824e4e34096b7e85bcc79a5a5a5e9154.ppt

- Количество слайдов: 24

Financing Reliability NASUCA Annual Meeting - 2012 Ron Binz, Public Policy Consulting November 12, 2012 • Baltimore

Outline of this Presentation • Utility capital requirements are growing sharply amid difficult circumstances – Reliability investments are special case of a larger trend • A new utility business model will emerge • This challenge requires two fundamental changes – “Risk-Aware” regulation – A new regulatory model • This presents an opportunity for consumer leaders

• Authors – – Ron Binz Richard Sedano Denise Furey Dan Mullen Available at www. ceres. org

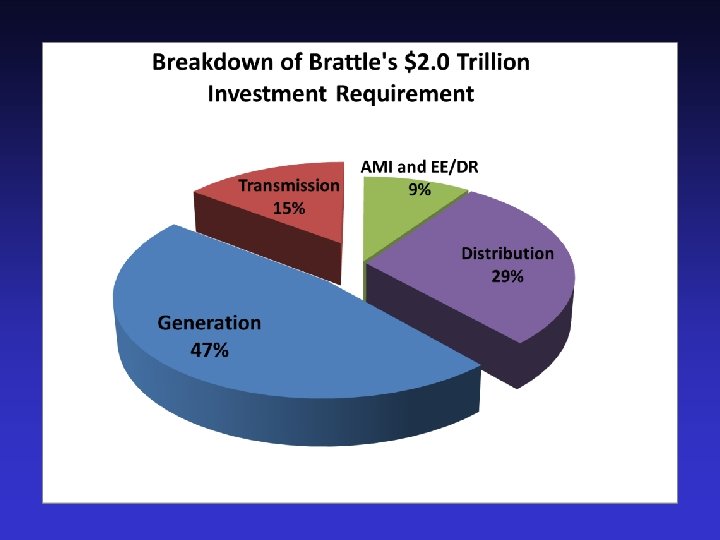

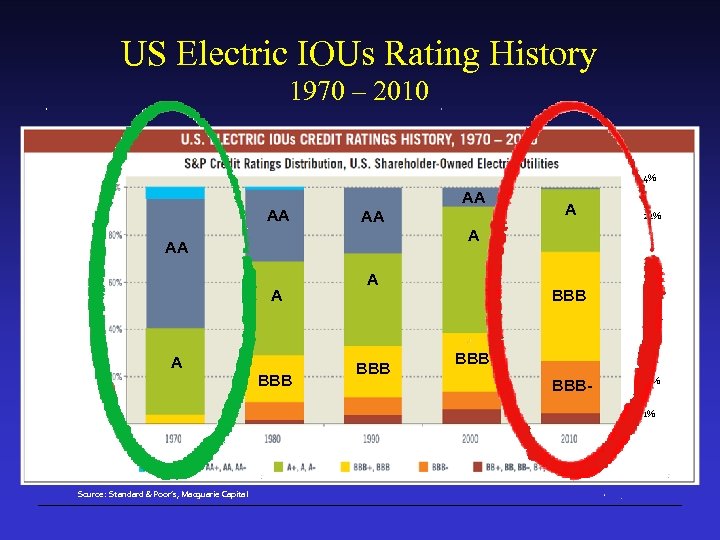

High Stakes • The US electric industry is entering a “build cycle” with much higher investment than in recent history – Brattle Group estimates $2 trillion by 2030 • Causes – – – Aging infrastructure New transmission requirements Demand side and smart grid Much stronger air and water regulation, including GHGs Fuel economics • Challenges to utilities – – Flat load growth Distributed generation Uncertain economy Financial metrics less forgiving than in 1980 s

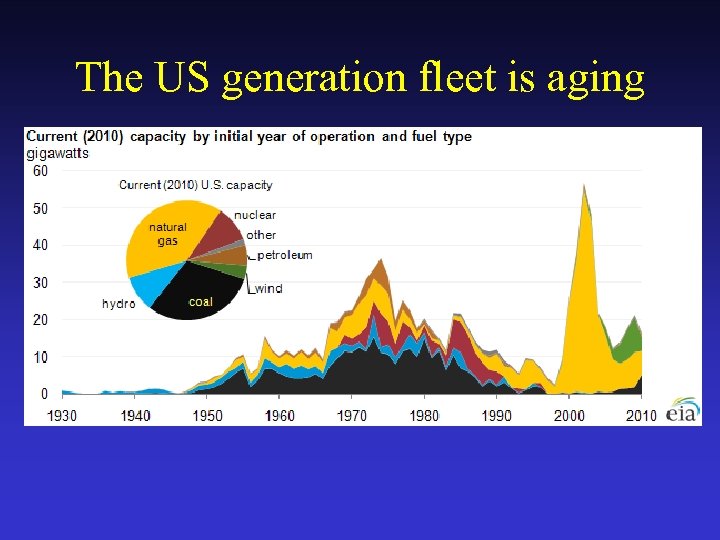

The US generation fleet is aging

US Electric IOUs Rating History 1970 – 2010 4% AA AA A 22% BBB AA 46% A AA A A BBB BBB- 27% 1% Source: Standard & Poor’s, Macquarie Capital

The Key Question How do we ensure that $2 trillion is spent wisely?

