2102961e25dc3ed46f6678100498b04e.ppt

- Количество слайдов: 41

Financing Hightech Startups Georg Licht Centre for European Economic Research (ZEW) Industrial Economics and International Management Mannheim DIMETIC Ph. D Workshop July 8, 2009 Pécs, Hungary

Financing Hightech Startups Georg Licht Centre for European Economic Research (ZEW) Industrial Economics and International Management Mannheim DIMETIC Ph. D Workshop July 8, 2009 Pécs, Hungary

Outline v Some examples of startups in high tech v How are entrepreneurial ventures financed? v Business Angels v Venture Capital v Banks

Outline v Some examples of startups in high tech v How are entrepreneurial ventures financed? v Business Angels v Venture Capital v Banks

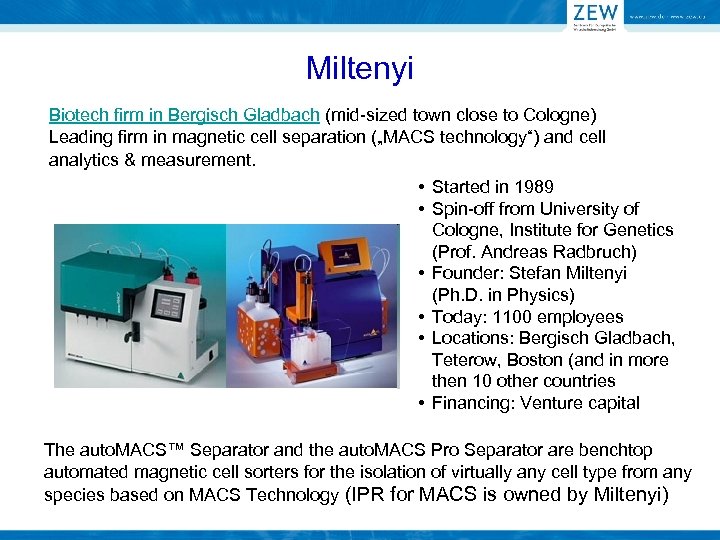

Miltenyi Biotech firm in Bergisch Gladbach (mid-sized town close to Cologne) Leading firm in magnetic cell separation („MACS technology“) and cell analytics & measurement. • Started in 1989 • Spin-off from University of Cologne, Institute for Genetics (Prof. Andreas Radbruch) • Founder: Stefan Miltenyi (Ph. D. in Physics) • Today: 1100 employees • Locations: Bergisch Gladbach, Teterow, Boston (and in more then 10 other countries • Financing: Venture capital The auto. MACS™ Separator and the auto. MACS Pro Separator are benchtop automated magnetic cell sorters for the isolation of virtually any cell type from any species based on MACS Technology (IPR for MACS is owned by Miltenyi)

Miltenyi Biotech firm in Bergisch Gladbach (mid-sized town close to Cologne) Leading firm in magnetic cell separation („MACS technology“) and cell analytics & measurement. • Started in 1989 • Spin-off from University of Cologne, Institute for Genetics (Prof. Andreas Radbruch) • Founder: Stefan Miltenyi (Ph. D. in Physics) • Today: 1100 employees • Locations: Bergisch Gladbach, Teterow, Boston (and in more then 10 other countries • Financing: Venture capital The auto. MACS™ Separator and the auto. MACS Pro Separator are benchtop automated magnetic cell sorters for the isolation of virtually any cell type from any species based on MACS Technology (IPR for MACS is owned by Miltenyi)

Metaio v v v v Leading in development of Augmented Reality Technology. Unique software platform to combine interaktiv solutions and application in mixed real and virtual worlds Application: Marketing (e. g. furniture, cars, . . ), automation, factory planing, Application possible via internet, mobile phones, PCs, . . Started in 2003 in Munich Spin-off from Munich Technical University Today: 50 employees Sales and development units in San Francisco and Seoul Financing: Cash flow, founding teams equity + government R&D money

Metaio v v v v Leading in development of Augmented Reality Technology. Unique software platform to combine interaktiv solutions and application in mixed real and virtual worlds Application: Marketing (e. g. furniture, cars, . . ), automation, factory planing, Application possible via internet, mobile phones, PCs, . . Started in 2003 in Munich Spin-off from Munich Technical University Today: 50 employees Sales and development units in San Francisco and Seoul Financing: Cash flow, founding teams equity + government R&D money

COPS

COPS

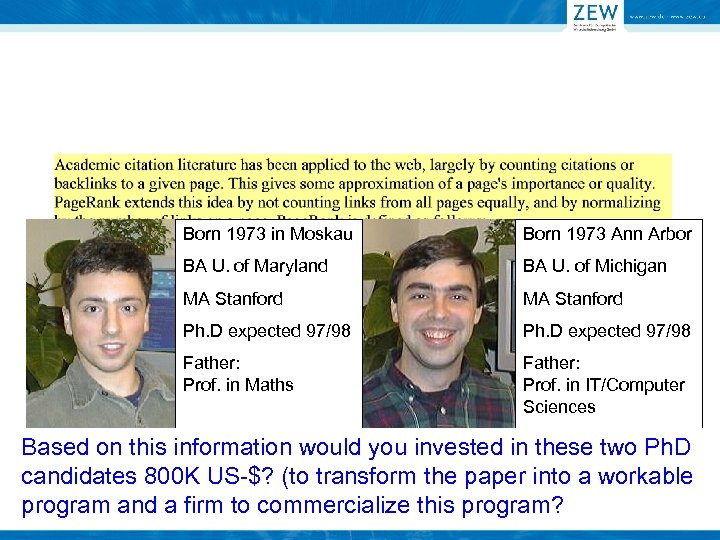

Born 1973 in Moskau Born 1973 Ann Arbor BA U. of Maryland BA U. of Michigan MA Stanford Ph. D expected 97/98 Father: Prof. in Maths Father: Prof. in IT/Computer Sciences Based on this information would you invested in these two Ph. D candidates 800 K US-$? (to transform the paper into a workable program and a firm to commercialize this program?

Born 1973 in Moskau Born 1973 Ann Arbor BA U. of Maryland BA U. of Michigan MA Stanford Ph. D expected 97/98 Father: Prof. in Maths Father: Prof. in IT/Computer Sciences Based on this information would you invested in these two Ph. D candidates 800 K US-$? (to transform the paper into a workable program and a firm to commercialize this program?

