1f2d30a9e7712a29bf643dae14743d53.ppt

- Количество слайдов: 34

financial statements demystified

financial statements demystified

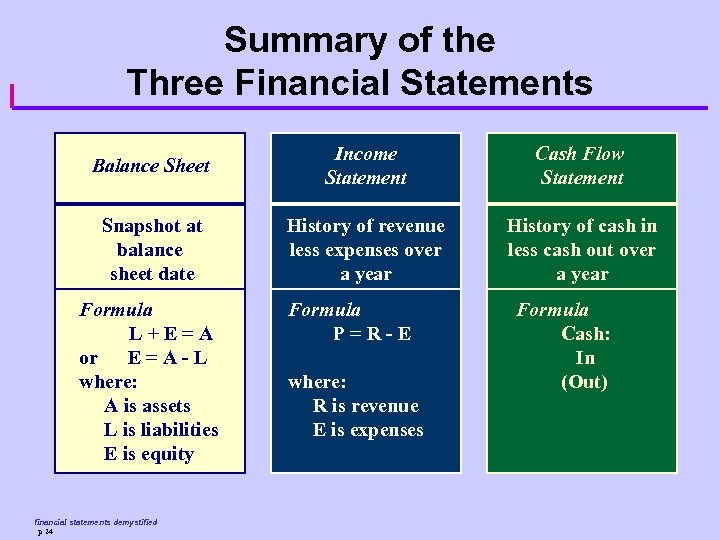

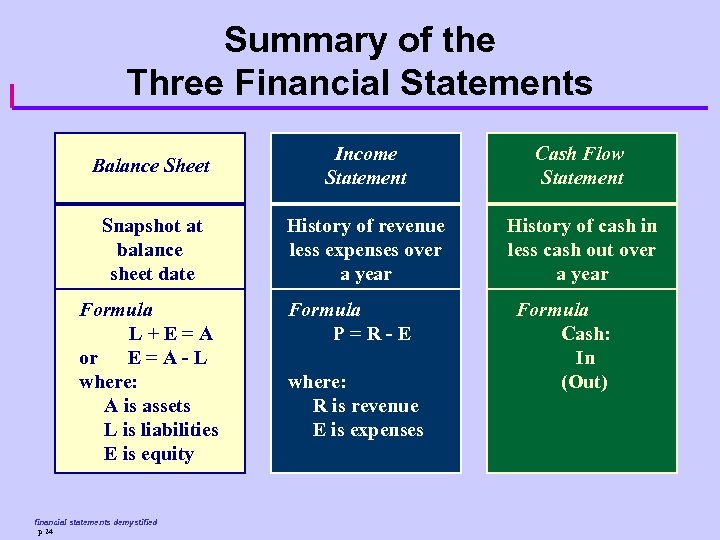

Summary of the Three Financial Statements Balance Sheet Income Statement Cash Flow Statement Snapshot at balance sheet date History of revenue less expenses over a year History of cash in less cash out over a year Formula L+E=A or E=A-L where: A is assets L is liabilities E is equity financial statements demystified p 24 Formula P=R-E where: R is revenue E is expenses Formula Cash: In (Out)

Summary of the Three Financial Statements Balance Sheet Income Statement Cash Flow Statement Snapshot at balance sheet date History of revenue less expenses over a year History of cash in less cash out over a year Formula L+E=A or E=A-L where: A is assets L is liabilities E is equity financial statements demystified p 24 Formula P=R-E where: R is revenue E is expenses Formula Cash: In (Out)

financial statements demystified

financial statements demystified

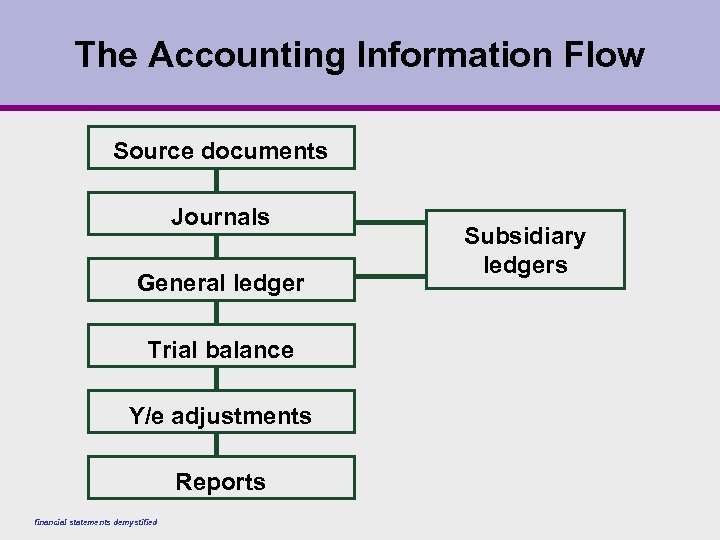

The Accounting Information Flow Source documents Journals General ledger Trial balance Y/e adjustments Reports financial statements demystified Subsidiary ledgers

The Accounting Information Flow Source documents Journals General ledger Trial balance Y/e adjustments Reports financial statements demystified Subsidiary ledgers

financial statements demystified

financial statements demystified

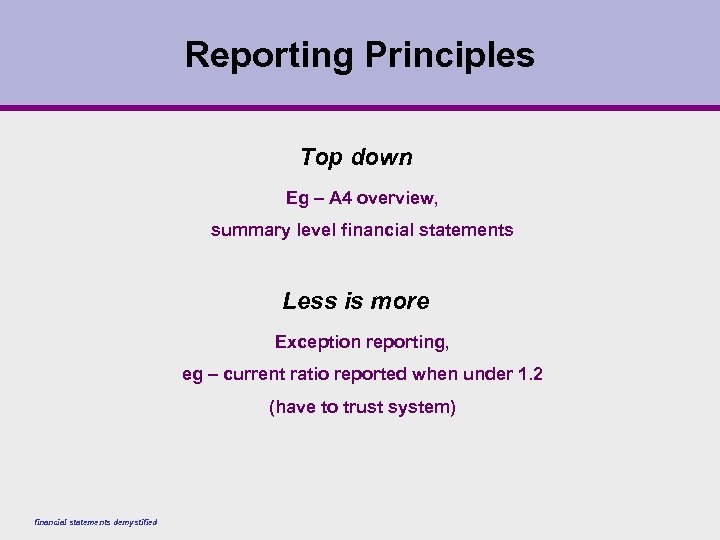

Reporting Principles Top down Eg – A 4 overview, summary level financial statements Less is more Exception reporting, eg – current ratio reported when under 1. 2 (have to trust system) financial statements demystified

