84c7a1b1b7ac2b26f76cd679c6081220.ppt

- Количество слайдов: 20

Financial Sector Reform in Bangladesh: Developments and Achievements November, 2005 Fakhruddin Ahmed

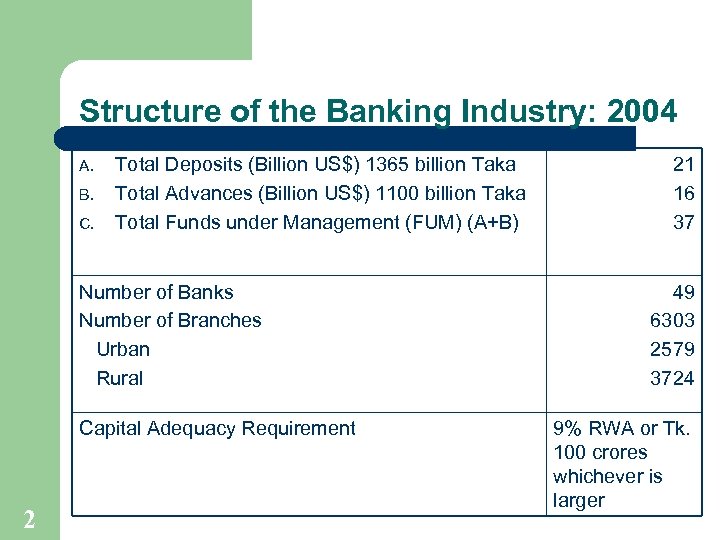

Structure of the Banking Industry: 2004 A. B. C. Total Deposits (Billion US$) 1365 billion Taka Total Advances (Billion US$) 1100 billion Taka Total Funds under Management (FUM) (A+B) Number of Banks Number of Branches Urban Rural Capital Adequacy Requirement 2 21 16 37 49 6303 2579 3724 9% RWA or Tk. 100 crores whichever is larger

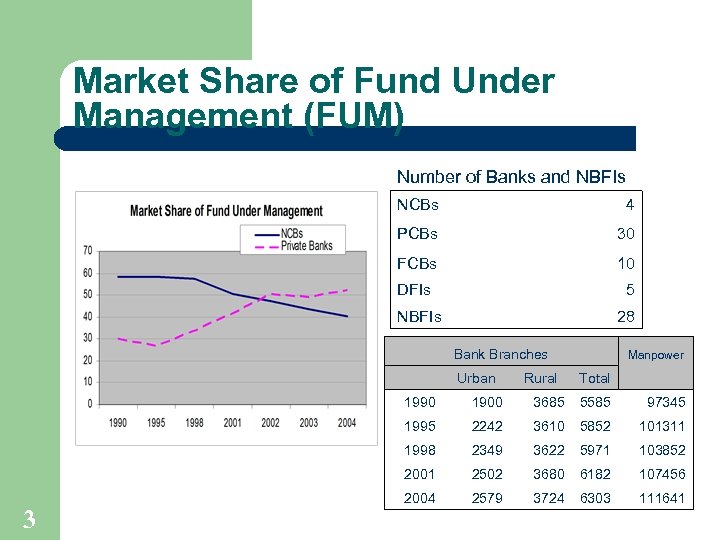

Market Share of Fund Under Management (FUM) Number of Banks and NBFIs NCBs 4 PCBs 30 FCBs 10 DFIs 5 NBFIs 28 Bank Branches Urban Rural Manpower Total 1990 3685 5585 97345 1995 2242 3610 5852 101311 1998 2349 3622 5971 103852 2001 3 1900 2502 3680 6182 107456 2004 2579 3724 6303 111641

