6b7a998e4d10af5924f35137d934b68d.ppt

- Количество слайдов: 23

FINANCING INFRASTRUCTURE : Breaking the Barriers to Sustainable Development Adeola Managing Director Project & Export Finance Standard Chartered Bank, London April 2009

Agenda q Introduction q Infrastructure Finance Trends q Breaking the Barriers to Sustainable Investment q Conclusions & Recommendations q Leveraging on Experience 2

Standard Chartered-Leading the Way in Africa, ME & Asia q Leading the way in Asia, Africa and the Middle East Ø Ø q Largest international bank in the Middle East & Africa Strong focus on China, Japan, Korea, and Africa top 3 foreign bank in each major market Our Global Presence Ø Ø 550 locations serving 56 countries Our Local Presence Ø Ø q Trade Finance Bilateral Credit Long term credit rating A 2 (Moody’s) and A (S&P) Ø q FTSE 100 and Hong Kong Stock Exchange listed Cash management On the ground expertise in Asia, Africa, the Middle East, India region and Latin America Facilitates delivery of innovative products, supported by quality delivery systems and excellent customer service Our Value Proposition and Product delivery Ø Strong on-shore presence and in-depth local knowledge Ø Relationship and leverage with key corporates and institutions Ø Raising Capital and Risk Management Strategy and Equity M&A Forfaiting FX, Derivatives Structured Trade Finance Securitisation Fixed Income Loan syndication LBO/MBO Equity Private Placement Private Equity Investing Coupled with a deep understanding of the local markets, our product capabilities are tailored to suit client’s needs. Project & Export Finance Arranging & Advisory Providing banking solutions to meet the needs of our clients 3

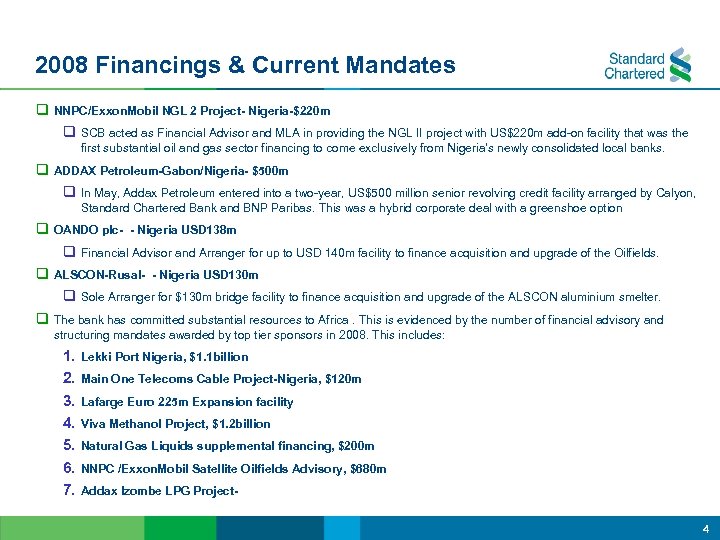

2008 Financings & Current Mandates q NNPC/Exxon. Mobil NGL 2 Project- Nigeria-$220 m q SCB acted as Financial Advisor and MLA in providing the NGL II project with US$220 m add-on facility that was the first substantial oil and gas sector financing to come exclusively from Nigeria’s newly consolidated local banks. q ADDAX Petroleum-Gabon/Nigeria- $500 m q In May, Addax Petroleum entered into a two-year, US$500 million senior revolving credit facility arranged by Calyon, Standard Chartered Bank and BNP Paribas. This was a hybrid corporate deal with a greenshoe option q OANDO plc- - Nigeria USD 138 m q Financial Advisor and Arranger for up to USD 140 m facility to finance acquisition and upgrade of the Oilfields. q ALSCON-Rusal- - Nigeria USD 130 m q Sole Arranger for $130 m bridge facility to finance acquisition and upgrade of the ALSCON aluminium smelter. q The bank has committed substantial resources to Africa. This is evidenced by the number of financial advisory and structuring mandates awarded by top tier sponsors in 2008. This includes: 1. 2. 3. 4. 5. 6. 7. Lekki Port Nigeria, $1. 1 billion Main One Telecoms Cable Project-Nigeria, $120 m Lafarge Euro 225 m Expansion facility Viva Methanol Project, $1. 2 billion Natural Gas Liquids supplemental financing, $200 m NNPC /Exxon. Mobil Satellite Oilfields Advisory, $680 m Addax Izombe LPG Project 4