Reporting Principles Top down Eg – A 4 overview, summary level financial statements Less is more Exception reporting, eg – current ratio reported when under 1. 2 (have to trust system) financial statements demystified

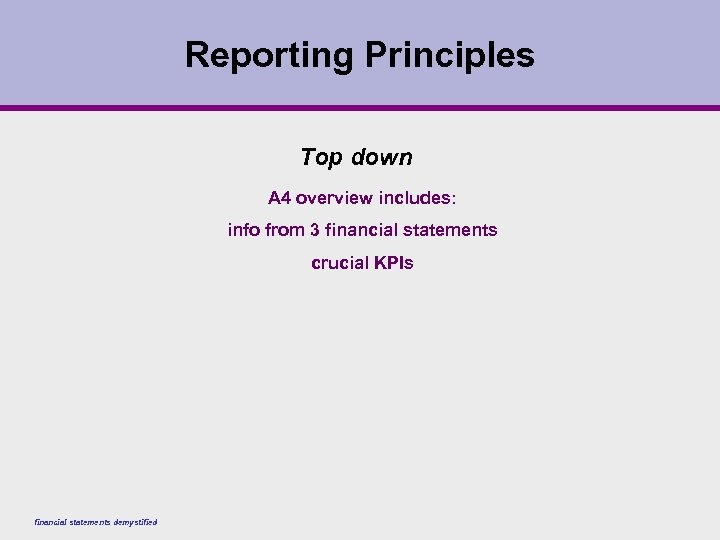

Reporting Principles Top down A 4 overview includes: info from 3 financial statements crucial KPIs financial statements demystified

Reporting Principles Top down A 4 overview includes: info from 3 financial statements crucial KPIs financial statements demystified

Reporting Principles Top down Performance dashboard is an automated version Limit info to key performance elements updated daily Automate – link to robust, reliable, integrated systems financial statements demystified

Reporting Principles Top down Performance dashboard is an automated version Limit info to key performance elements updated daily Automate – link to robust, reliable, integrated systems financial statements demystified

Reporting Principles Future and Past Reporting enhanced when: ü In context of strategy ü 5 year corporate plan ü Annual financial budget ü Actual YTD (& month) IS – also CF forecast, BS, ratios, KPIs ü 5 year review IS, CF, BS & ratios ü Same format for budgets & historic reporting financial statements demystified

Reporting Principles Future and Past Reporting enhanced when: ü In context of strategy ü 5 year corporate plan ü Annual financial budget ü Actual YTD (& month) IS – also CF forecast, BS, ratios, KPIs ü 5 year review IS, CF, BS & ratios ü Same format for budgets & historic reporting financial statements demystified

Reporting Principles Future and Past Why five years: Analysts recommend 5 years, 3 minimum We think better in context Review budgets in context: Consider having 3 prior years instead of just last year’s actual Obtaining more comprehensive reporting: Add historic YTD cash flow statement reporting Add views generated through Excel spreadsheets Obtain assurance financial statements demystified

Reporting Principles Future and Past Why five years: Analysts recommend 5 years, 3 minimum We think better in context Review budgets in context: Consider having 3 prior years instead of just last year’s actual Obtaining more comprehensive reporting: Add historic YTD cash flow statement reporting Add views generated through Excel spreadsheets Obtain assurance financial statements demystified

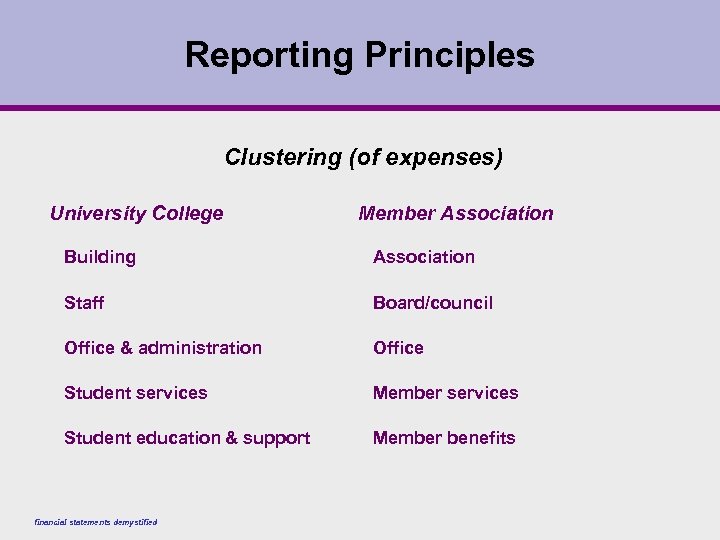

Reporting Principles Clustering (of expenses) University College Member Association Building Association Staff Board/council Office & administration Office Student services Member services Student education & support Member benefits financial statements demystified

Reporting Principles Clustering (of expenses) University College Member Association Building Association Staff Board/council Office & administration Office Student services Member services Student education & support Member benefits financial statements demystified

