0208047b9fb30ab3de5e1e6cdeba5451.ppt

- Количество слайдов: 36

Finding Funding Sources for Client Start-Ups and Expansions 2008 Community Food Security Coalition/Food. Bin Conference Diane Holtaway

Finding Funding Sources for Client Start-Ups and Expansions 2008 Community Food Security Coalition/Food. Bin Conference Diane Holtaway

Capital…A fundamental need for establishing a new business …. • • • Personal Cash shortfalls Credit card limits No available cushion Late receivables Cash on delivery Large upfront security deposits Start-up operating costs Long sales cycle Large working capital needs 2

Capital…A fundamental need for establishing a new business …. • • • Personal Cash shortfalls Credit card limits No available cushion Late receivables Cash on delivery Large upfront security deposits Start-up operating costs Long sales cycle Large working capital needs 2

. . . Or For A New Business, Expansion or Venture? • A client has a strong business idea with great financial potential? • There’s a ready market that needs this product or service? • Client is ready to expand their business – facilities, production, open up new markets, etc. • Client desires to launch a 3

. . . Or For A New Business, Expansion or Venture? • A client has a strong business idea with great financial potential? • There’s a ready market that needs this product or service? • Client is ready to expand their business – facilities, production, open up new markets, etc. • Client desires to launch a 3

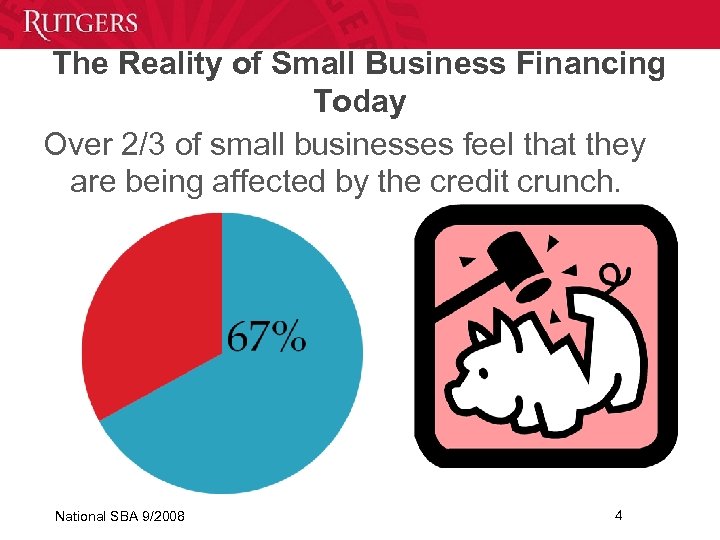

The Reality of Small Business Financing Today Over 2/3 of small businesses feel that they are being affected by the credit crunch. National SBA 9/2008 4

The Reality of Small Business Financing Today Over 2/3 of small businesses feel that they are being affected by the credit crunch. National SBA 9/2008 4

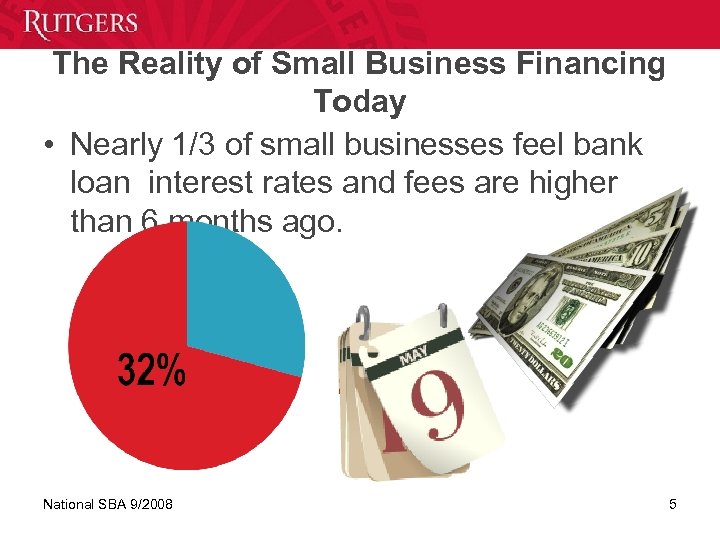

The Reality of Small Business Financing Today • Nearly 1/3 of small businesses feel bank loan interest rates and fees are higher than 6 months ago. National SBA 9/2008 5

The Reality of Small Business Financing Today • Nearly 1/3 of small businesses feel bank loan interest rates and fees are higher than 6 months ago. National SBA 9/2008 5

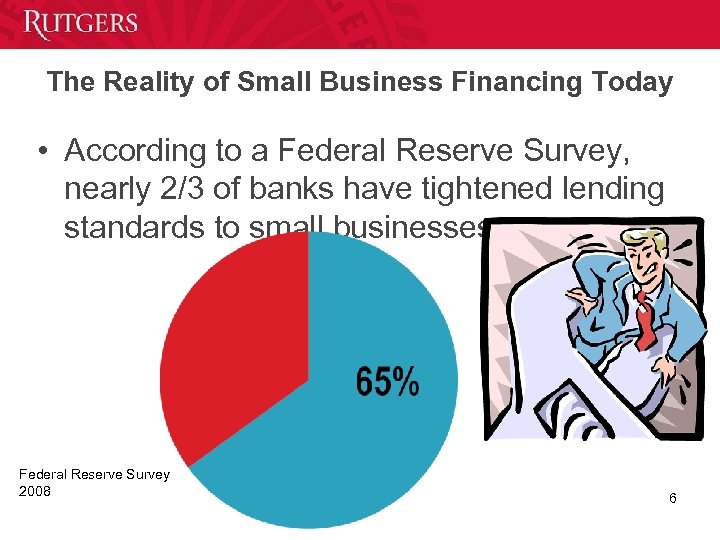

The Reality of Small Business Financing Today • According to a Federal Reserve Survey, nearly 2/3 of banks have tightened lending standards to small businesses. Federal Reserve Survey 2008 6

