9e38203b4b3241d6978605e01db2c10f.ppt

- Количество слайдов: 45

Financing home purchase for firsttime buyers in Guangzhou and Zhuhai: a tale of two Chinese cities ¨ Peter Li ¨ Faculty of Architecture, Design and Planning ¨ University of Sydney ¨ December 2007

Background ¨ Two men meet in Heaven, one from China, one from America. The Chinese man says, “Yesterday, I finally accumulated enough money to buy a house, and the American says, “Yesterday, I finally paid off the mortgage on the house I bought 20 years ago. ” (Business Beijing Online, 2000). ¨ Do people in an old city finance their first home differently from people in a new city? ¨ Let us look at the case of Guangzhou and Zhuhai in south China.

Background ¨ The financial and property markets in China are becoming internationalized. ¨ As more avenues of housing finance are available, more and more people are expected to rely on mortgage loan from the newly minted financial institutions in major Chinese cities. Mortgage broker, Zhuhai

Introduction ¨ Aims ¨ 1. Based on initial findings of 500 interviews of first time home buyers in Guangzhou and Zhuhai in 2006, the study gives an idea of the number of respondents who bought their homes outright without resort to mortgage facilities of any kind. ¨ 2. This paper aims to find out their means of fulfilling the homeownership dream in China.

Objectives ¨ (1) The interview findings suggest assistance from relatives and friends were sought in order to climb up the housing ladder. ¨ (2) The objectives are to explore the other sources of funds for first-time homebuyers in Guangzhou and Zhuhai, such as part-time jobs and life savings, in addition to family assistance.

1. 2 Literature Review ¨ (Li and Yi, 2007) on housing finance in China was a good starting point. ¨ Apart from that, little is known about the sources of finance for first home buyers (FHB) in China, which forms the focus of this paper.

1. 2. 1 Review of Previous Studies ¨ Previous studies on Chinese housing dwell mainly on housing policies (Lee 2000; Wang and Murie 1999; Wu 2001), housing provisions (Tolley 1991; Wu 1996), housing problems (Chiu, 1996 a; Chiu 1996 b; the World Bank 1992; Zhou and Logan 1996; Shaw 1997; Wang and Murie 2000) reform & housing preferences (Li, 2003; Wang & Li, 2006).

1. 2. 2 Limitation of Previous Studies ¨ Little has been extended to studying the avenues of housing finance particularly for FHB in the post. Deng period. ¨ Hence, the focus of this paper will be on the means of acquiring homeownership for FHB in Guangzhou and Zhuhai. ¨ Sale of public housing at greatly reduced prices in the 1990 s told part of the story. Housing reform flats were also sold at incredibly low prices for sitting tenants.

2. The Analytical Framework ¨ Over the last two decades, housing in socialist China was characterized by the welfare nature of housing provision system. To rid the state of the housing burden, there has been a gradual change from ‘work unit’ housing to a free market for housing where people can now choose to buy or rent a house or an apartment. ¨ The transition from state-owned housing to private homeownership signaled not only a change from a planned economy to a market economy (Li, 2003), but it also represented a transitional stage of housing opportunities unique to mainland China.

2. 1 The Demand Side of Affordable Housing ¨ The ultimate goal of housing reform was commercialization of housing. Low income appeared to be a great stumbling block to increasing the effective demand for housing consumption. ¨ In the wake of the Asian financial crisis in 1997, the government decided to expand housing construction and to increase the effective demand for housing by putting an end to welfare distribution of housing. In other words, work units or state-owned enterprises would no longer construct, purchase and distribute housing to staff. and workers.

2. 2 The Supply Side of Affordable Housing ¨ After Deng Xiao ping’s inspection of southern China, the idea of a ‘socialist market economy with Chinese characteristics’ emerged and the Chinese economy took off. However, speculation resulted in bubbles in the real estate market, especially in the coastal cities. The supply of luxury apartments and villas far exceeded demand. ¨ The housing industry has become one of the main driving forces of the economy of modern China. Steady economic growth, housing reforms, the second-hand housing market, higher income and higher costs of building have contributed to rising house prices. As house prices escalate, housing will become unaffordable to homebuyers.

