7093ffd1beb08f3eaa72fbe6de536b21.ppt

- Количество слайдов: 64

Financing Residential Real Estate Lesson 11: FHA-Insured Loans

Financing Residential Real Estate Lesson 11: FHA-Insured Loans

Introduction In this lesson we will cover: l FHA loan programs, l rules for FHA loans (including those governing maximum loan amounts, the minimum cash investment, sales concessions, secondary financing, and assumption), l FHA insurance premiums, l underwriting FHA loans, and l specialized FHA programs.

Introduction In this lesson we will cover: l FHA loan programs, l rules for FHA loans (including those governing maximum loan amounts, the minimum cash investment, sales concessions, secondary financing, and assumption), l FHA insurance premiums, l underwriting FHA loans, and l specialized FHA programs.

Overview of FHA Loans Federal Housing Administration (FHA) was created in 1934 as part of National Housing Act.

Overview of FHA Loans Federal Housing Administration (FHA) was created in 1934 as part of National Housing Act.

Overview of FHA Loans Federal Housing Administration (FHA) was created in 1934 as part of National Housing Act. Purpose of act was to: lgenerate new jobs by increasing construction activity, lstabilize mortgage market, and lpromote financing, repair, improvement, and sale of real estate.

Overview of FHA Loans Federal Housing Administration (FHA) was created in 1934 as part of National Housing Act. Purpose of act was to: lgenerate new jobs by increasing construction activity, lstabilize mortgage market, and lpromote financing, repair, improvement, and sale of real estate.

Overview of FHA Loans Federal Housing Administration Today, the FHA is part of the Department of Housing and Urban Development (HUD). Primary function is insuring mortgage loans. Compensates lenders for losses from borrower default. Does not build homes or make loans.

Overview of FHA Loans Federal Housing Administration Today, the FHA is part of the Department of Housing and Urban Development (HUD). Primary function is insuring mortgage loans. Compensates lenders for losses from borrower default. Does not build homes or make loans.

Overview of FHA Loans FHA mortgage insurance FHA insurance program is called the Mutual Mortgage Insurance Plan. Funded by premiums paid by FHA borrowers.

Overview of FHA Loans FHA mortgage insurance FHA insurance program is called the Mutual Mortgage Insurance Plan. Funded by premiums paid by FHA borrowers.

Overview of FHA Loans FHA mortgage insurance Prospective FHA borrowers apply to lender, not directly to FHA.

Overview of FHA Loans FHA mortgage insurance Prospective FHA borrowers apply to lender, not directly to FHA.

Overview of FHA Loans FHA mortgage insurance Prospective FHA borrowers apply to lender, not directly to FHA. Lenders authorized to make FHA loans either: lsubmit applications to FHA for approval, or lunderwrite applications themselves.

Overview of FHA Loans FHA mortgage insurance Prospective FHA borrowers apply to lender, not directly to FHA. Lenders authorized to make FHA loans either: lsubmit applications to FHA for approval, or lunderwrite applications themselves.

Overview of FHA Loans FHA mortgage insurance Prospective FHA borrowers apply to lender, not directly to FHA. Lenders authorized to make FHA loans either: lsubmit applications to FHA for approval, or lunderwrite applications themselves. Direct endorsement lender: Lender authorized to underwrite its own FHA loans.

Overview of FHA Loans FHA mortgage insurance Prospective FHA borrowers apply to lender, not directly to FHA. Lenders authorized to make FHA loans either: lsubmit applications to FHA for approval, or lunderwrite applications themselves. Direct endorsement lender: Lender authorized to underwrite its own FHA loans.

Overview of FHA Loans FHA mortgage insurance If FHA borrower defaults on loan: l. FHA reimburses lender for full amount of loss. l. Borrower required to repay FHA.

Overview of FHA Loans FHA mortgage insurance If FHA borrower defaults on loan: l. FHA reimburses lender for full amount of loss. l. Borrower required to repay FHA.

Overview of FHA Loans Role of FHA loans FHA-insured loan program is intended to help low- and moderate-income home buyers.

Overview of FHA Loans Role of FHA loans FHA-insured loan program is intended to help low- and moderate-income home buyers.

Overview of FHA Loans Role of FHA loans FHA-insured loan program is intended to help low- and moderate-income home buyers. But eligibility isn’t restricted by income. Instead, FHA sets maximum loan amounts. Maximum generally only enough to buy moderately priced house.

