df0b0c8ded25a7d89f9f937916fe2d84.ppt

- Количество слайдов: 42

Financial Risk Management Zvi Wiener Following P. Jorion, Financial Risk Manager Handbook http: //pluto. huji. ac. il/~mswiener/zvi. html FRM 972 -2 -588 -3049

Financial Risk Management Zvi Wiener Following P. Jorion, Financial Risk Manager Handbook http: //pluto. huji. ac. il/~mswiener/zvi. html FRM 972 -2 -588 -3049

Chapter 11 Introduction to Market Risk Management Following P. Jorion 2001 Financial Risk Manager Handbook http: //pluto. huji. ac. il/~mswiener/zvi. html FRM 972 -2 -588 -3049

Chapter 11 Introduction to Market Risk Management Following P. Jorion 2001 Financial Risk Manager Handbook http: //pluto. huji. ac. il/~mswiener/zvi. html FRM 972 -2 -588 -3049

Old ways to measure risk • notional amounts • sensitivity measures (duration, Greeks( • scenarios • ALM, DFA assume linearity do not describe probability Ch. 11, Handbook Zvi Wiener 3

Old ways to measure risk • notional amounts • sensitivity measures (duration, Greeks( • scenarios • ALM, DFA assume linearity do not describe probability Ch. 11, Handbook Zvi Wiener 3

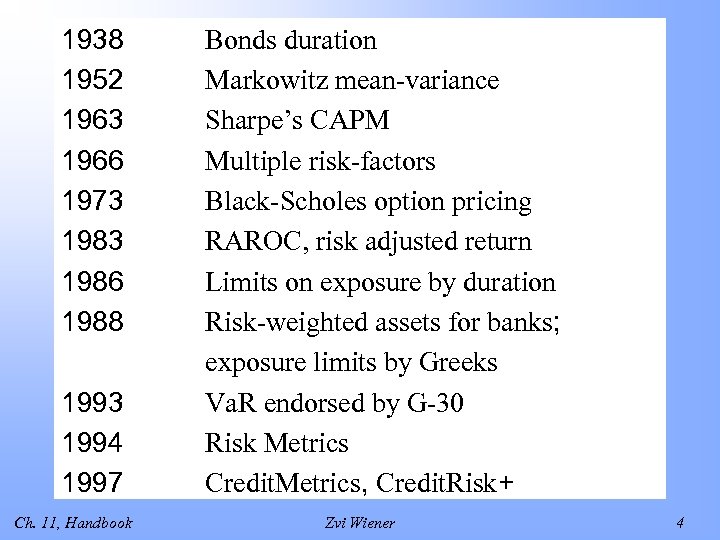

1938 1952 1963 1966 1973 1986 1988 1993 1994 1997 Ch. 11, Handbook Bonds duration Markowitz mean-variance Sharpe’s CAPM Multiple risk-factors Black-Scholes option pricing RAROC, risk adjusted return Limits on exposure by duration Risk-weighted assets for banks; exposure limits by Greeks Va. R endorsed by G-30 Risk Metrics Credit. Metrics, Credit. Risk+ Zvi Wiener 4

1938 1952 1963 1966 1973 1986 1988 1993 1994 1997 Ch. 11, Handbook Bonds duration Markowitz mean-variance Sharpe’s CAPM Multiple risk-factors Black-Scholes option pricing RAROC, risk adjusted return Limits on exposure by duration Risk-weighted assets for banks; exposure limits by Greeks Va. R endorsed by G-30 Risk Metrics Credit. Metrics, Credit. Risk+ Zvi Wiener 4

How much can we lose? Everything correct, but useless answer. How much can we lose realistically? Ch. 11, Handbook Zvi Wiener 5

How much can we lose? Everything correct, but useless answer. How much can we lose realistically? Ch. 11, Handbook Zvi Wiener 5

What is the current Risk? • Bonds • Stocks • Options • Credit • Forex • Total Ch. 11, Handbook duration, convexity volatility delta, gamma, vega rating target zone ? Zvi Wiener 6