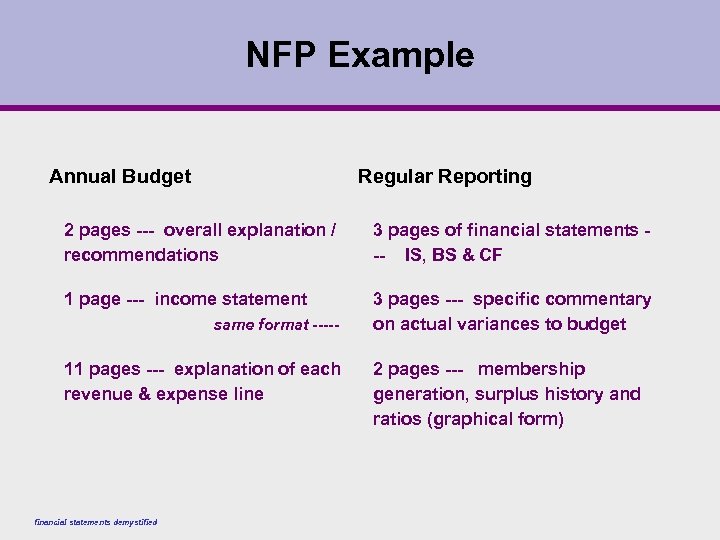

NFP Example Annual Budget Regular Reporting 2 pages --- overall explanation / recommendations 3 pages of financial statements -- IS, BS & CF 1 page --- income statement 3 pages --- specific commentary on actual variances to budget same format ----- 11 pages --- explanation of each revenue & expense line financial statements demystified 2 pages --- membership generation, surplus history and ratios (graphical form)

NFP Example Annual Budget Regular Reporting 2 pages --- overall explanation / recommendations 3 pages of financial statements -- IS, BS & CF 1 page --- income statement 3 pages --- specific commentary on actual variances to budget same format ----- 11 pages --- explanation of each revenue & expense line financial statements demystified 2 pages --- membership generation, surplus history and ratios (graphical form)

financial statements demystified

financial statements demystified

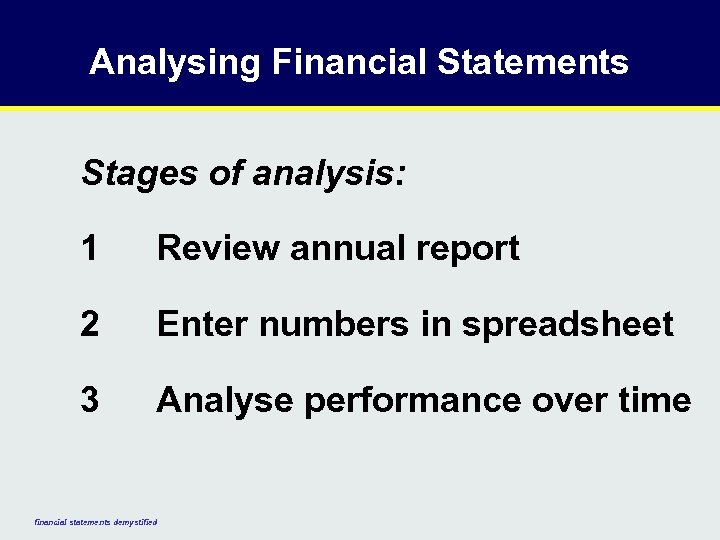

Analysing Financial Statements Stages of analysis: 1 Review annual report 2 Enter numbers in spreadsheet 3 Analyse performance over time financial statements demystified

Analysing Financial Statements Stages of analysis: 1 Review annual report 2 Enter numbers in spreadsheet 3 Analyse performance over time financial statements demystified

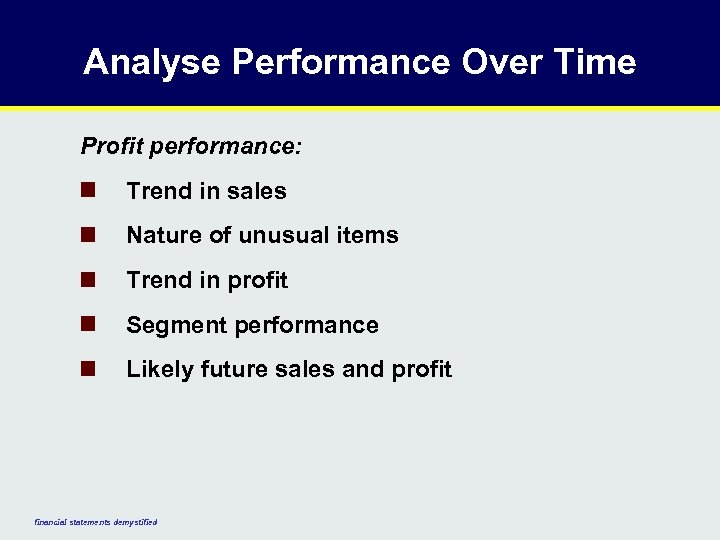

Analyse Performance Over Time Profit performance: n Trend in sales n Nature of unusual items n Trend in profit n Segment performance n Likely future sales and profit financial statements demystified

Analyse Performance Over Time Profit performance: n Trend in sales n Nature of unusual items n Trend in profit n Segment performance n Likely future sales and profit financial statements demystified

