8ae82ef5cb8aa36852c0023f74a0a9c1.ppt

- Количество слайдов: 28

Finding Opportunities in Difficult Markets November 21, 2014 Hancock Institutional Advisors, LLC SEC Registered Investment Advisor Nick Trentmann, Portfolio Manager Jeff Holley, Portfolio Manager Hancock Securities Group, LLC Member FINRA, SIPC, MSRB Hancock Institutional Advisors, LLC SEC Registered Investment Advisor Hancock Management Services, LLC Confidential and Proprietary 383 Marshall Avenue St. Louis, MO 63119 (314) 997 -3191 (tel) (314) 997 -3358 (fax) 1 www. hsg-hia. com

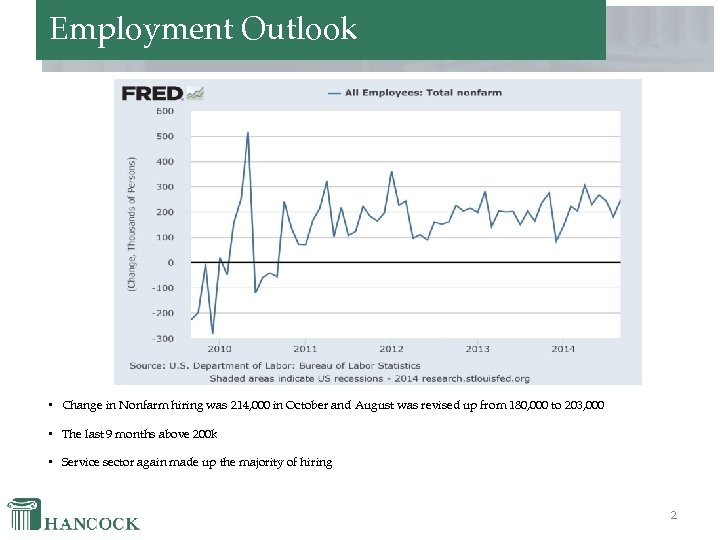

Employment Outlook • Change in Nonfarm hiring was 214, 000 in October and August was revised up from 180, 000 to 203, 000 • The last 9 months above 200 k • Service sector again made up the majority of hiring 2

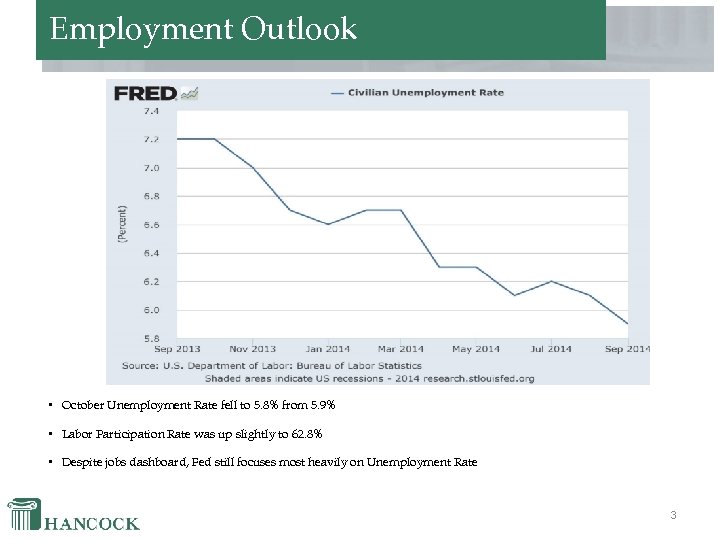

Employment Outlook • October Unemployment Rate fell to 5. 8% from 5. 9% • Labor Participation Rate was up slightly to 62. 8% • Despite jobs dashboard, Fed still focuses most heavily on Unemployment Rate 3

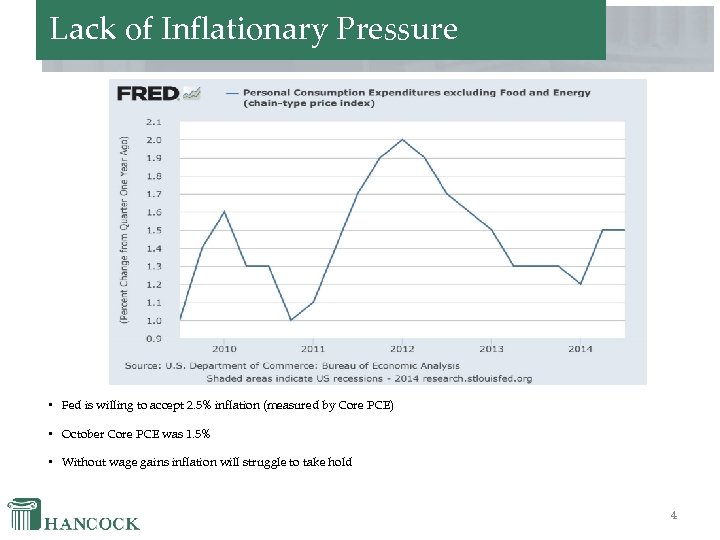

Lack of Inflationary Pressure • Fed is willing to accept 2. 5% inflation (measured by Core PCE) • October Core PCE was 1. 5% • Without wage gains inflation will struggle to take hold 4

