7e80cb2c7040d19061d848a09cfddb67.ppt

- Количество слайдов: 26

Finite Insurance: Limiting Transactional Risk World Services Group May 7, 2004 ADVANCING CORPORATE STRATEGY THROUGH ALTERNATIVE SOLUTIONS presented by: Todd Cunningham Assistant Vice President, AIG Risk Finance

Finite Insurance: Limiting Transactional Risk World Services Group May 7, 2004 ADVANCING CORPORATE STRATEGY THROUGH ALTERNATIVE SOLUTIONS presented by: Todd Cunningham Assistant Vice President, AIG Risk Finance

Agenda • Introduction • Alternative Risk Financing Techniques – Loss Portfolio Transfers – Structured Insurance Solutions • Scenarios ADVANCING CORPORATE STRATEGY THROUGH ALTERNATIVE SOLUTIONS

Agenda • Introduction • Alternative Risk Financing Techniques – Loss Portfolio Transfers – Structured Insurance Solutions • Scenarios ADVANCING CORPORATE STRATEGY THROUGH ALTERNATIVE SOLUTIONS

Current Situation • Insurance Market – – Higher retention levels Loss of certain key coverages Layers with rates on line of 20% or more Single-year basis only • Industries Impacted ADVANCING CORPORATE STRATEGY THROUGH ALTERNATIVE SOLUTIONS – – Healthcare Construction Financial Services Manufacturing

Current Situation • Insurance Market – – Higher retention levels Loss of certain key coverages Layers with rates on line of 20% or more Single-year basis only • Industries Impacted ADVANCING CORPORATE STRATEGY THROUGH ALTERNATIVE SOLUTIONS – – Healthcare Construction Financial Services Manufacturing

Alternative Risk Financing Techniques • Retrospective Exposures – Loss Portfolio Transfers • Primary casualty liabilities • Exotic liabilities (asbestos, product liability) • Captive run-off • Prospective Exposures – Finite Products - structured insurance solutions – Structured Hedging ADVANCING CORPORATE STRATEGY THROUGH ALTERNATIVE SOLUTIONS • Structured derivative and insurance transactions • Financial risks

Alternative Risk Financing Techniques • Retrospective Exposures – Loss Portfolio Transfers • Primary casualty liabilities • Exotic liabilities (asbestos, product liability) • Captive run-off • Prospective Exposures – Finite Products - structured insurance solutions – Structured Hedging ADVANCING CORPORATE STRATEGY THROUGH ALTERNATIVE SOLUTIONS • Structured derivative and insurance transactions • Financial risks

Loss Portfolio Transfers • The assumption of liabilities, typically developed over a substantial period of time (retrospective exposures) • May cap potentially devastating balance sheet exposures related to prior events • May create a more stable financial environment for the companies involved • Also known as a “liability buyout” ADVANCING CORPORATE STRATEGY THROUGH ALTERNATIVE SOLUTIONS

Loss Portfolio Transfers • The assumption of liabilities, typically developed over a substantial period of time (retrospective exposures) • May cap potentially devastating balance sheet exposures related to prior events • May create a more stable financial environment for the companies involved • Also known as a “liability buyout” ADVANCING CORPORATE STRATEGY THROUGH ALTERNATIVE SOLUTIONS

Loss Portfolio Transfers - Benefits - • Eliminate operational obstacles, advance growth • Address volatility of accrued liabilities by transferring risks to an insurer • Diminish negative impact to future profits • Release security behind existing insurance • May accelerate tax deduction of the liabilities • Manage cash flow with premium finance • Facilitate merger, acquisition, or divestiture ADVANCING CORPORATE STRATEGY THROUGH ALTERNATIVE SOLUTIONS

Loss Portfolio Transfers - Benefits - • Eliminate operational obstacles, advance growth • Address volatility of accrued liabilities by transferring risks to an insurer • Diminish negative impact to future profits • Release security behind existing insurance • May accelerate tax deduction of the liabilities • Manage cash flow with premium finance • Facilitate merger, acquisition, or divestiture ADVANCING CORPORATE STRATEGY THROUGH ALTERNATIVE SOLUTIONS