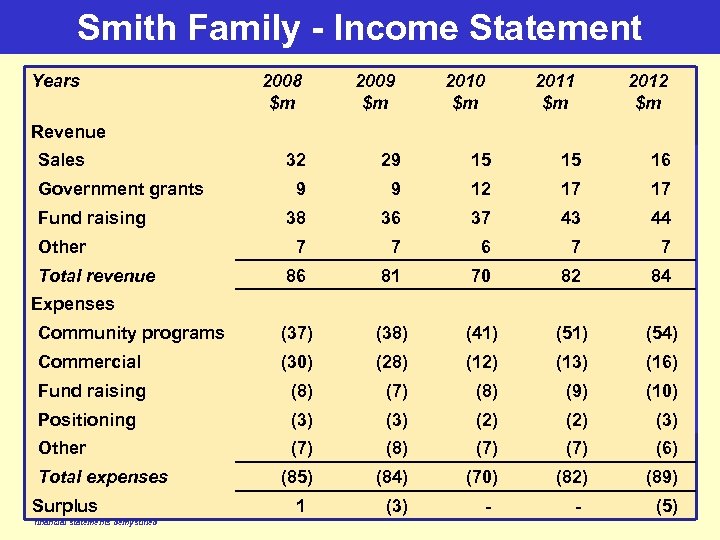

Smith Family - Income Statement Years 2008 $m 2009 $m 2010 $m 2011 $m 2012 $m Revenue Sales 32 29 15 15 16 9 9 12 17 17 38 36 37 43 44 7 7 6 7 7 86 81 70 82 84 Community programs (37) (38) (41) (54) Commercial (30) (28) (12) (13) (16) Fund raising (8) (7) (8) (9) (10) Positioning (3) (2) (3) Other (7) (8) (7) (6) (85) (84) (70) (82) (89) 1 (3) Government grants Fund raising Other Total revenue Expenses Total expenses Surplus financial statements demystified - - (5)

Smith Family - Income Statement Years 2008 $m 2009 $m 2010 $m 2011 $m 2012 $m Revenue Sales 32 29 15 15 16 9 9 12 17 17 38 36 37 43 44 7 7 6 7 7 86 81 70 82 84 Community programs (37) (38) (41) (54) Commercial (30) (28) (12) (13) (16) Fund raising (8) (7) (8) (9) (10) Positioning (3) (2) (3) Other (7) (8) (7) (6) (85) (84) (70) (82) (89) 1 (3) Government grants Fund raising Other Total revenue Expenses Total expenses Surplus financial statements demystified - - (5)

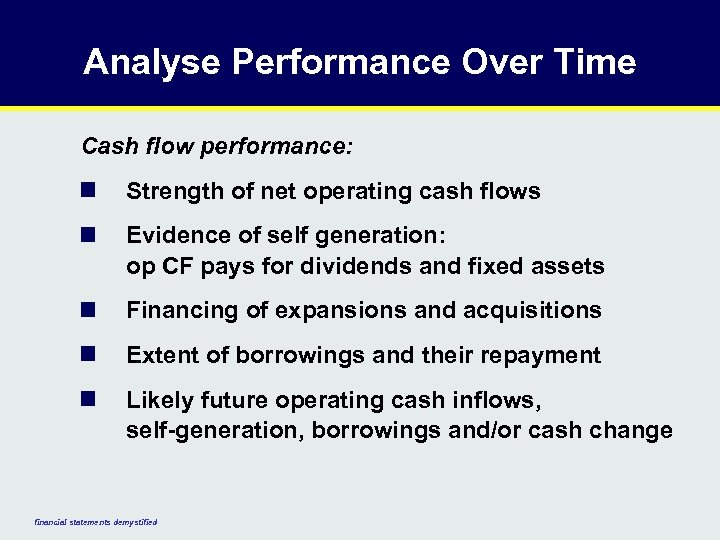

Analyse Performance Over Time Cash flow performance: n Strength of net operating cash flows n Evidence of self generation: op CF pays for dividends and fixed assets n Financing of expansions and acquisitions n Extent of borrowings and their repayment n Likely future operating cash inflows, self-generation, borrowings and/or cash change financial statements demystified

Analyse Performance Over Time Cash flow performance: n Strength of net operating cash flows n Evidence of self generation: op CF pays for dividends and fixed assets n Financing of expansions and acquisitions n Extent of borrowings and their repayment n Likely future operating cash inflows, self-generation, borrowings and/or cash change financial statements demystified

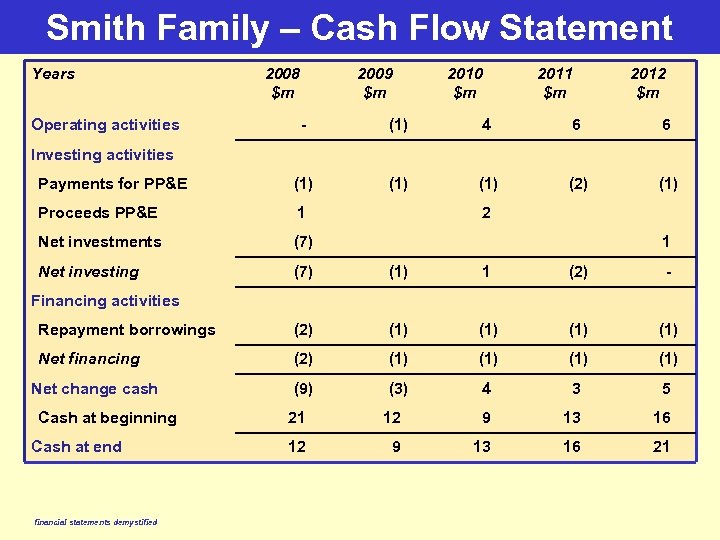

Smith Family – Cash Flow Statement Years Operating activities 2008 $m 2009 $m 2010 $m 2011 $m 2012 $m - (1) 4 6 6 Payments for PP&E (1) (1) (2) (1) Proceeds PP&E 1 Net investments (7) Net investing (7) (1) 1 (2) - Repayment borrowings (2) (1) (1) Net financing (2) (1) (1) (9) (3) 4 3 5 Investing activities 2 1 Financing activities Net change cash Cash at beginning Cash at end financial statements demystified 21 12 9 13 16 21

