817a70cfc81bfd09d90a2b04f6c26f7a.ppt

- Количество слайдов: 179

FINANCIAL SERVICES CENTER TRAINING FACILITY AUSTIN, TX PRESENTS FSC Training Staff (512) 460 -5059 A/O Apr 2010

FINANCIAL SERVICES CENTER TRAINING FACILITY AUSTIN, TX PRESENTS FSC Training Staff (512) 460 -5059 A/O Apr 2010

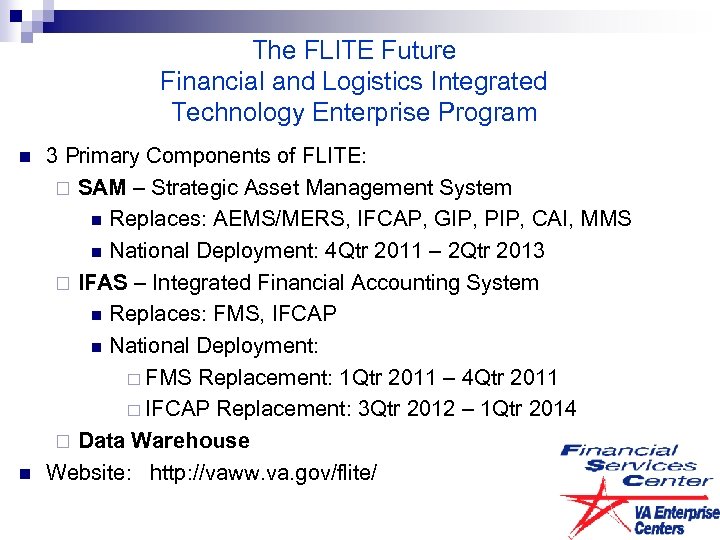

The FLITE Future Financial and Logistics Integrated Technology Enterprise Program n n 3 Primary Components of FLITE: ¨ SAM – Strategic Asset Management System n Replaces: AEMS/MERS, IFCAP, GIP, PIP, CAI, MMS n National Deployment: 4 Qtr 2011 – 2 Qtr 2013 ¨ IFAS – Integrated Financial Accounting System n Replaces: FMS, IFCAP n National Deployment: ¨ FMS Replacement: 1 Qtr 2011 – 4 Qtr 2011 ¨ IFCAP Replacement: 3 Qtr 2012 – 1 Qtr 2014 ¨ Data Warehouse Website: http: //vaww. va. gov/flite/

The FLITE Future Financial and Logistics Integrated Technology Enterprise Program n n 3 Primary Components of FLITE: ¨ SAM – Strategic Asset Management System n Replaces: AEMS/MERS, IFCAP, GIP, PIP, CAI, MMS n National Deployment: 4 Qtr 2011 – 2 Qtr 2013 ¨ IFAS – Integrated Financial Accounting System n Replaces: FMS, IFCAP n National Deployment: ¨ FMS Replacement: 1 Qtr 2011 – 4 Qtr 2011 ¨ IFCAP Replacement: 3 Qtr 2012 – 1 Qtr 2014 ¨ Data Warehouse Website: http: //vaww. va. gov/flite/

TABLE OF CONTENTS Section 1 Introduction/Outline Section 2 FMS Research Techniques MSGL GLTS GLDB Section 3 Accounts Receivables Negative PV 03 Treasury Offset Program (TOP) System Section 3 a Payments Zero PV 01 Section 4 Payroll Transactions Section 5 Travel Transactions Section 6 Financial Indicator Report Section 7 F 911 vs Macro Section 8 Annual close Memo Section 9 Annual Close/Trial Balance Section 10 Journal Voucher 1 -1 thru 1 -2 2 -1 thru 2 -25 3 -1 thru 3 -24 4 -1 thru 4 -28 5 -1 thru 5 -39 6 -1 thru 6 -6 7 -1 thru 7 -8 8 -1 thru 8 -10 9 -1 thru 9 -6 10 -1 thru 10 -6

TABLE OF CONTENTS Section 1 Introduction/Outline Section 2 FMS Research Techniques MSGL GLTS GLDB Section 3 Accounts Receivables Negative PV 03 Treasury Offset Program (TOP) System Section 3 a Payments Zero PV 01 Section 4 Payroll Transactions Section 5 Travel Transactions Section 6 Financial Indicator Report Section 7 F 911 vs Macro Section 8 Annual close Memo Section 9 Annual Close/Trial Balance Section 10 Journal Voucher 1 -1 thru 1 -2 2 -1 thru 2 -25 3 -1 thru 3 -24 4 -1 thru 4 -28 5 -1 thru 5 -39 6 -1 thru 6 -6 7 -1 thru 7 -8 8 -1 thru 8 -10 9 -1 thru 9 -6 10 -1 thru 10 -6

Introduction

Introduction

Introduction Class Schedule: Class start: 8: 30 a. m. Class ends: 4: 00 p. m. Objective: At completion of this course the student will be able to: • FMS Research Techniques MSGL GLTS GLDB • Accounts Receivables Billing Documents (BD) Negative PV 03 Treasury Offset Program System (TOP) • Payroll Transactions Expenditures (PR ) Billing Documents (BD) Unfunded Expense (UE) • TDY Travel F 854 Report Out of Balances for Employee Advances Common Problems Solutions 1 -1

Introduction Class Schedule: Class start: 8: 30 a. m. Class ends: 4: 00 p. m. Objective: At completion of this course the student will be able to: • FMS Research Techniques MSGL GLTS GLDB • Accounts Receivables Billing Documents (BD) Negative PV 03 Treasury Offset Program System (TOP) • Payroll Transactions Expenditures (PR ) Billing Documents (BD) Unfunded Expense (UE) • TDY Travel F 854 Report Out of Balances for Employee Advances Common Problems Solutions 1 -1

Introduction Objective: At completion of this course the student will be able to: • Financial Indicators Web Site 889 B report 3875 • F 911 report vs Macro Common Issues • Annual Close Memo • Annual Close and Trial Balance • Journal Vouchers Station’s Journal voucher FSC Journal voucher 1 -2

Introduction Objective: At completion of this course the student will be able to: • Financial Indicators Web Site 889 B report 3875 • F 911 report vs Macro Common Issues • Annual Close Memo • Annual Close and Trial Balance • Journal Vouchers Station’s Journal voucher FSC Journal voucher 1 -2

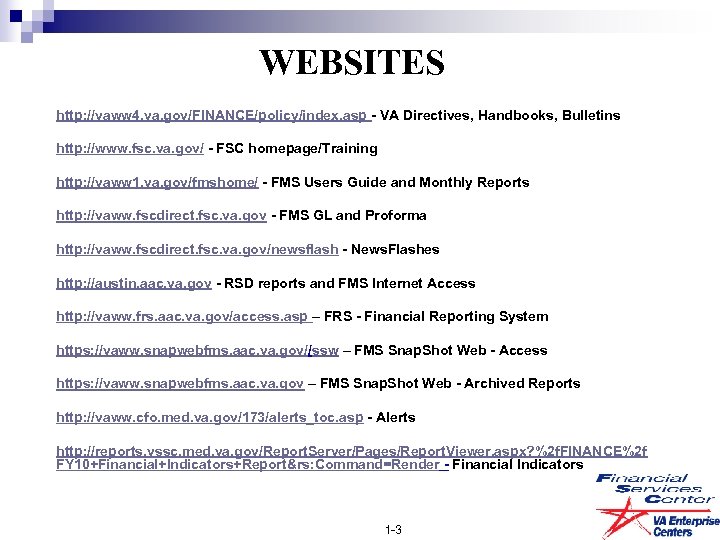

WEBSITES http: //vaww 4. va. gov/FINANCE/policy/index. asp - VA Directives, Handbooks, Bulletins http: //www. fsc. va. gov/ - FSC homepage/Training http: //vaww 1. va. gov/fmshome/ - FMS Users Guide and Monthly Reports http: //vaww. fscdirect. fsc. va. gov - FMS GL and Proforma http: //vaww. fscdirect. fsc. va. gov/newsflash - News. Flashes http: //austin. aac. va. gov - RSD reports and FMS Internet Access http: //vaww. frs. aac. va. gov/access. asp – FRS - Financial Reporting System https: //vaww. snapwebfms. aac. va. gov//ssw – FMS Snap. Shot Web - Access https: //vaww. snapwebfms. aac. va. gov – FMS Snap. Shot Web - Archived Reports http: //vaww. cfo. med. va. gov/173/alerts_toc. asp - Alerts http: //reports. vssc. med. va. gov/Report. Server/Pages/Report. Viewer. aspx? %2 f. FINANCE%2 f FY 10+Financial+Indicators+Report&rs: Command=Render - Financial Indicators 1 -3

WEBSITES http: //vaww 4. va. gov/FINANCE/policy/index. asp - VA Directives, Handbooks, Bulletins http: //www. fsc. va. gov/ - FSC homepage/Training http: //vaww 1. va. gov/fmshome/ - FMS Users Guide and Monthly Reports http: //vaww. fscdirect. fsc. va. gov - FMS GL and Proforma http: //vaww. fscdirect. fsc. va. gov/newsflash - News. Flashes http: //austin. aac. va. gov - RSD reports and FMS Internet Access http: //vaww. frs. aac. va. gov/access. asp – FRS - Financial Reporting System https: //vaww. snapwebfms. aac. va. gov//ssw – FMS Snap. Shot Web - Access https: //vaww. snapwebfms. aac. va. gov – FMS Snap. Shot Web - Archived Reports http: //vaww. cfo. med. va. gov/173/alerts_toc. asp - Alerts http: //reports. vssc. med. va. gov/Report. Server/Pages/Report. Viewer. aspx? %2 f. FINANCE%2 f FY 10+Financial+Indicators+Report&rs: Command=Render - Financial Indicators 1 -3

FMS Research Techniques

FMS Research Techniques

These are FMS tables used for researching 2 -1

These are FMS tables used for researching 2 -1

2 -2

2 -2

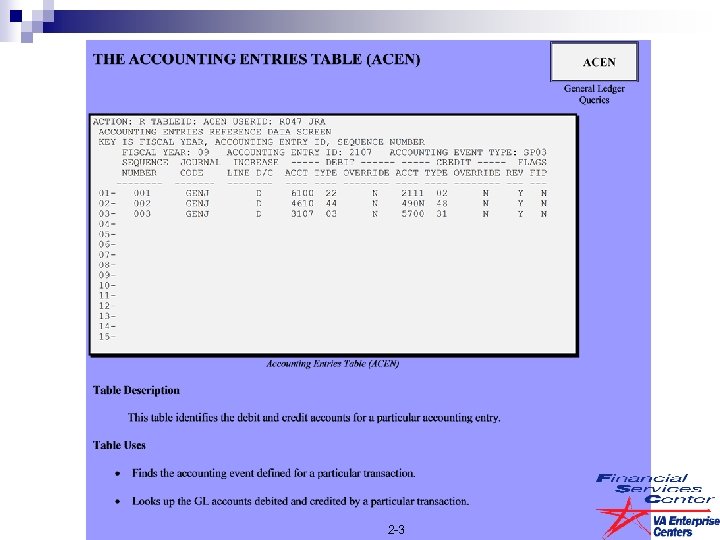

2 -3

2 -3

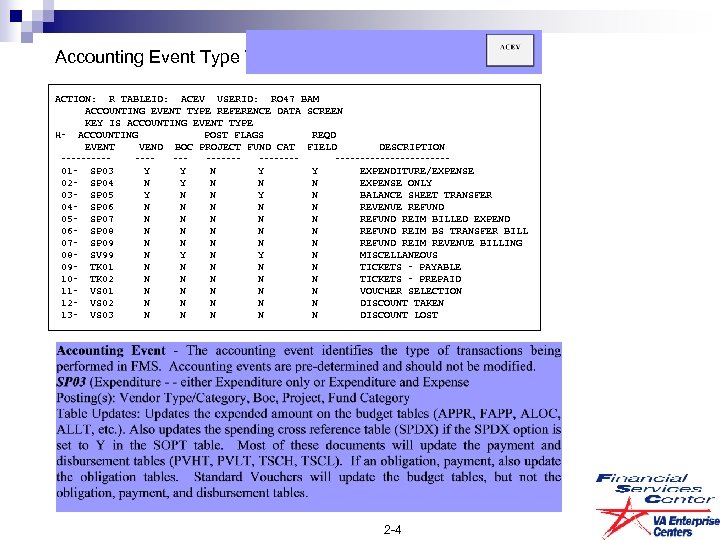

Accounting Event Type Table ACTION: R TABLEID: ACEV USERID: RO 47 BAM ACCOUNTING EVENT TYPE REFERENCE DATA SCREEN KEY IS ACCOUNTING EVENT TYPE H‑ ACCOUNTING POST FLAGS REQD EVENT VEND BOC PROJECT FUND CAT FIELD DESCRIPTION ‑‑‑‑‑ ‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑ 01‑ SP 03 Y Y N Y Y EXPENDITURE/EXPENSE 02‑ SP 04 N Y N N N EXPENSE ONLY 03‑ SP 05 Y N N Y N BALANCE SHEET TRANSFER 04‑ SP 06 N N N REVENUE REFUND 05‑ SP 07 N N N REFUND REIM BILLED EXPEND 06‑ SP 08 N N N REFUND REIM BS TRANSFER BILL 07‑ SP 09 N N N REFUND REIM REVENUE BILLING 08‑ SV 99 N Y N MISCELLANEOUS 09‑ TK 01 N N N TICKETS ‑ PAYABLE 10‑ TK 02 N N N TICKETS ‑ PREPAID 11‑ VS 01 N N N VOUCHER SELECTION 12‑ VS 02 N N N DISCOUNT TAKEN 13‑ VS 03 N N N DISCOUNT LOST 2 -4

Accounting Event Type Table ACTION: R TABLEID: ACEV USERID: RO 47 BAM ACCOUNTING EVENT TYPE REFERENCE DATA SCREEN KEY IS ACCOUNTING EVENT TYPE H‑ ACCOUNTING POST FLAGS REQD EVENT VEND BOC PROJECT FUND CAT FIELD DESCRIPTION ‑‑‑‑‑ ‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑ 01‑ SP 03 Y Y N Y Y EXPENDITURE/EXPENSE 02‑ SP 04 N Y N N N EXPENSE ONLY 03‑ SP 05 Y N N Y N BALANCE SHEET TRANSFER 04‑ SP 06 N N N REVENUE REFUND 05‑ SP 07 N N N REFUND REIM BILLED EXPEND 06‑ SP 08 N N N REFUND REIM BS TRANSFER BILL 07‑ SP 09 N N N REFUND REIM REVENUE BILLING 08‑ SV 99 N Y N MISCELLANEOUS 09‑ TK 01 N N N TICKETS ‑ PAYABLE 10‑ TK 02 N N N TICKETS ‑ PREPAID 11‑ VS 01 N N N VOUCHER SELECTION 12‑ VS 02 N N N DISCOUNT TAKEN 13‑ VS 03 N N N DISCOUNT LOST 2 -4

2 -5

2 -5

Example of BOCT FY Differences It is important to look up the BOC by fiscal year of the transaction. For example: You are trying to process an EW from Fund 0160 A 1, FY 10, BOC 1150 for performance awards to Fund 0160 X 4, BFY 94. If you look on the BOCT table for FY 94 BOC 1150 did not exist. In scanning the BOCT table for FY 94 you will find that BOC 1114 is for performance awards. ACTION: R TABLEID: BOCT USERID: S 104 AFA BUDGET OBJECT CODE REFERENCE DATA SCREEN KEY IS BUDGET FISCAL YEAR, BUDGET OBJECT CODE FED BOC SUB BOC OBL= REST BOC OBJ PS BOC 1099 TRAVEL BUDG POST EXP LKUP DEACT FY CODE CLS IND IND FLAG LMT FLAG BOC FLAG DATE -- --- --- ---- ---- ---- 01 - 10 1150 11 Y Y N N N 11 N Y N NAME: PERFORMANCE AWARDS SHORT: PERFMNC AWDS 02 - 10 1151 110 11 Y Y N N N 11 N Y N NAME: EXECUTIVE NURSES SPECIAL PAY SHORT: NURS SPCL PY ACTION: R TABLEID: BOCT USERID: S 104 AFA BUDGET OBJECT CODE REFERENCE DATA SCREEN KEY IS BUDGET FISCAL YEAR, BUDGET OBJECT CODE FED BOC SUB BOC OBL= REST BOC OBJ PS BOC 1099 TRAVEL BUDG POST EXP LKUP DEACT FY CODE CLS IND IND FLAG LMT FLAG BOC FLAG DATE -- --- --- ---- ---- ---- 01 - 94 1111 110 11 Y Y C N N 11 N Y N NAME: SPECIAL PAY F/T DENTISTS SHORT: F/T DEN S/P 02 - 94 1112 110 11 Y Y C N N 11 N Y N NAME: SPECIAL PAY P/T PHYSICIANS SHORT: P/T PHYS S/P 03 - 94 1113 110 11 Y Y C N N 11 N Y N NAME: SPECIAL PAY F/T PHYSICIANS SHORT: F/T PHYS S/P 04 - 94 1114 110 11 Y Y C N N 11 N Y N NAME: PERFORMANCE AWARDS SHORT: PERF. AWARDS 05 - 94 1115 110 11 Y Y C N N 11 N Y N NAME: SENIOR EXEC. SERVICE BONUS SHORT: SES BONUS 06 - 94 1116 110 11 Y Y C N N 11 N Y N NAME: REEMPLOYED ANNUITANTS REIMB SHORT: REEMP. ANNUI 2 -6

Example of BOCT FY Differences It is important to look up the BOC by fiscal year of the transaction. For example: You are trying to process an EW from Fund 0160 A 1, FY 10, BOC 1150 for performance awards to Fund 0160 X 4, BFY 94. If you look on the BOCT table for FY 94 BOC 1150 did not exist. In scanning the BOCT table for FY 94 you will find that BOC 1114 is for performance awards. ACTION: R TABLEID: BOCT USERID: S 104 AFA BUDGET OBJECT CODE REFERENCE DATA SCREEN KEY IS BUDGET FISCAL YEAR, BUDGET OBJECT CODE FED BOC SUB BOC OBL= REST BOC OBJ PS BOC 1099 TRAVEL BUDG POST EXP LKUP DEACT FY CODE CLS IND IND FLAG LMT FLAG BOC FLAG DATE -- --- --- ---- ---- ---- 01 - 10 1150 11 Y Y N N N 11 N Y N NAME: PERFORMANCE AWARDS SHORT: PERFMNC AWDS 02 - 10 1151 110 11 Y Y N N N 11 N Y N NAME: EXECUTIVE NURSES SPECIAL PAY SHORT: NURS SPCL PY ACTION: R TABLEID: BOCT USERID: S 104 AFA BUDGET OBJECT CODE REFERENCE DATA SCREEN KEY IS BUDGET FISCAL YEAR, BUDGET OBJECT CODE FED BOC SUB BOC OBL= REST BOC OBJ PS BOC 1099 TRAVEL BUDG POST EXP LKUP DEACT FY CODE CLS IND IND FLAG LMT FLAG BOC FLAG DATE -- --- --- ---- ---- ---- 01 - 94 1111 110 11 Y Y C N N 11 N Y N NAME: SPECIAL PAY F/T DENTISTS SHORT: F/T DEN S/P 02 - 94 1112 110 11 Y Y C N N 11 N Y N NAME: SPECIAL PAY P/T PHYSICIANS SHORT: P/T PHYS S/P 03 - 94 1113 110 11 Y Y C N N 11 N Y N NAME: SPECIAL PAY F/T PHYSICIANS SHORT: F/T PHYS S/P 04 - 94 1114 110 11 Y Y C N N 11 N Y N NAME: PERFORMANCE AWARDS SHORT: PERF. AWARDS 05 - 94 1115 110 11 Y Y C N N 11 N Y N NAME: SENIOR EXEC. SERVICE BONUS SHORT: SES BONUS 06 - 94 1116 110 11 Y Y C N N 11 N Y N NAME: REEMPLOYED ANNUITANTS REIMB SHORT: REEMP. ANNUI 2 -6

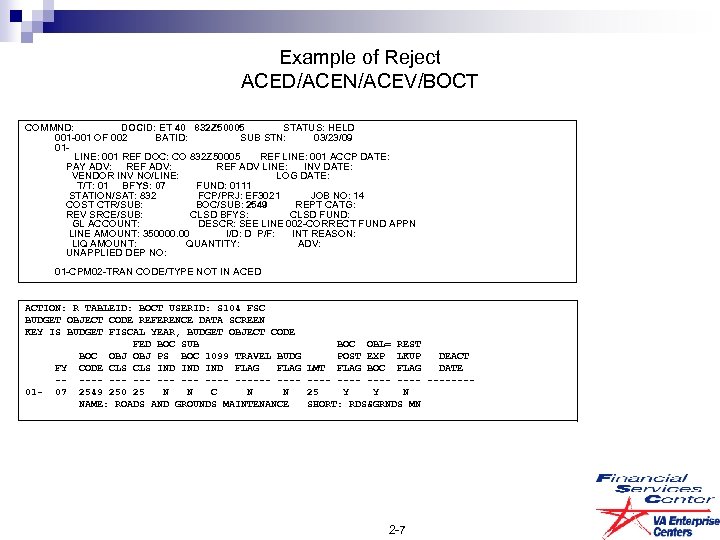

Example of Reject ACED/ACEN/ACEV/BOCT COMMND: DOCID: ET 40 832 Z 50005 STATUS: HELD 001 -001 OF 002 BATID: SUB STN: 03/23/09 01 - LINE: 001 REF DOC: CO 832 Z 50005 REF LINE: 001 ACCP DATE: PAY ADV: REF ADV: REF ADV LINE: INV DATE: VENDOR INV NO/LINE: LOG DATE: T/T: 01 BFYS: 07 FUND: 0111 STATION/SAT: 832 FCP/PRJ: EF 3021 JOB NO: 14 COST CTR/SUB: BOC/SUB: 2549 REPT CATG: REV SRCE/SUB: CLSD BFYS: CLSD FUND: GL ACCOUNT: DESCR: SEE LINE 002 -CORRECT FUND APPN LINE AMOUNT: 350000. 00 I/D: D P/F: INT REASON: LIQ AMOUNT: QUANTITY: ADV: UNAPPLIED DEP NO: 01 -CPM 02 -TRAN CODE/TYPE NOT IN ACED ACTION: R TABLEID: BOCT USERID: S 104 FSC BUDGET OBJECT CODE REFERENCE DATA SCREEN KEY IS BUDGET FISCAL YEAR, BUDGET OBJECT CODE FED BOC SUB BOC OBL= REST BOC OBJ PS BOC 1099 TRAVEL BUDG POST EXP LKUP DEACT FY CODE CLS IND IND FLAG LMT FLAG BOC FLAG DATE -- --- --- ---- ---- ---- 01 - 07 2549 250 25 N N C N N 25 Y Y N NAME: ROADS AND GROUNDS MAINTENANCE SHORT: RDS&GRNDS MN 2 -7

