Aidaaa.pptx

- Количество слайдов: 21

Financial Statement Analysis of JSC «Bayan-Sulu» Done by: Abdrakhman Aida Bolatova Bakhyt Acc-232

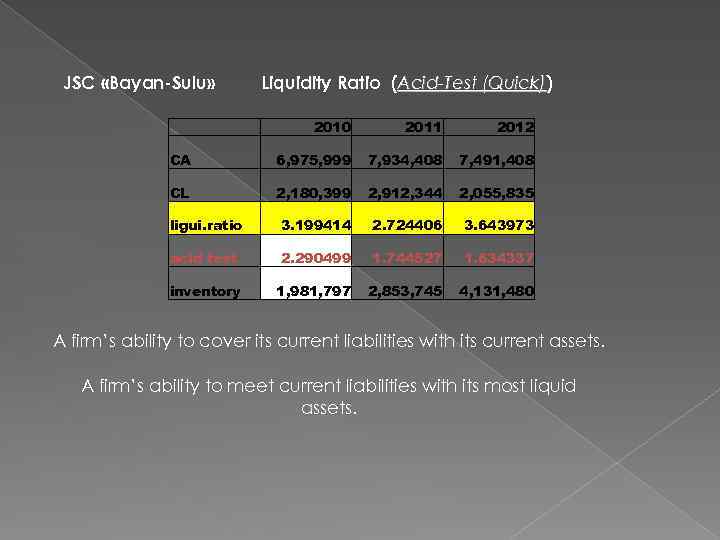

JSC «Bayan-Sulu» Liquidity Ratio (Acid-Test (Quick)) (Quick) 2010 2011 2012 CA 6, 975, 999 7, 934, 408 7, 491, 408 CL 2, 180, 399 2, 912, 344 2, 055, 835 ligui. ratio 3. 199414 2. 724406 3. 643973 acid test 2. 290499 1. 744527 1. 634337 inventory 1, 981, 797 2, 853, 745 4, 131, 480 A firm’s ability to cover its current liabilities with its current assets. A firm’s ability to meet current liabilities with its most liquid assets.

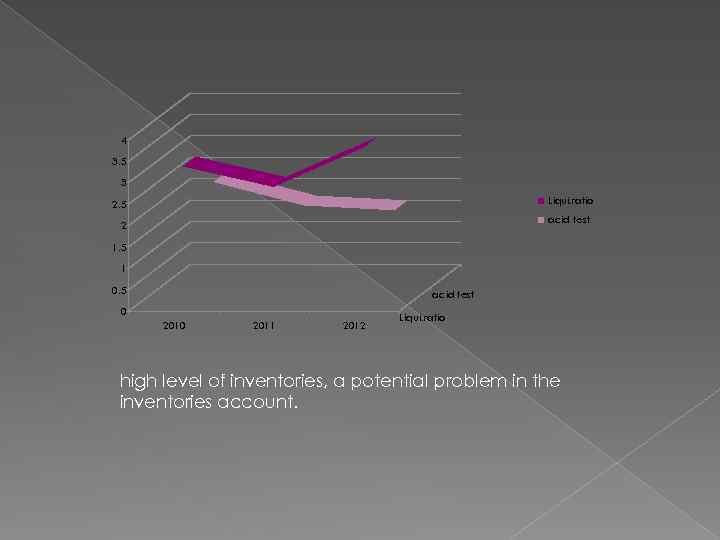

4 3. 5 3 Liqui. ratio 2. 5 acid test 2 1. 5 1 0. 5 acid test 0 2011 2012 Liqui. ratio high level of inventories, a potential problem in the inventories account.

Financial Leverage Ratios Debt-to-Equity Total Debt Shareholders’ Equity 2010 2011 2012 sh-t. debt 2180399 2912344 2055835 lon-t. debt 1890440 1767537 1615561 total debt 4070839 4679881 3671396 shar. equity 9625985 Debt to eq. 0, 422901 0, 486172 0, 381405 We can see to what extent the firm is financed by debt.