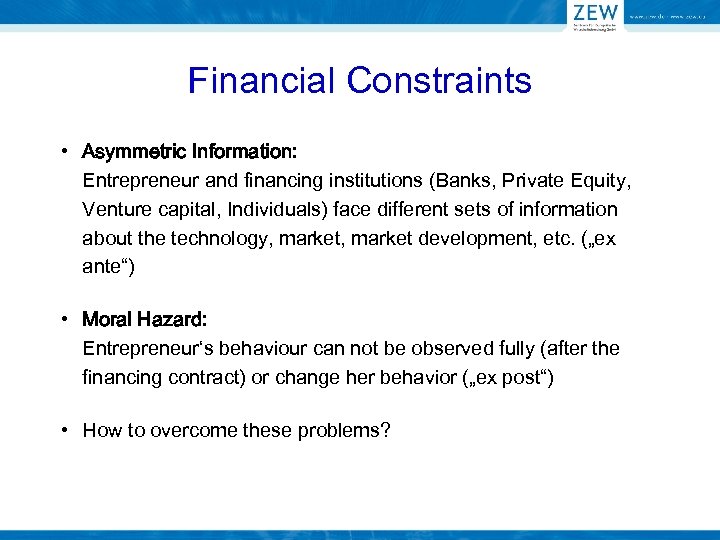

Financial Constraints • Asymmetric Information: Entrepreneur and financing institutions (Banks, Private Equity, Venture capital, Individuals) face different sets of information about the technology, market development, etc. („ex ante“) • Moral Hazard: Entrepreneur‘s behaviour can not be observed fully (after the financing contract) or change her behavior („ex post“) • How to overcome these problems?

Financial Constraints • Asymmetric Information: Entrepreneur and financing institutions (Banks, Private Equity, Venture capital, Individuals) face different sets of information about the technology, market development, etc. („ex ante“) • Moral Hazard: Entrepreneur‘s behaviour can not be observed fully (after the financing contract) or change her behavior („ex post“) • How to overcome these problems?

How are young ventures financed?

How are young ventures financed?

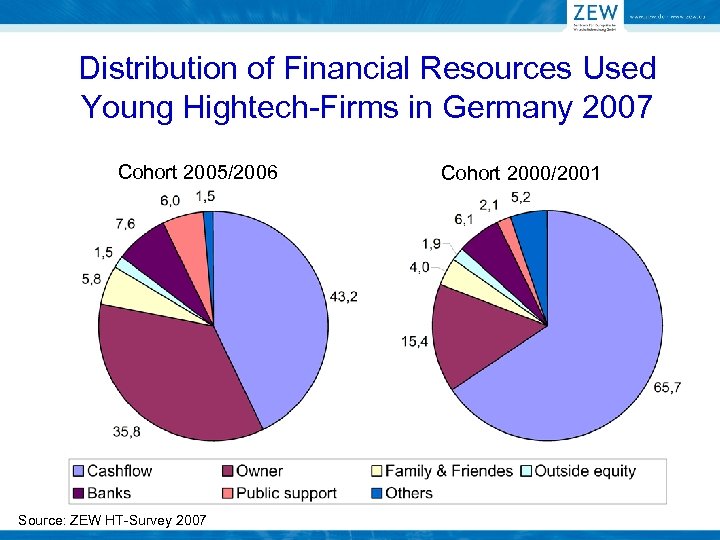

Distribution of Financial Resources Used Young Hightech-Firms in Germany 2007 Cohort 2005/2006 Source: ZEW HT-Survey 2007 Cohort 2000/2001

Distribution of Financial Resources Used Young Hightech-Firms in Germany 2007 Cohort 2005/2006 Source: ZEW HT-Survey 2007 Cohort 2000/2001

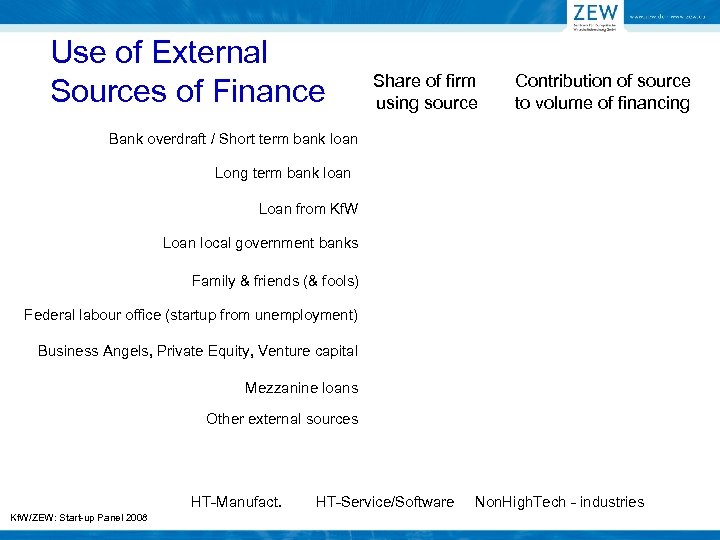

Use of External Sources of Finance Share of firm using source Contribution of source to volume of financing Bank overdraft / Short term bank loan Long term bank loan Loan from Kf. W Loan local government banks Family & friends (& fools) Federal labour office (startup from unemployment) Business Angels, Private Equity, Venture capital Mezzanine loans Other external sources HT-Manufact. Kf. W/ZEW: Start-up Panel 2008 HT-Service/Software Non. High. Tech - industries

Use of External Sources of Finance Share of firm using source Contribution of source to volume of financing Bank overdraft / Short term bank loan Long term bank loan Loan from Kf. W Loan local government banks Family & friends (& fools) Federal labour office (startup from unemployment) Business Angels, Private Equity, Venture capital Mezzanine loans Other external sources HT-Manufact. Kf. W/ZEW: Start-up Panel 2008 HT-Service/Software Non. High. Tech - industries