Smith Family – Cash Flow Statement Years Operating activities 2008 $m 2009 $m 2010 $m 2011 $m 2012 $m - (1) 4 6 6 Payments for PP&E (1) (1) (2) (1) Proceeds PP&E 1 Net investments (7) Net investing (7) (1) 1 (2) - Repayment borrowings (2) (1) (1) Net financing (2) (1) (1) (9) (3) 4 3 5 Investing activities 2 1 Financing activities Net change cash Cash at beginning Cash at end financial statements demystified 21 12 9 13 16 21

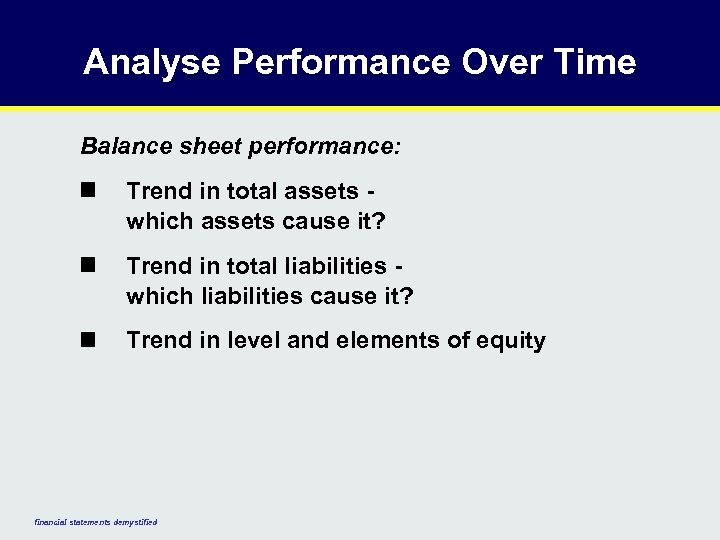

Analyse Performance Over Time Balance sheet performance: n Trend in total assets which assets cause it? n Trend in total liabilities which liabilities cause it? n Trend in level and elements of equity financial statements demystified

Analyse Performance Over Time Balance sheet performance: n Trend in total assets which assets cause it? n Trend in total liabilities which liabilities cause it? n Trend in level and elements of equity financial statements demystified

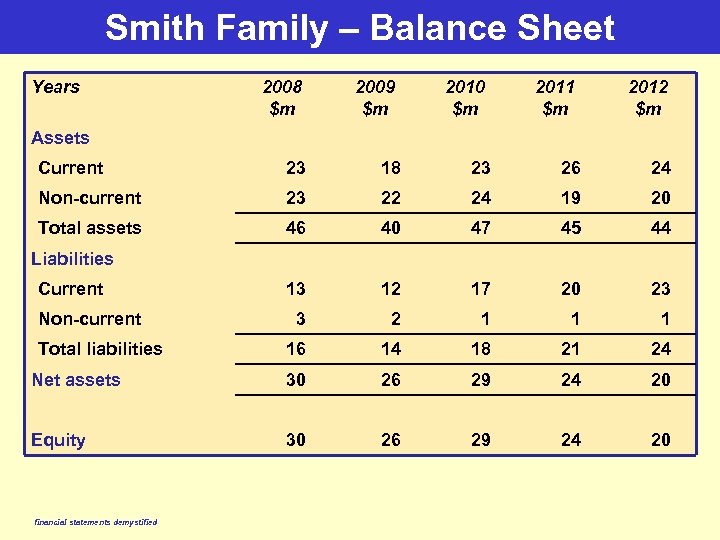

Smith Family – Balance Sheet Years 2008 $m 2009 $m 2010 $m 2011 $m 2012 $m Assets Current 23 18 23 26 24 Non-current 23 22 24 19 20 Total assets 46 40 47 45 44 13 12 17 20 23 3 2 1 16 14 18 21 24 Net assets 30 26 29 24 20 Equity 30 26 29 24 20 Liabilities Current Non-current Total liabilities financial statements demystified

Smith Family – Balance Sheet Years 2008 $m 2009 $m 2010 $m 2011 $m 2012 $m Assets Current 23 18 23 26 24 Non-current 23 22 24 19 20 Total assets 46 40 47 45 44 13 12 17 20 23 3 2 1 16 14 18 21 24 Net assets 30 26 29 24 20 Equity 30 26 29 24 20 Liabilities Current Non-current Total liabilities financial statements demystified

financial statements demystified

financial statements demystified

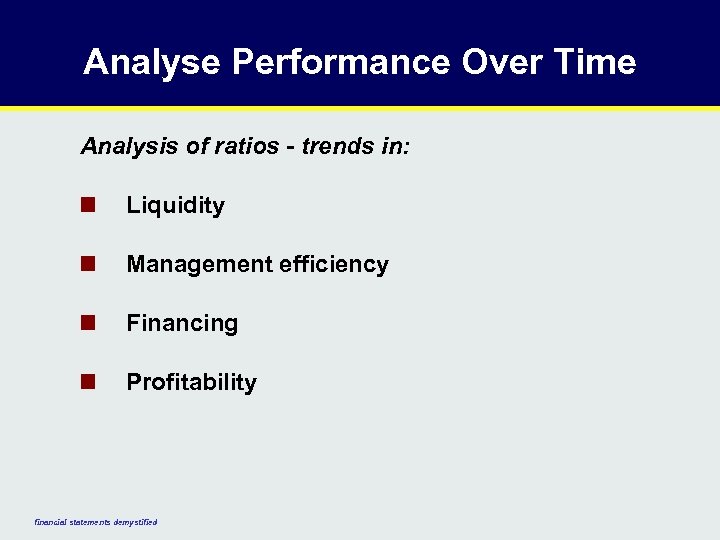

Analyse Performance Over Time Analysis of ratios - trends in: n Liquidity n Management efficiency n Financing n Profitability financial statements demystified

Analyse Performance Over Time Analysis of ratios - trends in: n Liquidity n Management efficiency n Financing n Profitability financial statements demystified

