

First Industrial’s Portfolio From FR Annual Report

Industry Overview • Real Estate Investment Trust (REIT): a company that owns and operates income-producing real estate. • REIT shares are publicly traded on major stock exchanges, giving anyone the ability to invest in large-scale real estate. • REITs are required to distribute 90% of their annual income in the form of dividends, giving high dividend yields to its investors. • Diversification advantage of REIT • Give individual investors opportunity to access real estate market. • Fairly low correlation between REITs and other risky assets.

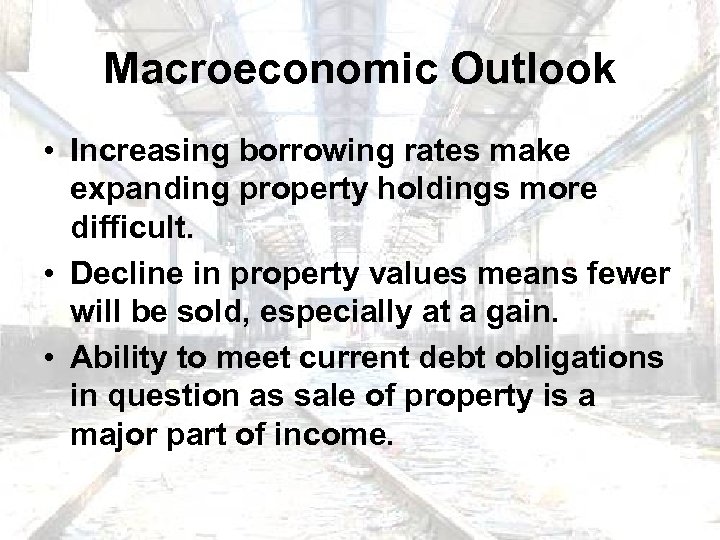

Macroeconomic Outlook • Increasing borrowing rates make expanding property holdings more difficult. • Decline in property values means fewer will be sold, especially at a gain. • Ability to meet current debt obligations in question as sale of property is a major part of income.

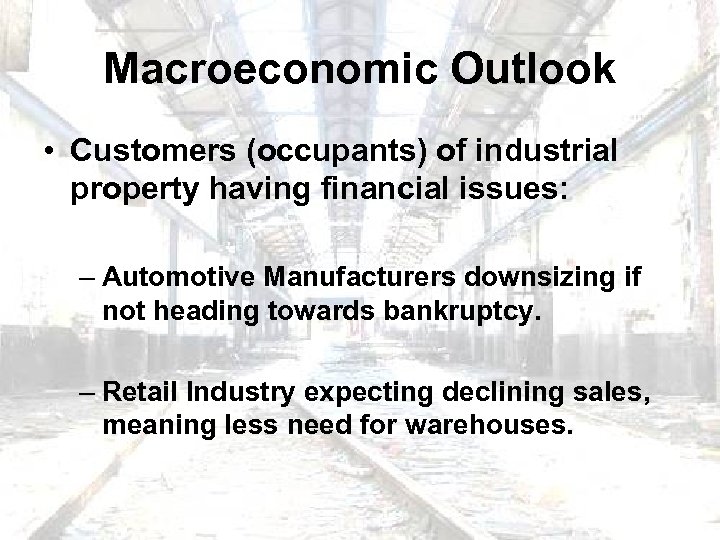

Macroeconomic Outlook • Customers (occupants) of industrial property having financial issues: – Automotive Manufacturers downsizing if not heading towards bankruptcy. – Retail Industry expecting declining sales, meaning less need for warehouses.

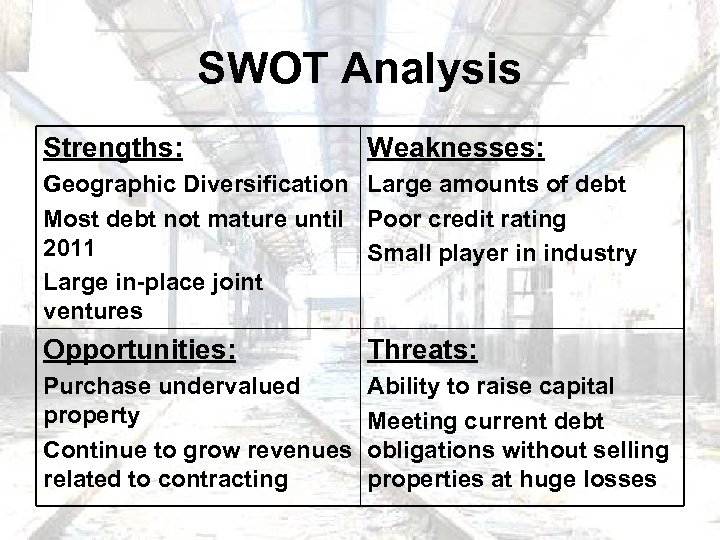

SWOT Analysis Strengths: Weaknesses: Geographic Diversification Large amounts of debt Most debt not mature until Poor credit rating 2011 Small player in industry Large in-place joint ventures Opportunities: Threats: Purchase undervalued property Continue to grow revenues related to contracting Ability to raise capital Meeting current debt obligations without selling properties at huge losses

