c4fcd34d8793f4b1dcee1c228e9e54fd.ppt

- Количество слайдов: 20

Financing Agribusiness in Serbia and Montenegro Levent Aydinoglu, Associate Banker Belgrade, 27 May 2004

Structure of the presentation l l l EBRD and agribusiness EBRD experience in agribusiness financing in CEE and CIS Selected agribusiness transactions Opportunities for financing agribusiness in Serbia and Montenegro Contact Information

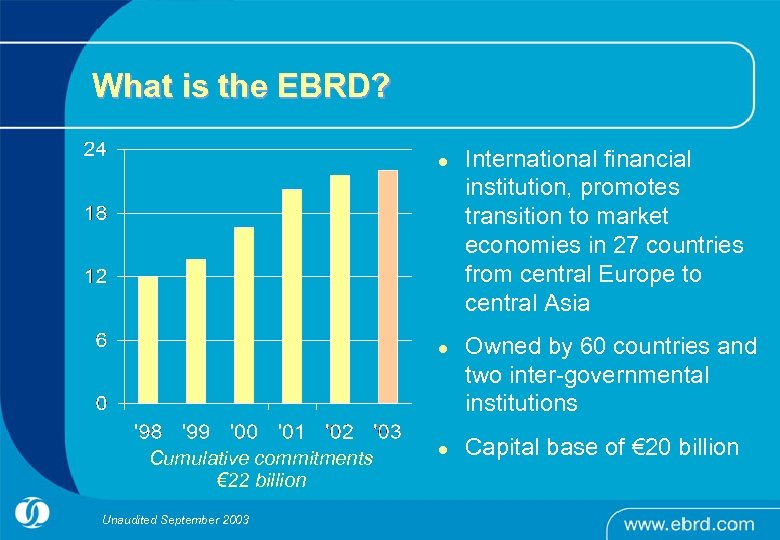

What is the EBRD? l l Cumulative commitments € 22 billion Unaudited September 2003 l International financial institution, promotes transition to market economies in 27 countries from central Europe to central Asia Owned by 60 countries and two inter-governmental institutions Capital base of € 20 billion

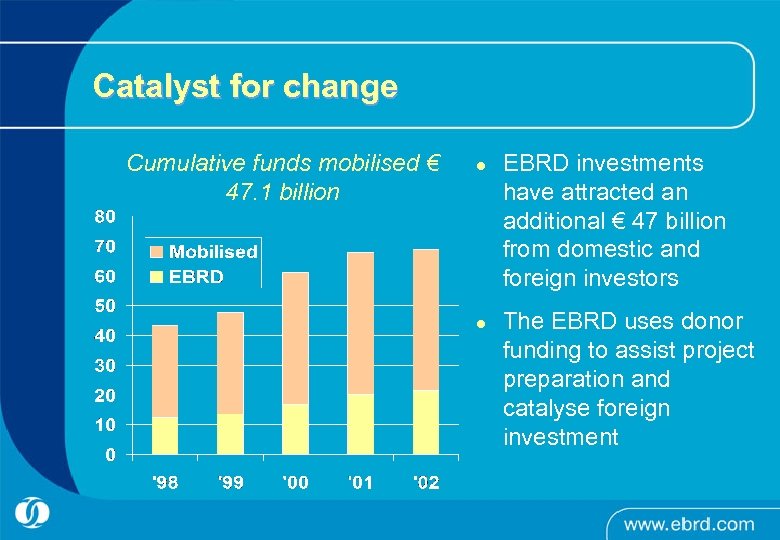

Catalyst for change Cumulative funds mobilised € 47. 1 billion l l EBRD investments have attracted an additional € 47 billion from domestic and foreign investors The EBRD uses donor funding to assist project preparation and catalyse foreign investment

Financial flexibility - Loans Wide range of loans l fixed or floating rate loans l l choice of currencies l l short to long-term maturities l Financing structured to meet project-specific needs including repayment schedules Tailored to particular situation of the country/region and sector Pricing reflects risks with project, borrower and country

EBRD and Agribusiness l l l AAA-rated multilateral institution founded in 1991, owned by 60 national and two supranational shareholders Playing a leading role in Central & Eastern Europe (CEE) and the former Soviet Union (CIS) Business oriented - working closely with private sector clients on commercial transactions

