Lection Derivatives.pptx

- Количество слайдов: 35

Financial risks in FT: hedging vs. insurance

Financial risks in FT: hedging vs. insurance

Exchange rate exposure You make forward purchases of foreign currencies and wish to protect yourself against unfavourable trends in the foreign currencies that you have to buy. You make forward sales of foreign currencies and wish to protect yourself against unfavourable trends in the foreign currencies that you have to sell.

Exchange rate exposure You make forward purchases of foreign currencies and wish to protect yourself against unfavourable trends in the foreign currencies that you have to buy. You make forward sales of foreign currencies and wish to protect yourself against unfavourable trends in the foreign currencies that you have to sell.

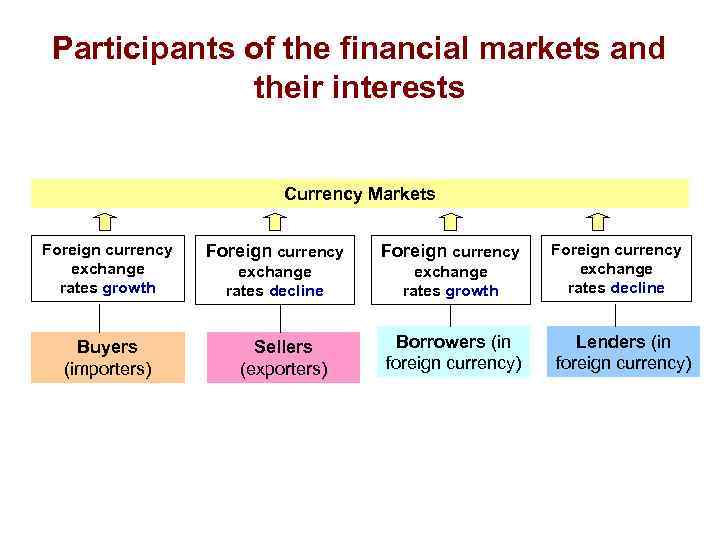

Participants of the financial markets and their interests Currency Markets Foreign currency exchange rates growth Buyers (importers) Foreign currency exchange rates decline exchange rates growth Sellers (exporters) Borrowers (in foreign currency) Foreign currency exchange rates decline Lenders (in foreign currency)

Participants of the financial markets and their interests Currency Markets Foreign currency exchange rates growth Buyers (importers) Foreign currency exchange rates decline exchange rates growth Sellers (exporters) Borrowers (in foreign currency) Foreign currency exchange rates decline Lenders (in foreign currency)

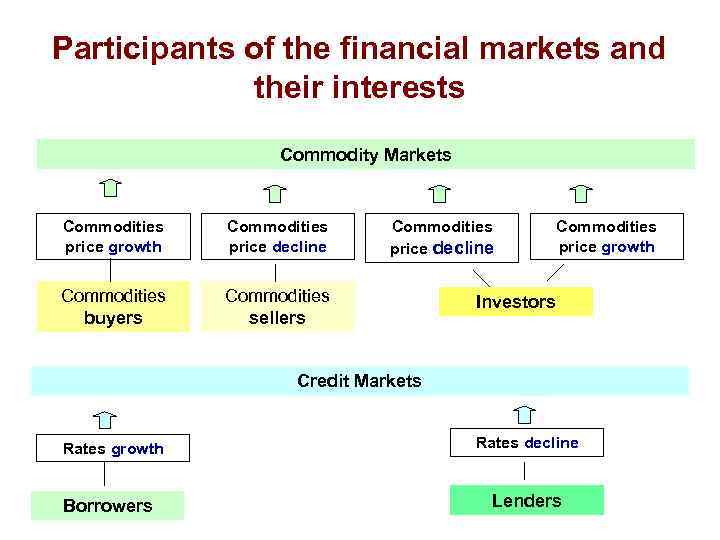

Participants of the financial markets and their interests Commodity Markets Commodities price growth Commodities price decline Commodities buyers Commodities price decline Commodities sellers Commodities price growth Investors Credit Markets Rates growth Borrowers Rates decline Lenders

Participants of the financial markets and their interests Commodity Markets Commodities price growth Commodities price decline Commodities buyers Commodities price decline Commodities sellers Commodities price growth Investors Credit Markets Rates growth Borrowers Rates decline Lenders

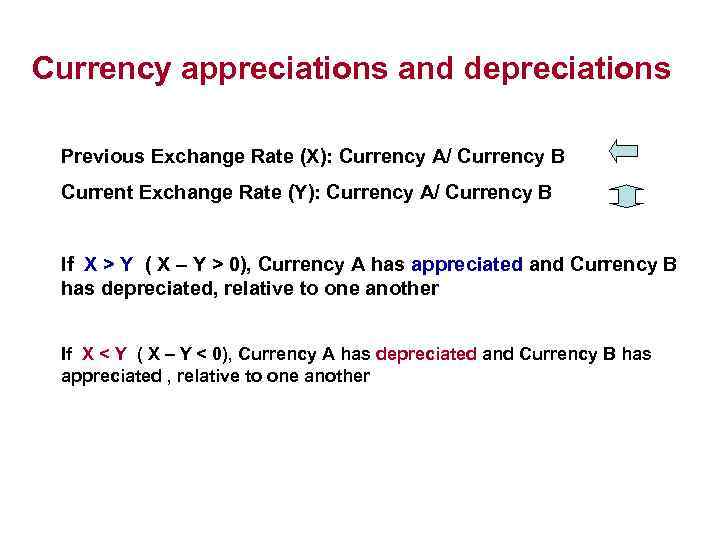

Currency appreciations and depreciations Previous Exchange Rate (X): Currency A/ Currency B Current Exchange Rate (Y): Currency A/ Currency B If X > Y ( X – Y > 0), Currency A has appreciated and Currency B has depreciated, relative to one another If X < Y ( X – Y < 0), Currency A has depreciated and Currency B has appreciated , relative to one another

Currency appreciations and depreciations Previous Exchange Rate (X): Currency A/ Currency B Current Exchange Rate (Y): Currency A/ Currency B If X > Y ( X – Y > 0), Currency A has appreciated and Currency B has depreciated, relative to one another If X < Y ( X – Y < 0), Currency A has depreciated and Currency B has appreciated , relative to one another

Foreign currency exchange rate risks Translation risks Arising from the ownership of operating companies outside the home country. The greater the proportion of asset, liability and equity classes denominated in a foreign currency, the greater the translation risk. Transaction risks (contractual risks) Arising from the time delay between entering into a contract and settling it. The greater the time differential between the entrance and settlement of the contract, the greater the transaction risk, because there is more time for the two exchange rates to fluctuate Non contractual risks Arise because exchange rate fluctuations can affect the competitive position of the firm

Foreign currency exchange rate risks Translation risks Arising from the ownership of operating companies outside the home country. The greater the proportion of asset, liability and equity classes denominated in a foreign currency, the greater the translation risk. Transaction risks (contractual risks) Arising from the time delay between entering into a contract and settling it. The greater the time differential between the entrance and settlement of the contract, the greater the transaction risk, because there is more time for the two exchange rates to fluctuate Non contractual risks Arise because exchange rate fluctuations can affect the competitive position of the firm

