db36088da3da290166ab1f3193a8b32f.ppt

- Количество слайдов: 26

Financing Opportunities for Brownfield Regeneration Mária Zúbková, Barbara Vojvodíková, Jiřina Bergatt Jackson „This project has been funded with support from the European Commission. This publication [communication] reflects the views only of the author, and the Commission cannot be held responsible for any use which may be made of the information contained therein. “

Awareness • Instruments for financial support of brownfields redevelopment • Local, regional and national public and private sources and initiatives • International programmes • Public – Private - Partnership

Goals of the teaching unit • Introduce the system of financial supporting brownfields regeneration • Describe individual sources of funding using local, regional and national public and private sources • Introduce the EU initiatives to fund redevelopment which are available also in other EU member states • Which are the usual cases of Public-Private Partnership (PPP) • Display current situation of financial supporting brownfield regeneration in the Slovak Republic and in the Czech Republic

Key Financial Instruments Grant schemes (public, private) Direct investments (public, private) Funds (EU Structural funds, National development funds) Insurance and cumulative funds, Tax systems (state or local, land or income or special) and delivery, • Credits, loans, interests, and subsidies. • Partnerships in financing the process of brownfield redevelopment (PPP projects) • • •

Public and private sources • Public sources (municipalities or regions entering the process of regeneration): • budgets of municipalities, regions or state budget, • EU funds through the operational programmes, • donations and grants from other funds and organizations. • Private sources – either the previous owner of the property or input of a private investor as a new owner for the purpose of business.

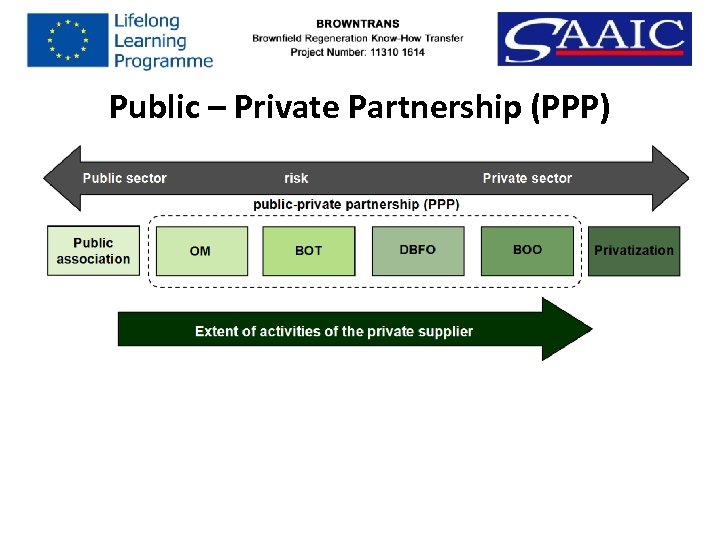

Public – Private Partnership (PPP)

Public – Private Partnership (PPP) There are several models of PPP but these are the most used: • OM - Operation & Maintain • BOT - Build-Operate-Transfer • DBFO - Design-Build-Finance-Operate • BOO - Build-Own-Operate

Contents - Czech Republic • Main target areas for public funding • Short introduction to financial tools available in the Czech Republic • Operational Programmes in the Czech Republic • JESSICA • European Union Programmes

Main target areas for public funding in the Czech Republic Property Fund (in past) v. National Financial sources used for: Decontamination v. Operation programmes v. Resolutions of the Czech government v. Urban regeneration-related grants, by the Czech Ministry of Regional Development v. JESSICA v. Operation Programmes Urban development Special funding for special brownfield types Education Operation programmes Leonardo da Vinci Fund v. Grant financing for ex-army brownfields by the Czech Ministry of Regional Development v. Support grants for listed historical and cultural properties v. Resolutions of the Czech government

Short introduction of: National Property Fund that was established on yields from privatization (currently those sources are part of the Ministry of Finance of the Czech Republic). • costs related to removal of environmental damage caused by existing activities of a company • costs and the support of investing and non-investing actions connected with remedy of damage caused on the living environment by mineral mining and on revitalization of affected lands (brownfields).

