9c0d25c10f8017ed227a9b15cfc31fe8.ppt

- Количество слайдов: 36

Financing Power Projects in Africa Jeannot Boussougouth Senior Manager: Energy, Utilities and Infrastructure Investment Banking Coverage Jeannot. Boussougouth@standardbank. co. za Standard Bank 1 July 2011 UNECA 2011, Addis Ababa

Contents 1 Section Page 1. Introduction 2 2. Standard Bank 4 2. 1 Natural partner in Africa 5 2. 2 Recent Accolades 6 2. 3 Selected Infrastructure Credentials 7 3. Our African Infrastructure Understanding 10 4. Business and Financing Challenges 13 5. Requirements for Successful Private Sector Participation 16 6. Potential Financial Structure 23 7. Standard Bank’s Value Proposition 25 8. Case Study: Morupule B Coal Power Plant Financing 34

Private and confidential Section: 1 Introduction

Introduction n Standard Bank is the largest bank in Africa – – Our current market capitalisation is USD 24. 77 billion (11 January 2011) and our Total Assets are USD 182. 6 billion (June 2010 Interims) – We are 20% owned by ICBC (the world’s largest bank) – n We are present in 17 countries across Africa (especially Sub-Saharan Africa) In most African countries, Standard Bank operates as an integrated corporate and investment bank The purpose of today’s presentation is to : – Introduce Standard Bank to the audience in terms of our offering, capabilities and strengths in Africa – Highlight business and financing challenges in the African power space – Highlight Standard Bank’s proposed financing solutions, including ECAs – Highlight some of the most attractive power projects in Africa 3

Private and confidential Section: 2 Standard Bank

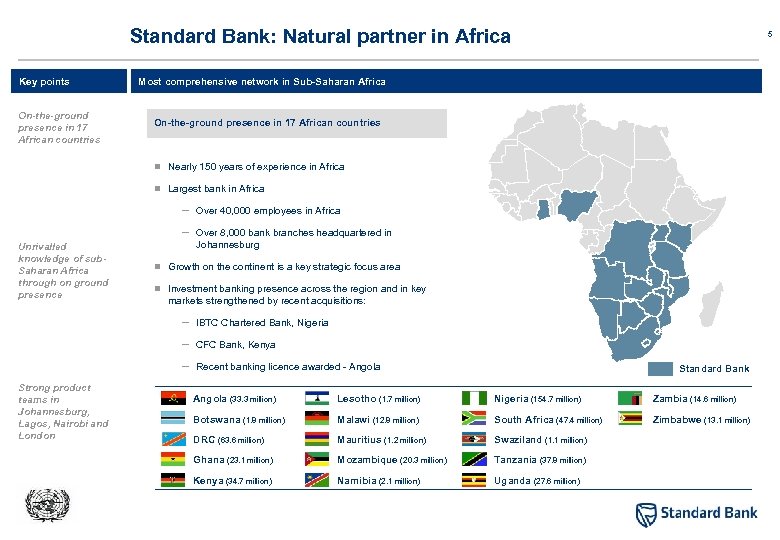

Standard Bank: Natural partner in Africa Key points On-the-ground presence in 17 African countries 5 Most comprehensive network in Sub-Saharan Africa On-the-ground presence in 17 African countries n Nearly 150 years of experience in Africa n Largest bank in Africa – – Unrivalled knowledge of sub. Saharan Africa through on ground presence Over 40, 000 employees in Africa Over 8, 000 bank branches headquartered in Johannesburg n Growth on the continent is a key strategic focus area n Investment banking presence across the region and in key markets strengthened by recent acquisitions: – – CFC Bank, Kenya – Strong product teams in Johannesburg, Lagos, Nairobi and London IBTC Chartered Bank, Nigeria Recent banking licence awarded - Angola Standard Bank Angola (33. 3 million) Lesotho (1. 7 million) Nigeria (154. 7 million) Zambia (14. 6 million) Botswana (1. 8 million) Malawi (12. 8 million) South Africa (47. 4 million) Zimbabwe (13. 1 million) DRC (63. 6 million) Mauritius (1. 2 million) Swaziland (1. 1 million) Ghana (23. 1 million) Mozambique (20. 3 million) Tanzania (37. 8 million) Kenya (34. 7 million) Namibia (2. 1 million) Uganda (27. 6 million)

Recent Accolades 6 Key points Euromoney: Best Investment Bank in Africa (2010) African Banker: Investment Bank of the Year, Africa (2009) Africa Investor: Best Africa investment Bank (2009) The Banker – 2010, 2009, 2008 Deal of the Year Africa: Bonds (2010) n Deal of the Year Africa: Capital Raising (2010) n Deal of the Year Africa: Structured Finance (2010) n African Bank of the Year (2009, 2008) n Bank of the Year, South Africa (2009, 2008) n Best Investment Bank from Africa (2009, 2008) n Best Bank in Botswana, Lesotho, Malawi, Swaziland , Tanzania (2009) n Deal of the Year for the Ruashi Copper Mining Project in DRC (2008) n Deal of the Year - Botswana for National Development Bank BWP 100 million 11. 25% notes due 2017 (2008) n Deal of the Year - DRC for the Ruashi Copper Mining Project (2008) n Deal of the Year - Finland for Talvivaara Nickel Project US$320 m debt facility (2008) n Deal of the Year - Germany for Kreditanstalt fur Wiederaufbau NGN 28. 7 billion 8. 5% notes due by 2011 (2008) n Deal of the Year - Tanzania Electricity Supply Limited TZS 300 billion syndicated loan (2008) n Deal of the Year - Zambia Sugar Project (2008) n Deal of the Year (South Africa) for the 20% investment by ICBC in Standard Bank (2008) n Deal of the Year Award - Bahrain for Arcapita Bank US$1. 1 b syndicated Murabaha facility (2008) n Most innovative in Trade and Project Finance (2008) n Ranked No 1 in sub-saharan Africa and No 106 in The Banker Top 1000 World Banks (2008) n Euromoney – 2010, 2009 Best Investment Bank in Africa (2010) n Best Investment Bank in Nigeria (2010) n Best Bank in South Africa (2010) n Best Equity House in Africa (2009) n Lakatabu Expansion - Africa Industrial Deal of the Year (2009) n MTN Uganda - Africa Telecoms Deal of the Year. (2009) n Zain - Middle East Telecoms Deal of the Year (2009) n African Banker – 2009, 2008 n n n Investment Bank of the Year, Africa (2009) Best Issuing House in Africa (awarded to Stanbic IBTC Bank) (2008) Deal of the Year - ICBC 20% acquisition of Standard Bank (2008) Global Finance Magazine – 2009 n n n Africa Investor – 2009 n n n Best Africa Investment Bank (2009) Best Africa Research Team (2009) Infrastructure Deal of the Year for Gautrain (2008) n n Best Debt Bank in Africa (2009) Best Foreign Exchange Provider in South Africa (2009) Best Investment Bank in Nigeria (2009) Best Investment Bank in South Africa (2009) EMEAFinance – 2009, 2008 n n n Environmental Finance Magazine - 2009 n Carbon Finance Deal of the Year for Camco. Standard Bank Structured Carbon Credits Transaction (2009) n n n Best Investment Bank in Africa (2009, 2008) Best Investment Bank in Nigeria (awarded to Stanbic IBTC Bank) (2009) Best Natural Resources Deal in EMEA: Kayelekera Uranium project (2009) Best Oil and Gas Deal in Africa: Oando (2009) Best Project Finance Deal in Africa: Botswana Power Corporation (2009) Best Project Finance House in Africa (2009) Standard Bank has won various awards that demonstrate our capabilities across the entire range of advisory and funding services in Africa