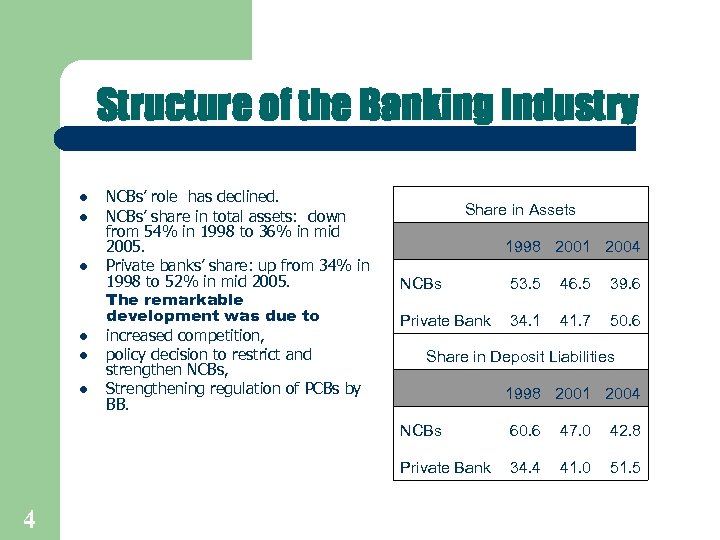

Structure of the Banking Industry l l l NCBs’ role has declined. NCBs’ share in total assets: down from 54% in 1998 to 36% in mid 2005. Private banks’ share: up from 34% in 1998 to 52% in mid 2005. The remarkable development was due to increased competition, policy decision to restrict and strengthen NCBs, Strengthening regulation of PCBs by BB. Share in Assets 1998 2001 2004 NCBs 53. 5 46. 5 39. 6 Private Bank 34. 1 41. 7 50. 6 Share in Deposit Liabilities 4 1998 2001 2004 NCBs 60. 6 47. 0 42. 8 Private Bank 34. 4 41. 0 51. 5

Performance l Capital requirement of banks raised, l Asset quality of the banking system improved, l 5 Healthy Return on assets/equity.

Capital Adequacy of the Banks Measures Taken (2002 -2003) l l Minimum capital requirement on risk-weighted basis was raised from 8% to 9%; Minimum capital requirement raised from Tk. 40 crores to Tk. 100 crores ($17 million). Outcome l l 6 Increased floating of banks’ share in capital market to source capital; Healthy increase in share prices of banks; Banks’ share in total market capitalization rose from 10% in June 1998 (PCBs capital adequacy ratio was 9. 2%) to 47% in December 2004; Private banks’ capital adequacy ratio has increased from 11 % in 1998 to 12. 2% in 2004.

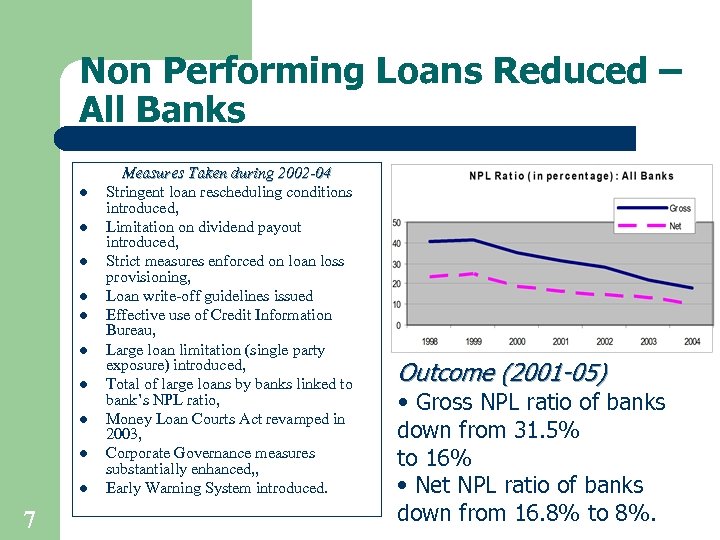

Non Performing Loans Reduced – All Banks l l l l l 7 Measures Taken during 2002 -04 Stringent loan rescheduling conditions introduced, Limitation on dividend payout introduced, Strict measures enforced on loan loss provisioning, Loan write-off guidelines issued Effective use of Credit Information Bureau, Large loan limitation (single party exposure) introduced, Total of large loans by banks linked to bank’s NPL ratio, Money Loan Courts Act revamped in 2003, Corporate Governance measures substantially enhanced, , Early Warning System introduced. Outcome (2001 -05) • Gross NPL ratio of banks down from 31. 5% to 16% • Net NPL ratio of banks down from 16. 8% to 8%.