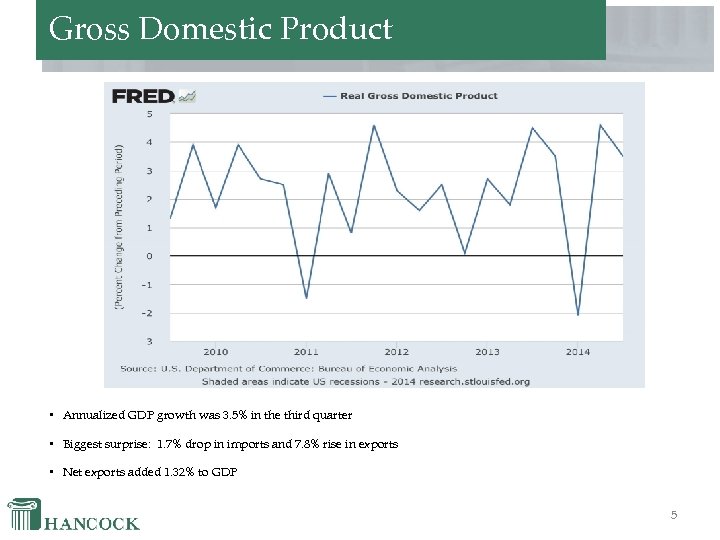

Gross Domestic Product • Annualized GDP growth was 3. 5% in the third quarter • Biggest surprise: 1. 7% drop in imports and 7. 8% rise in exports • Net exports added 1. 32% to GDP 5

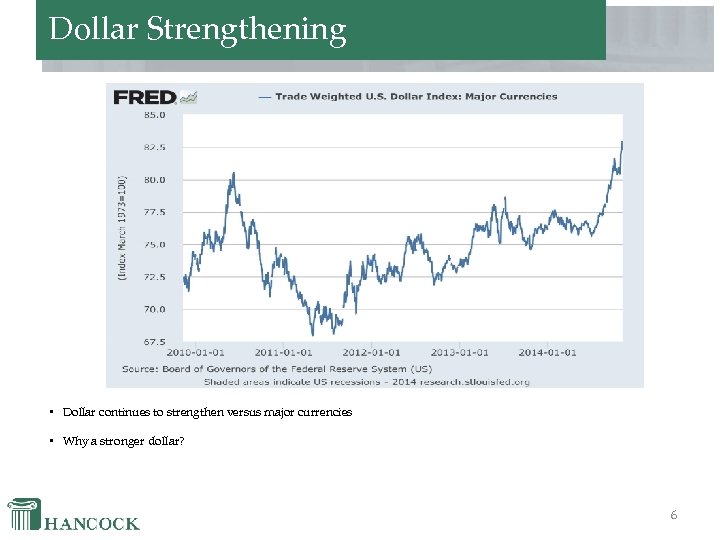

Dollar Strengthening • Dollar continues to strengthen versus major currencies • Why a stronger dollar? 6

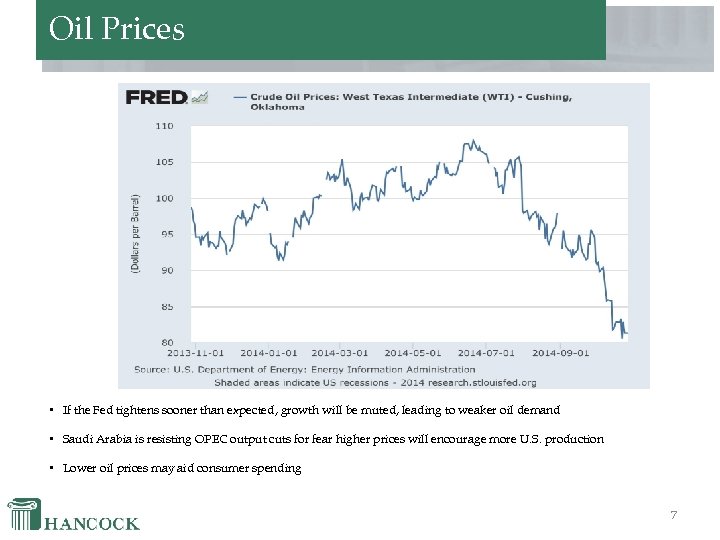

Oil Prices • If the Fed tightens sooner than expected, growth will be muted, leading to weaker oil demand • Saudi Arabia is resisting OPEC output cuts for fear higher prices will encourage more U. S. production • Lower oil prices may aid consumer spending 7