Loss Portfolio Transfers - Typical Risks - • • ADVANCING CORPORATE STRATEGY THROUGH ALTERNATIVE SOLUTIONS Medical malpractice & hospital professional liabilities Warranty liabilities Merger & Acquisition-related risks Asbestos and occupational disease liabilities Primary retentions of WC, GL, AL Captive insurance companies Public entity-related liabilities Intellectual property (patent, copyright infringement)

Loss Portfolio Transfers - Typical Risks - • • ADVANCING CORPORATE STRATEGY THROUGH ALTERNATIVE SOLUTIONS Medical malpractice & hospital professional liabilities Warranty liabilities Merger & Acquisition-related risks Asbestos and occupational disease liabilities Primary retentions of WC, GL, AL Captive insurance companies Public entity-related liabilities Intellectual property (patent, copyright infringement)

Loss Portfolio Transfers - Pricing - • Assumes future liability to an aggregate limit – – – ADVANCING CORPORATE STRATEGY THROUGH ALTERNATIVE SOLUTIONS Reserve estimate (to ultimate losses) Payout pattern Discount @ Treasury strip rates Insurer profit margin Claims handling costs Intermediary compensation

Loss Portfolio Transfers - Pricing - • Assumes future liability to an aggregate limit – – – ADVANCING CORPORATE STRATEGY THROUGH ALTERNATIVE SOLUTIONS Reserve estimate (to ultimate losses) Payout pattern Discount @ Treasury strip rates Insurer profit margin Claims handling costs Intermediary compensation

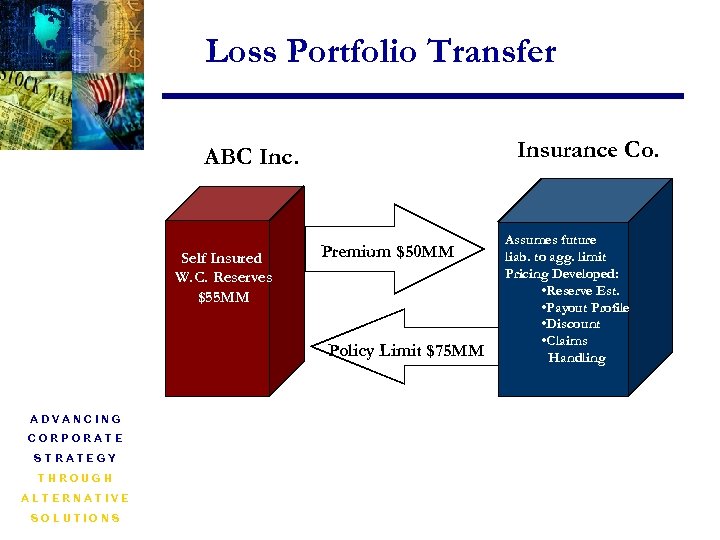

Loss Portfolio Transfer Insurance Co. ABC Inc. Self Insured W. C. Reserves $55 MM Premium $50 MM Policy Limit $75 MM ADVANCING CORPORATE STRATEGY THROUGH ALTERNATIVE SOLUTIONS Assumes future liab. to agg. limit Pricing Developed: • Reserve Est. • Payout Profile • Discount • Claims Handling

Loss Portfolio Transfer Insurance Co. ABC Inc. Self Insured W. C. Reserves $55 MM Premium $50 MM Policy Limit $75 MM ADVANCING CORPORATE STRATEGY THROUGH ALTERNATIVE SOLUTIONS Assumes future liab. to agg. limit Pricing Developed: • Reserve Est. • Payout Profile • Discount • Claims Handling

Loss Portfolio Transfers • Facts – – Client - Self insured years 1996 - 2002 Accrued Liability - $55 million Deferred Tax Asset - $18. 7 million Net Loss - $36. 3 million • Solution – Policy Limit - $75 million – Premium- $50 million – Tax benefit- $17 million • Benefit ADVANCING CORPORATE STRATEGY THROUGH ALTERNATIVE SOLUTIONS – $3. 3 million in net cash – $20 million in additional insurance protection • (to cover under-valuation of accrued liability)

