Корпоративные финансы ФИН ОТЧЕТНОСТЬ.pptx

- Количество слайдов: 15

FINANCIAL STATEMENTS Chapter 3 Balance Sheet Income Statement of Cash Flows

Finance from a Personal Viewpoint A. All us own things and owe money B. If we own more than we owe – we are said to have a positive net worth. C. In Finance: 1. What we own are called Assets. 2. What we owe are called Liabilities. 3. If our Assets exceed our Liabilities then we have [positive] Equity. 4. Accordingly: Assets = Liabilities + Equity

Balance Sheet A. The Balance Sheet answers two general questions: How has the firm invested its capital (money)? a. Current Assets (cash, receivables, inventory) b. Fixed Assets (plant, property, equipment) 2. How has the firm financed its capital investment? a. Borrowing: short-term (current liabilities) and long -term debt b. Equity (stock) and Retained Earnings 1. Page 3

INCOME STATEMENT A. The income statement gives information relating to the firm’s Revenues and Expenses for the last accounting (fiscal) period. B. The I/S is frequently called the P&L (Profit and Loss). C. The most important use is for determining how profitably a firm is operating. Page 4

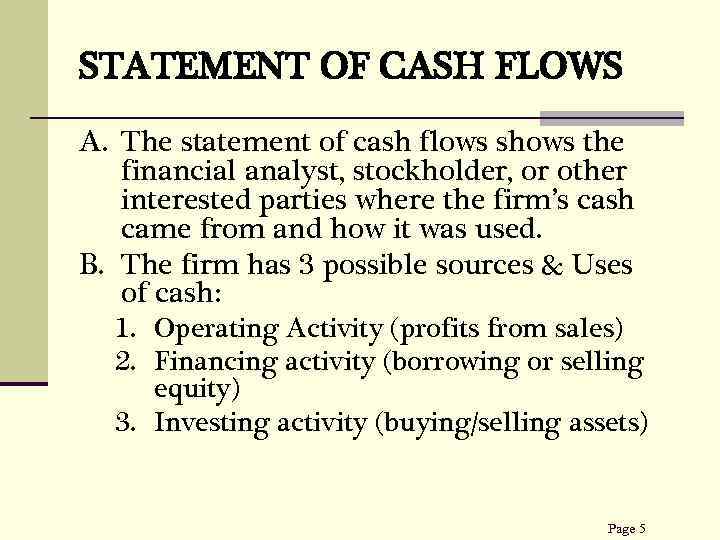

STATEMENT OF CASH FLOWS A. The statement of cash flows shows the financial analyst, stockholder, or other interested parties where the firm’s cash came from and how it was used. B. The firm has 3 possible sources & Uses of cash: 1. Operating Activity (profits from sales) 2. Financing activity (borrowing or selling equity) 3. Investing activity (buying/selling assets) Page 5

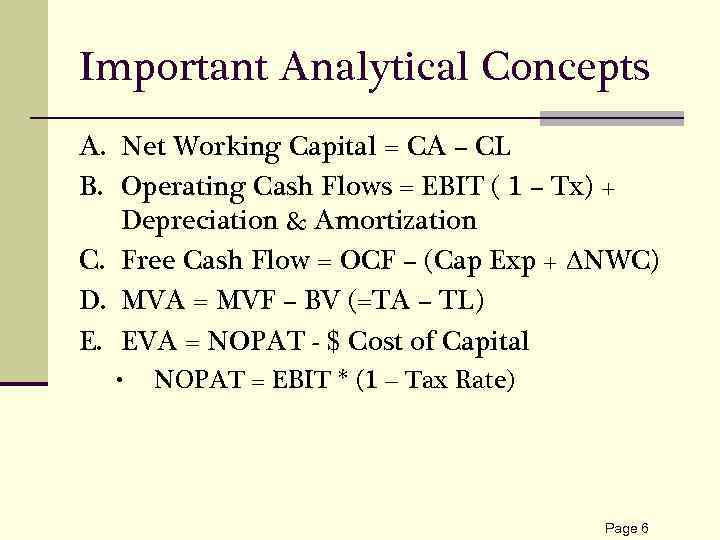

Important Analytical Concepts A. Net Working Capital = CA – CL B. Operating Cash Flows = EBIT ( 1 – Tx) + Depreciation & Amortization C. Free Cash Flow = OCF – (Cap Exp + DNWC) D. MVA = MVF – BV (=TA – TL) E. EVA = NOPAT - $ Cost of Capital • NOPAT = EBIT * (1 – Tax Rate) Page 6