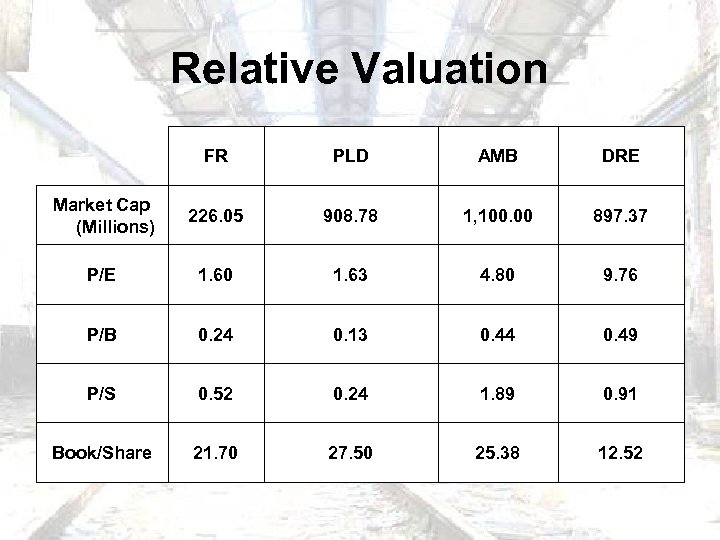

Relative Valuation FR PLD AMB DRE Market Cap (Millions) 226. 05 908. 78 1, 100. 00 897. 37 P/E 1. 60 1. 63 4. 80 9. 76 P/B 0. 24 0. 13 0. 44 0. 49 P/S 0. 52 0. 24 1. 89 0. 91 Book/Share 21. 70 27. 50 25. 38 12. 52

Relative Valuation $2. 75 $10. 57

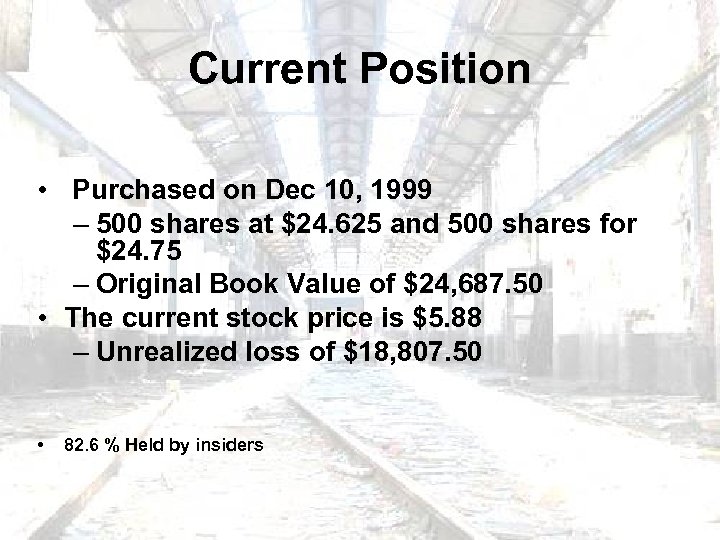

Current Position • Purchased on Dec 10, 1999 – 500 shares at $24. 625 and 500 shares for $24. 75 – Original Book Value of $24, 687. 50 • The current stock price is $5. 88 – Unrealized loss of $18, 807. 50 • 82. 6 % Held by insiders