Loss Portfolio Transfers • Facts – – Client - Self insured years 1996 - 2002 Accrued Liability - $55 million Deferred Tax Asset - $18. 7 million Net Loss - $36. 3 million • Solution – Policy Limit - $75 million – Premium- $50 million – Tax benefit- $17 million • Benefit ADVANCING CORPORATE STRATEGY THROUGH ALTERNATIVE SOLUTIONS – $3. 3 million in net cash – $20 million in additional insurance protection • (to cover under-valuation of accrued liability)

Structured Insurance Solutions • Insurance solutions which often combine insurance and capital market techniques • May contain: – a component of funding by client, – structured policy limits, and – a provision for insured to benefit from favorable loss experience • Highly customized programs to protect insureds from financial, strategic or operational risks ADVANCING CORPORATE STRATEGY THROUGH ALTERNATIVE SOLUTIONS

Structured Insurance Solutions • Insurance solutions which often combine insurance and capital market techniques • May contain: – a component of funding by client, – structured policy limits, and – a provision for insured to benefit from favorable loss experience • Highly customized programs to protect insureds from financial, strategic or operational risks ADVANCING CORPORATE STRATEGY THROUGH ALTERNATIVE SOLUTIONS

Structured Insurance Solutions - Characteristics - • Multi year policy term • Customized limits of liability • Potential for sharing of favorable loss experience (experience accounts) • Coverage for uninsurable or difficult to insure risks • Customized structures ADVANCING CORPORATE STRATEGY THROUGH ALTERNATIVE SOLUTIONS

Structured Insurance Solutions - Characteristics - • Multi year policy term • Customized limits of liability • Potential for sharing of favorable loss experience (experience accounts) • Coverage for uninsurable or difficult to insure risks • Customized structures ADVANCING CORPORATE STRATEGY THROUGH ALTERNATIVE SOLUTIONS

Structured Insurance Solutions - Risks - • Difficult to insure risks – Construction defects - Medical/hospital professional – Product liability - Casualty and property – Financial lines - Residual Value • Capacity constrained risks – Product recall, patent infringement, trade credit • Perceived ‘mispriced” risks • Capital Market-based exposures • Unique risks ADVANCING CORPORATE STRATEGY THROUGH ALTERNATIVE SOLUTIONS

Structured Insurance Solutions - Risks - • Difficult to insure risks – Construction defects - Medical/hospital professional – Product liability - Casualty and property – Financial lines - Residual Value • Capacity constrained risks – Product recall, patent infringement, trade credit • Perceived ‘mispriced” risks • Capital Market-based exposures • Unique risks ADVANCING CORPORATE STRATEGY THROUGH ALTERNATIVE SOLUTIONS

Structured Insurance Solutions - Benefits - • Quantify maximum losses for a period of time • Lock in multi-year pricing (insulate market fluctuations) • Address volatility of potential liabilities that affect balance sheet • Stabilize cash flows • Maximize tax efficiencies • Benefit financially from favorable loss experience • Provide evidence of insurance coverage • Facilitate an underlying transaction ADVANCING CORPORATE STRATEGY THROUGH ALTERNATIVE SOLUTIONS

Structured Insurance Solutions - Benefits - • Quantify maximum losses for a period of time • Lock in multi-year pricing (insulate market fluctuations) • Address volatility of potential liabilities that affect balance sheet • Stabilize cash flows • Maximize tax efficiencies • Benefit financially from favorable loss experience • Provide evidence of insurance coverage • Facilitate an underlying transaction ADVANCING CORPORATE STRATEGY THROUGH ALTERNATIVE SOLUTIONS