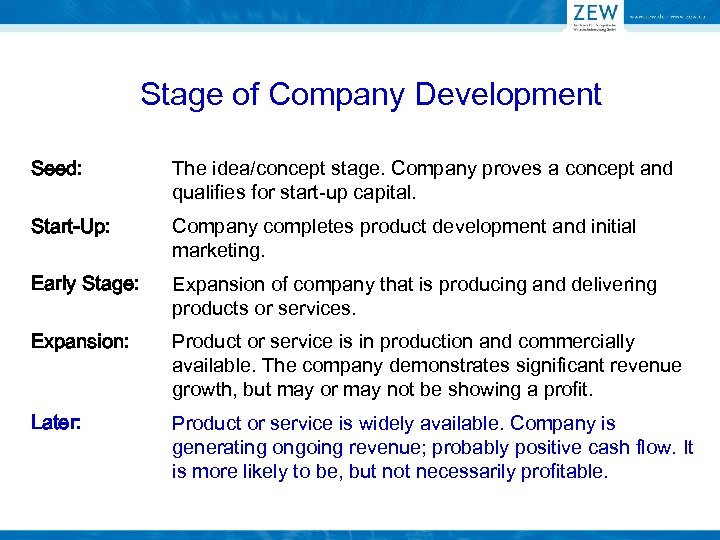

Stage of Company Development Seed: The idea/concept stage. Company proves a concept and qualifies for start-up capital. Start-Up: Company completes product development and initial marketing. Early Stage: Expansion of company that is producing and delivering products or services. Expansion: Product or service is in production and commercially available. The company demonstrates significant revenue growth, but may or may not be showing a profit. Later: Product or service is widely available. Company is generating ongoing revenue; probably positive cash flow. It is more likely to be, but not necessarily profitable.

Stage of Company Development Seed: The idea/concept stage. Company proves a concept and qualifies for start-up capital. Start-Up: Company completes product development and initial marketing. Early Stage: Expansion of company that is producing and delivering products or services. Expansion: Product or service is in production and commercially available. The company demonstrates significant revenue growth, but may or may not be showing a profit. Later: Product or service is widely available. Company is generating ongoing revenue; probably positive cash flow. It is more likely to be, but not necessarily profitable.

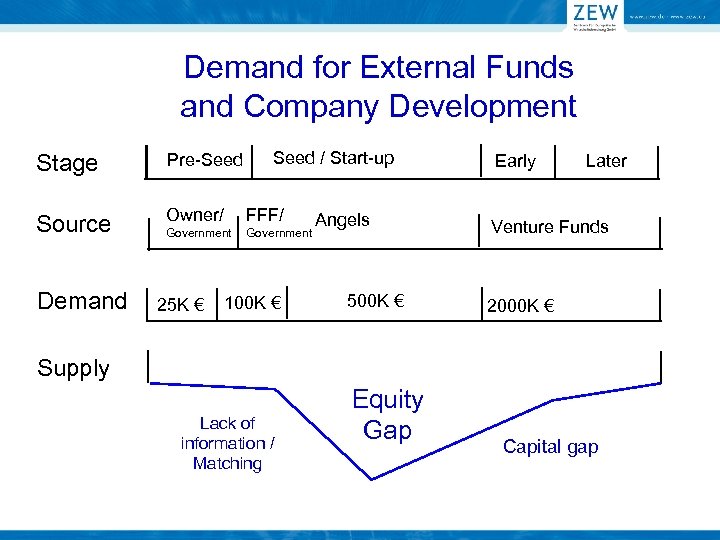

Demand for External Funds and Company Development Stage Pre-Seed Source Owner/ Demand Government 25 K € Seed / Start-up FFF/ Government 100 K € Supply Lack of information / Matching Angels 500 K € Equity Gap Early Later Venture Funds 2000 K € Capital gap

Demand for External Funds and Company Development Stage Pre-Seed Source Owner/ Demand Government 25 K € Seed / Start-up FFF/ Government 100 K € Supply Lack of information / Matching Angels 500 K € Equity Gap Early Later Venture Funds 2000 K € Capital gap

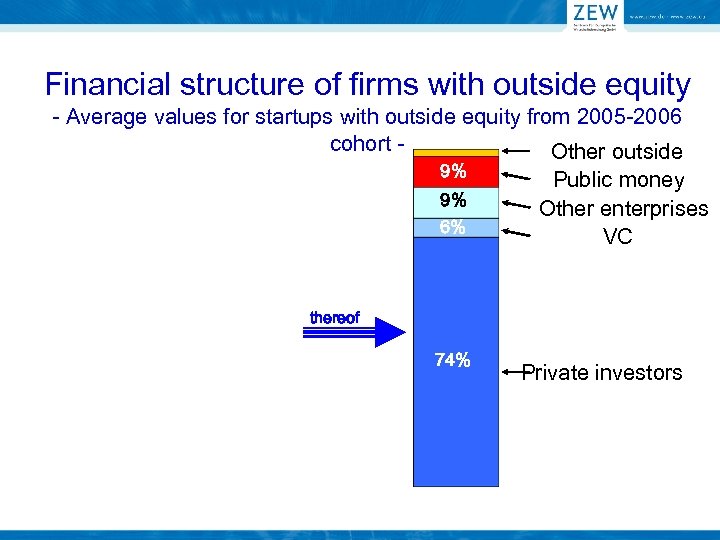

Financial structure of firms with outside equity - Average values for startups with outside equity from 2005 -2006 cohort - thereof

Financial structure of firms with outside equity - Average values for startups with outside equity from 2005 -2006 cohort - thereof

Financial structure of firms with outside equity - Average values for startups with outside equity from 2005 -2006 cohort Other outside 9% 9% 6% Public money Other enterprises VC thereof 74% Private investors

Financial structure of firms with outside equity - Average values for startups with outside equity from 2005 -2006 cohort Other outside 9% 9% 6% Public money Other enterprises VC thereof 74% Private investors

Business Angel Finance

Business Angel Finance

Business Angels v Rich individuals v Investing their own money v Aiming at profit v Investing in small companies not listed at a stock exchange v No family ties v (sometimes philanthropic motivation) v Investing in seed and early stages v Investment size: 20 k Euro to 250 k Euro (as a rule)

Business Angels v Rich individuals v Investing their own money v Aiming at profit v Investing in small companies not listed at a stock exchange v No family ties v (sometimes philanthropic motivation) v Investing in seed and early stages v Investment size: 20 k Euro to 250 k Euro (as a rule)