What is the current Risk? • Bonds • Stocks • Options • Credit • Forex • Total Ch. 11, Handbook duration, convexity volatility delta, gamma, vega rating target zone ? Zvi Wiener 6

Standard Approach Ch. 11, Handbook Zvi Wiener 7

Standard Approach Ch. 11, Handbook Zvi Wiener 7

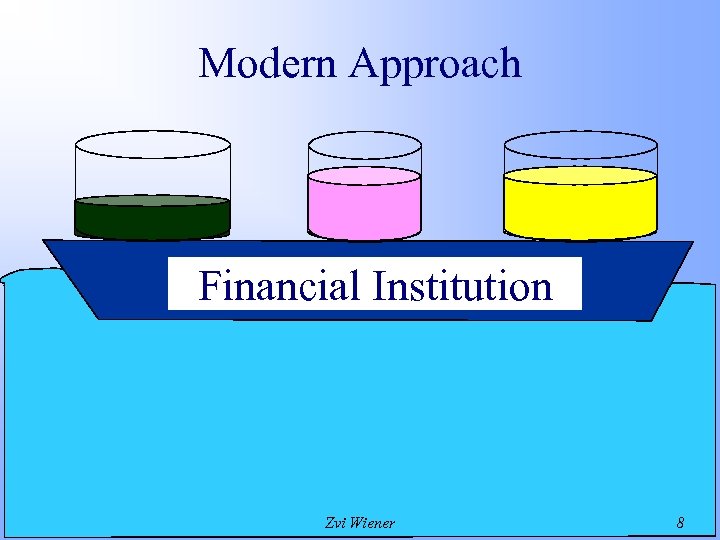

Modern Approach Financial Institution Ch. 11, Handbook Zvi Wiener 8

Modern Approach Financial Institution Ch. 11, Handbook Zvi Wiener 8

Definition Va. R is defined as the predicted worst-case loss at a specific confidence level (e. g. 99%) over a certain period of time. Ch. 11, Handbook Zvi Wiener 9

Definition Va. R is defined as the predicted worst-case loss at a specific confidence level (e. g. 99%) over a certain period of time. Ch. 11, Handbook Zvi Wiener 9

Definition (Jorion) Va. R is the maximum loss over a target horizon such that there is a low, prespecified probability that the actual loss will be larger. Ch. 11, Handbook Zvi Wiener 10

Definition (Jorion) Va. R is the maximum loss over a target horizon such that there is a low, prespecified probability that the actual loss will be larger. Ch. 11, Handbook Zvi Wiener 10