Example of Reject ACED/ACEN/ACEV/BOCT COMMND: DOCID: ET 40 832 Z 50005 STATUS: HELD 001 -001 OF 002 BATID: SUB STN: 03/23/09 01 - LINE: 001 REF DOC: CO 832 Z 50005 REF LINE: 001 ACCP DATE: PAY ADV: REF ADV: REF ADV LINE: INV DATE: VENDOR INV NO/LINE: LOG DATE: T/T: 01 BFYS: 07 FUND: 0111 STATION/SAT: 832 FCP/PRJ: EF 3021 JOB NO: 14 COST CTR/SUB: BOC/SUB: 2549 REPT CATG: REV SRCE/SUB: CLSD BFYS: CLSD FUND: GL ACCOUNT: DESCR: SEE LINE 002 -CORRECT FUND APPN LINE AMOUNT: 350000. 00 I/D: D P/F: INT REASON: LIQ AMOUNT: QUANTITY: ADV: UNAPPLIED DEP NO: 01 -CPM 02 -TRAN CODE/TYPE NOT IN ACED ACTION: R TABLEID: BOCT USERID: S 104 FSC BUDGET OBJECT CODE REFERENCE DATA SCREEN KEY IS BUDGET FISCAL YEAR, BUDGET OBJECT CODE FED BOC SUB BOC OBL= REST BOC OBJ PS BOC 1099 TRAVEL BUDG POST EXP LKUP DEACT FY CODE CLS IND IND FLAG LMT FLAG BOC FLAG DATE -- --- --- ---- ---- ---- 01 - 07 2549 250 25 N N C N N 25 Y Y N NAME: ROADS AND GROUNDS MAINTENANCE SHORT: RDS&GRNDS MN 2 -7

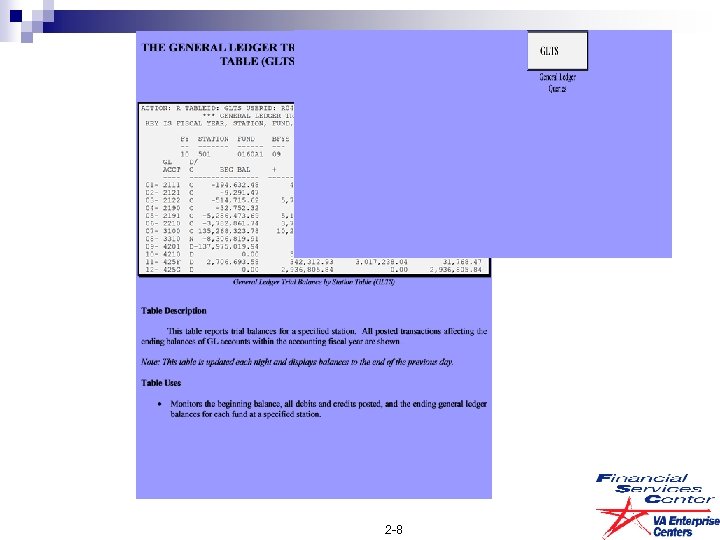

2 -8

2 -8

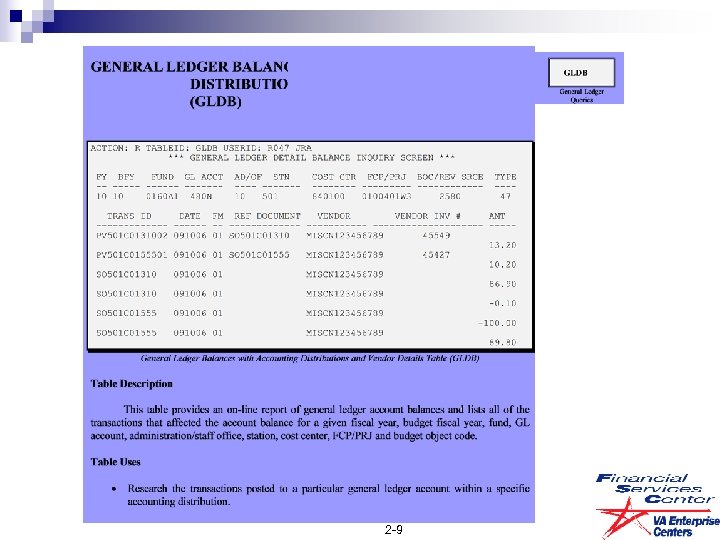

2 -9

2 -9

2 -10

2 -10

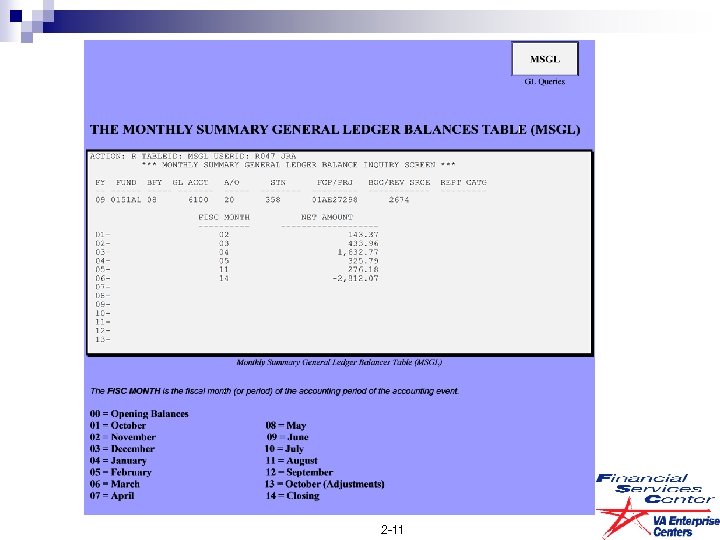

2 -11

2 -11

2 -12

2 -12

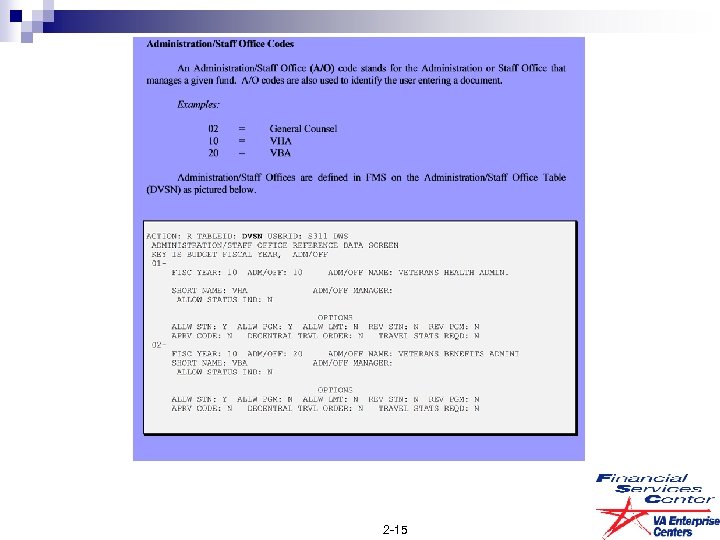

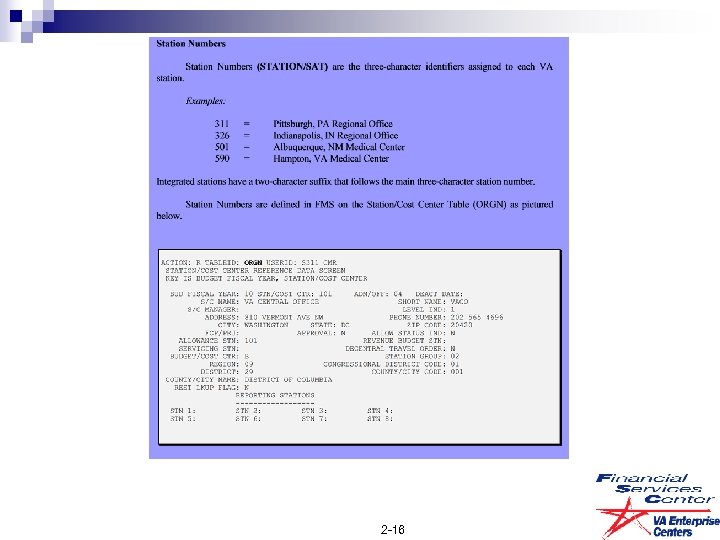

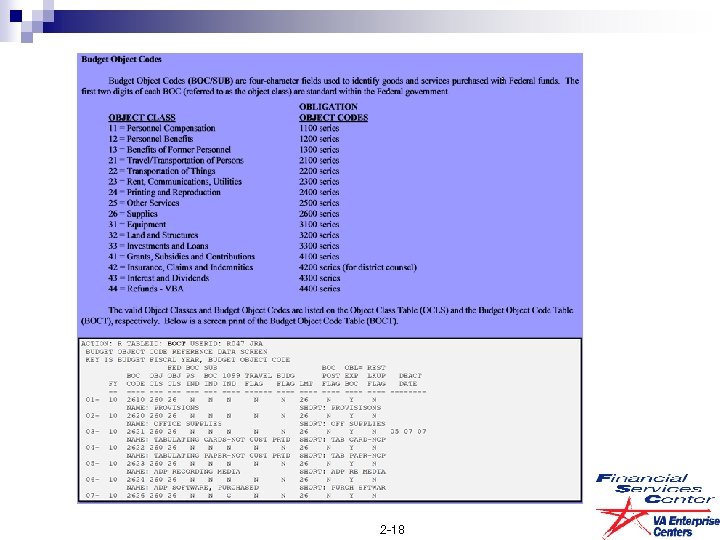

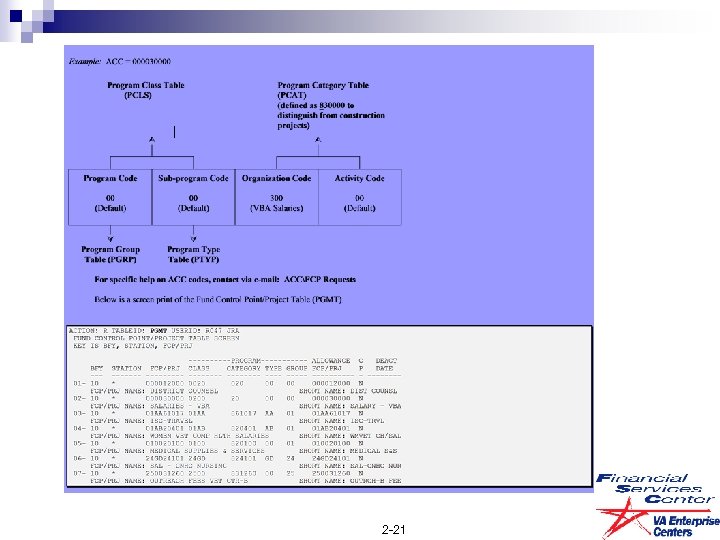

The FMS Accounting Codes are used to indicate the accounting distribution associated with each document. When entering the accounting codes, enter only those which are relevant to the budget affected by the document. Fund codes (FUND) represent various combinations of an appropriation code, category, and limitation. The new budget structure uses the FMS "Fund Code" to identify the limitation code in addition to the appropriation and apportionment codes, (e. g. 0160 A 1). An Administration/Staff Office (A/O) code stands for the Administration or Staff Office that manages a given fund. A/O codes are also used to identify the user entering a document. A/O 04 – FSC/VACO Finance 10 – Medical Centers 20 – VBA Veterans Benefit Admin 40 – National Cemetery 90 – OAMM/Supply Fund (4537 B) 08 – Construction (if CO is funding) 02 – District Counsel Station Numbers (STATION/SAT) are three-character identifiers assigned to each VA station. Budget Object Codes (BOC/SUB) are four-character fields used to identify goods and services purchased with Federal funds. The first two digits of each BOC (referred to as the object class) are standard within the Federal government. Cost Centers (COST CTR/SUB) are six-character, non-budgetary, organization codes used to record expenditures of funds by various organizations within VA. Fund Control Point (FCP) – also known as Accounting Classification Codes (ACC) – this is comprised of four codes with the following format: Character Description 1 -2 Program Code 3 -4 Sub-program Code 5 -7 Organization Code 8 -9 Activity Code 2 -13

The FMS Accounting Codes are used to indicate the accounting distribution associated with each document. When entering the accounting codes, enter only those which are relevant to the budget affected by the document. Fund codes (FUND) represent various combinations of an appropriation code, category, and limitation. The new budget structure uses the FMS "Fund Code" to identify the limitation code in addition to the appropriation and apportionment codes, (e. g. 0160 A 1). An Administration/Staff Office (A/O) code stands for the Administration or Staff Office that manages a given fund. A/O codes are also used to identify the user entering a document. A/O 04 – FSC/VACO Finance 10 – Medical Centers 20 – VBA Veterans Benefit Admin 40 – National Cemetery 90 – OAMM/Supply Fund (4537 B) 08 – Construction (if CO is funding) 02 – District Counsel Station Numbers (STATION/SAT) are three-character identifiers assigned to each VA station. Budget Object Codes (BOC/SUB) are four-character fields used to identify goods and services purchased with Federal funds. The first two digits of each BOC (referred to as the object class) are standard within the Federal government. Cost Centers (COST CTR/SUB) are six-character, non-budgetary, organization codes used to record expenditures of funds by various organizations within VA. Fund Control Point (FCP) – also known as Accounting Classification Codes (ACC) – this is comprised of four codes with the following format: Character Description 1 -2 Program Code 3 -4 Sub-program Code 5 -7 Organization Code 8 -9 Activity Code 2 -13

2 -14

2 -14

2 -15

2 -15

2 -16

2 -16

2 -17

2 -17

2 -18

2 -18

2 -19

2 -19

2 -20

2 -20

2 -21

2 -21

2 -22

2 -22

Proforma Web site n http: //vaww. fscdirect. fsc. va. gov/ n Discuss comparable transaction codes and transaction type for transaction code CR. 2 -23

Proforma Web site n http: //vaww. fscdirect. fsc. va. gov/ n Discuss comparable transaction codes and transaction type for transaction code CR. 2 -23

2 -24

2 -24

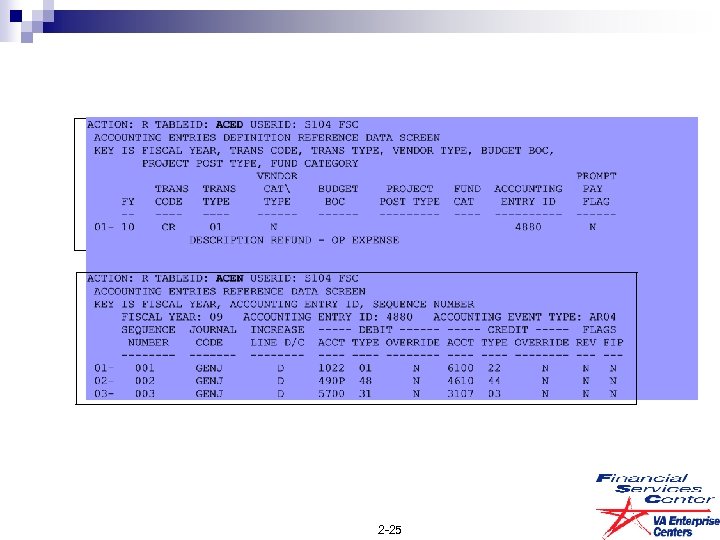

2 -25

2 -25

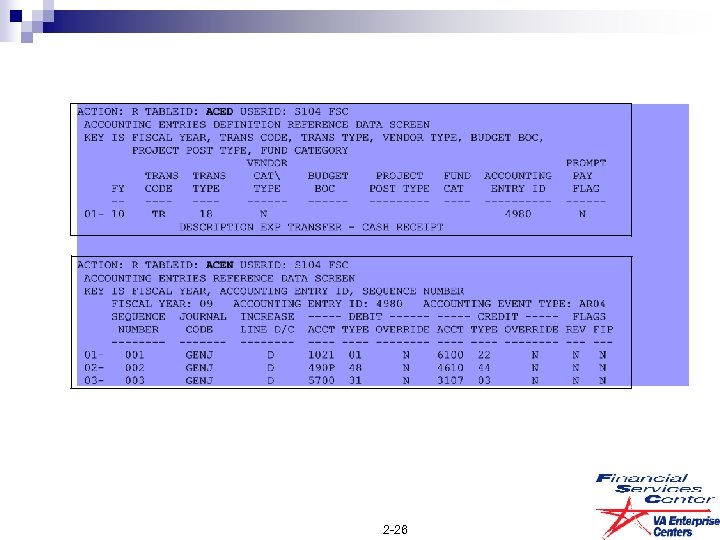

2 -26

2 -26

2 -27

2 -27

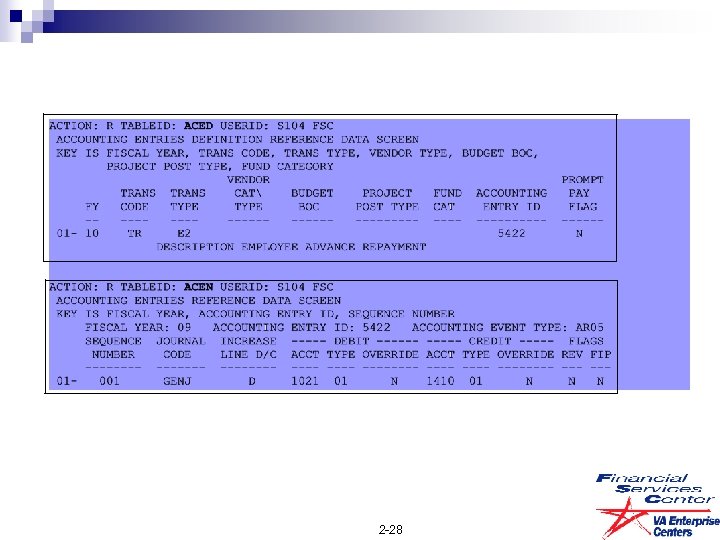

2 -28

2 -28

Accounts Receivable, Negative PV 03 s, Treasury Offset Program (TOP)

Accounts Receivable, Negative PV 03 s, Treasury Offset Program (TOP)

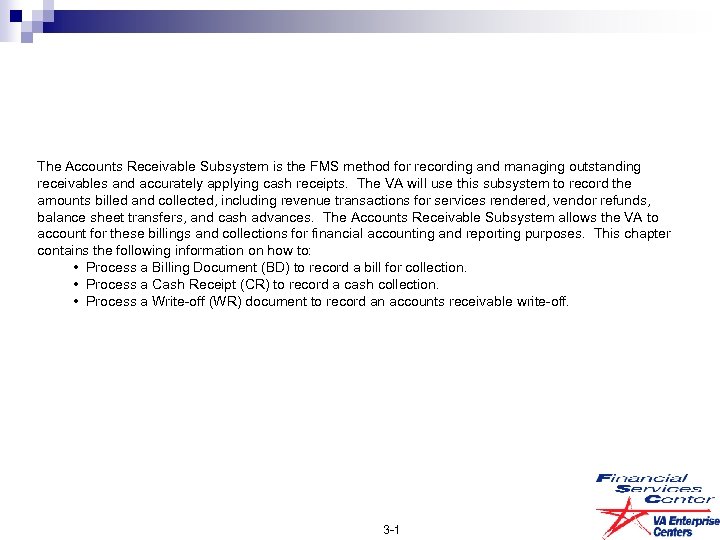

The Accounts Receivable Subsystem is the FMS method for recording and managing outstanding receivables and accurately applying cash receipts. The VA will use this subsystem to record the amounts billed and collected, including revenue transactions for services rendered, vendor refunds, balance sheet transfers, and cash advances. The Accounts Receivable Subsystem allows the VA to account for these billings and collections for financial accounting and reporting purposes. This chapter contains the following information on how to: • Process a Billing Document (BD) to record a bill for collection. • Process a Cash Receipt (CR) to record a cash collection. • Process a Write-off (WR) document to record an accounts receivable write-off. 3 -1

The Accounts Receivable Subsystem is the FMS method for recording and managing outstanding receivables and accurately applying cash receipts. The VA will use this subsystem to record the amounts billed and collected, including revenue transactions for services rendered, vendor refunds, balance sheet transfers, and cash advances. The Accounts Receivable Subsystem allows the VA to account for these billings and collections for financial accounting and reporting purposes. This chapter contains the following information on how to: • Process a Billing Document (BD) to record a bill for collection. • Process a Cash Receipt (CR) to record a cash collection. • Process a Write-off (WR) document to record an accounts receivable write-off. 3 -1