Overview of FHA Loans Role of FHA loans FHA-insured loan program is intended to help low- and moderate-income home buyers. But eligibility isn’t restricted by income. Instead, FHA sets maximum loan amounts. Maximum generally only enough to buy moderately priced house.

Overview of FHA Loans Role of FHA loans FHA-insured loan program is intended to help low- and moderate-income home buyers. But eligibility isn’t restricted by income. Instead, FHA sets maximum loan amounts. Maximum generally only enough to buy moderately priced house. l. FHA also has low downpayment requirements, lenient underwriting standards, etc. , to help buyers.

Overview of FHA Loans Role of FHA loans FHA-insured loan program is intended to help low- and moderate-income home buyers. But eligibility isn’t restricted by income. Instead, FHA sets maximum loan amounts. Maximum generally only enough to buy moderately priced house. l. FHA also has low downpayment requirements, lenient underwriting standards, etc. , to help buyers.

Overview of FHA Loans Role of FHA loans fell out of favor during subprime boom. l. Conventional underwriting standards were loosened and loans were easier to obtain. l. FHA maximum loan amounts were too low to use in some areas.

Overview of FHA Loans Role of FHA loans fell out of favor during subprime boom. l. Conventional underwriting standards were loosened and loans were easier to obtain. l. FHA maximum loan amounts were too low to use in some areas.

Overview of FHA Loans Role of FHA loans Now, however, low-downpayment conventional loans are harder to get, and FHA maximum loan amounts have been increased. FHA loans are once again becoming more popular.

Overview of FHA Loans Role of FHA loans Now, however, low-downpayment conventional loans are harder to get, and FHA maximum loan amounts have been increased. FHA loans are once again becoming more popular.

Overview of FHA Loans FHA loan programs FHA has many different programs to fit different needs. Programs are referred to by section numbers taken from provisions of National Housing Act.

Overview of FHA Loans FHA loan programs FHA has many different programs to fit different needs. Programs are referred to by section numbers taken from provisions of National Housing Act.

FHA Loan Programs Section 203(b) – standard program Section 203(b) is the standard FHA program. Most FHA loans are 203(b) loans. Other programs are based on 203(b).

FHA Loan Programs Section 203(b) – standard program Section 203(b) is the standard FHA program. Most FHA loans are 203(b) loans. Other programs are based on 203(b).

FHA Loan Programs Section 203(b) – standard program Section 203(b) is the standard FHA program. Most FHA loans are 203(b) loans. Other programs are based on 203(b) loan can be used for purchase or refinancing of principal residences with up to four units.

FHA Loan Programs Section 203(b) – standard program Section 203(b) is the standard FHA program. Most FHA loans are 203(b) loans. Other programs are based on 203(b) loan can be used for purchase or refinancing of principal residences with up to four units.

FHA Loan Programs Section 203(k) – rehabilitation loans 203(k) program insures mortgages used to purchase/refinance and rehabilitate homes. 203(k) loans are discussed in more detail at the end of this lesson.

FHA Loan Programs Section 203(k) – rehabilitation loans 203(k) program insures mortgages used to purchase/refinance and rehabilitate homes. 203(k) loans are discussed in more detail at the end of this lesson.

FHA Loan Programs Section 234(c) – condominium units 234(c) program covers purchase or refinancing of unit in condominium approved by FHA.

FHA Loan Programs Section 234(c) – condominium units 234(c) program covers purchase or refinancing of unit in condominium approved by FHA.

FHA Loan Programs Section 234(c) – condominium units 234(c) program covers purchase or refinancing of unit in condominium approved by FHA. l. Developer usually applies for FHA approval when project is built or converted.

FHA Loan Programs Section 234(c) – condominium units 234(c) program covers purchase or refinancing of unit in condominium approved by FHA. l. Developer usually applies for FHA approval when project is built or converted.

FHA Loan Programs Section 234(c) – condominium units 234(c) program covers purchase or refinancing of unit in condominium approved by FHA. l. Developer usually applies for FHA approval when project is built or converted. l. Spot loan: Loan for condominium unit in project that isn’t FHA-approved.