The Reality of Small Business Financing Today • According to a Federal Reserve Survey, nearly 2/3 of banks have tightened lending standards to small businesses. Federal Reserve Survey 2008 6

Funding A Business Today • Who Can Help ? • Spectrum of Funding Sources • Presenting Your Company To The Financial Community 7

Funding A Business Today • Who Can Help ? • Spectrum of Funding Sources • Presenting Your Company To The Financial Community 7

The Good News: Funding is still available You just have to harder …. . and prepare better than the competition 8

The Good News: Funding is still available You just have to harder …. . and prepare better than the competition 8

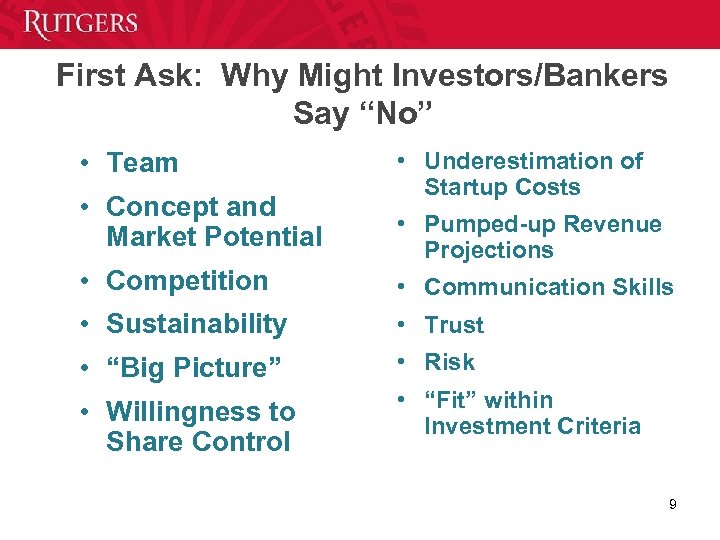

First Ask: Why Might Investors/Bankers Say “No” • Team • Concept and Market Potential • Underestimation of Startup Costs • Pumped-up Revenue Projections • Competition • Communication Skills • Sustainability • Trust • “Big Picture” • Risk • Willingness to Share Control • “Fit” within Investment Criteria 9

First Ask: Why Might Investors/Bankers Say “No” • Team • Concept and Market Potential • Underestimation of Startup Costs • Pumped-up Revenue Projections • Competition • Communication Skills • Sustainability • Trust • “Big Picture” • Risk • Willingness to Share Control • “Fit” within Investment Criteria 9

First Ask: Why Might Investors/Bankers Say “No” • Businesses want money for nothing. They want money without any strings attached. “Give me a check but don’t tell me how to run my business” • Business owners overvalue their company. Many entrepreneurs look at how much control they are willing to relinquish and base their valuation on owning at least 51% of the company after they take in outside capital (pre-capital value + cash = post-capital value) • Companies need more money than they actually think they do. Need to partner with an investor whose deep pockets can write a check at a crucial moment. Adam Borden, Managing Partner, Bradmer Foods LLC, 10

First Ask: Why Might Investors/Bankers Say “No” • Businesses want money for nothing. They want money without any strings attached. “Give me a check but don’t tell me how to run my business” • Business owners overvalue their company. Many entrepreneurs look at how much control they are willing to relinquish and base their valuation on owning at least 51% of the company after they take in outside capital (pre-capital value + cash = post-capital value) • Companies need more money than they actually think they do. Need to partner with an investor whose deep pockets can write a check at a crucial moment. Adam Borden, Managing Partner, Bradmer Foods LLC, 10

Funding Your Business • Who Can Help? • Spectrum of Funding Sources • Presenting Your Company To The Financial Community 11

Funding Your Business • Who Can Help? • Spectrum of Funding Sources • Presenting Your Company To The Financial Community 11