Definition of Firms with Equity Financing by Private Investors & Business Angels Private Investors: Individuals investing in young firms (incl. Investments via BA Fonds or BA networks) Business Angels: Private Investors providing money and additional support services for their portfolio companies Firm management values the support as „helpful“ (Advice, Contacts, Infrastructure, Administration, R&D, Production, . . )

Definition of Firms with Equity Financing by Private Investors & Business Angels Private Investors: Individuals investing in young firms (incl. Investments via BA Fonds or BA networks) Business Angels: Private Investors providing money and additional support services for their portfolio companies Firm management values the support as „helpful“ (Advice, Contacts, Infrastructure, Administration, R&D, Production, . . )

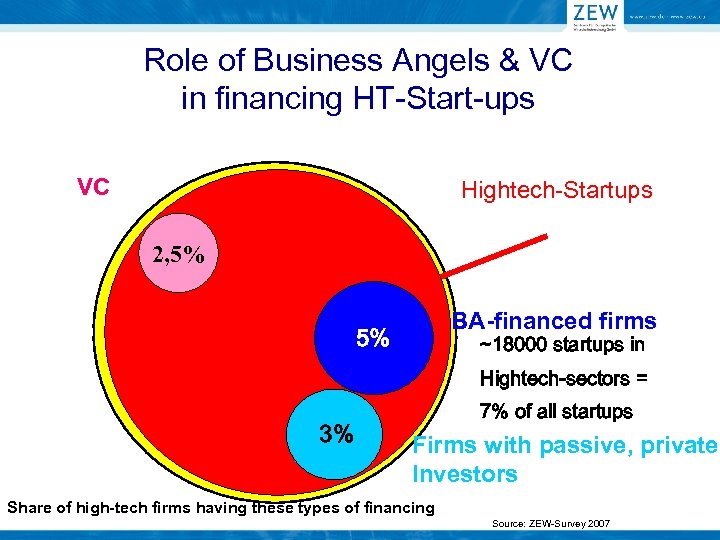

Role of Business Angels & VC in financing HT-Start-ups VC Hightech-Startups Alle Unternehmens 2, 5% gründungen BA-financed firms 5% ~18000 startups in Hightech-sectors = 3% 7% of all startups Firms with passive, private Investors Share of high-tech firms having these types of financing Source: ZEW-Survey 2007

Role of Business Angels & VC in financing HT-Start-ups VC Hightech-Startups Alle Unternehmens 2, 5% gründungen BA-financed firms 5% ~18000 startups in Hightech-sectors = 3% 7% of all startups Firms with passive, private Investors Share of high-tech firms having these types of financing Source: ZEW-Survey 2007

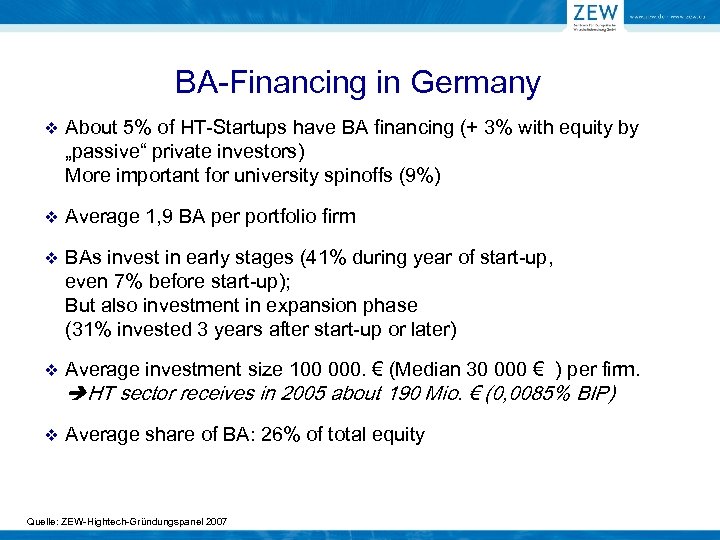

BA-Financing in Germany v About 5% of HT-Startups have BA financing (+ 3% with equity by „passive“ private investors) More important for university spinoffs (9%) v Average 1, 9 BA per portfolio firm v BAs invest in early stages (41% during year of start-up, even 7% before start-up); But also investment in expansion phase (31% invested 3 years after start-up or later) v Average investment size 100 000. € (Median 30 000 € ) per firm. v Average share of BA: 26% of total equity HT sector receives in 2005 about 190 Mio. € (0, 0085% BIP) Quelle: ZEW-Hightech-Gründungspanel 2007

BA-Financing in Germany v About 5% of HT-Startups have BA financing (+ 3% with equity by „passive“ private investors) More important for university spinoffs (9%) v Average 1, 9 BA per portfolio firm v BAs invest in early stages (41% during year of start-up, even 7% before start-up); But also investment in expansion phase (31% invested 3 years after start-up or later) v Average investment size 100 000. € (Median 30 000 € ) per firm. v Average share of BA: 26% of total equity HT sector receives in 2005 about 190 Mio. € (0, 0085% BIP) Quelle: ZEW-Hightech-Gründungspanel 2007

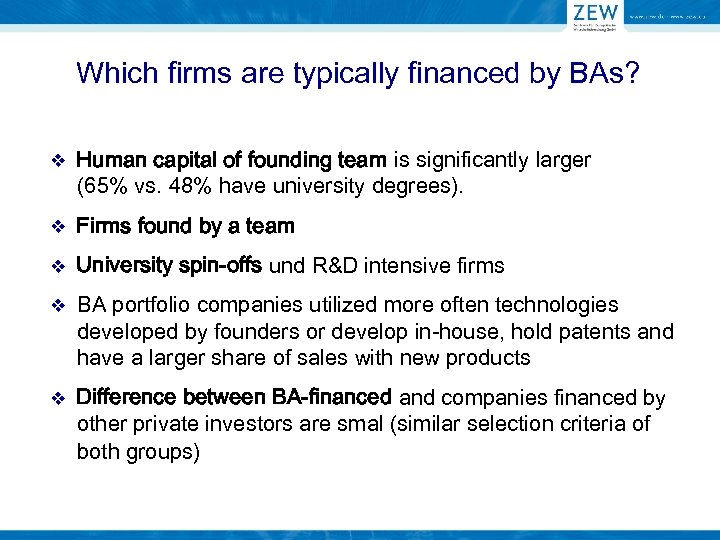

Which firms are typically financed by BAs? v Human capital of founding team is significantly larger (65% vs. 48% have university degrees). v Firms found by a team v University spin-offs und R&D intensive firms v BA portfolio companies utilized more often technologies developed by founders or develop in-house, hold patents and have a larger share of sales with new products v Difference between BA-financed and companies financed by other private investors are smal (similar selection criteria of both groups)