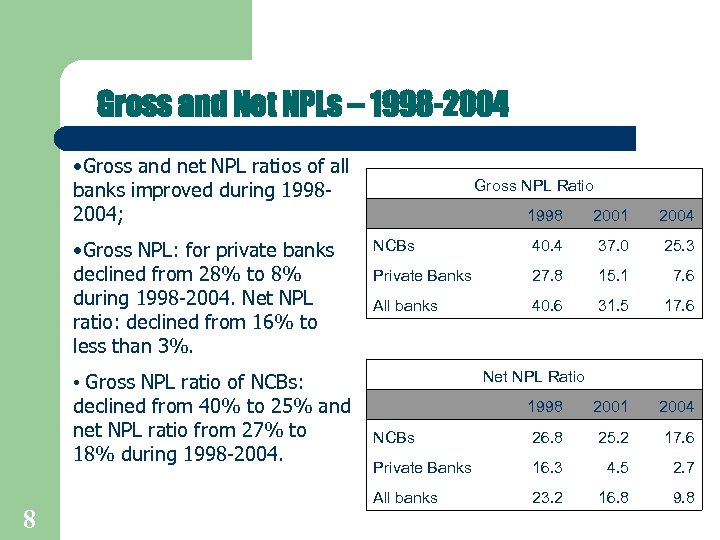

Gross and Net NPLs – 1998 -2004 • Gross and net NPL ratios of all banks improved during 19982004; • Gross NPL: for private banks declined from 28% to 8% during 1998 -2004. Net NPL ratio: declined from 16% to less than 3%. • Gross NPL ratio of NCBs: declined from 40% to 25% and net NPL ratio from 27% to 18% during 1998 -2004. 8 Gross NPL Ratio 1998 2001 2004 NCBs 40. 4 37. 0 25. 3 Private Banks 27. 8 15. 1 7. 6 All banks 40. 6 31. 5 17. 6 Net NPL Ratio 1998 2001 2004 NCBs 26. 8 25. 2 17. 6 Private Banks 16. 3 4. 5 2. 7 All banks 23. 2 16. 8 9. 8

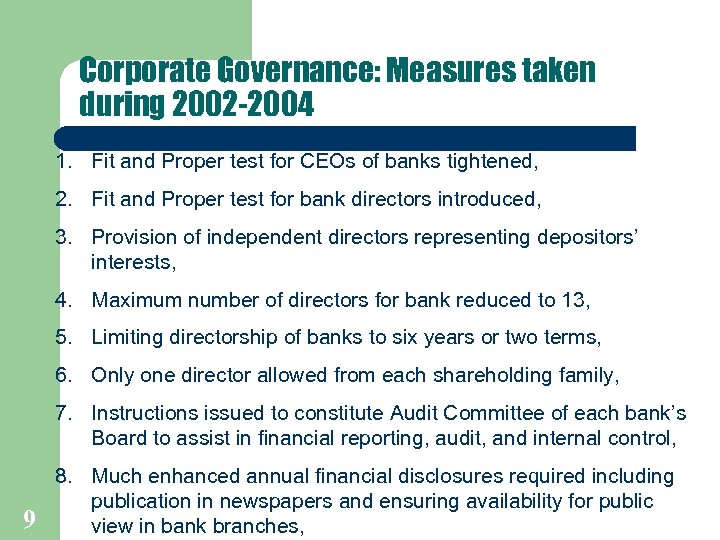

Corporate Governance: Measures taken during 2002 -2004 1. Fit and Proper test for CEOs of banks tightened, 2. Fit and Proper test for bank directors introduced, 3. Provision of independent directors representing depositors’ interests, 4. Maximum number of directors for bank reduced to 13, 5. Limiting directorship of banks to six years or two terms, 6. Only one director allowed from each shareholding family, 7. Instructions issued to constitute Audit Committee of each bank’s Board to assist in financial reporting, audit, and internal control, 9 8. Much enhanced annual financial disclosures required including publication in newspapers and ensuring availability for public view in bank branches,

