9fa96fe7bf69f8f093d1f929eda3b358.ppt

- Количество слайдов: 45

Financing a College Education 2014 -2015

Financing a College Education 2014 -2015

Why Are You Here? ¨ College is critical to your future ¨ Jobs of the future will require more skills than those provided by a high school education alone ¨ Students who go to college have financial advantages – their life-time earnings are higher than those of high school graduates – they are less likely to be unemployed – their children are more likely to attend college 2

Why Are You Here? ¨ College is critical to your future ¨ Jobs of the future will require more skills than those provided by a high school education alone ¨ Students who go to college have financial advantages – their life-time earnings are higher than those of high school graduates – they are less likely to be unemployed – their children are more likely to attend college 2

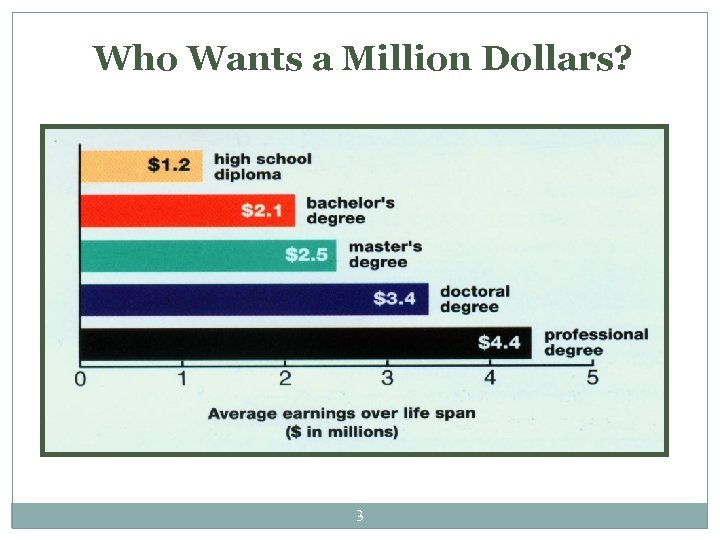

Who Wants a Million Dollars? 3

Who Wants a Million Dollars? 3

Workshop Agenda 4 The financial aid equation Who gets the money? Types of financial aid - grants, scholarships, work, and loans How to apply for financial aid Free scholarship searches

Workshop Agenda 4 The financial aid equation Who gets the money? Types of financial aid - grants, scholarships, work, and loans How to apply for financial aid Free scholarship searches

Who Gets the $$ 5 Basic Student Eligibility Requirements: Must be a US Citizen or an Eligible Non-Citizen Males must be registered with the Selective Services Must not be in Default on any Federal Loans Must be enrolled at least ½ time as a regular student in an eligible degree seeking program Must have received their high school diploma, GED Must make Satisfactory Academic Progress (SAP) Be clear of any Drug Charges

Who Gets the $$ 5 Basic Student Eligibility Requirements: Must be a US Citizen or an Eligible Non-Citizen Males must be registered with the Selective Services Must not be in Default on any Federal Loans Must be enrolled at least ½ time as a regular student in an eligible degree seeking program Must have received their high school diploma, GED Must make Satisfactory Academic Progress (SAP) Be clear of any Drug Charges

Basic Concepts of Financial Aid: 6 Cost of Attendance Expected Family Contribution Financial Need-Based Aid Non Need-Based Aid

Basic Concepts of Financial Aid: 6 Cost of Attendance Expected Family Contribution Financial Need-Based Aid Non Need-Based Aid

The Costs of Going to College (Cost of Attendance) Tuition & Fees Books & Supplies Room & Board Personal Expenses Transportation 7

The Costs of Going to College (Cost of Attendance) Tuition & Fees Books & Supplies Room & Board Personal Expenses Transportation 7

Expected Family Contribution 8 The Expected Family Contribution (EFC) - Calculated by the FAFSA - Amount a family is expected to contribute to education according to the DOE (not an actual contribution number) - It lets the college know what Grants and Loans you may be eligible for

Expected Family Contribution 8 The Expected Family Contribution (EFC) - Calculated by the FAFSA - Amount a family is expected to contribute to education according to the DOE (not an actual contribution number) - It lets the college know what Grants and Loans you may be eligible for

Need-Based Aid? 9 - Grants - Scholarships - Federal Work Study - Federal Subsidized Direct Loan This is the “Cheapest” or “Free’ist” money you can receive

Need-Based Aid? 9 - Grants - Scholarships - Federal Work Study - Federal Subsidized Direct Loan This is the “Cheapest” or “Free’ist” money you can receive