Which firms are typically financed by BAs? v Human capital of founding team is significantly larger (65% vs. 48% have university degrees). v Firms found by a team v University spin-offs und R&D intensive firms v BA portfolio companies utilized more often technologies developed by founders or develop in-house, hold patents and have a larger share of sales with new products v Difference between BA-financed and companies financed by other private investors are smal (similar selection criteria of both groups)

Support by Business Angels Areas of support by BAs Multiple answers possible Source: ZEW HT Survey

Support by Business Angels Areas of support by BAs Multiple answers possible Source: ZEW HT Survey

How portfolio companies value the support by BAs? Remark: These are conditional probabilities because only those firms are considered which have received some „slight support“ in these areas. Source: ZEW HT Survey 2007

How portfolio companies value the support by BAs? Remark: These are conditional probabilities because only those firms are considered which have received some „slight support“ in these areas. Source: ZEW HT Survey 2007

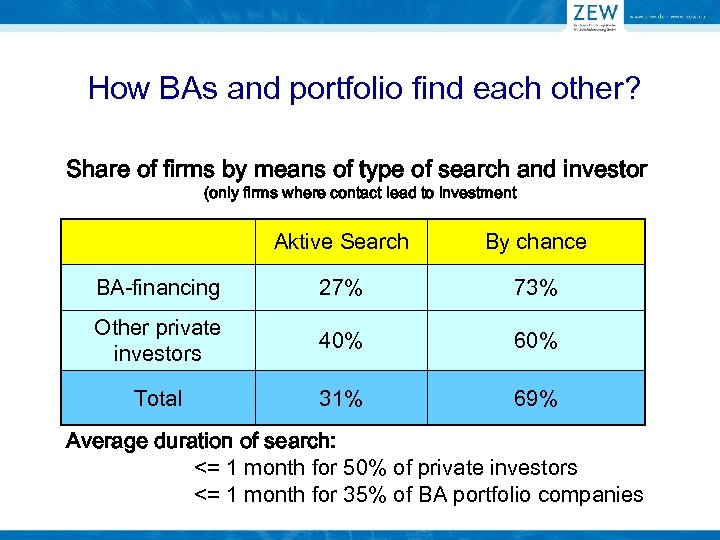

How BAs and portfolio find each other? Share of firms by means of type of search and investor (only firms where contact lead to investment Aktive Search By chance BA-financing 27% 73% Other private investors 40% 60% Total 31% 69% Average duration of search: <= 1 month for 50% of private investors <= 1 month for 35% of BA portfolio companies

How BAs and portfolio find each other? Share of firms by means of type of search and investor (only firms where contact lead to investment Aktive Search By chance BA-financing 27% 73% Other private investors 40% 60% Total 31% 69% Average duration of search: <= 1 month for 50% of private investors <= 1 month for 35% of BA portfolio companies

Who was helpful in finding a private investor? Multiply answers possible Source: ZEW HT Survey 2007

Who was helpful in finding a private investor? Multiply answers possible Source: ZEW HT Survey 2007

Success probability for various channels? Relation between contract points, which turned into an equity invest and all contact points tried to receive an investment Slource: ZEW-HAT survey 2007

Success probability for various channels? Relation between contract points, which turned into an equity invest and all contact points tried to receive an investment Slource: ZEW-HAT survey 2007

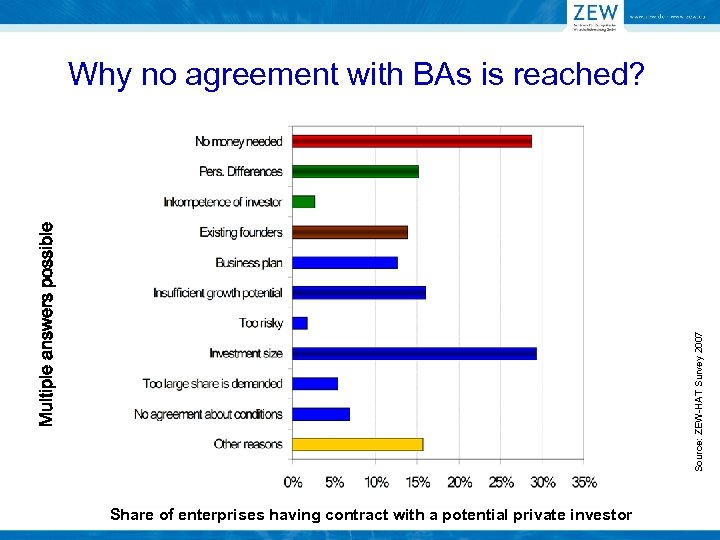

Source: ZEW-HAT Survey 2007 Multiple answers possible Why no agreement with BAs is reached? Share of enterprises having contract with a potential private investor

Source: ZEW-HAT Survey 2007 Multiple answers possible Why no agreement with BAs is reached? Share of enterprises having contract with a potential private investor