FHA Loan Programs Section 234(c) – condominium units 234(c) program covers purchase or refinancing of unit in condominium approved by FHA. l. Developer usually applies for FHA approval when project is built or converted. l. Spot loan: Loan for condominium unit in project that isn’t FHA-approved.

FHA Loan Programs Section 251 – ARMs Section 251 ARM program can be used to purchase or refinance owner-occupied residence with up to four units. Must have 30 -year loan term. After initial fixed-rate period, adjustments occur on an annual basis.

FHA Loan Programs Section 251 – ARMs Section 251 ARM program can be used to purchase or refinance owner-occupied residence with up to four units. Must have 30 -year loan term. After initial fixed-rate period, adjustments occur on an annual basis.

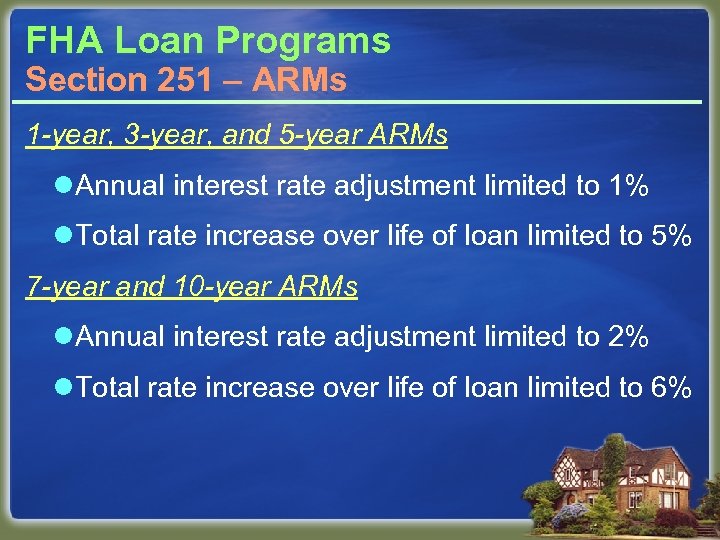

FHA Loan Programs Section 251 – ARMs 1 -year, 3 -year, and 5 -year ARMs l. Annual interest rate adjustment limited to 1% l. Total rate increase over life of loan limited to 5%

FHA Loan Programs Section 251 – ARMs 1 -year, 3 -year, and 5 -year ARMs l. Annual interest rate adjustment limited to 1% l. Total rate increase over life of loan limited to 5%

FHA Loan Programs Section 251 – ARMs 1 -year, 3 -year, and 5 -year ARMs l. Annual interest rate adjustment limited to 1% l. Total rate increase over life of loan limited to 5% 7 -year and 10 -year ARMs l. Annual interest rate adjustment limited to 2% l. Total rate increase over life of loan limited to 6%

FHA Loan Programs Section 251 – ARMs 1 -year, 3 -year, and 5 -year ARMs l. Annual interest rate adjustment limited to 1% l. Total rate increase over life of loan limited to 5% 7 -year and 10 -year ARMs l. Annual interest rate adjustment limited to 2% l. Total rate increase over life of loan limited to 6%

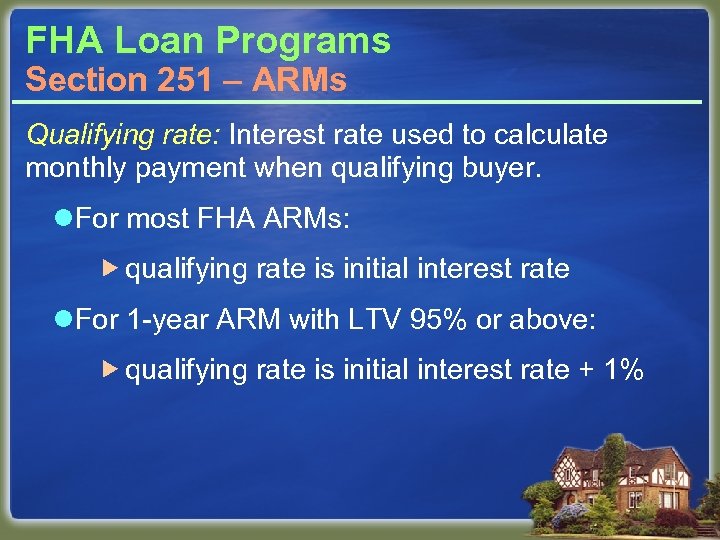

FHA Loan Programs Section 251 – ARMs Qualifying rate: Interest rate used to calculate monthly payment when qualifying buyer. l. For most FHA ARMs: qualifying rate is initial interest rate l. For 1 -year ARM with LTV 95% or above: qualifying rate is initial interest rate + 1%