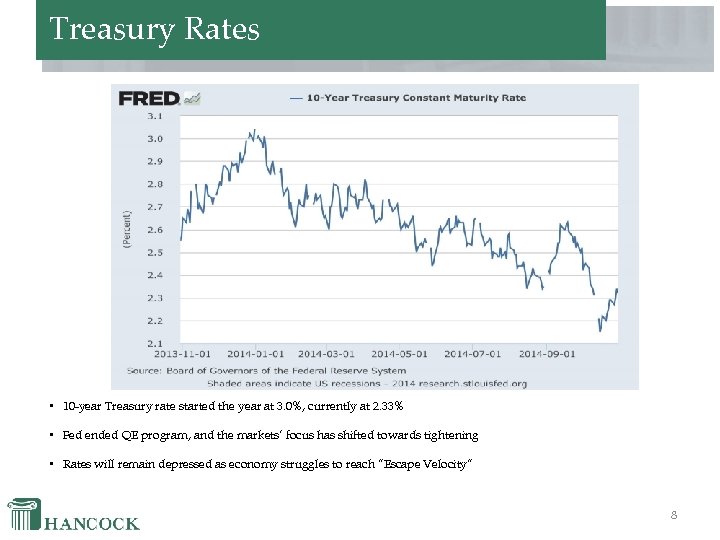

Treasury Rates • 10 -year Treasury rate started the year at 3. 0%, currently at 2. 33% • Fed ended QE program, and the markets’ focus has shifted towards tightening • Rates will remain depressed as economy struggles to reach “Escape Velocity” 8

Themes from 2014 • Rates are extremely low. • Very active Fed. • Market expects funds locked at 0. 25% until 2015. • Yield curve will steepen before Fed Funds rise. • Cash flow over the next two years not helpful. • Avoid tail risk. • Some increase in optionality is acceptable. • Avoid decisions today that limit options in the future. • The longer we stay at low rates, the greater the risks become to rising rates. • Look at the portfolio as a whole, not just individual bonds. 9

Themes from 2014 What didn’t work? – – – Long-Dated Step-Ups Multi-call Options with Long Maturities Mortgage Backed Securities What worked? – – – Floating Rate Structures Credit (Corporate) One-Time Call Options with Mid-Maturities 10

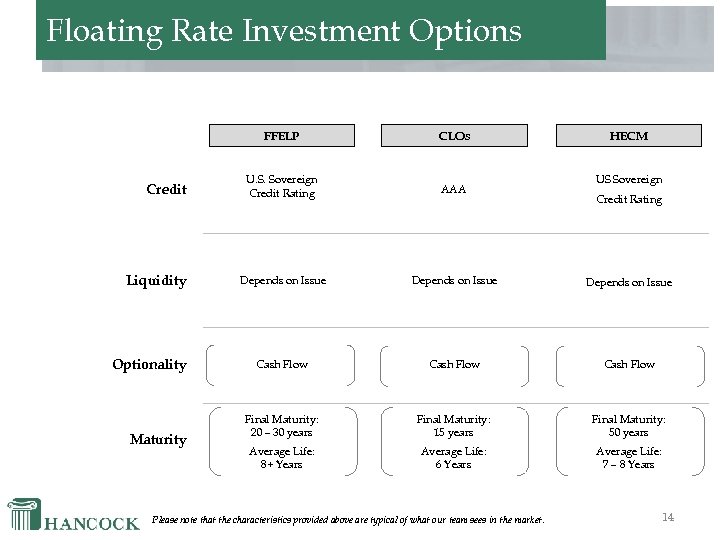

Defensive Bonds Floating Rate Securities – – Federal Family Education Loan Program (FFELP) Corporate Floaters Home Equity Conversion Mortgage (HECM) Collateralized Loan Obligation (CLO) 5 - to 10 -Year Part of the Curve – – – Picks up income versus floaters Rolls the curve Risk: underperforms if an aggressive rise in rates 11