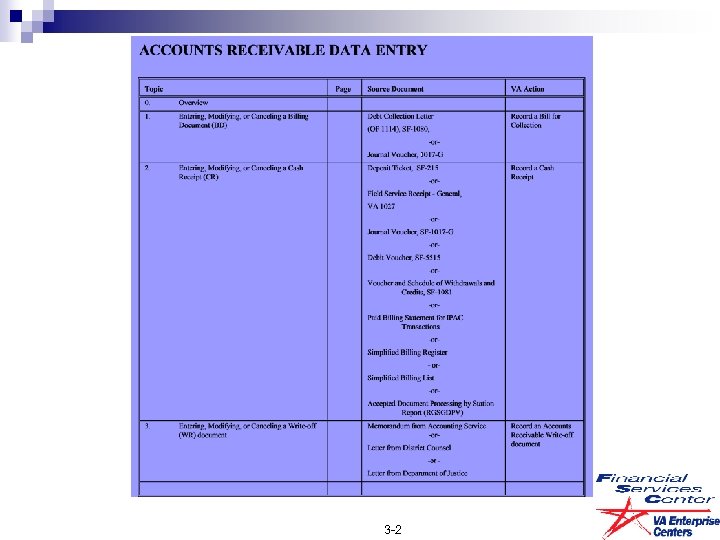

3 -2

3 -2

3 -3

3 -3

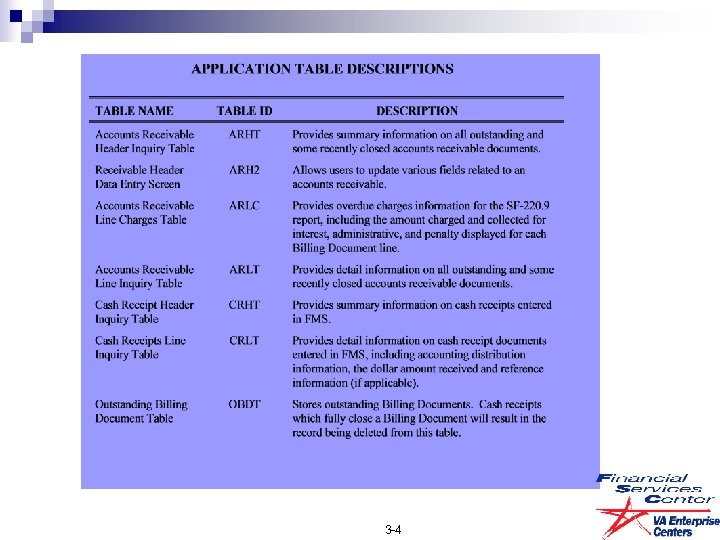

3 -4

3 -4

3 -5

3 -5

3 -6

3 -6

3 -7

3 -7

3 -8

3 -8

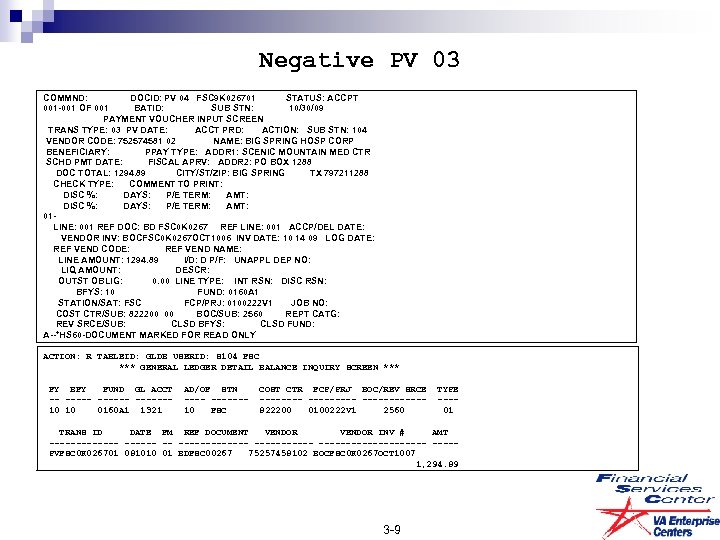

Negative PV 03 COMMND: DOCID: PV 04 FSC 9 K 026701 STATUS: ACCPT 001 -001 OF 001 BATID: SUB STN: 10/30/09 PAYMENT VOUCHER INPUT SCREEN TRANS TYPE: 03 PV DATE: ACCT PRD: ACTION: SUB STN: 104 VENDOR CODE: 752574581 02 NAME: BIG SPRING HOSP CORP BENEFICIARY: PPAY TYPE: ADDR 1: SCENIC MOUNTAIN MED CTR SCHD PMT DATE: FISCAL APRV: ADDR 2: PO BOX 1288 DOC TOTAL: 1294. 89 CITY/ST/ZIP: BIG SPRING TX 797211288 CHECK TYPE: COMMENT TO PRINT: DISC %: DAYS: P/E TERM: AMT: 01 - LINE: 001 REF DOC: BD FSC 0 K 0267 REF LINE: 001 ACCP/DEL DATE: VENDOR INV: BOCFSC 0 K 0267 OCT 1006 INV DATE: 10 14 09 LOG DATE: REF VEND CODE: REF VEND NAME: LINE AMOUNT: 1294. 89 I/D: D P/F: UNAPPL DEP NO: LIQ AMOUNT: DESCR: OUTST OBLIG: 0. 00 LINE TYPE: INT RSN: DISC RSN: BFYS: 10 FUND: 0160 A 1 STATION/SAT: FSC FCP/PRJ: 0100222 V 1 JOB NO: COST CTR/SUB: 822200 00 BOC/SUB: 2560 REPT CATG: REV SRCE/SUB: CLSD BFYS: CLSD FUND: A--*HS 60 -DOCUMENT MARKED FOR READ ONLY ACTION: R TABLEID: GLDB USERID: S 104 FSC *** GENERAL LEDGER DETAIL BALANCE INQUIRY SCREEN *** FY BFY FUND GL ACCT AD/OF STN COST CTR FCP/PRJ BOC/REV SRCE TYPE -- ------- -------- ---- 10 10 0160 A 1 1321 10 FSC 822200 0100222 V 1 2560 01 TRANS ID DATE FM REF DOCUMENT VENDOR INV # AMT ------- -- ----------- ----- PVFSC 0 K 026701 081010 01 BDFSC 00267 75257458102 BOCFSC 0 K 0267 OCT 1007 1, 294. 89 3 -9

Negative PV 03 COMMND: DOCID: PV 04 FSC 9 K 026701 STATUS: ACCPT 001 -001 OF 001 BATID: SUB STN: 10/30/09 PAYMENT VOUCHER INPUT SCREEN TRANS TYPE: 03 PV DATE: ACCT PRD: ACTION: SUB STN: 104 VENDOR CODE: 752574581 02 NAME: BIG SPRING HOSP CORP BENEFICIARY: PPAY TYPE: ADDR 1: SCENIC MOUNTAIN MED CTR SCHD PMT DATE: FISCAL APRV: ADDR 2: PO BOX 1288 DOC TOTAL: 1294. 89 CITY/ST/ZIP: BIG SPRING TX 797211288 CHECK TYPE: COMMENT TO PRINT: DISC %: DAYS: P/E TERM: AMT: 01 - LINE: 001 REF DOC: BD FSC 0 K 0267 REF LINE: 001 ACCP/DEL DATE: VENDOR INV: BOCFSC 0 K 0267 OCT 1006 INV DATE: 10 14 09 LOG DATE: REF VEND CODE: REF VEND NAME: LINE AMOUNT: 1294. 89 I/D: D P/F: UNAPPL DEP NO: LIQ AMOUNT: DESCR: OUTST OBLIG: 0. 00 LINE TYPE: INT RSN: DISC RSN: BFYS: 10 FUND: 0160 A 1 STATION/SAT: FSC FCP/PRJ: 0100222 V 1 JOB NO: COST CTR/SUB: 822200 00 BOC/SUB: 2560 REPT CATG: REV SRCE/SUB: CLSD BFYS: CLSD FUND: A--*HS 60 -DOCUMENT MARKED FOR READ ONLY ACTION: R TABLEID: GLDB USERID: S 104 FSC *** GENERAL LEDGER DETAIL BALANCE INQUIRY SCREEN *** FY BFY FUND GL ACCT AD/OF STN COST CTR FCP/PRJ BOC/REV SRCE TYPE -- ------- -------- ---- 10 10 0160 A 1 1321 10 FSC 822200 0100222 V 1 2560 01 TRANS ID DATE FM REF DOCUMENT VENDOR INV # AMT ------- -- ----------- ----- PVFSC 0 K 026701 081010 01 BDFSC 00267 75257458102 BOCFSC 0 K 0267 OCT 1007 1, 294. 89 3 -9

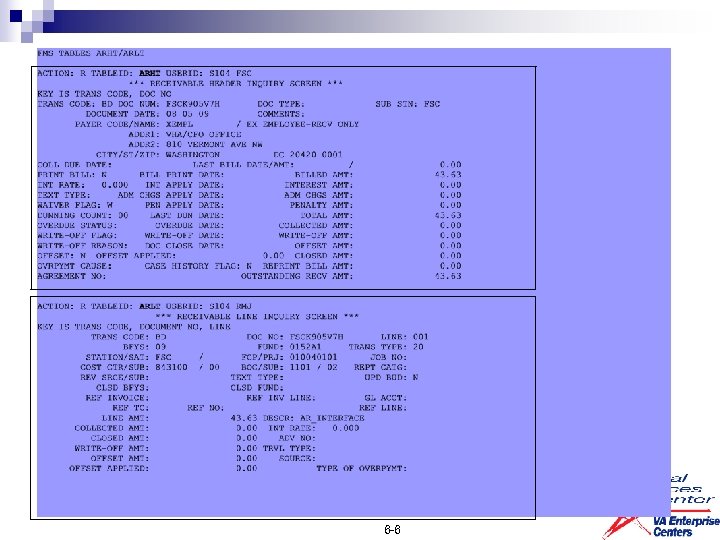

Negative PV 03 ACTION: R TABLEID: ARHT USERID: S 104 RMJ *** RECEIVABLE HEADER INQUIRY SCREEN *** KEY IS TRANS CODE, DOC NO TRANS CODE: BD DOC NUM: FSC 0 K 0267 DOC TYPE: SUB STN: 104 DOCUMENT DATE: 10 03 09 COMMENTS: PAYER CODE/NAME: 75257458102 / BIG SPRING HOSP CORP ADDR 1: SCENIC MOUNTAIN MED CTR ADDR 2: PO BOX 1288 CITY/ST/ZIP: BIG SPRING TX 79721 1288 COLL DUE DATE: LAST BILL DATE/AMT: / 0. 00 PRINT BILL: N BILL PRINT DATE: BILLED AMT: 1, 294. 89 INT RATE: 0. 000 INT APPLY DATE: INTEREST AMT: 0. 00 TEXT TYPE: ADM CHGS APPLY DATE: ADM CHGS AMT: 0. 00 WAIVER FLAG: PEN APPLY DATE: PENALTY AMT: 0. 00 DUNNING COUNT: 00 LAST DUN DATE: TOTAL AMT: 1, 294. 89 OVERDUE STATUS: OVERDUE DATE: COLLECTED AMT: 0. 00 WRITE-OFF FLAG: WRITE-OFF DATE: WRITE-OFF AMT: 0. 00 WRITE-OFF REASON: DOC CLOSE DATE: 10 10 09 OFFSET AMT: 1, 294. 89 OFFSET: Y OFFSET APPLIED: 0. 00 CLOSED AMT: 1, 294. 89 OVRPYMT CAUSE: CASE HISTORY FLAG: N REPRINT BILL AMT: 0. 00 AGREEMENT NO: OUTSTANDING RECV AMT: 0. 00 RGLDATV RSD FORM: F 840 10/30/09 PV 03 FSC 0 K 026701 001 10 0160 A 1 10 0100222 V 1 2560 N 1321 1, 294. 89 1313 1, 294. 89 490 N 1, 294. 89 3107 1, 294. 89 5700 1, 294. 89 4610 1, 294. 89 9946 1, 294. 89 9945 1, 294. 89 3 -10

Negative PV 03 ACTION: R TABLEID: ARHT USERID: S 104 RMJ *** RECEIVABLE HEADER INQUIRY SCREEN *** KEY IS TRANS CODE, DOC NO TRANS CODE: BD DOC NUM: FSC 0 K 0267 DOC TYPE: SUB STN: 104 DOCUMENT DATE: 10 03 09 COMMENTS: PAYER CODE/NAME: 75257458102 / BIG SPRING HOSP CORP ADDR 1: SCENIC MOUNTAIN MED CTR ADDR 2: PO BOX 1288 CITY/ST/ZIP: BIG SPRING TX 79721 1288 COLL DUE DATE: LAST BILL DATE/AMT: / 0. 00 PRINT BILL: N BILL PRINT DATE: BILLED AMT: 1, 294. 89 INT RATE: 0. 000 INT APPLY DATE: INTEREST AMT: 0. 00 TEXT TYPE: ADM CHGS APPLY DATE: ADM CHGS AMT: 0. 00 WAIVER FLAG: PEN APPLY DATE: PENALTY AMT: 0. 00 DUNNING COUNT: 00 LAST DUN DATE: TOTAL AMT: 1, 294. 89 OVERDUE STATUS: OVERDUE DATE: COLLECTED AMT: 0. 00 WRITE-OFF FLAG: WRITE-OFF DATE: WRITE-OFF AMT: 0. 00 WRITE-OFF REASON: DOC CLOSE DATE: 10 10 09 OFFSET AMT: 1, 294. 89 OFFSET: Y OFFSET APPLIED: 0. 00 CLOSED AMT: 1, 294. 89 OVRPYMT CAUSE: CASE HISTORY FLAG: N REPRINT BILL AMT: 0. 00 AGREEMENT NO: OUTSTANDING RECV AMT: 0. 00 RGLDATV RSD FORM: F 840 10/30/09 PV 03 FSC 0 K 026701 001 10 0160 A 1 10 0100222 V 1 2560 N 1321 1, 294. 89 1313 1, 294. 89 490 N 1, 294. 89 3107 1, 294. 89 5700 1, 294. 89 4610 1, 294. 89 9946 1, 294. 89 9945 1, 294. 89 3 -10

Negative PV 03 RARVGLV FSC 0160 A 1 REPORT ID: RARVGLV *** DEPT OF VETERANS AFFAIRS (FMS) *** PAGE: 22 RSD FORM: F 853 VERIFICATION OF GENERAL LEDGER BALANCES - ACCOUNTS RECEIVABLE TIME: 22 RUN DATE: 10/31/09 FEDERAL/NON-FEDERAL REPORT AS OF 10/30/09 STN: FSC BFYS: 10 FUND: 0160 A 1 PAYOR TYPE CATEGORY: NON-FEDERAL WEST TEXAS VA HEALTHCARE SYSTM MEDICAL SERVICES - LMT 1 A/O: 10 VETERANS HEALTH ADMIN REV LAST ACT DOCUMENT ID LINE FCP/PRJ BOC SRCE REF DOC ID LINE DATE PAYOR CODE NAME OUTSTANDING AMOUNT BD FSC 0 K 0267 001 0100222 V 1 2560 12/14/08 10/30/09 752574581 02 BIG SPRING HOSP CORP 1, 294. 89 NUMBER OF RECORDS: 89 STN 519 SUBTOTAL AMOUNT: 39, 279. 63 RARVGLV FSC 0160 A 1 REPORT ID: RARVGLV *** DEPT OF VETERANS AFFAIRS (FMS) *** PAGE: 23 RSD FORM: F 853 VERIFICATION OF GENERAL LEDGER BALANCES - ACCOUNTS RECEIVABLE TIME: 22 RUN DATE: 10/31/09 FEDERAL/NON-FEDERAL REPORT AS OF 10/31/09 STN: FSC BFYS: 10 FUND: 0160 A 1 PAYOR TYPE CATEGORY: NON-FEDERAL WEST TEXAS VA HEALTHCARE SYSTM MEDICAL SERVICES - LMT 1 OUTSTANDING AMOUNT ---------- ACCOUNTS RECEIVABLE TOTAL: 39, 279. 63 G/L ACCOUNT BALANCES: G/L ACCT NAME BALANCE ---------- 1311 AR-REIM-OTH 37, 806. 90 1313 AR-REFD-OTH 177. 84 1321 AR-REFD-CR M 1, 294. 89 G/L TOTAL: 39, 279. 63 DIFFERENCE: 0. 00 3 -11

Negative PV 03 RARVGLV FSC 0160 A 1 REPORT ID: RARVGLV *** DEPT OF VETERANS AFFAIRS (FMS) *** PAGE: 22 RSD FORM: F 853 VERIFICATION OF GENERAL LEDGER BALANCES - ACCOUNTS RECEIVABLE TIME: 22 RUN DATE: 10/31/09 FEDERAL/NON-FEDERAL REPORT AS OF 10/30/09 STN: FSC BFYS: 10 FUND: 0160 A 1 PAYOR TYPE CATEGORY: NON-FEDERAL WEST TEXAS VA HEALTHCARE SYSTM MEDICAL SERVICES - LMT 1 A/O: 10 VETERANS HEALTH ADMIN REV LAST ACT DOCUMENT ID LINE FCP/PRJ BOC SRCE REF DOC ID LINE DATE PAYOR CODE NAME OUTSTANDING AMOUNT BD FSC 0 K 0267 001 0100222 V 1 2560 12/14/08 10/30/09 752574581 02 BIG SPRING HOSP CORP 1, 294. 89 NUMBER OF RECORDS: 89 STN 519 SUBTOTAL AMOUNT: 39, 279. 63 RARVGLV FSC 0160 A 1 REPORT ID: RARVGLV *** DEPT OF VETERANS AFFAIRS (FMS) *** PAGE: 23 RSD FORM: F 853 VERIFICATION OF GENERAL LEDGER BALANCES - ACCOUNTS RECEIVABLE TIME: 22 RUN DATE: 10/31/09 FEDERAL/NON-FEDERAL REPORT AS OF 10/31/09 STN: FSC BFYS: 10 FUND: 0160 A 1 PAYOR TYPE CATEGORY: NON-FEDERAL WEST TEXAS VA HEALTHCARE SYSTM MEDICAL SERVICES - LMT 1 OUTSTANDING AMOUNT ---------- ACCOUNTS RECEIVABLE TOTAL: 39, 279. 63 G/L ACCOUNT BALANCES: G/L ACCT NAME BALANCE ---------- 1311 AR-REIM-OTH 37, 806. 90 1313 AR-REFD-OTH 177. 84 1321 AR-REFD-CR M 1, 294. 89 G/L TOTAL: 39, 279. 63 DIFFERENCE: 0. 00 3 -11

Negative PV 03 ACTION: R TABLEID: UPVT USERID: S 104 FSC *** UNPAID VOUCHER INQUIRY SCREEN *** KEY IS SCHEDULE DATE, DISBURSING OFFICE, VENDOR CODE, TRANS CODE, VOUCHER NUMBER, TRAVEL ADVANCE NUMBER SCHEDULE TRANS VOUCHER TRVL ADV DATE D. O. VENDOR CODE NUMBER AMOUNT -------- ----------- 01 - 10 30 09 220 752574581 02 PV FSC 0 K 026701 -1, 294. 89 RSD Form: F 826 Status of Allowance STN: FSC BFYS: 10 Fund: 0160 A/O: 10 Fund Code: 0160 A 1 WEST TEXAS VA HEALTHCARE SYSTM MEDICAL SERVICES - LMT 1 VETERANS HEALTH ADMIN Program: 28 Total Available Budget Obligations Amount Orgn/Act thru MAR 10 280022166 HALFWAY HOUSE 3, 328. 00 0. 00 Undist to Program: 142, 902. 00 ================== Program 28 Total: 162, 380. 00 19, 478. 00 142, 902. 00 Suballowance for 0160 A 1 Total: 14, 707, 424. 71 20, 415, 086. 68 -5, 707, 661. 97 Allowance for 0160 A 1 Total: 20, 463, 251. 00 20, 415, 086. 68 48, 164. 32 NOTE: THIS TOTAL DOES NOT DEDUCT A BALANCE OF $1, 294. 89 IN G/L 1321 AND MUST REMAIN UNOBLIGATED FOR BFY 10, FUNDCODE 0160 A 1. 3 -12

Negative PV 03 ACTION: R TABLEID: UPVT USERID: S 104 FSC *** UNPAID VOUCHER INQUIRY SCREEN *** KEY IS SCHEDULE DATE, DISBURSING OFFICE, VENDOR CODE, TRANS CODE, VOUCHER NUMBER, TRAVEL ADVANCE NUMBER SCHEDULE TRANS VOUCHER TRVL ADV DATE D. O. VENDOR CODE NUMBER AMOUNT -------- ----------- 01 - 10 30 09 220 752574581 02 PV FSC 0 K 026701 -1, 294. 89 RSD Form: F 826 Status of Allowance STN: FSC BFYS: 10 Fund: 0160 A/O: 10 Fund Code: 0160 A 1 WEST TEXAS VA HEALTHCARE SYSTM MEDICAL SERVICES - LMT 1 VETERANS HEALTH ADMIN Program: 28 Total Available Budget Obligations Amount Orgn/Act thru MAR 10 280022166 HALFWAY HOUSE 3, 328. 00 0. 00 Undist to Program: 142, 902. 00 ================== Program 28 Total: 162, 380. 00 19, 478. 00 142, 902. 00 Suballowance for 0160 A 1 Total: 14, 707, 424. 71 20, 415, 086. 68 -5, 707, 661. 97 Allowance for 0160 A 1 Total: 20, 463, 251. 00 20, 415, 086. 68 48, 164. 32 NOTE: THIS TOTAL DOES NOT DEDUCT A BALANCE OF $1, 294. 89 IN G/L 1321 AND MUST REMAIN UNOBLIGATED FOR BFY 10, FUNDCODE 0160 A 1. 3 -12