FHA Loan Programs Section 251 – ARMs Qualifying rate: Interest rate used to calculate monthly payment when qualifying buyer. l. For most FHA ARMs: qualifying rate is initial interest rate l. For 1 -year ARM with LTV 95% or above: qualifying rate is initial interest rate + 1%

FHA Loan Programs Section 255 – HECMs Section 255 provides insurance for reverse mortgages, which the FHA calls home equity conversion mortgages (HECMs). 255 loans are discussed in more detail at the end of this lesson.

FHA Loan Programs Section 255 – HECMs Section 255 provides insurance for reverse mortgages, which the FHA calls home equity conversion mortgages (HECMs). 255 loans are discussed in more detail at the end of this lesson.

Summary Overview of FHA Loans ÄFHA ÄHUD ÄMutual Mortgage Insurance Plan ÄDirect endorsement lenders Ä203(b) program Ä234(c) program Ä251 program

Summary Overview of FHA Loans ÄFHA ÄHUD ÄMutual Mortgage Insurance Plan ÄDirect endorsement lenders Ä203(b) program Ä234(c) program Ä251 program

Rules for FHA Loans When FHA-insured financing is used, transaction must comply with FHA rules regarding: lowner-occupancy, lmaximum loan amount, lminimum cash investment, lsales concessions, lsecondary financing, lproperty flipping, and lassumption.

Rules for FHA Loans When FHA-insured financing is used, transaction must comply with FHA rules regarding: lowner-occupancy, lmaximum loan amount, lminimum cash investment, lsales concessions, lsecondary financing, lproperty flipping, and lassumption.

Rules for FHA Loans Owner-occupancy FHA borrower must intend to occupy home as principal residence.

Rules for FHA Loans Owner-occupancy FHA borrower must intend to occupy home as principal residence.

Rules for FHA Loans Owner-occupancy FHA borrower must intend to occupy home as principal residence. l. FHA loan may be used for secondary residence only in limited circumstances involving hardship.

Rules for FHA Loans Owner-occupancy FHA borrower must intend to occupy home as principal residence. l. FHA loan may be used for secondary residence only in limited circumstances involving hardship.

Rules for FHA Loans Owner-occupancy FHA borrower must intend to occupy home as principal residence. l. FHA loan may be used for secondary residence only in limited circumstances involving hardship. l. Investor loans generally not permitted. Exception may be made for investor buying property that HUD owns due to foreclosure.

Rules for FHA Loans Owner-occupancy FHA borrower must intend to occupy home as principal residence. l. FHA loan may be used for secondary residence only in limited circumstances involving hardship. l. Investor loans generally not permitted. Exception may be made for investor buying property that HUD owns due to foreclosure.

Rules for FHA Loans Local maximum loan amounts FHA sets maximum loan amounts that vary from area to area and are based on local median housing costs. These limits are tied to the conforming loan limits set annually by the secondary market agencies.

Rules for FHA Loans Local maximum loan amounts FHA sets maximum loan amounts that vary from area to area and are based on local median housing costs. These limits are tied to the conforming loan limits set annually by the secondary market agencies.

FHA Local Maximum Loan Amounts Basic maximum – most areas Currently, the basic maximum for FHA loans is 65% of Freddie Mac’s conforming loan limit. In 2009, conforming loan limit for one-unit property is $417, 000. l. So 2009 basic maximum FHA loan amount for a one-unit property is $217, 050: $417, 000 ×. 65 = $271, 050

FHA Local Maximum Loan Amounts Basic maximum – most areas Currently, the basic maximum for FHA loans is 65% of Freddie Mac’s conforming loan limit. In 2009, conforming loan limit for one-unit property is $417, 000. l. So 2009 basic maximum FHA loan amount for a one-unit property is $217, 050: $417, 000 ×. 65 = $271, 050

FHA Local Maximum Loan Amounts Maximums in high-cost areas In high-cost areas, the maximum may be increased up to 125% of the area median home price. l. But maximum loan amount in any area can’t exceed 175% of conforming loan limit. In 2009, this “ceiling” is $729, 750. Higher ceiling applies in AK, HI, Guam, and Virgin Islands.