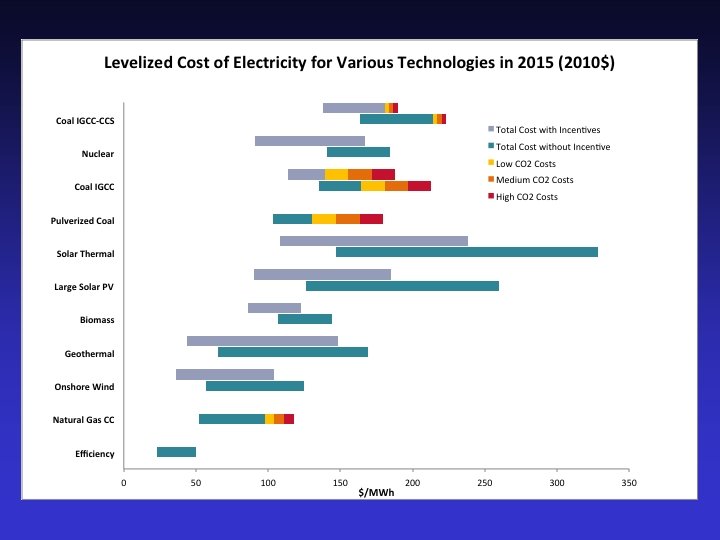

Notes • Unadjusted 2010 cost estimates were used for consistency CO 2 costs • Costs for wind and photovoltaics have fallen sharply in last two years (faster than these 2010 estimates) With incentives • Cost of nuclear power has risen post-Fukushima (more than these 2010 estimates) No incentives

A Catalog of Investment Risk • Cost-related • Time-related Seven categories of risk used in scoring… Construction cost overruns – Construction delays – – – – Capital • Construction cost availability Operational surprises • Fuel and Operating Fuel cost escalation • New Regulations “Bet the company” investments Management imprudence • Carbon Price Resources limited • Water Constraints Consumer reaction to rates • Capital Shock • Planning – Changing markets – Environmental regulations cost – Changes in load – Technology advancement – Catastrophe – Contingent projects – Government policies

Cost Risk

Seven Essential Strategies for Risk-Aware Regulation • • Diversify utility supply Utilize robust planning processes Employ transparent ratemaking practice Use financial and physical hedges Hold utilities accountable Practice active, “legislative” regulation Reform, re-invent ratemaking policies

Utilities 2020 • Foundation funded • Run by two former state regulators named Ron • Advised by board of experts • Goal: to explore new business models and advocate new regulatory models to enable new utility business models to evolve.

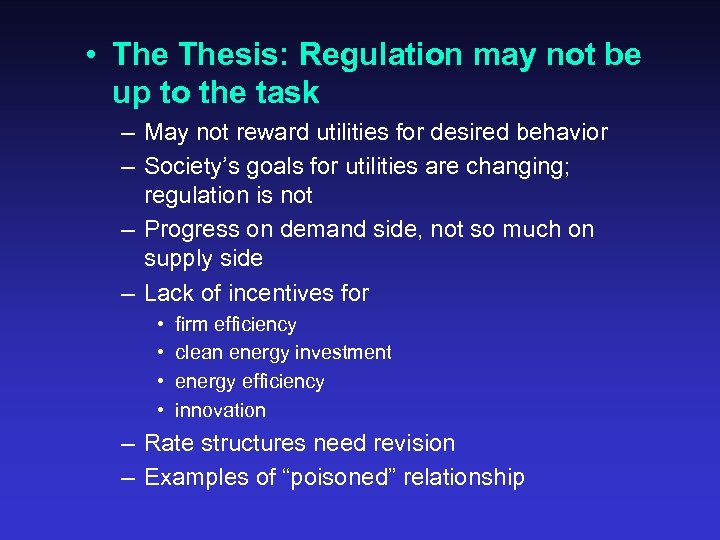

• Thesis: Regulation may not be up to the task – May not reward utilities for desired behavior – Society’s goals for utilities are changing; regulation is not – Progress on demand side, not so much on supply side – Lack of incentives for • • firm efficiency clean energy investment energy efficiency innovation – Rate structures need revision – Examples of “poisoned” relationship