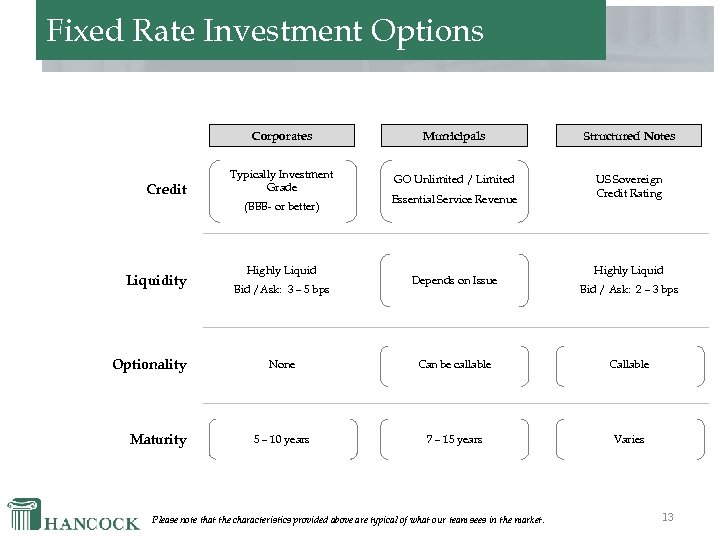

Four Ways to Increase Income 1. Credit 2. Liquidity 3. Optionality (Cash Flow Volatility) 4. Maturity 12

Fixed Rate Investment Options Corporates Credit Municipals Structured Notes Typically Investment Grade GO Unlimited / Limited US Sovereign Credit Rating (BBB- or better) Liquidity Optionality Maturity Highly Liquid Bid /Ask: 3 – 5 bps Essential Service Revenue Depends on Issue Highly Liquid Bid / Ask: 2 – 3 bps None Can be callable Callable 5 – 10 years 7 – 15 years Varies Please note that the characteristics provided above are typical of what our team sees in the market. 13

Floating Rate Investment Options FFELP Credit Liquidity Optionality Maturity CLOs U. S. Sovereign Credit Rating AAA Depends on Issue Cash Flow Final Maturity: 20 – 30 years Final Maturity: 15 years Final Maturity: 50 years Average Life: 8+ Years Average Life: 6 Years Average Life: 7 – 8 Years Please note that the characteristics provided above are typical of what our team sees in the market. HECM US Sovereign Credit Rating 14

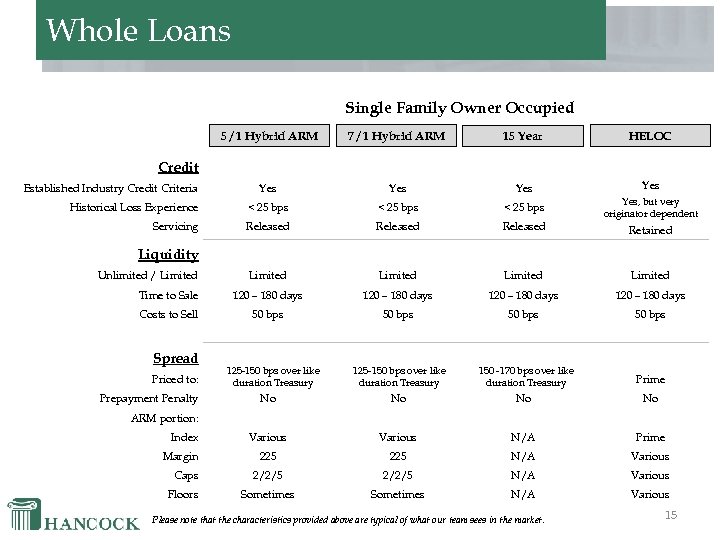

Whole Loans Single Family Owner Occupied 5 / 1 Hybrid ARM 7 / 1 Hybrid ARM 15 Year HELOC Yes Yes Historical Loss Experience < 25 bps Servicing Released Yes, but very originator dependent Limited Time to Sale 120 – 180 days Costs to Sell 50 bps 125 -150 bps over like duration Treasury 150 -170 bps over like duration Treasury Prime No No Various N/A Prime 225 N/A Various Caps 2/2/5 N/A Various Floors Sometimes N/A Various Credit Established Industry Credit Criteria Retained Liquidity Unlimited / Limited Spread Priced to: Prepayment Penalty 125 -150 bps over like duration Treasury ARM portion: Index Margin Please note that the characteristics provided above are typical of what our team sees in the market. 15