2. 3 Data and Methodology ¨ The present study was conducted with a random sample of about 500 FHB in Guangzhou and Zhuhai. The data were gathered through in-depth interviews. ¨ Other data-gathering methods such as a mailed questionnaire would not allow for clarification or discussion of the topic or issue from interviewees’ perspective. Similarly, online questionnaire survey as suggested by one of the interviewees in Guangzhou would not allow the researcher to explore deeply what the homebuyer felt about a given issue.

2. 3 Data and Methodology ¨ The interviews were conducted in private without the assistance of state or local officials. Confidentiality of the subjects was assured and privacy of the interviewees respected. ¨ Methodology: In-depth interviews for a random sample of first-time homebuyers in Guangzhou and Zhuhai, China.

Data and Methodology ¨ Academics at Zhongshan University in Guangzhou (which happened to have a campus in Zhuhai for freshmen and sophomores) provided information on the districts, such as Punyu in Guangzhou and Gongbei in Zhuhai, to conduct the in-depth interviews by random sampling. ¨ After the field work in 2006, 500 in-depth interviews were made which translated into x pages of single-spaced 12 point type interview transcriptions and notes.

Gongbei check-point, Zhuhai

Data and Methodology ¨ The interviews were transcribed by hand then typed into a computer file. ¨ The quantitative data gathered from the random sample would be analyzed using SPSS, supplemented by the words of the interviewees for better understanding and interpretations of the findings.

Housing affordability in Guangzhou & Zhuhai 3. 1 Housing affordability has attracted much attention in China recently. With real incomes lagging behind increases in house prices, urban housing has become less affordable for Chinese households. ¨ Housing affordability can be defined as the ratio between household income available for housing payments and the required payment (instead of the full price) for the housing unit (World Bank, 1992).

Housing affordability in Guangzhou and Zhuhai 3. 2 Concepts related to housing affordability ¨ The House Price to Income (HPI) Ratio ¨ The HPI Ratio is a good indicator of the affordability of medium housing prices to middleincome families. For developed countries, it is from 1. 8 to 5. 5 whereas for developing countries, from 4 to 6. When the HPI Ratio falls between 3 and 6, house prices are generally affordable (Zhongguo fangdichan 2002). ¨