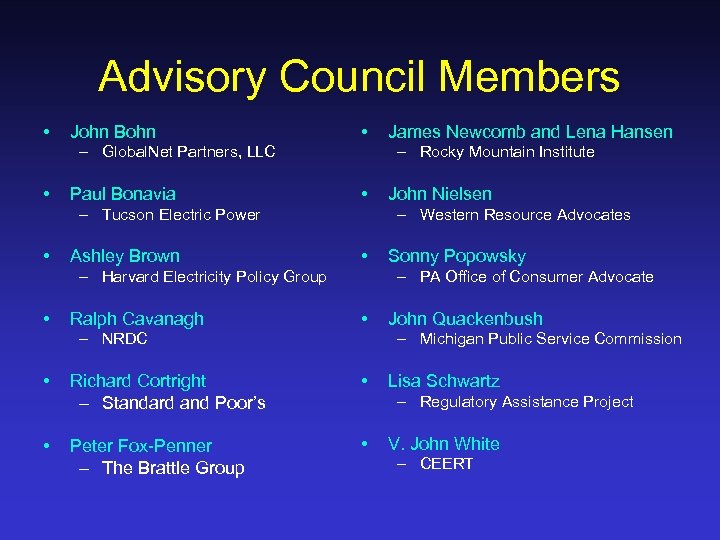

Advisory Council Members • John Bohn • – Global. Net Partners, LLC • Paul Bonavia – Rocky Mountain Institute • – Tucson Electric Power • Ashley Brown Ralph Cavanagh • • Richard Cortright – Standard and Poor’s Peter Fox-Penner – The Brattle Group Sonny Popowsky – PA Office of Consumer Advocate • – NRDC • John Nielsen – Western Resource Advocates – Harvard Electricity Policy Group • James Newcomb and Lena Hansen John Quackenbush – Michigan Public Service Commission • Lisa Schwartz – Regulatory Assistance Project • V. John White – CEERT

• Methods: – Interviews with utility CEOs and leading states regulators – Evaluations of other systems here and abroad – Dialogues with utility execs and commissioners

What we’ve heard from utility CEOs: • CEOs want a clearer, more consistent direction from state energy policies • Utilities have little incentive for innovation, firm level efficiency • Commissions need a better understanding of the utility business and its needs • Utilities want certainty on climate policy • Utilities want healthier working relationships with commissioners and staff

What we’ve heard from commissioners: • A primary concern is with increasing utility rates • Regulators are open to modifying the regulatory model; looking for ideas • Some commissioners are dissatisfied with the adversarial process • Many commissioners face severe barriers to communications with stakeholders, and even fellow commissioners • Commissions have inadequate resources

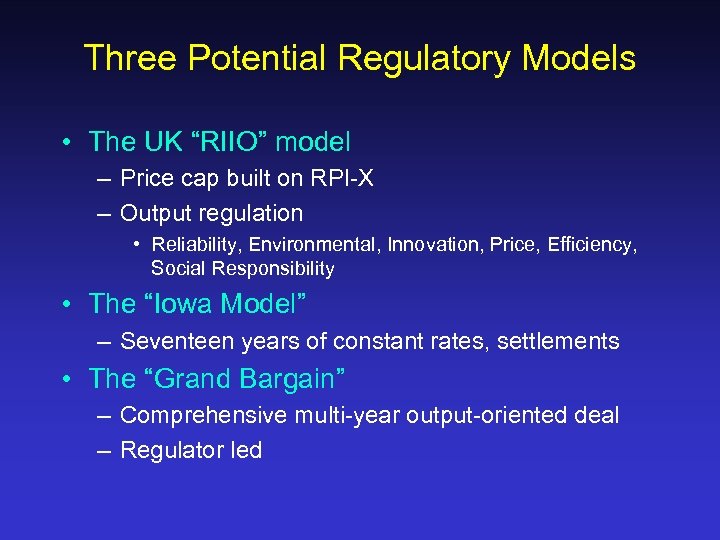

Three Potential Regulatory Models • The UK “RIIO” model – Price cap built on RPI-X – Output regulation • Reliability, Environmental, Innovation, Price, Efficiency, Social Responsibility • The “Iowa Model” – Seventeen years of constant rates, settlements • The “Grand Bargain” – Comprehensive multi-year output-oriented deal – Regulator led

Thanks for the invitation I look forward to your questions.

824e4e34096b7e85bcc79a5a5a5e9154.ppt