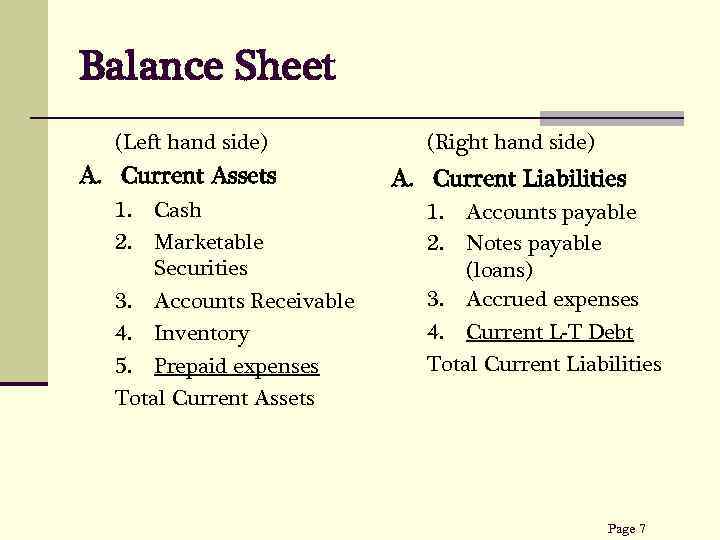

Balance Sheet (Left hand side) A. Current Assets 1. 2. Cash Marketable Securities 3. Accounts Receivable 4. Inventory 5. Prepaid expenses Total Current Assets (Right hand side) A. Current Liabilities 1. 2. Accounts payable Notes payable (loans) 3. Accrued expenses 4. Current L-T Debt Total Current Liabilities Page 7

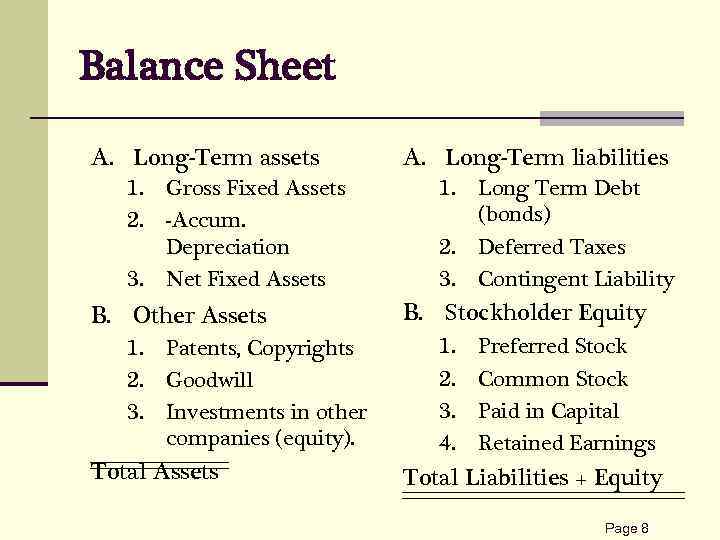

Balance Sheet A. Long-Term assets 1. 2. 3. Gross Fixed Assets -Accum. Depreciation Net Fixed Assets B. Other Assets 1. 2. 3. Patents, Copyrights Goodwill Investments in other companies (equity). Total Assets A. Long-Term liabilities 1. 2. 3. Long Term Debt (bonds) Deferred Taxes Contingent Liability B. Stockholder Equity 1. 2. 3. 4. Preferred Stock Common Stock Paid in Capital Retained Earnings Total Liabilities + Equity Page 8