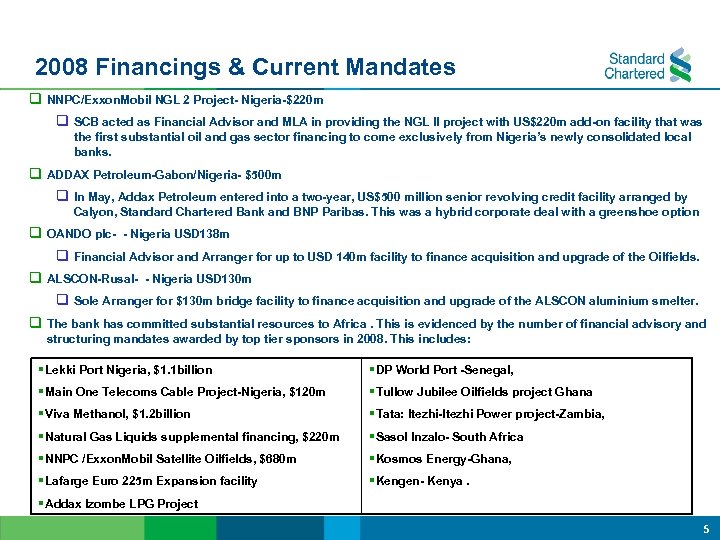

2008 Financings & Current Mandates q NNPC/Exxon. Mobil NGL 2 Project- Nigeria-$220 m q SCB acted as Financial Advisor and MLA in providing the NGL II project with US$220 m add-on facility that was the first substantial oil and gas sector financing to come exclusively from Nigeria’s newly consolidated local banks. q ADDAX Petroleum-Gabon/Nigeria- $500 m q In May, Addax Petroleum entered into a two-year, US$500 million senior revolving credit facility arranged by Calyon, Standard Chartered Bank and BNP Paribas. This was a hybrid corporate deal with a greenshoe option q OANDO plc- - Nigeria USD 138 m q Financial Advisor and Arranger for up to USD 140 m facility to finance acquisition and upgrade of the Oilfields. q ALSCON-Rusal- - Nigeria USD 130 m q Sole Arranger for $130 m bridge facility to finance acquisition and upgrade of the ALSCON aluminium smelter. q The bank has committed substantial resources to Africa. This is evidenced by the number of financial advisory and structuring mandates awarded by top tier sponsors in 2008. This includes: §Lekki Port Nigeria, $1. 1 billion §Main One Telecoms Cable Project-Nigeria, $120 m §Viva Methanol, $1. 2 billion §Natural Gas Liquids supplemental financing, $220 m §NNPC /Exxon. Mobil Satellite Oilfields, $680 m §Lafarge Euro 225 m Expansion facility §Addax Izombe LPG Project §DP World Port -Senegal, §Tullow Jubilee Oilfields project Ghana §Tata: Itezhi-Itezhi Power project-Zambia, §Sasol Inzalo- South Africa §Kosmos Energy-Ghana, §Kengen- Kenya. 5

Infrastructure Finance Trends: Statistics and Commentaries

Infrastructure Projects- Setting the Scene q. Physical Infrastructure projects are ‘those services without which primary, secondary, and tertiary production activities cannot function’ Specifically capital-intensive facilities in: § § § Electric power (generation and distribution) Energy (refineries, pipelines, processing facilities, etc. ) Telecommunications Transportation (ports, toll roads, railways, etc. ) Water / Sewerage q. The Input – technology, capital equipment, expertise are sourced mainly in the international markets and typically financed in international currencies. q. The output (e. g. , electricity, petroleum products) is sold primarily in the domestic market and paid for in local currency q. The Debt/Bonds used to finance these projects are therefore exposed to 2 main risks § Devaluation – Reduction of USD value of cashflows below debt service levels. § Convertibility – Risks that local authorities may block the exchange of local currency revenues into dollars or block currency transfers from the host country 7