What Is Financial Need? 10 Cost of Attendance - EFC_ _____ Financial Need* *amount of money you can receive in needbased aid

What Is Financial Need? 10 Cost of Attendance - EFC_ _____ Financial Need* *amount of money you can receive in needbased aid

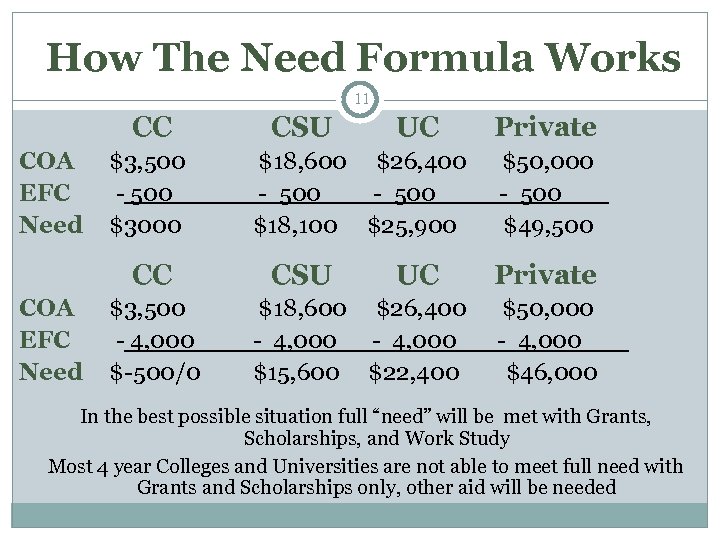

How The Need Formula Works 11 CC COA EFC Need $3, 500 - 500 $3000 CC COA EFC Need $3, 500 - 4, 000 $-500/0 CSU UC Private $18, 600 $26, 400 $50, 000 - 500___ $18, 100 $25, 900 $49, 500 CSU UC Private $18, 600 $26, 400 $50, 000 - 4, 000___ $15, 600 $22, 400 $46, 000 In the best possible situation full “need” will be met with Grants, Scholarships, and Work Study Most 4 year Colleges and Universities are not able to meet full need with Grants and Scholarships only, other aid will be needed

How The Need Formula Works 11 CC COA EFC Need $3, 500 - 500 $3000 CC COA EFC Need $3, 500 - 4, 000 $-500/0 CSU UC Private $18, 600 $26, 400 $50, 000 - 500___ $18, 100 $25, 900 $49, 500 CSU UC Private $18, 600 $26, 400 $50, 000 - 4, 000___ $15, 600 $22, 400 $46, 000 In the best possible situation full “need” will be met with Grants, Scholarships, and Work Study Most 4 year Colleges and Universities are not able to meet full need with Grants and Scholarships only, other aid will be needed

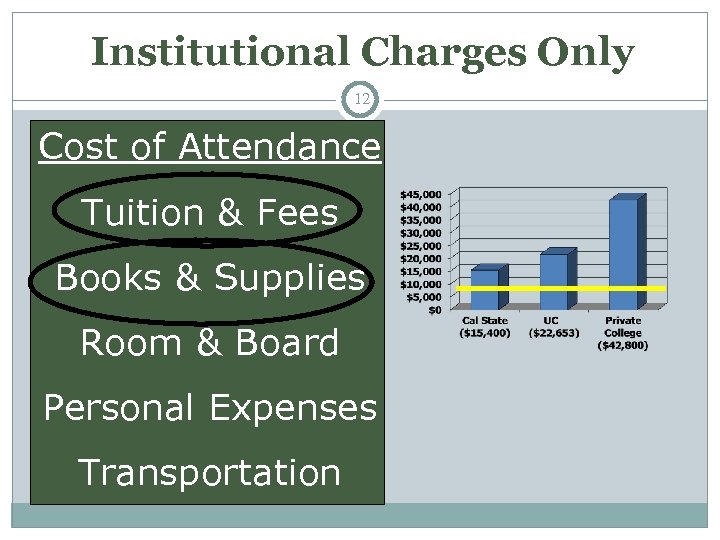

Institutional Charges Only 12 Cost of Attendance Tuition & Fees Books & Supplies Room & Board Personal Expenses Transportation

Institutional Charges Only 12 Cost of Attendance Tuition & Fees Books & Supplies Room & Board Personal Expenses Transportation

