8c5178987125e46b6115ce34415e2ed5.ppt

- Количество слайдов: 22

FINANCIAL SOLUTION FOR THE KENYAN IN DIASPORA LOS ANGELES 12 TH NOVEMBER 2011

FINANCIAL SOLUTION FOR THE KENYAN IN DIASPORA LOS ANGELES 12 TH NOVEMBER 2011

THE CO-OPERATIVE BANK • The Co-operative Bank was formed by co-operators through their co-operative societies in 1965 to deliver financial services to the Co-operative Movement in general for maximum benefit of the societies’ members. Started operations in 1968 • Listed on the NSE in 2008 • The Co-operative is the key strategic investor holding a 65% stake in the bank. • 35% is owned by private investors

THE CO-OPERATIVE BANK • The Co-operative Bank was formed by co-operators through their co-operative societies in 1965 to deliver financial services to the Co-operative Movement in general for maximum benefit of the societies’ members. Started operations in 1968 • Listed on the NSE in 2008 • The Co-operative is the key strategic investor holding a 65% stake in the bank. • 35% is owned by private investors

THE CO-OPERATIVE BANK • One of the largest tier 1 banks in Kenya in terms of asset base and Share capital. • 526 ATMs and over 140 branches placed both onsite and offsite for customer convenience. • The Bank is a key stakeholder of the Co-operative Movement , a key segment of our economy mobilizing over 30% of Gross Domestic Savings. • Over 4 M customers • The bank has a comprehensive network of correspondent banks covering all major financial centres and currencies in the world.

THE CO-OPERATIVE BANK • One of the largest tier 1 banks in Kenya in terms of asset base and Share capital. • 526 ATMs and over 140 branches placed both onsite and offsite for customer convenience. • The Bank is a key stakeholder of the Co-operative Movement , a key segment of our economy mobilizing over 30% of Gross Domestic Savings. • Over 4 M customers • The bank has a comprehensive network of correspondent banks covering all major financial centres and currencies in the world.

DIASPORA BANKING Co-operative bank has been offering Diaspora banking services for over 4 years. During these times we have been able to grow and be one of the biggest providers of Diaspora banking services. This has been achieved by; – Giving the diaspora control of there finances at home – Opening channels to invest in various sectors – Educate diasporas on Kenyan economic market – Offer easy banking solutions – We also offer a Jamhuri account and the Good home mortgage’s for the diasporas in the following currencies KSH, USD, GBP and EURO

DIASPORA BANKING Co-operative bank has been offering Diaspora banking services for over 4 years. During these times we have been able to grow and be one of the biggest providers of Diaspora banking services. This has been achieved by; – Giving the diaspora control of there finances at home – Opening channels to invest in various sectors – Educate diasporas on Kenyan economic market – Offer easy banking solutions – We also offer a Jamhuri account and the Good home mortgage’s for the diasporas in the following currencies KSH, USD, GBP and EURO

REAL ESTATE INVESTMENT IN KENYA PRESENTATION Kenuks- Kenya UK Savings and Credit Society 3/17/2018 5

REAL ESTATE INVESTMENT IN KENYA PRESENTATION Kenuks- Kenya UK Savings and Credit Society 3/17/2018 5

Introduction • Kenya is rated as one of the countries with a very vibrant financial system in Africa. • Not withstanding there are serious funding gaps in housing, resistance to adopt non traditional building technology and infrastructural challenges. • runaway land prices • Lack of an active secondary mortgage market • slow land registration process. • shortage of houses. 3/17/2018 6

Introduction • Kenya is rated as one of the countries with a very vibrant financial system in Africa. • Not withstanding there are serious funding gaps in housing, resistance to adopt non traditional building technology and infrastructural challenges. • runaway land prices • Lack of an active secondary mortgage market • slow land registration process. • shortage of houses. 3/17/2018 6