Short introduction of: Resolutions of the Czech government in 2002 and 2003 • Funds for Solving ecological damage arisen before privatization of lignite mining companies in Ústecký region and Carlsbad region (5 milliard CZK), • Funds for state participation on costs related to removal of ecological damage arisen before privatization of mining companies in relation to restructuring of mining and revitalization in a area of Moravian-Silesian region (20 milliard CZK)

Short introduction of: Grant financing for ex-army brownfields by the Czech Ministry of Regional Development • This tool emerges on the request of the Czech mayors who concluded that the reuse of ex-army property that had been transferred into local communities ownership had needed finance for site projects and site preparations, these communities had not had. A modest amount of grant finance for these purposes still exists until now.

Short introduction of: Support grants for listed historical and cultural properties • There are several programmes that have been run by the Czech Ministry of Culture for a number of years. The main focus was on sheltering grants that were designed to protect these properties until their new use could be determined. All grants required financial participation on the side of their owners.

Short introduction of: Urban regeneration-related grants, by the Czech Ministry of Regional Development • This was a system, where communities applied for financing various urban projects. It was criticised as being not very transparent and it was replaced by grants financing ex-army brownfields and housing ownership support and housing regeneration financing.

Short introduction of Operational Programmes: • • • Operational Programme Enterprise and Innovation Operational Programme Environment Regional Operational Programme North Moravia Regional Operational Programme South East Regional Operational Programme North East Regional Operational Programme Middle Bohemia Regional Operational Programme South West Regional Operational Programme North West Regional Operational Programme Middle Moravia

Short introduction of JESSICA Joint European Support for Sustainable Investment in City Areas • Financial means from Structural Funds are invested by the leading organization into holding funds or directly into Urban development fund. • Financial means can be inserted into Urban development funds also by municipalities, European Investment Bank, Council of Europe Development Bank, commercial banks and other financial institutions. • http: //jessica. europa. eu

Contents – Slovak Republic • Key Financial Instruments • Partnerships in financing the process of brownfield redevelopment • Project Financing

Grant schemes in Slovakia – public or private • Grant scheme for the redevelopment of villages public. • Grant schemes focused on the redevelopment of public spaces and public buildings or environmental projects financed by big companies like refinery Slovnaft, T-Com, Orange and others – private. • Norwegian Financial Mechanism – private. • Subsidies for site development and construction of technical infrastructure – public.

Direct investments – public or private • Fully worked-up developments financed by public or private sectors • The majority of sources for Slovak brownfield regeneration financing came, and would have to keep coming from private investors. • The role of the public sector and local governments is to use their unique regulative powers, local leadership position and if needed also to “seed” finance, to remove barriers for private sector investment.

EU Structural funds Conditions for successful obtaining financing from EU funds are mainly: • Elaboration of brownfield due diligence (technical, legal, environmental) • Produce a feasibility study of brownfield redevelopment • Build a project team composed of members of government, experts, developers, real estate consultant, potential investors, i. e. the future users • Build the project time schedule.

Insurance and cumulative funds • State guaranties for financial loans • Bank Guarantees for Loans provided by the Slovak Guaranty and Development Bank • EIB in the past financed the international Investors to set up Property funds, with aim to help maturing the local property markets. • Environmental Fund financed from environmental taxes and hazardous plays taxes

Tax systems (state or local, land or income or special) and delivery • Income taxes • Local property tax belongs to local communities • Property and land transfer taxes (mostly concern the transfer of property and land for business) • VAT

Loans and Credits • Loans of Commercial Banks • National Loans from Environmental Fund. • State Support Programme for the Housing Stock Renewal through the Granting of Bank Guarantees for Loans • State subsidises public “construction” savings, which is a very popular scheme with public, yielding good returns • Mortgages

Project financing • Large redevelopment projects are currently funded through project financing where the funds put into the project are reimbursable from the revenues that the project generates. • Precondition for successful preparation and implementation of investment project is the systematic application of principles and methods of project management. • Project assets and the generated cash flow create priority for the loan security.

Conclusions • There is broad variety of Financial Instruments in the process of brownfields redevelopment • It is necessary for government and administration to create funds or some other funding tools • It is necessary for stakeholders to have insight into offered funding possibilities and their conditions • Projects must meet specific criteria in order to get funded • Public – Private Partnership may be the fastest and under conditions the best form of securing funding for brownfields re-development

Thank you for your attention http: //browntrans. vsb. cz „This project has been funded with support from the European Commission. This publication [communication] reflects the views only of the author, and the Commission cannot be held responsible for any use which may be made of the information contained therein. “

db36088da3da290166ab1f3193a8b32f.ppt