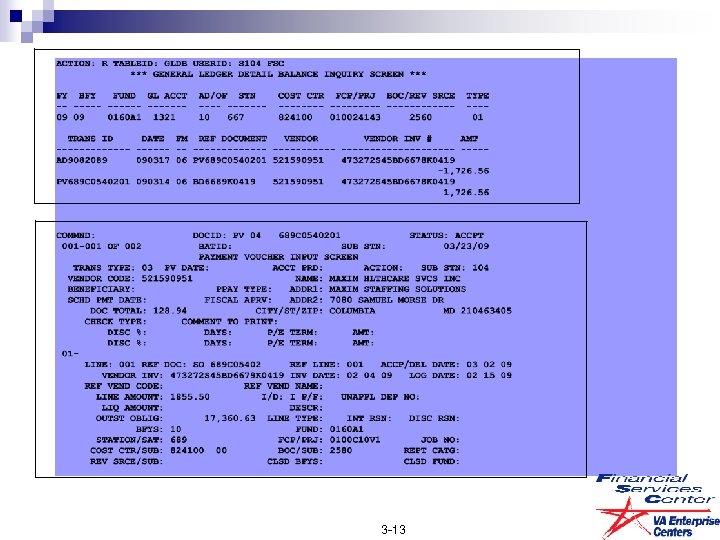

3 -13

3 -13

3 -14

3 -14

Here is the information, which will clarify who is responsible for the accounts receivables. http: //www. va. gov/publ/direc/finance/M 4 P 8 C 27. htm n n n n . RECORDS, REPORTS, AND ACCOUNTING 27. 01 RECORDS a. As managers, all field station Fiscal activities, VACO Finance Service, and the Debt Management Center (DMC) must establish and maintain accounts receivable records in a current status by program, type of debt, and appropriation. All collection actions taken, collections received, amounts offset, waiver action, etc. , including adjustments of any kind on a debtor's account, are to be timely documented in the Department's accounts receivable records. b. Complete records are to be maintained, by program, type of debt, and appropriation, of accounts receivable waived, compromised, suspended, terminated or referred to the District Counsel (DC) or Department of Justice (DOJ) for enforced collection so that reports required by paragraph 27. 02 and ad hoc reports required by management can be completed. c. All VA components who refer accounts receivable to other VA components or external agencies for additional collection action or advice are responsible for keeping informed of the current status of those receivables (reconciling their accounts with the component the debts were referred to) and for reporting and accounting purposes. Here is some additional information. This report is generated each pay period. At the time payroll processes a Record Print Out (RPO) is generated for employees on LWOP and whose FEHB is advanced by the agency. This information goes to FMS and appears on the F 842 report in RSD. 3 -15

Here is the information, which will clarify who is responsible for the accounts receivables. http: //www. va. gov/publ/direc/finance/M 4 P 8 C 27. htm n n n n . RECORDS, REPORTS, AND ACCOUNTING 27. 01 RECORDS a. As managers, all field station Fiscal activities, VACO Finance Service, and the Debt Management Center (DMC) must establish and maintain accounts receivable records in a current status by program, type of debt, and appropriation. All collection actions taken, collections received, amounts offset, waiver action, etc. , including adjustments of any kind on a debtor's account, are to be timely documented in the Department's accounts receivable records. b. Complete records are to be maintained, by program, type of debt, and appropriation, of accounts receivable waived, compromised, suspended, terminated or referred to the District Counsel (DC) or Department of Justice (DOJ) for enforced collection so that reports required by paragraph 27. 02 and ad hoc reports required by management can be completed. c. All VA components who refer accounts receivable to other VA components or external agencies for additional collection action or advice are responsible for keeping informed of the current status of those receivables (reconciling their accounts with the component the debts were referred to) and for reporting and accounting purposes. Here is some additional information. This report is generated each pay period. At the time payroll processes a Record Print Out (RPO) is generated for employees on LWOP and whose FEHB is advanced by the agency. This information goes to FMS and appears on the F 842 report in RSD. 3 -15

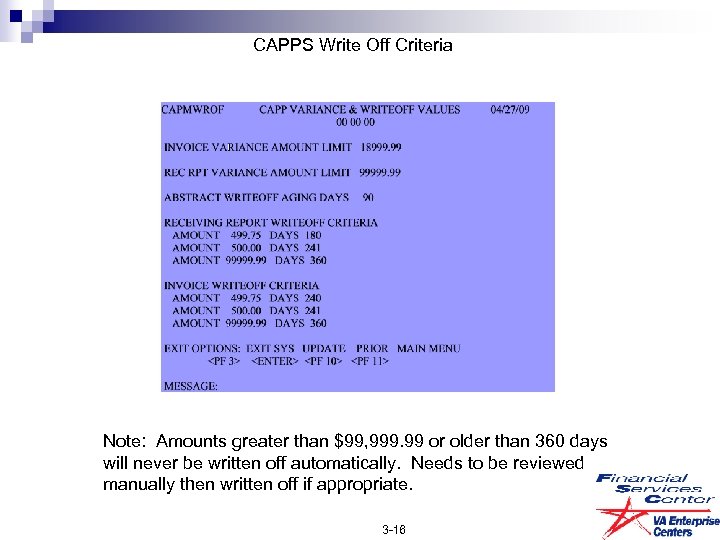

CAPPS Write Off Criteria Note: Amounts greater than $99, 999. 99 or older than 360 days will never be written off automatically. Needs to be reviewed manually then written off if appropriate. 3 -16

CAPPS Write Off Criteria Note: Amounts greater than $99, 999. 99 or older than 360 days will never be written off automatically. Needs to be reviewed manually then written off if appropriate. 3 -16

REPORT NAME: CAPJ PAGE 99 REPORT NO. 040 06/16/09 FMS/CAPP RECEIVING REPORT WRITEOFFS VARIABLE TABLE DOLLAR AMOUNT AND AGING CRITERIA AMOUNT LIMIT 499. 75 AND DAYS 180 AMOUNT LIMIT 500. 00 AND DAYS 241 AMOUNT LIMIT 99, 999. 99 AND DAYS 360 EASTERN DIVISION STATION PAT DOC TYPE DLN SHIPPING RR AMOUNT ADJ/ENTRY OPR FSC A 79002 A 32668111104 . 00 . 02 CAPSPLIT STATION TOTALS . 00 . 02 ITEM TOTAL 1 NOTE: There are three types of document types for the receiving report write off: A is for abstracted receivers, stations received more goods than what the vendor is billing for. R-is for open receivers awaiting invoices. W is for receiving reports written off. The document types will be seen in the CAPPS System and this report. When the modifications are done by the stations through FMS, the stations must contact Austin (FOS) to have the CAPPS System updated manually. When the CAPPS system does a write off, you will see a “W” for the document type and a 0. 00 CV document will be generated. 3 -17

REPORT NAME: CAPJ PAGE 99 REPORT NO. 040 06/16/09 FMS/CAPP RECEIVING REPORT WRITEOFFS VARIABLE TABLE DOLLAR AMOUNT AND AGING CRITERIA AMOUNT LIMIT 499. 75 AND DAYS 180 AMOUNT LIMIT 500. 00 AND DAYS 241 AMOUNT LIMIT 99, 999. 99 AND DAYS 360 EASTERN DIVISION STATION PAT DOC TYPE DLN SHIPPING RR AMOUNT ADJ/ENTRY OPR FSC A 79002 A 32668111104 . 00 . 02 CAPSPLIT STATION TOTALS . 00 . 02 ITEM TOTAL 1 NOTE: There are three types of document types for the receiving report write off: A is for abstracted receivers, stations received more goods than what the vendor is billing for. R-is for open receivers awaiting invoices. W is for receiving reports written off. The document types will be seen in the CAPPS System and this report. When the modifications are done by the stations through FMS, the stations must contact Austin (FOS) to have the CAPPS System updated manually. When the CAPPS system does a write off, you will see a “W” for the document type and a 0. 00 CV document will be generated. 3 -17

ACTION: R TABLEID: DXRF USERID: S 104 FIH *** DOCUMENT CROSS REFERENCE INQUIRY SCREEN *** KEY IS TRANS ID, F/B POINTER, REF TRANS ID, ACCEPDATE, DOC ACTION TRANS CODE: MO TRANS NUMBER: FSCA 99002 DOC TOTAL: 2, 198. 10 OUTST AMT: 0. 00 REF TRANS ID ACCEP DOC F/B/A TC NUMBER DATE ACT VENDOR AMOUNT ----------- --------- 01 - A 11 21 08 E 840603850 2, 198. 12 LAST BATCH NUMBER: CLEARING ACTION: 02 - A 01 04 09 S 840603850 -0. 02 LAST BATCH NUMBER: ER 004 CLEARING ACTION: 03 - F RT FSCA 9900201 11 22 08 E 840603850 2, 198. 12 LAST BATCH NUMBER: CLEARING ACTION: 04 - F RT FSCA 9900201 01 04 09 M 840603850 -0. 02 LAST BATCH NUMBER: ER 004 CLEARING ACTION: ACTION: R TABLEID: DXRF USERID: S 104 FIH *** DOCUMENT CROSS REFERENCE INQUIRY SCREEN *** KEY IS TRANS ID, F/B POINTER, REF TRANS ID, ACCEPDATE, DOC ACTION TRANS CODE: RT TRANS NUMBER: FSC 900201 DOC TOTAL: 2, 198. 10 OUTST AMT: 0. 00 REF TRANS ID ACCEP DOC F/B/A TC NUMBER DATE ACT VENDOR AMOUNT ----------- --------- 01 - B MO FSCA 89002 11 22 08 E 840603850 2, 198. 12 LAST BATCH NUMBER: CLEARING ACTION: 02 - B MO FSCA 89002 01 04 09 M 840603850 -0. 02 LAST BATCH NUMBER: ER 004 CLEARING ACTION: 03 - F CV FSCA 8900201 12 04 08 E 840603850 2, 198. 10 LAST BATCH NUMBER: CLEARING ACTION: NOTE: MO was established for $2198. 12 on 11/21/08. Receiver updated FMS on 11/22/08 for $2198. 12, vendor invoiced for $2198. 10 (CV document) on 12/04/08. Station did modification of 0. 02 on 01/04/09. Station must notify Austin to manually update the CAPPS System for the modification. 3 -18

ACTION: R TABLEID: DXRF USERID: S 104 FIH *** DOCUMENT CROSS REFERENCE INQUIRY SCREEN *** KEY IS TRANS ID, F/B POINTER, REF TRANS ID, ACCEPDATE, DOC ACTION TRANS CODE: MO TRANS NUMBER: FSCA 99002 DOC TOTAL: 2, 198. 10 OUTST AMT: 0. 00 REF TRANS ID ACCEP DOC F/B/A TC NUMBER DATE ACT VENDOR AMOUNT ----------- --------- 01 - A 11 21 08 E 840603850 2, 198. 12 LAST BATCH NUMBER: CLEARING ACTION: 02 - A 01 04 09 S 840603850 -0. 02 LAST BATCH NUMBER: ER 004 CLEARING ACTION: 03 - F RT FSCA 9900201 11 22 08 E 840603850 2, 198. 12 LAST BATCH NUMBER: CLEARING ACTION: 04 - F RT FSCA 9900201 01 04 09 M 840603850 -0. 02 LAST BATCH NUMBER: ER 004 CLEARING ACTION: ACTION: R TABLEID: DXRF USERID: S 104 FIH *** DOCUMENT CROSS REFERENCE INQUIRY SCREEN *** KEY IS TRANS ID, F/B POINTER, REF TRANS ID, ACCEPDATE, DOC ACTION TRANS CODE: RT TRANS NUMBER: FSC 900201 DOC TOTAL: 2, 198. 10 OUTST AMT: 0. 00 REF TRANS ID ACCEP DOC F/B/A TC NUMBER DATE ACT VENDOR AMOUNT ----------- --------- 01 - B MO FSCA 89002 11 22 08 E 840603850 2, 198. 12 LAST BATCH NUMBER: CLEARING ACTION: 02 - B MO FSCA 89002 01 04 09 M 840603850 -0. 02 LAST BATCH NUMBER: ER 004 CLEARING ACTION: 03 - F CV FSCA 8900201 12 04 08 E 840603850 2, 198. 10 LAST BATCH NUMBER: CLEARING ACTION: NOTE: MO was established for $2198. 12 on 11/21/08. Receiver updated FMS on 11/22/08 for $2198. 12, vendor invoiced for $2198. 10 (CV document) on 12/04/08. Station did modification of 0. 02 on 01/04/09. Station must notify Austin to manually update the CAPPS System for the modification. 3 -18

ACTION: R TABLEID: OBLH USERID: S 104 FIH *** ORDERS HEADER INQUIRY SCREEN *** KEY IS TRANS CODE, ORDER NUMBER TRANS CODE: MO ORDER NUMBER: FSCA 79002 TRANS TYPE: 01 SUB STN: FSC VENDOR CODE: 840603850 CONTRACT NO: AUTO ACCRUE: N NAME: WINDSOR INDS INC ALT PAYEE: / ORIGINAL AMT: 2, 198. 12 PO DATE: 11 21 06 AMENDMENT AMT: -0. 02 LAST ACTIVITY DATE: 11 22 06 ORDERED AMT: 2, 198. 10 BEGIN DATE: 11 21 06 CLOSED AMT: 2, 198. 10 END DATE: 12 01 06 ACCRUED AMT: 0. 00 NO CONTRACT MONTHS: EXPENDED AMT: 2, 198. 10 FOB: D OUTSTANDING AMT: 0. 00 CLOSED DATE: 11 22 06 MISC REF AMT: 0. 00 DISC %: 0. 000 DAYS: 00 P/E TERM: 00 HOLDBACK AMT: 0. 00 ADVANCED AMT: 0. 00 DOC TYPE: COMMENTS: OUT ADVANCE AMT: 0. 00 RESP PERSON: NOTE: Station de-obligated 0. 02 because vendor invoice was $2198. 10 and receiver was $$2198. 12 leaving a difference of 0. 02, this amount amended the obligation. 3 -19

ACTION: R TABLEID: OBLH USERID: S 104 FIH *** ORDERS HEADER INQUIRY SCREEN *** KEY IS TRANS CODE, ORDER NUMBER TRANS CODE: MO ORDER NUMBER: FSCA 79002 TRANS TYPE: 01 SUB STN: FSC VENDOR CODE: 840603850 CONTRACT NO: AUTO ACCRUE: N NAME: WINDSOR INDS INC ALT PAYEE: / ORIGINAL AMT: 2, 198. 12 PO DATE: 11 21 06 AMENDMENT AMT: -0. 02 LAST ACTIVITY DATE: 11 22 06 ORDERED AMT: 2, 198. 10 BEGIN DATE: 11 21 06 CLOSED AMT: 2, 198. 10 END DATE: 12 01 06 ACCRUED AMT: 0. 00 NO CONTRACT MONTHS: EXPENDED AMT: 2, 198. 10 FOB: D OUTSTANDING AMT: 0. 00 CLOSED DATE: 11 22 06 MISC REF AMT: 0. 00 DISC %: 0. 000 DAYS: 00 P/E TERM: 00 HOLDBACK AMT: 0. 00 ADVANCED AMT: 0. 00 DOC TYPE: COMMENTS: OUT ADVANCE AMT: 0. 00 RESP PERSON: NOTE: Station de-obligated 0. 02 because vendor invoice was $2198. 10 and receiver was $$2198. 12 leaving a difference of 0. 02, this amount amended the obligation. 3 -19

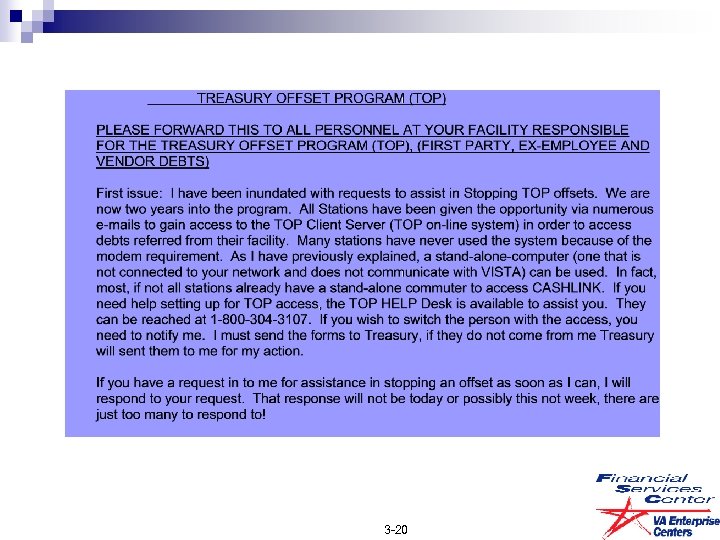

3 -20

3 -20

3 -21

3 -21

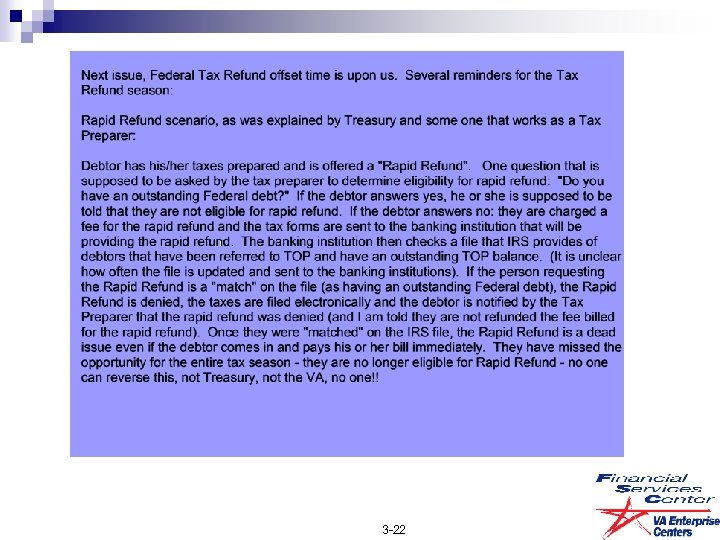

3 -22

3 -22

3 -23

3 -23

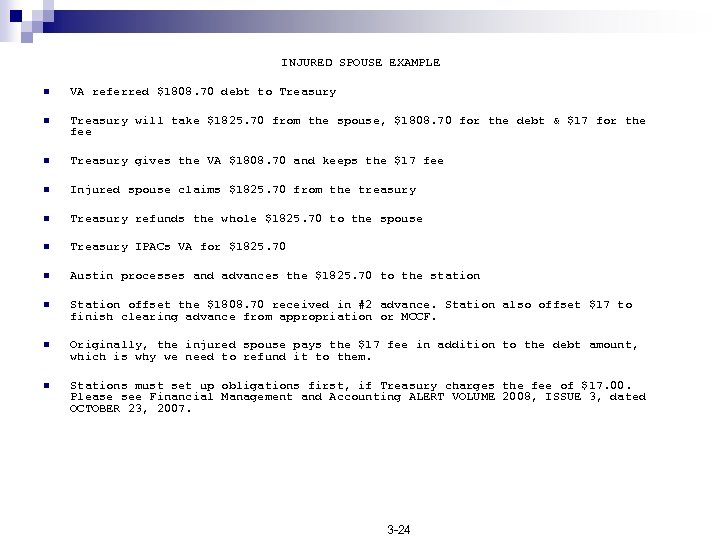

INJURED SPOUSE EXAMPLE n VA referred $1808. 70 debt to Treasury n Treasury will take $1825. 70 from the spouse, $1808. 70 for the debt & $17 for the fee n Treasury gives the VA $1808. 70 and keeps the $17 fee n Injured spouse claims $1825. 70 from the treasury n Treasury refunds the whole $1825. 70 to the spouse n Treasury IPACs VA for $1825. 70 n Austin processes and advances the $1825. 70 to the station n Station offset the $1808. 70 received in #2 advance. Station also offset $17 to finish clearing advance from appropriation or MCCF. n Originally, the injured spouse pays the $17 fee in addition to the debt amount, which is why we need to refund it to them. n Stations must set up obligations first, if Treasury charges the fee of $17. 00. Please see Financial Management and Accounting ALERT VOLUME 2008, ISSUE 3, dated OCTOBER 23, 2007. 3 -24

INJURED SPOUSE EXAMPLE n VA referred $1808. 70 debt to Treasury n Treasury will take $1825. 70 from the spouse, $1808. 70 for the debt & $17 for the fee n Treasury gives the VA $1808. 70 and keeps the $17 fee n Injured spouse claims $1825. 70 from the treasury n Treasury refunds the whole $1825. 70 to the spouse n Treasury IPACs VA for $1825. 70 n Austin processes and advances the $1825. 70 to the station n Station offset the $1808. 70 received in #2 advance. Station also offset $17 to finish clearing advance from appropriation or MCCF. n Originally, the injured spouse pays the $17 fee in addition to the debt amount, which is why we need to refund it to them. n Stations must set up obligations first, if Treasury charges the fee of $17. 00. Please see Financial Management and Accounting ALERT VOLUME 2008, ISSUE 3, dated OCTOBER 23, 2007. 3 -24