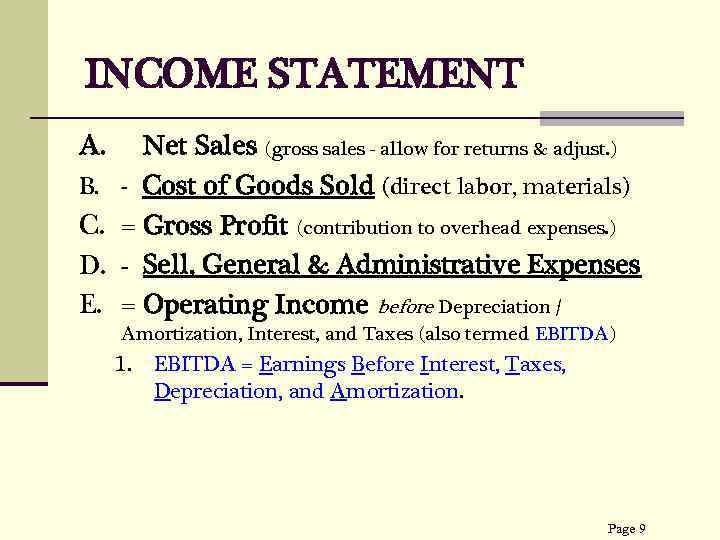

INCOME STATEMENT A. B. C. D. E. Net Sales (gross sales - allow for returns & adjust. ) - Cost of Goods Sold (direct labor, materials) = Gross Profit (contribution to overhead expenses. ) - Sell, General & Administrative Expenses = Operating Income before Depreciation / Amortization, Interest, and Taxes (also termed EBITDA) 1. EBITDA = Earnings Before Interest, Taxes, Depreciation, and Amortization. Page 9

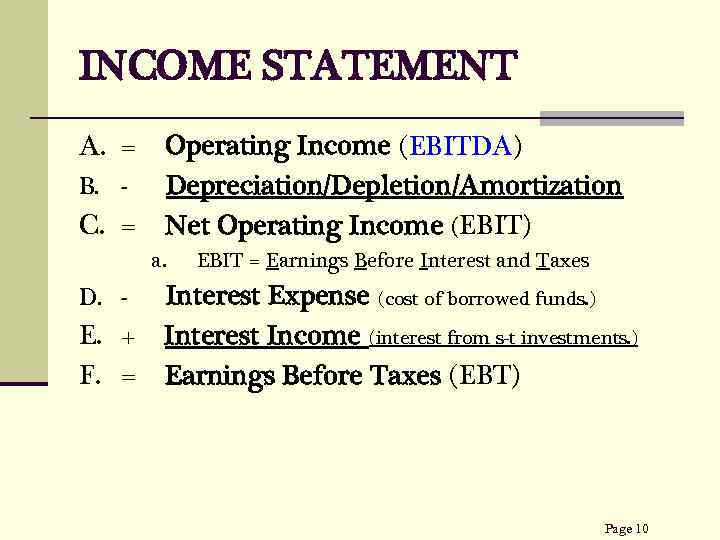

INCOME STATEMENT A. = B. - C. = Operating Income (EBITDA) Depreciation/Depletion/Amortization Net Operating Income (EBIT) a. D. - E. + F. = EBIT = Earnings Before Interest and Taxes Interest Expense (cost of borrowed funds. ) Interest Income (interest from s-t investments. ) Earnings Before Taxes (EBT) Page 10