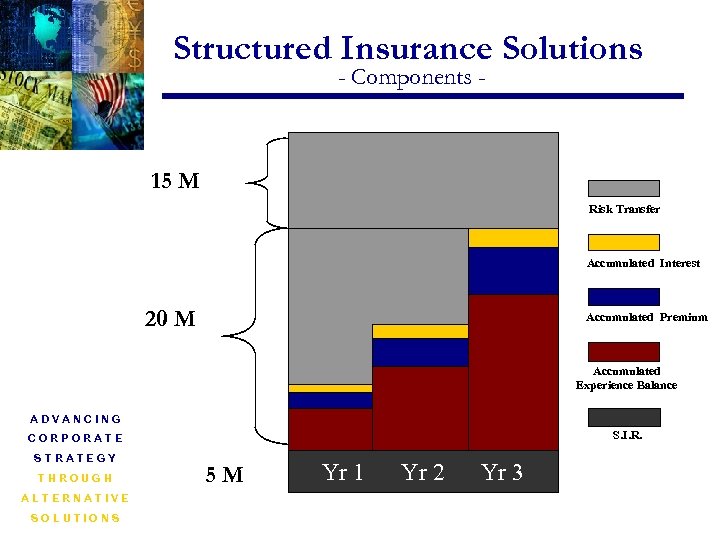

Structured Insurance Solutions - Components - 15 M Risk Transfer Accumulated Interest 20 M Accumulated Premium Accumulated Experience Balance ADVANCING S. I. R. CORPORATE STRATEGY THROUGH ALTERNATIVE SOLUTIONS 5 M Yr 1 Yr 2 Yr 3

Structured Insurance Solutions - Components - 15 M Risk Transfer Accumulated Interest 20 M Accumulated Premium Accumulated Experience Balance ADVANCING S. I. R. CORPORATE STRATEGY THROUGH ALTERNATIVE SOLUTIONS 5 M Yr 1 Yr 2 Yr 3

Structured Insurance Solutions - Underwriting Criteria - • • • ADVANCING CORPORATE STRATEGY THROUGH ALTERNATIVE SOLUTIONS Identify client objectives/motivation Conduct preliminary risk assessment Develop underwriting data Preliminary cash analysis Establish timing objective

Structured Insurance Solutions - Underwriting Criteria - • • • ADVANCING CORPORATE STRATEGY THROUGH ALTERNATIVE SOLUTIONS Identify client objectives/motivation Conduct preliminary risk assessment Develop underwriting data Preliminary cash analysis Establish timing objective

Structured Insurance Solutions - Pricing Considerations - • • ADVANCING CORPORATE STRATEGY THROUGH ALTERNATIVE SOLUTIONS Analysis of risk Loss payout profile PV costs at current market interest rates Risk Premium Profit and administration Applicable premium taxes Term Administration costs

Structured Insurance Solutions - Pricing Considerations - • • ADVANCING CORPORATE STRATEGY THROUGH ALTERNATIVE SOLUTIONS Analysis of risk Loss payout profile PV costs at current market interest rates Risk Premium Profit and administration Applicable premium taxes Term Administration costs

Client Profile l Difficult-to-insure, long-tail exposures l l l l THROUGH ALTERNATIVE SOLUTIONS l Sufficient liquidity to address the issue Minimum target premium of $5 M Wants a solution reflective of a specific risk profile Leveraged risk transfer is not the primary motivation Has a risk that can be sufficiently analyzed and priced l Evidence of insurance required l Senior decision maker involved CORPORATE STRATEGY l Loss data available l ADVANCING l Patent Infringement Trade Credit & Political Risk Property Product Liability Structured solution desired l l l Liquidity l l Medical Malpractice Financial Lines (E&O, D&O) Casualty Warranty l Senior decision maker seeking to resolve a material problem in a defined time-frame

Client Profile l Difficult-to-insure, long-tail exposures l l l l THROUGH ALTERNATIVE SOLUTIONS l Sufficient liquidity to address the issue Minimum target premium of $5 M Wants a solution reflective of a specific risk profile Leveraged risk transfer is not the primary motivation Has a risk that can be sufficiently analyzed and priced l Evidence of insurance required l Senior decision maker involved CORPORATE STRATEGY l Loss data available l ADVANCING l Patent Infringement Trade Credit & Political Risk Property Product Liability Structured solution desired l l l Liquidity l l Medical Malpractice Financial Lines (E&O, D&O) Casualty Warranty l Senior decision maker seeking to resolve a material problem in a defined time-frame