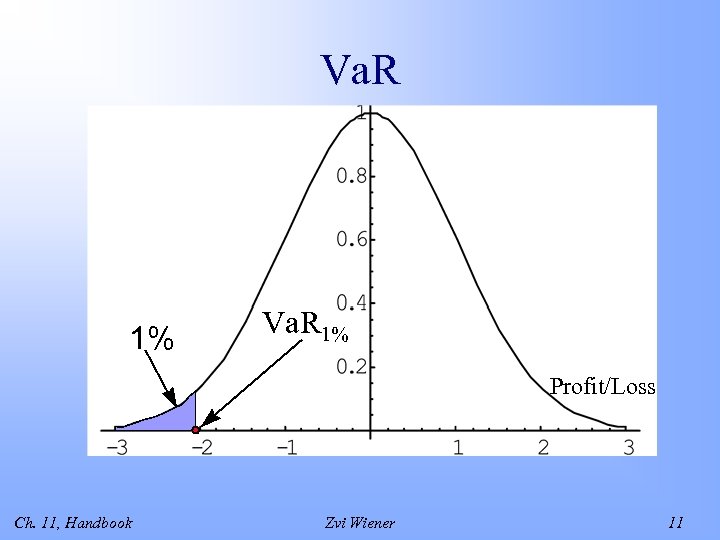

Va. R 1% Profit/Loss Ch. 11, Handbook Zvi Wiener 11

Va. R 1% Profit/Loss Ch. 11, Handbook Zvi Wiener 11

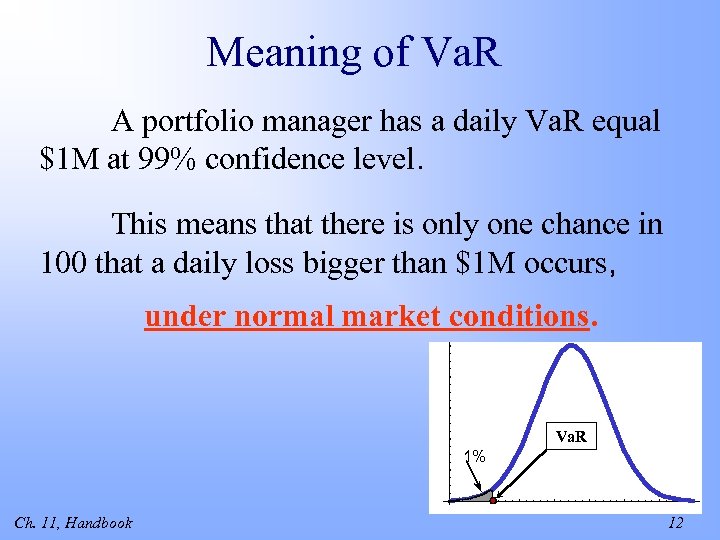

Meaning of Va. R A portfolio manager has a daily Va. R equal $1 M at 99% confidence level. This means that there is only one chance in 100 that a daily loss bigger than $1 M occurs, under normal market conditions. Va. R 1% Ch. 11, Handbook 12

Meaning of Va. R A portfolio manager has a daily Va. R equal $1 M at 99% confidence level. This means that there is only one chance in 100 that a daily loss bigger than $1 M occurs, under normal market conditions. Va. R 1% Ch. 11, Handbook 12

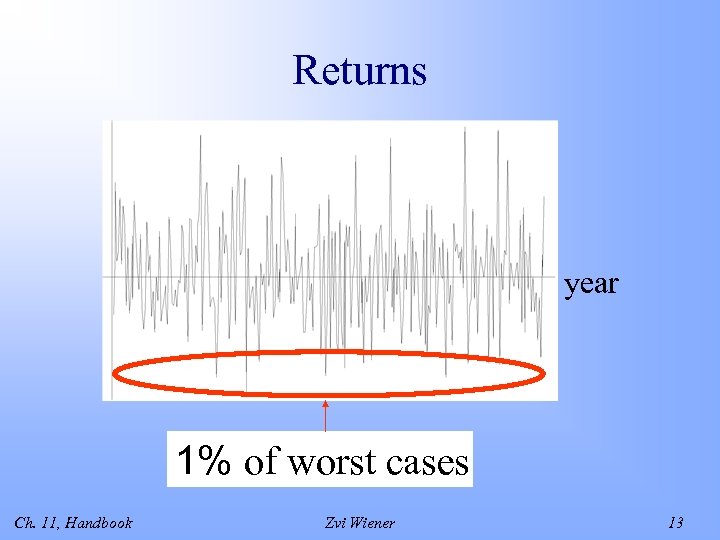

Returns year 1% of worst cases Ch. 11, Handbook Zvi Wiener 13

Returns year 1% of worst cases Ch. 11, Handbook Zvi Wiener 13

Main Ideas • A few well known risk factors • Historical data + economic views • Diversification effects • Testability • Easy to communicate Ch. 11, Handbook Zvi Wiener 14

Main Ideas • A few well known risk factors • Historical data + economic views • Diversification effects • Testability • Easy to communicate Ch. 11, Handbook Zvi Wiener 14

History of Va. R • ’ 80 s - major US banks - proprietary • 93 G-30 recommendations • - 94 Risk. Metrics by J. P. Morgan • - 98 Basel • SEC, FSA, ISDA, pension funds, dealers • Widely used and misused! Ch. 11, Handbook Zvi Wiener 15

History of Va. R • ’ 80 s - major US banks - proprietary • 93 G-30 recommendations • - 94 Risk. Metrics by J. P. Morgan • - 98 Basel • SEC, FSA, ISDA, pension funds, dealers • Widely used and misused! Ch. 11, Handbook Zvi Wiener 15