The Infrastructure Situation at a Glance q. Infrastructure investment – a 15 -25+year proposition that requires insight & foresight! Ø Governments – adopting concessions/greenfield projects , PPPs vs. asset privatisations q. Sector Trends Ø Telecommunications: strong cashflow from cellular services. Currently Private sector driven Ø Power: Poor cashflows due to sub-economic tarrifs and under-investment § Historically, cross-subsidised to benefit small residential consumers, implying politically difficult adjustment process to generate sustainable cashflows. § Private sector involvement without govt capacity support may be limited to independent power producer (IPP) projects servicing large customers (industrials, distributors, etc. ) Ø Transport: § airports and shipping ports generate strong cashflow today. § roads and rail networks generate limited revenues and may need govt transfers (shadow tolling). Ø Water and Sewerage: limited cashflow in Emerging mkts- viewed as the ultimate “public good”. 8

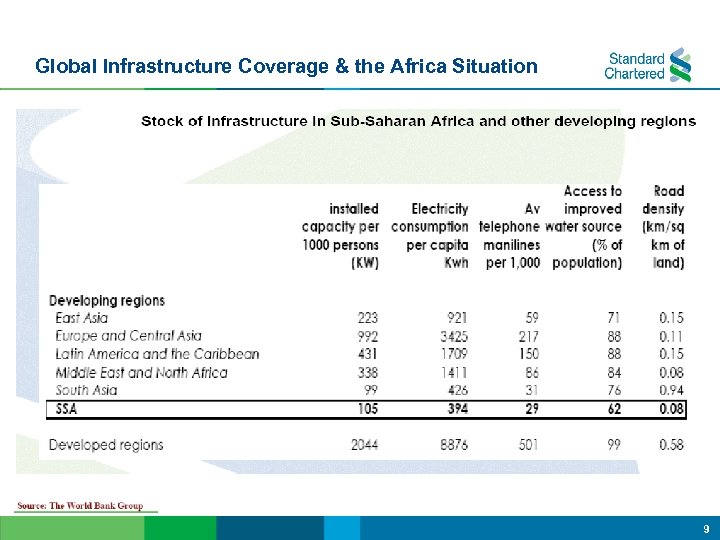

Global Infrastructure Coverage & the Africa Situation 9

Infrastructure Finance Trends q Traditionally financed out of general government revenues q Trend in recent years for infrastructure to be financed on a project basis or for infrastructure projects to be purchased or developed by the private sector. q Given the high initial capital costs of infrastructure projects, long-term financing is essential for privatelyowned infrastructure projects to be financially viable q Financing is now available from the private sector – in many instances with foreign private investors and creditors playing a major role q Key Growth Drivers § Privatisation- Govts adopting concessions/ PPP greenfield projects vs. asset privatisations § Commodity related infrastructure e. g. Mining, “Infrastructure enablers” offered by Resource players § Improving Governance e. g. Pension fund and Policy reforms § Private Equity Funds looking for higher yields (Reducing margins in Europe & Middle East Markets) § Technology leverage 10