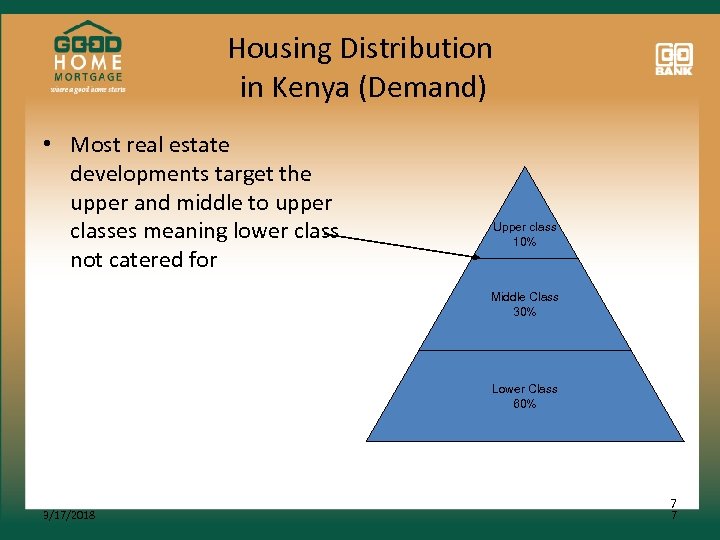

Housing Distribution in Kenya (Demand) • Most real estate developments target the upper and middle to upper classes meaning lower class not catered for Upper class 10% Middle Class 30% Lower Class 60% 3/17/2018 7 7

Housing Distribution in Kenya (Demand) • Most real estate developments target the upper and middle to upper classes meaning lower class not catered for Upper class 10% Middle Class 30% Lower Class 60% 3/17/2018 7 7

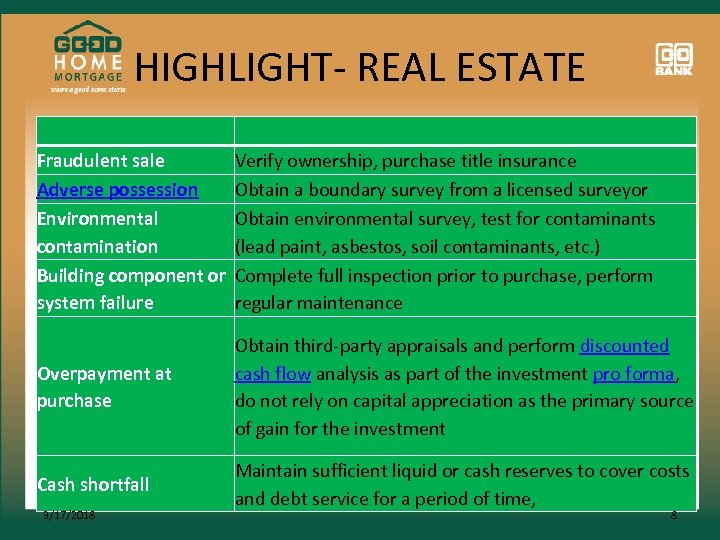

HIGHLIGHT- REAL ESTATE Fraudulent sale Verify ownership, purchase title insurance Adverse possession Obtain a boundary survey from a licensed surveyor Environmental Obtain environmental survey, test for contaminants contamination (lead paint, asbestos, soil contaminants, etc. ) Building component or Complete full inspection prior to purchase, perform system failure regular maintenance Overpayment at purchase Obtain third-party appraisals and perform discounted cash flow analysis as part of the investment pro forma, do not rely on capital appreciation as the primary source of gain for the investment Cash shortfall Maintain sufficient liquid or cash reserves to cover costs and debt service for a period of time, 3/17/2018 8

HIGHLIGHT- REAL ESTATE Fraudulent sale Verify ownership, purchase title insurance Adverse possession Obtain a boundary survey from a licensed surveyor Environmental Obtain environmental survey, test for contaminants contamination (lead paint, asbestos, soil contaminants, etc. ) Building component or Complete full inspection prior to purchase, perform system failure regular maintenance Overpayment at purchase Obtain third-party appraisals and perform discounted cash flow analysis as part of the investment pro forma, do not rely on capital appreciation as the primary source of gain for the investment Cash shortfall Maintain sufficient liquid or cash reserves to cover costs and debt service for a period of time, 3/17/2018 8

HIGHLIGHT- REAL ESTATE RISK Economic downturn Purchase properties with distinctive features in desirable locations to stand out from competition, control cost structure, have tenants sign long term leases Tenant destruction of property Screen potential tenants carefully, hire experienced property managers Underestimation of risk Carefully analyze financial performance using conservative assumptions, ensure that the property can generate enough cash flow to support itself Fire, flood, personal injury Purchase properties based on a conservative approach that the market might decline and rental income may also decrease Insurance policy on the property Tax Planning Plan purchases and sales around an exit strategy to save taxes. Market Decline 3/17/2018 9

HIGHLIGHT- REAL ESTATE RISK Economic downturn Purchase properties with distinctive features in desirable locations to stand out from competition, control cost structure, have tenants sign long term leases Tenant destruction of property Screen potential tenants carefully, hire experienced property managers Underestimation of risk Carefully analyze financial performance using conservative assumptions, ensure that the property can generate enough cash flow to support itself Fire, flood, personal injury Purchase properties based on a conservative approach that the market might decline and rental income may also decrease Insurance policy on the property Tax Planning Plan purchases and sales around an exit strategy to save taxes. Market Decline 3/17/2018 9