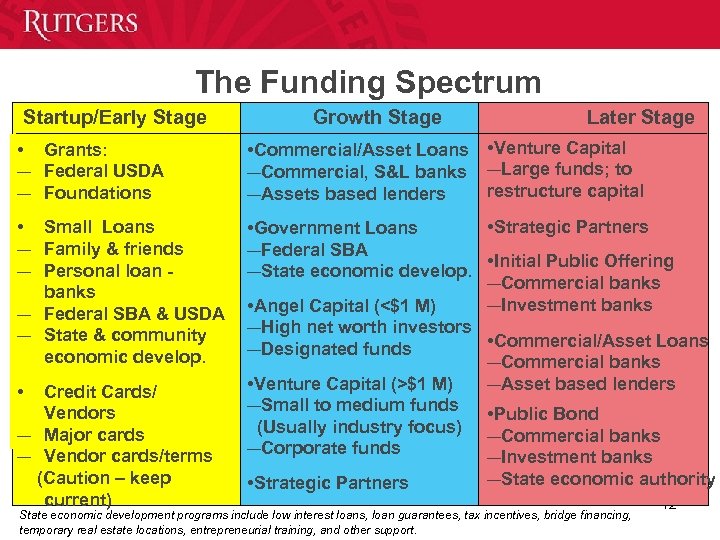

The Funding Spectrum Startup/Early Stage Growth Stage Later Stage • Venture Capital ―Large funds; to restructure capital • Grants: ― Federal USDA ― Foundations • Commercial/Asset Loans ―Commercial, S&L banks ―Assets based lenders • Small Loans ― Family & friends ― Personal loan banks ― Federal SBA & USDA ― State & community economic develop. • Strategic Partners • Government Loans ―Federal SBA • Initial Public Offering ―State economic develop. ―Commercial banks ―Investment banks • Angel Capital (<$1 M) ―High net worth investors • Commercial/Asset Loans ―Designated funds ―Commercial banks • Venture Capital (>$1 M) ―Asset based lenders ―Small to medium funds • Public Bond (Usually industry focus) ―Commercial banks ―Corporate funds ―Investment banks • Credit Cards/ Vendors ― Major cards ― Vendor cards/terms (Caution – keep current) • Strategic Partners ―State economic authority State economic development programs include low interest loans, loan guarantees, tax incentives, bridge financing, temporary real estate locations, entrepreneurial training, and other support. 12

The Funding Spectrum Startup/Early Stage Growth Stage Later Stage • Venture Capital ―Large funds; to restructure capital • Grants: ― Federal USDA ― Foundations • Commercial/Asset Loans ―Commercial, S&L banks ―Assets based lenders • Small Loans ― Family & friends ― Personal loan banks ― Federal SBA & USDA ― State & community economic develop. • Strategic Partners • Government Loans ―Federal SBA • Initial Public Offering ―State economic develop. ―Commercial banks ―Investment banks • Angel Capital (<$1 M) ―High net worth investors • Commercial/Asset Loans ―Designated funds ―Commercial banks • Venture Capital (>$1 M) ―Asset based lenders ―Small to medium funds • Public Bond (Usually industry focus) ―Commercial banks ―Corporate funds ―Investment banks • Credit Cards/ Vendors ― Major cards ― Vendor cards/terms (Caution – keep current) • Strategic Partners ―State economic authority State economic development programs include low interest loans, loan guarantees, tax incentives, bridge financing, temporary real estate locations, entrepreneurial training, and other support. 12

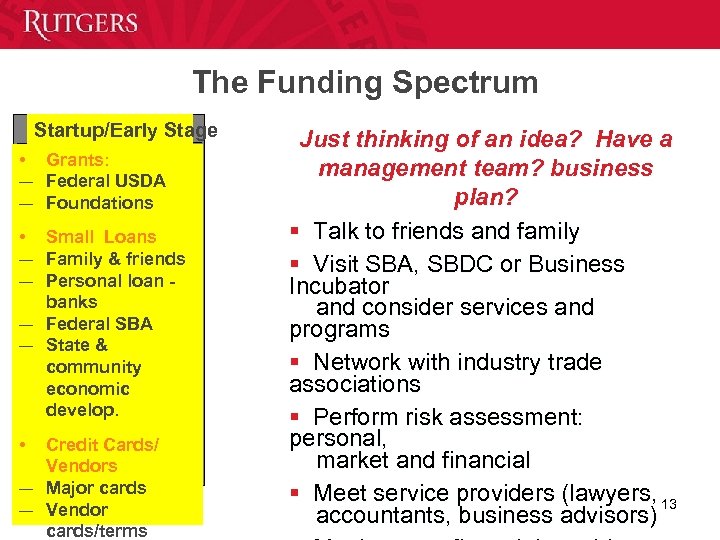

The Funding Spectrum Startup/Early Stage • Grants: ― Federal USDA ― Foundations • Small Loans ― Family & friends ― Personal loan banks ― Federal SBA ― State & community economic develop. • Credit Cards/ Vendors ― Major cards ― Vendor cards/terms Just thinking of an idea? Have a management team? business plan? § Talk to friends and family § Visit SBA, SBDC or Business Incubator and consider services and programs § Network with industry trade associations § Perform risk assessment: personal, market and financial § Meet service providers (lawyers, 13 accountants, business advisors)

The Funding Spectrum Startup/Early Stage • Grants: ― Federal USDA ― Foundations • Small Loans ― Family & friends ― Personal loan banks ― Federal SBA ― State & community economic develop. • Credit Cards/ Vendors ― Major cards ― Vendor cards/terms Just thinking of an idea? Have a management team? business plan? § Talk to friends and family § Visit SBA, SBDC or Business Incubator and consider services and programs § Network with industry trade associations § Perform risk assessment: personal, market and financial § Meet service providers (lawyers, 13 accountants, business advisors)

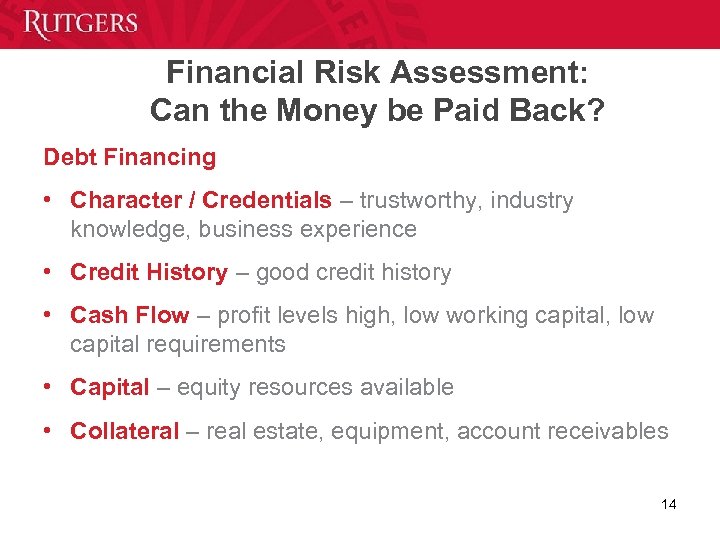

Financial Risk Assessment: Can the Money be Paid Back? Debt Financing • Character / Credentials – trustworthy, industry knowledge, business experience • Credit History – good credit history • Cash Flow – profit levels high, low working capital, low capital requirements • Capital – equity resources available • Collateral – real estate, equipment, account receivables 14