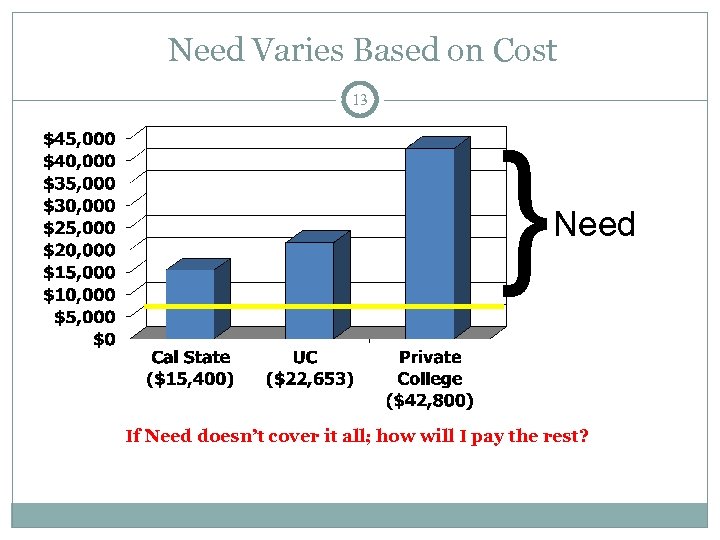

Need Varies Based on Cost 13 } Need If Need doesn’t cover it all; how will I pay the rest?

Need Varies Based on Cost 13 } Need If Need doesn’t cover it all; how will I pay the rest?

Non Need-Based Aid 14 - Federal Unsubsidized Direct Loan - Federal PLUS Loan (Parent and Grad) - Private Bank Loans

Non Need-Based Aid 14 - Federal Unsubsidized Direct Loan - Federal PLUS Loan (Parent and Grad) - Private Bank Loans

The Primary Sources of Financial Aid 15 Federal Financial Aid State Aid Colleges and universities Private agencies and organizations

The Primary Sources of Financial Aid 15 Federal Financial Aid State Aid Colleges and universities Private agencies and organizations

Federal Financial Aid Funding 16 PELL Grants Up to $5780 per Academic Year (may possibly change depending on budget outcomes) Based on your EFC from the FAFSA & Enrollment Status Federal Work Study Loans Subsidized Unsubsidized

Federal Financial Aid Funding 16 PELL Grants Up to $5780 per Academic Year (may possibly change depending on budget outcomes) Based on your EFC from the FAFSA & Enrollment Status Federal Work Study Loans Subsidized Unsubsidized

Federal Financial Aid Funding 17 Federal Perkins Loans 5% fixed rate Up to $5, 500 per academic year Federal Stafford Loans Subsidized loan up to $3500 per academic year, interest adjusted annually Unsubsidized loan up to $6000 per academic year, interest adjusted annually Federal Direct Loans Interest paid by the government while in school, up to 150% of the published length of the program Unsubsidized Subsidized Interest accruing and paid by you w/ an option to pay while you are completing your program PLUS Loan – Parent or Grad loan Parental Loan (taken out by parent for student, parent is responsible for this loan)

Federal Financial Aid Funding 17 Federal Perkins Loans 5% fixed rate Up to $5, 500 per academic year Federal Stafford Loans Subsidized loan up to $3500 per academic year, interest adjusted annually Unsubsidized loan up to $6000 per academic year, interest adjusted annually Federal Direct Loans Interest paid by the government while in school, up to 150% of the published length of the program Unsubsidized Subsidized Interest accruing and paid by you w/ an option to pay while you are completing your program PLUS Loan – Parent or Grad loan Parental Loan (taken out by parent for student, parent is responsible for this loan)

State Aid Funding 18 Cal-Grant A Cal-Grant B Cal-Grant C Chafee Grant

State Aid Funding 18 Cal-Grant A Cal-Grant B Cal-Grant C Chafee Grant

Cal Grant A Entitlement 19 Requirements High school GPA of 3. 0 or greater, Must be working toward a two-year or four-year degree Demonstrate financial need, Meet parental income and asset requirements, and File a FAFSA and GPA Verification by March 2, 2013 Covers System-wide fees at UC and CSU campuses, $12, 192 and $5, 970 respectively As much as $9, 223 at independent California colleges or universities up to 4 years

Cal Grant A Entitlement 19 Requirements High school GPA of 3. 0 or greater, Must be working toward a two-year or four-year degree Demonstrate financial need, Meet parental income and asset requirements, and File a FAFSA and GPA Verification by March 2, 2013 Covers System-wide fees at UC and CSU campuses, $12, 192 and $5, 970 respectively As much as $9, 223 at independent California colleges or universities up to 4 years