Forwards

Forwards

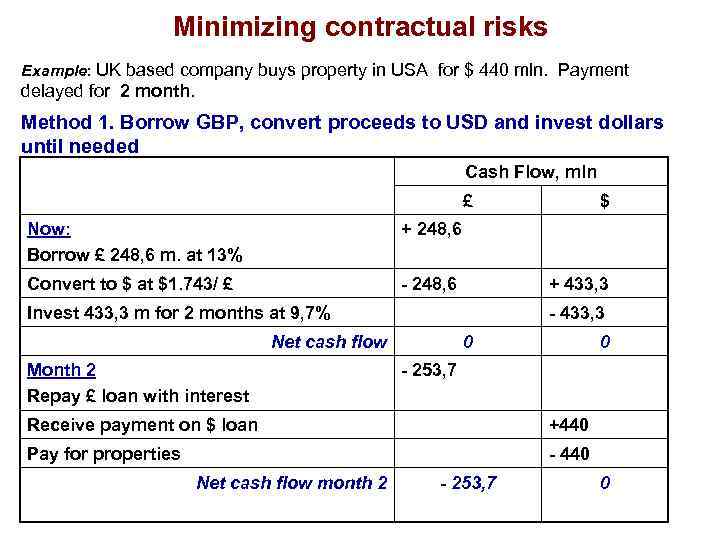

Minimizing contractual risks Example: UK based company buys property in USA for $ 440 mln. Payment delayed for 2 month. Method 1. Borrow GBP, convert proceeds to USD and invest dollars until needed Cash Flow, mln £ Now: Borrow £ 248, 6 m. at 13% + 248, 6 Convert to $ at $1. 743/ £ - 248, 6 $ + 433, 3 Invest 433, 3 m for 2 months at 9, 7% - 433, 3 Net cash flow Month 2 Repay £ loan with interest 0 0 - 253, 7 Receive payment on $ loan +440 Pay for properties - 440 Net cash flow month 2 - 253, 7 0

Minimizing contractual risks Example: UK based company buys property in USA for $ 440 mln. Payment delayed for 2 month. Method 1. Borrow GBP, convert proceeds to USD and invest dollars until needed Cash Flow, mln £ Now: Borrow £ 248, 6 m. at 13% + 248, 6 Convert to $ at $1. 743/ £ - 248, 6 $ + 433, 3 Invest 433, 3 m for 2 months at 9, 7% - 433, 3 Net cash flow Month 2 Repay £ loan with interest 0 0 - 253, 7 Receive payment on $ loan +440 Pay for properties - 440 Net cash flow month 2 - 253, 7 0

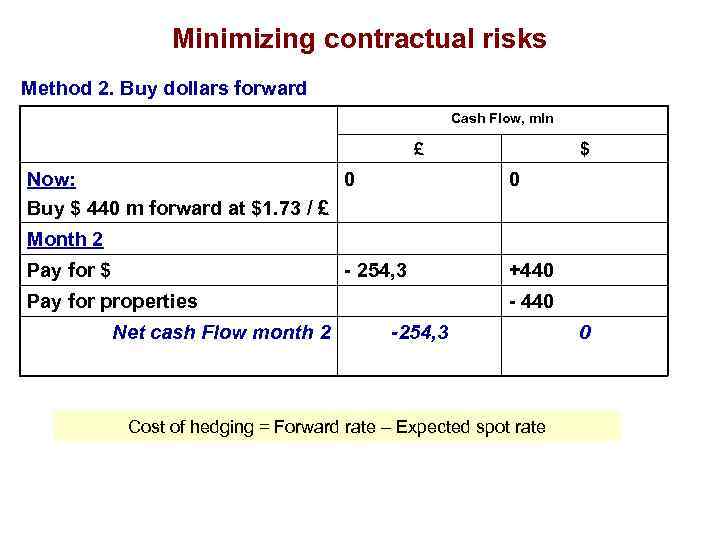

Minimizing contractual risks Method 2. Buy dollars forward Cash Flow, mln £ Now: 0 Buy $ 440 m forward at $1. 73 / £ $ 0 Month 2 Pay for $ - 254, 3 Pay for properties Net cash Flow month 2 +440 -254, 3 Cost of hedging = Forward rate – Expected spot rate 0

Minimizing contractual risks Method 2. Buy dollars forward Cash Flow, mln £ Now: 0 Buy $ 440 m forward at $1. 73 / £ $ 0 Month 2 Pay for $ - 254, 3 Pay for properties Net cash Flow month 2 +440 -254, 3 Cost of hedging = Forward rate – Expected spot rate 0

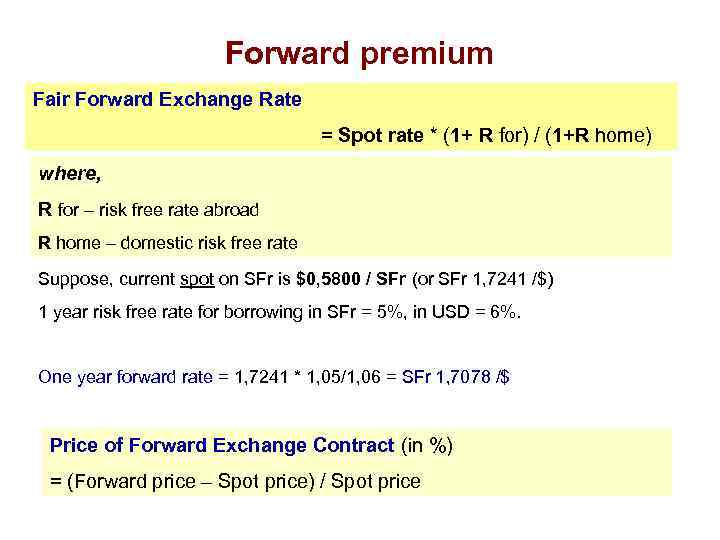

Forward premium Fair Forward Exchange Rate = Spot rate * (1+ R for) / (1+R home) where, R for – risk free rate abroad R home – domestic risk free rate Suppose, current spot on SFr is $0, 5800 / SFr (or SFr 1, 7241 /$) 1 year risk free rate for borrowing in SFr = 5%, in USD = 6%. One year forward rate = 1, 7241 * 1, 05/1, 06 = SFr 1, 7078 /$ Price of Forward Exchange Contract (in %) = (Forward price – Spot price) / Spot price

Forward premium Fair Forward Exchange Rate = Spot rate * (1+ R for) / (1+R home) where, R for – risk free rate abroad R home – domestic risk free rate Suppose, current spot on SFr is $0, 5800 / SFr (or SFr 1, 7241 /$) 1 year risk free rate for borrowing in SFr = 5%, in USD = 6%. One year forward rate = 1, 7241 * 1, 05/1, 06 = SFr 1, 7078 /$ Price of Forward Exchange Contract (in %) = (Forward price – Spot price) / Spot price

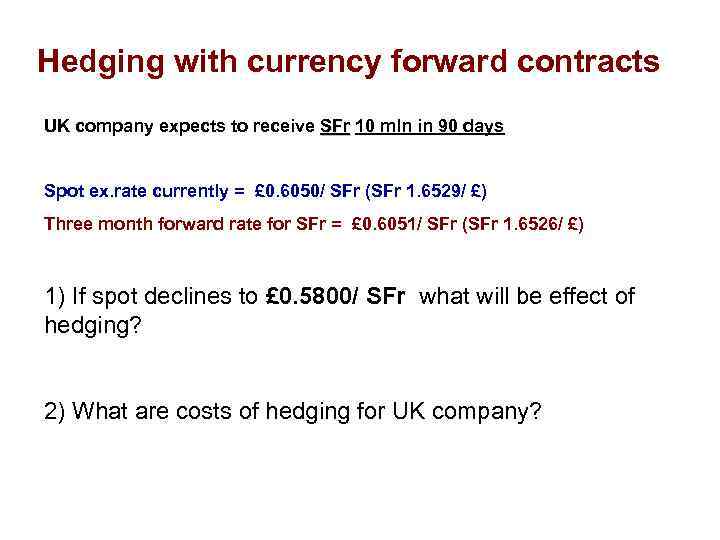

Hedging with currency forward contracts UK company expects to receive SFr 10 mln in 90 days Spot ex. rate currently = £ 0. 6050/ SFr (SFr 1. 6529/ £) Three month forward rate for SFr = £ 0. 6051/ SFr (SFr 1. 6526/ £) 1) If spot declines to £ 0. 5800/ SFr what will be effect of hedging? 2) What are costs of hedging for UK company?