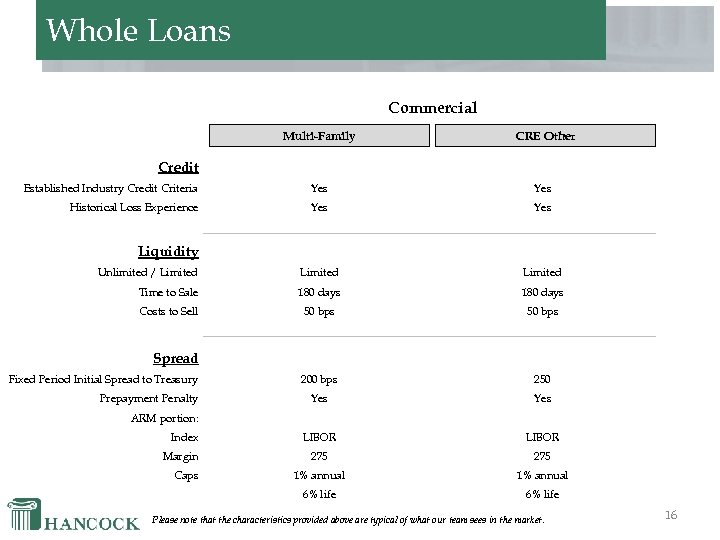

Whole Loans Commercial Multi-Family CRE Other Established Industry Credit Criteria Yes Historical Loss Experience Yes Unlimited / Limited Time to Sale 180 days Costs to Sell 50 bps 200 bps 250 Yes LIBOR 275 1% annual 6% life Credit Liquidity Spread Fixed Period Initial Spread to Treasury Prepayment Penalty ARM portion: Index Margin Caps Please note that the characteristics provided above are typical of what our team sees in the market. 16

Takeaways 1. Greatest spread remain in corporate issues 2. Reduce amount of cash flows in less than 2 years 3. Yield curve is attractive in the 5 - to 10 -year sector 4. Rates in the 5 - to 10 -year part of the curve have room to fall 5. Fed purchases/reduced volume = MBS spreads to remain tight 6. Roll of curve is attractive 17

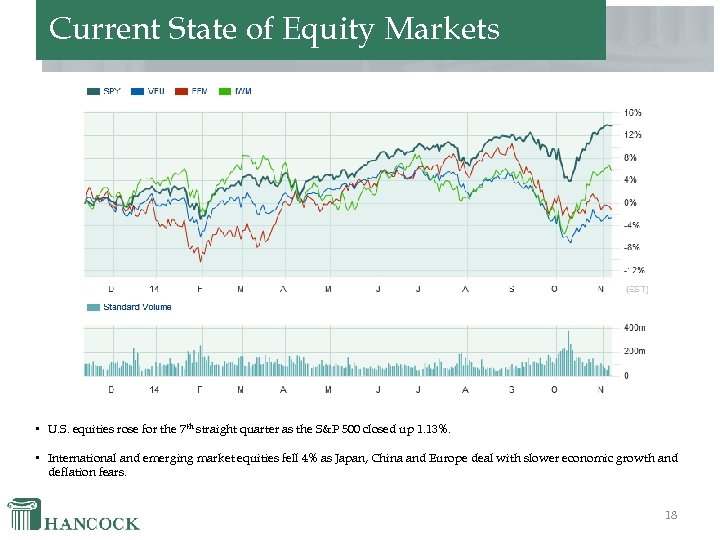

Current State of Equity Markets • U. S. equities rose for the 7 th straight quarter as the S&P 500 closed up 1. 13%. • International and emerging market equities fell 4% as Japan, China and Europe deal with slower economic growth and deflation fears. 18

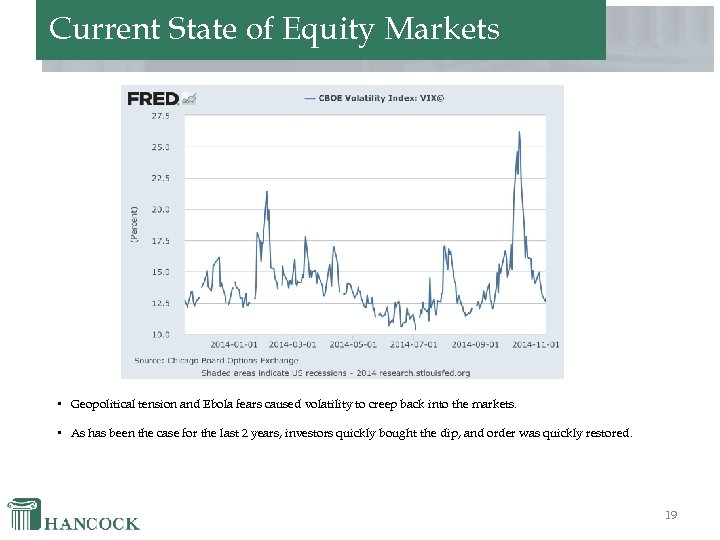

Current State of Equity Markets • Geopolitical tension and Ebola fears caused volatility to creep back into the markets. • As has been the case for the last 2 years, investors quickly bought the dip, and order was quickly restored. 19