Cal Grant B Entitlement 20 Requirements High school GPA of 2. 0 or greater Must be working on coursework at least one academic year in length. Demonstrate financial need Meet parental income and asset requirements File a FAFSA and GPA Verification by March 2, 2013 Covers $1, 473 Books and Supplies up to 4 years After your Freshman year it covers system-wide fees at UC and CSU campuses for second through fourth years as much as $9, 223 at independent California colleges or universities for second through fourth years

Cal Grant B Entitlement 20 Requirements High school GPA of 2. 0 or greater Must be working on coursework at least one academic year in length. Demonstrate financial need Meet parental income and asset requirements File a FAFSA and GPA Verification by March 2, 2013 Covers $1, 473 Books and Supplies up to 4 years After your Freshman year it covers system-wide fees at UC and CSU campuses for second through fourth years as much as $9, 223 at independent California colleges or universities for second through fourth years

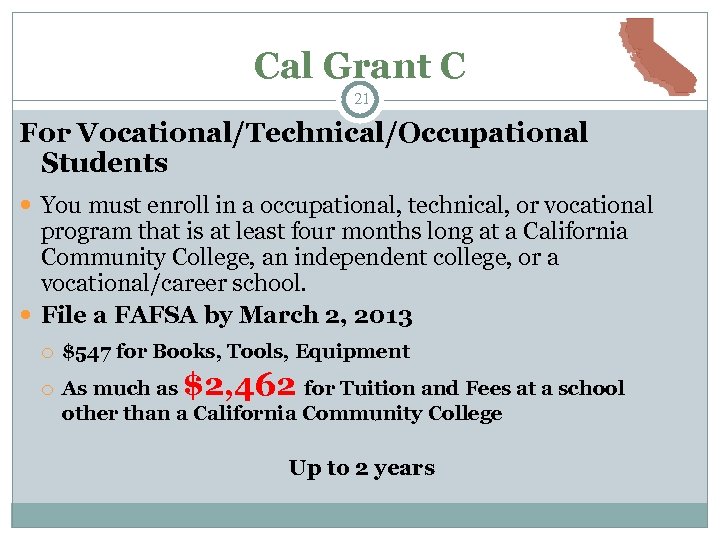

Cal Grant C 21 For Vocational/Technical/Occupational Students You must enroll in a occupational, technical, or vocational program that is at least four months long at a California Community College, an independent college, or a vocational/career school. File a FAFSA by March 2, 2013 $547 for Books, Tools, Equipment As much as for Tuition and Fees at a school other than a California Community College $2, 462 Up to 2 years

Cal Grant C 21 For Vocational/Technical/Occupational Students You must enroll in a occupational, technical, or vocational program that is at least four months long at a California Community College, an independent college, or a vocational/career school. File a FAFSA by March 2, 2013 $547 for Books, Tools, Equipment As much as for Tuition and Fees at a school other than a California Community College $2, 462 Up to 2 years

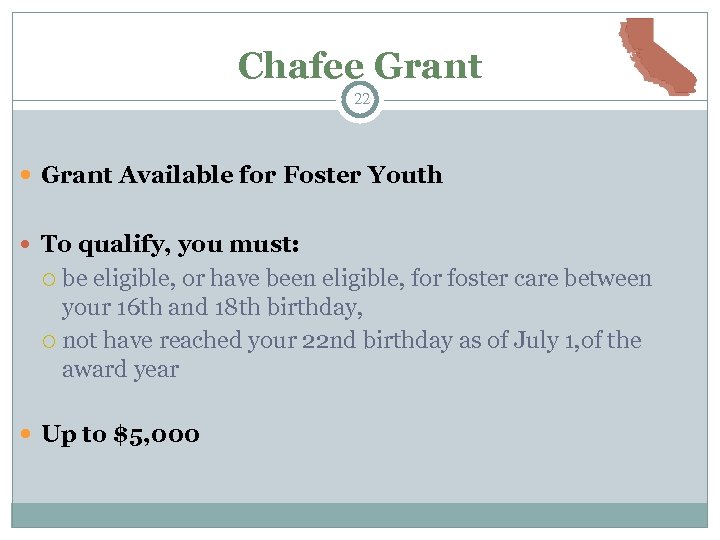

Chafee Grant 22 Grant Available for Foster Youth To qualify, you must: be eligible, or have been eligible, for foster care between your 16 th and 18 th birthday, not have reached your 22 nd birthday as of July 1, of the award year Up to $5, 000