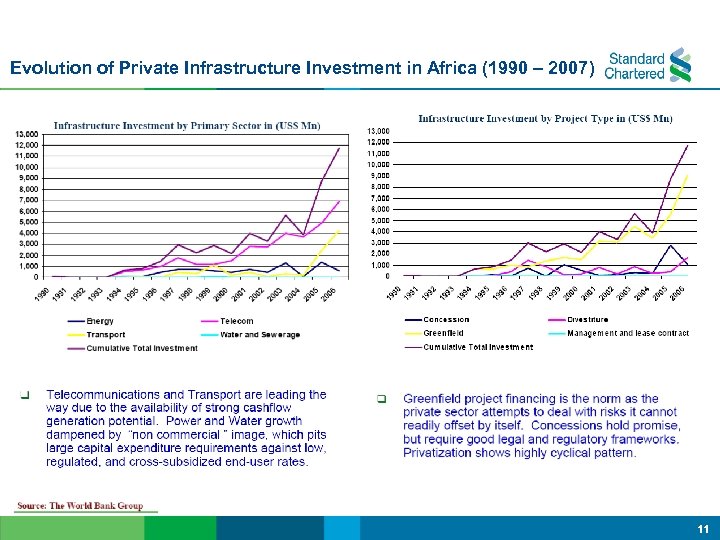

Evolution of Private Infrastructure Investment in Africa (1990 – 2007) 11

Breaking the Barriers to Sustainable Investment

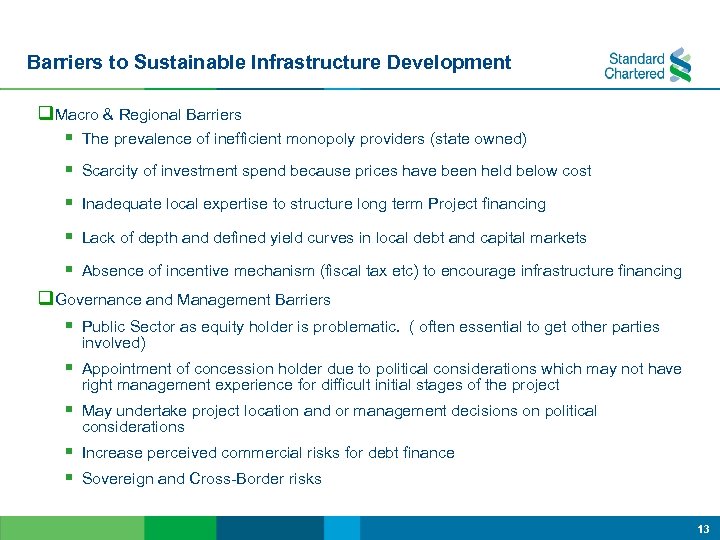

Barriers to Sustainable Infrastructure Development q. Macro & Regional Barriers § The prevalence of inefficient monopoly providers (state owned) § Scarcity of investment spend because prices have been held below cost § Inadequate local expertise to structure long term Project financing § Lack of depth and defined yield curves in local debt and capital markets § Absence of incentive mechanism (fiscal tax etc) to encourage infrastructure financing q. Governance and Management Barriers § Public Sector as equity holder is problematic. ( often essential to get other parties involved) § Appointment of concession holder due to political considerations which may not have right management experience for difficult initial stages of the project § May undertake project location and or management decisions on political considerations § Increase perceived commercial risks for debt finance § Sovereign and Cross-Border risks 13

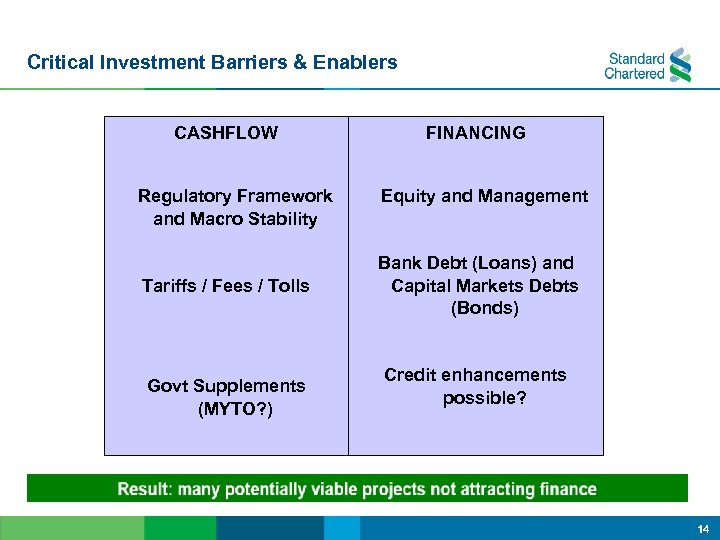

Critical Investment Barriers & Enablers CASHFLOW Regulatory Framework and Macro Stability Tariffs / Fees / Tolls Govt Supplements (MYTO? ) FINANCING Equity and Management Bank Debt (Loans) and Capital Markets Debts (Bonds) Credit enhancements possible? 14

What is required to achieve sustainable development? q. Sponsors: Local parties to improve credit worthiness, corporate governance and management capacity q. Banks: Innovative structures to project, corporate, and sovereign financings, with the aim of improving credit ratings for transactions: § Structures to mitigate the risk of devaluation, and § Structure to facilitate the use of local debt and capital markets, which can provide financing denominated in the currency in which the project earns its revenues § Structure to breach the sovereign ceiling, which therefore permit the transaction’s (global scale) local currency rating to become its foreign currency rating q. Governments: Strong institutional framework for protecting creditors rights and improved access to legal enforcement and remedy q. Development Finance Institutions and ECAs: – Country risk mitigation instruments (PRI & Gtees) – Deepen depth of Africa capital markets (Credit enhancement for Debts & Bonds, risk participations etc) Need for diversification of funding sources( Equity, Debt & Capital Markets) and mobilisation of long term investment from local and international markets 15