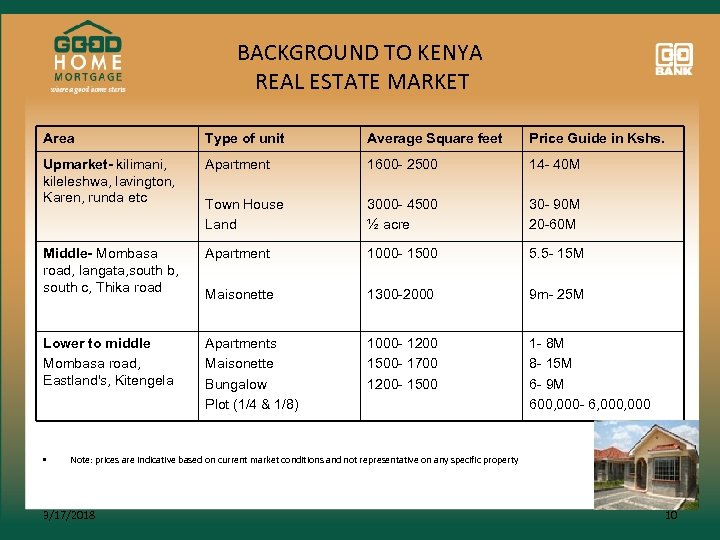

BACKGROUND TO KENYA REAL ESTATE MARKET Area Type of unit Average Square feet Price Guide in Kshs. Upmarket- kilimani, kileleshwa, lavington, Karen, runda etc Apartment 1600 - 2500 14 - 40 M Town House Land 3000 - 4500 ½ acre 30 - 90 M 20 -60 M Middle- Mombasa road, langata, south b, south c, Thika road Apartment 1000 - 1500 5. 5 - 15 M Maisonette 1300 -2000 9 m- 25 M Lower to middle Mombasa road, Eastland's, Kitengela Apartments Maisonette Bungalow Plot (1/4 & 1/8) 1000 - 1200 1500 - 1700 1200 - 1500 1 - 8 M 8 - 15 M 6 - 9 M 600, 000 - 6, 000 • Note: prices are indicative based on current market conditions and not representative on any specific property 3/17/2018 10

BACKGROUND TO KENYA REAL ESTATE MARKET Area Type of unit Average Square feet Price Guide in Kshs. Upmarket- kilimani, kileleshwa, lavington, Karen, runda etc Apartment 1600 - 2500 14 - 40 M Town House Land 3000 - 4500 ½ acre 30 - 90 M 20 -60 M Middle- Mombasa road, langata, south b, south c, Thika road Apartment 1000 - 1500 5. 5 - 15 M Maisonette 1300 -2000 9 m- 25 M Lower to middle Mombasa road, Eastland's, Kitengela Apartments Maisonette Bungalow Plot (1/4 & 1/8) 1000 - 1200 1500 - 1700 1200 - 1500 1 - 8 M 8 - 15 M 6 - 9 M 600, 000 - 6, 000 • Note: prices are indicative based on current market conditions and not representative on any specific property 3/17/2018 10

3/17/2018 11

3/17/2018 11

What is Good home Mortgage? • Is the mortgage product for Co-operative Bank of Kenya • It seeks to simplify the mortgage process • Targeted products hence offering a large array of real estate acquisition and construction solutions • We can finance anywhere in Kenya provided it is within a municipality • We can provide multifaceted solutions in conjunction with other cooperative bank product offerings. 3/17/2018 12

What is Good home Mortgage? • Is the mortgage product for Co-operative Bank of Kenya • It seeks to simplify the mortgage process • Targeted products hence offering a large array of real estate acquisition and construction solutions • We can finance anywhere in Kenya provided it is within a municipality • We can provide multifaceted solutions in conjunction with other cooperative bank product offerings. 3/17/2018 12