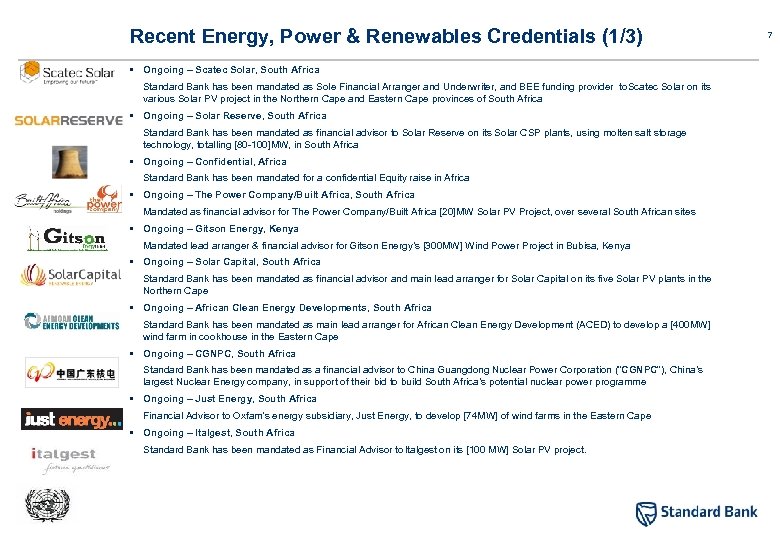

Recent Energy, Power & Renewables Credentials (1/3) § Ongoing – Scatec Solar, South Africa Standard Bank has been mandated as Sole Financial Arranger and Underwriter, and BEE funding provider to. Scatec Solar on its various Solar PV project in the Northern Cape and Eastern Cape provinces of South Africa § Ongoing – Solar Reserve, South Africa Standard Bank has been mandated as financial advisor to Solar Reserve on its Solar CSP plants, using molten salt storage technology, totalling [80 -100]MW, in South Africa § Ongoing – Confidential, Africa Standard Bank has been mandated for a confidential Equity raise in Africa § Ongoing – The Power Company/Built Africa, South Africa Mandated as financial advisor for The Power Company/Built Africa [20]MW Solar PV Project, over several South African sites § Ongoing – Gitson Energy, Kenya Mandated lead arranger & financial advisor for Gitson Energy’s [300 MW] Wind Power Project in Bubisa, Kenya § Ongoing – Solar Capital, South Africa Standard Bank has been mandated as financial advisor and main lead arranger for Solar Capital on its five Solar PV plants in the Northern Cape § Ongoing – African Clean Energy Developments, South Africa Standard Bank has been mandated as main lead arranger for African Clean Energy Development (ACED) to develop a [400 MW] wind farm in cookhouse in the Eastern Cape § Ongoing – CGNPC, South Africa Standard Bank has been mandated as a financial advisor to China Guangdong Nuclear Power Corporation (“CGNPC”), China’s largest Nuclear Energy company, in support of their bid to build South Africa’s potential nuclear power programme § Ongoing – Just Energy, South Africa Financial Advisor to Oxfam’s energy subsidiary, Just Energy, to develop [74 MW] of wind farms in the Eastern Cape § Ongoing – Italgest, South Africa Standard Bank has been mandated as Financial Advisor to Italgest on its [100 MW] Solar PV project. 7

Recent Energy, Power & Renewables Credentials (1/2) § Ongoing – BHP Billiton, DRC Mandated Transaction Advisor to BHP Billiton SA (Pty) Limited on the INGA 3 hydro-electric project concept study in the Democratic Republic of Congo. § Ongoing – Mphanda Nkuwa Hydropower Project, Mozambique Financial advisor to the Mphanda Nkuwa consortium on the development of 1500 MW hydro electric project in Mozambique § Ongoing – Anglo American, South Africa Standard Bank has been mandated as the Financial Advisor to Anglo American’s [450 MW] discard coal-fired IPP near. Witbank § Ongoing – SARGE, South Africa Standard Bank has been mandated as the sole Project and Equity Raising Financial Advisor and Lead Arranger to the SARGE 50 MW, Solar PV project in the Northern Cape, as well as 216 MW of wind projects § Ongoing – Forest Oil Corporation, South Africa Standard Bank has been mandated as Financial Adviser to Forest Oil Corporation in connection with the development of an integrated [750 -800 MW] natural gas to power project § Ongoing - Oelsner Group Wind Farms , South Africa Standard Bank mandated Financial Advisor and Lead Arranger to Oelsner Groups’ two wind farms being Kerrifontein (20. 8 MW) and Langefontein (50 MW) § Ongoing – Confidential , South Africa Standard Bank has been mandated as the sole Project and Equity Raising Financial Advisor and Lead Arranger to a SA renewable energy company on a multiple wind farm project § Ongoing – Volta River Authority, Ghana Standard bank has been mandated as Financial advisor to VRA on the expansion of the Takoradi power plant § Ongoing - Aldwych International, Kenya Joint Lead Arranger for long-term financing to Aldwych International for the 300 MW Lake Turkana Wind Project valued at US$760 m § Ongoing - Gulf Power, Kenya Co-lead Arranger of the Greenfield 84 MW Athi River HFO power plant developed by Gulf Energy 8