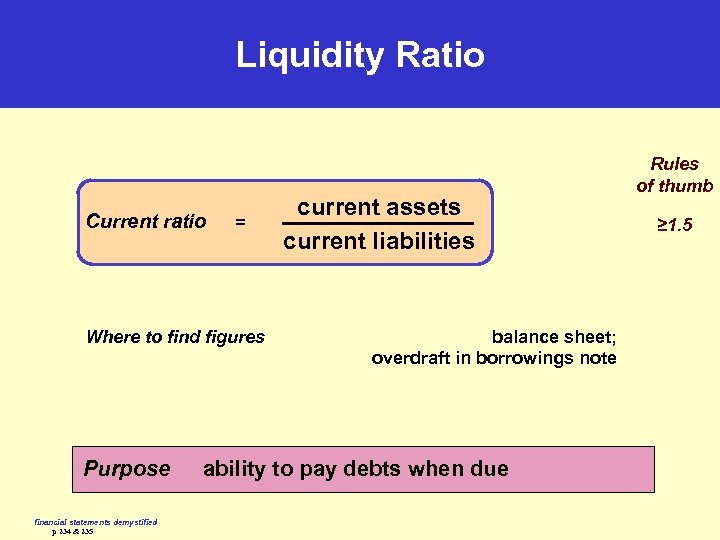

Liquidity Ratio Current ratio = Where to find figures Purpose financial statements demystified p 234 & 235 current assets current liabilities balance sheet; overdraft in borrowings note ability to pay debts when due Rules of thumb ≥ 1. 5

Liquidity Ratio Current ratio = Where to find figures Purpose financial statements demystified p 234 & 235 current assets current liabilities balance sheet; overdraft in borrowings note ability to pay debts when due Rules of thumb ≥ 1. 5

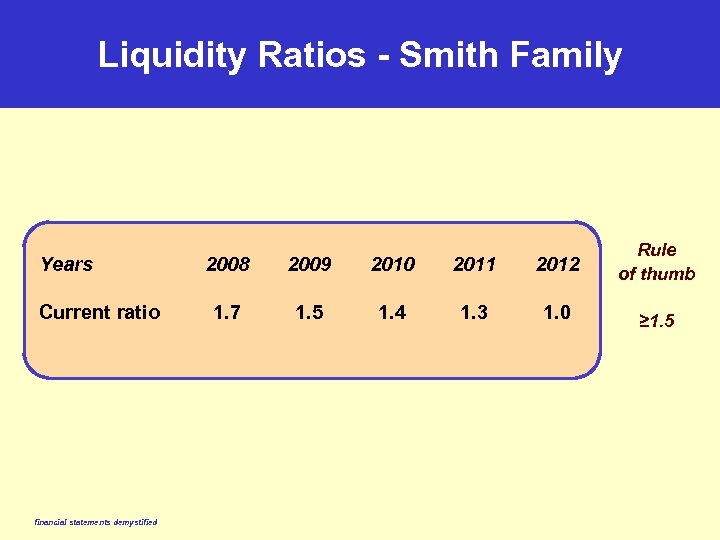

Liquidity Ratios - Smith Family Years Current ratio financial statements demystified 2008 2009 2010 2011 2012 Rule of thumb 1. 7 1. 5 1. 4 1. 3 1. 0 ≥ 1. 5

Liquidity Ratios - Smith Family Years Current ratio financial statements demystified 2008 2009 2010 2011 2012 Rule of thumb 1. 7 1. 5 1. 4 1. 3 1. 0 ≥ 1. 5

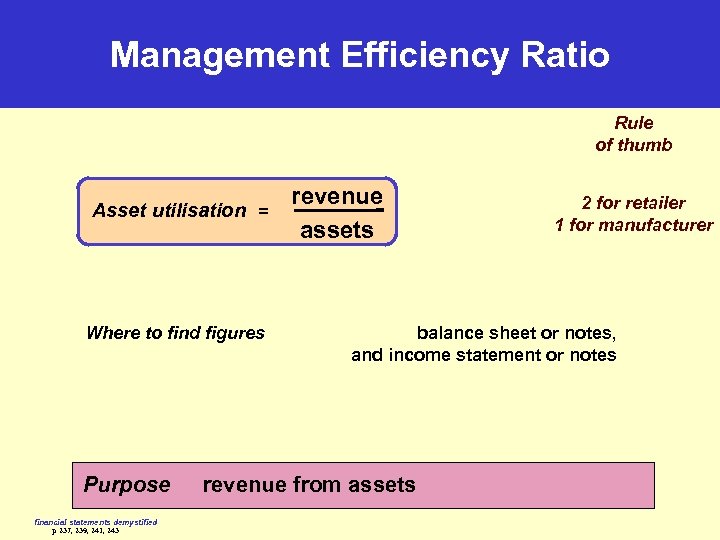

Management Efficiency Ratio Rule of thumb Asset utilisation = Where to find figures Purpose financial statements demystified p 237, 239, 241, 243 revenue assets 2 for retailer 1 for manufacturer balance sheet or notes, and income statement or notes revenue from assets

Management Efficiency Ratio Rule of thumb Asset utilisation = Where to find figures Purpose financial statements demystified p 237, 239, 241, 243 revenue assets 2 for retailer 1 for manufacturer balance sheet or notes, and income statement or notes revenue from assets