INJURED SPOUSE TRANSACTIONS (EXAMPLE) The below are FMS screen shots of transaction code TR Header screen with doc total of $17. 00, this is the TOPS fee. COMMND: DOCID: TR 10 52330805025 STATUS: ACCPT BATID: SUB STN: 09/25/09 CASH RECEIPT INPUT SCREEN BATCH DATE: NUM DOCS: NET: CR DATE: ACCTG PRD: ACTION: SUB STN: 523 TRANS TYPE: BFYS: FUND: CASH ACCT: DEP NUMBER: 30705025 DOC TYPE: BILL FUND: DOC TOTAL: 17. 00 DISB OFFICE: 220 ACCOMPLISHED DATE: 09 24 09 REF DOC: This is the two line TR. This is the amount taken from the injured spouse and the $17. 00 Top fee included (which is the advanced amount). This is the amount of the IPAC from Treasury and you will see it on the ADVX table. COMMND: DOCID: TR 10 52330805025 STATUS: ACCPT 001 -002 OF 002 BATID: SUB STN: 09/25/09 LINE: 001 REF TC: DV REF DOC NO: 52330705025 REF LINE: 044 TRANS TYPE: 15 BFYS: FUND: 0160 A 1 STATION/SAT: 523 FCP/PRJ: JOB NO: COST CTR/SUB: BOC/SUB: REPT CATG: REV SRCE/SUB: CLSD BFYS: CLSD FUND: CHECK NO: ACTION OUT: GL ACCT: ADV IND: Y ADV: ADV NO: TRAV TYPE: VND/PRV: 104 VAFC 00 AMOUNT: 1825. 70 I/D: I UNAPPLIED DEP NO: AGR NO: DESCR: The TR 75, 65 or 33 document will depend on the vendor code and fund you are using in this case it is an employee. This is the amount refunded back to the injured spouse. LINE: 002 REF TC: REF DOC NO: REF LINE: TRANS TYPE: 65 BFYS: 09 FUND: 0129 A 1 STATION/SAT: 523 FCP/PRJ: 010070701 JOB NO: COST CTR/SUB: 570500 BOC/SUB: 1101 08 REPT CATG: REV SRCE/SUB: CLSD BFYS: CLSD FUND: CHECK NO: ACTION OUT: GL ACCT: ADV IND: ADV NO: TRAV TYPE: VND/PRV: MISCN AMOUNT: 1808. 70 I/D: D UNAPPLIED DEP NO: AGR NO: DESCR: 3 -25

INJURED SPOUSE TRANSACTIONS (EXAMPLE) The below are FMS screen shots of transaction code TR Header screen with doc total of $17. 00, this is the TOPS fee. COMMND: DOCID: TR 10 52330805025 STATUS: ACCPT BATID: SUB STN: 09/25/09 CASH RECEIPT INPUT SCREEN BATCH DATE: NUM DOCS: NET: CR DATE: ACCTG PRD: ACTION: SUB STN: 523 TRANS TYPE: BFYS: FUND: CASH ACCT: DEP NUMBER: 30705025 DOC TYPE: BILL FUND: DOC TOTAL: 17. 00 DISB OFFICE: 220 ACCOMPLISHED DATE: 09 24 09 REF DOC: This is the two line TR. This is the amount taken from the injured spouse and the $17. 00 Top fee included (which is the advanced amount). This is the amount of the IPAC from Treasury and you will see it on the ADVX table. COMMND: DOCID: TR 10 52330805025 STATUS: ACCPT 001 -002 OF 002 BATID: SUB STN: 09/25/09 LINE: 001 REF TC: DV REF DOC NO: 52330705025 REF LINE: 044 TRANS TYPE: 15 BFYS: FUND: 0160 A 1 STATION/SAT: 523 FCP/PRJ: JOB NO: COST CTR/SUB: BOC/SUB: REPT CATG: REV SRCE/SUB: CLSD BFYS: CLSD FUND: CHECK NO: ACTION OUT: GL ACCT: ADV IND: Y ADV: ADV NO: TRAV TYPE: VND/PRV: 104 VAFC 00 AMOUNT: 1825. 70 I/D: I UNAPPLIED DEP NO: AGR NO: DESCR: The TR 75, 65 or 33 document will depend on the vendor code and fund you are using in this case it is an employee. This is the amount refunded back to the injured spouse. LINE: 002 REF TC: REF DOC NO: REF LINE: TRANS TYPE: 65 BFYS: 09 FUND: 0129 A 1 STATION/SAT: 523 FCP/PRJ: 010070701 JOB NO: COST CTR/SUB: 570500 BOC/SUB: 1101 08 REPT CATG: REV SRCE/SUB: CLSD BFYS: CLSD FUND: CHECK NO: ACTION OUT: GL ACCT: ADV IND: ADV NO: TRAV TYPE: VND/PRV: MISCN AMOUNT: 1808. 70 I/D: D UNAPPLIED DEP NO: AGR NO: DESCR: 3 -25

INJURED SPOUSE TRANSACTIONS (EXAMPLE) This TR has caused a 224 out of balance. Remember SDD number. This one line ET will balance to the TR using the same Doc ID and Direct Disbursement number (SDD number). COMMND: DOCID: ET 10 52330705025 STATUS: ACCPT BATID: SUB STN: 09/25/09 DIRECT DISBURSEMENT INPUT SCREEN BATCH DATE: NUM DOCS: NET: TRANS TYPE: DD DATE: ACCT PRD: ACTION: SUB STN: 523 BFYS: FUND: COMMENTS: VENDOR CODE: MISCN NAME: MISC COMMERCIAL VENDOR DIRECT DISB NO: 30705025 INTR-AGCY SYMBOL: DISB OFFICE: 220 DOC TOTAL: 17. 00 AGREEMENT NO: ADV LIQ AMT: REF DOC NO: The ET will allow you to reference the obligation. This is the TOP fee. COMMND: DOCID: ET 10 52330705025 STATUS: ACCPT 001 -001 OF 001 BATID: SUB STN: 09/25/09 01 - LINE: 001 REF DOC: SO 523307050 REF LINE: 001 ACCP DATE: PAY ADV: REF ADV: REF ADV LINE: INV DATE: VENDOR INV NO/LINE: LOG DATE: T/T: TP BFYS: 09 FUND: 0129 A 1 STATION/SAT: 523 FCP/PRJ: 010070700 JOB NO: COST CTR/SUB: 570500 BOC/SUB: 2580 REPT CATG: REV SRCE/SUB: CLSD BFYS: CLSD FUND: GL ACCOUNT: DESCR: LINE AMOUNT: 17. 00 I/D: I P/F: INT REASON: LIQ AMOUNT: QUANTITY: ADV: UNAPPLIED DEP NO: 3 -26

INJURED SPOUSE TRANSACTIONS (EXAMPLE) This TR has caused a 224 out of balance. Remember SDD number. This one line ET will balance to the TR using the same Doc ID and Direct Disbursement number (SDD number). COMMND: DOCID: ET 10 52330705025 STATUS: ACCPT BATID: SUB STN: 09/25/09 DIRECT DISBURSEMENT INPUT SCREEN BATCH DATE: NUM DOCS: NET: TRANS TYPE: DD DATE: ACCT PRD: ACTION: SUB STN: 523 BFYS: FUND: COMMENTS: VENDOR CODE: MISCN NAME: MISC COMMERCIAL VENDOR DIRECT DISB NO: 30705025 INTR-AGCY SYMBOL: DISB OFFICE: 220 DOC TOTAL: 17. 00 AGREEMENT NO: ADV LIQ AMT: REF DOC NO: The ET will allow you to reference the obligation. This is the TOP fee. COMMND: DOCID: ET 10 52330705025 STATUS: ACCPT 001 -001 OF 001 BATID: SUB STN: 09/25/09 01 - LINE: 001 REF DOC: SO 523307050 REF LINE: 001 ACCP DATE: PAY ADV: REF ADV: REF ADV LINE: INV DATE: VENDOR INV NO/LINE: LOG DATE: T/T: TP BFYS: 09 FUND: 0129 A 1 STATION/SAT: 523 FCP/PRJ: 010070700 JOB NO: COST CTR/SUB: 570500 BOC/SUB: 2580 REPT CATG: REV SRCE/SUB: CLSD BFYS: CLSD FUND: GL ACCOUNT: DESCR: LINE AMOUNT: 17. 00 I/D: I P/F: INT REASON: LIQ AMOUNT: QUANTITY: ADV: UNAPPLIED DEP NO: 3 -26

INJURED SPOUSE TRANSACTIONS (EXAMPLE) Obligation is now expensed. ACTION: R TABLEID: OBLH USERID: S 104 FIH *** ORDERS HEADER INQUIRY SCREEN *** KEY IS TRANS CODE, ORDER NUMBER TRANS CODE: SO ORDER NUMBER: 523307050 TRANS TYPE: 01 SUB STN: 523 VENDOR CODE: MISCN CONTRACT NO: AUTO ACCRUE: N NAME: MISC COMMERCIAL VENDOR ALT PAYEE: / ORIGINAL AMT: 17. 00 PO DATE: 09 24 09 AMENDMENT AMT: 0. 00 LAST ACTIVITY DATE: 09 24 09 ORDERED AMT: 17. 00 BEGIN DATE: 09 24 09 CLOSED AMT: 17. 00 END DATE: 09 24 09 ACCRUED AMT: 0. 00 NO CONTRACT MONTHS: EXPENDED AMT: 17. 00 FOB: OUTSTANDING AMT: 0. 00 CLOSED DATE: 09 24 09 MISC REF AMT: 0. 00 DISC %: 0. 000 DAYS: 00 P/E TERM: 00 HOLDBACK AMT: 0. 00 ADVANCED AMT: 0. 00 DOC TYPE: COMMENTS: OUT ADVANCE AMT: 0. 00 RESP PERSON: 3 -27

INJURED SPOUSE TRANSACTIONS (EXAMPLE) Obligation is now expensed. ACTION: R TABLEID: OBLH USERID: S 104 FIH *** ORDERS HEADER INQUIRY SCREEN *** KEY IS TRANS CODE, ORDER NUMBER TRANS CODE: SO ORDER NUMBER: 523307050 TRANS TYPE: 01 SUB STN: 523 VENDOR CODE: MISCN CONTRACT NO: AUTO ACCRUE: N NAME: MISC COMMERCIAL VENDOR ALT PAYEE: / ORIGINAL AMT: 17. 00 PO DATE: 09 24 09 AMENDMENT AMT: 0. 00 LAST ACTIVITY DATE: 09 24 09 ORDERED AMT: 17. 00 BEGIN DATE: 09 24 09 CLOSED AMT: 17. 00 END DATE: 09 24 09 ACCRUED AMT: 0. 00 NO CONTRACT MONTHS: EXPENDED AMT: 17. 00 FOB: OUTSTANDING AMT: 0. 00 CLOSED DATE: 09 24 09 MISC REF AMT: 0. 00 DISC %: 0. 000 DAYS: 00 P/E TERM: 00 HOLDBACK AMT: 0. 00 ADVANCED AMT: 0. 00 DOC TYPE: COMMENTS: OUT ADVANCE AMT: 0. 00 RESP PERSON: 3 -27

Treasury Offset Program (TOP) 3 -28

Treasury Offset Program (TOP) 3 -28

DMS Application Suite Create Helpdesk Tickets SQL Launcher n Treasury Offset n Obligation History n Payment History n Vendor EFT Compliance n Library View n Local Accounting n 3 -29

DMS Application Suite Create Helpdesk Tickets SQL Launcher n Treasury Offset n Obligation History n Payment History n Vendor EFT Compliance n Library View n Local Accounting n 3 -29

Treasury Offset Program (TOP) The Financial Services Center (FSC), Financial Accounting Service (FAS), Accounting, Reconciliation & Reports Division (ARRD) will record a transaction (OS-15) in the Financial Management System (FMS), which notifies field facilities when one of their payments has been offset by TOP. The FMS OS-15 transaction records a zero dollar amount to Standard General Ledger accounts 99 D 1 and 99 D 2 and reference the payment obligation. Additionally, the transaction is reflected on field facilities’ daily Accepted Document Listing (RGSADLV – F 829) and on FMS research tables (DXRF, PVHT/PVLT, GLDB). Since the OS-15 records a zero dollar amount, the offset amount and agency information is reflected in the invoice number field of the transaction. For example, VENDOR INV: TOP- $300. 00 – IRS. In some cases, the TOP offset may affect several payments to a vendor on the same day. In that case, the OS-15 is recorded to one payment/obligation and the total amount of the offset reflected in the invoice number field. The OS document number reflects the same document number, which was offset by TOP. 3 -30

Treasury Offset Program (TOP) The Financial Services Center (FSC), Financial Accounting Service (FAS), Accounting, Reconciliation & Reports Division (ARRD) will record a transaction (OS-15) in the Financial Management System (FMS), which notifies field facilities when one of their payments has been offset by TOP. The FMS OS-15 transaction records a zero dollar amount to Standard General Ledger accounts 99 D 1 and 99 D 2 and reference the payment obligation. Additionally, the transaction is reflected on field facilities’ daily Accepted Document Listing (RGSADLV – F 829) and on FMS research tables (DXRF, PVHT/PVLT, GLDB). Since the OS-15 records a zero dollar amount, the offset amount and agency information is reflected in the invoice number field of the transaction. For example, VENDOR INV: TOP- $300. 00 – IRS. In some cases, the TOP offset may affect several payments to a vendor on the same day. In that case, the OS-15 is recorded to one payment/obligation and the total amount of the offset reflected in the invoice number field. The OS document number reflects the same document number, which was offset by TOP. 3 -30

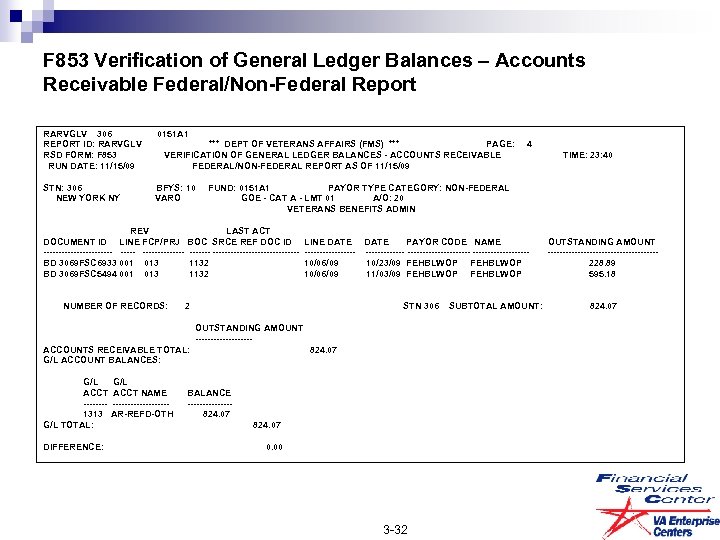

Accounts Receivables Reports n F 853 run on the EOM and 10 th WD REPORT NAME-> CD. RARVGLV. OCT 07 FORM-> F 853 VERIFICATION OF GENERAL LEDGER BALANCES – ACCOUNTS RECEIVABLE FEDERAL/NON-FEDERAL REPORT n F 842 run on the EOM and 10 th WD REPORT NAME-> CD. RARABRV. OCT 07 FORM-> F 842 AGING ACCOUNTS RECEIVABLE REPORT 3 -31

Accounts Receivables Reports n F 853 run on the EOM and 10 th WD REPORT NAME-> CD. RARVGLV. OCT 07 FORM-> F 853 VERIFICATION OF GENERAL LEDGER BALANCES – ACCOUNTS RECEIVABLE FEDERAL/NON-FEDERAL REPORT n F 842 run on the EOM and 10 th WD REPORT NAME-> CD. RARABRV. OCT 07 FORM-> F 842 AGING ACCOUNTS RECEIVABLE REPORT 3 -31

F 853 Verification of General Ledger Balances – Accounts Receivable Federal/Non-Federal Report RARVGLV 306 0151 A 1 REPORT ID: RARVGLV *** DEPT OF VETERANS AFFAIRS (FMS) *** PAGE: 4 RSD FORM: F 853 VERIFICATION OF GENERAL LEDGER BALANCES - ACCOUNTS RECEIVABLE TIME: 23: 40 RUN DATE: 11/15/09 FEDERAL/NON-FEDERAL REPORT AS OF 11/15/09 STN: 306 BFYS: 10 FUND: 0151 A 1 PAYOR TYPE CATEGORY: NON-FEDERAL NEW YORK NY VARO GOE - CAT A - LMT 01 A/O: 20 VETERANS BENEFITS ADMIN REV LAST ACT DOCUMENT ID LINE FCP/PRJ BOC SRCE REF DOC ID LINE DATE PAYOR CODE NAME OUTSTANDING AMOUNT ------------ ------------------ ----------------- ------------------BD 3069 FSC 6933 001 013 1132 10/06/09 10/23/09 FEHBLWOP 228. 89 BD 3069 FSC 5494 001 013 1132 10/06/09 11/03/09 FEHBLWOP 595. 18 NUMBER OF RECORDS: 2 STN 306 SUBTOTAL AMOUNT: 824. 07 OUTSTANDING AMOUNT ---------- ACCOUNTS RECEIVABLE TOTAL: 824. 07 G/L ACCOUNT BALANCES: G/L ACCT NAME BALANCE -------------- 1313 AR-REFD-OTH 824. 07 G/L TOTAL: 824. 07 DIFFERENCE: 0. 00 3 -32

F 853 Verification of General Ledger Balances – Accounts Receivable Federal/Non-Federal Report RARVGLV 306 0151 A 1 REPORT ID: RARVGLV *** DEPT OF VETERANS AFFAIRS (FMS) *** PAGE: 4 RSD FORM: F 853 VERIFICATION OF GENERAL LEDGER BALANCES - ACCOUNTS RECEIVABLE TIME: 23: 40 RUN DATE: 11/15/09 FEDERAL/NON-FEDERAL REPORT AS OF 11/15/09 STN: 306 BFYS: 10 FUND: 0151 A 1 PAYOR TYPE CATEGORY: NON-FEDERAL NEW YORK NY VARO GOE - CAT A - LMT 01 A/O: 20 VETERANS BENEFITS ADMIN REV LAST ACT DOCUMENT ID LINE FCP/PRJ BOC SRCE REF DOC ID LINE DATE PAYOR CODE NAME OUTSTANDING AMOUNT ------------ ------------------ ----------------- ------------------BD 3069 FSC 6933 001 013 1132 10/06/09 10/23/09 FEHBLWOP 228. 89 BD 3069 FSC 5494 001 013 1132 10/06/09 11/03/09 FEHBLWOP 595. 18 NUMBER OF RECORDS: 2 STN 306 SUBTOTAL AMOUNT: 824. 07 OUTSTANDING AMOUNT ---------- ACCOUNTS RECEIVABLE TOTAL: 824. 07 G/L ACCOUNT BALANCES: G/L ACCT NAME BALANCE -------------- 1313 AR-REFD-OTH 824. 07 G/L TOTAL: 824. 07 DIFFERENCE: 0. 00 3 -32

F 842 Aging Accounts Receivables RSD FORM: F 842 AGING ACCOUNTS RECEIVABLE REPORT TIME: 23: 40 RUN DATE: 11/15/09 AS OF 11/15/09 STN: 306 FUND: 0151 A 1 BFY: 10 PAYOR TYPE CATEGORY: NON-FEDERAL NEW YORK NY VARO GOE - CAT A - LMT 01 AGING DOCUMENT ESTAB LAST ACTV DAYS ORIGINAL COLLECTED WRITE-OFF BALANCE PAYOR VENDOR/ CATEGORY NUMBER DATE LATE AMOUNT DUE CODE EMPLOYEE NAME ------------- -------------- -------NOT DELQ BD 3060 FSCL 6933 10/06/09 10/23/09 0 228. 89 228. 89 FEHBLWOP NOT DELQ BD 3060 FSC 5494 10/06/09 11/03/09 0 595. 18 595. 18 FEHBLWOP NOT DELQ SUBTOTAL: 824. 07 STN: 306 FUND: 0151 A 1 BFY: 10 TOTAL: 824. 07 NUMBER OF RECORDS: 2 STN: 306 TOTAL: 824. 07 824. 07 3 -33

F 842 Aging Accounts Receivables RSD FORM: F 842 AGING ACCOUNTS RECEIVABLE REPORT TIME: 23: 40 RUN DATE: 11/15/09 AS OF 11/15/09 STN: 306 FUND: 0151 A 1 BFY: 10 PAYOR TYPE CATEGORY: NON-FEDERAL NEW YORK NY VARO GOE - CAT A - LMT 01 AGING DOCUMENT ESTAB LAST ACTV DAYS ORIGINAL COLLECTED WRITE-OFF BALANCE PAYOR VENDOR/ CATEGORY NUMBER DATE LATE AMOUNT DUE CODE EMPLOYEE NAME ------------- -------------- -------NOT DELQ BD 3060 FSCL 6933 10/06/09 10/23/09 0 228. 89 228. 89 FEHBLWOP NOT DELQ BD 3060 FSC 5494 10/06/09 11/03/09 0 595. 18 595. 18 FEHBLWOP NOT DELQ SUBTOTAL: 824. 07 STN: 306 FUND: 0151 A 1 BFY: 10 TOTAL: 824. 07 NUMBER OF RECORDS: 2 STN: 306 TOTAL: 824. 07 824. 07 3 -33