Standard Bank – Recent Energy, Power & Renewables Credentials (3/3) § Ongoing – redcap, South Africa Standard Bank has been mandated as the Lead Arranger for the Kouga Wind Farm project § Ongoing - AMD Energia, South Africa Standard Bank has been mandated as the Lead Arranger for Alt-E’s multiple solar PV projects § Ongoing – Confidential, Africa Standard Bank has been mandated as the Buyside Financial Adviser for the purchase of a power station § Ongoing – Confidential, Africa Standard Bank has been mandated as the Sellside Financial Adviser for the sale of a power station § Ongoing – Aeolus, Kenya Standard Bank has been mandated as the Financial Advisor and Lead Arranger to Aeolus Kenya Ltd on a 60 MW wind farm project § Ongoing – Electromaxx, Uganda Sole Lead Arranger of the expansion from 25 MW to 50 MW of the Electromaxx HFO power plant facility § 2010 – Companhia Moçambicana de Hidrocarbonetos, S. A. (“CMH”), Mozambique Standard Bank acted as FA and lead arranger to Companhia Moçambicana de Hidrocarbonetos, S. A. for the funding of its share of the project costs for the expansion of the Central Processing Facility at the Pande and Temane fields’ reservoirs near Bazaruto § 2009 - Mmamabula Energy Project, Botswana Mandated by CIC Energy for a 1200 MW coal fired power plant, coal mine and related infrastructure in Mmamabula, Botswana. Project size of US$5 billion and mandated as co-lead arrangers for the ECIC covered ZAR tranche as well as the ZAR commercial facility. § 2009 – Eskom, South Africa Standard Bank acted as the Mandated Lead Arranger in the Kusile Boilers contract. Standard Bank acted with 4 international banks in funding the Euro 705 million contract over 12 years. Export Credit was also arranged with Euler Hermes (German ECA) over the foreign content of the contract with Hitachi Power Europe. 9

Private and confidential Section: 3 Our African Infrastructure Understanding

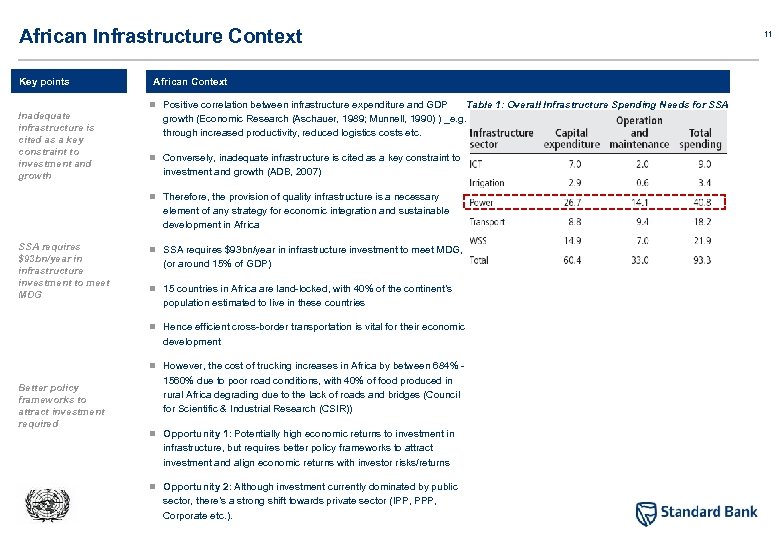

African Infrastructure Context Key points African Context n Positive correlation between infrastructure expenditure and GDP Inadequate infrastructure is cited as a key constraint to investment and growth Table 1: Overall Infrastructure Spending Needs for SSA growth (Economic Research (Aschauer, 1989; Munnell, 1990) ) _e. g. through increased productivity, reduced logistics costs etc. n Conversely, inadequate infrastructure is cited as a key constraint to investment and growth (ADB, 2007) n Therefore, the provision of quality infrastructure is a necessary element of any strategy for economic integration and sustainable development in Africa SSA requires $93 bn/year in infrastructure investment to meet MDG n SSA requires $93 bn/year in infrastructure investment to meet MDG, (or around 15% of GDP) n 15 countries in Africa are land-locked, with 40% of the continent’s population estimated to live in these countries n Hence efficient cross-border transportation is vital for their economic development n However, the cost of trucking increases in Africa by between 684% - Better policy frameworks to attract investment required 1560% due to poor road conditions, with 40% of food produced in rural Africa degrading due to the lack of roads and bridges (Council for Scientific & Industrial Research (CSIR)) n Opportunity 1: Potentially high economic returns to investment in infrastructure, but requires better policy frameworks to attract investment and align economic returns with investor risks/returns n Opportunity 2: Although investment currently dominated by public sector, there’s a strong shift towards private sector (IPP, PPP, Corporate etc. ). 11

African Infrastructure Characteristics Key points African Infrastructure Characteristics n Context: On-the-ground presence in 17 African countries n Investing in African power / infrastructure is not usually for the marginal player – more a specialist activity so less subject to boom and bust n Project lead times will likely take longer than the credit crunch/global recession, e. g. often 3 years plus n Developer Perspective: n Some cut backs in capital expenditure (e. g. focus on lower risk markets) but reduced bank financing capacity is a larger issue Ability of African banks to raise USD dramatically affected n Financing Perspective: n Ability of African banks to raise USD has been dramatically affected, hence a focus on local currency financings which caps project size n Current turmoil in the global credit markets has impacted on closings and increased borrowing costs. However, few clients have walked away with more club deals seen. Limitation on banks’ liquidity/capacity BUT project finance less affected than most debt financing classes n Flight to ECAs and DFIs across all markets, not just Africa. Follow on question is their ultimate African appetite given competing liquidity demands Flight to ECAs and DFIs across all markets n Supplier Perspective: n Recent softening of forward-looking equipment prices but no dramatic plummet. Note most bail-outs encourage infrastructure spending 12

Private and confidential Section: 4 Business and Financing Challenges

Business and Financing Challenges Key points High opportunity costs of insufficient electricity supply Key Issues n Opportunity Costs of insufficient electricity supply/electrification Cost of Unserved Energy: $1. 50/k. Wh (IRP 2010), $10/k. Wh (Dept of Energy) – Small Diesel Generator: $1/k. Wh plus – OCGT Diesel turbines: 30 c – 50 c/k. Wh peaking power – Greater certainty in future tariffs is paramount – Subsistence charcoal: destruction of our forests – Reality Check: the real developmental costs of delayed decisions!!. . . n New Generation Planning – – Should include interest during construction (IDC) – As an indicator to politicians, regulators and consumers about what realities we face – Effective domestic wheeling framework needed A complete financial model not a shopping list of projects Greater certainty in future tariffs is key to funding new investments today – Greater support to credit ratings of utilities (key to tapping current EM liquidity) n Effective Domestic Wheeling framework – Framework must be standardised and transparent for all arrangements – Pricing and risk sharing should facilitate wheeling not prevent it 14