FHA Local Maximum Loan Amounts Maximums in high-cost areas In high-cost areas, the maximum may be increased up to 125% of the area median home price. l. But maximum loan amount in any area can’t exceed 175% of conforming loan limit. In 2009, this “ceiling” is $729, 750. Higher ceiling applies in AK, HI, Guam, and Virgin Islands.

FHA Local Maximum Loan Amounts Adjusted to reflect housing costs FHA generally sets maximum loan amounts on a county-by-county basis. l. Limit may be adjusted periodically to reflect changes in the cost of housing. l. Check with a local lender for the current FHA maximum loan amount in your area.

FHA Local Maximum Loan Amounts Adjusted to reflect housing costs FHA generally sets maximum loan amounts on a county-by-county basis. l. Limit may be adjusted periodically to reflect changes in the cost of housing. l. Check with a local lender for the current FHA maximum loan amount in your area.

Rules for FHA Loans Minimum cash investment and LTV Borrower must make minimum cash investment of at least 3. 5% of appraised value or sales price, whichever is less. So maximum loan-to-value ratio for FHA loans is 96. 5%. Borrower-paid closing costs, discount points, and prepaid expenses don’t count toward minimum cash investment.

Rules for FHA Loans Minimum cash investment and LTV Borrower must make minimum cash investment of at least 3. 5% of appraised value or sales price, whichever is less. So maximum loan-to-value ratio for FHA loans is 96. 5%. Borrower-paid closing costs, discount points, and prepaid expenses don’t count toward minimum cash investment.

Rules for FHA Loans Loan charges and closing costs Interest rates are negotiable between lender and FHA borrower. Lenders can charge whatever closing costs are “customary and reasonable” in their area. Prepayment penalties are prohibited.

Rules for FHA Loans Loan charges and closing costs Interest rates are negotiable between lender and FHA borrower. Lenders can charge whatever closing costs are “customary and reasonable” in their area. Prepayment penalties are prohibited.

Rules for FHA Loans Sales concessions FHA limits amount that seller or other interested party can contribute to buyer in transaction. Purpose is to prevent parties from using contributions to defeat FHA’s LTV and minimum cash investment rules.

Rules for FHA Loans Sales concessions FHA limits amount that seller or other interested party can contribute to buyer in transaction. Purpose is to prevent parties from using contributions to defeat FHA’s LTV and minimum cash investment rules.

FHA Sales Concession Rules Seller contributions It’s a seller contribution if seller (or other interested party) pays for all or part of: lbuyer’s closing costs or prepaid expenses lany discount points ltemporary or permanent buydown lbuyer’s mortgage interest lupfront premium for mortgage insurance

FHA Sales Concession Rules Seller contributions It’s a seller contribution if seller (or other interested party) pays for all or part of: lbuyer’s closing costs or prepaid expenses lany discount points ltemporary or permanent buydown lbuyer’s mortgage interest lupfront premium for mortgage insurance

FHA Sales Concession Rules Seller contributions are limited to 6% of sales price. Excess contributions are treated as inducements to purchase and deducted from sales price in loan amount calculations. 6% limit doesn’t apply to fees and closing costs that sellers typically pay according to local custom.

FHA Sales Concession Rules Seller contributions are limited to 6% of sales price. Excess contributions are treated as inducements to purchase and deducted from sales price in loan amount calculations. 6% limit doesn’t apply to fees and closing costs that sellers typically pay according to local custom.

FHA Insurance Premiums Insurance premiums for FHA loans are called the MIP (mortgage insurance premiums). For most programs, borrowers pay: an upfront premium, plus annual premiums.

FHA Insurance Premiums Insurance premiums for FHA loans are called the MIP (mortgage insurance premiums). For most programs, borrowers pay: an upfront premium, plus annual premiums.

FHA Insurance Premiums Upfront MIP Upfront premium (UFMIP) is also called the one-time premium (OTMIP). Percentage of loan amount. Currently 1. 75%. In 2008, FHA briefly applied risk-based pricing to UFMIP, but plan was put on hold. l. Riskier borrowers with high LTVs were charged higher percentage of loan amount for UFMIP.