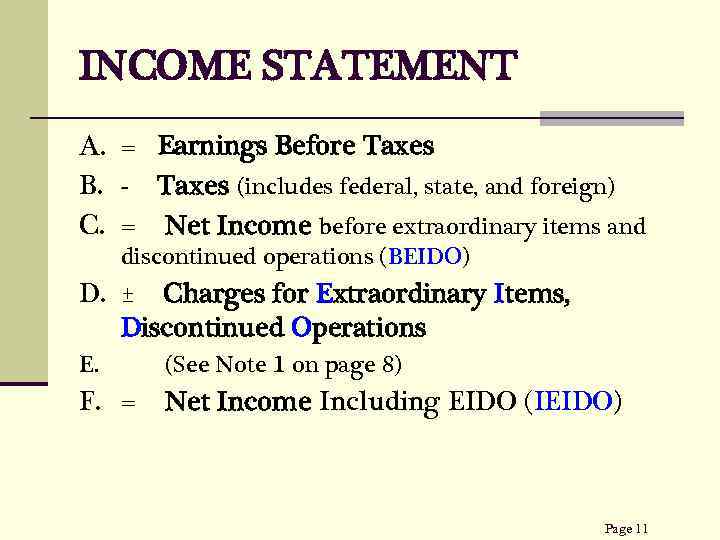

INCOME STATEMENT A. = Earnings Before Taxes B. - Taxes (includes federal, state, and foreign) C. = Net Income before extraordinary items and discontinued operations (BEIDO) D. ± Charges for Extraordinary Items, Discontinued Operations E. (See Note 1 on page 8) F. = Net Income Including EIDO (IEIDO) Page 11

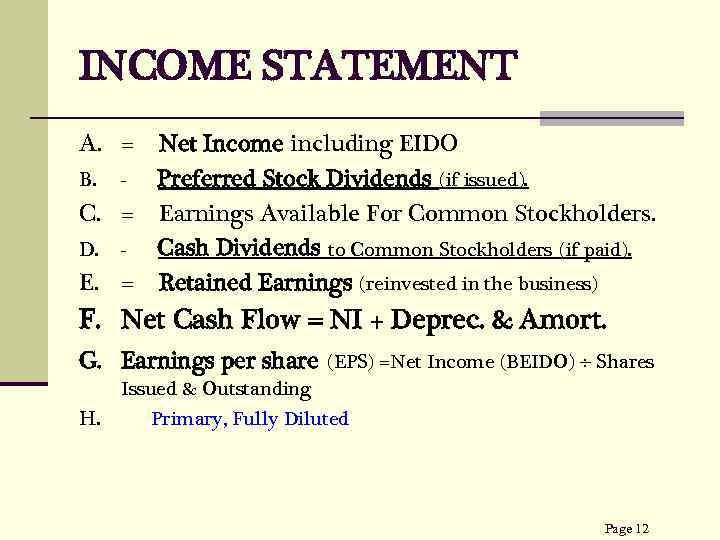

INCOME STATEMENT A. = Net Income including EIDO B. Preferred Stock Dividends (if issued). C. = Earnings Available For Common Stockholders. D. Cash Dividends to Common Stockholders (if paid). E. = Retained Earnings (reinvested in the business) F. Net Cash Flow = NI + Deprec. & Amort. G. Earnings per share (EPS) =Net Income (BEIDO) Shares H. Issued & Outstanding Primary, Fully Diluted Page 12

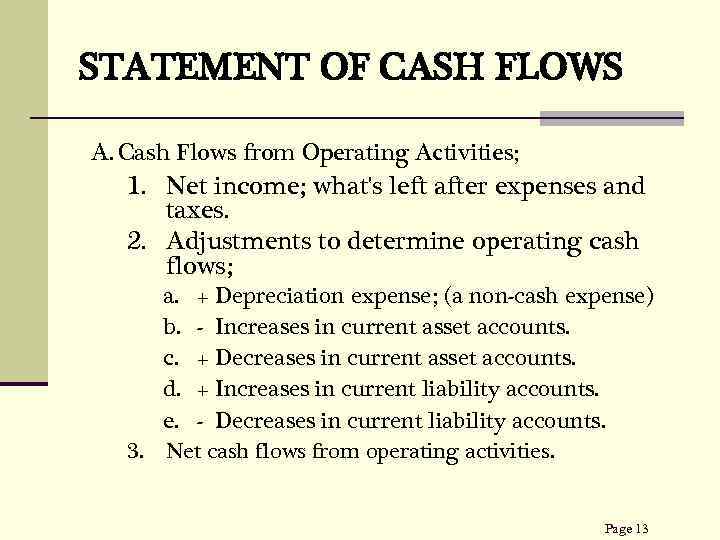

STATEMENT OF CASH FLOWS A. Cash Flows from Operating Activities; 1. Net income; what's left after expenses and taxes. 2. Adjustments to determine operating cash flows; a. b. c. d. e. + Depreciation expense; (a non-cash expense) - Increases in current asset accounts. + Decreases in current asset accounts. + Increases in current liability accounts. - Decreases in current liability accounts. 3. Net cash flows from operating activities. Page 13