Chafee Grant 22 Grant Available for Foster Youth To qualify, you must: be eligible, or have been eligible, for foster care between your 16 th and 18 th birthday, not have reached your 22 nd birthday as of July 1, of the award year Up to $5, 000

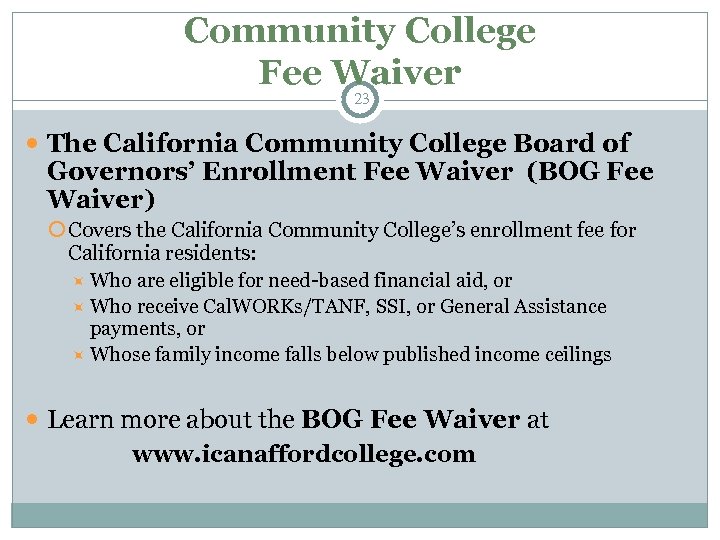

Community College Fee Waiver 23 The California Community College Board of Governors’ Enrollment Fee Waiver (BOG Fee Waiver) Covers the California Community College’s enrollment fee for California residents: Who are eligible for need-based financial aid, or Who receive Cal. WORKs/TANF, SSI, or General Assistance payments, or Whose family income falls below published income ceilings Learn more about the BOG Fee Waiver at www. icanaffordcollege. com

Community College Fee Waiver 23 The California Community College Board of Governors’ Enrollment Fee Waiver (BOG Fee Waiver) Covers the California Community College’s enrollment fee for California residents: Who are eligible for need-based financial aid, or Who receive Cal. WORKs/TANF, SSI, or General Assistance payments, or Whose family income falls below published income ceilings Learn more about the BOG Fee Waiver at www. icanaffordcollege. com

Scholarships 24 Use FREE Scholarship Searches Available from colleges, companies, community-based groups and other agencies and organizations Usually require separate applications May require transcript, essay, interview, or audition Check with your high school, college or university about scholarship opportunities Beware of scholarship search companies that charge a fee Scholarships are a numbers game, the more you apply for the better the odds of receiving one www. fastweb. com www. collegeanswer. com

Scholarships 24 Use FREE Scholarship Searches Available from colleges, companies, community-based groups and other agencies and organizations Usually require separate applications May require transcript, essay, interview, or audition Check with your high school, college or university about scholarship opportunities Beware of scholarship search companies that charge a fee Scholarships are a numbers game, the more you apply for the better the odds of receiving one www. fastweb. com www. collegeanswer. com

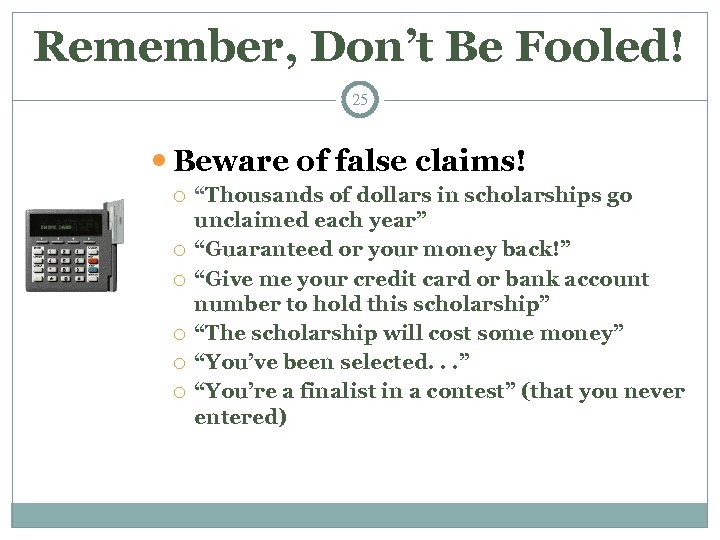

Remember, Don’t Be Fooled! 25 Beware of false claims! “Thousands of dollars in scholarships go unclaimed each year” “Guaranteed or your money back!” “Give me your credit card or bank account number to hold this scholarship” “The scholarship will cost some money” “You’ve been selected. . . ” “You’re a finalist in a contest” (that you never entered)