Business and Financing Challenges Key points Effective risk allocating approach Key Issues (Contd. . . ) n Leveraging credit quality private off-takers Allocating risk to those that are able to best manage it – Creating a domestic industrial/mining offtaker group. e. g. CEC Energy – Innovative commodity risk management (commodity price indexation in loan terms) – Unrivalled knowledge of sub. Saharan Africa through on ground presence – Allowing more private players on regional power pools (e. g. SAPP) – Enables smaller countries to reduce burden on their utilities/Treasury n Cross-border PPAs – Chicken and Egg situation (smaller countries can’t build large projects alone) – Mozambique’s Mpanda Nkuwa 1, 500 MW hydro project would benefit entire region but needs Eskom – – Strong product teams in Johannesburg, Lagos, Nairobi and London Challenge: CESUL line and Mpanda Nkuwa require back-to-back contracts Could a Mozambique coal IPP sign a private PPA with mine in SA or Zambia? n Integrated Mining/ Power projects – Reality check: new mining investment is key to our economies over next 20 years – Using Diesel Generators cost GDP and jobs – New quality creditors for power projects: Commodity Buyers 15

Private and confidential Section: 5 Requirements for successful private sector participation

Key Requirements Key points Finalise the enabling framework Overview n Finalise the enabling framework to allow and facilitate private sector participation in the power sector – E. g. In SA. New Generation Regulations of August 2009 is a positive step, but market requires more clarity on process (amongst several other issues) – Rules on Selection Criteria for Renewable Energy Projects n Market requires a bankable PPA (which allows for the appropriate risk allocation between the private sector and the buyer (SOEs or any Integrated System Operators)). This should include such items as: A balanced liability regime – Appropriate protections for the generation companies for risks not within their control A stablisation clause for changes of law – Fair termination events for buyer and seller – Appropriate termination compensation regime – Government support required to stand behind buyer – – Bankable PPA are required Clauses allowing for restructuring which may affect the buyer (e. g. unbundling of the Public utility) n Government support required to stand behind buyer, in order to provide comfort to private sector (developers, equity participants, lenders, etc. ) that PPA availability payments will be made accordingly and termination provisions are fair (and termination payments will be funded) – E. g. In SA, if buyer is Eskom, NT support for PPA required as Eskom is already highly leveraged. Further PPA-type commitments could negatively impact on Eskom’s balance sheet and current debt covenants. Risk that private sector not prepared to enter into PPAs with Eskom without Government backstop 17

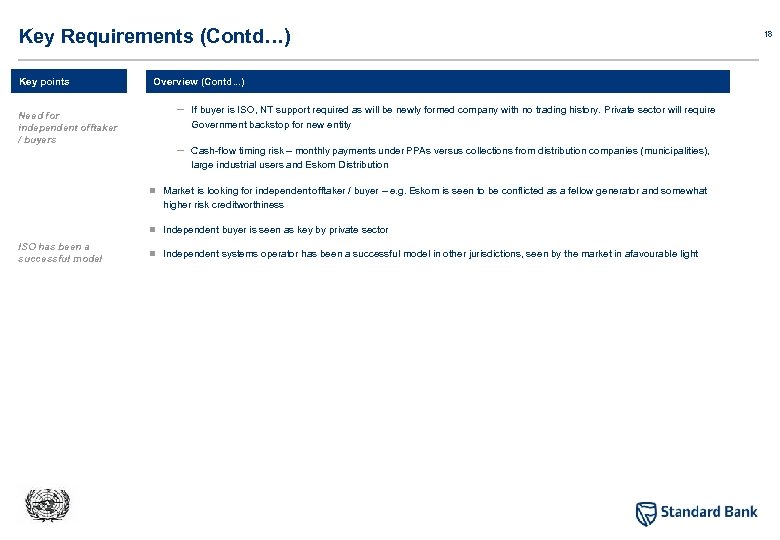

Key Requirements (Contd…) Key points Need for independent offtaker / buyers Overview (Contd. . . ) – If buyer is ISO, NT support required as will be newly formed company with no trading history. Private sector will require Government backstop for new entity – Cash-flow timing risk – monthly payments under PPAs versus collections from distribution companies (municipalities), large industrial users and Eskom Distribution n Market is looking for independent offtaker / buyer – e. g. Eskom is seen to be conflicted as a fellow generator and somewhat higher risk creditworthiness n Independent buyer is seen as key by private sector ISO has been a successful model n Independent systems operator has been a successful model in other jurisdictions, seen by the market in afavourable light 18

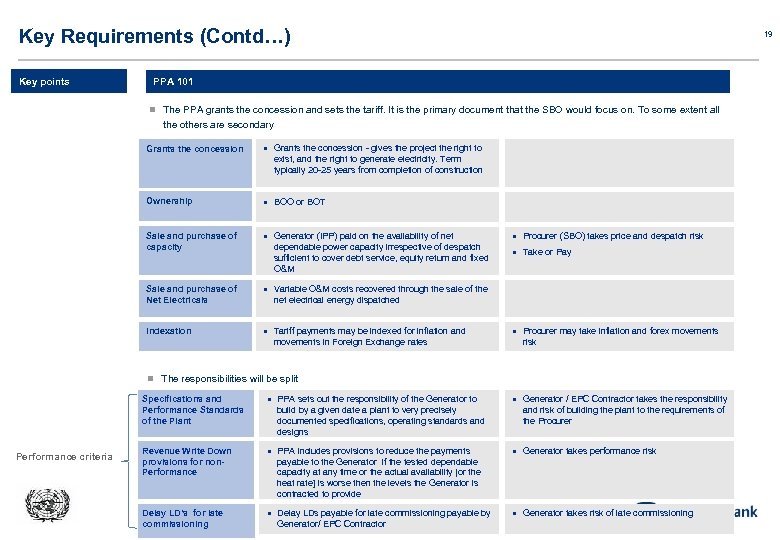

Key Requirements (Contd…) Key points 19 PPA 101 n The PPA grants the concession and sets the tariff. It is the primary document that the SBO would focus on. To some extent all the others are secondary Grants the concession · Grants the concession - gives the project the right to exist, and the right to generate electricity. Term typically 20 -25 years from completion of construction Ownership · BOO or BOT Sale and purchase of capacity · Generator (IPP) paid on the availability of net Sale and purchase of Net Electricals · Variable O&M costs recovered through the sale of the Indexation · Tariff payments may be indexed for inflation and dependable power capacity irrespective of despatch sufficient to cover debt service, equity return and fixed O&M · Procurer (SBO) takes price and despatch risk · Take or Pay net electrical energy dispatched movements in Foreign Exchange rates · Procurer may take inflation and forex movements risk n The responsibilities will be split Specifications and Performance Standards of the Plant Performance criteria · PPA sets out the responsibility of the Generator to Revenue Write Down provisions for non. Performance · PPA includes provisions to reduce the payments Delay LD’s for late commissioning · Delay LDs payable for late commissioning payable by build by a given date a plant to very precisely documented specifications, operating standards and designs · Generator / EPC Contractor takes the responsibility and risk of building the plant to the requirements of the Procurer · Generator takes performance risk payable to the Generator if the tested dependable capacity at any time or the actual availability [or the heat rate] is worse then the levels the Generator is contracted to provide Generator/ EPC Contractor · Generator takes risk of late commissioning