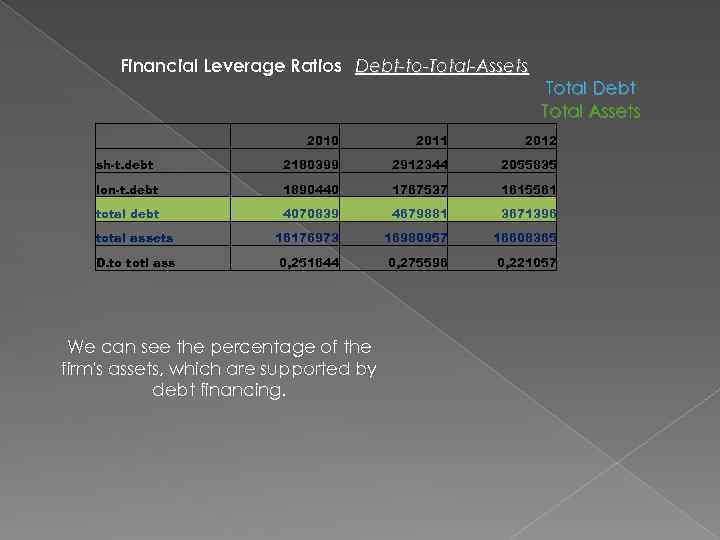

Financial Leverage Ratios Debt-to-Total-Assets Total Debt Total Assets 2010 2011 2012 sh-t. debt 2180399 2912344 2055835 lon-t. debt 1890440 1767537 1615561 total debt 4070839 4679881 3671396 total assets 16176973 16980957 16608365 D. to totl ass 0, 251644 0, 275596 0, 221057 We can see the percentage of the firm's assets, which are supported by debt financing.

Financial Leverage Ratios Total Capitalization Long-term Debt Total Capitalization (i. e. , LT-Debt + Equity) 2010 2011 2012 1890440 1767537 1615561 equty 12106134 12301075 12936969 total capit. 13996574 14068612 14552530 0, 135064 0, 125637 0, 111016 long-t debt ratio We can see the ratio of long-term debt to long-term financing of the firm.

Interest Coverage Ratios EBIT Interest Charges 2010 2011 2012 EBIT 685470 867904 772316 Int. Charges 225016 206078 116299 3, 046317 4, 211532 6, 640779 ratio a firm’s ability to cover interest charges.

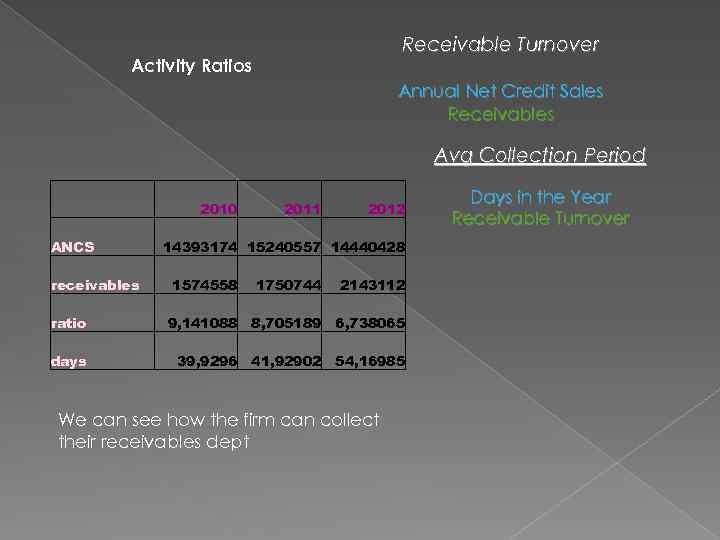

Receivable Turnover Activity Ratios Annual Net Credit Sales Receivables Avg Collection Period 2010 ANCS receivables 2011 2012 14393174 15240557 14440428 1574558 1750744 2143112 ratio 9, 141088 8, 705189 6, 738065 days 39, 9296 41, 92902 54, 16985 We can see how the firm can collect their receivables dept Days in the Year Receivable Turnover