Scenarios • Construction – Construction Defect • Healthcare – Managed Care E&O • Manufacturing – Product Recall • Technology – Shock Loss Protection • Other ADVANCING CORPORATE STRATEGY THROUGH ALTERNATIVE SOLUTIONS – Captive Purchase – Asbestos Liability

Scenarios • Construction – Construction Defect • Healthcare – Managed Care E&O • Manufacturing – Product Recall • Technology – Shock Loss Protection • Other ADVANCING CORPORATE STRATEGY THROUGH ALTERNATIVE SOLUTIONS – Captive Purchase – Asbestos Liability

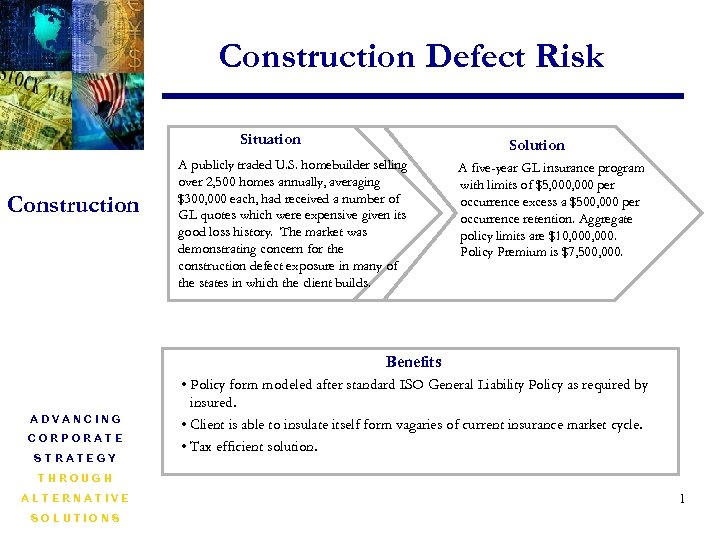

Construction Defect Risk Situation Construction Solution A publicly traded U. S. homebuilder selling over 2, 500 homes annually, averaging $300, 000 each, had received a number of GL quotes which were expensive given its good loss history. The market was demonstrating concern for the construction defect exposure in many of the states in which the client builds. A five-year GL insurance program with limits of $5, 000 per occurrence excess a $500, 000 per occurrence retention. Aggregate policy limits are $10, 000. Policy Premium is $7, 500, 000. Benefits ADVANCING CORPORATE STRATEGY • Policy form modeled after standard ISO General Liability Policy as required by insured. • Client is able to insulate itself form vagaries of current insurance market cycle. • Tax efficient solution. THROUGH ALTERNATIVE SOLUTIONS 1

Construction Defect Risk Situation Construction Solution A publicly traded U. S. homebuilder selling over 2, 500 homes annually, averaging $300, 000 each, had received a number of GL quotes which were expensive given its good loss history. The market was demonstrating concern for the construction defect exposure in many of the states in which the client builds. A five-year GL insurance program with limits of $5, 000 per occurrence excess a $500, 000 per occurrence retention. Aggregate policy limits are $10, 000. Policy Premium is $7, 500, 000. Benefits ADVANCING CORPORATE STRATEGY • Policy form modeled after standard ISO General Liability Policy as required by insured. • Client is able to insulate itself form vagaries of current insurance market cycle. • Tax efficient solution. THROUGH ALTERNATIVE SOLUTIONS 1

Managed Care E&O Situation Healthcare Solution A regional HMO was seeking alternatives to the traditional insurance market, citing an increase in renewal rates. The client was interested in an insurance program in which they could benefit from their positive loss performance while cutting back on current insurance costs. Client also has to show evidence of insurance. The three-year policy limits are $40, 000 per claim with a $55, 000 policy period aggregate. Benefits ADVANCING CORPORATE STRATEGY THROUGH ALTERNATIVE SOLUTIONS • Provided multiple-year coverage. • Transaction provides client with a tax-efficient structured insurance solution. • Program enables client to satisfy its certificate of insurance requirement.