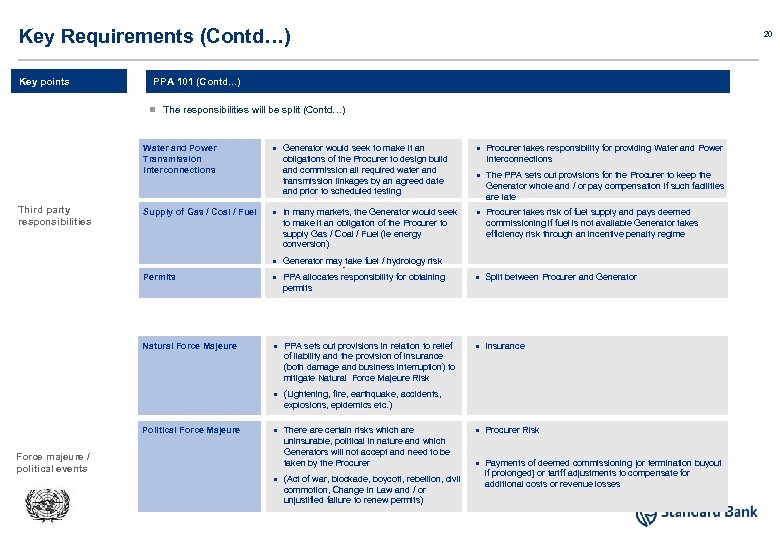

Key Requirements (Contd…) Key points 20 PPA 101 (Contd. . . ) n The responsibilities will be split (Contd…) Water and Power Transmission interconnections Third party responsibilities Supply of Gas / Coal / Fuel · Generator would seek to make it an obligations of the Procurer to design build and commission all required water and transmission linkages by an agreed date and prior to scheduled testing · In many markets, the Generator would seek to make it an obligation of the Procurer to supply Gas / Coal / Fuel (ie energy conversion) · Procurer takes responsibility for providing Water and Power Interconnections · The PPA sets out provisions for the Procurer to keep the Generator whole and / or pay compensation if such facilities are late · Procurer takes risk of fuel supply and pays deemed commissioning if fuel is not available Generator takes efficiency risk through an incentive penalty regime · Generator may take fuel / hydrology risk assuming satisfactory pricing and supply risks permits Permits · PPA allocates responsibility for obtaining · Split between Procurer and Generator Natural Force Majeure · PPA sets out provisions in relation to relief · Insurance of liability and the provision of insurance (both damage and business interruption) to mitigate Natural Force Majeure Risk · (Lightening, fire, earthquake, accidents, explosions, epidemics etc. ) Political Force Majeure Force majeure / political events · There are certain risks which are uninsurable, political in nature and which Generators will not accept and need to be taken by the Procurer · (Act of war, blockade, boycott, rebellion, civil commotion, Change in Law and / or unjustified failure to renew permits) · Procurer Risk · Payments of deemed commissioning [or termination buyout if prolonged] or tariff adjustments to compensate for additional costs or revenue losses

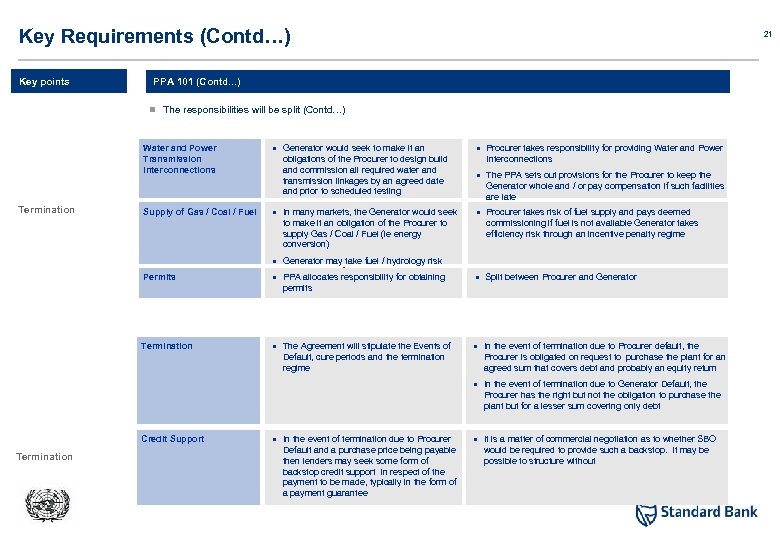

Key Requirements (Contd…) Key points 21 PPA 101 (Contd. . . ) n The responsibilities will be split (Contd…) Water and Power Transmission interconnections Termination Supply of Gas / Coal / Fuel · Generator would seek to make it an obligations of the Procurer to design build and commission all required water and transmission linkages by an agreed date and prior to scheduled testing · In many markets, the Generator would seek to make it an obligation of the Procurer to supply Gas / Coal / Fuel (ie energy conversion) · Procurer takes responsibility for providing Water and Power Interconnections · The PPA sets out provisions for the Procurer to keep the Generator whole and / or pay compensation if such facilities are late · Procurer takes risk of fuel supply and pays deemed commissioning if fuel is not available Generator takes efficiency risk through an incentive penalty regime · Generator may take fuel / hydrology risk assuming satisfactory pricing and supply risks permits Permits · PPA allocates responsibility for obtaining · Split between Procurer and Generator Termination · The Agreement will stipulate the Events of · In the event of termination due to Procurer default, the Default, cure periods and the termination regime Procurer is obligated on request to purchase the plant for an agreed sum that covers debt and probably an equity return · In the event of termination due to Generator Default, the Procurer has the right but not the obligation to purchase the plant but for a lesser sum covering only debt Credit Support Termination · In the event of termination due to Procurer Default and a purchase price being payable then lenders may seek some form of backstop credit support in respect of the payment to be made, typically in the form of a payment guarantee · It is a matter of commercial negotiation as to whether SBO would be required to provide such a backstop. It may be possible to structure without