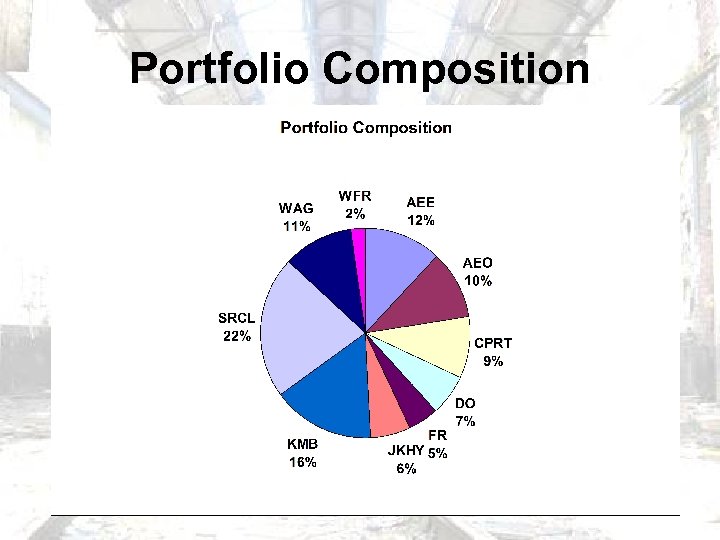

Portfolio Composition

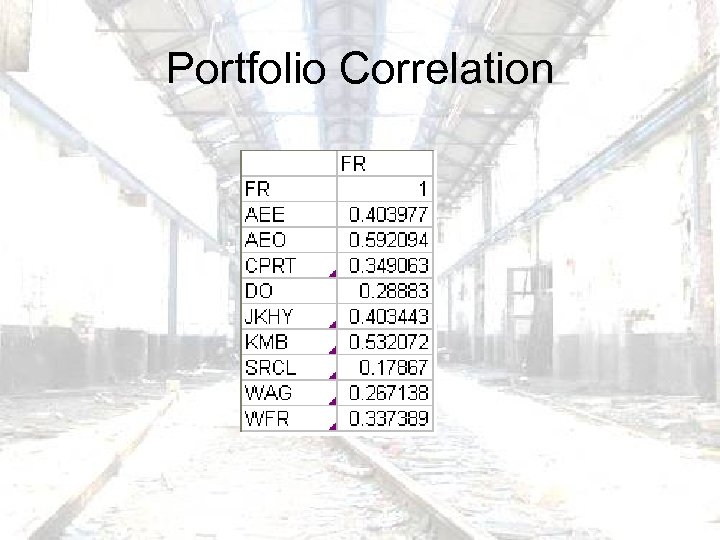

Portfolio Correlation

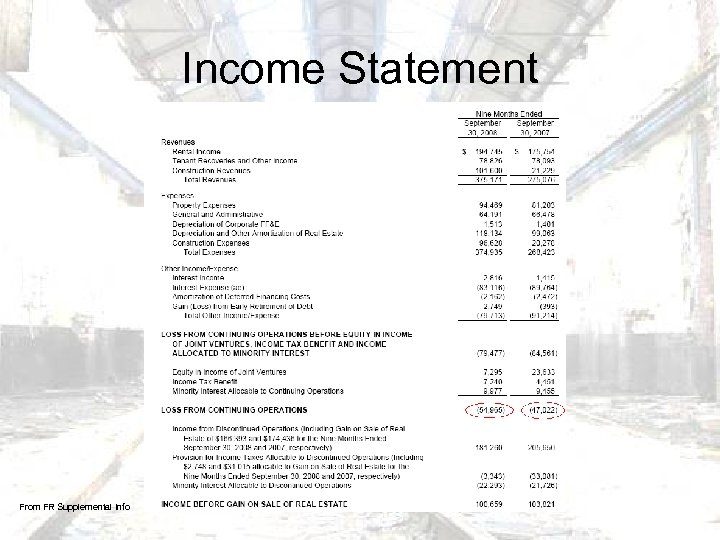

Income Statement From FR Supplemental Info

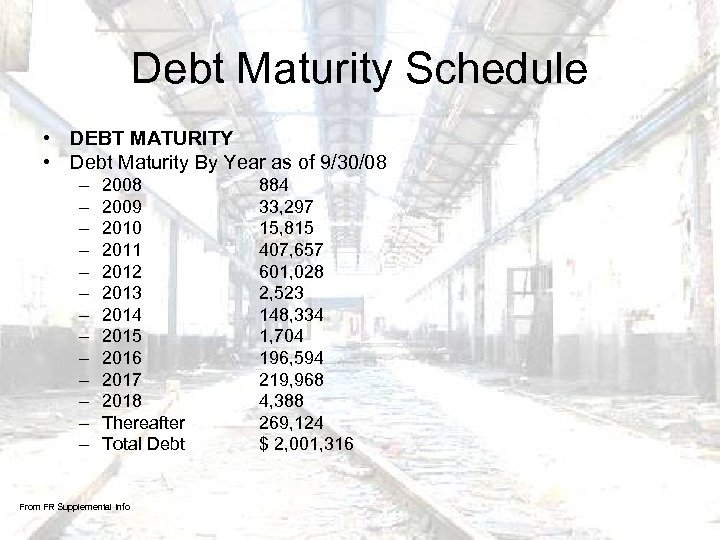

Debt Maturity Schedule • DEBT MATURITY • Debt Maturity By Year as of 9/30/08 – – – – 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 Thereafter Total Debt From FR Supplemental Info 884 33, 297 15, 815 407, 657 601, 028 2, 523 148, 334 1, 704 196, 594 219, 968 4, 388 269, 124 $ 2, 001, 316