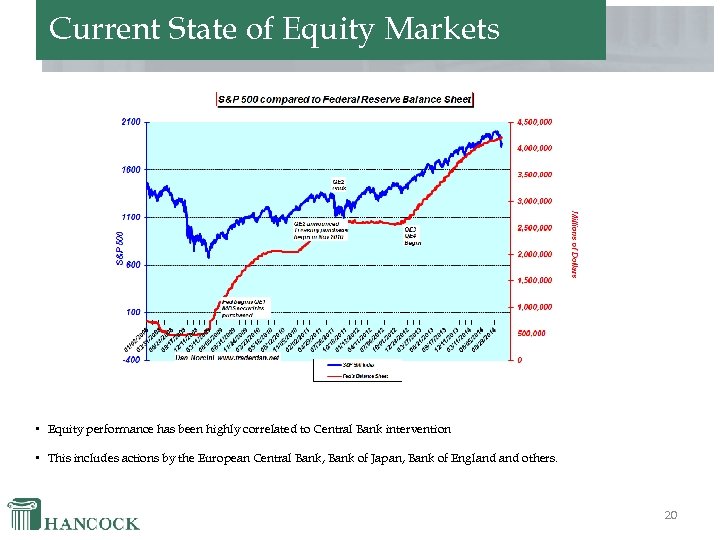

Current State of Equity Markets • Equity performance has been highly correlated to Central Bank intervention • This includes actions by the European Central Bank, Bank of Japan, Bank of England others. 20

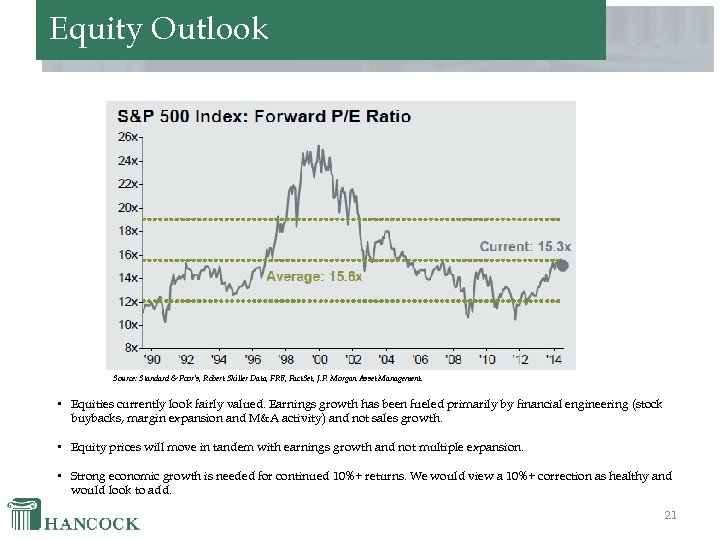

Equity Outlook Source: Standard & Poor’s, Robert Shiller Data, FRB, Fact. Set, J. P. Morgan Asset Management. • Equities currently look fairly valued. Earnings growth has been fueled primarily by financial engineering (stock buybacks, margin expansion and M&A activity) and not sales growth. • Equity prices will move in tandem with earnings growth and not multiple expansion. • Strong economic growth is needed for continued 10%+ returns. We would view a 10%+ correction as healthy and would look to add. 21

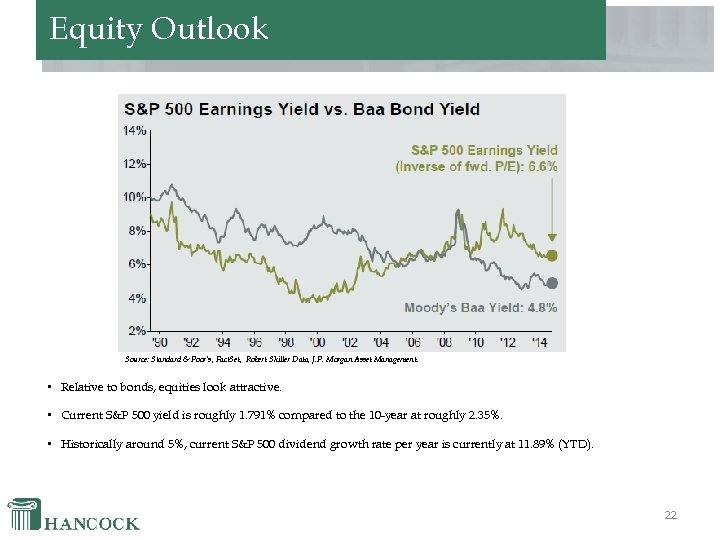

Equity Outlook Source: Standard & Poor’s, Fact. Set, Robert Shiller Data, J. P. Morgan Asset Management. • Relative to bonds, equities look attractive. • Current S&P 500 yield is roughly 1. 791% compared to the 10 -year at roughly 2. 35%. • Historically around 5%, current S&P 500 dividend growth rate per year is currently at 11. 89% (YTD). 22