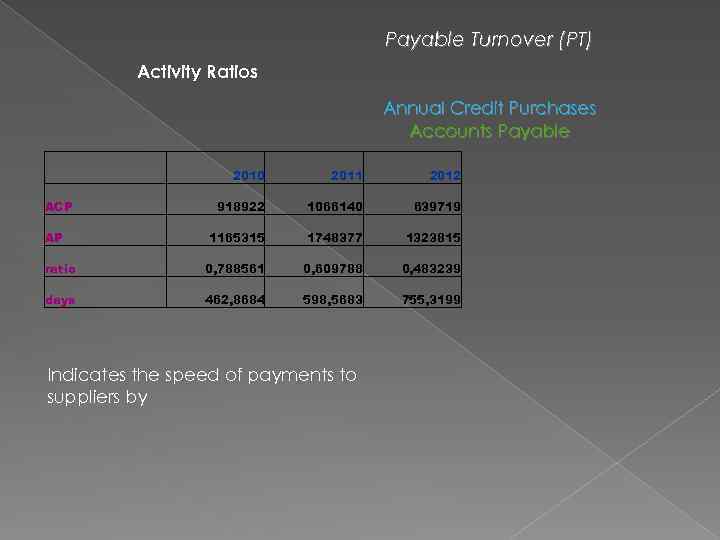

Payable Turnover (PT) Activity Ratios Annual Credit Purchases Accounts Payable 2010 2011 2012 918922 1066140 639719 1165315 1748377 1323815 ratio 0, 788561 0, 609788 0, 483239 days 462, 8684 598, 5683 755, 3199 ACP AP Indicates the speed of payments to suppliers by

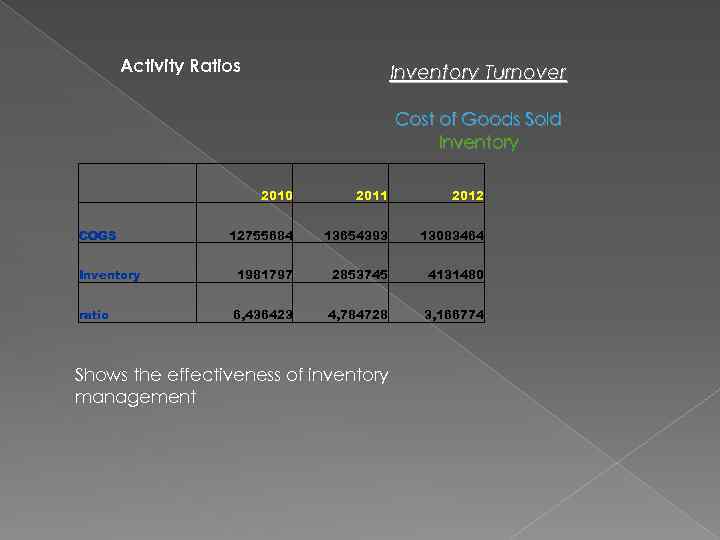

Activity Ratios Inventory Turnover Cost of Goods Sold Inventory COGS Inventory ratio 2010 2011 2012 12755684 13654393 13083464 1981797 2853745 4131480 6, 436423 4, 784728 3, 166774 Shows the effectiveness of inventory management