Managed Care E&O Situation Healthcare Solution A regional HMO was seeking alternatives to the traditional insurance market, citing an increase in renewal rates. The client was interested in an insurance program in which they could benefit from their positive loss performance while cutting back on current insurance costs. Client also has to show evidence of insurance. The three-year policy limits are $40, 000 per claim with a $55, 000 policy period aggregate. Benefits ADVANCING CORPORATE STRATEGY THROUGH ALTERNATIVE SOLUTIONS • Provided multiple-year coverage. • Transaction provides client with a tax-efficient structured insurance solution. • Program enables client to satisfy its certificate of insurance requirement.

Product Recall Situation Manufacturing An auto parts manufacturer faced large volatility in earnings per share due to its product recall exposure. Solution An insurance program covering product recall, product extortion and warranty exposures over a multi-year term. Benefits • Allowed insured to fund the cost of recalls over several years. • Transferred volatility risk. ADVANCING CORPORATE STRATEGY THROUGH ALTERNATIVE SOLUTIONS • Tax efficient solution. • Provided coverage that was otherwise unavailable in the market.

Product Recall Situation Manufacturing An auto parts manufacturer faced large volatility in earnings per share due to its product recall exposure. Solution An insurance program covering product recall, product extortion and warranty exposures over a multi-year term. Benefits • Allowed insured to fund the cost of recalls over several years. • Transferred volatility risk. ADVANCING CORPORATE STRATEGY THROUGH ALTERNATIVE SOLUTIONS • Tax efficient solution. • Provided coverage that was otherwise unavailable in the market.

Shock Loss Protection Situation Technology ADVANCING CORPORATE STRATEGY THROUGH ALTERNATIVE SOLUTIONS A software company may have substantial exposures to future litigation for copyright infringement. Solution An insurance policy that provided protection against multiple perils that had the potential to adversely affect earnings. The policy provided this protection for 10 years. Benefits • Potential to minimize exposure to copyright infringement lawsuits over the long term. • Client initially retains claims control, which enables it to defend claims in the manner it deems appropriate. • A tax efficient structure. • Substantial policy limits that were otherwise unavailable.

Shock Loss Protection Situation Technology ADVANCING CORPORATE STRATEGY THROUGH ALTERNATIVE SOLUTIONS A software company may have substantial exposures to future litigation for copyright infringement. Solution An insurance policy that provided protection against multiple perils that had the potential to adversely affect earnings. The policy provided this protection for 10 years. Benefits • Potential to minimize exposure to copyright infringement lawsuits over the long term. • Client initially retains claims control, which enables it to defend claims in the manner it deems appropriate. • A tax efficient structure. • Substantial policy limits that were otherwise unavailable.

Captive Purchase Situation Other A UK entity inherited a redundant reinsurance captive through a recent M&A transaction. Solution Three Steps: • A sale of the captive to an unrelated 3 rd party. • A buyout of the insurable risks in the captive. Management wished to shut it down in the most tax effective manner. • A closeout of the captive by the unrelated 3 rd party. Benefits ADVANCING • By arranging the purchase of the outstanding shares of the captive, it was completely removed from the client’s balance sheet. CORPORATE • Client was able to record its gain on its investment in the captive. STRATEGY THROUGH ALTERNATIVE SOLUTIONS • Client fully transferred all potential future liabilities from the captive (through the 3 rd party) to the insurer.

Captive Purchase Situation Other A UK entity inherited a redundant reinsurance captive through a recent M&A transaction. Solution Three Steps: • A sale of the captive to an unrelated 3 rd party. • A buyout of the insurable risks in the captive. Management wished to shut it down in the most tax effective manner. • A closeout of the captive by the unrelated 3 rd party. Benefits ADVANCING • By arranging the purchase of the outstanding shares of the captive, it was completely removed from the client’s balance sheet. CORPORATE • Client was able to record its gain on its investment in the captive. STRATEGY THROUGH ALTERNATIVE SOLUTIONS • Client fully transferred all potential future liabilities from the captive (through the 3 rd party) to the insurer.