FRM-99, Question 89 What is the correct interpretation of a $3 overnight Va. R figure with 99% confidence level? A. expect to lose at most $3 in 1 out of next 100 days B. expect to lose at least $3 in 95 out of next 100 days C. expect to lose at least $3 in 1 out of next 100 days D. expect to lose at most $6 in 2 out of next 100 days Ch. 11, Handbook Zvi Wiener 16

FRM-99, Question 89 What is the correct interpretation of a $3 overnight Va. R figure with 99% confidence level? A. expect to lose at most $3 in 1 out of next 100 days B. expect to lose at least $3 in 95 out of next 100 days C. expect to lose at least $3 in 1 out of next 100 days D. expect to lose at most $6 in 2 out of next 100 days Ch. 11, Handbook Zvi Wiener 16

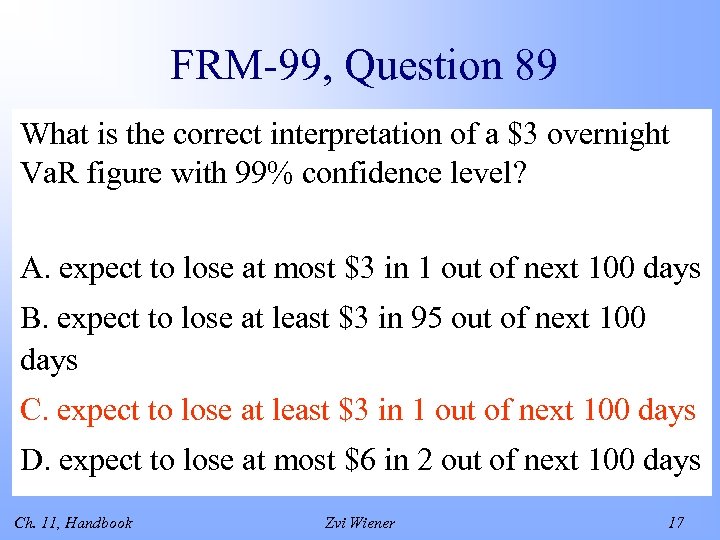

FRM-99, Question 89 What is the correct interpretation of a $3 overnight Va. R figure with 99% confidence level? A. expect to lose at most $3 in 1 out of next 100 days B. expect to lose at least $3 in 95 out of next 100 days C. expect to lose at least $3 in 1 out of next 100 days D. expect to lose at most $6 in 2 out of next 100 days Ch. 11, Handbook Zvi Wiener 17

FRM-99, Question 89 What is the correct interpretation of a $3 overnight Va. R figure with 99% confidence level? A. expect to lose at most $3 in 1 out of next 100 days B. expect to lose at least $3 in 95 out of next 100 days C. expect to lose at least $3 in 1 out of next 100 days D. expect to lose at most $6 in 2 out of next 100 days Ch. 11, Handbook Zvi Wiener 17

Va. R caveats • Va. R does not describe the worst loss • Va. R does not describe losses in the left tail • Va. R is measured with some error Ch. 11, Handbook Zvi Wiener 18

Va. R caveats • Va. R does not describe the worst loss • Va. R does not describe losses in the left tail • Va. R is measured with some error Ch. 11, Handbook Zvi Wiener 18

Other Measures of Risk • The entire distribution • The expected left tail loss • The standard deviation • The semi-standard deviation Ch. 11, Handbook Zvi Wiener 19

Other Measures of Risk • The entire distribution • The expected left tail loss • The standard deviation • The semi-standard deviation Ch. 11, Handbook Zvi Wiener 19