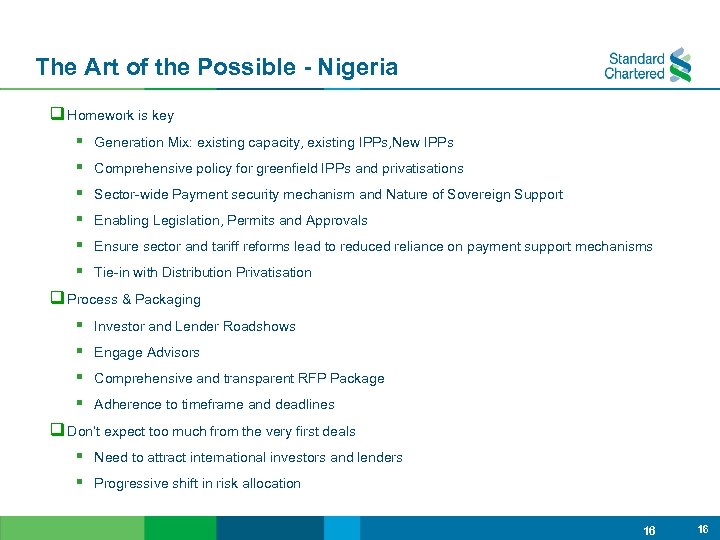

The Art of the Possible - Nigeria q Homework is key § Generation Mix: existing capacity, existing IPPs, New IPPs § Comprehensive policy for greenfield IPPs and privatisations § Sector-wide Payment security mechanism and Nature of Sovereign Support § Enabling Legislation, Permits and Approvals § Ensure sector and tariff reforms lead to reduced reliance on payment support mechanisms § Tie-in with Distribution Privatisation q Process & Packaging § Investor and Lender Roadshows § Engage Advisors § Comprehensive and transparent RFP Package § Adherence to timeframe and deadlines q Don’t expect too much from the very first deals § Need to attract international investors and lenders § Progressive shift in risk allocation 16 16

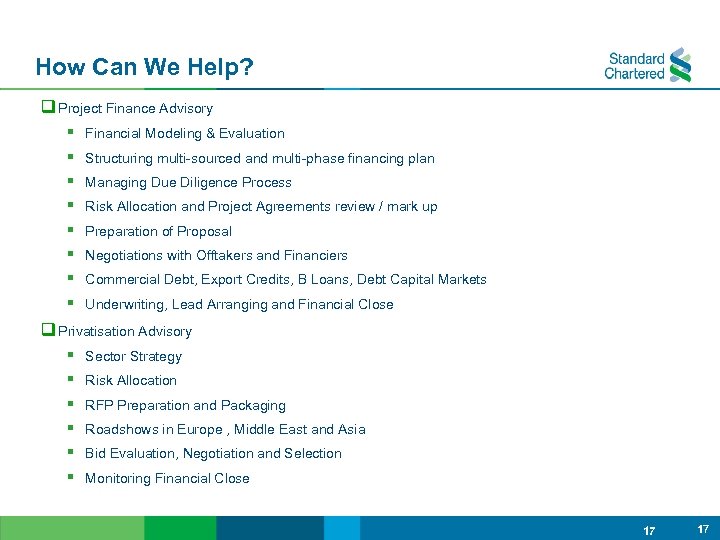

How Can We Help? q Project Finance Advisory § Financial Modeling & Evaluation § Structuring multi-sourced and multi-phase financing plan § Managing Due Diligence Process § Risk Allocation and Project Agreements review / mark up § Preparation of Proposal § Negotiations with Offtakers and Financiers § Commercial Debt, Export Credits, B Loans, Debt Capital Markets § Underwriting, Lead Arranging and Financial Close q Privatisation Advisory § Sector Strategy § Risk Allocation § RFP Preparation and Packaging § Roadshows in Europe , Middle East and Asia § Bid Evaluation, Negotiation and Selection § Monitoring Financial Close 17 17