Hedging with currency forward contracts UK company expects to receive SFr 10 mln in 90 days Spot ex. rate currently = £ 0. 6050/ SFr (SFr 1. 6529/ £) Three month forward rate for SFr = £ 0. 6051/ SFr (SFr 1. 6526/ £) 1) If spot declines to £ 0. 5800/ SFr what will be effect of hedging? 2) What are costs of hedging for UK company?

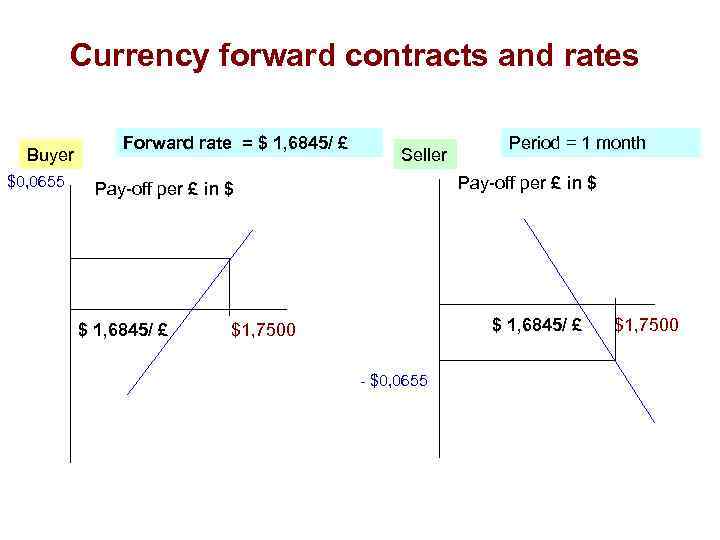

Currency forward contracts and rates Buyer $0, 0655 Forward rate = $ 1, 6845/ £ Seller Pay-off per £ in $ $ 1, 6845/ £ Period = 1 month $ 1, 6845/ £ $1, 7500 - $0, 0655 $1, 7500

Currency forward contracts and rates Buyer $0, 0655 Forward rate = $ 1, 6845/ £ Seller Pay-off per £ in $ $ 1, 6845/ £ Period = 1 month $ 1, 6845/ £ $1, 7500 - $0, 0655 $1, 7500

Options

Options

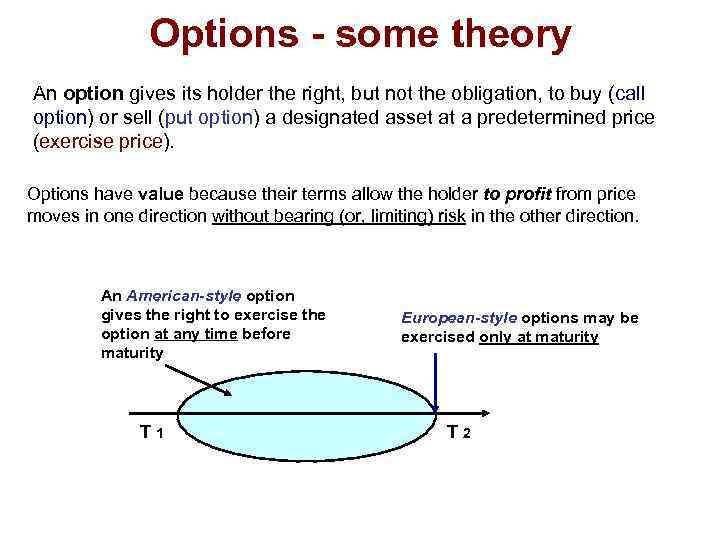

Options - some theory An option gives its holder the right, but not the obligation, to buy (call option) or sell (put option) a designated asset at a predetermined price (exercise price). Options have value because their terms allow the holder to profit from price moves in one direction without bearing (or, limiting) risk in the other direction. An American-style option gives the right to exercise the option at any time before maturity T 1 European-style options may be exercised only at maturity T 2

Options - some theory An option gives its holder the right, but not the obligation, to buy (call option) or sell (put option) a designated asset at a predetermined price (exercise price). Options have value because their terms allow the holder to profit from price moves in one direction without bearing (or, limiting) risk in the other direction. An American-style option gives the right to exercise the option at any time before maturity T 1 European-style options may be exercised only at maturity T 2

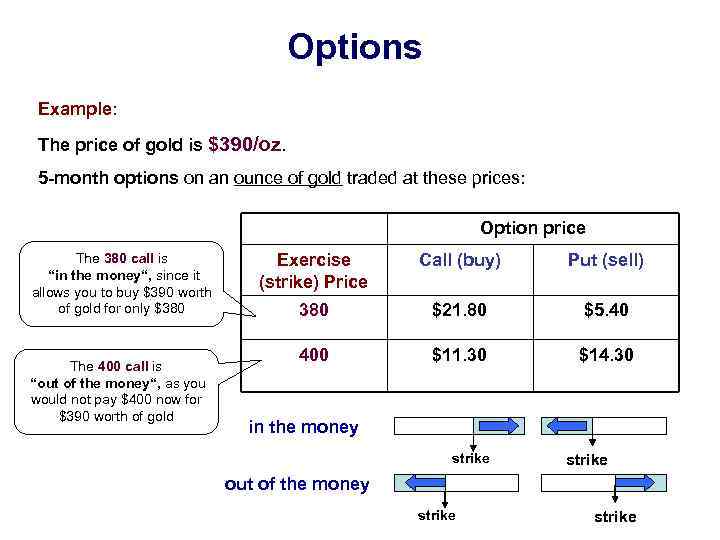

Options Example: The price of gold is $390/oz. 5 -month options on an ounce of gold traded at these prices: Option price The 380 call is “in the money“, since it allows you to buy $390 worth of gold for only $380 The 400 call is “out of the money“, as you would not pay $400 now for $390 worth of gold Exercise (strike) Price Call (buy) Put (sell) 380 $21. 80 $5. 40 400 $11. 30 $14. 30 in the money strike out of the money strike

Options Example: The price of gold is $390/oz. 5 -month options on an ounce of gold traded at these prices: Option price The 380 call is “in the money“, since it allows you to buy $390 worth of gold for only $380 The 400 call is “out of the money“, as you would not pay $400 now for $390 worth of gold Exercise (strike) Price Call (buy) Put (sell) 380 $21. 80 $5. 40 400 $11. 30 $14. 30 in the money strike out of the money strike

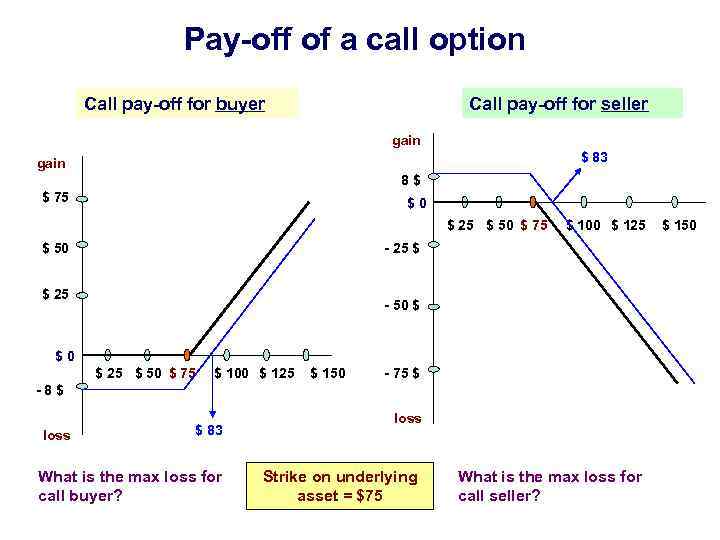

Pay-off of a call option Call pay-off for buyer Call pay-off for seller gain $ 83 gain 8$ $ 75 $0 $ 25 $ 50 $ 75 $ 100 $ 125 - 25 $ $ 50 $ 25 - 50 $ $0 $ 25 $ 50 $ 75 $ 100 $ 125 $ 150 - 75 $ -8$ loss $ 83 What is the max loss for call buyer? loss Strike on underlying asset = $75 What is the max loss for call seller? $ 150