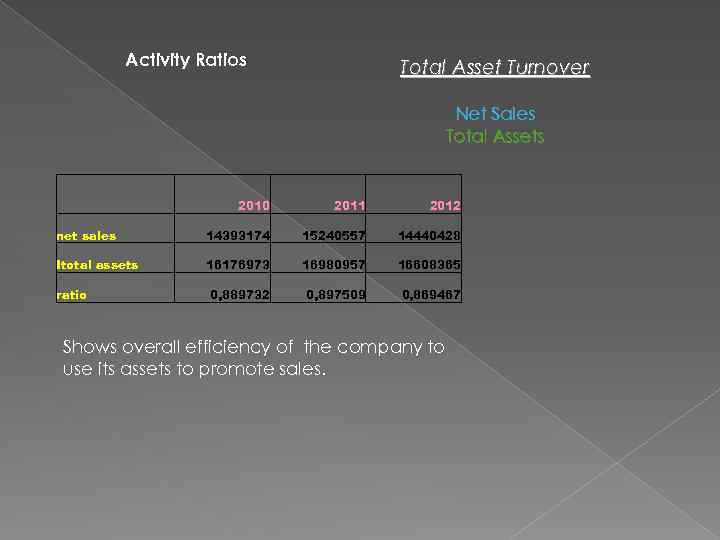

Activity Ratios Total Asset Turnover Net Sales Total Assets 2010 2011 2012 net sales 14393174 15240557 14440428 Itotal assets 16176973 16980957 16608365 0, 889732 0, 897509 0, 869467 ratio Shows overall efficiency of the company to use its assets to promote sales.

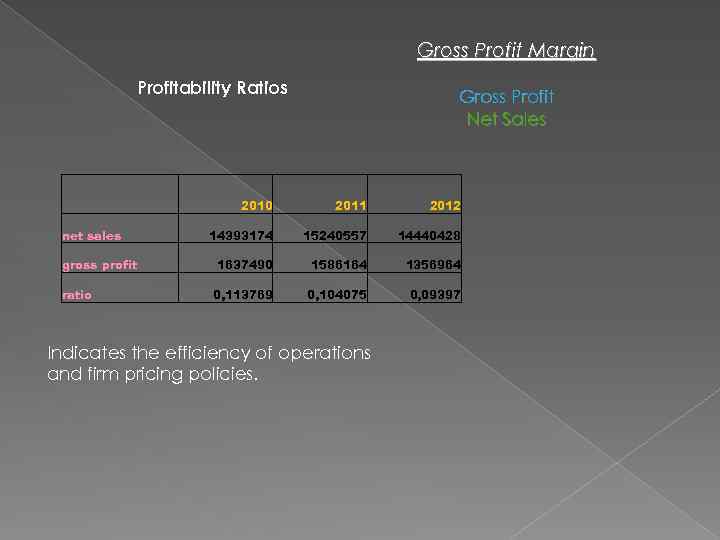

Gross Profit Margin Profitability Ratios net sales gross profit ratio Gross Profit Net Sales 2010 2011 2012 14393174 15240557 14440428 1637490 1586164 1356964 0, 113769 0, 104075 0, 09397 Indicates the efficiency of operations and firm pricing policies.

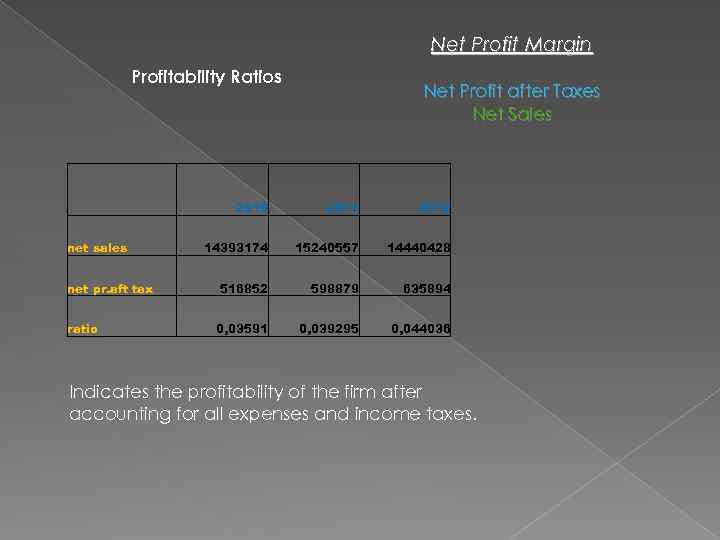

Net Profit Margin Profitability Ratios net sales net pr. aft tax ratio Net Profit after Taxes Net Sales 2010 2011 2012 14393174 15240557 14440428 516852 598879 635894 0, 03591 0, 039295 0, 044036 Indicates the profitability of the firm after accounting for all expenses and income taxes.