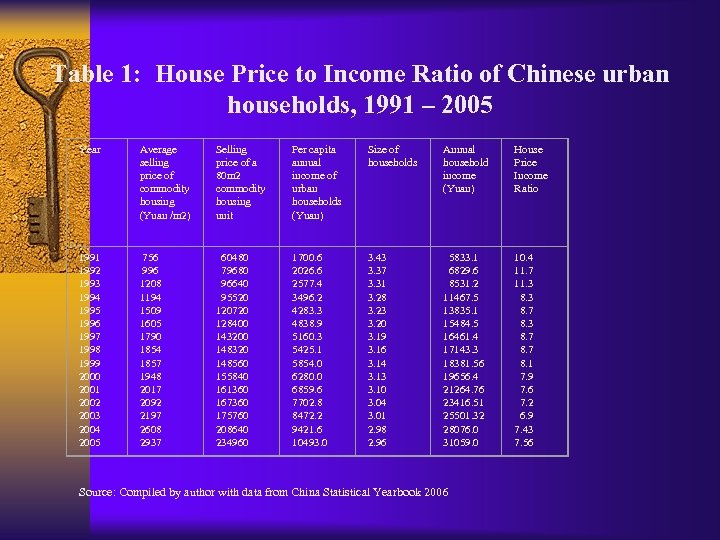

Table 1: House Price to Income Ratio of Chinese urban households, 1991 – 2005 Year 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 Average selling price of commodity housing (Yuan /m 2) Selling price of a 80 m 2 commodity housing unit Per capita annual income of urban households (Yuan) Size of households Annual household income (Yuan) House Price Income Ratio 756 996 1208 1194 1509 1605 1790 1854 1857 1948 2017 2092 2197 2608 2937 60480 79680 96640 95520 120720 128400 143200 148320 148560 155840 161360 167360 175760 208640 234960 1700. 6 2026. 6 2577. 4 3496. 2 4283. 3 4838. 9 5160. 3 5425. 1 5854. 0 6280. 0 6859. 6 7702. 8 8472. 2 9421. 6 10493. 0 3. 43 3. 37 3. 31 3. 28 3. 23 3. 20 3. 19 3. 16 3. 14 3. 13 3. 10 3. 04 3. 01 2. 98 2. 96 5833. 1 6829. 6 8531. 2 11467. 5 13835. 1 15484. 5 16461. 4 17143. 3 18381. 56 19656. 4 21264. 76 23416. 51 25501. 32 28076. 0 31059. 0 10. 4 11. 7 11. 3 8. 7 8. 1 7. 9 7. 6 7. 2 6. 9 7. 43 7. 56 Source: Compiled by author with data from China Statistical Yearbook 2006

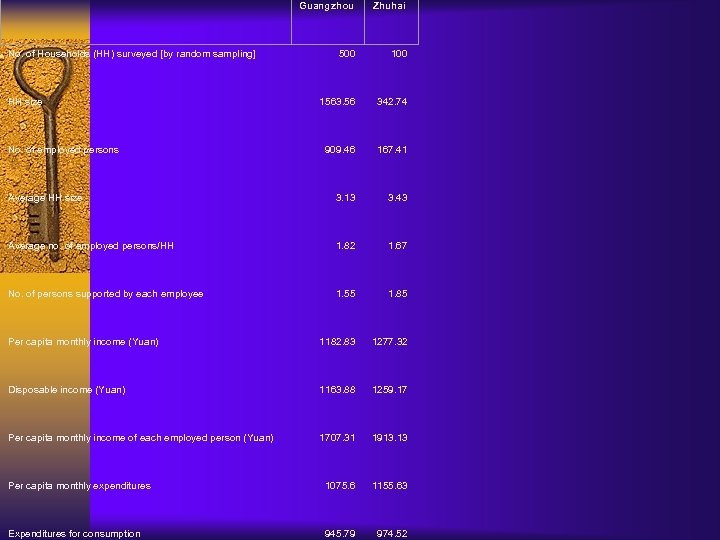

Guangzhou Zhuhai 500 1563. 56 342. 74 909. 46 167. 41 Average HH size 3. 13 3. 43 Average no. of employed persons/HH 1. 82 1. 67 No. of persons supported by each employee 1. 55 1. 85 Per capita monthly income (Yuan) 1182. 83 1277. 32 Disposable income (Yuan) 1163. 88 1259. 17 Per capita monthly income of each employed person (Yuan) 1707. 31 1913. 13 Per capita monthly expenditures 1075. 6 1155. 63 Expenditures for consumption 945. 79 974. 52 No. of Households (HH) surveyed [by random sampling] HH size No. of employed persons

Comparison of FHB in Guangzhou & Zhuhai I. Socio-economic background 1. Gender 2. Age group 3. Marital status 4. Number of children 5. Staying with parents 6. Staying with grandparents 7. Occupation 8. Part-time job ¨ 26% respondents in Zhuhai stayed with parents , Guangzhou 18% (Pilot survey, 2004).

Comparison of FHB in Guangzhou & Zhuhai II. Household income ¨ 1. Personal income 2. Household income 3. Income from other members of the family ¨ 58% respondents in Guangzhou received income support from spouse for home purchase, Zhuhai 30% (Pilot survey, 2004)

Comparison of FHB in Guangzhou & Zhuhai III. Housing Finance Source of funding for home purchase: 1. One-off payment or by mortgage 2. Which bank? 3. Mortgage payment as a share of monthly income 4. Amount of down payment 5. Down payment as percentage of purchase price Commodity housing, Zhuhai

Comparison of FHB in Guangzhou & Zhuhai IV. Housing Finance 7. Mortgage period 8. Mortgage rate 9. Amount of mortgage as % of property price 10. Penalty for late payments 11. Administrative fee for early re-payments 12. Home insurance 13. Mortgage payments Estate agency, Zhuhai

Comparison of FHB in Guangzhou & Zhuhai 1. 2. 3. 4. 5. 6. Contribution from other family members on down payment Contribution from other family members on mortgage payments Impact of tax reduction on affordability of FHB Impact of reduction in land costs on affordability of FHB Impact of down payment subsidies on affordability of FHB Impact of mortgage interest subsidies on affordability of FHB

Affordable Housing: the China approach compared with Hong Kong approach & policy suggestions ¨ ‘One country Two systems’- capitalist Hong Kong and socialist market economy of Mainland China. ¨ The China approach ¨ Sky-rocketing house prices get in the way of realizing the dream of owning a home by most Chinese. ¨ Housing is not a consumer good to most Chinese, but an investment.