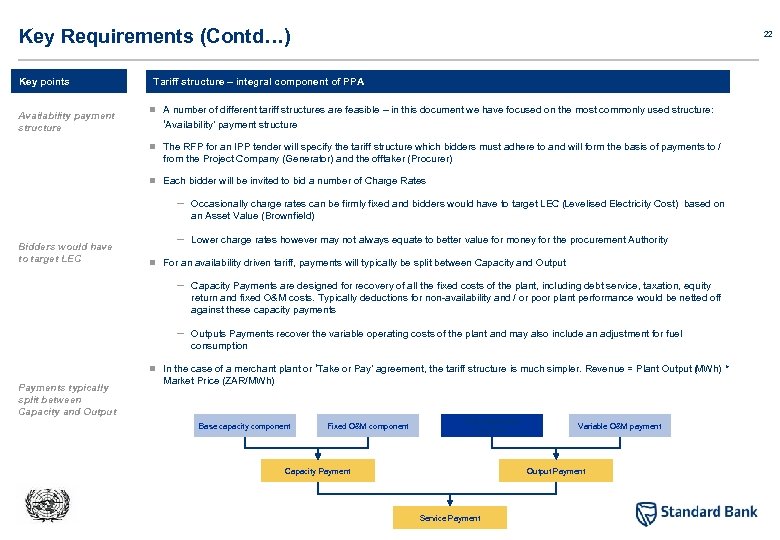

Key Requirements (Contd…) Key points Availability payment structure 22 Tariff structure – integral component of PPA n A number of different tariff structures are feasible – in this document we have focused on the most commonly used structure: ‘Availability’ payment structure n The RFP for an IPP tender will specify the tariff structure which bidders must adhere to and will form the basis of payments to / from the Project Company (Generator) and the offtaker (Procurer) n Each bidder will be invited to bid a number of Charge Rates – Bidders would have to target LEC Occasionally charge rates can be firmly fixed and bidders would have to target LEC (Levelised Electricity Cost) based on an Asset Value (Brownfield) – Lower charge rates however may not always equate to better value for money for the procurement Authority n For an availability driven tariff, payments will typically be split between Capacity and Output – Capacity Payments are designed for recovery of all the fixed costs of the plant, including debt service, taxation, equity return and fixed O&M costs. Typically deductions for non-availability and / or poor plant performance would be netted off against these capacity payments – Outputs Payments recover the variable operating costs of the plant and may also include an adjustment for fuel consumption n In the case of a merchant plant or ‘Take or Pay’ agreement, the tariff structure is much simpler. Revenue = Plant Output ( Wh) * M Payments typically split between Capacity and Output Market Price (ZAR/MWh) Base capacity component Fixed O&M component Fuel adjustment payment Capacity Payment Variable O&M payment Output Payment Service Payment

Private and confidential Section: 6 Potential Financing Structure

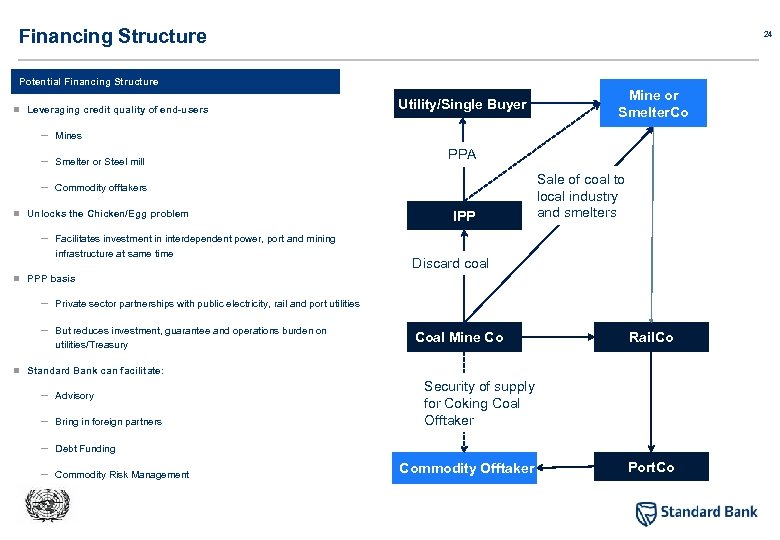

Financing Structure 24 Potential Financing Structure n Leveraging credit quality of end-users – Smelter or Steel mill – Commodity offtakers Mine or Smelter. Co Mines – Utility/Single Buyer n Unlocks the Chicken/Egg problem – Facilitates investment in interdependent power, port and mining infrastructure at same time PPA IPP Sale of coal to local industry and smelters Discard coal n PPP basis – Private sector partnerships with public electricity, rail and port utilities – But reduces investment, guarantee and operations burden on utilities/Treasury Coal Mine Co Rail. Co n Standard Bank can facilitate: – Advisory – Bring in foreign partners – Debt Funding – Commodity Risk Management Security of supply for Coking Coal Offtaker Commodity Offtaker Port. Co

Private and confidential Section 7: Standard Bank’s Value Proposition

Standard Bank’s Value Proposition: Robust Project Advisory/Finance Services 26 Our Project Advisory and Finance Services

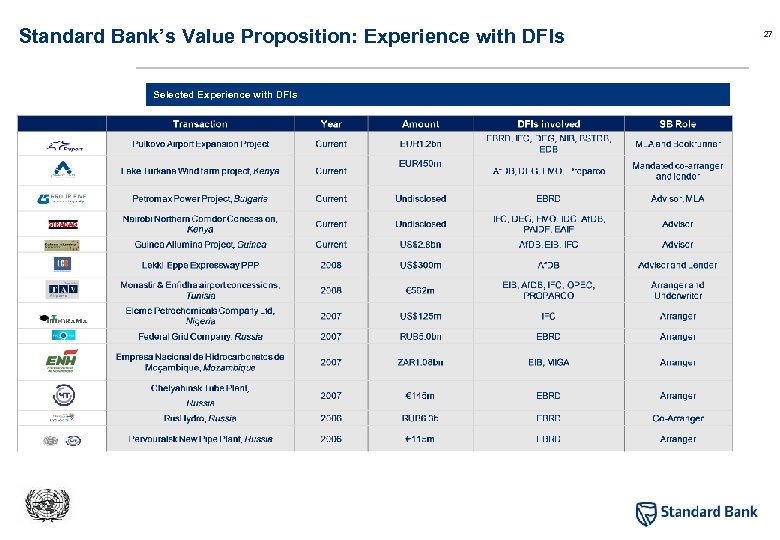

Standard Bank’s Value Proposition: Experience with DFIs Selected Experience with DFIs 27

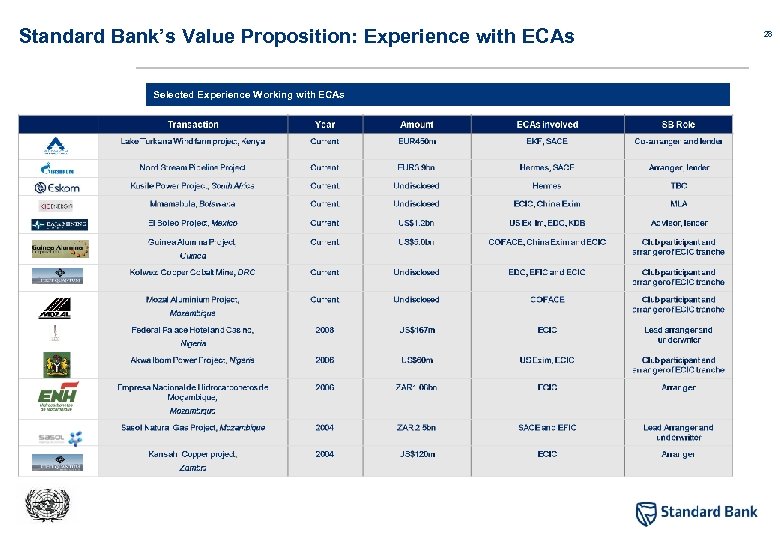

Standard Bank’s Value Proposition: Experience with ECAs Selected Experience Working with ECAs 28