FHA Insurance Premiums Upfront MIP Upfront premium (UFMIP) is also called the one-time premium (OTMIP). Percentage of loan amount. Currently 1. 75%. In 2008, FHA briefly applied risk-based pricing to UFMIP, but plan was put on hold. l. Riskier borrowers with high LTVs were charged higher percentage of loan amount for UFMIP.

Upfront MIP Paying the UFMIP can be: paid in cash at closing by either borrower or seller, or financed over loan term. If financed: UFMIP + Base Loan = Total Amount Financed

Upfront MIP Paying the UFMIP can be: paid in cash at closing by either borrower or seller, or financed over loan term. If financed: UFMIP + Base Loan = Total Amount Financed

Upfront MIP Financed UFMIP and loan amount l. FHA buyer can borrow local maximum loan amount plus UFMIP. l. Total amount financed can’t exceed property’s appraised value.

Upfront MIP Financed UFMIP and loan amount l. FHA buyer can borrow local maximum loan amount plus UFMIP. l. Total amount financed can’t exceed property’s appraised value.

Upfront MIP Financed UFMIP and loan fees l. Loan origination fee is based only on base loan amount, not including UFMIP. l. Discount points are based on total amount financed, including UFMIP.

Upfront MIP Financed UFMIP and loan fees l. Loan origination fee is based only on base loan amount, not including UFMIP. l. Discount points are based on total amount financed, including UFMIP.

Upfront MIP UFMIP refund FHA borrower may be entitled to refund of part of UFMIP if loan is paid off early. l. Refunds eliminated for loans made on or after December 8, 2004.

Upfront MIP UFMIP refund FHA borrower may be entitled to refund of part of UFMIP if loan is paid off early. l. Refunds eliminated for loans made on or after December 8, 2004.

FHA Insurance Premiums Annual MIP Most FHA borrowers are required to pay annual premiums in addition to UFMIP. l. One-twelfth of premium included in monthly loan payment.

FHA Insurance Premiums Annual MIP Most FHA borrowers are required to pay annual premiums in addition to UFMIP. l. One-twelfth of premium included in monthly loan payment.

FHA Insurance Premiums Annual MIP Most FHA borrowers are required to pay annual premiums in addition to UFMIP. l. One-twelfth of premium included in monthly loan payment. l. Between 0. 25% and 0. 55% of loan balance per year, depending on loan term and LTV.

FHA Insurance Premiums Annual MIP Most FHA borrowers are required to pay annual premiums in addition to UFMIP. l. One-twelfth of premium included in monthly loan payment. l. Between 0. 25% and 0. 55% of loan balance per year, depending on loan term and LTV.

Annual MIP Cancellation Loan term exceeds 15 years Annual premium is canceled: when LTV reaches 78%, if premiums have been paid for at least 5 years.

Annual MIP Cancellation Loan term exceeds 15 years Annual premium is canceled: when LTV reaches 78%, if premiums have been paid for at least 5 years.

Annual MIP Cancellation Loan term of 15 years or less Annual premium is canceled: when LTV reaches 78%, regardless of how long premium has been paid.

Annual MIP Cancellation Loan term of 15 years or less Annual premium is canceled: when LTV reaches 78%, regardless of how long premium has been paid.

Annual MIP Cancellation FHA determines when borrower has reached 78% threshold based on loan’s amortization schedule. Borrower who prepays can request earlier cancellation. l. Even after cancellation of annual MIP, FHA mortgage insurance remains in effect for rest of term.

Annual MIP Cancellation FHA determines when borrower has reached 78% threshold based on loan’s amortization schedule. Borrower who prepays can request earlier cancellation. l. Even after cancellation of annual MIP, FHA mortgage insurance remains in effect for rest of term.

Summary FHA Insurance Premiums ÄUFMIP (OTMIP) ÄTotal amount financed ÄAnnual MIP ÄCancellation

Summary FHA Insurance Premiums ÄUFMIP (OTMIP) ÄTotal amount financed ÄAnnual MIP ÄCancellation

FHA Underwriting FHA underwriting standards aren’t as strict as Fannie Mae/Freddie Mac standards.

FHA Underwriting FHA underwriting standards aren’t as strict as Fannie Mae/Freddie Mac standards.