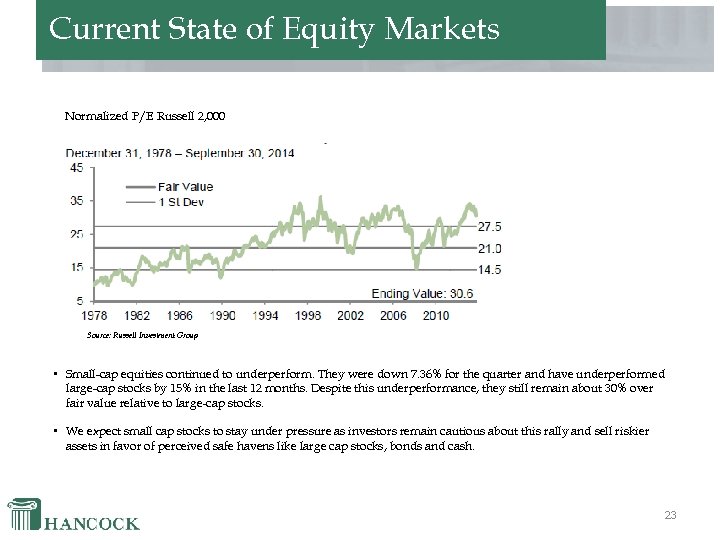

Current State of Equity Markets Normalized P/E Russell 2, 000 Source: Russell Investment Group • Small-cap equities continued to underperform. They were down 7. 36% for the quarter and have underperformed large-cap stocks by 15% in the last 12 months. Despite this underperformance, they still remain about 30% over fair value relative to large-cap stocks. • We expect small cap stocks to stay under pressure as investors remain cautious about this rally and sell riskier assets in favor of perceived safe havens like large cap stocks, bonds and cash. 23

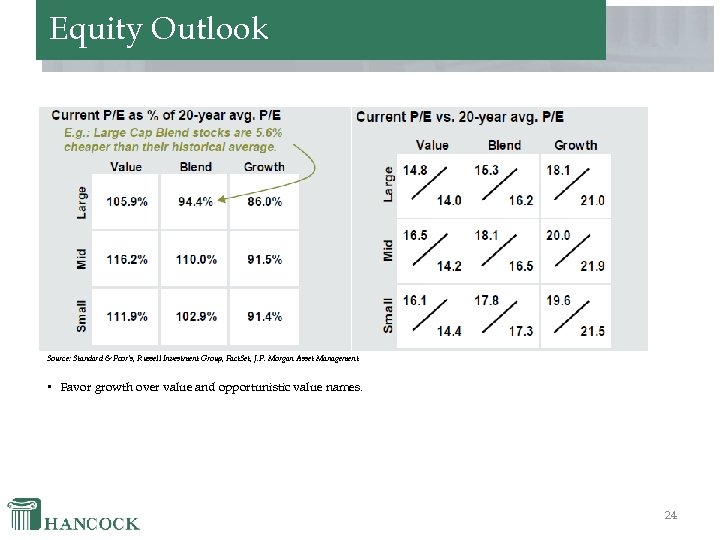

Equity Outlook Source: Standard & Poor’s, Russell Investment Group, Fact. Set, J. P. Morgan Asset Management. • Favor growth over value and opportunistic value names. 24

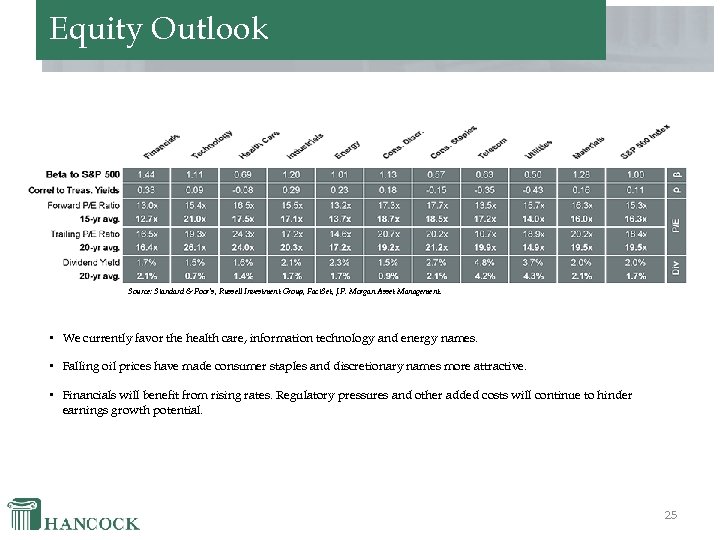

Equity Outlook Source: Standard & Poor’s, Russell Investment Group, Fact. Set, J. P. Morgan Asset Management. • We currently favor the health care, information technology and energy names. • Falling oil prices have made consumer staples and discretionary names more attractive. • Financials will benefit from rising rates. Regulatory pressures and other added costs will continue to hinder earnings growth potential. 25