Financial Risk Assessment: Can the Money be Paid Back? Debt Financing • Character / Credentials – trustworthy, industry knowledge, business experience • Credit History – good credit history • Cash Flow – profit levels high, low working capital, low capital requirements • Capital – equity resources available • Collateral – real estate, equipment, account receivables 14

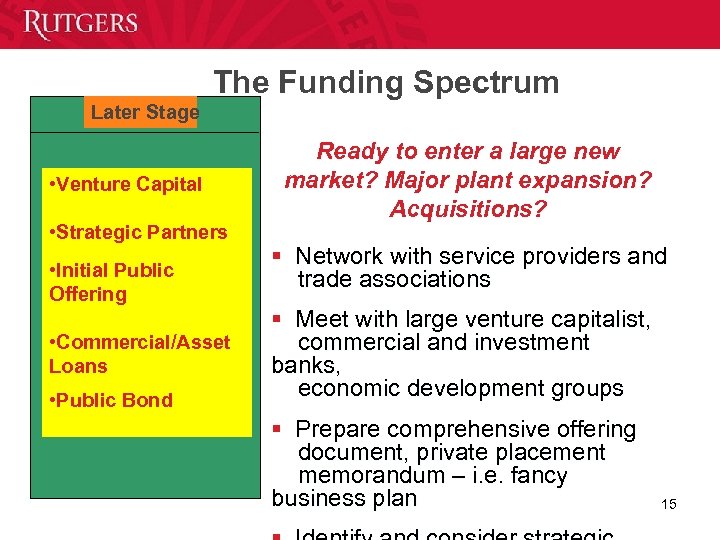

The Funding Spectrum Later Stage • Venture Capital • Strategic Partners • Initial Public Offering • Commercial/Asset Loans • Public Bond Ready to enter a large new market? Major plant expansion? Acquisitions? § Network with service providers and trade associations § Meet with large venture capitalist, commercial and investment banks, economic development groups § Prepare comprehensive offering document, private placement memorandum – i. e. fancy business plan 15

The Funding Spectrum Later Stage • Venture Capital • Strategic Partners • Initial Public Offering • Commercial/Asset Loans • Public Bond Ready to enter a large new market? Major plant expansion? Acquisitions? § Network with service providers and trade associations § Meet with large venture capitalist, commercial and investment banks, economic development groups § Prepare comprehensive offering document, private placement memorandum – i. e. fancy business plan 15

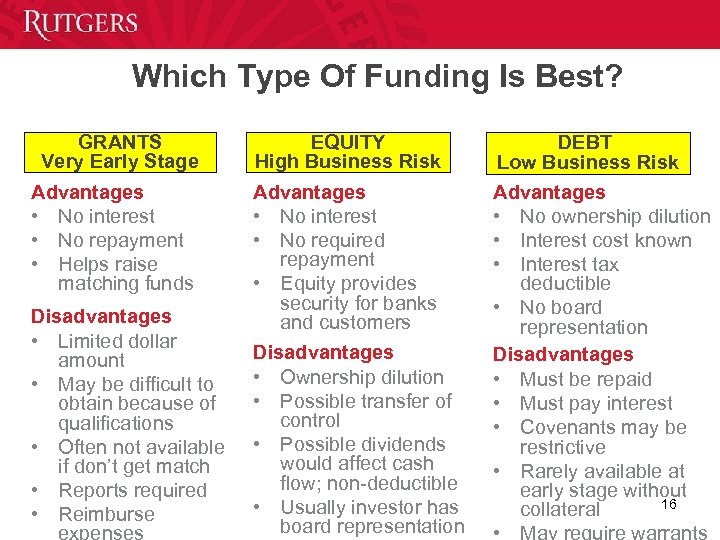

Which Type Of Funding Is Best? GRANTS Very Early Stage EQUITY High Business Risk DEBT Low Business Risk Advantages • No interest • No repayment • Helps raise matching funds Advantages • No interest • No required repayment • Equity provides security for banks and customers Advantages • No ownership dilution • Interest cost known • Interest tax deductible • No board representation Disadvantages • Must be repaid • Must pay interest • Covenants may be restrictive • Rarely available at early stage without 16 collateral • May require warrants Disadvantages • Limited dollar amount • May be difficult to obtain because of qualifications • Often not available if don’t get match • Reports required • Reimburse expenses Disadvantages • Ownership dilution • Possible transfer of control • Possible dividends would affect cash flow; non-deductible • Usually investor has board representation

Which Type Of Funding Is Best? GRANTS Very Early Stage EQUITY High Business Risk DEBT Low Business Risk Advantages • No interest • No repayment • Helps raise matching funds Advantages • No interest • No required repayment • Equity provides security for banks and customers Advantages • No ownership dilution • Interest cost known • Interest tax deductible • No board representation Disadvantages • Must be repaid • Must pay interest • Covenants may be restrictive • Rarely available at early stage without 16 collateral • May require warrants Disadvantages • Limited dollar amount • May be difficult to obtain because of qualifications • Often not available if don’t get match • Reports required • Reimburse expenses Disadvantages • Ownership dilution • Possible transfer of control • Possible dividends would affect cash flow; non-deductible • Usually investor has board representation