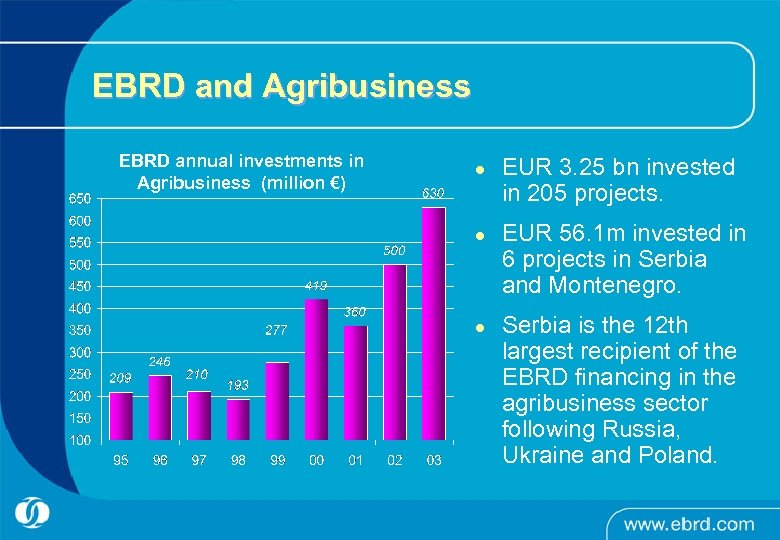

EBRD and Agribusiness EBRD annual investments in Agribusiness (million €) l l l EUR 3. 25 bn invested in 205 projects. EUR 56. 1 m invested in 6 projects in Serbia and Montenegro. Serbia is the 12 th largest recipient of the EBRD financing in the agribusiness sector following Russia, Ukraine and Poland.

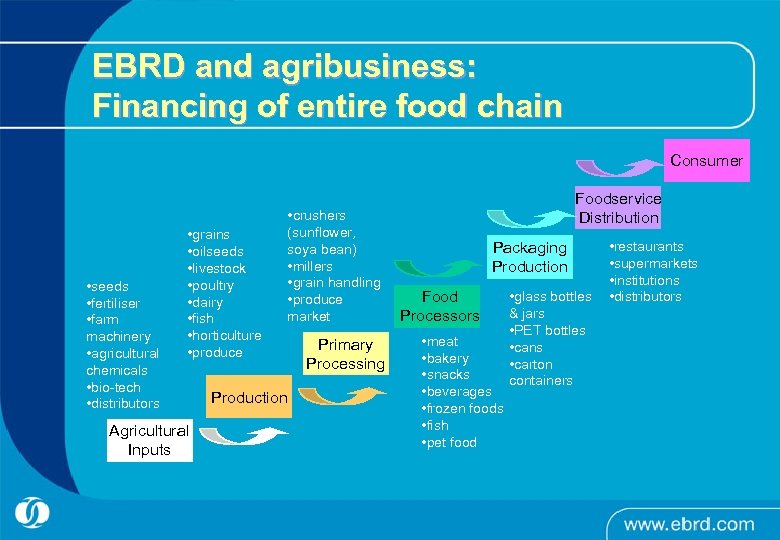

EBRD and agribusiness: Financing of entire food chain Consumer • seeds • fertiliser • farm machinery • agricultural chemicals • bio-tech • distributors • grains • oilseeds • livestock • poultry • dairy • fish • horticulture • produce Agricultural Inputs Production • crushers (sunflower, soya bean) • millers • grain handling • produce market Primary Processing Foodservice Distribution Packaging Production Food Processors • meat • bakery • snacks • beverages • frozen foods • fish • pet food • glass bottles & jars • PET bottles • cans • carton containers • restaurants • supermarkets • institutions • distributors

EBRD and agribusiness: Financing local & foreign market leaders

Recent Agribusiness Projects in Serbia and Montenegro Name of Project EBRD Finance Debt/Equity (Euro) Serbia/EPH/Warehouse Receipt Programme 6 m Debt Fresh & Co Frikom Grand Marbo SFIR 10 m 10. 1 m 7 m 7 m 16 m Equity Debt

Selected Investments in 2003 Grand Coffee l Local entrepreneur with successful track record l Serbia and Montenegro's largest coffee company l € 7 million debt to finance domestic and regional expansion

Selected Investments in 2003 Bonduelle l Bonduelle, world’s top processed-vegetable producer l € 15 m equity investment l For the construction of a greenfield vegetable canning plant, located in the Kransnodar region, Russia l To produce 60, 000 tonnes of fresh packaged vegetables

Selected agribusiness transactions l l Financing to DOEP (Cereol’s subsidiary) leading producer of refined edible oil in Ukraine A syndicated loan of US$ 43 m, structured and arranged by EBRD, to co-finance purchases of sunflower seeds and related working capital requirements.