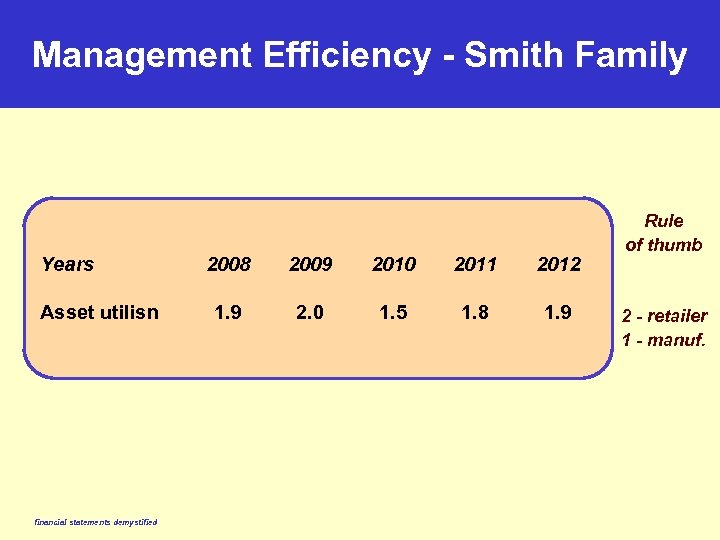

Management Efficiency - Smith Family Years Asset utilisn financial statements demystified 2008 2009 2010 2011 2012 1. 9 2. 0 1. 5 1. 8 1. 9 Rule of thumb 2 - retailer 1 - manuf.

Management Efficiency - Smith Family Years Asset utilisn financial statements demystified 2008 2009 2010 2011 2012 1. 9 2. 0 1. 5 1. 8 1. 9 Rule of thumb 2 - retailer 1 - manuf.

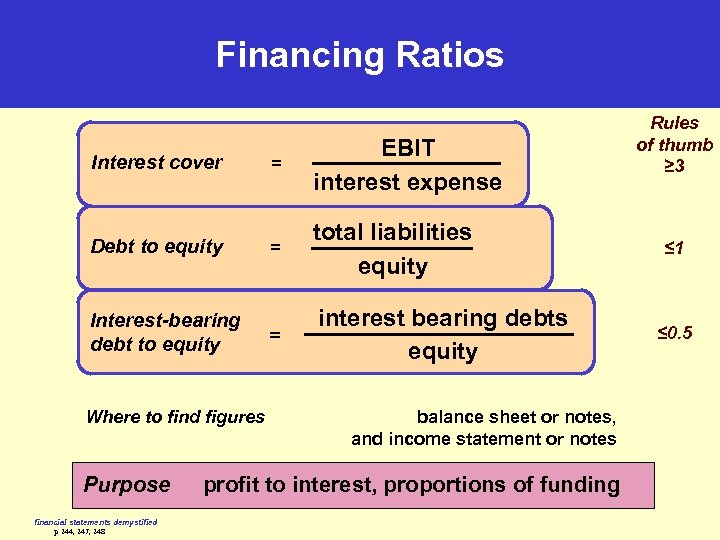

Financing Ratios Interest cover = EBIT interest expense Debt to equity = total liabilities equity = interest bearing debts equity Interest-bearing debt to equity Where to find figures Purpose financial statements demystified p 244, 247, 248 balance sheet or notes, and income statement or notes profit to interest, proportions of funding Rules of thumb ≥ 3 ≤ 1 ≤ 0. 5

Financing Ratios Interest cover = EBIT interest expense Debt to equity = total liabilities equity = interest bearing debts equity Interest-bearing debt to equity Where to find figures Purpose financial statements demystified p 244, 247, 248 balance sheet or notes, and income statement or notes profit to interest, proportions of funding Rules of thumb ≥ 3 ≤ 1 ≤ 0. 5

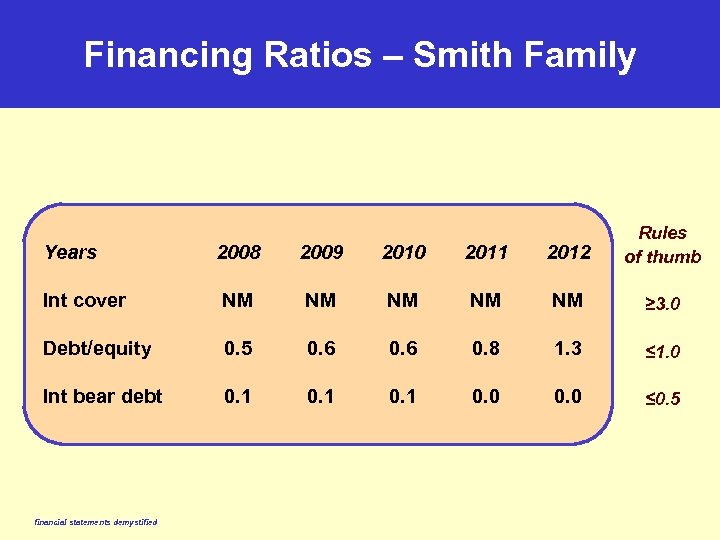

Financing Ratios – Smith Family 2008 2009 2010 2011 2012 Rules of thumb Int cover NM NM NM ≥ 3. 0 Debt/equity 0. 5 0. 6 0. 8 1. 3 ≤ 1. 0 Int bear debt 0. 1 0. 0 ≤ 0. 5 Years financial statements demystified

Financing Ratios – Smith Family 2008 2009 2010 2011 2012 Rules of thumb Int cover NM NM NM ≥ 3. 0 Debt/equity 0. 5 0. 6 0. 8 1. 3 ≤ 1. 0 Int bear debt 0. 1 0. 0 ≤ 0. 5 Years financial statements demystified