Government Funding Programs 17

Government Funding Programs 17

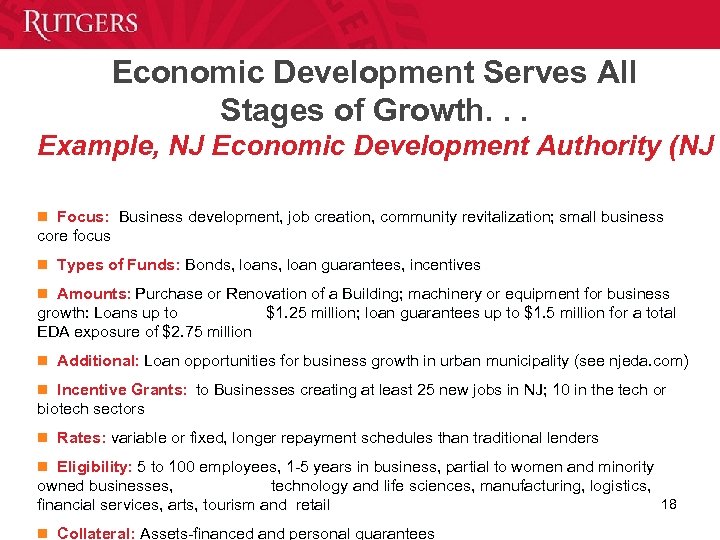

Economic Development Serves All Stages of Growth. . . Example, NJ Economic Development Authority (NJ n Focus: Business development, job creation, community revitalization; small business core focus n Types of Funds: Bonds, loan guarantees, incentives n Amounts: Purchase or Renovation of a Building; machinery or equipment for business growth: Loans up to $1. 25 million; loan guarantees up to $1. 5 million for a total EDA exposure of $2. 75 million n Additional: Loan opportunities for business growth in urban municipality (see njeda. com) n Incentive Grants: to Businesses creating at least 25 new jobs in NJ; 10 in the tech or biotech sectors n Rates: variable or fixed, longer repayment schedules than traditional lenders n Eligibility: 5 to 100 employees, 1 -5 years in business, partial to women and minority owned businesses, technology and life sciences, manufacturing, logistics, 18 financial services, arts, tourism and retail n Collateral: Assets-financed and personal guarantees

Economic Development Serves All Stages of Growth. . . Example, NJ Economic Development Authority (NJ n Focus: Business development, job creation, community revitalization; small business core focus n Types of Funds: Bonds, loan guarantees, incentives n Amounts: Purchase or Renovation of a Building; machinery or equipment for business growth: Loans up to $1. 25 million; loan guarantees up to $1. 5 million for a total EDA exposure of $2. 75 million n Additional: Loan opportunities for business growth in urban municipality (see njeda. com) n Incentive Grants: to Businesses creating at least 25 new jobs in NJ; 10 in the tech or biotech sectors n Rates: variable or fixed, longer repayment schedules than traditional lenders n Eligibility: 5 to 100 employees, 1 -5 years in business, partial to women and minority owned businesses, technology and life sciences, manufacturing, logistics, 18 financial services, arts, tourism and retail n Collateral: Assets-financed and personal guarantees

SBA Programs • The Small Business Administration provides loan guaranties, through private lenders and non-profit institutions, for viable small businesses that have real potential, but cannot qualify for loans from traditional sources. • 7(a) program: – Business plan required – Guarantee : up to 150 K 85%; 75% of loans over $150, 000 to $2. 0 MM – Use of funds: expand or renovate facilities, construction of new facilities, land buildings, machinery, equipment, lease improvements, working capital – Terms: 7 years or less, 2. 25% above prime (max), 7 -25 years 2. 75% above prime (max), usually 10 year maximum – Individual negotiates best rate – Eligibility: Operating for profit, Qualifies as small business 19 – Collateral: Must pledge sufficient assets

SBA Programs • The Small Business Administration provides loan guaranties, through private lenders and non-profit institutions, for viable small businesses that have real potential, but cannot qualify for loans from traditional sources. • 7(a) program: – Business plan required – Guarantee : up to 150 K 85%; 75% of loans over $150, 000 to $2. 0 MM – Use of funds: expand or renovate facilities, construction of new facilities, land buildings, machinery, equipment, lease improvements, working capital – Terms: 7 years or less, 2. 25% above prime (max), 7 -25 years 2. 75% above prime (max), usually 10 year maximum – Individual negotiates best rate – Eligibility: Operating for profit, Qualifies as small business 19 – Collateral: Must pledge sufficient assets

SBA Programs • Micro loans: – $1, 000 to $35, 000 – Avg. $13, 000 – Available through SBA intermediaries – for ex. in NJ, the Cooperative Business Assistance Corp. , Regional Business Assistance Corp, Greater Newark Business Development Consortiums – Business Plan required – Collateral required – Rates – between 8 -13% 20

SBA Programs • Micro loans: – $1, 000 to $35, 000 – Avg. $13, 000 – Available through SBA intermediaries – for ex. in NJ, the Cooperative Business Assistance Corp. , Regional Business Assistance Corp, Greater Newark Business Development Consortiums – Business Plan required – Collateral required – Rates – between 8 -13% 20

SBA Programs • 504 Program: – Focus: Business expansion and job creation – Long term, fixed rate mortgage financing for acquisition and or renovation of capital assets, including land, buildings and equipment – Characteristics: • Business plan required • Lower down payment – 10% • Rate usually below market rate – (Sept. rate 6. 5%) • Use of Funds: Construction/renovation, purchase of facility or capital equipment • >$50, 000 to $4. 0 MM • Eligibility: Small business, for profit, retail, service, wholesale or manufacturing 21 • Collateral: assets-financed