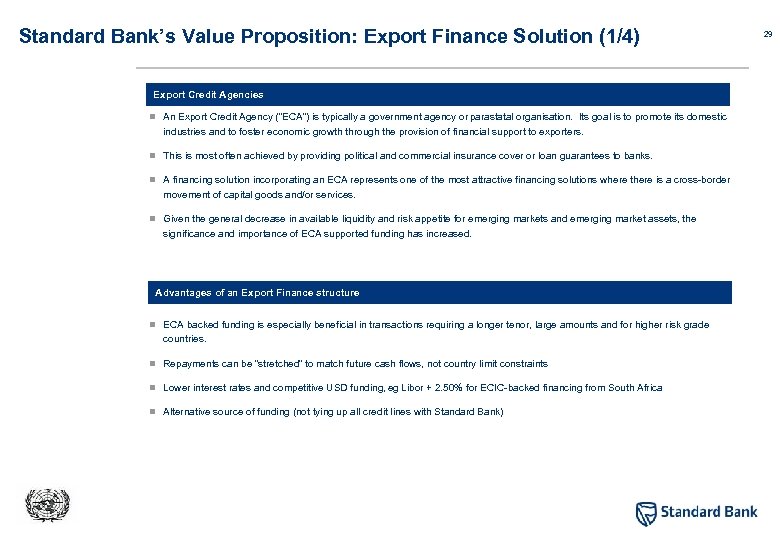

Standard Bank’s Value Proposition: Export Finance Solution (1/4) Export Credit Agencies n An Export Credit Agency (“ECA”) is typically a government agency or parastatal organisation. Its goal is to promote its domestic industries and to foster economic growth through the provision of financial support to exporters. n This is most often achieved by providing political and commercial insurance cover or loan guarantees to banks. n A financing solution incorporating an ECA represents one of the most attractive financing solutions where there is a cross-border movement of capital goods and/or services. n Given the general decrease in available liquidity and risk appetite for emerging markets and emerging market assets, the significance and importance of ECA supported funding has increased. Advantages of an Export Finance structure n ECA backed funding is especially beneficial in transactions requiring a longer tenor, large amounts and for higher risk grade countries. n Repayments can be “stretched” to match future cash flows, not country limit constraints n Lower interest rates and competitive USD funding, eg Libor + 2. 50% for ECIC-backed financing from South Africa n Alternative source of funding (not tying up all credit lines with Standard Bank) 29

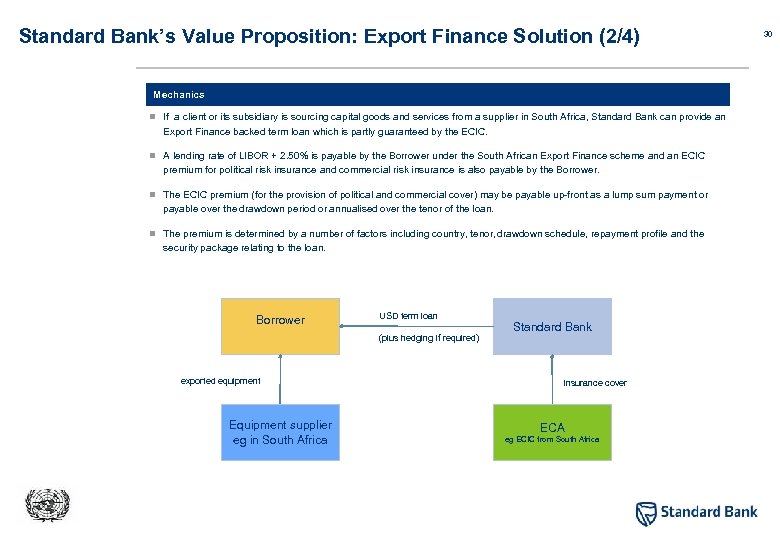

Standard Bank’s Value Proposition: Export Finance Solution (2/4) Mechanics n If a client or its subsidiary is sourcing capital goods and services from a supplier in South Africa, Standard Bank can provide an Export Finance backed term loan which is partly guaranteed by the ECIC. n A lending rate of LIBOR + 2. 50% is payable by the Borrower under the South African Export Finance scheme and an ECIC premium for political risk insurance and commercial risk insurance is also payable by the Borrower. n The ECIC premium (for the provision of political and commercial cover) may be payable up-front as a lump sum payment or payable over the drawdown period or annualised over the tenor of the loan. n The premium is determined by a number of factors including country, tenor, drawdown schedule, repayment profile and the security package relating to the loan. Borrower USD term loan (plus hedging if required) exported equipment Equipment supplier eg in South Africa Standard Bank Insurance cover ECA eg ECIC from South Africa 30

Standard Bank’s Value Proposition: Export Finance Solution (3/4) ECIC n The principal objectives of the ECIC are: – to facilitate and encourage South African export trade by underwriting bank loans and investments outside the country, in order to enable foreign buyers to purchase capital goods and services from the Republic; and – to provide investment insurance to South African companies investing in assets offshore. n Unlike a number of other export credit agencies (such as EFIC for instance), ECIC does not lend directly to projects. – ECIC provides insurance cover (100% Political and 85% Commercial Risk cover) to Lenders that are signatories to their Export Credit Support Agreement and Standard Bank provides the liquidity. n The ECIC have appetite for most countries in Africa and are mandated to cover countries around the world in general. – Their appetite both in terms of number of transactions supported as well as quantum of support per transaction differs from country to country. – They are actively looking to diversify their insurance portfolio and are most keen on countries where they currently have low levels of exposure. 31

Standard Bank’s Value Proposition: Export Finance Solution (4/4) Criteria to qualify for ECIC support n Tied Export Programme – The ECIC will support projects (under their “tied” export program) where there is an export of capital goods and services from South Africa. – ECIC will support 85% of the South African export contract (SA contract value) and will require the Borrower to make a down payment of 15% of the SA contract value to the South African exporter. – The minimum ECIC requirement for South African content is 50% of the value of the South African export contract. – The ECIC provides insurance for credits of a minimum of 2 years and typically up to a maximum of 12 years (in the recent past we have seen longer tenors). 32