Remember, Don’t Be Fooled! 25 Beware of false claims! “Thousands of dollars in scholarships go unclaimed each year” “Guaranteed or your money back!” “Give me your credit card or bank account number to hold this scholarship” “The scholarship will cost some money” “You’ve been selected. . . ” “You’re a finalist in a contest” (that you never entered)

Applying For Financial Aid In 2013 -2014 26 You and your parent will need a PIN # (Based on Dependency) Fill out a FAFSA (Free Application for Federal Student Aid) between January 1 st and March 2 nd www. fafsa. ed. gov 2011 parent and student IRS Federal Tax Returns (including all schedules and W-2 forms) or other income documentation Cal Grant GPA Verification Form (you or your school may do this) Some colleges may request: CSS/Financial Aid PROFILE www. collegeboard. com

Applying For Financial Aid In 2013 -2014 26 You and your parent will need a PIN # (Based on Dependency) Fill out a FAFSA (Free Application for Federal Student Aid) between January 1 st and March 2 nd www. fafsa. ed. gov 2011 parent and student IRS Federal Tax Returns (including all schedules and W-2 forms) or other income documentation Cal Grant GPA Verification Form (you or your school may do this) Some colleges may request: CSS/Financial Aid PROFILE www. collegeboard. com

CEF Merit Achievement Award 27 Every year CEF offers several Merit Achievement Awards Offered to High School Seniors that have been accepted to 4 -year college/university Minimum Requirements Min. GPA 3. 0 Min. SAT Score 1800 Personal Statement Two Letter of Recommendations Community Services Check CEF web Site on May 1 st www. Copticedu. org/meritaward Applications are due on May 31

CEF Merit Achievement Award 27 Every year CEF offers several Merit Achievement Awards Offered to High School Seniors that have been accepted to 4 -year college/university Minimum Requirements Min. GPA 3. 0 Min. SAT Score 1800 Personal Statement Two Letter of Recommendations Community Services Check CEF web Site on May 1 st www. Copticedu. org/meritaward Applications are due on May 31

Apply For a PIN 28 Federal PIN (Personal Identification Number) serves as the electronic signature on the FAFSA and other federal aid documents Student and at least one custodial parent need a PIN May also be used to: Check on FAFSA status Verify FAFSA data Make FAFSA Corrections on the Web Reapply for financial aid in future years Apply NOW for your PINs at: www. pin. ed. gov

Apply For a PIN 28 Federal PIN (Personal Identification Number) serves as the electronic signature on the FAFSA and other federal aid documents Student and at least one custodial parent need a PIN May also be used to: Check on FAFSA status Verify FAFSA data Make FAFSA Corrections on the Web Reapply for financial aid in future years Apply NOW for your PINs at: www. pin. ed. gov

To Register for a PIN: www. pin. ed. gov 29

To Register for a PIN: www. pin. ed. gov 29

Filling Out the FAFSA 30 (Optional) Use FAFSA on the Web Worksheet to get ready. • • • Get worksheet at www. Federal. Student. Aid. ed. gov/worksheet Use checklist to gather documents you need. Fill out worksheet to prepare your answers. Fill out your FAFSA online at www. fafsa. ed. gov • • • Apply on or after Jan. 1 but as early as possible to meet all deadlines. Need help? Use “Live Help” icon or call 1 -800 -4 -FED-AID. Don’t forget to print confirmation page. Watch for response by e-mail, from Federal. Student. Aid. FAFSA@cpsemail. ed. gov, or by mail • • Double-check your information online at www. fafsa. ed. gov (use your PIN to log on) or on the paper Student Aid Report mailed to you Correct any mistakes and update any information as necessary

Filling Out the FAFSA 30 (Optional) Use FAFSA on the Web Worksheet to get ready. • • • Get worksheet at www. Federal. Student. Aid. ed. gov/worksheet Use checklist to gather documents you need. Fill out worksheet to prepare your answers. Fill out your FAFSA online at www. fafsa. ed. gov • • • Apply on or after Jan. 1 but as early as possible to meet all deadlines. Need help? Use “Live Help” icon or call 1 -800 -4 -FED-AID. Don’t forget to print confirmation page. Watch for response by e-mail, from Federal. Student. Aid. FAFSA@cpsemail. ed. gov, or by mail • • Double-check your information online at www. fafsa. ed. gov (use your PIN to log on) or on the paper Student Aid Report mailed to you Correct any mistakes and update any information as necessary