Affordable Housing: the China approach compared with Hong Kong approach & policy suggestions ¨ Like health care and education, housing is a quasi- public good provided by the government. ¨ Rapid urbanization and explosion in urban population have led to severe shortage of housing in many cities. ¨ For higher returns on investment, there is oversupply of luxury flats by developers but chronic shortage of affordable housing for low- income families.

Affordable Housing: the China approach compared with Hong Kong approach & policy suggestions ¨ The Hong Kong approach ¨ Public housing programs are mainly administered by the Hong Kong Housing Authority (since 1953), with more than half of the over 7 million population now living in public housing estates. ¨ A non-profit making HK Housing Society was also established in 1952 to produce affordable housing for the lower income group. It manages some 42 estates in the territory.

Affordable Housing: the China approach compared with Hong Kong approach & policy suggestions ¨ In December 2003, 49. 6% of the population in HK lived in public housing in more than 200 estates across the Special Admin. Region. ¨ The Housing Authority also built flats under the Home Ownership Scheme (HOS) for sale to eligible families. ¨ Similarly, subsidized public flats under the ‘Tenant Purchase Scheme’ were once sold to sitting tenants at very affordable prices but was not as popular as HOS due to existing low rents and maintenance responsibilities.

Affordable Housing: the China approach compared with Hong Kong approach & policy suggestions ¨ Sale of Home Ownership flats was suspended from Nov. 2002 to Jan. 2007, lest it was a drag on the property market. ¨ It was replaced by a Home Assistance Loan scheme which provided interest-free loans to enable low-income families in Hong Kong to buy in the private market.

Affordable Housing: the China approach compared with Hong Kong approach & policy suggestions ¨ Policy suggestions ¨ Lai (1998) argues that ’more living and floor space produced under a property market-led regime of housing governance is less likely to achieve the social objective of decent and affordable housing for the whole nation. ’ ¨ To protect the interests of the low-income groups, the Chinese government should provide low-rent homes as a form of housing security system.

Affordable Housing: the China approach compared with Hong Kong approach & policy suggestions ¨ ‘The present housing reform is only liberalizing the property housing market. There is no public social housing program to provide for those in need. This omission might one day trigger off social instability in urban areas’(Lai, 1998). ¨ Hence, a special body like the HK Housing Authority should be set up to implement public housing programs in Mainland China.

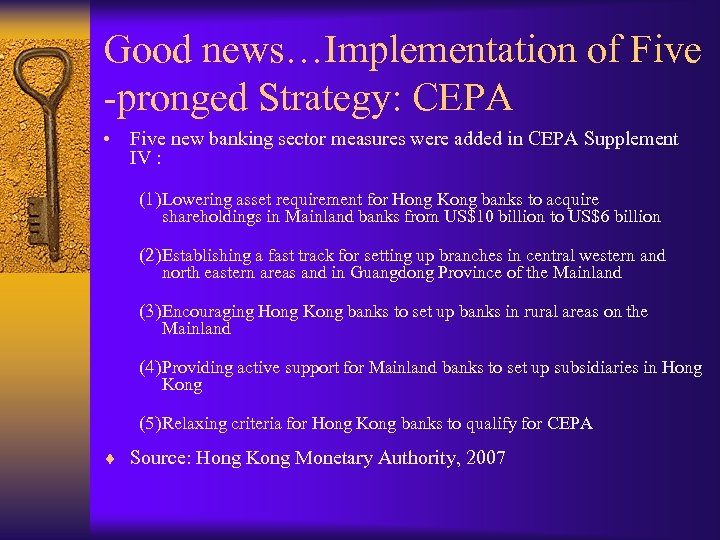

Good news…Implementation of Five -pronged Strategy: CEPA • Five new banking sector measures were added in CEPA Supplement IV : (1) Lowering asset requirement for Hong Kong banks to acquire shareholdings in Mainland banks from US$10 billion to US$6 billion (2) Establishing a fast track for setting up branches in central western and north eastern areas and in Guangdong Province of the Mainland (3) Encouraging Hong Kong banks to set up banks in rural areas on the Mainland (4) Providing active support for Mainland banks to set up subsidiaries in Hong Kong (5) Relaxing criteria for Hong Kong banks to qualify for CEPA ¨ Source: Hong Kong Monetary Authority, 2007