Pay-off of a call option Call pay-off for buyer Call pay-off for seller gain $ 83 gain 8$ $ 75 $0 $ 25 $ 50 $ 75 $ 100 $ 125 - 25 $ $ 50 $ 25 - 50 $ $0 $ 25 $ 50 $ 75 $ 100 $ 125 $ 150 - 75 $ -8$ loss $ 83 What is the max loss for call buyer? loss Strike on underlying asset = $75 What is the max loss for call seller? $ 150

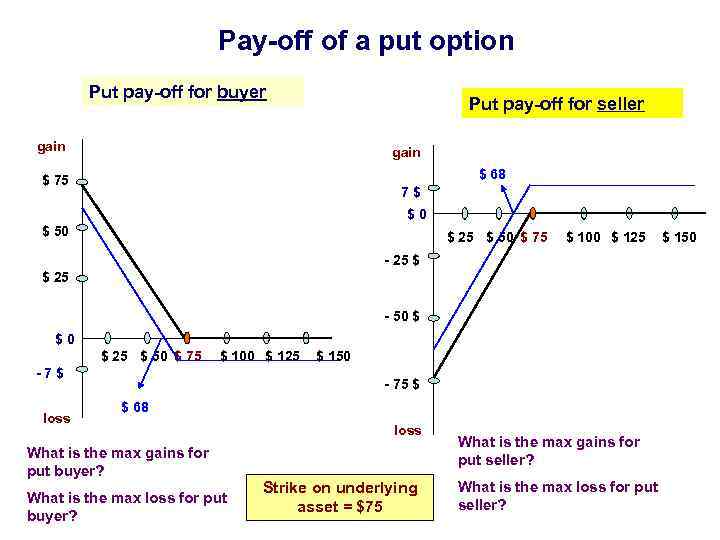

Pay-off of a put option Put pay-off for buyer Put pay-off for seller gain $ 68 $ 75 7$ $0 $ 50 $ 25 $ 50 $ 75 $ 100 $ 125 - 25 $ $ 25 - 50 $ $0 $ 25 $ 50 $ 75 $ 100 $ 125 -7$ loss $ 150 - 75 $ $ 68 What is the max gains for put buyer? What is the max loss for put buyer? loss Strike on underlying asset = $75 What is the max gains for put seller? What is the max loss for put seller? $ 150

Pay-off of a put option Put pay-off for buyer Put pay-off for seller gain $ 68 $ 75 7$ $0 $ 50 $ 25 $ 50 $ 75 $ 100 $ 125 - 25 $ $ 25 - 50 $ $0 $ 25 $ 50 $ 75 $ 100 $ 125 -7$ loss $ 150 - 75 $ $ 68 What is the max gains for put buyer? What is the max loss for put buyer? loss Strike on underlying asset = $75 What is the max gains for put seller? What is the max loss for put seller? $ 150

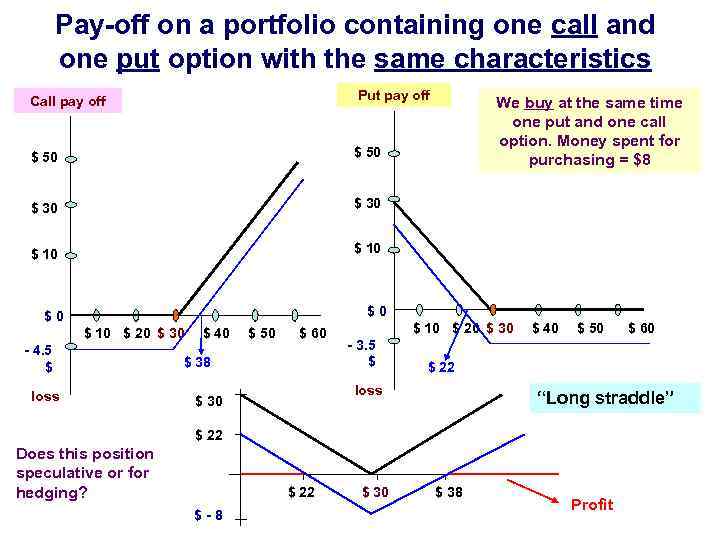

Pay-off on a portfolio containing one call and one put option with the same characteristics Call pay off Put pay off $ 50 $ 30 $ 10 We buy at the same time one put and one call option. Money spent for purchasing = $8 $0 $0 $ 10 $ 20 $ 30 - 4. 5 $ loss $ 40 $ 50 $ 60 $ 38 $ 10 $ 20 $ 30 - 3. 5 $ $ 50 “Long straddle” $ 22 Does this position speculative or for hedging? $ 22 $-8 $ 30 $ 60 $ 22 loss $ 30 $ 40 $ 38 Profit

Pay-off on a portfolio containing one call and one put option with the same characteristics Call pay off Put pay off $ 50 $ 30 $ 10 We buy at the same time one put and one call option. Money spent for purchasing = $8 $0 $0 $ 10 $ 20 $ 30 - 4. 5 $ loss $ 40 $ 50 $ 60 $ 38 $ 10 $ 20 $ 30 - 3. 5 $ $ 50 “Long straddle” $ 22 Does this position speculative or for hedging? $ 22 $-8 $ 30 $ 60 $ 22 loss $ 30 $ 40 $ 38 Profit

Futures Contracts

Futures Contracts

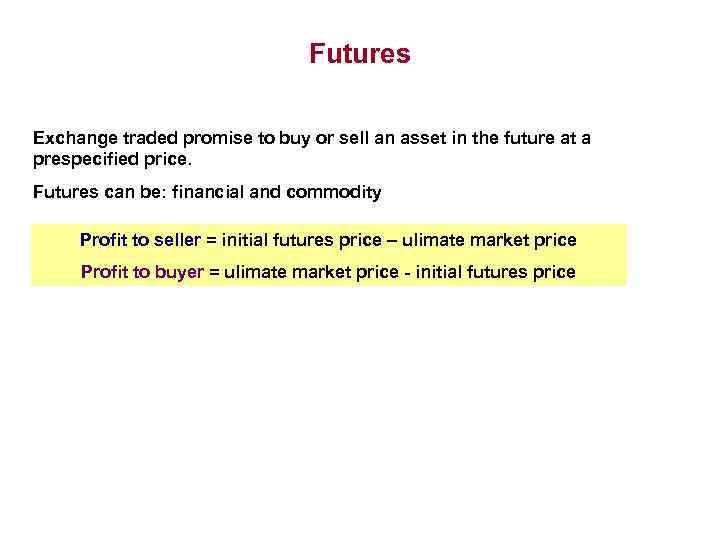

Futures Exchange traded promise to buy or sell an asset in the future at a prespecified price. Futures can be: financial and commodity Profit to seller = initial futures price – ulimate market price Profit to buyer = ulimate market price - initial futures price

Futures Exchange traded promise to buy or sell an asset in the future at a prespecified price. Futures can be: financial and commodity Profit to seller = initial futures price – ulimate market price Profit to buyer = ulimate market price - initial futures price