FAFSA on the Web: www. fafsa. ed. gov 31

FAFSA on the Web: www. fafsa. ed. gov 31

Other Common Application Items 32 College Board’s PROFILE application Copies of most recent tax return Verification Worksheet Institutional Aid Application

Other Common Application Items 32 College Board’s PROFILE application Copies of most recent tax return Verification Worksheet Institutional Aid Application

Important Reminders 33 1. Watch for e-mails or letters from the schools you are considering • • Give the schools any additional paperwork they ask for Meet all deadlines or you could miss out on aid! 2. Each school will tell you how much aid you can get at that school. 3. Once you decide which school to attend, keep in touch with the financial aid office to find out when and how you will get your aid.

Important Reminders 33 1. Watch for e-mails or letters from the schools you are considering • • Give the schools any additional paperwork they ask for Meet all deadlines or you could miss out on aid! 2. Each school will tell you how much aid you can get at that school. 3. Once you decide which school to attend, keep in touch with the financial aid office to find out when and how you will get your aid.

Dependency Status 34 Who’s a Dependant student? Ask yourself these questions ❑ I was born before January 1, 1991 ❑ I am serving on active duty in the U. S. Armed Forces ❑ Since I turned age 13, both of my parents were deceased ❑ I was a dependent of the court or ward of the court since turning age 13 ❑ I am married ❑ I am a veteran of the U. S. Armed Forces ❑ I was in foster care since turning age 13 ❑ I am currently or I was an emancipated minor

Dependency Status 34 Who’s a Dependant student? Ask yourself these questions ❑ I was born before January 1, 1991 ❑ I am serving on active duty in the U. S. Armed Forces ❑ Since I turned age 13, both of my parents were deceased ❑ I was a dependent of the court or ward of the court since turning age 13 ❑ I am married ❑ I am a veteran of the U. S. Armed Forces ❑ I was in foster care since turning age 13 ❑ I am currently or I was an emancipated minor

Dependency Status 35 Who’s a Dependant student? – continued ❑ I will be working on a master’s or doctorate program (e. g. , MA, MBA, MD, JD, Ph. D, Ed. D, graduate certificate) ❑ I now have or will have children for whom I will provide more than half of their support between July 1, 2014 and June 30, 2015 ❑ I have dependents (other than children or my spouse) who live with me and I provide more than half of their support ❑ I am homeless or I am at risk of being homeless ❑ I am currently or I was in legal guardianship If you answer NO to all these questions, you need your parents information

Dependency Status 35 Who’s a Dependant student? – continued ❑ I will be working on a master’s or doctorate program (e. g. , MA, MBA, MD, JD, Ph. D, Ed. D, graduate certificate) ❑ I now have or will have children for whom I will provide more than half of their support between July 1, 2014 and June 30, 2015 ❑ I have dependents (other than children or my spouse) who live with me and I provide more than half of their support ❑ I am homeless or I am at risk of being homeless ❑ I am currently or I was in legal guardianship If you answer NO to all these questions, you need your parents information

Undocumented Students 36 Undocumented and under-documented students are NOT eligible for federal aid but MAY be eligible for State Aid Apply for all scholarships for which the student may be eligible Check with colleges and universities to see if institutional financial aid is available Watch for changes in federal and state laws regarding the eligibility of undocumented or under-documented students

Undocumented Students 36 Undocumented and under-documented students are NOT eligible for federal aid but MAY be eligible for State Aid Apply for all scholarships for which the student may be eligible Check with colleges and universities to see if institutional financial aid is available Watch for changes in federal and state laws regarding the eligibility of undocumented or under-documented students

AB 540 37 What is it? Assembly Bill 540 that allows undocumented students to pay instate tuition for California community colleges and public universities. Who is eligible under AB 540? You must have completed 3 years of high school in California and graduated from a California high school or attainment of the equivalent You must also complete an AB 540 affidavit at the college/university that you will attend, stating that you meet AB 540 eligibility requirements which includes that you are in the process of, or will soon be, applying for legal residency.

AB 540 37 What is it? Assembly Bill 540 that allows undocumented students to pay instate tuition for California community colleges and public universities. Who is eligible under AB 540? You must have completed 3 years of high school in California and graduated from a California high school or attainment of the equivalent You must also complete an AB 540 affidavit at the college/university that you will attend, stating that you meet AB 540 eligibility requirements which includes that you are in the process of, or will soon be, applying for legal residency.