Summary q. We believe that Nigeria has a huge scope for value creating investment in infrastructure § But most African markets do not have sufficient tax and government revenues for pure public sector funding q. Funding is not the critical barrier § Project finance remains available for well structured projects § Credit markets can dealing with currency and political risks, for bankable projects q. Revenue is not generally the critical barrier § The Governments in Nigeria have started the broad policies and regulatory changes to support stable revenue streams § There are greater challenges associated with revenue transfer arrangements e. g. in water & sewerage, roads A key management and institutional gap remains. This can be overcome by greater involvement of private equity and debt in financing of infrastructure 18

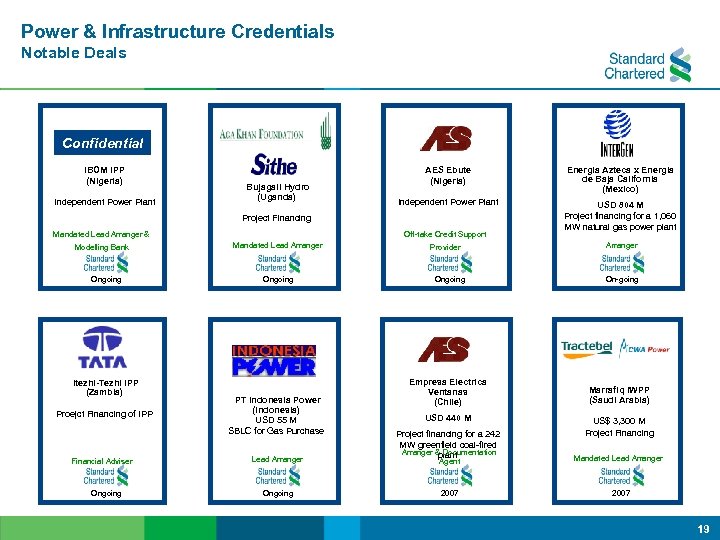

Power & Infrastructure Credentials Notable Deals Confidential IBOM IPP (Nigeria) Independent Power Plant Bujagali Hydro (Uganda) AES Ebute (Nigeria) Energia Azteca x Energia de Baja California (Mexico) Independent Power Plant USD 804 M Project financing for a 1, 060 MW natural gas power plant Project Financing Mandated Lead Arranger & Modelling Bank Ongoing Itezhi-Tezhi IPP (Zambia) Proejct Financing of IPP Financial Adviser Ongoing Off-take Credit Support Mandated Lead Arranger Ongoing PT Indonesia Power (Indonesia) USD 55 M SBLC for Gas Purchase Provider Ongoing Empresa Electrica Ventanas (Chile) USD 440 M Lead Arranger Project financing for a 242 MW greenfield coal-fired Arranger & Documentation plant Ongoing 2007 Agent Arranger On-going Marrafiq IWPP (Saudi Arabia) US$ 3, 300 M Project Financing Mandated Lead Arranger 2007 19