SBA Programs • 504 Program: – Focus: Business expansion and job creation – Long term, fixed rate mortgage financing for acquisition and or renovation of capital assets, including land, buildings and equipment – Characteristics: • Business plan required • Lower down payment – 10% • Rate usually below market rate – (Sept. rate 6. 5%) • Use of Funds: Construction/renovation, purchase of facility or capital equipment • >$50, 000 to $4. 0 MM • Eligibility: Small business, for profit, retail, service, wholesale or manufacturing 21 • Collateral: assets-financed

SBA Has Strong Lending Track Record • SBA – Ben & Jerry’s – Initial expansion loan was awarded to assist this rapidly growing ice cream manufacturer. • Business & Industry Guaranteed Loan Program – Barrel O’ Fun Snack Food Company, Perham, MN received $11. 5 million to construct 95, 000 sq. ft. building and buy equipment, to expand production and warehouse capacity • Hampshire Pet Products, Joplin, MO, a manufacturer of dog biscuits and treats, received $9. 5 million to add equipment and expand production and employment. 22

SBA Has Strong Lending Track Record • SBA – Ben & Jerry’s – Initial expansion loan was awarded to assist this rapidly growing ice cream manufacturer. • Business & Industry Guaranteed Loan Program – Barrel O’ Fun Snack Food Company, Perham, MN received $11. 5 million to construct 95, 000 sq. ft. building and buy equipment, to expand production and warehouse capacity • Hampshire Pet Products, Joplin, MO, a manufacturer of dog biscuits and treats, received $9. 5 million to add equipment and expand production and employment. 22

Why SBA May Not Guarantee a Loan • Applicant has poor credit • At least 20% equity required (not borrowed) • Business plan must demonstrate pay back according to loan terms • Initial lack of collateral 23

Why SBA May Not Guarantee a Loan • Applicant has poor credit • At least 20% equity required (not borrowed) • Business plan must demonstrate pay back according to loan terms • Initial lack of collateral 23

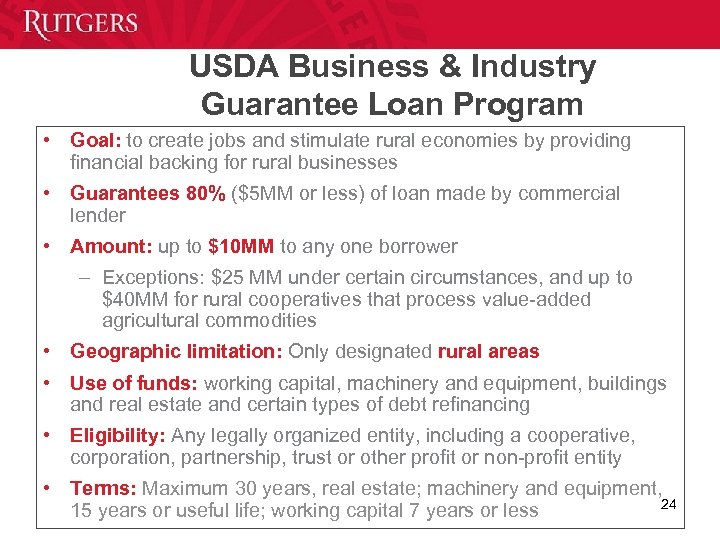

USDA Business & Industry Guarantee Loan Program • Goal: to create jobs and stimulate rural economies by providing financial backing for rural businesses • Guarantees 80% ($5 MM or less) of loan made by commercial lender • Amount: up to $10 MM to any one borrower – Exceptions: $25 MM under certain circumstances, and up to $40 MM for rural cooperatives that process value-added agricultural commodities • Geographic limitation: Only designated rural areas • Use of funds: working capital, machinery and equipment, buildings and real estate and certain types of debt refinancing • Eligibility: Any legally organized entity, including a cooperative, corporation, partnership, trust or other profit or non-profit entity • Terms: Maximum 30 years, real estate; machinery and equipment, 24 15 years or useful life; working capital 7 years or less

USDA Business & Industry Guarantee Loan Program • Goal: to create jobs and stimulate rural economies by providing financial backing for rural businesses • Guarantees 80% ($5 MM or less) of loan made by commercial lender • Amount: up to $10 MM to any one borrower – Exceptions: $25 MM under certain circumstances, and up to $40 MM for rural cooperatives that process value-added agricultural commodities • Geographic limitation: Only designated rural areas • Use of funds: working capital, machinery and equipment, buildings and real estate and certain types of debt refinancing • Eligibility: Any legally organized entity, including a cooperative, corporation, partnership, trust or other profit or non-profit entity • Terms: Maximum 30 years, real estate; machinery and equipment, 24 15 years or useful life; working capital 7 years or less

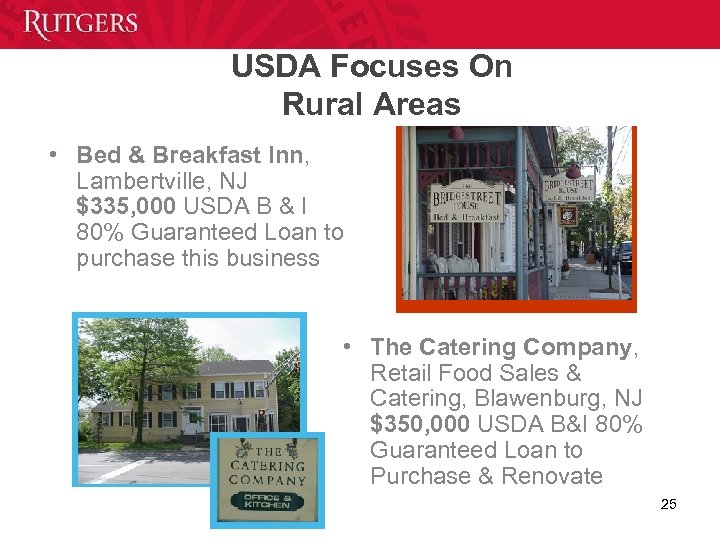

USDA Focuses On Rural Areas • Bed & Breakfast Inn, Lambertville, NJ $335, 000 USDA B & I 80% Guaranteed Loan to purchase this business • The Catering Company, Retail Food Sales & Catering, Blawenburg, NJ $350, 000 USDA B&I 80% Guaranteed Loan to Purchase & Renovate 25