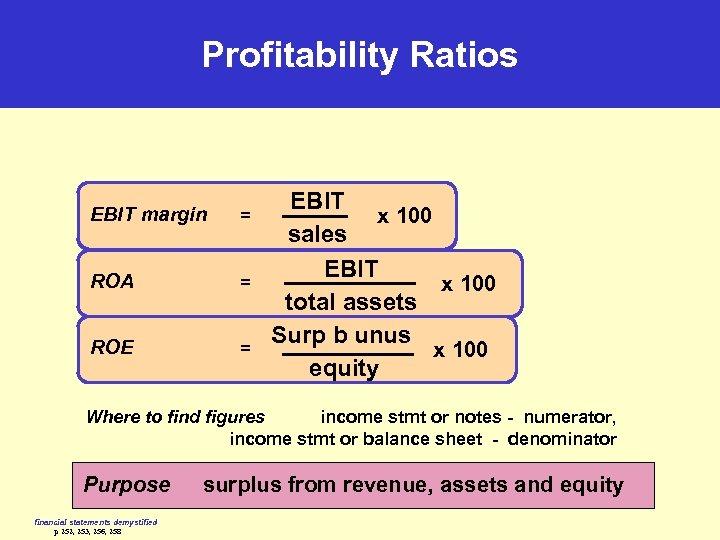

Profitability Ratios EBIT margin = ROA = ROE = EBIT x 100 sales EBIT x 100 total assets Surp b unus x 100 equity Where to find figures income stmt or notes - numerator, income stmt or balance sheet - denominator Purpose financial statements demystified p 252, 253, 256, 258 surplus from revenue, assets and equity

Profitability Ratios EBIT margin = ROA = ROE = EBIT x 100 sales EBIT x 100 total assets Surp b unus x 100 equity Where to find figures income stmt or notes - numerator, income stmt or balance sheet - denominator Purpose financial statements demystified p 252, 253, 256, 258 surplus from revenue, assets and equity

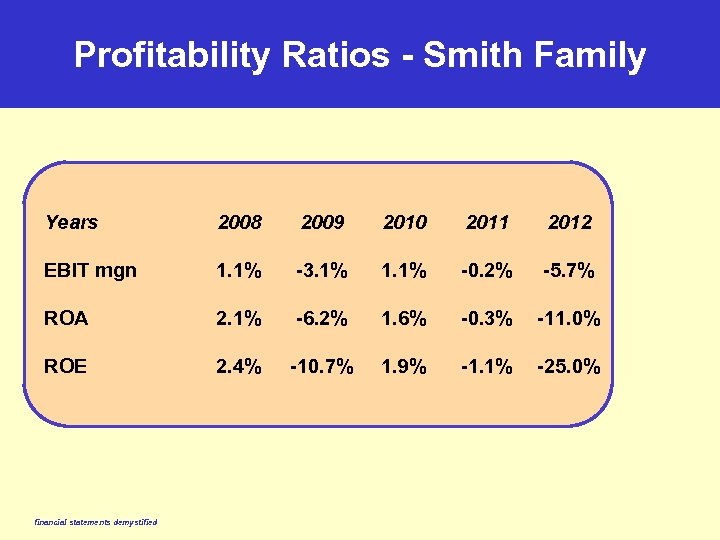

Profitability Ratios - Smith Family Years 2008 2009 2010 2011 2012 EBIT mgn 1. 1% -3. 1% 1. 1% -0. 2% -5. 7% ROA 2. 1% -6. 2% 1. 6% -0. 3% -11. 0% ROE 2. 4% -10. 7% 1. 9% -1. 1% -25. 0% financial statements demystified

Profitability Ratios - Smith Family Years 2008 2009 2010 2011 2012 EBIT mgn 1. 1% -3. 1% 1. 1% -0. 2% -5. 7% ROA 2. 1% -6. 2% 1. 6% -0. 3% -11. 0% ROE 2. 4% -10. 7% 1. 9% -1. 1% -25. 0% financial statements demystified

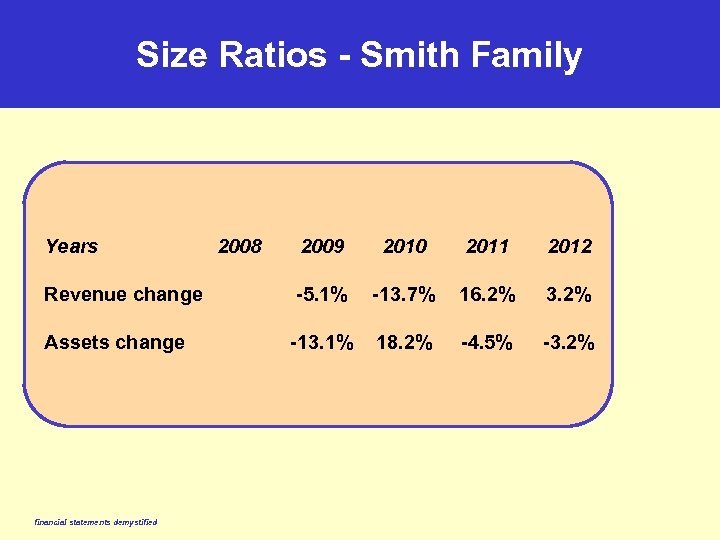

Size Ratios - Smith Family Years 2009 2010 2011 2012 Revenue change -5. 1% -13. 7% 16. 2% 3. 2% Assets change -13. 1% 18. 2% -4. 5% -3. 2% financial statements demystified 2008

Size Ratios - Smith Family Years 2009 2010 2011 2012 Revenue change -5. 1% -13. 7% 16. 2% 3. 2% Assets change -13. 1% 18. 2% -4. 5% -3. 2% financial statements demystified 2008

financial statements demystified

financial statements demystified

Summary of the Three Financial Statements Balance Sheet Income Statement Cash Flow Statement Snapshot at balance sheet date History of revenue less expenses over a year History of cash in less cash out over a year Formula L+E=A or E=A-L where: A is assets L is liabilities E is equity financial statements demystified p 24 Formula P=R-E where: R is revenue E is expenses Formula Cash: In (Out)

Summary of the Three Financial Statements Balance Sheet Income Statement Cash Flow Statement Snapshot at balance sheet date History of revenue less expenses over a year History of cash in less cash out over a year Formula L+E=A or E=A-L where: A is assets L is liabilities E is equity financial statements demystified p 24 Formula P=R-E where: R is revenue E is expenses Formula Cash: In (Out)

financial statements demystified

financial statements demystified