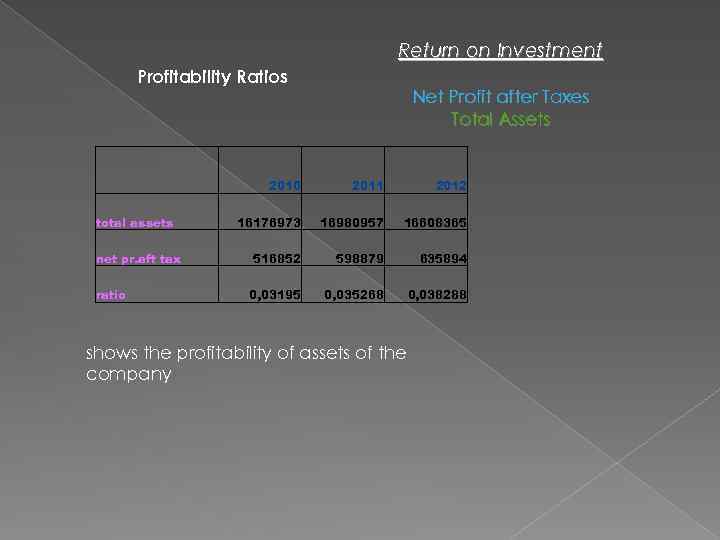

Return on Investment Profitability Ratios total assets net pr. aft tax ratio Net Profit after Taxes Total Assets 2010 2011 2012 16176973 16980957 16608365 516852 598879 635894 0, 03195 0, 035268 0, 038288 shows the profitability of assets of the company

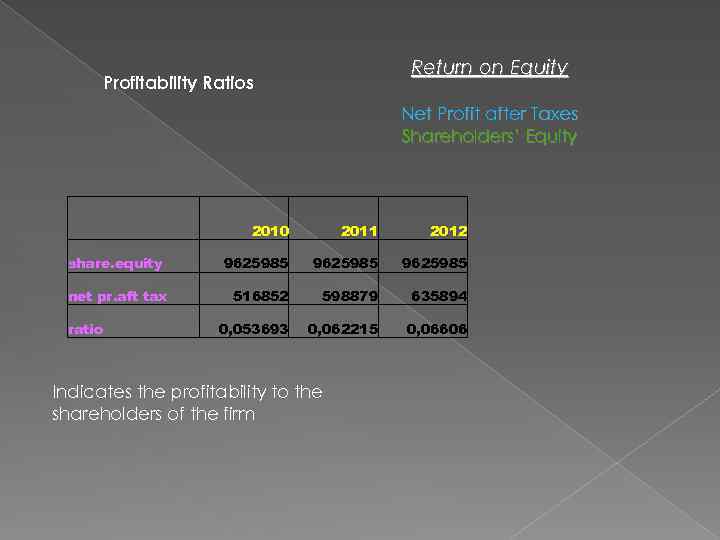

Return on Equity Profitability Ratios Net Profit after Taxes Shareholders’ Equity share. equity net pr. aft tax ratio 2010 2011 2012 9625985 516852 598879 635894 0, 053693 0, 062215 0, 06606 Indicates the profitability to the shareholders of the firm