Account Payables

Account Payables

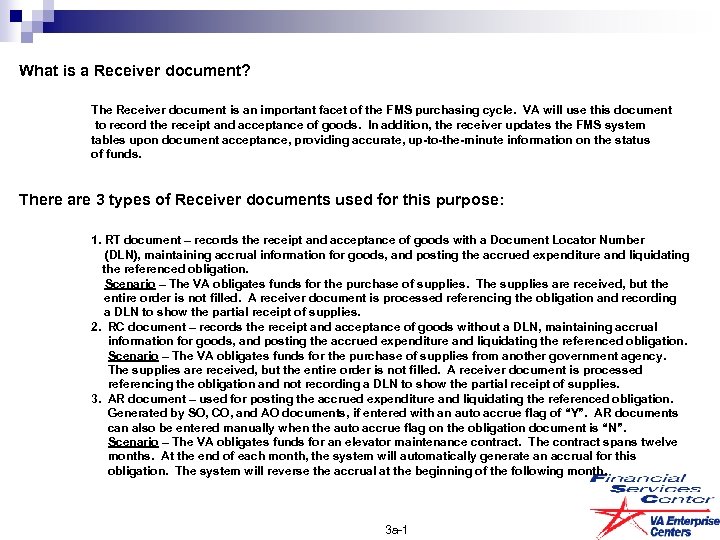

What is a Receiver document? The Receiver document is an important facet of the FMS purchasing cycle. VA will use this document to record the receipt and acceptance of goods. In addition, the receiver updates the FMS system tables upon document acceptance, providing accurate, up-to-the-minute information on the status of funds. There are 3 types of Receiver documents used for this purpose: 1. RT document – records the receipt and acceptance of goods with a Document Locator Number (DLN), maintaining accrual information for goods, and posting the accrued expenditure and liquidating the referenced obligation. Scenario – The VA obligates funds for the purchase of supplies. The supplies are received, but the entire order is not filled. A receiver document is processed referencing the obligation and recording a DLN to show the partial receipt of supplies. 2. RC document – records the receipt and acceptance of goods without a DLN, maintaining accrual information for goods, and posting the accrued expenditure and liquidating the referenced obligation. Scenario – The VA obligates funds for the purchase of supplies from another government agency. The supplies are received, but the entire order is not filled. A receiver document is processed referencing the obligation and not recording a DLN to show the partial receipt of supplies. 3. AR document – used for posting the accrued expenditure and liquidating the referenced obligation. Generated by SO, CO, and AO documents, if entered with an auto accrue flag of “Y”. AR documents can also be entered manually when the auto accrue flag on the obligation document is “N”. Scenario – The VA obligates funds for an elevator maintenance contract. The contract spans twelve months. At the end of each month, the system will automatically generate an accrual for this obligation. The system will reverse the accrual at the beginning of the following month. 3 a-1

What is a Receiver document? The Receiver document is an important facet of the FMS purchasing cycle. VA will use this document to record the receipt and acceptance of goods. In addition, the receiver updates the FMS system tables upon document acceptance, providing accurate, up-to-the-minute information on the status of funds. There are 3 types of Receiver documents used for this purpose: 1. RT document – records the receipt and acceptance of goods with a Document Locator Number (DLN), maintaining accrual information for goods, and posting the accrued expenditure and liquidating the referenced obligation. Scenario – The VA obligates funds for the purchase of supplies. The supplies are received, but the entire order is not filled. A receiver document is processed referencing the obligation and recording a DLN to show the partial receipt of supplies. 2. RC document – records the receipt and acceptance of goods without a DLN, maintaining accrual information for goods, and posting the accrued expenditure and liquidating the referenced obligation. Scenario – The VA obligates funds for the purchase of supplies from another government agency. The supplies are received, but the entire order is not filled. A receiver document is processed referencing the obligation and not recording a DLN to show the partial receipt of supplies. 3. AR document – used for posting the accrued expenditure and liquidating the referenced obligation. Generated by SO, CO, and AO documents, if entered with an auto accrue flag of “Y”. AR documents can also be entered manually when the auto accrue flag on the obligation document is “N”. Scenario – The VA obligates funds for an elevator maintenance contract. The contract spans twelve months. At the end of each month, the system will automatically generate an accrual for this obligation. The system will reverse the accrual at the beginning of the following month. 3 a-1

RECEIVERS DATA ENTRY Topic Page Source Document VA Action 0. Overview 1. Entering a Receiver (RT) Document with a DLN Order for Supplies or Services, VA 2138 (with receipt data for supplies), -or. Request, Turn-in, and Receipt for Property or Services, VA 2237 (with receipt data for supplies) -or. Estimated Miscellaneous Obligation or Change in Obligation, VA 1358 (with receipt data) Record the receipt of goods with a DLN 2. Entering a Receiver (RC) Document without a DLN Order for Supplies or Services, VA 2138 (with receipt data for supplies), -or. Request, Turn-in, and Receipt for Property or Services, VA 2237 (with receipt data for supplies) -or. Estimated Miscellaneous Obligation or Change in Obligation, VA 1358 (with receipt data) Record the receipt of goods without a DLN 3. Modifying a Receiver (RT or RC) Document Order for Supplies or Services, VA 2138 (with receipt data for supplies revised) -or. Request, Turn-in, and Receipt for Property or Services, VA 2237 (with receipt data for supplies - revised) -or. Adjustment Voucher, VA 90 -140 -or. Estimated Miscellaneous Obligation or Change in Obligation, VA 1358 (with receipt data) Modify the receipt of goods 4. Canceling a Receiver (RT or RC) Document Adjust Voucher for Cancellation, VA 90 -140 Cancel the receipt of goods 5. Entering, Modifying, or Canceling a Receiver Accrual (AR) Document Notification of Manual Accrual SF-1358 (marked for Accruals) Record the receipt of services 3 a-2

RECEIVERS DATA ENTRY Topic Page Source Document VA Action 0. Overview 1. Entering a Receiver (RT) Document with a DLN Order for Supplies or Services, VA 2138 (with receipt data for supplies), -or. Request, Turn-in, and Receipt for Property or Services, VA 2237 (with receipt data for supplies) -or. Estimated Miscellaneous Obligation or Change in Obligation, VA 1358 (with receipt data) Record the receipt of goods with a DLN 2. Entering a Receiver (RC) Document without a DLN Order for Supplies or Services, VA 2138 (with receipt data for supplies), -or. Request, Turn-in, and Receipt for Property or Services, VA 2237 (with receipt data for supplies) -or. Estimated Miscellaneous Obligation or Change in Obligation, VA 1358 (with receipt data) Record the receipt of goods without a DLN 3. Modifying a Receiver (RT or RC) Document Order for Supplies or Services, VA 2138 (with receipt data for supplies revised) -or. Request, Turn-in, and Receipt for Property or Services, VA 2237 (with receipt data for supplies - revised) -or. Adjustment Voucher, VA 90 -140 -or. Estimated Miscellaneous Obligation or Change in Obligation, VA 1358 (with receipt data) Modify the receipt of goods 4. Canceling a Receiver (RT or RC) Document Adjust Voucher for Cancellation, VA 90 -140 Cancel the receipt of goods 5. Entering, Modifying, or Canceling a Receiver Accrual (AR) Document Notification of Manual Accrual SF-1358 (marked for Accruals) Record the receipt of services 3 a-2

*ITS VERY IMPORTANT TO ENTER THE DATE THAT THE GOODS WERE ACTUALLY RECEIVED. IF A RECEIVED DATE IS FROM A PRIOR MONTH THAN CURRENTLY PROCESSING, YOU WILL NEED TO ENTER THE CURRENT ACCOUNTING PERIOD (ACCT PRD: ) FIELD. 3 a-3

*ITS VERY IMPORTANT TO ENTER THE DATE THAT THE GOODS WERE ACTUALLY RECEIVED. IF A RECEIVED DATE IS FROM A PRIOR MONTH THAN CURRENTLY PROCESSING, YOU WILL NEED TO ENTER THE CURRENT ACCOUNTING PERIOD (ACCT PRD: ) FIELD. 3 a-3

n Invoice is received ¨ Payment person verifies goods were received by reviewing RC/RT or AR entry in FMS ¨ Once validated, a PV 01 transaction entry into FMS is accomplished ¨ If this is the final payment ensure an “F” is annotated in the field P/F n This automatically zeros out any amount left on the obligation 3 a-4

n Invoice is received ¨ Payment person verifies goods were received by reviewing RC/RT or AR entry in FMS ¨ Once validated, a PV 01 transaction entry into FMS is accomplished ¨ If this is the final payment ensure an “F” is annotated in the field P/F n This automatically zeros out any amount left on the obligation 3 a-4

n Invoice is received ¨ Payment person verifies goods were received by reviewing RC/RT or AR entry in FMS ¨ Payment person enters a PV 01 transaction into FMS A “F” was not annotated in the field P/F and it was the final payment n To clear the obligation a zero PV 01 payment transaction into FMS is required with an “F” in the P/F field. n 3 a-5

n Invoice is received ¨ Payment person verifies goods were received by reviewing RC/RT or AR entry in FMS ¨ Payment person enters a PV 01 transaction into FMS A “F” was not annotated in the field P/F and it was the final payment n To clear the obligation a zero PV 01 payment transaction into FMS is required with an “F” in the P/F field. n 3 a-5

Example of the “F” not being entered ACTION: R TABLEID: RCLA USERID: S 104 RMJ *** RECEIVER ACCOUNTING LINE INQUIRY SCREEN *** KEY IS TRANSACTION CODE, RECEIVER NUMBER, ACCOUNTING LINE NUMBER TRANSACTION CODE: RC RECEIVER NO: 523 A 0999901 01 - LINE NO: 001 REF LINE NO: 001 TRANS TYPE: 01 BFYS: 10 FUND: 0160 A 1 STATION/SAT: 523 / COST CTR/SUB: 827200 / FCP/PRJ: 010022300 BOC/SUB: 2580 / JOB NO: RPTG CATG: ACCRUAL AMT: 500. 00 CLSD BFYS: CLSD FUND: VOUCHER AMT: 500. 00 DESCR: LIQ AMT: 499. 00 OUTST AMT: 1. 00 CLOSED AMT: 499. 00 02 - LINE NO: REF LINE NO: TRANS TYPE: COMMND: DOCID: PV 10 523 A 0999902 STATUS: ACCPT 001 -001 OF 001 BATID: SUB STN: 08/03/07 3 a-6

Example of the “F” not being entered ACTION: R TABLEID: RCLA USERID: S 104 RMJ *** RECEIVER ACCOUNTING LINE INQUIRY SCREEN *** KEY IS TRANSACTION CODE, RECEIVER NUMBER, ACCOUNTING LINE NUMBER TRANSACTION CODE: RC RECEIVER NO: 523 A 0999901 01 - LINE NO: 001 REF LINE NO: 001 TRANS TYPE: 01 BFYS: 10 FUND: 0160 A 1 STATION/SAT: 523 / COST CTR/SUB: 827200 / FCP/PRJ: 010022300 BOC/SUB: 2580 / JOB NO: RPTG CATG: ACCRUAL AMT: 500. 00 CLSD BFYS: CLSD FUND: VOUCHER AMT: 500. 00 DESCR: LIQ AMT: 499. 00 OUTST AMT: 1. 00 CLOSED AMT: 499. 00 02 - LINE NO: REF LINE NO: TRANS TYPE: COMMND: DOCID: PV 10 523 A 0999902 STATUS: ACCPT 001 -001 OF 001 BATID: SUB STN: 08/03/07 3 a-6

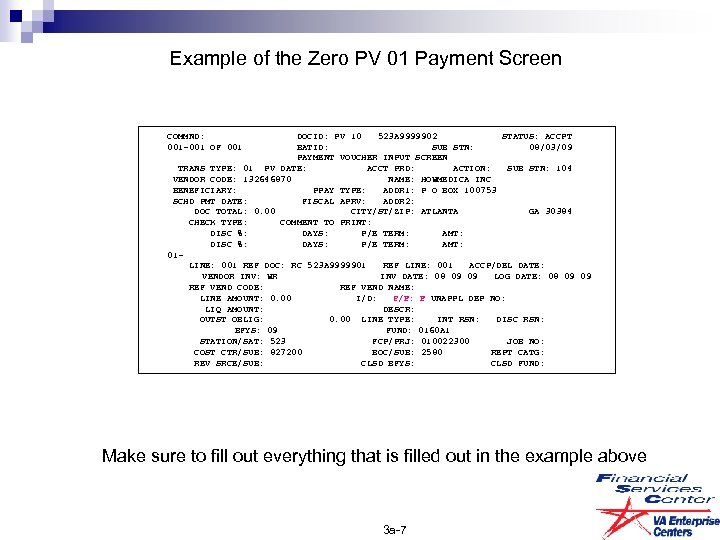

Example of the Zero PV 01 Payment Screen COMMND: DOCID: PV 10 523 A 9999902 STATUS: ACCPT 001 -001 OF 001 BATID: SUB STN: 08/03/09 PAYMENT VOUCHER INPUT SCREEN TRANS TYPE: 01 PV DATE: ACCT PRD: ACTION: SUB STN: 104 VENDOR CODE: 132646870 NAME: HOWMEDICA INC BENEFICIARY: PPAY TYPE: ADDR 1: P O BOX 100753 SCHD PMT DATE: FISCAL APRV: ADDR 2: DOC TOTAL: 0. 00 CITY/ST/ZIP: ATLANTA GA 30384 CHECK TYPE: COMMENT TO PRINT: DISC %: DAYS: P/E TERM: AMT: 01 - LINE: 001 REF DOC: RC 523 A 9999901 REF LINE: 001 ACCP/DEL DATE: VENDOR INV: WR INV DATE: 08 09 09 LOG DATE: 08 09 09 REF VEND CODE: REF VEND NAME: LINE AMOUNT: 0. 00 I/D: P/F: F UNAPPL DEP NO: LIQ AMOUNT: DESCR: OUTST OBLIG: 0. 00 LINE TYPE: INT RSN: DISC RSN: BFYS: 09 FUND: 0160 A 1 STATION/SAT: 523 FCP/PRJ: 010022300 JOB NO: COST CTR/SUB: 827200 BOC/SUB: 2580 REPT CATG: REV SRCE/SUB: CLSD BFYS: CLSD FUND: Make sure to fill out everything that is filled out in the example above 3 a-7

Example of the Zero PV 01 Payment Screen COMMND: DOCID: PV 10 523 A 9999902 STATUS: ACCPT 001 -001 OF 001 BATID: SUB STN: 08/03/09 PAYMENT VOUCHER INPUT SCREEN TRANS TYPE: 01 PV DATE: ACCT PRD: ACTION: SUB STN: 104 VENDOR CODE: 132646870 NAME: HOWMEDICA INC BENEFICIARY: PPAY TYPE: ADDR 1: P O BOX 100753 SCHD PMT DATE: FISCAL APRV: ADDR 2: DOC TOTAL: 0. 00 CITY/ST/ZIP: ATLANTA GA 30384 CHECK TYPE: COMMENT TO PRINT: DISC %: DAYS: P/E TERM: AMT: 01 - LINE: 001 REF DOC: RC 523 A 9999901 REF LINE: 001 ACCP/DEL DATE: VENDOR INV: WR INV DATE: 08 09 09 LOG DATE: 08 09 09 REF VEND CODE: REF VEND NAME: LINE AMOUNT: 0. 00 I/D: P/F: F UNAPPL DEP NO: LIQ AMOUNT: DESCR: OUTST OBLIG: 0. 00 LINE TYPE: INT RSN: DISC RSN: BFYS: 09 FUND: 0160 A 1 STATION/SAT: 523 FCP/PRJ: 010022300 JOB NO: COST CTR/SUB: 827200 BOC/SUB: 2580 REPT CATG: REV SRCE/SUB: CLSD BFYS: CLSD FUND: Make sure to fill out everything that is filled out in the example above 3 a-7

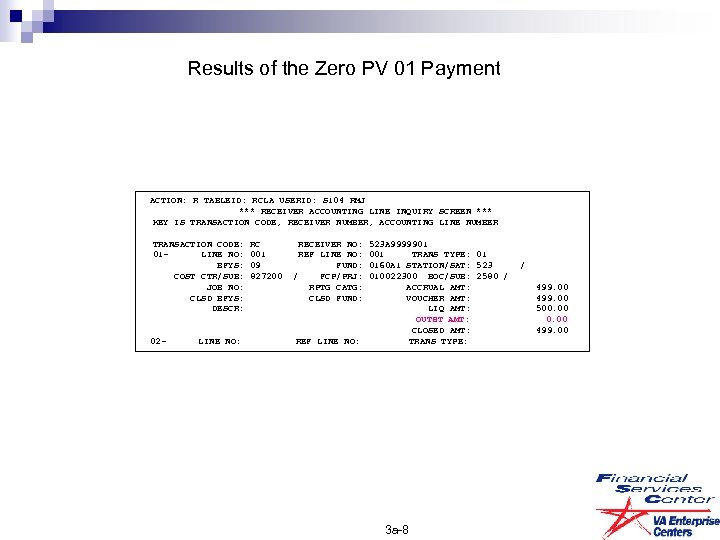

Results of the Zero PV 01 Payment ACTION: R TABLEID: RCLA USERID: S 104 RMJ *** RECEIVER ACCOUNTING LINE INQUIRY SCREEN *** KEY IS TRANSACTION CODE, RECEIVER NUMBER, ACCOUNTING LINE NUMBER TRANSACTION CODE: RC RECEIVER NO: 523 A 9999901 01 - LINE NO: 001 REF LINE NO: 001 TRANS TYPE: 01 BFYS: 09 FUND: 0160 A 1 STATION/SAT: 523 / COST CTR/SUB: 827200 / FCP/PRJ: 010022300 BOC/SUB: 2580 / JOB NO: RPTG CATG: ACCRUAL AMT: 499. 00 CLSD BFYS: CLSD FUND: VOUCHER AMT: 499. 00 DESCR: LIQ AMT: 500. 00 OUTST AMT: 0. 00 CLOSED AMT: 499. 00 02 - LINE NO: REF LINE NO: TRANS TYPE: 3 a-8

Results of the Zero PV 01 Payment ACTION: R TABLEID: RCLA USERID: S 104 RMJ *** RECEIVER ACCOUNTING LINE INQUIRY SCREEN *** KEY IS TRANSACTION CODE, RECEIVER NUMBER, ACCOUNTING LINE NUMBER TRANSACTION CODE: RC RECEIVER NO: 523 A 9999901 01 - LINE NO: 001 REF LINE NO: 001 TRANS TYPE: 01 BFYS: 09 FUND: 0160 A 1 STATION/SAT: 523 / COST CTR/SUB: 827200 / FCP/PRJ: 010022300 BOC/SUB: 2580 / JOB NO: RPTG CATG: ACCRUAL AMT: 499. 00 CLSD BFYS: CLSD FUND: VOUCHER AMT: 499. 00 DESCR: LIQ AMT: 500. 00 OUTST AMT: 0. 00 CLOSED AMT: 499. 00 02 - LINE NO: REF LINE NO: TRANS TYPE: 3 a-8

F 851 Report This is a good report to watch for outstanding amounts and how long it has been open RPEVGLV STA 0160 X 4 REPORT ID: RPEVGLV *** DEPT OF VETERANS AFFAIRS (FMS) *** PAGE: 1 RSD FORM: F 851 VERIFICATION OF GENERAL LEDGER BALANCES - PAYABLES TIME: 23: 03 RUN DATE: 07/31/09 FEDERAL/NON-FEDERAL REPORT AS OF 07/31/09 STN: STA BFYS: 94 FUND: 0160 X 4 PAYABLE TYPE: ACCOUNTS PAYABLE Austin VAMC A/O: 10 MEDICAL SVCS - MCCF VEN TYPE CAT: NON-FEDERAL VETERANS HEALTH ADMIN. DOCUMENT ID FCP/PROJ VENDOR CODE NAME DATE DYS OPEN ACCRUAL AMOUNT VOUCHERED AMOUNT OUTSTANDING AMOUNT ---------------------------------- RT STAL 9000102 01 HC 20600 592663954 OFFICE DEPOT IN 11/13/08 260 198. 99 179. 10 19. 89 RT STAL 9001101 01 HC 34300 541458884 CAPITOL BUILDIN 05/31/08 61 2, 228. 59 1, 883. 42 345. 17 RT STAL 9001301 01 HC 34300 541458884 CAPITOL BUILDIN 04/26/08 96 1, 323. 00 1, 290. 70 32. 30 NUMBER OF RECORDS: 3 STN 688 SUBTOTAL: 3, 750. 58 3, 353. 22 397. 36 PAYABLES TOTALS: 3, 750. 58 3, 353. 22 397. 36 3 a-9

F 851 Report This is a good report to watch for outstanding amounts and how long it has been open RPEVGLV STA 0160 X 4 REPORT ID: RPEVGLV *** DEPT OF VETERANS AFFAIRS (FMS) *** PAGE: 1 RSD FORM: F 851 VERIFICATION OF GENERAL LEDGER BALANCES - PAYABLES TIME: 23: 03 RUN DATE: 07/31/09 FEDERAL/NON-FEDERAL REPORT AS OF 07/31/09 STN: STA BFYS: 94 FUND: 0160 X 4 PAYABLE TYPE: ACCOUNTS PAYABLE Austin VAMC A/O: 10 MEDICAL SVCS - MCCF VEN TYPE CAT: NON-FEDERAL VETERANS HEALTH ADMIN. DOCUMENT ID FCP/PROJ VENDOR CODE NAME DATE DYS OPEN ACCRUAL AMOUNT VOUCHERED AMOUNT OUTSTANDING AMOUNT ---------------------------------- RT STAL 9000102 01 HC 20600 592663954 OFFICE DEPOT IN 11/13/08 260 198. 99 179. 10 19. 89 RT STAL 9001101 01 HC 34300 541458884 CAPITOL BUILDIN 05/31/08 61 2, 228. 59 1, 883. 42 345. 17 RT STAL 9001301 01 HC 34300 541458884 CAPITOL BUILDIN 04/26/08 96 1, 323. 00 1, 290. 70 32. 30 NUMBER OF RECORDS: 3 STN 688 SUBTOTAL: 3, 750. 58 3, 353. 22 397. 36 PAYABLES TOTALS: 3, 750. 58 3, 353. 22 397. 36 3 a-9