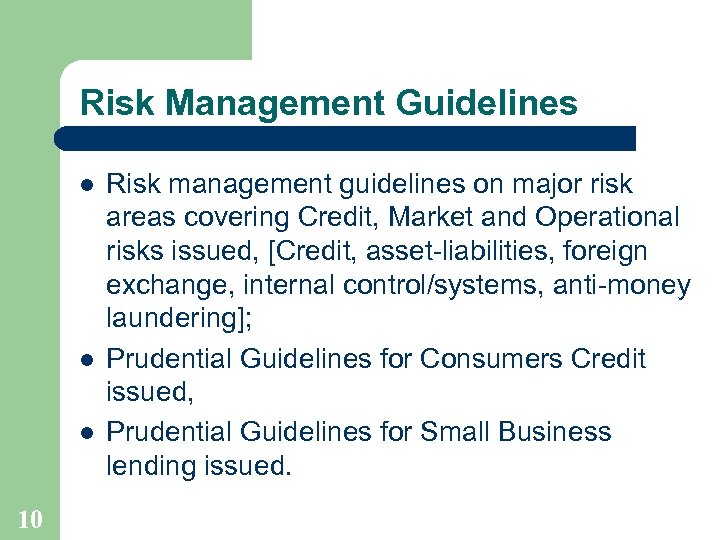

Risk Management Guidelines l l l 10 Risk management guidelines on major risk areas covering Credit, Market and Operational risks issued, [Credit, asset-liabilities, foreign exchange, internal control/systems, anti-money laundering]; Prudential Guidelines for Consumers Credit issued, Prudential Guidelines for Small Business lending issued.

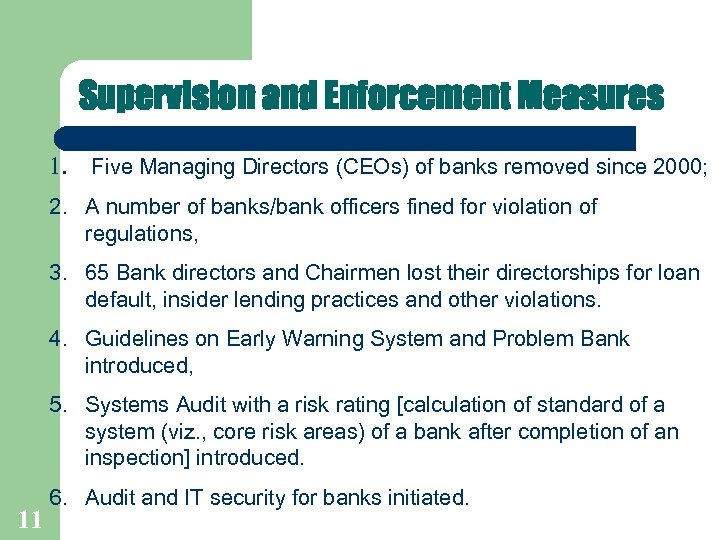

Supervision and Enforcement Measures 1. Five Managing Directors (CEOs) of banks removed since 2000; 2. A number of banks/bank officers fined for violation of regulations, 3. 65 Bank directors and Chairmen lost their directorships for loan default, insider lending practices and other violations. 4. Guidelines on Early Warning System and Problem Bank introduced, 5. Systems Audit with a risk rating [calculation of standard of a system (viz. , core risk areas) of a bank after completion of an inspection] introduced. 11 6. Audit and IT security for banks initiated.