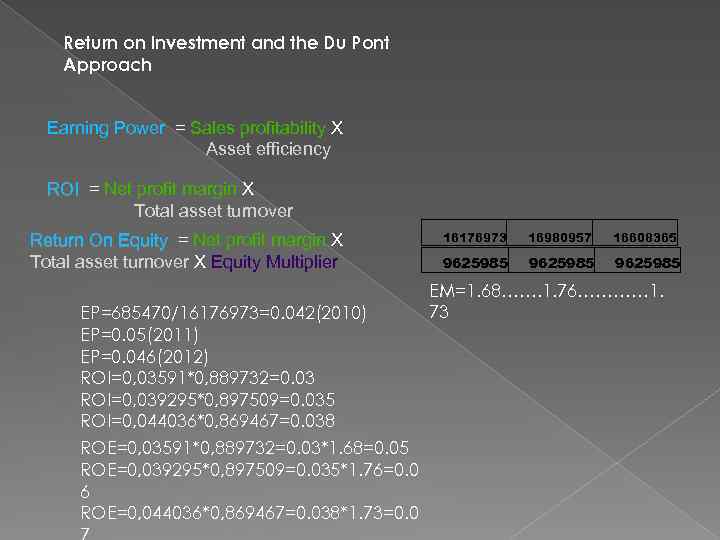

Return on Investment and the Du Pont Approach Earning Power = Sales profitability X Asset efficiency ROI = Net profit margin X Total asset turnover Return On Equity = Net profit margin X Total asset turnover X Equity Multiplier EP=685470/16176973=0. 042(2010) EP=0. 05(2011) EP=0. 046(2012) ROI=0, 03591*0, 889732=0. 03 ROI=0, 039295*0, 897509=0. 035 ROI=0, 044036*0, 869467=0. 038 ROE=0, 03591*0, 889732=0. 03*1. 68=0. 05 ROE=0, 039295*0, 897509=0. 035*1. 76=0. 0 6 ROE=0, 044036*0, 869467=0. 038*1. 73=0. 0 16176973 16980957 16608365 9625985 EM=1. 68……. 1. 76………… 1. 73

The profitability ratios for Bayan-Sulu have been rising since 2010. then in 2012 we can see that ratio did not change so much. - Inventories are too high.

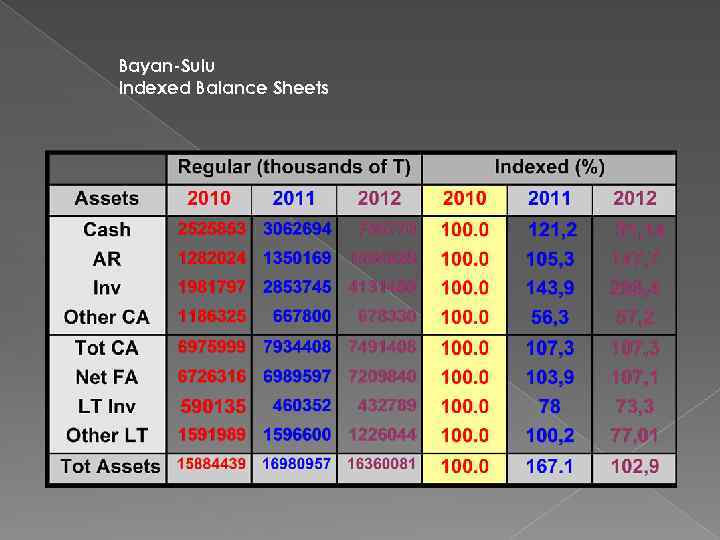

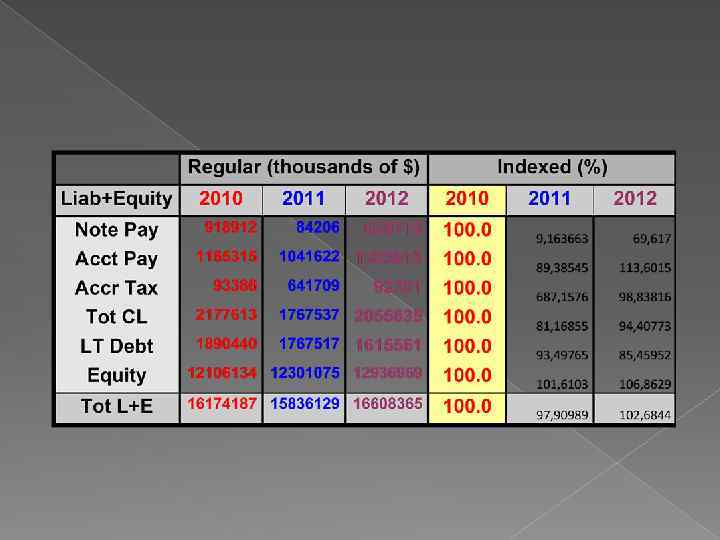

Bayan-Sulu Indexed Balance Sheets

Aidaaa.pptx