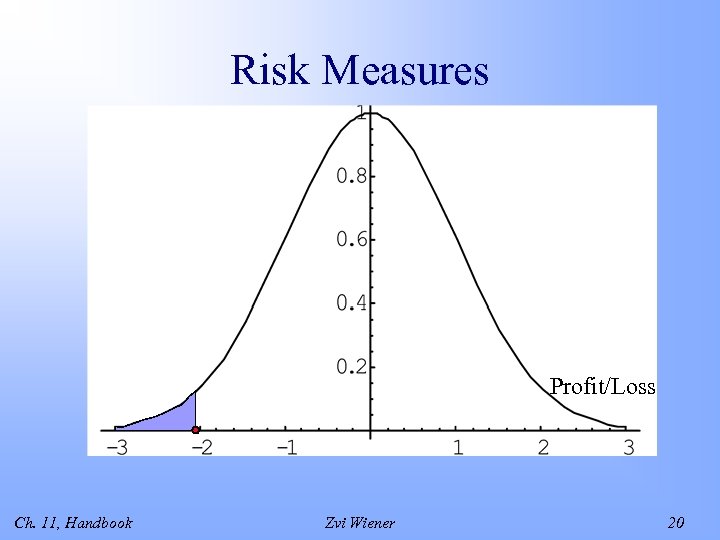

Risk Measures Profit/Loss Ch. 11, Handbook Zvi Wiener 20

Risk Measures Profit/Loss Ch. 11, Handbook Zvi Wiener 20

Properties of Risk Measure • Monotonicity (X

Properties of Risk Measure • Monotonicity (X

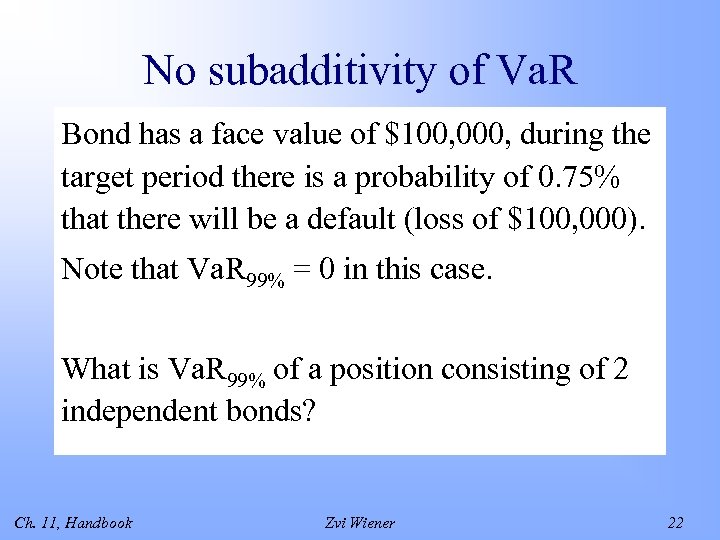

No subadditivity of Va. R Bond has a face value of $100, 000, during the target period there is a probability of 0. 75% that there will be a default (loss of $100, 000). Note that Va. R 99% = 0 in this case. What is Va. R 99% of a position consisting of 2 independent bonds? Ch. 11, Handbook Zvi Wiener 22

No subadditivity of Va. R Bond has a face value of $100, 000, during the target period there is a probability of 0. 75% that there will be a default (loss of $100, 000). Note that Va. R 99% = 0 in this case. What is Va. R 99% of a position consisting of 2 independent bonds? Ch. 11, Handbook Zvi Wiener 22

FRM-98, Question 22 Consider arbitrary portfolios A and B and their combined portfolio C. Which of the following relationships always holds for Va. Rs of A, B, and C? A. Va. RA+ Va. RB = Va. RC B. Va. RA+ Va. RB Va. RC C. Va. RA+ Va. RB Va. RC D. None of the above Ch. 11, Handbook Zvi Wiener 23

FRM-98, Question 22 Consider arbitrary portfolios A and B and their combined portfolio C. Which of the following relationships always holds for Va. Rs of A, B, and C? A. Va. RA+ Va. RB = Va. RC B. Va. RA+ Va. RB Va. RC C. Va. RA+ Va. RB Va. RC D. None of the above Ch. 11, Handbook Zvi Wiener 23

FRM-98, Question 22 Consider arbitrary portfolios A and B and their combined portfolio C. Which of the following relationships always holds for Va. Rs of A, B, and C? A. Va. RA+ Va. RB = Va. RC B. Va. RA+ Va. RB Va. RC C. Va. RA+ Va. RB Va. RC D. None of the above Ch. 11, Handbook Zvi Wiener 24