Venture Capital Financing

Venture Capital Financing

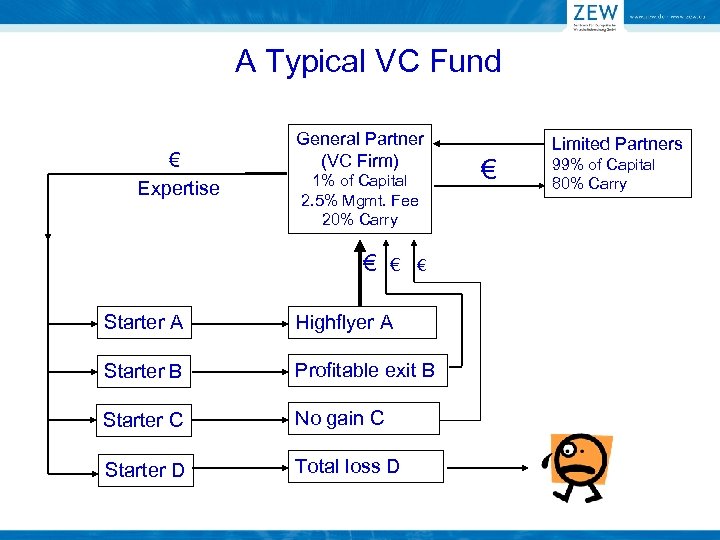

A Typical VC Fund € Expertise General Partner (VC Firm) 1% of Capital 2. 5% Mgmt. Fee 20% Carry € € € Starter A Highflyer A Starter B Profitable exit B Starter C No gain C Starter D Total loss D € Limited Partners 99% of Capital 80% Carry

A Typical VC Fund € Expertise General Partner (VC Firm) 1% of Capital 2. 5% Mgmt. Fee 20% Carry € € € Starter A Highflyer A Starter B Profitable exit B Starter C No gain C Starter D Total loss D € Limited Partners 99% of Capital 80% Carry

How Firms signal their type v Track record of owners / founders v Owners / founders invest their own money v IPR (Patents, …. ) v Government R&D support v Links to other organisations v (BAs)

How Firms signal their type v Track record of owners / founders v Owners / founders invest their own money v IPR (Patents, …. ) v Government R&D support v Links to other organisations v (BAs)

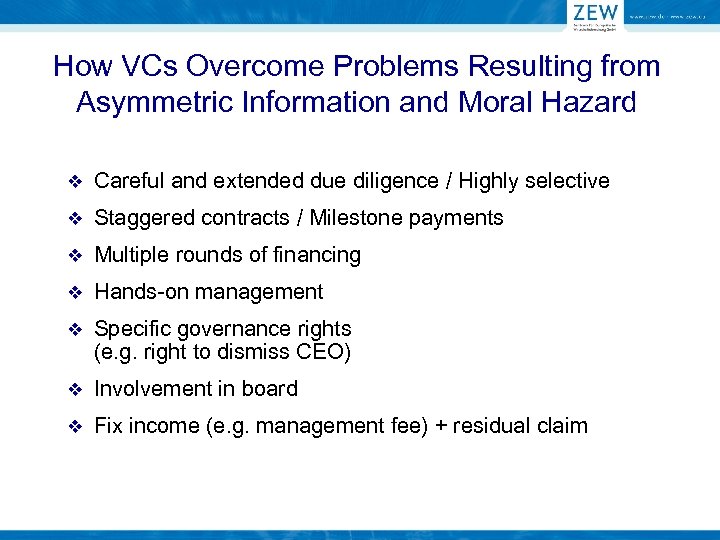

How VCs Overcome Problems Resulting from Asymmetric Information and Moral Hazard v Careful and extended due diligence / Highly selective v Staggered contracts / Milestone payments v Multiple rounds of financing v Hands-on management v Specific governance rights (e. g. right to dismiss CEO) v Involvement in board v Fix income (e. g. management fee) + residual claim

How VCs Overcome Problems Resulting from Asymmetric Information and Moral Hazard v Careful and extended due diligence / Highly selective v Staggered contracts / Milestone payments v Multiple rounds of financing v Hands-on management v Specific governance rights (e. g. right to dismiss CEO) v Involvement in board v Fix income (e. g. management fee) + residual claim

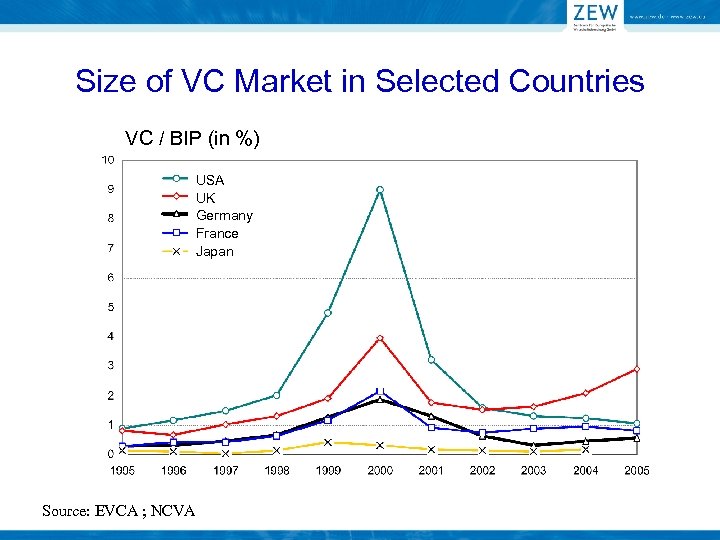

Size of VC Market in Selected Countries VC / BIP (in %) USA UK Germany France Japan Source: EVCA ; NCVA

Size of VC Market in Selected Countries VC / BIP (in %) USA UK Germany France Japan Source: EVCA ; NCVA

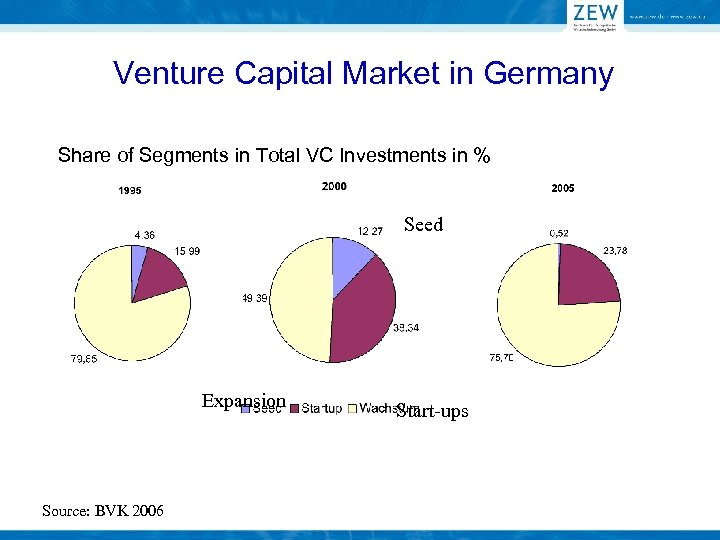

Venture Capital Market in Germany Share of Segments in Total VC Investments in % Seed Expansion Source: BVK 2006 Start-ups