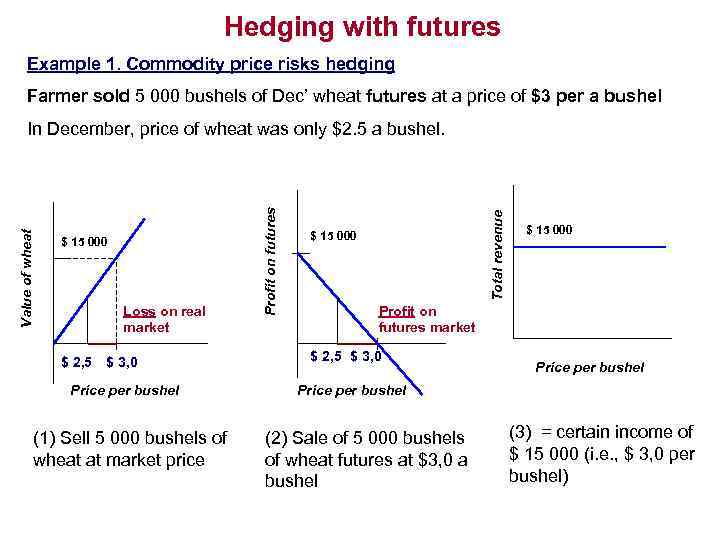

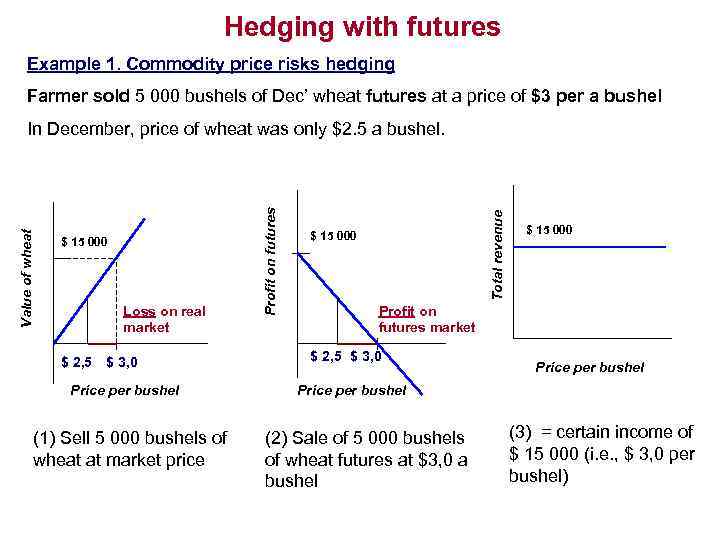

Hedging with futures Example 1. Commodity price risks hedging Farmer sold 5 000 bushels of Dec’ wheat futures at a price of $3 per a bushel Loss on real market $ 2, 5 $ 3, 0 Price per bushel (1) Sell 5 000 bushels of wheat at market price Total revenue $ 15 000 Profit on futures Value of wheat In December, price of wheat was only $2. 5 a bushel. $ 15 000 Profit on futures market $ 2, 5 $ 3, 0 Price per bushel (2) Sale of 5 000 bushels of wheat futures at $3, 0 a bushel (3) = certain income of $ 15 000 (i. e. , $ 3, 0 per bushel)

Hedging with futures Example 1. Commodity price risks hedging Farmer sold 5 000 bushels of Dec’ wheat futures at a price of $3 per a bushel Loss on real market $ 2, 5 $ 3, 0 Price per bushel (1) Sell 5 000 bushels of wheat at market price Total revenue $ 15 000 Profit on futures Value of wheat In December, price of wheat was only $2. 5 a bushel. $ 15 000 Profit on futures market $ 2, 5 $ 3, 0 Price per bushel (2) Sale of 5 000 bushels of wheat futures at $3, 0 a bushel (3) = certain income of $ 15 000 (i. e. , $ 3, 0 per bushel)

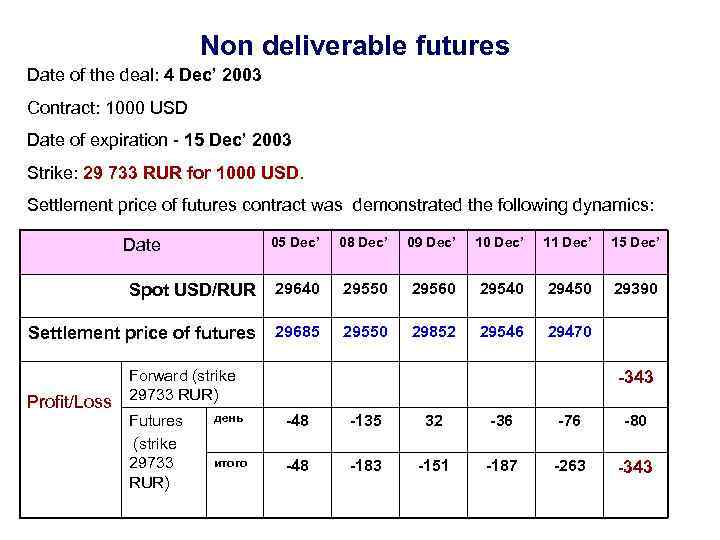

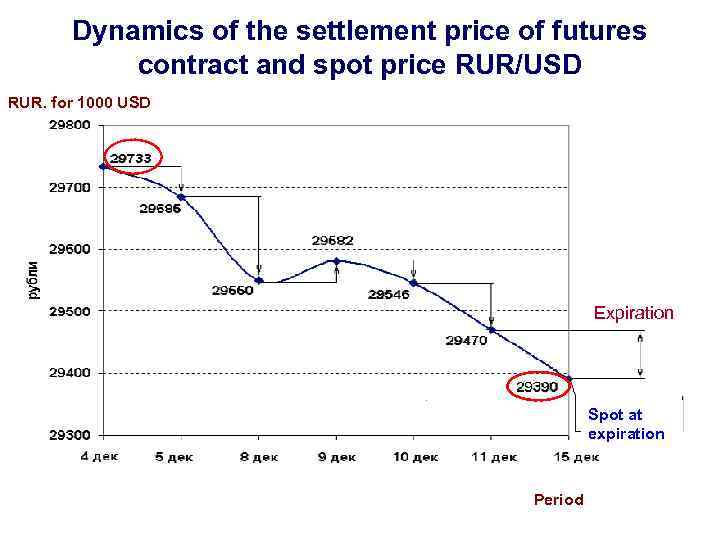

Non deliverable futures Date of the deal: 4 Dec’ 2003 Contract: 1000 USD Date of expiration - 15 Dec’ 2003 Strike: 29 733 RUR for 1000 USD. Settlement price of futures contract was demonstrated the following dynamics: 05 Dec’ 08 Dec’ 09 Dec’ 10 Dec’ 11 Dec’ 15 Dec’ Spot USD/RUR 29640 29550 29560 29540 29450 29390 Settlement price of futures 29685 29550 29852 29546 29470 Date Profit/Loss Forward (strike 29733 RUR) Futures (strike 29733 RUR) -343 день -48 -135 32 -36 -76 -80 итого -48 -183 -151 -187 -263 -343

Non deliverable futures Date of the deal: 4 Dec’ 2003 Contract: 1000 USD Date of expiration - 15 Dec’ 2003 Strike: 29 733 RUR for 1000 USD. Settlement price of futures contract was demonstrated the following dynamics: 05 Dec’ 08 Dec’ 09 Dec’ 10 Dec’ 11 Dec’ 15 Dec’ Spot USD/RUR 29640 29550 29560 29540 29450 29390 Settlement price of futures 29685 29550 29852 29546 29470 Date Profit/Loss Forward (strike 29733 RUR) Futures (strike 29733 RUR) -343 день -48 -135 32 -36 -76 -80 итого -48 -183 -151 -187 -263 -343

Dynamics of the settlement price of futures contract and spot price RUR/USD RUR. for 1000 USD Expiration Spot at expiration Period

Dynamics of the settlement price of futures contract and spot price RUR/USD RUR. for 1000 USD Expiration Spot at expiration Period