USDA Focuses On Rural Areas • Bed & Breakfast Inn, Lambertville, NJ $335, 000 USDA B & I 80% Guaranteed Loan to purchase this business • The Catering Company, Retail Food Sales & Catering, Blawenburg, NJ $350, 000 USDA B&I 80% Guaranteed Loan to Purchase & Renovate 25

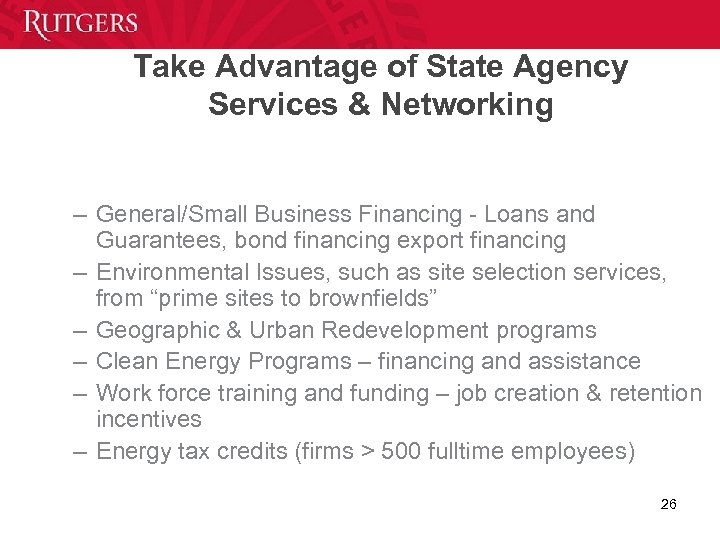

Take Advantage of State Agency Services & Networking – General/Small Business Financing - Loans and Guarantees, bond financing export financing – Environmental Issues, such as site selection services, from “prime sites to brownfields” – Geographic & Urban Redevelopment programs – Clean Energy Programs – financing and assistance – Work force training and funding – job creation & retention incentives – Energy tax credits (firms > 500 fulltime employees) 26

Take Advantage of State Agency Services & Networking – General/Small Business Financing - Loans and Guarantees, bond financing export financing – Environmental Issues, such as site selection services, from “prime sites to brownfields” – Geographic & Urban Redevelopment programs – Clean Energy Programs – financing and assistance – Work force training and funding – job creation & retention incentives – Energy tax credits (firms > 500 fulltime employees) 26

Funding Your Business • Who Can Help • Spectrum of Funding Sources • Presenting Your Company To Funding Sources 27

Funding Your Business • Who Can Help • Spectrum of Funding Sources • Presenting Your Company To Funding Sources 27

A Business Plan Is A Good Place To Start 1. 2. 3. 4. 5. 6. Business overview and focus Industry and competitive assessment Marketing plan – who is the customer? Operations detailed growth plan Management and employees Financial projections and analysis 28

A Business Plan Is A Good Place To Start 1. 2. 3. 4. 5. 6. Business overview and focus Industry and competitive assessment Marketing plan – who is the customer? Operations detailed growth plan Management and employees Financial projections and analysis 28

1. Business overview and focus • Clearly describe your firm and goals Be focused, Be realistic, Know yourself, Know where you want to go and how you plan to get there. • Understand the Features and Benefits of your Product – “Features Tell, Benefits Sell” • Demonstrate your business’ competitive advantages 29

1. Business overview and focus • Clearly describe your firm and goals Be focused, Be realistic, Know yourself, Know where you want to go and how you plan to get there. • Understand the Features and Benefits of your Product – “Features Tell, Benefits Sell” • Demonstrate your business’ competitive advantages 29

2. Industry and competitive assessment • Describe the industry size, growth and environment • Describe competitive and substitute products • Demonstrate your business’ competitive advantages 30

2. Industry and competitive assessment • Describe the industry size, growth and environment • Describe competitive and substitute products • Demonstrate your business’ competitive advantages 30

3. Marketing plan – who is the customer? • • Who is the customer? Be Clear! What is the customer’s need? What is your product’s value proposition? Detail marketing plan to reach customer – Direct marketing, collateral, ads, website, public relations, word-of-mouth, etc. • Sales and distribution strategy • Competitive and value pricing 31

3. Marketing plan – who is the customer? • • Who is the customer? Be Clear! What is the customer’s need? What is your product’s value proposition? Detail marketing plan to reach customer – Direct marketing, collateral, ads, website, public relations, word-of-mouth, etc. • Sales and distribution strategy • Competitive and value pricing 31

4. Operations detailed growth plan • Detailed operating plan includes goals, milestones, and resources needed • Identifies regulatory issues, facility and technology requirements, key vendors, strategic partnerships and service providers 32

4. Operations detailed growth plan • Detailed operating plan includes goals, milestones, and resources needed • Identifies regulatory issues, facility and technology requirements, key vendors, strategic partnerships and service providers 32