Venture Capital Market in Germany Share of Segments in Total VC Investments in % Seed Expansion Source: BVK 2006 Start-ups

Banks and Financing of SMEs

Banks and Financing of SMEs

Dominance of Loans - Supply Side Explanations v Continental European “Relationship-Banking”: § “Three-pillar-model”: Large private banks, Small (regional) private banks, Public/Community banks § Strong regional anchorage § Traditionally: pricing of loans not risk adequate v Strong position of creditors in case of default (Insolvency)

Dominance of Loans - Supply Side Explanations v Continental European “Relationship-Banking”: § “Three-pillar-model”: Large private banks, Small (regional) private banks, Public/Community banks § Strong regional anchorage § Traditionally: pricing of loans not risk adequate v Strong position of creditors in case of default (Insolvency)

Dominance of Loans - Demand Side Explanations v Size-related restrictions regarding certain financing options (Significant fixed costs related to the size of loans) v Fiscal treatment of loans vs. equity v Outstanding position of the entrepreneur-personality § Accentuation of operative business vs. financing-management § Comparable low knowledge of financing-issues in medium- sized companies § No systematic analysis of financing alternatives § High preference in the entrepreneurial freedom of decisions

Dominance of Loans - Demand Side Explanations v Size-related restrictions regarding certain financing options (Significant fixed costs related to the size of loans) v Fiscal treatment of loans vs. equity v Outstanding position of the entrepreneur-personality § Accentuation of operative business vs. financing-management § Comparable low knowledge of financing-issues in medium- sized companies § No systematic analysis of financing alternatives § High preference in the entrepreneurial freedom of decisions

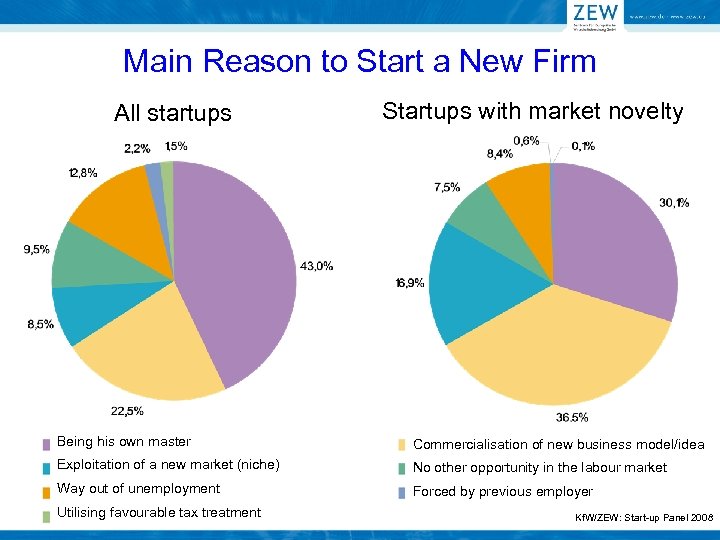

Main Reason to Start a New Firm All startups Startups with market novelty Being his own master Commercialisation of new business model/idea Exploitation of a new market (niche) No other opportunity in the labour market Way out of unemployment Forced by previous employer Utilising favourable tax treatment Kf. W/ZEW: Start-up Panel 2008

Main Reason to Start a New Firm All startups Startups with market novelty Being his own master Commercialisation of new business model/idea Exploitation of a new market (niche) No other opportunity in the labour market Way out of unemployment Forced by previous employer Utilising favourable tax treatment Kf. W/ZEW: Start-up Panel 2008

Further Reading RECOMMENDED v Gompers, P. And J. Lerner (1999), The Venture Capital Cycle, MIT Press: Boston v Freear, J. , Sohl, J. and Wetzel, W. , 1994, Angels and non-Angels: are there differences? , Journal of Business Venturing, 9, 85 -94. v UN Economic Commission For Europe (2007), Financing Innovative Development. Comparative Review of the Experiences of UNECE Countries in Early-Stage Financing, New York and Geneva. v Shane, Scott (2008), The Illusions of Entrepreneurship – The Costly Myths that Entrepreneurs, Investors and Policy Makers Live By, Yale University Press: New Haven. (esp. chapter 5: How are New Businesses Financed? ) v Gorman/Sahlman (1989): What do Venture Capitalists do? in: Journal of Business Venturing, 4. Jg. , S. 231 -248 ADDITIONAL LITERATURE v Vise, David A. , Mark Malseed (2005), The Google Story – Inside the Hottest Business, Media and Technology of Our Times, Delacorte Press/Random House: New York. . v Sahlman (1990): The Structure and Governance of Venture-Capital Organizations, in: Journal of Financial Economics, 27, 473 -521. v Kaplan, S. and Zingales, L. (1997) ‘Do investment - cash flow sensitivies provide useful measures of financing constraints? ’, Quarterly Journal of Economics 112, 169 -216. v Hubbard, R. G. (1998): ‘Capital-Market Imperfections and Investment’, Journal of Economic Literature, 36, 193 -225.

Further Reading RECOMMENDED v Gompers, P. And J. Lerner (1999), The Venture Capital Cycle, MIT Press: Boston v Freear, J. , Sohl, J. and Wetzel, W. , 1994, Angels and non-Angels: are there differences? , Journal of Business Venturing, 9, 85 -94. v UN Economic Commission For Europe (2007), Financing Innovative Development. Comparative Review of the Experiences of UNECE Countries in Early-Stage Financing, New York and Geneva. v Shane, Scott (2008), The Illusions of Entrepreneurship – The Costly Myths that Entrepreneurs, Investors and Policy Makers Live By, Yale University Press: New Haven. (esp. chapter 5: How are New Businesses Financed? ) v Gorman/Sahlman (1989): What do Venture Capitalists do? in: Journal of Business Venturing, 4. Jg. , S. 231 -248 ADDITIONAL LITERATURE v Vise, David A. , Mark Malseed (2005), The Google Story – Inside the Hottest Business, Media and Technology of Our Times, Delacorte Press/Random House: New York. . v Sahlman (1990): The Structure and Governance of Venture-Capital Organizations, in: Journal of Financial Economics, 27, 473 -521. v Kaplan, S. and Zingales, L. (1997) ‘Do investment - cash flow sensitivies provide useful measures of financing constraints? ’, Quarterly Journal of Economics 112, 169 -216. v Hubbard, R. G. (1998): ‘Capital-Market Imperfections and Investment’, Journal of Economic Literature, 36, 193 -225.