FHA Underwriting Credit reputation FHA requires lenders to consider credit scores, if available. No FHA loan if credit score is below 500 (unless LTV is under 90%). l. This minimum is considerably lower than Fannie Mae or Freddie Mac minimums.

FHA Underwriting Credit reputation FHA requires lenders to consider credit scores, if available. No FHA loan if credit score is below 500 (unless LTV is under 90%). l. This minimum is considerably lower than Fannie Mae or Freddie Mac minimums.

FHA Underwriting Credit reputation Nontraditional credit analysis: l. Applicant may qualify for FHA loan even if no credit report and no credit scores available. l. Underwriter analyzes applicant's reliability over past year in paying rent, utilities, and other obligations.

FHA Underwriting Credit reputation Nontraditional credit analysis: l. Applicant may qualify for FHA loan even if no credit report and no credit scores available. l. Underwriter analyzes applicant's reliability over past year in paying rent, utilities, and other obligations.

FHA Underwriting Income analysis FHA underwriter determines applicant’s monthly effective income. Effective income Gross income from all sources expected to continue for first 3 years of loan term.

FHA Underwriting Income analysis FHA underwriter determines applicant’s monthly effective income. Effective income Gross income from all sources expected to continue for first 3 years of loan term.

FHA Underwriting Assets for closing At closing, borrower needs enough cash to cover: ¡ minimum cash investment; ¡ prepaid expenses; ¡ any discount points; ¡ upfront MIP (if not financed); ¡ any closing costs, repair costs, or other expenses not financed.

FHA Underwriting Assets for closing At closing, borrower needs enough cash to cover: ¡ minimum cash investment; ¡ prepaid expenses; ¡ any discount points; ¡ upfront MIP (if not financed); ¡ any closing costs, repair costs, or other expenses not financed.

Assets for Closing No reserves required Generally, borrower not required to have reserves for FHA loan. l. But reserves may be a compensating factor if income ratios exceed limits.

Assets for Closing No reserves required Generally, borrower not required to have reserves for FHA loan. l. But reserves may be a compensating factor if income ratios exceed limits.

Assets for Closing Gift funds FHA borrower may use gift funds for part or even all of the funds needed for closing. l. Donor must be employer, labor union, close relative, close friend, charitable organization, or government agency. l. Gift letter is required.

Assets for Closing Gift funds FHA borrower may use gift funds for part or even all of the funds needed for closing. l. Donor must be employer, labor union, close relative, close friend, charitable organization, or government agency. l. Gift letter is required.

Assets for Closing Borrowed funds FHA borrower may also borrow funds needed for closing. Unsecured loan: Lender must be a close family member. Secured loan: Collateral must be property other than the home being purchased. Lender can’t be seller, real estate agent, or other interested party.

Assets for Closing Borrowed funds FHA borrower may also borrow funds needed for closing. Unsecured loan: Lender must be a close family member. Secured loan: Collateral must be property other than the home being purchased. Lender can’t be seller, real estate agent, or other interested party.

Section 255 – FHA HECMs Home equity conversion mortgages FHA calls its reverse mortgages home equity conversion mortgages (HECMs). Used by elderly homeowner to convert equity into monthly income or line of credit. l. Repayment not required as long as home remains owner’s primary residence.

Section 255 – FHA HECMs Home equity conversion mortgages FHA calls its reverse mortgages home equity conversion mortgages (HECMs). Used by elderly homeowner to convert equity into monthly income or line of credit. l. Repayment not required as long as home remains owner’s primary residence.

Section 255 – FHA HECMs Requirements l. Homeowner must be at least 62. l. Property must be principal residence and owned free and clear (or with only small mortgage balance). l. Loan amount depends on local area maximum, appraised value, current interest rate, and borrower’s age. l. No income requirements or credit qualifications.

Section 255 – FHA HECMs Requirements l. Homeowner must be at least 62. l. Property must be principal residence and owned free and clear (or with only small mortgage balance). l. Loan amount depends on local area maximum, appraised value, current interest rate, and borrower’s age. l. No income requirements or credit qualifications.

Section 255 – FHA HECMs Sale of property Lender recovers principal and interest when property is sold. Any excess sale proceeds to go seller (or heirs).

Section 255 – FHA HECMs Sale of property Lender recovers principal and interest when property is sold. Any excess sale proceeds to go seller (or heirs).