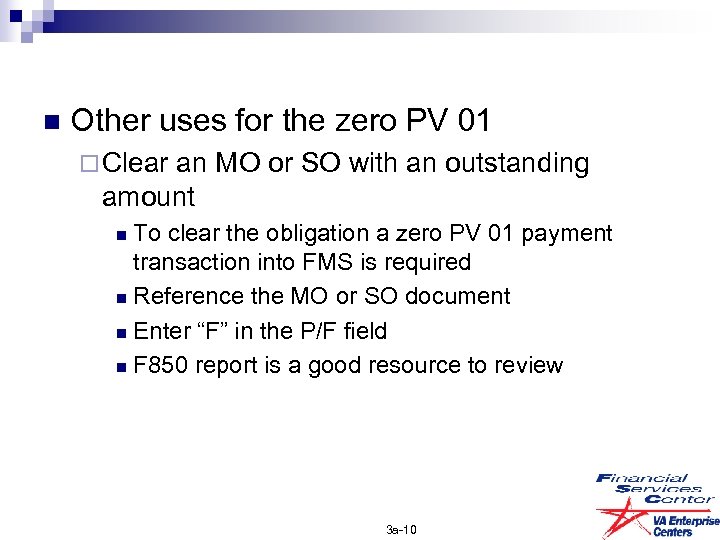

n Other uses for the zero PV 01 ¨ Clear an MO or SO with an outstanding amount To clear the obligation a zero PV 01 payment transaction into FMS is required n Reference the MO or SO document n Enter “F” in the P/F field n F 850 report is a good resource to review n 3 a-10

n Other uses for the zero PV 01 ¨ Clear an MO or SO with an outstanding amount To clear the obligation a zero PV 01 payment transaction into FMS is required n Reference the MO or SO document n Enter “F” in the P/F field n F 850 report is a good resource to review n 3 a-10

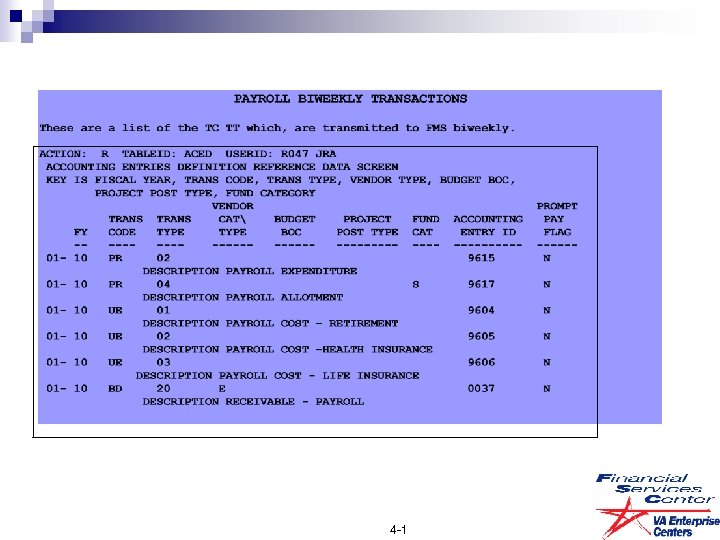

Payroll Transactions/Expenditures

Payroll Transactions/Expenditures

4 -1

4 -1

4 -2

4 -2

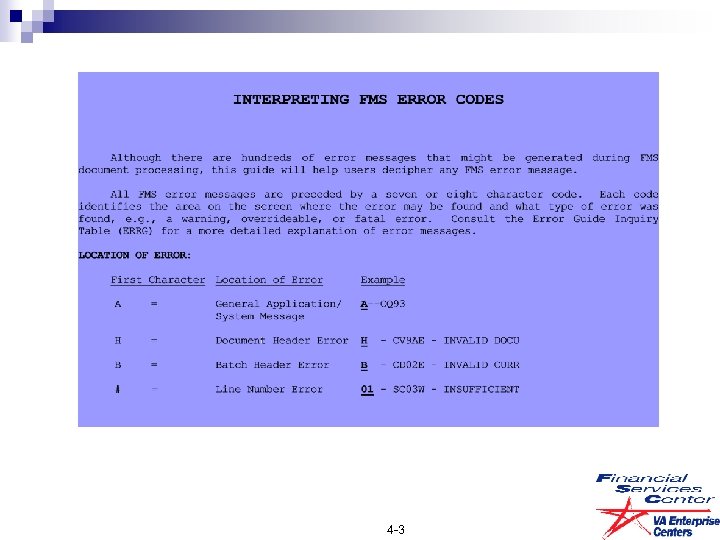

4 -3

4 -3

4 -4

4 -4

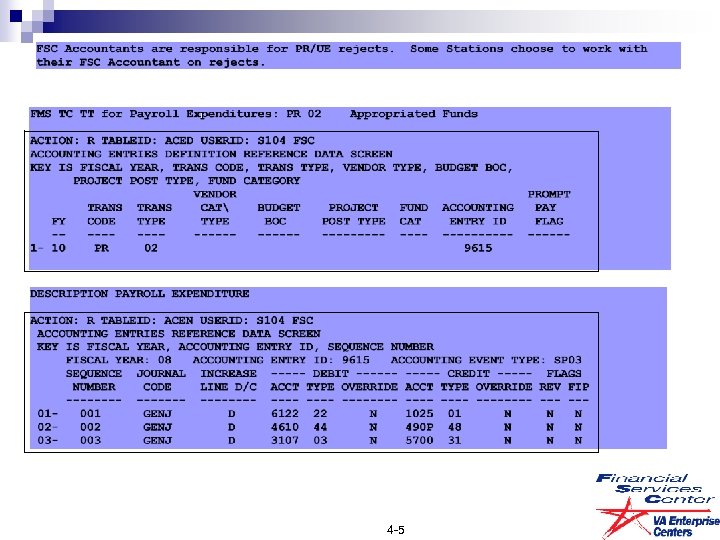

4 -5

4 -5

4 -6

4 -6

FMS ERROR TABLE ERRG ACTION: R TABLEID: ERRG USERID: S 104 RMJ *** ERROR GUIDE INQUIRY TABLE *** KEY IS ERROR CODE ERROR CODE: SC 08 E ERROR MESSAGE: SUBALLOW SPEND CTL NOT FOUND PROBLEM: NO ENTRY IN THE SUBALLOWANCE SPENDING CONTROL TABLE (SASP) WAS FOUND. SOLUTION: SPECIFY A DIFFERENT SUBALLOWANCE CODE OR HAVE THE GIVEN SUBALLOWANCE ESTABLISHED. 4 -7

FMS ERROR TABLE ERRG ACTION: R TABLEID: ERRG USERID: S 104 RMJ *** ERROR GUIDE INQUIRY TABLE *** KEY IS ERROR CODE ERROR CODE: SC 08 E ERROR MESSAGE: SUBALLOW SPEND CTL NOT FOUND PROBLEM: NO ENTRY IN THE SUBALLOWANCE SPENDING CONTROL TABLE (SASP) WAS FOUND. SOLUTION: SPECIFY A DIFFERENT SUBALLOWANCE CODE OR HAVE THE GIVEN SUBALLOWANCE ESTABLISHED. 4 -7

4 -8

4 -8

4 -9

4 -9

FMS TABLE ERRG ACTION: R TABLEID: ERRG USERID: S 104 FSC *** ERROR GUIDE INQUIRY TABLE *** KEY IS ERROR CODE ERROR CODE: SC 06 W ERROR MESSAGE: INSUFFICIENT ALLOWANCE FUNDS PROBLEM: THIS IS A WARNING MESSAGE. THE TRANSACTION EXCEEDS THE AVAILABLE ALLOWANCE FUNDS. SOLUTION: REVIEW THE ALLOWANCE AND CONTROL OPTIONS. 4 -10

FMS TABLE ERRG ACTION: R TABLEID: ERRG USERID: S 104 FSC *** ERROR GUIDE INQUIRY TABLE *** KEY IS ERROR CODE ERROR CODE: SC 06 W ERROR MESSAGE: INSUFFICIENT ALLOWANCE FUNDS PROBLEM: THIS IS A WARNING MESSAGE. THE TRANSACTION EXCEEDS THE AVAILABLE ALLOWANCE FUNDS. SOLUTION: REVIEW THE ALLOWANCE AND CONTROL OPTIONS. 4 -10

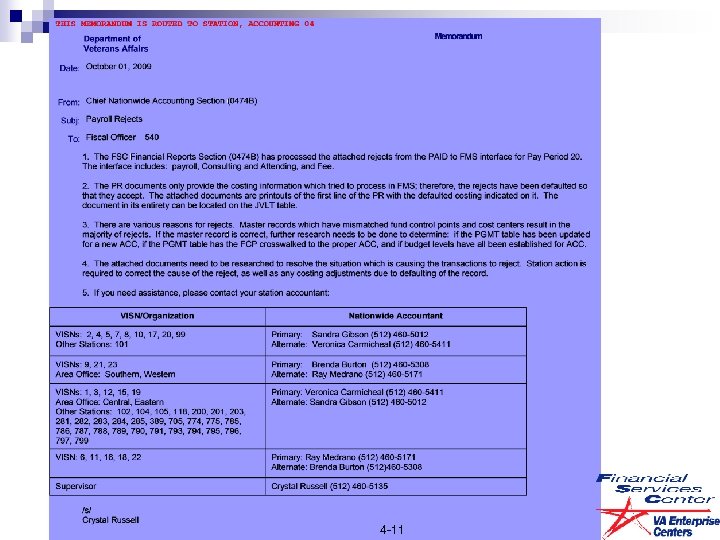

4 -11

4 -11

4 -12

4 -12

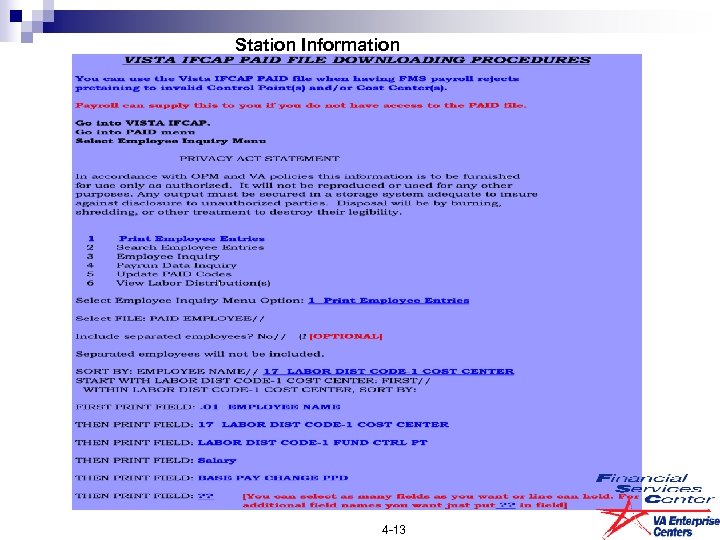

Station Information 4 -13

Station Information 4 -13

4 -14

4 -14

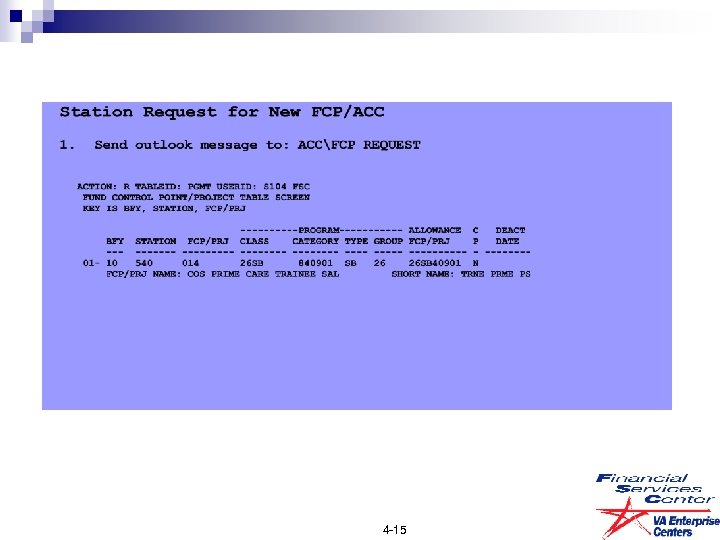

4 -15

4 -15

4 -16

4 -16

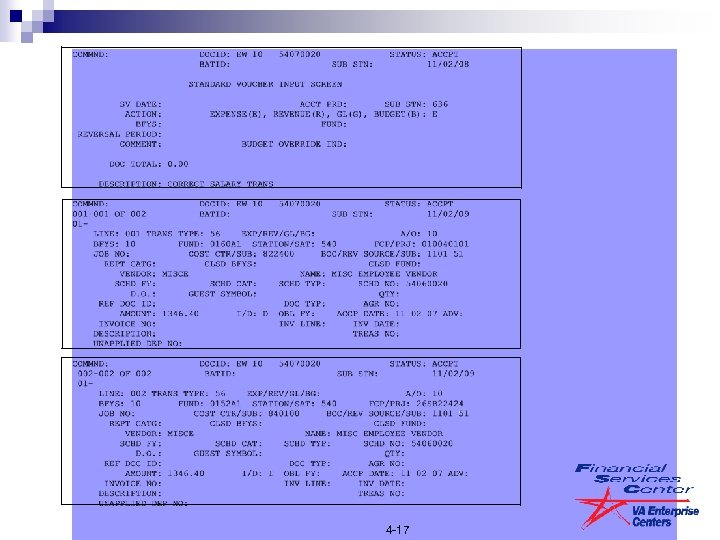

4 -17

4 -17

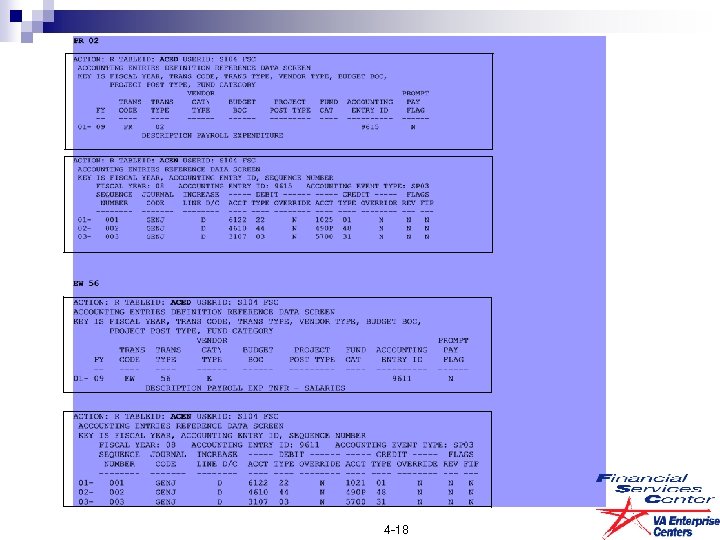

4 -18

4 -18

4 -19

4 -19

4 -20

4 -20

4 -21

4 -21

4 -22

4 -22

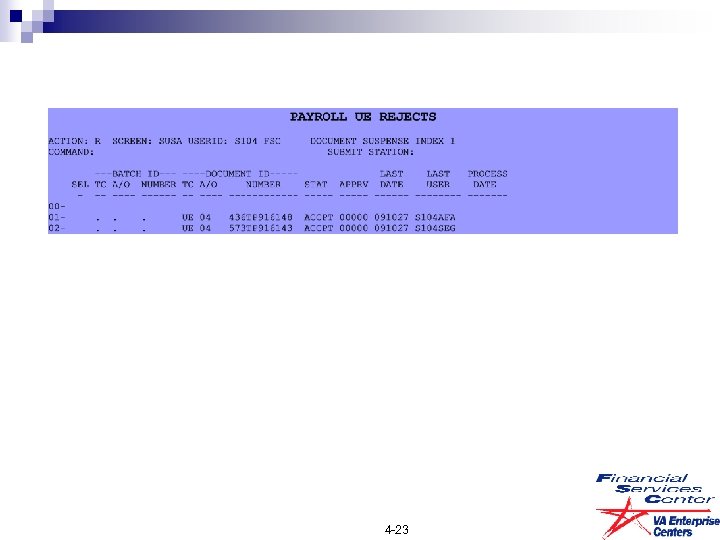

4 -23

4 -23

UNFUNDED EXPENSE (UE) 4 -24

UNFUNDED EXPENSE (UE) 4 -24

4 -25

4 -25

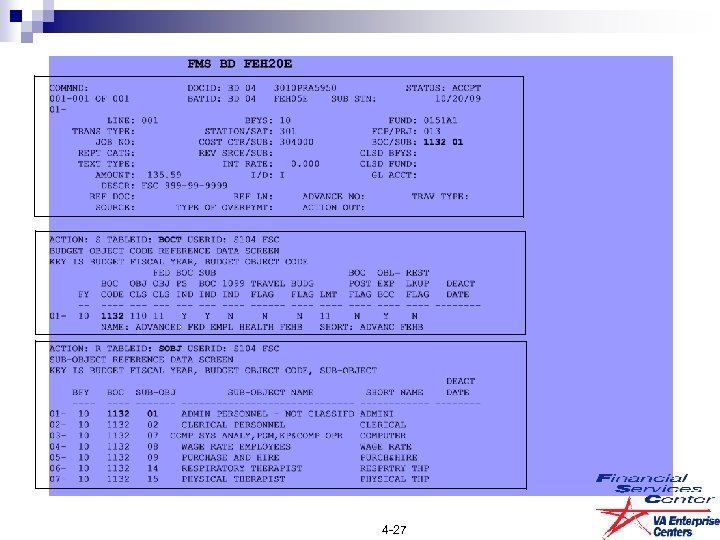

Federal Employee Health Leave Without Pay 4 -26

Federal Employee Health Leave Without Pay 4 -26

4 -27

4 -27

TDY Travel

TDY Travel

5 -1

5 -1

5 -2

5 -2

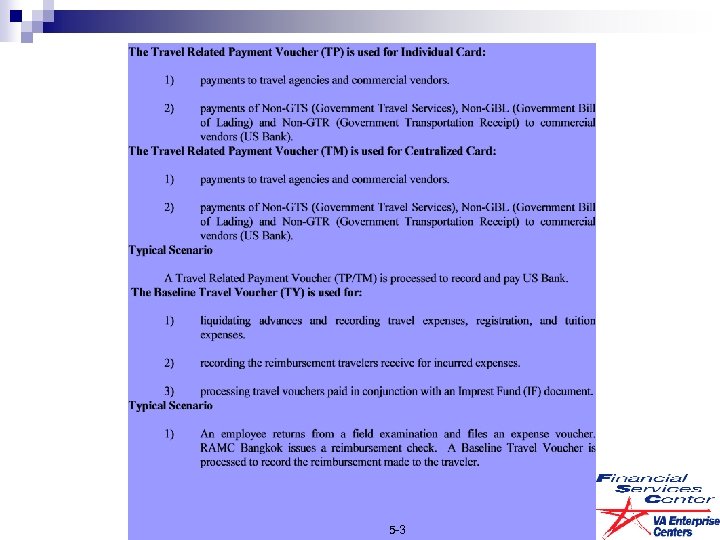

5 -3

5 -3

5 -4

5 -4

5 -5

5 -5

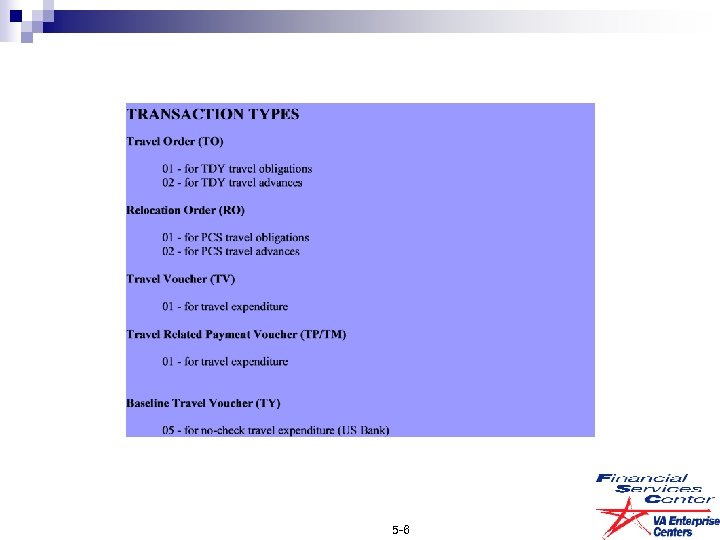

5 -6

5 -6

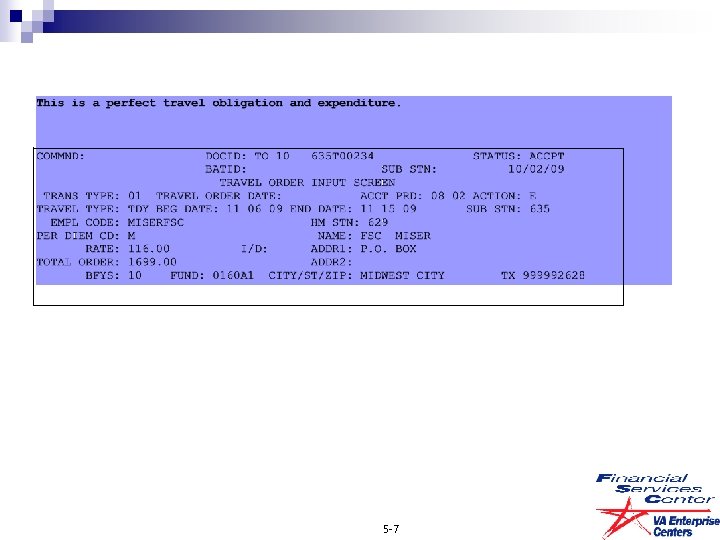

5 -7

5 -7

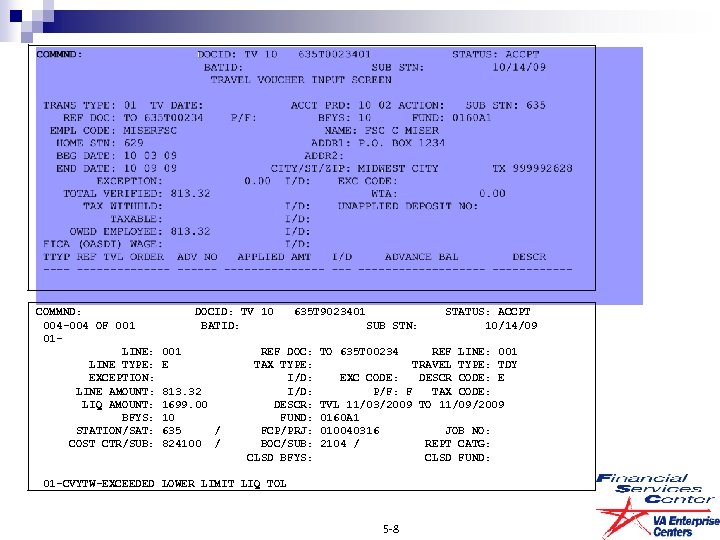

COMMND: DOCID: TV 10 635 T 9023401 STATUS: ACCPT 004 -004 OF 001 BATID: SUB STN: 10/14/09 01 - LINE: 001 REF DOC: TO 635 T 00234 REF LINE: 001 LINE TYPE: E TAX TYPE: TRAVEL TYPE: TDY EXCEPTION: I/D: EXC CODE: DESCR CODE: E LINE AMOUNT: 813. 32 I/D: P/F: F TAX CODE: LIQ AMOUNT: 1699. 00 DESCR: TVL 11/03/2009 TO 11/09/2009 BFYS: 10 FUND: 0160 A 1 STATION/SAT: 635 / FCP/PRJ: 010040316 JOB NO: COST CTR/SUB: 824100 / BOC/SUB: 2104 / REPT CATG: CLSD BFYS: CLSD FUND: 01 -CVYTW-EXCEEDED LOWER LIMIT LIQ TOL 5 -8