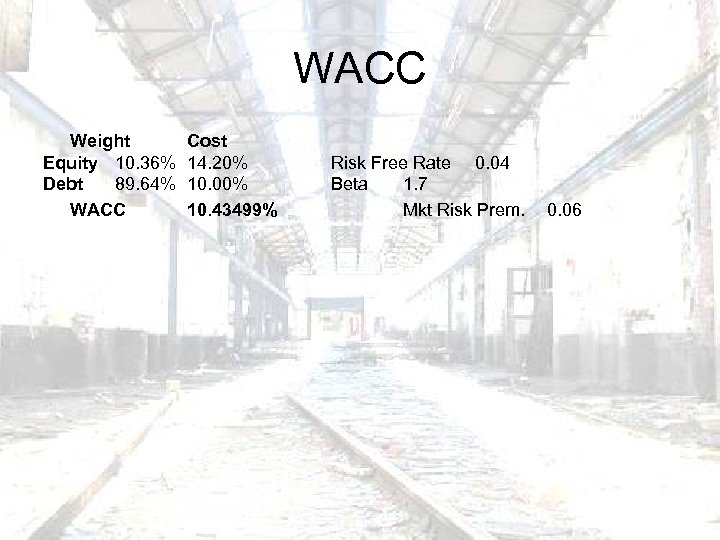

WACC Weight Equity 10. 36% Debt 89. 64% WACC Cost 14. 20% 10. 00% 10. 43499% Risk Free Rate 0. 04 Beta 1. 7 Mkt Risk Prem. 0. 06

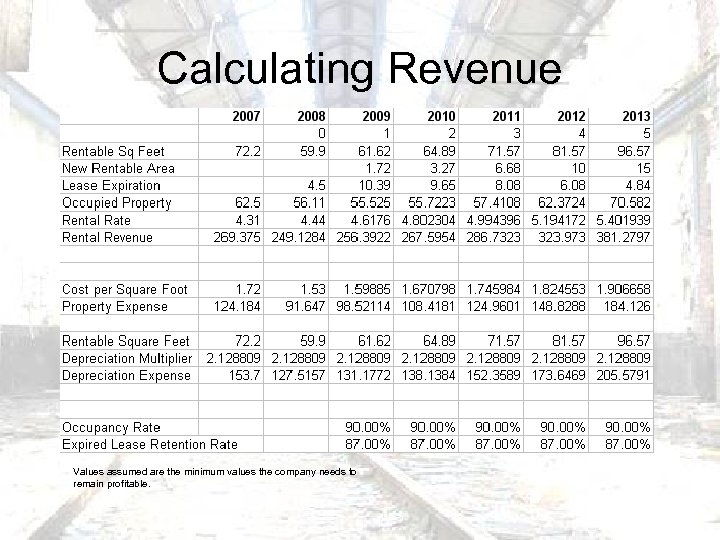

Calculating Revenue Values assumed are the minimum values the company needs to remain profitable.

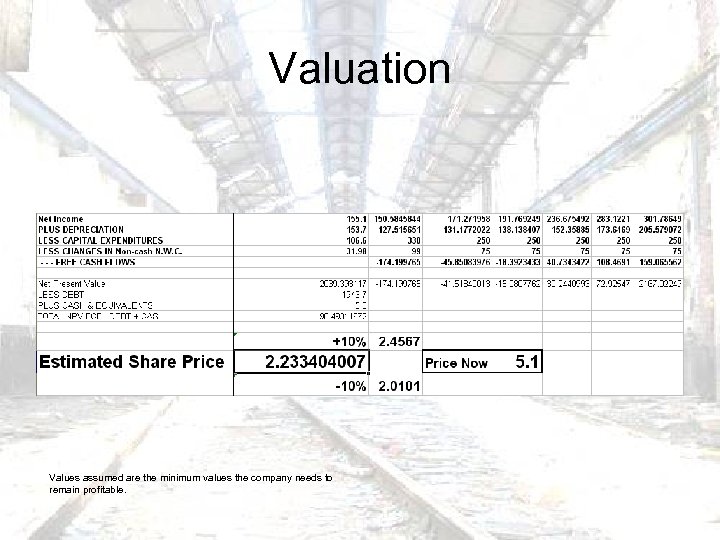

Valuation Values assumed are the minimum values the company needs to remain profitable.

Recommendation • We recommend a market sale of 1000 shares of First Industrial. It is our belief that the values assumed are not capable under current economic conditions. • This yielded an approximate loss of $18, 807. 50

74116c9d451e91fa740d7eb597e31175.ppt