EBRD experience in agribusiness financing: Key issues faced (1) Working capital: l lack of security and of financial support to farming and primary processing sector (2) Government policies: l changing laws/regulations, complex restructuring of agriconglomerates, EU accession talks cause further uncertainties (3) Production efficiency/competitiveness: l structural reasons for lower yields (4) Global industry challenges apply as well… l bargaining power of food producers vs retail chains

EBRD experience in agribusiness financing: Key issues learnt l Strong processors are the key to a healthy sector – provide a sustainable market for agricultural products l It is better to focus on the best companies – with long term views, and competitive advantages (marketing, distribution) l There are no standard financial solutions – agribusiness companies often need tailor made solutions l We have to understand the whole food chain – to make sure sufficient quality supplies are available l A better legal and institutional framework is a must – For farmers and processors to get the financing they need

Opportunities for financing agribusiness in Serbia and Montenegro: Traditional finance Debt l Senior, subordinated, convertible l Working capital l Equity l Common stock l Preferred shares Long-term maturities l l l Denominated in major currencies Flexible tailor-made security package Political risk guarantees Co-financing / Syndications l l Mezzanine financing Large minority positions Political risk guarantees (portage equity) l Substantial inhouse syndication department Equity / debt underwriting

Opportunities for financing agribusiness in Serbia and Montenegro l l Large number of high quality food producers with well known branded product Increasing penetration of organised retail and the opportunities and challenges this creates l Restructuring of food industry is not complete yet. l Financing needs are enormous.

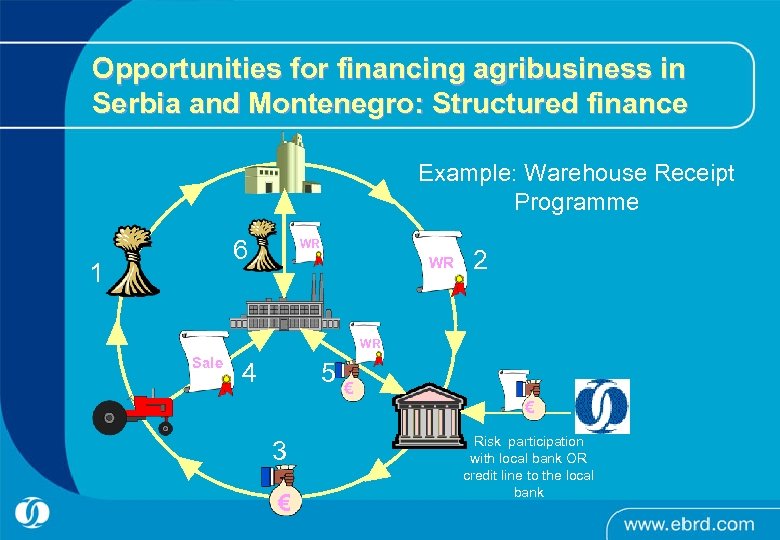

Opportunities for financing agribusiness in Serbia and Montenegro: Structured finance Example: Warehouse Receipt Programme 6 1 WR WR 2 WR Sale 4 5 € € 3 € Risk participation with local bank OR credit line to the local bank

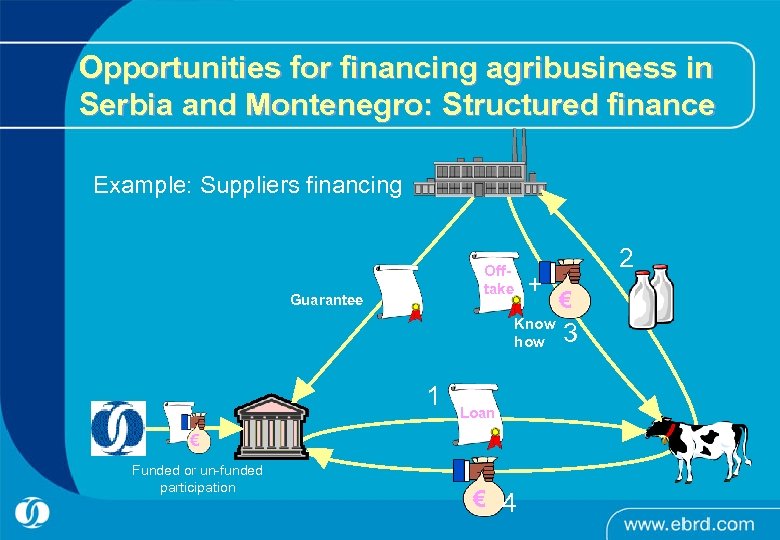

Opportunities for financing agribusiness in Serbia and Montenegro: Structured finance Example: Suppliers financing Offtake Guarantee + Know how 1 Loan € Funded or un-funded participation € 4 2 € 3

Contacts Levent Aydinoglu Tel: +44 207 338 7021 Email: Aydinogl@ebrd. com Associate Banker, Agribusiness Team

c4fcd34d8793f4b1dcee1c228e9e54fd.ppt