Conclusions ¨ 6. 1 Implications of the Research ¨ It is interesting to note that the interview data suggest more home buyers in Guangzhou (58. 5%) bought their first home by one-off payment than home buyers in Zhuhai (42. 8%), reflected probably by higher income earnings in Guangzhou and the new housing allowance scheme there from 1998.

Conclusions 6. 2 Suggestions for further Research ¨ As newcomers to the capitalist market, Chinese households finance their home purchase differently from people buying in a mature capitalist market. ¨ By asking the same interview questions for a control group of first-time buyers in Hong Kong, the differences in home financing between FHB in in Hong Kong and their counterparts in Guangzhou & Zhuhai can be found.

Thank you very much!

References ¨ Chiu, Rebecca L. H. (1996 a) “Housing”, chapter 14 in Shanghai: Transformation and modernization under China’s open policy, Yeung, Y. M. and Sung Yun-wing, eds. , The Chinese University Press, Hong Kong, 341 -374. ¨ Chiu, Rebecca L. H. (1996 b) “Housing affordability in Shenzhen Special Economic Zone: A forerunner of China’s housing reform”, Housing Studies, Vol. 11, No. 4, October, 561 -580.

References ¨ Lai, On-kwok (1998) “Governance and the housing question in a transitional economy, the political economy of housing policy in China reconsidered”, HABITAT INTERNATIONAL, Vol. 22, No. 3, pp. 231 -243. ¨ Levy, Daborah and Henry, Mattew (2003) “A comparative analysis of US, UK and Australian published property research methodologies and methods”, Pacific Rim Property Research Journal, volume 9, number 2, June 148 -162.

References ¨ Hong Kong Monetary Authority ‘Briefing to the Legislative Council Panel on Financial Affairs’ 8 November 2007

References ¨ Lee, James (2000) ‘From welfare housing to home ownership: The dilemma of China’s housing reform’, Housing Studies 15(1) pp. 61 -76. ¨ Li, Peter (2003), “Housing reforms in China: a paradigm shift to market economy”, Pacific Rim Property Research Journal, volume 9, number 2, June 180 -196.

References ¨ LI, Si-Ming & YI, Zheng (2007) “Financing Home Purchase in China, with Special Reference to Guangzhou”, Housing Studies vol. 22, no. 3, 409 -425.

References ¨ Shaw, Victor N. (1997) “Urban Housing reform in China”, Habitat International, Vol. 21, No. 2, June, 199 -212. ¨ Wang, Y. P. & Li, S. M. (2006) Socioeconomic differentials and stated housing preferences in Guangzhou, China, Habitat International, 30 (2006), 305 -326.

References ¨ Wang, Y. P. and Murie, A. (2000) ‘Social and Spatial Implications of Housing Reform in China’, International Journal of Urban and Regional Research, 24. 2, 397 -417. ¨ World Bank (1992) China: Implementation Options for Urban Housing Reform, Washington, D. C.

References ¨ Wu, Fulong (1996) “Changes in the structure of public housing provision in urban China’, Urban Studies, Vol. 33, No. 9, November, 1601 -1627. ¨ Wu, Fulong (2001) ‘China’s recent urban development in the process of land housing marketisation and economic globalisation, HABITAT INTERNATIONAL 25, 273 -289. ¨ Zhongguo fangdichan 2002/2 (China Real Estate, February 2002), p. 14.

References ¨ Zhou, Min and John R. Logan (1996) “Market transition and the commodification of housing in urban China”, International Journal of Urban and Regional Research, Vol. 20, No. 3 September, 400 -421.

9e38203b4b3241d6978605e01db2c10f.ppt