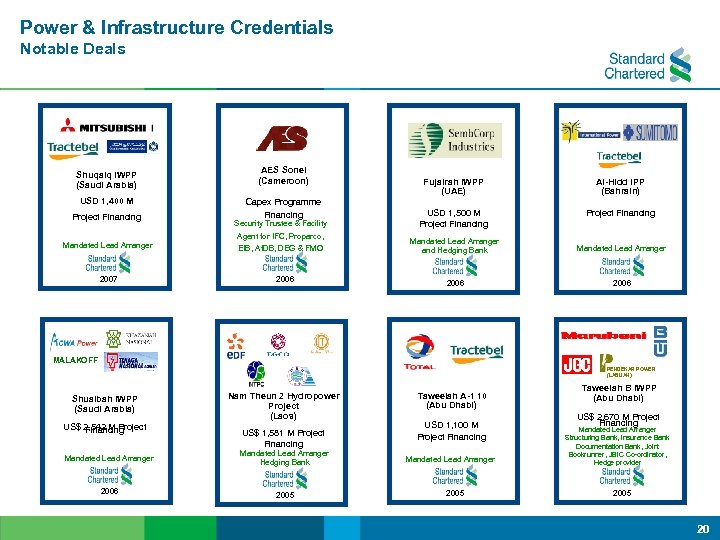

Power & Infrastructure Credentials Notable Deals Shuqaiq IWPP (Saudi Arabia) USD 1, 400 M Project Financing AES Sonel (Cameroon) Capex Programme Financing Security Trustee & Facility Agent for IFC, Proparco, Mandated Lead Arranger 2007 EIB, Af. DB, DEG & FMO 2006 Fujairah IWPP (UAE) Al-Hidd IPP (Bahrain) USD 1, 500 M Project Financing Mandated Lead Arranger and Hedging Bank Mandated Lead Arranger 2006 MALAKOFF PENDEKAR POWER (LABUAN) Shuaibah IWPP (Saudi Arabia) US$ 2, 542 M Project Financing Nam Theun 2 Hydropower Project (Laos) US$ 1, 581 M Project Financing Mandated Lead Arranger Hedging Bank 2006 2005 Taweelah A-1 10 (Abu Dhabi) USD 1, 100 M Project Financing Mandated Lead Arranger 2005 Taweelah B IWPP (Abu Dhabi) US$ 2, 670 M Project Financing Mandated Lead Arranger Structuring Bank, Insurance Bank Documentation Bank, Joint Bookrunner, JBIC Co-ordinator, Hedge provider 2005 20

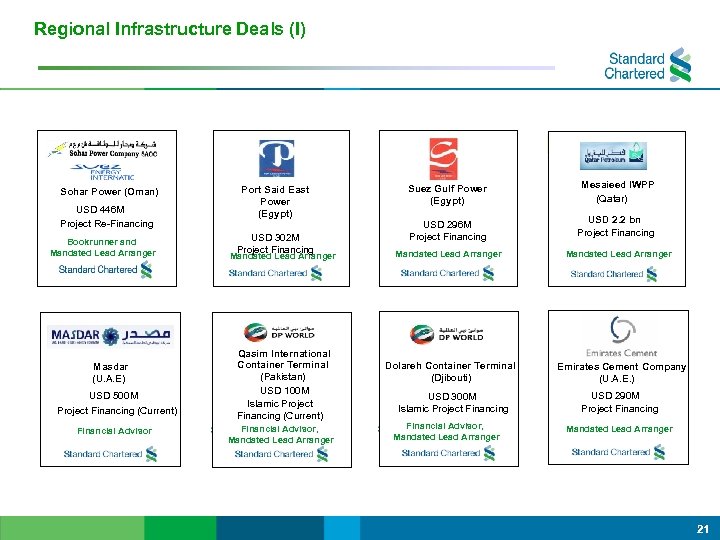

Regional Infrastructure Deals (I) Sohar Power (Oman) USD 446 M Project Re-Financing Bookrunner and Mandated Lead Arranger Umm-Al-Naar IWPP (U. A. E) Masdar USD 855 m (U. A. E) Project Financing USD 855 m Project Financing USD 500 M Project Financing (Current) Mandated Lead Arranger Financial Advisor Port Said East Power (Egypt) USD 302 M Project Financing Mandated Lead Arranger Umm-Al-Naar IWPP (U. A. E) Umm-Al-Naar IWPP Qasim International (U. A. E) Container USD 855 m Terminal (Pakistan) Project Financing USD 855 m USD 100 M Project Financing Islamic Project Financing (Current) Mandated Lead Arranger Financial Advisor, Mandated Lead Arranger Suez Gulf Power (Egypt) (U. A. E) Umm-Al-Naar IWPP Mesaieed IWPP (U. A. E) USD 855 m (Qatar) Project Financing USD 855 m USD 296 M Project Financing USD 2. 2 bn Project Financing Mandated Lead Arranger Umm-Al-Naar IWPP (U. A. E) Umm-Al-Naar IWPP Dolareh (U. A. E) Container Terminal USD 855 m (Djibouti) Project Financing USD 855 m Project Financing USD 300 M Islamic Project Financing Mandated Lead Arranger Financial Advisor, Mandated Lead Arranger XXX Emirates Cement Company (XXX) (U. A. E. ) USD XXX USD 290 M Project Financing Mandated Lead Arranger 21