5. Management and employees • Competent and passionate management team; and employee growth plan • Detailed staffing requirements, including seasonal and temporary staffing issues • Identify regulatory issues and trade related issues 33

5. Management and employees • Competent and passionate management team; and employee growth plan • Detailed staffing requirements, including seasonal and temporary staffing issues • Identify regulatory issues and trade related issues 33

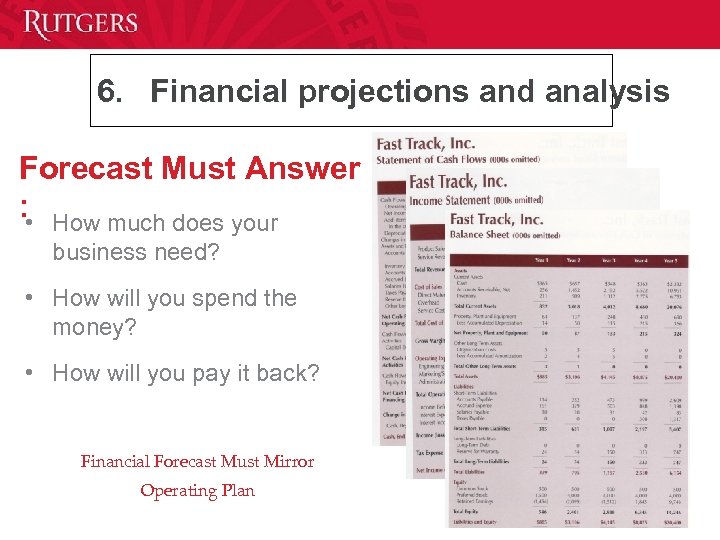

6. Financial projections and analysis Forecast Must Answer : • How much does your business need? • How will you spend the money? • How will you pay it back? Financial Forecast Must Mirror Operating Plan 34

6. Financial projections and analysis Forecast Must Answer : • How much does your business need? • How will you spend the money? • How will you pay it back? Financial Forecast Must Mirror Operating Plan 34

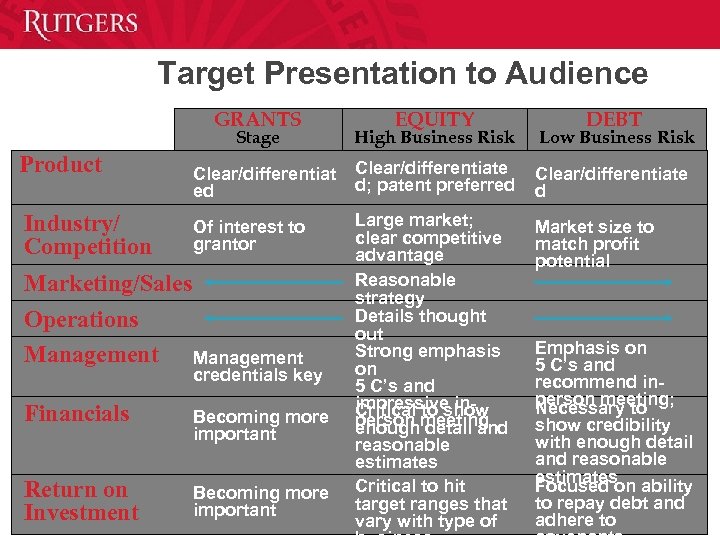

Target Presentation to Audience GRANTS Stage Product Industry/ Competition EQUITY DEBT High Business Risk Low Business Risk Clear/differentiat ed Clear/differentiate d; patent preferred Clear/differentiate d Of interest to grantor Large market; clear competitive advantage Reasonable strategy Details thought out Strong emphasis on 5 C’s and impressive in. Critical to show person meeting enough detail and reasonable estimates Critical to hit target ranges that vary with type of Market size to match profit potential Marketing/Sales Operations Management credentials key Financials Becoming more important Return on Investment Becoming more important Emphasis on 5 C’s and recommend inperson meeting; Necessary to show credibility with enough detail and reasonable estimates ability Focused on to repay debt and 35 adhere to

Target Presentation to Audience GRANTS Stage Product Industry/ Competition EQUITY DEBT High Business Risk Low Business Risk Clear/differentiat ed Clear/differentiate d; patent preferred Clear/differentiate d Of interest to grantor Large market; clear competitive advantage Reasonable strategy Details thought out Strong emphasis on 5 C’s and impressive in. Critical to show person meeting enough detail and reasonable estimates Critical to hit target ranges that vary with type of Market size to match profit potential Marketing/Sales Operations Management credentials key Financials Becoming more important Return on Investment Becoming more important Emphasis on 5 C’s and recommend inperson meeting; Necessary to show credibility with enough detail and reasonable estimates ability Focused on to repay debt and 35 adhere to

Rutgers Food Innovation Center Contact Information • Lou Cooperhouse, Director cooperhouse@aesop. rutgers. edu • Diane Holtaway, Associate Director, Client Services holtaway@aesop. rutgers. edu – Phone 856 -459 -1900 – Fax – 856 -459 -3043 – 450 East Broad Street Bridgeton, NJ 08302 Website: www. foodinnovation. rutgers. edu 36

Rutgers Food Innovation Center Contact Information • Lou Cooperhouse, Director cooperhouse@aesop. rutgers. edu • Diane Holtaway, Associate Director, Client Services holtaway@aesop. rutgers. edu – Phone 856 -459 -1900 – Fax – 856 -459 -3043 – 450 East Broad Street Bridgeton, NJ 08302 Website: www. foodinnovation. rutgers. edu 36