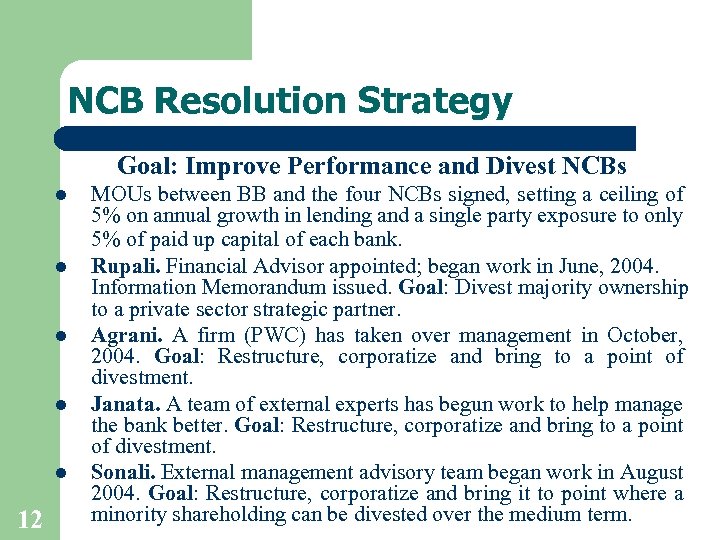

NCB Resolution Strategy Goal: Improve Performance and Divest NCBs l l l 12 MOUs between BB and the four NCBs signed, setting a ceiling of 5% on annual growth in lending and a single party exposure to only 5% of paid up capital of each bank. Rupali. Financial Advisor appointed; began work in June, 2004. Information Memorandum issued. Goal: Divest majority ownership to a private sector strategic partner. Agrani. A firm (PWC) has taken over management in October, 2004. Goal: Restructure, corporatize and bring to a point of divestment. Janata. A team of external experts has begun work to help manage the bank better. Goal: Restructure, corporatize and bring to a point of divestment. Sonali. External management advisory team began work in August 2004. Goal: Restructure, corporatize and bring it to point where a minority shareholding can be divested over the medium term.

Fiscal Policy Provided Cornerstone of Macroeconomic Stability l l 13 Financial sector reforms & achievements during the last 3 years occurred in a stable macroeconomic environment; Macroeconomic stability and improvement in monetary policy framework made possible by prudent fiscal policy; During the 3 -year period, FY 02 -FY 04, government brought down fiscal deficit from over 5 percent of GDP in the previous years to below 4 percent of GDP by raising revenue and streamlining expenditure; More importantly, increasingly higher share of deficit has been financed from concessional aid leading to a marked decline in domestic financing, allowing private sector credit growth at a healthy rate and reduction in interest rate.

Monetary Policy Operation – Made More Effective l l 14 Daily and weekly Liquidity Forecasting Framework Developed [since 2002]; BB introduced repo [2002] and reverse repo [2003] facility for more effective monetary policy operation – i. e. , managing liquidity on a daily basis; Long-term Treasury Bonds for 5 year and 10 year introduced in 2003 for effective benchmarking of longterm loans; Electronic registry of bonds (scrip less) introduced in 2003.

Interest Rate Development FACTS • • Recent Measures • Macro stability achieved; strict limit on govt. borrowing from bank; • BB introduced repo and reverse repo for Nominal lending rates remained at more effective monetary operation; high levels until recently. • SLR reduced from 20% to 16%; Ø In 2001 inflation rate was 1. 9% • BB publishing rates to promote and average lending rate transparency and competition. 14. 4%. Interest rate was deregulated in early 1990 s OUTCOME • Yield on T-bills reduced • In Dec. 04 weighted average lending rate of commercial banks declined by about 2 percentage points from the level of FY 03; • Credit to private sector grew at a healthy double digit rate; 15 But interest rate edged upward in recent months and credit growth slowed down.