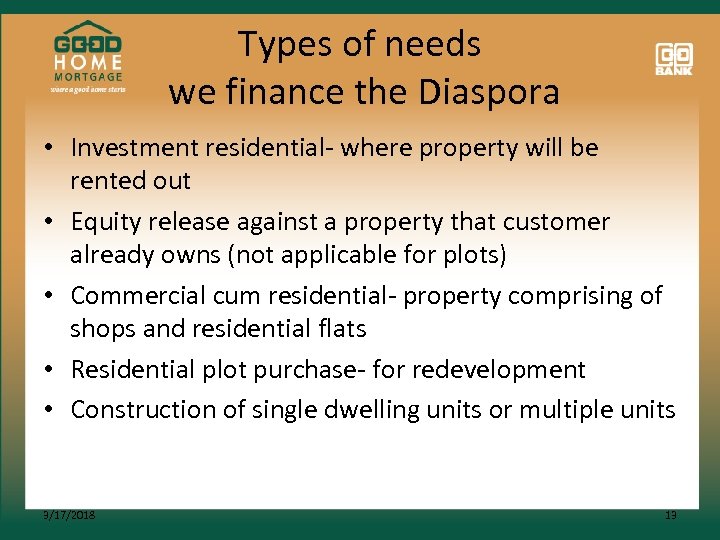

Types of needs we finance the Diaspora • Investment residential- where property will be rented out • Equity release against a property that customer already owns (not applicable for plots) • Commercial cum residential- property comprising of shops and residential flats • Residential plot purchase- for redevelopment • Construction of single dwelling units or multiple units 3/17/2018 13

Types of needs we finance the Diaspora • Investment residential- where property will be rented out • Equity release against a property that customer already owns (not applicable for plots) • Commercial cum residential- property comprising of shops and residential flats • Residential plot purchase- for redevelopment • Construction of single dwelling units or multiple units 3/17/2018 13

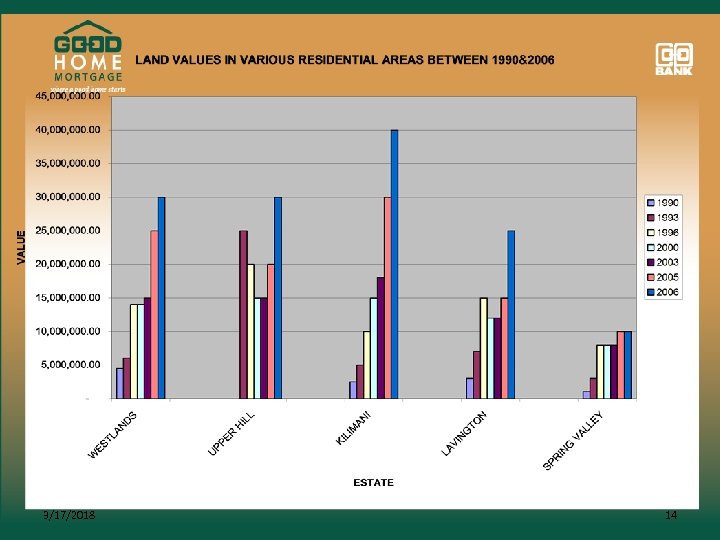

3/17/2018 14

3/17/2018 14

MORTGAGE STEPS The first step is to locate the property and do an initial property appraisal. • Assess the type of title. • Possible Value versus price. • Use versus location. • Accessibility of the property. • Adaptability to the intended use. • Above requires also an interview process to determine the suitability of the prospective borrower. • Evaluate what product package is suitable for the client considering nature of employment. 3/17/2018 15

MORTGAGE STEPS The first step is to locate the property and do an initial property appraisal. • Assess the type of title. • Possible Value versus price. • Use versus location. • Accessibility of the property. • Adaptability to the intended use. • Above requires also an interview process to determine the suitability of the prospective borrower. • Evaluate what product package is suitable for the client considering nature of employment. 3/17/2018 15

Key documents • 3 months payslips • 6 months bank statements (where salary is paid) • Letter of introduction from employer- stating income, duration of employment and retirement age • Current employment contract • Copy of passport (where expired page of renewal must be included) • Work permit/residency permit • Utility bill (water, electricity, cable TV, rental lease) • Latest tax returns (as may be requested for specific cases) • Open or operate a Co-operative Bank Jamhuri account • Duly completed loan application form 3/17/2018 16

Key documents • 3 months payslips • 6 months bank statements (where salary is paid) • Letter of introduction from employer- stating income, duration of employment and retirement age • Current employment contract • Copy of passport (where expired page of renewal must be included) • Work permit/residency permit • Utility bill (water, electricity, cable TV, rental lease) • Latest tax returns (as may be requested for specific cases) • Open or operate a Co-operative Bank Jamhuri account • Duly completed loan application form 3/17/2018 16