Examples of exchange-traded futures contracts EXCHANGE Grains and oilseeds FACE AMOUNT Corn Chicago Board of Trade 5000 bushels Corn Euronext LIFFE 50 tons Oats Chicago Board of Trade 5000 bushels Wheat Chicago Board of Trade 5000 bushels Canola Winnipeg Commodity Exchange 20 metric tons Euronext LIFFE 50 metric tons Rapeseed EXCHANGE Livestock and meat FACE AMOUNT Cattle - feeder Chicago Mercantile Exchange 50 000 lbs Cattle - live Chicago Mercantile Exchange 40 000 lbs Pork bellies Chicago Mercantile Exchange 40 000 lbs EXCHANGE Food and fibre FACE AMOUNT Cocoa Coffee, Sugar & Cocoa Exchange, New York 10 metric tons Cocoa Euronext LIFFE 10 metric tons Coffee, Sugar & Cocoa Exchange, New York 37 500 lbs Euronext LIFFE 10 tons Sugar-world Coffee, Sugar & Cocoa Exchange, New York 112 000 lbs Sugar - domestic Coffee, Sugar & Cocoa Exchange, New York 112 000 lbs Cotton New York Cotton Exchange 50 000 lbs Orange juice New York Cotton Exchange 15 000 lbs Coffee, robusta

Examples of exchange-traded futures contracts EXCHANGE Grains and oilseeds FACE AMOUNT Corn Chicago Board of Trade 5000 bushels Corn Euronext LIFFE 50 tons Oats Chicago Board of Trade 5000 bushels Wheat Chicago Board of Trade 5000 bushels Canola Winnipeg Commodity Exchange 20 metric tons Euronext LIFFE 50 metric tons Rapeseed EXCHANGE Livestock and meat FACE AMOUNT Cattle - feeder Chicago Mercantile Exchange 50 000 lbs Cattle - live Chicago Mercantile Exchange 40 000 lbs Pork bellies Chicago Mercantile Exchange 40 000 lbs EXCHANGE Food and fibre FACE AMOUNT Cocoa Coffee, Sugar & Cocoa Exchange, New York 10 metric tons Cocoa Euronext LIFFE 10 metric tons Coffee, Sugar & Cocoa Exchange, New York 37 500 lbs Euronext LIFFE 10 tons Sugar-world Coffee, Sugar & Cocoa Exchange, New York 112 000 lbs Sugar - domestic Coffee, Sugar & Cocoa Exchange, New York 112 000 lbs Cotton New York Cotton Exchange 50 000 lbs Orange juice New York Cotton Exchange 15 000 lbs Coffee, robusta

Examples of exchange-traded futures contracts EXCHANGE Metals and petroleum FACE AMOUNT Copper Comex, New York Mercantile Exchange 25 000 lbs Gold Comex, New York Mercantile Exchange 100 troy oz New York Mercantile Exchange 50 troy oz Comex, New York Mercantile Exchange 5000 troy oz Crude oil New York Mercantile Exchange 1000 bbls Natural gas New York Mercantile Exchange 10 000 MMBtu Copper London Metal Exchange 1000 kg Aluminium London Metal Exchange 1000 kg Platinum Silver EXCHANGE Interest rate FACE AMOUNT Treasury bonds Chicago Board of Trade $100 000 5 -year Treasury notes Chicago Board of Trade $100 000 30 -day federal funds Chicago Board of Trade $5 million Chicago Mercantile Exchange $3 million Euronext LIFFE £ 100 000 Chicago Mercantile Exchange $1 million LIBOR UK government long gilt Eurodollars

Examples of exchange-traded futures contracts EXCHANGE Metals and petroleum FACE AMOUNT Copper Comex, New York Mercantile Exchange 25 000 lbs Gold Comex, New York Mercantile Exchange 100 troy oz New York Mercantile Exchange 50 troy oz Comex, New York Mercantile Exchange 5000 troy oz Crude oil New York Mercantile Exchange 1000 bbls Natural gas New York Mercantile Exchange 10 000 MMBtu Copper London Metal Exchange 1000 kg Aluminium London Metal Exchange 1000 kg Platinum Silver EXCHANGE Interest rate FACE AMOUNT Treasury bonds Chicago Board of Trade $100 000 5 -year Treasury notes Chicago Board of Trade $100 000 30 -day federal funds Chicago Board of Trade $5 million Chicago Mercantile Exchange $3 million Euronext LIFFE £ 100 000 Chicago Mercantile Exchange $1 million LIBOR UK government long gilt Eurodollars

Examples of exchange-traded futures contracts EXCHANGE Index Dow Jones Industrial Average FACE AMOUNT Chicago Board of Trade $10 x average S&P 500 Chicago Mercantile Exchange $250 X average Nikkei 225 Chicago Mercantile Exchange $5 x average FTSE 100 Euronext LIFFE £ 10 x average MSCI Euro Index Euronext LIFFE € 20 x average EXCHANGE Currency FACE AMOUNT Japanese yen (¥) Chicago Mercantile Exchange ¥ 12: 5 million British pound (BP) Chicago Mercantile Exchange £ 62 500 Swiss franc [SF] Chicago Mercantile Exchange SF 125 000 Euronext LIFFE € 20 000 Euro (€)

Examples of exchange-traded futures contracts EXCHANGE Index Dow Jones Industrial Average FACE AMOUNT Chicago Board of Trade $10 x average S&P 500 Chicago Mercantile Exchange $250 X average Nikkei 225 Chicago Mercantile Exchange $5 x average FTSE 100 Euronext LIFFE £ 10 x average MSCI Euro Index Euronext LIFFE € 20 x average EXCHANGE Currency FACE AMOUNT Japanese yen (¥) Chicago Mercantile Exchange ¥ 12: 5 million British pound (BP) Chicago Mercantile Exchange £ 62 500 Swiss franc [SF] Chicago Mercantile Exchange SF 125 000 Euronext LIFFE € 20 000 Euro (€)

Hedging with futures Example 1. Commodity price risks hedging Farmer sold 5 000 bushels of Dec’ wheat futures at a price of $3 per a bushel Loss on real market $ 2, 5 $ 3, 0 Price per bushel (1) Sell 5 000 bushels of wheat at market price Total revenue $ 15 000 Profit on futures Value of wheat In December, price of wheat was only $2. 5 a bushel. $ 15 000 Profit on futures market $ 2, 5 $ 3, 0 Price per bushel (2) Sale of 5 000 bushels of wheat futures at $3, 0 a bushel (3) = certain income of $ 15 000 (i. e. , $ 3, 0 per bushel)

Hedging with futures Example 1. Commodity price risks hedging Farmer sold 5 000 bushels of Dec’ wheat futures at a price of $3 per a bushel Loss on real market $ 2, 5 $ 3, 0 Price per bushel (1) Sell 5 000 bushels of wheat at market price Total revenue $ 15 000 Profit on futures Value of wheat In December, price of wheat was only $2. 5 a bushel. $ 15 000 Profit on futures market $ 2, 5 $ 3, 0 Price per bushel (2) Sale of 5 000 bushels of wheat futures at $3, 0 a bushel (3) = certain income of $ 15 000 (i. e. , $ 3, 0 per bushel)