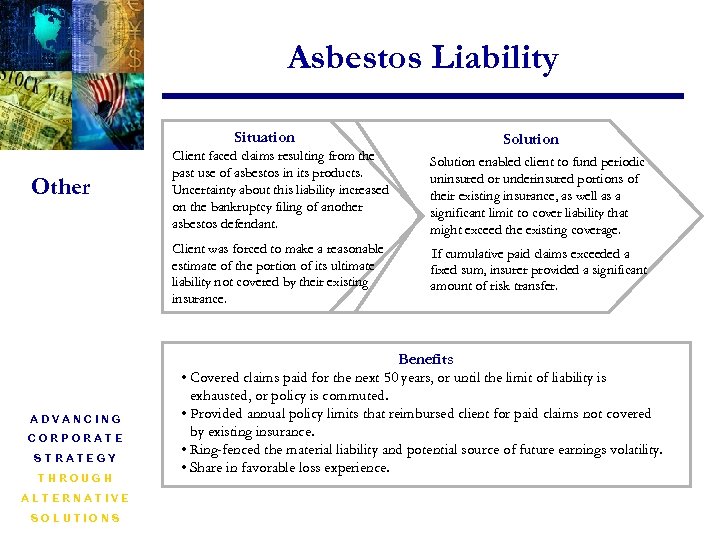

Asbestos Liability Situation Solution enabled client to fund periodic uninsured or underinsured portions of their existing insurance, as well as a significant limit to cover liability that might exceed the existing coverage. Client was forced to make a reasonable estimate of the portion of its ultimate liability not covered by their existing insurance. Other Client faced claims resulting from the past use of asbestos in its products. Uncertainty about this liability increased on the bankruptcy filing of another asbestos defendant. If cumulative paid claims exceeded a fixed sum, insurer provided a significant amount of risk transfer. Benefits ADVANCING CORPORATE STRATEGY THROUGH ALTERNATIVE SOLUTIONS • Covered claims paid for the next 50 years, or until the limit of liability is exhausted, or policy is commuted. • Provided annual policy limits that reimbursed client for paid claims not covered by existing insurance. • Ring-fenced the material liability and potential source of future earnings volatility. • Share in favorable loss experience.

Asbestos Liability Situation Solution enabled client to fund periodic uninsured or underinsured portions of their existing insurance, as well as a significant limit to cover liability that might exceed the existing coverage. Client was forced to make a reasonable estimate of the portion of its ultimate liability not covered by their existing insurance. Other Client faced claims resulting from the past use of asbestos in its products. Uncertainty about this liability increased on the bankruptcy filing of another asbestos defendant. If cumulative paid claims exceeded a fixed sum, insurer provided a significant amount of risk transfer. Benefits ADVANCING CORPORATE STRATEGY THROUGH ALTERNATIVE SOLUTIONS • Covered claims paid for the next 50 years, or until the limit of liability is exhausted, or policy is commuted. • Provided annual policy limits that reimbursed client for paid claims not covered by existing insurance. • Ring-fenced the material liability and potential source of future earnings volatility. • Share in favorable loss experience.

Disclaimer This presentation is for illustrative purposes only and should not be construed as an attempt to define any of the terms and conditions regarding a possible issuance of coverage. Clients are advised to make an independent review and reach their own conclusions regarding the economic benefits and risks of any proposed transaction, as well as the legal, regulatory, credit, tax and accounting aspects of a transaction as it relates to their particular circumstances. This presentation does not constitute an offer to sell coverage of the type generally described herein. Insurance provided by member companies of American International Group, Inc. ADVANCING CORPORATE STRATEGY THROUGH ALTERNATIVE SOLUTIONS 08/2003

Disclaimer This presentation is for illustrative purposes only and should not be construed as an attempt to define any of the terms and conditions regarding a possible issuance of coverage. Clients are advised to make an independent review and reach their own conclusions regarding the economic benefits and risks of any proposed transaction, as well as the legal, regulatory, credit, tax and accounting aspects of a transaction as it relates to their particular circumstances. This presentation does not constitute an offer to sell coverage of the type generally described herein. Insurance provided by member companies of American International Group, Inc. ADVANCING CORPORATE STRATEGY THROUGH ALTERNATIVE SOLUTIONS 08/2003