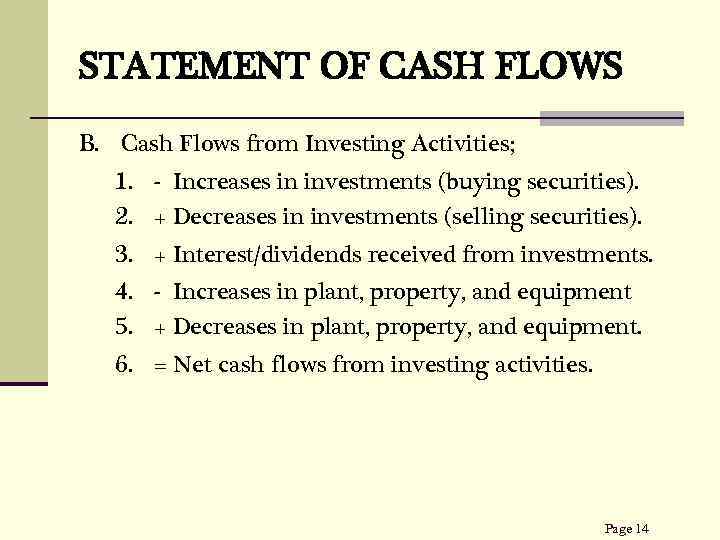

STATEMENT OF CASH FLOWS B. Cash Flows from Investing Activities; 1. - Increases in investments (buying securities). 2. + Decreases in investments (selling securities). 3. + Interest/dividends received from investments. 4. - Increases in plant, property, and equipment 5. + Decreases in plant, property, and equipment. 6. = Net cash flows from investing activities. Page 14

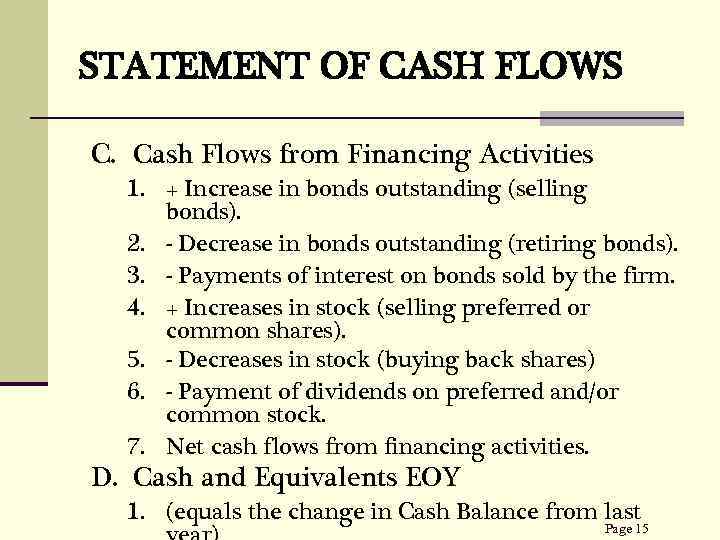

STATEMENT OF CASH FLOWS C. Cash Flows from Financing Activities 1. + Increase in bonds outstanding (selling bonds). 2. - Decrease in bonds outstanding (retiring bonds). 3. - Payments of interest on bonds sold by the firm. 4. + Increases in stock (selling preferred or common shares). 5. - Decreases in stock (buying back shares) 6. - Payment of dividends on preferred and/or common stock. 7. Net cash flows from financing activities. D. Cash and Equivalents EOY 1. (equals the change in Cash Balance from last Page 15

Корпоративные финансы ФИН ОТЧЕТНОСТЬ.pptx