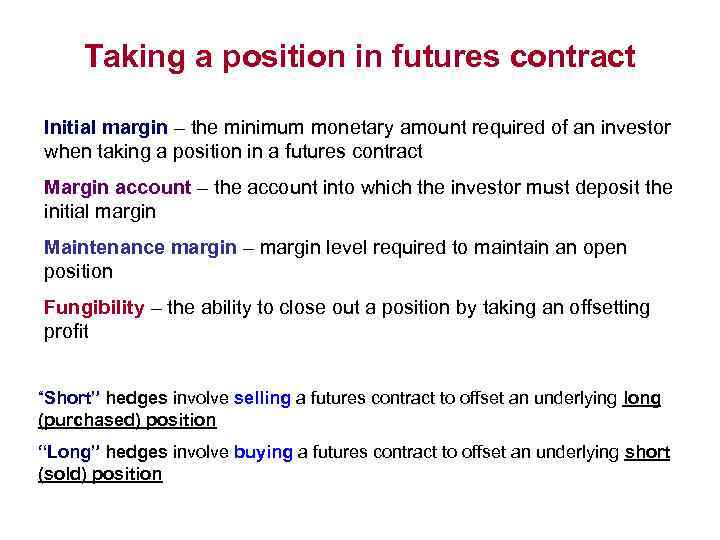

Taking a position in futures contract Initial margin – the minimum monetary amount required of an investor when taking a position in a futures contract Margin account – the account into which the investor must deposit the initial margin Maintenance margin – margin level required to maintain an open position Fungibility – the ability to close out a position by taking an offsetting profit “Short” hedges involve selling a futures contract to offset an underlying long (purchased) position “Long” hedges involve buying a futures contract to offset an underlying short (sold) position

Taking a position in futures contract Initial margin – the minimum monetary amount required of an investor when taking a position in a futures contract Margin account – the account into which the investor must deposit the initial margin Maintenance margin – margin level required to maintain an open position Fungibility – the ability to close out a position by taking an offsetting profit “Short” hedges involve selling a futures contract to offset an underlying long (purchased) position “Long” hedges involve buying a futures contract to offset an underlying short (sold) position

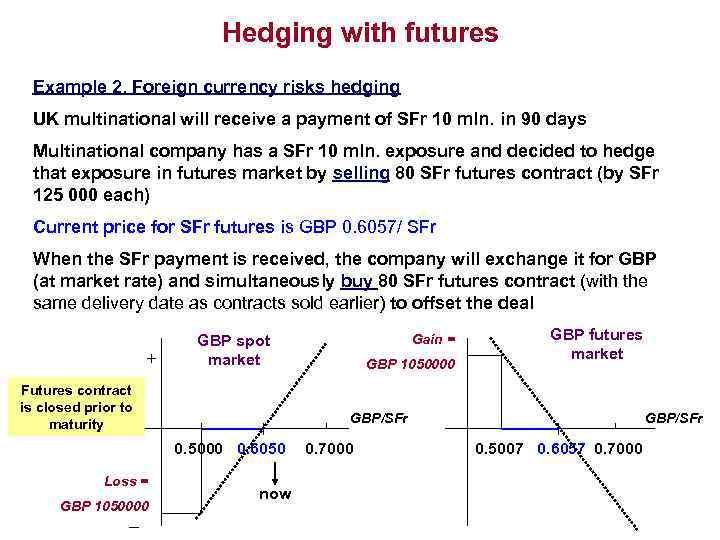

Hedging with futures Example 2. Foreign currency risks hedging UK multinational will receive a payment of SFr 10 mln. in 90 days Multinational company has a SFr 10 mln. exposure and decided to hedge that exposure in futures market by selling 80 SFr futures contract (by SFr 125 000 each) Current price for SFr futures is GBP 0. 6057/ SFr When the SFr payment is received, the company will exchange it for GBP (at market rate) and simultaneously buy 80 SFr futures contract (with the same delivery date as contracts sold earlier) to offset the deal + Futures contract is closed prior to maturity GBP 1050000 _ GBP 1050000 GBP futures market GBP/SFr 0. 5000 0. 6050 Loss = Gain = GBP spot market now 0. 7000 GBP/SFr 0. 5007 0. 6057 0. 7000

Hedging with futures Example 2. Foreign currency risks hedging UK multinational will receive a payment of SFr 10 mln. in 90 days Multinational company has a SFr 10 mln. exposure and decided to hedge that exposure in futures market by selling 80 SFr futures contract (by SFr 125 000 each) Current price for SFr futures is GBP 0. 6057/ SFr When the SFr payment is received, the company will exchange it for GBP (at market rate) and simultaneously buy 80 SFr futures contract (with the same delivery date as contracts sold earlier) to offset the deal + Futures contract is closed prior to maturity GBP 1050000 _ GBP 1050000 GBP futures market GBP/SFr 0. 5000 0. 6050 Loss = Gain = GBP spot market now 0. 7000 GBP/SFr 0. 5007 0. 6057 0. 7000

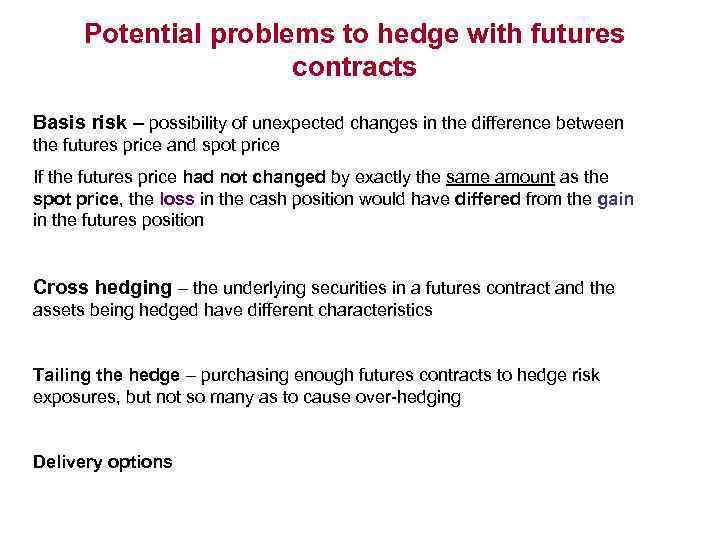

Potential problems to hedge with futures contracts Basis risk – possibility of unexpected changes in the difference between the futures price and spot price If the futures price had not changed by exactly the same amount as the spot price, the loss in the cash position would have differed from the gain in the futures position Cross hedging – the underlying securities in a futures contract and the assets being hedged have different characteristics Tailing the hedge – purchasing enough futures contracts to hedge risk exposures, but not so many as to cause over-hedging Delivery options

Potential problems to hedge with futures contracts Basis risk – possibility of unexpected changes in the difference between the futures price and spot price If the futures price had not changed by exactly the same amount as the spot price, the loss in the cash position would have differed from the gain in the futures position Cross hedging – the underlying securities in a futures contract and the assets being hedged have different characteristics Tailing the hedge – purchasing enough futures contracts to hedge risk exposures, but not so many as to cause over-hedging Delivery options

SWAPS

SWAPS

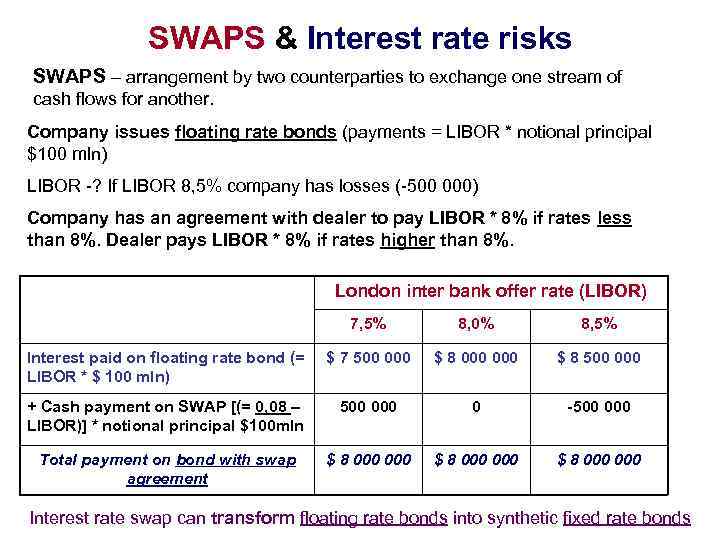

SWAPS & Interest rate risks SWAPS – arrangement by two counterparties to exchange one stream of cash flows for another. Company issues floating rate bonds (payments = LIBOR * notional principal $100 mln) LIBOR -? If LIBOR 8, 5% company has losses (-500 000) Company has an agreement with dealer to pay LIBOR * 8% if rates less than 8%. Dealer pays LIBOR * 8% if rates higher than 8%. London inter bank offer rate (LIBOR) 7, 5% 8, 0% 8, 5% Interest paid on floating rate bond (= LIBOR * $ 100 mln) $ 7 500 000 $ 8 500 000 + Cash payment on SWAP [(= 0, 08 – LIBOR)] * notional principal $100 mln 500 0 -500 000 Total payment on bond with swap agreement $ 8 000 000 $ 8 000 Interest rate swap can transform floating rate bonds into synthetic fixed rate bonds