The End Thanks for your attention

The End Thanks for your attention

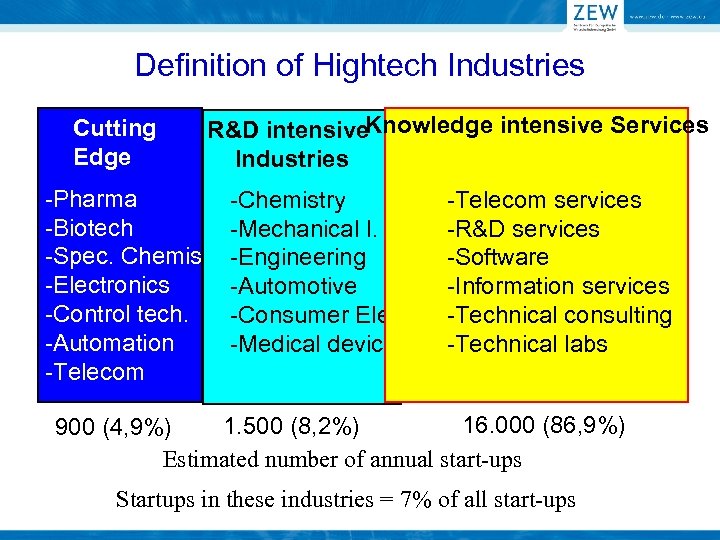

Definition of Hightech Industries Cutting Edge R&D intensive. Knowledge intensive Services Industries -Pharma -Biotech -Spec. Chemisty -Electronics -Control tech. -Automation -Telecom -Chemistry -Mechanical I. -Engineering -Automotive -Consumer Elec. -Medical devices -Telecom services -R&D services -Software -Information services -Technical consulting -Technical labs 16. 000 (86, 9%) 1. 500 (8, 2%) 900 (4, 9%) Estimated number of annual start-ups Startups in these industries = 7% of all start-ups

Definition of Hightech Industries Cutting Edge R&D intensive. Knowledge intensive Services Industries -Pharma -Biotech -Spec. Chemisty -Electronics -Control tech. -Automation -Telecom -Chemistry -Mechanical I. -Engineering -Automotive -Consumer Elec. -Medical devices -Telecom services -R&D services -Software -Information services -Technical consulting -Technical labs 16. 000 (86, 9%) 1. 500 (8, 2%) 900 (4, 9%) Estimated number of annual start-ups Startups in these industries = 7% of all start-ups

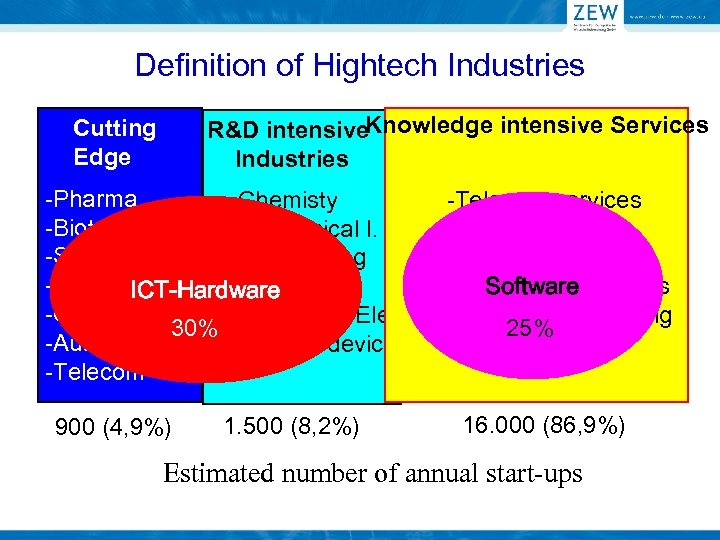

Definition of Hightech Industries R&D intensive. Knowledge intensive Services Industries Cutting Edge -Pharma -Chemisty -Biotech -Mechanical I. -Spec. Chemisty -Engineering -Electronics -Automotive ICT-Hardware -Control tech. -Consumer Elec. 30% -Automation -Medical devices -Telecom 900 (4, 9%) 1. 500 (8, 2%) -Telecom services -R&D services -Software -Information services -Technical consulting 25% -Technical labs 16. 000 (86, 9%) Estimated number of annual start-ups

Definition of Hightech Industries R&D intensive. Knowledge intensive Services Industries Cutting Edge -Pharma -Chemisty -Biotech -Mechanical I. -Spec. Chemisty -Engineering -Electronics -Automotive ICT-Hardware -Control tech. -Consumer Elec. 30% -Automation -Medical devices -Telecom 900 (4, 9%) 1. 500 (8, 2%) -Telecom services -R&D services -Software -Information services -Technical consulting 25% -Technical labs 16. 000 (86, 9%) Estimated number of annual start-ups

Econometric Evidence for Financial Constraints v v v Modigliani-Miller theorem: In the absence of taxes, bankruptcy costs, and asymmetric information, and in an efficient market, the value of a firm is unaffected by how a firm is financed. Variety of explanation why MM does not hold Hence: Search for evidence that (free) cash-flow has an impact on size and structure of investments of firms (e. g. R&D) Regression-based evidence is available for a large number of countries SMEs & young companies are more restricted

Econometric Evidence for Financial Constraints v v v Modigliani-Miller theorem: In the absence of taxes, bankruptcy costs, and asymmetric information, and in an efficient market, the value of a firm is unaffected by how a firm is financed. Variety of explanation why MM does not hold Hence: Search for evidence that (free) cash-flow has an impact on size and structure of investments of firms (e. g. R&D) Regression-based evidence is available for a large number of countries SMEs & young companies are more restricted