COMMND: DOCID: TV 10 635 T 9023401 STATUS: ACCPT 004 -004 OF 001 BATID: SUB STN: 10/14/09 01 - LINE: 001 REF DOC: TO 635 T 00234 REF LINE: 001 LINE TYPE: E TAX TYPE: TRAVEL TYPE: TDY EXCEPTION: I/D: EXC CODE: DESCR CODE: E LINE AMOUNT: 813. 32 I/D: P/F: F TAX CODE: LIQ AMOUNT: 1699. 00 DESCR: TVL 11/03/2009 TO 11/09/2009 BFYS: 10 FUND: 0160 A 1 STATION/SAT: 635 / FCP/PRJ: 010040316 JOB NO: COST CTR/SUB: 824100 / BOC/SUB: 2104 / REPT CATG: CLSD BFYS: CLSD FUND: 01 -CVYTW-EXCEEDED LOWER LIMIT LIQ TOL 5 -8

5 -9

5 -9

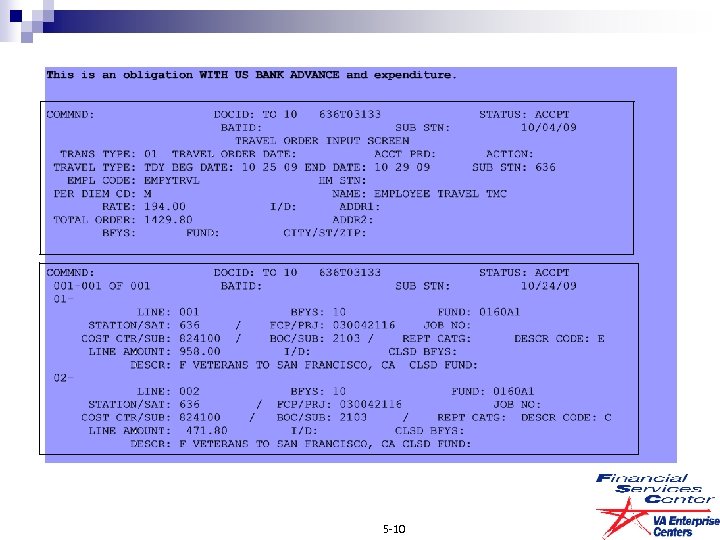

5 -10

5 -10

5 -11

5 -11

5 -12

5 -12

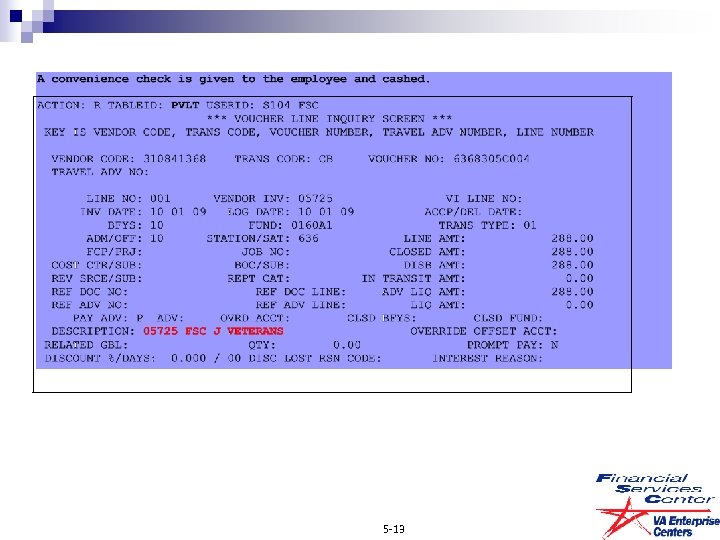

5 -13

5 -13

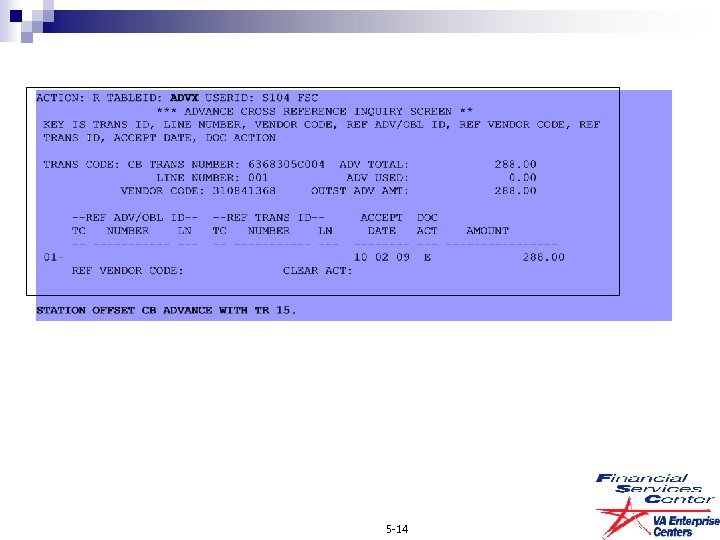

5 -14

5 -14

5 -15

5 -15

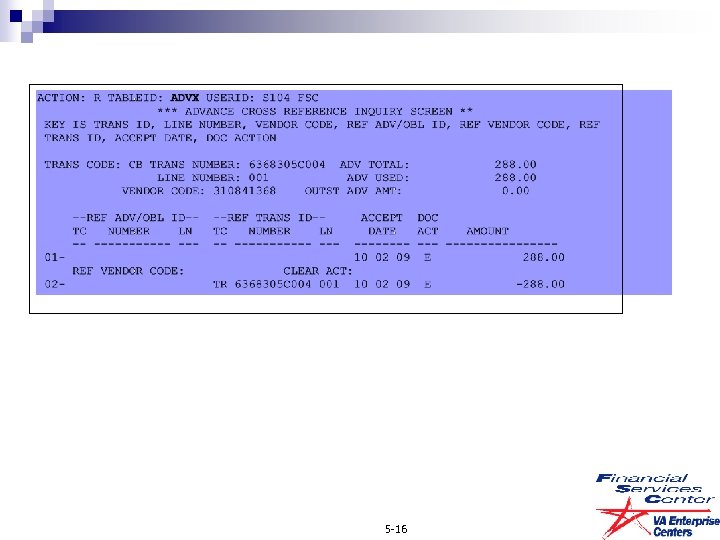

5 -16

5 -16

5 -17

5 -17

5 -18

5 -18

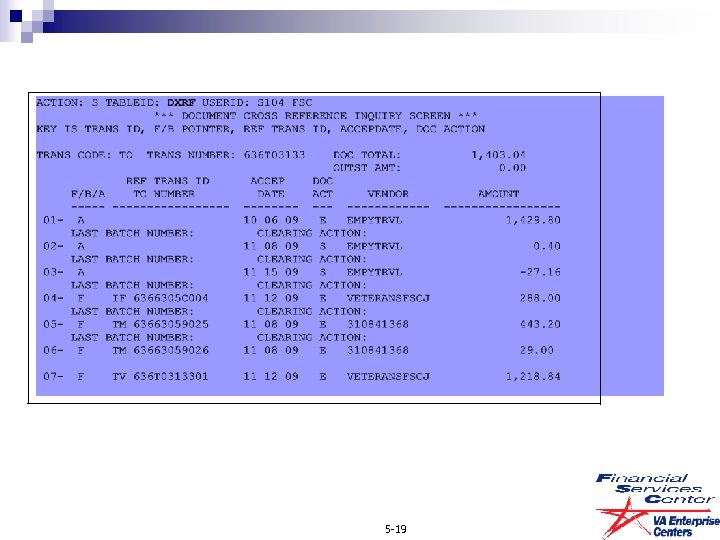

5 -19

5 -19

5 -20

5 -20

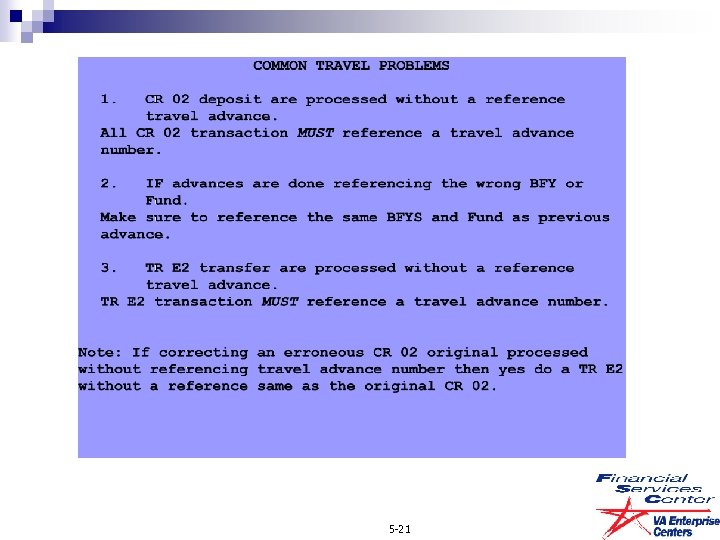

5 -21

5 -21

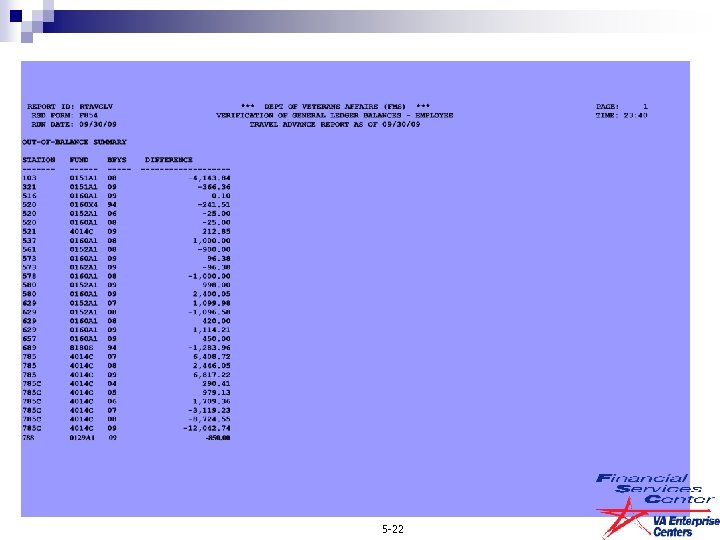

5 -22

5 -22

5 -23

5 -23

5 -24

5 -24

5 -25

5 -25

5 -26

5 -26

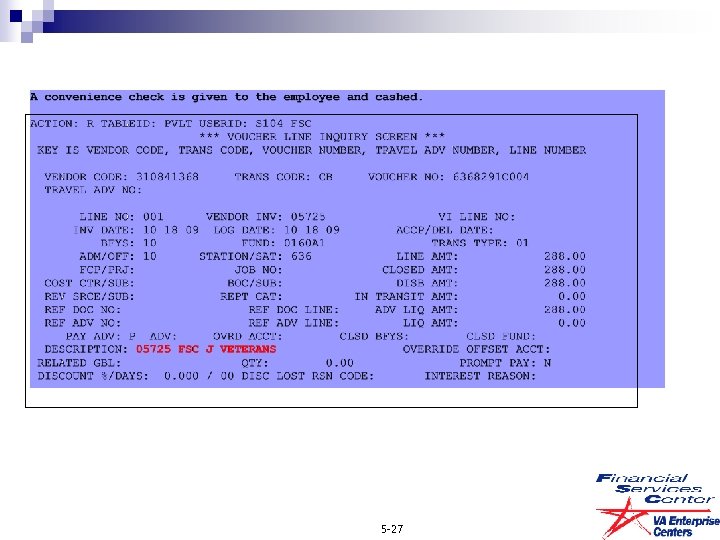

5 -27

5 -27

5 -28

5 -28

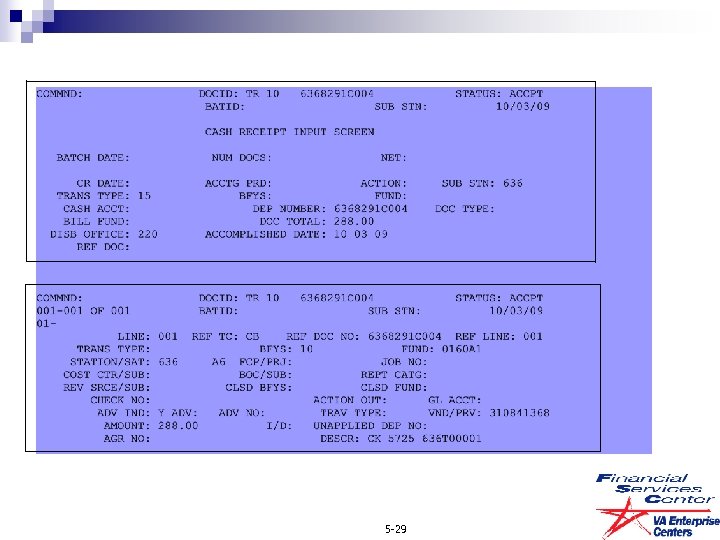

5 -29

5 -29

5 -30

5 -30

5 -31

5 -31

5 -32

5 -32

5 -33

5 -33

5 -34

5 -34

5 -35

5 -35

5 -36

5 -36

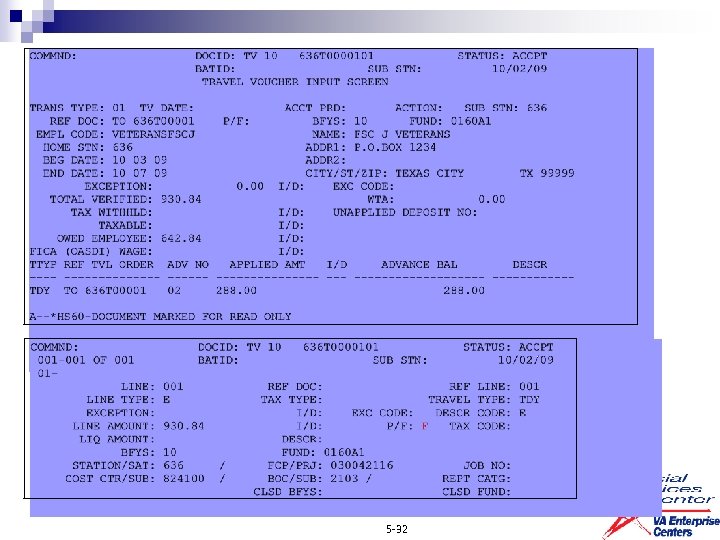

5 -37

5 -37

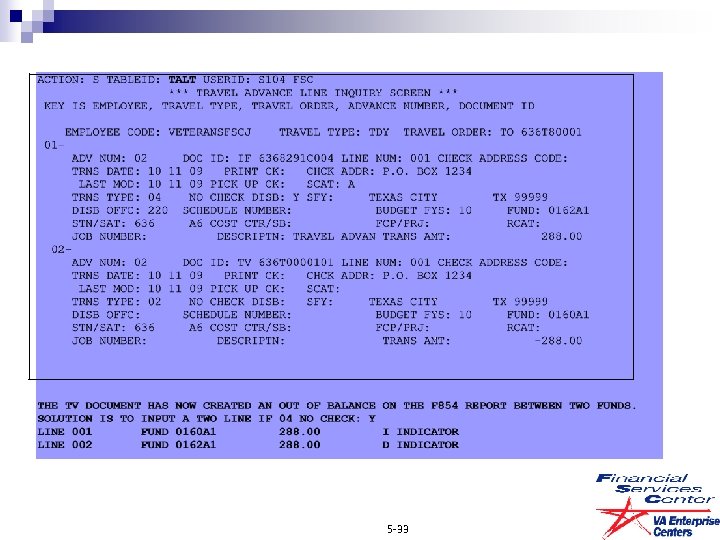

Financial Indicators

Financial Indicators

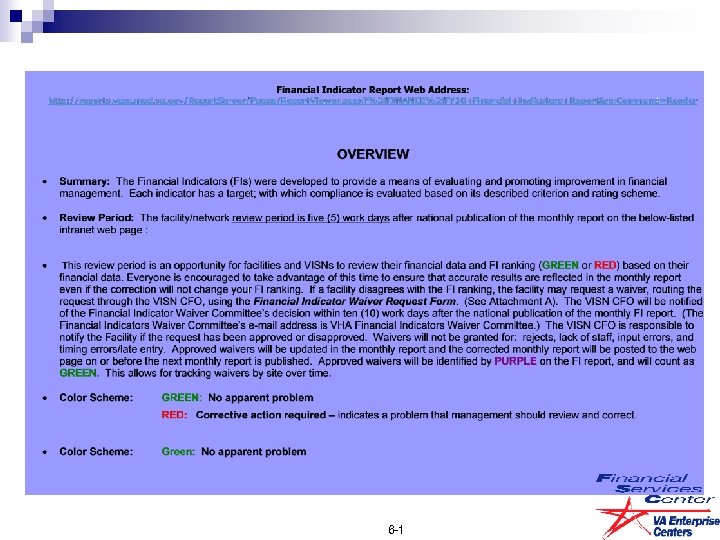

6 -1

6 -1

6 -2

6 -2

6 -3

6 -3

6 -4

6 -4

6 -5

6 -5

6 -6

6 -6

F 911 Report vs Macro

F 911 Report vs Macro

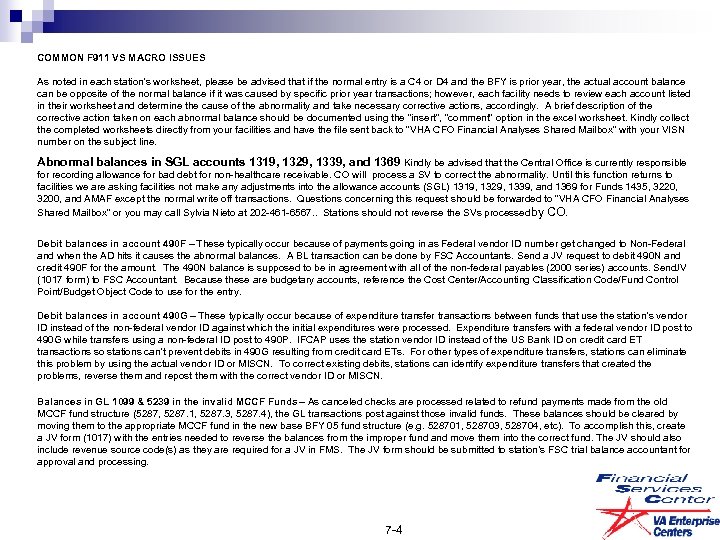

Accessing Ken Hudson Financial Macros through Sharepoint 1. Go to: http: //vaww. vha. vaco. portal. va. gov/sites/OF/CFOFO If you do not have access to this Sharepoint, you will receive an “Error: Access Denied”. Click on the “Request Access” link displayed on the page and follow the instructions. Shortly after, you should receive an email with permission to access the Sharepoint Site. 2. Once on the site: Click on “Shared Documents” on the list to the right. Click on “Monthly Recon Macros for Office 2007” (or 2003 if you are using MS Office Suite 2003) Click on “F 911_V 12. 4_2007” 3. Once the spreadsheet is downloaded you have to enable the Macro Content. Click on “Options” in the Security tab. Click on “Enable Content” then click “OK”. 4. Follow the instructions on the Macro to download your F 911 report from RSD. All requests for new Financial Macros and the management of all existing Financial Macros in the “Shared Documents” should be sent to Ms. Yong Osborne at yong. osborne@va. gov or #512 -326 -6827. 7 -1

Accessing Ken Hudson Financial Macros through Sharepoint 1. Go to: http: //vaww. vha. vaco. portal. va. gov/sites/OF/CFOFO If you do not have access to this Sharepoint, you will receive an “Error: Access Denied”. Click on the “Request Access” link displayed on the page and follow the instructions. Shortly after, you should receive an email with permission to access the Sharepoint Site. 2. Once on the site: Click on “Shared Documents” on the list to the right. Click on “Monthly Recon Macros for Office 2007” (or 2003 if you are using MS Office Suite 2003) Click on “F 911_V 12. 4_2007” 3. Once the spreadsheet is downloaded you have to enable the Macro Content. Click on “Options” in the Security tab. Click on “Enable Content” then click “OK”. 4. Follow the instructions on the Macro to download your F 911 report from RSD. All requests for new Financial Macros and the management of all existing Financial Macros in the “Shared Documents” should be sent to Ms. Yong Osborne at yong. osborne@va. gov or #512 -326 -6827. 7 -1

7 -2

7 -2

7 -3

7 -3