Additional requirements Property related • Copy of title for property offered as security • Draft sale agreement/letter of offer/sale agreement • Customer required to raise down payment plus additional cost/amounts detailed herewith 3/17/2018 Costs/amounts • Stamp Duty- 4% • Legal fees • Valuation fees (approx. 0. 4% of property value) • Commitment fees- 2% • One month instalment • Insurances (Fire & Life) (Cost range from 7 -9% of property value) 17

Additional requirements Property related • Copy of title for property offered as security • Draft sale agreement/letter of offer/sale agreement • Customer required to raise down payment plus additional cost/amounts detailed herewith 3/17/2018 Costs/amounts • Stamp Duty- 4% • Legal fees • Valuation fees (approx. 0. 4% of property value) • Commitment fees- 2% • One month instalment • Insurances (Fire & Life) (Cost range from 7 -9% of property value) 17

Construction • Approved Architectural & Structural plans • Bills of quantities from registered quantity surveyor • Evidence of customers equity (construction down payment) • Contractor appointment letter • CVs/Profiles of design team • Project feasibility report – for multiple units or project finance prepared by a project manager 3/17/2018 18

Construction • Approved Architectural & Structural plans • Bills of quantities from registered quantity surveyor • Evidence of customers equity (construction down payment) • Contractor appointment letter • CVs/Profiles of design team • Project feasibility report – for multiple units or project finance prepared by a project manager 3/17/2018 18

Loan processing The following are steps in the mortgage process: • Step 1: Documentation (presentation of complete application) • Step 2: Approval & offer letter (where loan is approved customer is given offer letter for signing). This may be passed onto agent for further forwarding to customer • Step 3: Instructions and legal process: after receipt of accepted offer legal team is advised to commence security perfection • Step 4: Disbursement (done after receipt of registered documents) and customer advised of payment 3/17/2018 19

Loan processing The following are steps in the mortgage process: • Step 1: Documentation (presentation of complete application) • Step 2: Approval & offer letter (where loan is approved customer is given offer letter for signing). This may be passed onto agent for further forwarding to customer • Step 3: Instructions and legal process: after receipt of accepted offer legal team is advised to commence security perfection • Step 4: Disbursement (done after receipt of registered documents) and customer advised of payment 3/17/2018 19

Diaspora Customer Tips • Always present full application documents for assessment on how much you qualify for before making down payment or signing sale agreement for any property. • If possible have a contact in kenya (preferably someone you trust) to visit the property and advice you on its state and carry out an official search on your behalf. • Give in complete requirements from onset of application to save on TAT • A customer may opt to use a power of attorney in which case this should registered at Ministry of lands and presented at point of applying for loan. 3/17/2018 20

Diaspora Customer Tips • Always present full application documents for assessment on how much you qualify for before making down payment or signing sale agreement for any property. • If possible have a contact in kenya (preferably someone you trust) to visit the property and advice you on its state and carry out an official search on your behalf. • Give in complete requirements from onset of application to save on TAT • A customer may opt to use a power of attorney in which case this should registered at Ministry of lands and presented at point of applying for loan. 3/17/2018 20

Why Good home Mortgage No penalty on accelerated lump sum payments. Attractive interest rates The interest is on a reducing balance. Tiered Interest rate subject to the term of the loan No penalty for early mortgage payoff No minimum or maximum limit to the amount that can be lent ü Good faith estimate: document showing itemized list of fees and costs associated with the mortgage. ü ü ü 3/17/2018 21

Why Good home Mortgage No penalty on accelerated lump sum payments. Attractive interest rates The interest is on a reducing balance. Tiered Interest rate subject to the term of the loan No penalty for early mortgage payoff No minimum or maximum limit to the amount that can be lent ü Good faith estimate: document showing itemized list of fees and costs associated with the mortgage. ü ü ü 3/17/2018 21

Communication • Account Opening can be facilitated by downloading our account form from our website www. co-opbank. co. ke or through the bank’s appointed agents. • The bank has a dedicated Diaspora Banking unit to address your issues back home. They can be reached on the mail address diasporabanking@co-opbank. co. ke, Cooperative House Building, Tel: - +254 20 3276000/972 • kindly contact us on 0703027000/0202776000, SMS 16111 or email us oncustomerservice@coopbank. co. ke

Communication • Account Opening can be facilitated by downloading our account form from our website www. co-opbank. co. ke or through the bank’s appointed agents. • The bank has a dedicated Diaspora Banking unit to address your issues back home. They can be reached on the mail address diasporabanking@co-opbank. co. ke, Cooperative House Building, Tel: - +254 20 3276000/972 • kindly contact us on 0703027000/0202776000, SMS 16111 or email us oncustomerservice@coopbank. co. ke