Private and confidential Section: 8 Case Study

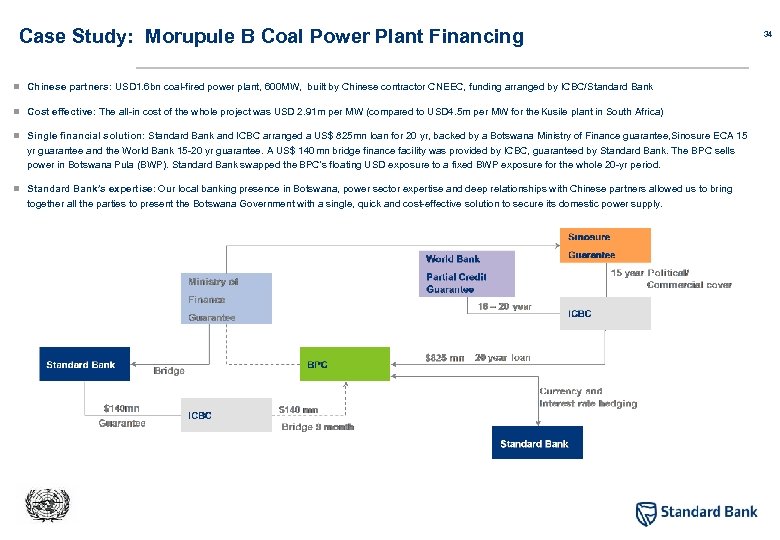

Case Study: Morupule B Coal Power Plant Financing n Chinese partners: USD 1. 6 bn coal-fired power plant, 600 MW, built by Chinese contractor CNEEC, funding arranged by ICBC/Standard Bank n Cost effective: The all-in cost of the whole project was USD 2. 91 m per MW (compared to USD 4. 5 m per MW for the Kusile plant in South Africa) n Single financial solution: Standard Bank and ICBC arranged a US$ 825 mn loan for 20 yr, backed by a Botswana Ministry of Finance guarantee, Sinosure ECA 15 yr guarantee and the World Bank 15 -20 yr guarantee. A US$ 140 mn bridge finance facility was provided by ICBC, guaranteed by Standard Bank. The BPC sells power in Botswana Pula (BWP). Standard Bank swapped the BPC’s floating USD exposure to a fixed BWP exposure for the whole 20 -yr period. n Standard Bank’s expertise: Our local banking presence in Botswana, power sector expertise and deep relationships with Chinese partners allowed us to bring together all the parties to present the Botswana Government with a single, quick and cost-effective solution to secure its domestic power supply. 34

Disclaimer 35 This presentation is provided for information purposes only on the express understanding that the information contained herein will be regarded as strictly confidential. It is not to be delivered nor shall its contents be disclosed to anyone other than the entity to which it is being provided and its employees and shall not be reproduced or used, in whole or in part, for any purpose other than for the consideration of the financing or transaction described herein, without the prior written consent of a member of the Standard Bank Group. The information contained in this presentation does not purport to be complete and is subject to change. This is a commercial communication. This presentation may relate to derivative products and you should not deal in such products unless you understand the nature and extent of your exposure to risk. The presentation does not include a personal recommendation and does not constitute an offer, or the solicitation of an offer for the sale or purchase of any financial product, service, investment or security. The investments and strategies discussed here may not be suitable for all investors; if you have any doubts you should consult your investment advisor. The investments discussed may fluctuate in price or value Whilst every care has been taken in preparing this presentation, no member of the Standard Bank Group gives any representation, warranty or undertaking and accepts no responsibility or liability as to the accuracy, or completeness, of the information in this presentation Past performance is not indicative of future results. For the avoidance of doubt, our duties and responsibilities shall not include tax advisory, legal, regulatory accounting or other specialist or technical advice or services. You are to rely on your own independent appraisal of and investigations into all matters and things contemplated by this presentation. By accepting this presentation, you agree to be bound by the foregoing limitations. Kindly note that this presentation does not represent an offer of funding since any facility to be granted in terms of this presentation would be subject to the Standard Band Group obtaining the requisite internal and external approvals. Copyright 2010 Standard Bank Group. All rights reserved. UK Residents This presentation is not intended for the use of retail clients and must not be acted on or relied on by persons who are retail clients. Any investment or investment activity to which this presentation relates is only available to persons other than retail clients and will be engaged in only with such persons. Standard Bank Plc (SB Plc) is authorised and regulated by the Financial Services Authority (FSA), entered in the FSA’s register (register number 124823) and has approved this presentation for distribution in the UK only to persons other than retail clients. Persons into whose possession this presentation comes are required by SB Plc to inform themselves about and to observe these restrictions. Telephone calls may be recorded for quality and regulatory purposes. Standard Bank Plc, 20 Gresham Street, London, EC 2 V 7 JE. South African Residents The Standard Bank of South Africa Limited (Reg. No. 1962/000738/06) is regulated by the South African Reserve Bank and is an Authorised Financial Services Provider and Credit Provider. United States Residents In the US, Standard Bank Plc is acting through its agents, Standard Americas, Inc. and Standard New York Securities, Inc. Both are affiliates of Standard Bank Plc. Standard Americas, Inc is registered as a commodity trading advisor and a commodity pool operator with the NFA. Standard New York Securities, Inc is a member of FINRA and SIPC. Neither are banks, regulated by the United States Federal Reserve Board, nor insured by the FDIC. Hong Kong Residents Standard Bank Asia Limited is a fully licensed bank under the Banking Ordinance and is a registered institution under the Securities and Futures Ordinance in Hong Kong. Standard Securities Asia Limited is a licensed corporation with the Securities and Futures Commission. Any investments and services contained or referred to in this presentation may not be suitable for you and it is recommended that you consult an independent investment advisor if you are in doubt about such investments or investment services. Dubai Residents Standard Bank Plc, Dubai Branch, is regulated by the Dubai Financial Services Authority (‘DFSA) (register number F 000028). Within the Dubai International Financial Centre, (‘DIFC’) the financial products or services to which this marketing material relates will only be made available to Professional Clients, including a Market Counterparty, who meet the regulatory criteria of being a Client. Turkey Residents Standard Unlu Menkul Degerler A. S. and Standard Unlu Portfoy Yonetimi A. S. are regulated by the Turkish Capital Markets Board “CMB”). According to CMB’s legislation, the information, comments and recommendations contained in this presentation are not investment advisory services. Investment advisory services are provided under an investment advisory agreement between a brokerage house, a portfolio management company, a bank that does not accept deposits or other capital markets professionals and the client. The comments and recommendations contained in this presentation are based on the personal opinions of the authors. These opinions may not be appropriate for your financial situation and risk and return preferences. For that reason, investment decisions relying solely on the information contained in this presentation may not meet your expectations.

9c0d25c10f8017ed227a9b15cfc31fe8.ppt