SWAPS & Interest rate risks SWAPS – arrangement by two counterparties to exchange one stream of cash flows for another. Company issues floating rate bonds (payments = LIBOR * notional principal $100 mln) LIBOR -? If LIBOR 8, 5% company has losses (-500 000) Company has an agreement with dealer to pay LIBOR * 8% if rates less than 8%. Dealer pays LIBOR * 8% if rates higher than 8%. London inter bank offer rate (LIBOR) 7, 5% 8, 0% 8, 5% Interest paid on floating rate bond (= LIBOR * $ 100 mln) $ 7 500 000 $ 8 500 000 + Cash payment on SWAP [(= 0, 08 – LIBOR)] * notional principal $100 mln 500 0 -500 000 Total payment on bond with swap agreement $ 8 000 000 $ 8 000 Interest rate swap can transform floating rate bonds into synthetic fixed rate bonds

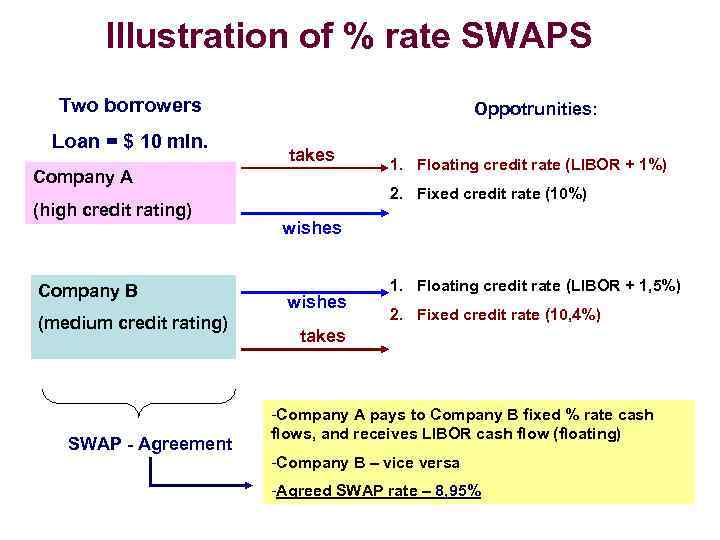

Illustration of % rate SWAPS Two borrowers Loan = $ 10 mln. Oppotrunities: takes Company А (high credit rating) Company B (medium credit rating) SWAP - Agreement 1. Floating credit rate (LIBOR + 1%) 2. Fixed credit rate (10%) wishes 1. Floating credit rate (LIBOR + 1, 5%) 2. Fixed credit rate (10, 4%) takes -Company А pays to Company B fixed % rate cash flows, and receives LIBOR cash flow (floating) -Company B – vice versa -Agreed SWAP rate – 8, 95%

Illustration of % rate SWAPS Two borrowers Loan = $ 10 mln. Oppotrunities: takes Company А (high credit rating) Company B (medium credit rating) SWAP - Agreement 1. Floating credit rate (LIBOR + 1%) 2. Fixed credit rate (10%) wishes 1. Floating credit rate (LIBOR + 1, 5%) 2. Fixed credit rate (10, 4%) takes -Company А pays to Company B fixed % rate cash flows, and receives LIBOR cash flow (floating) -Company B – vice versa -Agreed SWAP rate – 8, 95%

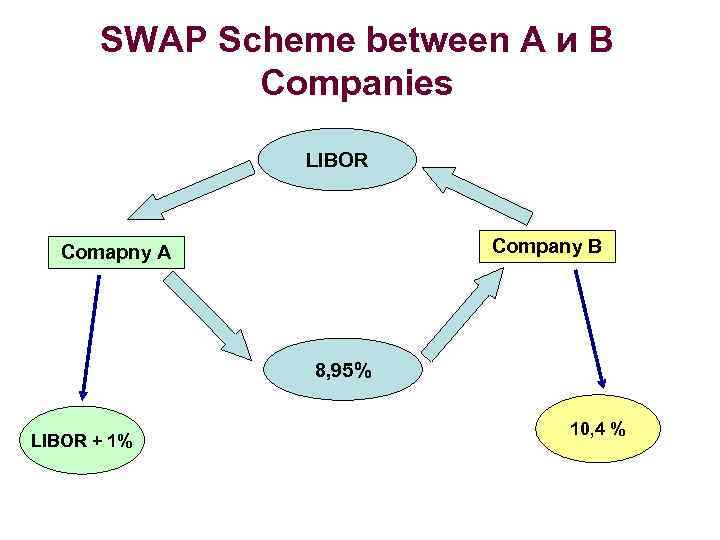

SWAP Scheme between А и В Companies LIBOR Company B Comapny А 8, 95% LIBOR + 1% 10, 4 %

SWAP Scheme between А и В Companies LIBOR Company B Comapny А 8, 95% LIBOR + 1% 10, 4 %

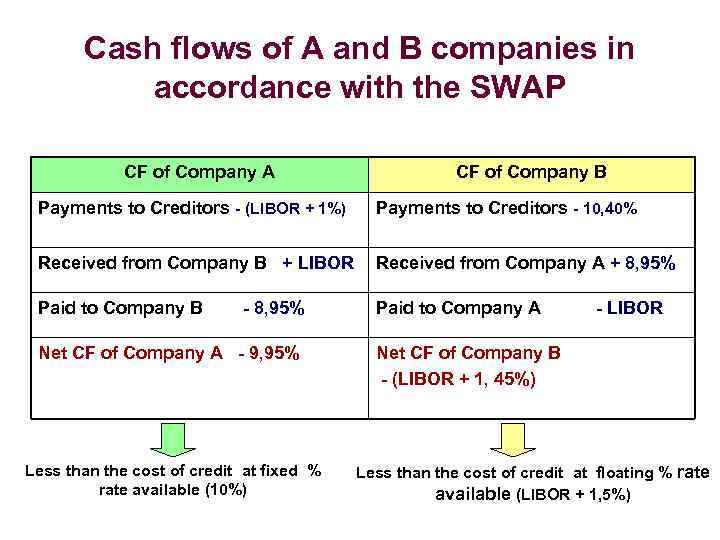

Cash flows of А and B companies in accordance with the SWAP CF of Company А CF of Company B Payments to Creditors - (LIBOR + 1%) Payments to Creditors - 10, 40% Received from Company B + LIBOR Received from Company A + 8, 95% Paid to Company B Paid to Company A - 8, 95% Net CF of Company A - 9, 95% Less than the cost of credit at fixed % rate available (10%) - LIBOR Net CF of Company B - (LIBOR + 1, 45%) Less than the cost of credit at floating % rate available (LIBOR + 1, 5%)

Cash flows of А and B companies in accordance with the SWAP CF of Company А CF of Company B Payments to Creditors - (LIBOR + 1%) Payments to Creditors - 10, 40% Received from Company B + LIBOR Received from Company A + 8, 95% Paid to Company B Paid to Company A - 8, 95% Net CF of Company A - 9, 95% Less than the cost of credit at fixed % rate available (10%) - LIBOR Net CF of Company B - (LIBOR + 1, 45%) Less than the cost of credit at floating % rate available (LIBOR + 1, 5%)