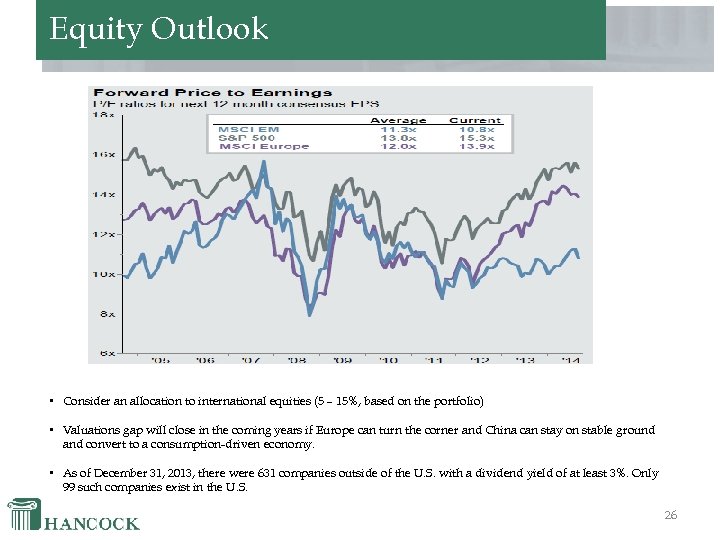

Equity Outlook • Consider an allocation to international equities (5 – 15%, based on the portfolio) • Valuations gap will close in the coming years if Europe can turn the corner and China can stay on stable ground and convert to a consumption-driven economy. • As of December 31, 2013, there were 631 companies outside of the U. S. with a dividend yield of at least 3%. Only 99 such companies exist in the U. S. 26

Portfolio Positioning • Stick with U. S. large cap dividend paying equities, specifically companies with strong balance sheets. • Increase allocation to alternative money managers – long/short equity, buy-write strategies and event driven funds. • For international stocks, look for experienced active managers with long term, multi cycle experience. Value focus with ability to add to positions in volatile markets. 27

Biographies and Disclaimer Nick J. Trentmann, Portfolio Manager At Hancock Institutional Advisors, LLC, Nick is responsible for portfolio and securities management and analytics for fixed income portfolios. He also assists in the firm’s sales and marketing efforts to institutional clients. Prior to joining Hancock in 2007, Nick was a financial advisor with Renaissance Financial and a credit analyst at Citi. Nick brings ten years experience in the financial services industry. Nick earned a bachelor’s degree from the University of Missouri. He holds Series 7 and 66 licenses from FINRA. Jeffrey R. Holley, Financial Advisor & Portfolio Manager At Hancock, Jeff Holley works alongside clients to help identify and achieve their financial goals. He conducts and distributes investment research throughout the firm, is a co-manager of the Conservative Equity Strategy, and serves on Hancock’s Investment Committee. In addition to his advisory-based roles, Jeff executes trades, maintains option orders, monitors the overall client allocation process, and writes investment commentary on behalf of the firm. Prior to joining Hancock in 2013, Jeff worked at Edward Jones where he most recently served as an Equities Investment Specialist, primarily involved in conducting research and providing solutions to Financial Advisors. Jeff earned a Bachelor of Science degree in Business Administration from the University of Missouri - Columbia. He holds Series 7 and 66 licenses from FINRA and is currently a Level II candidate in the CFA program. Jeff is an active member of Marian Middle School’s Young Friends Committee and Finance Committee. For copies of this presentation, please contact Nick at (314) 997 -3191 x 315 or ntrentmann@hsgstl. com. The material contained herein has been prepared from sources we believe to be reliable, but is provided without any representation as to accuracy or completeness. This material does not purport to be a complete analysis of the securities, companies or industries involved. This material is published solely for informational purposes and is not an offer to buy or sell or a solicitation of an offer to buy or sell any security or investment product. All opinions and estimates included with this material are our own unless otherwise stated and are subject to change without notice. All investments can fluctuate in price, value and/or income. Past performance is not necessarily a guide to future performance. This material has no regard to the specific investment objectives, financial situation or particular needs of any specific recipient. 28

8ae82ef5cb8aa36852c0023f74a0a9c1.ppt