AB 540 38 How do you apply for AB 540? * Students should speak with a college/university representative to receive accurate information about the specific campus as the requirements may differ from campus to campus. * For all UC and most CSU campuses, the fall term applicant must apply by November 30 th of the year before they wish to begin. Two sections must be left blank: 1. Social Security Number Section 2. Immigration Status Section * For community colleges, the student must turn in the AB 540 affidavit when they register for classes.

AB 540 38 How do you apply for AB 540? * Students should speak with a college/university representative to receive accurate information about the specific campus as the requirements may differ from campus to campus. * For all UC and most CSU campuses, the fall term applicant must apply by November 30 th of the year before they wish to begin. Two sections must be left blank: 1. Social Security Number Section 2. Immigration Status Section * For community colleges, the student must turn in the AB 540 affidavit when they register for classes.

California Dream Act – AB 130 & AB 131 39 AB 130 allows students who meet AB 540 criteria to: Apply for & receive private scholarships administered by the public colleges and universities, including scholarships funded through private donors alumni contributions individual departmental efforts

California Dream Act – AB 130 & AB 131 39 AB 130 allows students who meet AB 540 criteria to: Apply for & receive private scholarships administered by the public colleges and universities, including scholarships funded through private donors alumni contributions individual departmental efforts

California Dream Act – AB 130 & AB 131 40 AB 130 allows students who meet AB 540 criteria to: Apply for & receive institutional grants like UC Grant, State University Grant, Educational Opportunity Program and Educational Opportunity Program & Services fee waivers Apply for & receive Board of Governors fee waivers at the California Community Colleges Apply for & receive state financial aid, including Cal Grants and Chafee Foster Youth Grants for use at eligible public and private institutions

California Dream Act – AB 130 & AB 131 40 AB 130 allows students who meet AB 540 criteria to: Apply for & receive institutional grants like UC Grant, State University Grant, Educational Opportunity Program and Educational Opportunity Program & Services fee waivers Apply for & receive Board of Governors fee waivers at the California Community Colleges Apply for & receive state financial aid, including Cal Grants and Chafee Foster Youth Grants for use at eligible public and private institutions

California Dream Act – AB 130 & AB 131 41 Application The 2014 -15 online application will be available January 14 th Must complete and submit the application before the March 2 nd deadline. Must complete a GPA Verification form

California Dream Act – AB 130 & AB 131 41 Application The 2014 -15 online application will be available January 14 th Must complete and submit the application before the March 2 nd deadline. Must complete a GPA Verification form

Useful Websites 42 www. fafsa 4 caster. ed. gov www. finaid. org www. collegeboard. com www. fastweb. com www. scholarshipsearchsecrets. com These sites contain useful financial aid and scholarship information

Useful Websites 42 www. fafsa 4 caster. ed. gov www. finaid. org www. collegeboard. com www. fastweb. com www. scholarshipsearchsecrets. com These sites contain useful financial aid and scholarship information

Before You Decide On A College 43 Make a list of colleges and universities that have programs of interest to you Consult with your school counselor If possible, don’t make a final decision about which school you will attend until you have visited the colleges and universities Consider all factors – not just cost – when making the final decision

Before You Decide On A College 43 Make a list of colleges and universities that have programs of interest to you Consult with your school counselor If possible, don’t make a final decision about which school you will attend until you have visited the colleges and universities Consider all factors – not just cost – when making the final decision

Summary 44 Financial Aid Application www. fafsa. ed. gov Due date March 2 nd Get a PIN # www. pin. ed. gov College Board Applications www. collegeboard. com Copies of parents tax returns Watch for e-mail or letter from each school you applied for Apply for CEF Merit Award – Before May 31 st www. copticedu. org

Summary 44 Financial Aid Application www. fafsa. ed. gov Due date March 2 nd Get a PIN # www. pin. ed. gov College Board Applications www. collegeboard. com Copies of parents tax returns Watch for e-mail or letter from each school you applied for Apply for CEF Merit Award – Before May 31 st www. copticedu. org

Questions? ? 45 If you have any questions please feel free to contact: Christine Fanous (626) 422 -4443 cefcounselor@copticedu. org Cherif Youssef (818) 807 -8505 cyoussef 60@gmail. com www. copticedu. org

Questions? ? 45 If you have any questions please feel free to contact: Christine Fanous (626) 422 -4443 cefcounselor@copticedu. org Cherif Youssef (818) 807 -8505 cyoussef 60@gmail. com www. copticedu. org