FRM-98, Question 22 Consider arbitrary portfolios A and B and their combined portfolio C. Which of the following relationships always holds for Va. Rs of A, B, and C? A. Va. RA+ Va. RB = Va. RC B. Va. RA+ Va. RB Va. RC C. Va. RA+ Va. RB Va. RC D. None of the above Ch. 11, Handbook Zvi Wiener 24

Confidence level low confidence leads to an imprecise result. For example 99. 99% and 10 business days will require history of 100*10 = 100, 000 days in order to have only 1 point. Ch. 11, Handbook Zvi Wiener 25

Confidence level low confidence leads to an imprecise result. For example 99. 99% and 10 business days will require history of 100*10 = 100, 000 days in order to have only 1 point. Ch. 11, Handbook Zvi Wiener 25

Time horizon long time horizon can lead to an imprecise result. 1% - 10 days means that we will see such a loss approximately once in 100*10 = 3 years. 5% and 1 day horizon means once in a month. Various subportfolios may require various horizons. Ch. 11, Handbook Zvi Wiener 26

Time horizon long time horizon can lead to an imprecise result. 1% - 10 days means that we will see such a loss approximately once in 100*10 = 3 years. 5% and 1 day horizon means once in a month. Various subportfolios may require various horizons. Ch. 11, Handbook Zvi Wiener 26

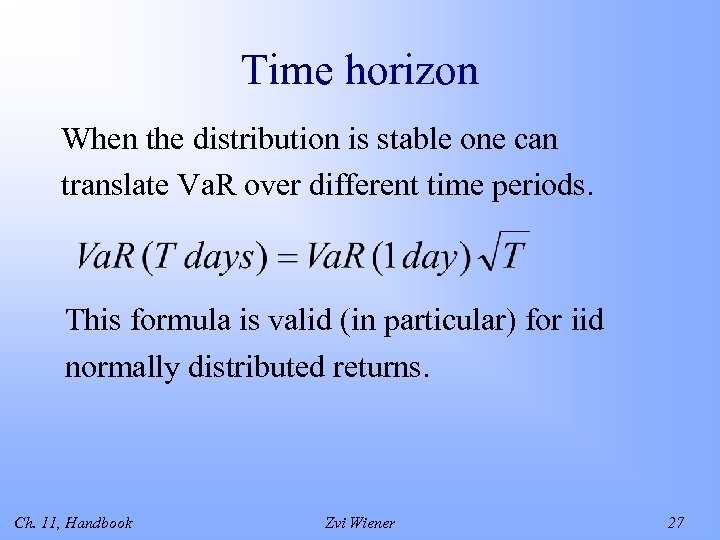

Time horizon When the distribution is stable one can translate Va. R over different time periods. This formula is valid (in particular) for iid normally distributed returns. Ch. 11, Handbook Zvi Wiener 27

Time horizon When the distribution is stable one can translate Va. R over different time periods. This formula is valid (in particular) for iid normally distributed returns. Ch. 11, Handbook Zvi Wiener 27

FRM-97, Question 7 To convert Va. R from a one day holding period to a ten day holding period the Va. R number is generally multiplied by: A. 2. 33 B. 3. 16 C. 7. 25 D. 10 Ch. 11, Handbook Zvi Wiener 28

FRM-97, Question 7 To convert Va. R from a one day holding period to a ten day holding period the Va. R number is generally multiplied by: A. 2. 33 B. 3. 16 C. 7. 25 D. 10 Ch. 11, Handbook Zvi Wiener 28

FRM-97, Question 7 To convert Va. R from a one day holding period to a ten day holding period the Va. R number is generally multiplied by: A. 2. 33 B. 3. 16 C. 7. 25 D. 10 Ch. 11, Handbook Zvi Wiener 29

FRM-97, Question 7 To convert Va. R from a one day holding period to a ten day holding period the Va. R number is generally multiplied by: A. 2. 33 B. 3. 16 C. 7. 25 D. 10 Ch. 11, Handbook Zvi Wiener 29

Basel Rules • horizon of 10 business days • 99% confidence interval • an observation period of at least a year of historical data, updated once a quarter Ch. 11, Handbook Zvi Wiener 30