Financial Market Development Lending to Specialized Sectors l Small Enterprise Fund, a refinance window for SME (at 5% interest rate) created in May, 2004: BB resources (about $17 million); World Bank ($10 million); and ADB ($30 million). $20 million disbursed May 04 – Feb 05. l Equity Entrepreneurship Fund, financed by Govt. & operated by BB. Disbursement growing fast. About $7 million in FY 03 and about $9 million in FY 04 and $30 million in FY 05 up to March 2005. 16

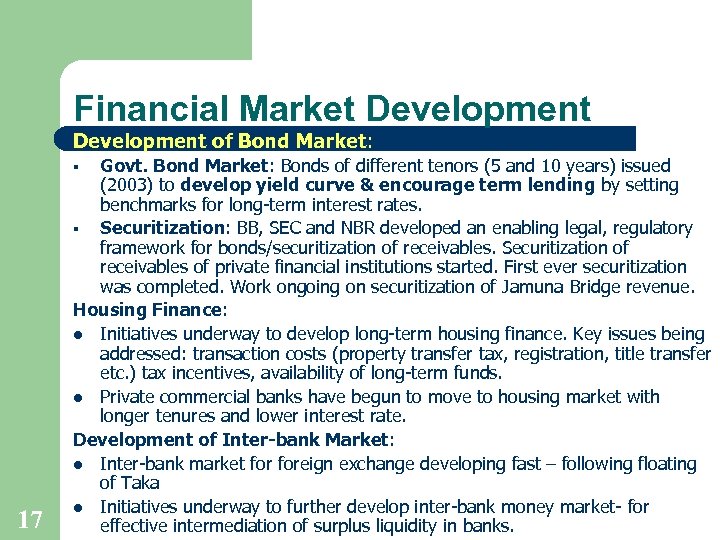

Financial Market Development of Bond Market: Govt. Bond Market: Bonds of different tenors (5 and 10 years) issued (2003) to develop yield curve & encourage term lending by setting benchmarks for long-term interest rates. § Securitization: BB, SEC and NBR developed an enabling legal, regulatory framework for bonds/securitization of receivables. Securitization of receivables of private financial institutions started. First ever securitization was completed. Work ongoing on securitization of Jamuna Bridge revenue. Housing Finance: l Initiatives underway to develop long-term housing finance. Key issues being addressed: transaction costs (property transfer tax, registration, title transfer etc. ) tax incentives, availability of long-term funds. l Private commercial banks have begun to move to housing market with longer tenures and lower interest rate. Development of Inter-bank Market: l Inter-bank market foreign exchange developing fast – following floating of Taka l Initiatives underway to further develop inter-bank money market- for effective intermediation of surplus liquidity in banks. § 17

Strengthening of the BB Components of Bangladesh Bank Strengthening Program: 1. computerization of operations of BB, 2. human resource development through reforms of recruitment, promotion and compensation policies, 3. Direct recruitment taking place every year for the past three years, 4. Promotion policy being radically changed to emphasize merit, 5. restructuring the different departments, 6. reengineering the business processes, 7. capacity building in the core activities 8. With enhanced capacity has come better enforcement of laws and regulations, 9. Within Research Department, Policy and Analysis Group set up through open advertisement. Agreement with World Bank Institute signed. 18 The goal is to transform the decades-old traditional and manual system to a modern, automated system.

Challenges Ahead l l l l 19 Broadening access to Middle and Lower Income Groups: By broadening their client base to cover the “missing middle” with new products, banks can diversify their risks and earn higher profits, Implementation of NCB Resolution Strategy, Introduction of information technology in banking system in an aggressive manner. This should be a major vehicle to provide better services at lower costs. Corporate Governance has to improve further. It should be a continuous process, Financial soundness indicators show an upward trend, but there are weaknesses and vulnerabilities that will need continued watching, Infrastructure Financing: The investment requirement for infrastructure development is large. While these investment needs continue to be financed through public investment, there is a need to develop ways to bring in larger private sector financing through the banking system and capital markets. Bank mergers should be encouraged. Bangladesh Bank strengthening has to continue.

Thanks Thank You 20

84c7a1b1b7ac2b26f76cd679c6081220.ppt