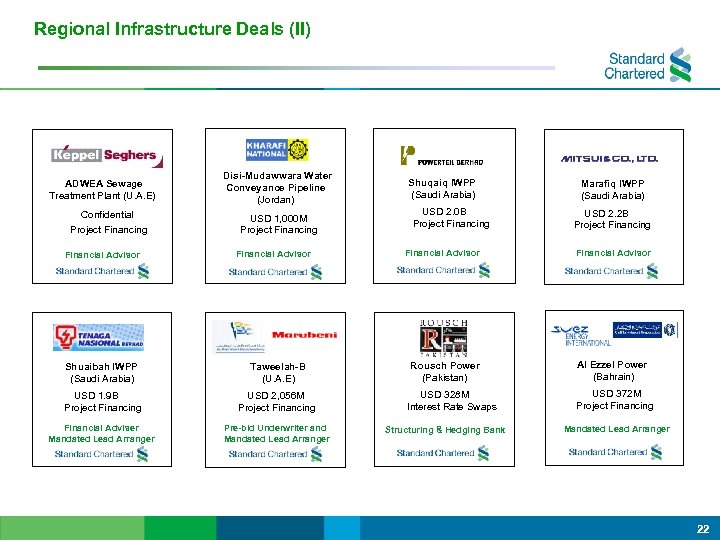

Regional Infrastructure Deals (II) ADWEA Sewage Treatment Plant (U. A. E) Confidential Project Financing Financial Advisor Umm-Al-Naar IWPP (U. A. E) Umm-Al-Naar IWPP Disi-Mudawwara Water (U. A. E) Conveyance Pipeline USD 855 m Project Financing (Jordan) USD 855 m Project Financing USD 1, 000 M Project Financing Shuqaiq IWPP XXX (Saudi Arabia) (XXX) USD XXX 2. 0 B Project Financing Marafiq IWPP XXX (Saudi Arabia) (XXX) USD 2. 2 B USD XXX Project Financing Mandated Lead Arranger Financial Advisor Shuaibah IWPP XXX (Saudi Arabia) (XXX) Taweelah-B (U. A. E) USD 1. 9 B USD XXX Project Financing USD 2, 056 M Project Financing Financial Adviser Mandated Lead Arranger Pre-bid Underwriter and Mandated Lead Arranger Financial Advisor Rousch Power Ras Laffan (Pakistan) (Qatar) 328 M USD 712 m Interest Rate Swaps Project Financing Structuring & Hedging Bank Mandated Lead Arranger Financial Advisor Al Ezzel Power XXX (Bahrain) (XXX) USD 372 M USD XXX Project Financing Mandated Lead Arranger 22

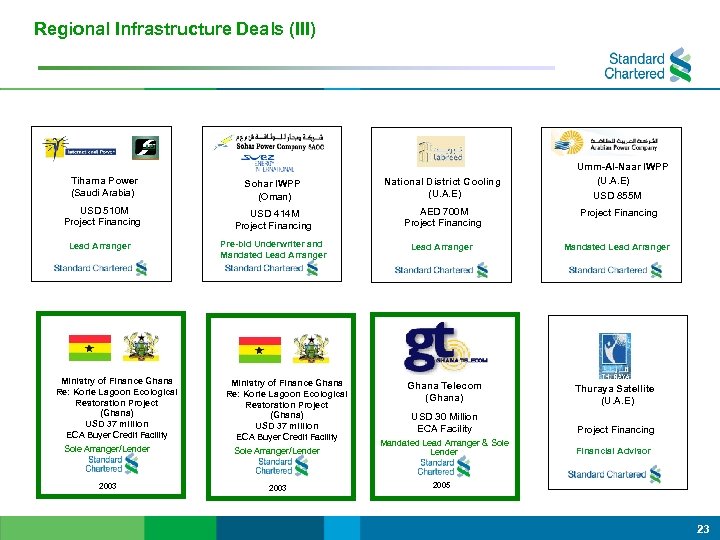

Regional Infrastructure Deals (III) Umm-Al-Naar IWPP (U. A. E) Tihama Power (Saudi Arabia) Sohar IWPP (Oman) National District Cooling (U. A. E) USD 510 M Project Financing USD 414 M Project Financing AED 700 M Project Financing Lead Arranger Pre-bid Underwriter and Mandated Lead Arranger Ministry of Finance Ghana Re: Korle Lagoon Ecological Restoration Project (Ghana) USD 37 million ECA Buyer Credit Facility Sole Arranger/Lender 2003 USD 855 M Ghana Telecom (Ghana) Thuraya Satellite (U. A. E) USD 30 Million ECA Facility Project Financing Mandated Lead Arranger & Sole Lender Financial Advisor 2005 23

6b7a998e4d10af5924f35137d934b68d.ppt