Basel Rules • horizon of 10 business days • 99% confidence interval • an observation period of at least a year of historical data, updated once a quarter Ch. 11, Handbook Zvi Wiener 30

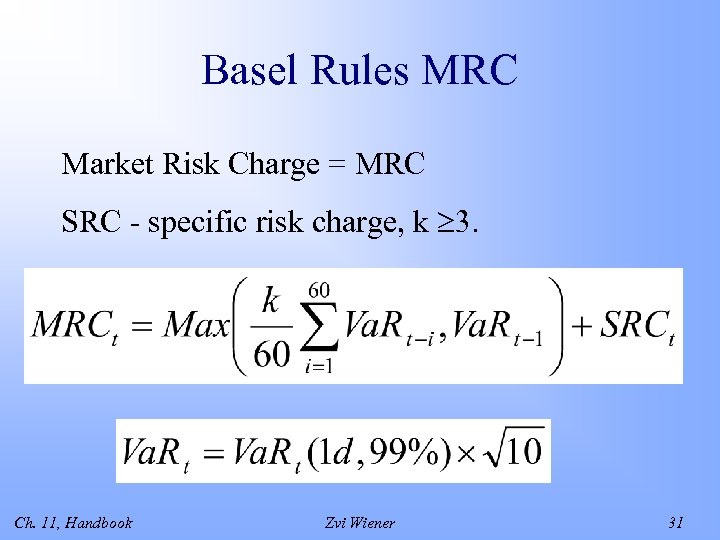

Basel Rules MRC Market Risk Charge = MRC SRC - specific risk charge, k 3. Ch. 11, Handbook Zvi Wiener 31

Basel Rules MRC Market Risk Charge = MRC SRC - specific risk charge, k 3. Ch. 11, Handbook Zvi Wiener 31

FRM-97, Question 16 Which of the following quantitative standards is NOT required by the Amendment to the Capital Accord to Incorporate Market Risk? A. Minimum holding period of 10 days B. 99% one-tailed confidence interval C. Minimum historical observations of two years D. Update the data sets at least quarterly Ch. 11, Handbook Zvi Wiener 32

FRM-97, Question 16 Which of the following quantitative standards is NOT required by the Amendment to the Capital Accord to Incorporate Market Risk? A. Minimum holding period of 10 days B. 99% one-tailed confidence interval C. Minimum historical observations of two years D. Update the data sets at least quarterly Ch. 11, Handbook Zvi Wiener 32

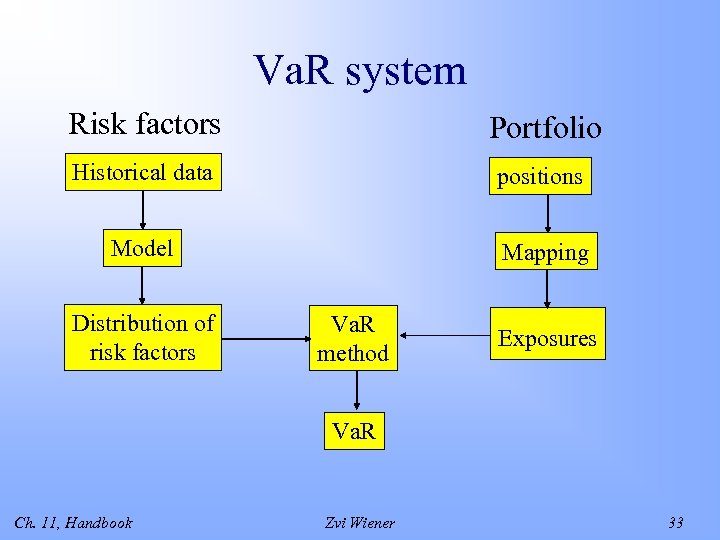

Va. R system Risk factors Portfolio Historical data positions Model Mapping Distribution of risk factors Va. R method Exposures Va. R Ch. 11, Handbook Zvi Wiener 33

Va. R system Risk factors Portfolio Historical data positions Model Mapping Distribution of risk factors Va. R method Exposures Va. R Ch. 11, Handbook Zvi Wiener 33

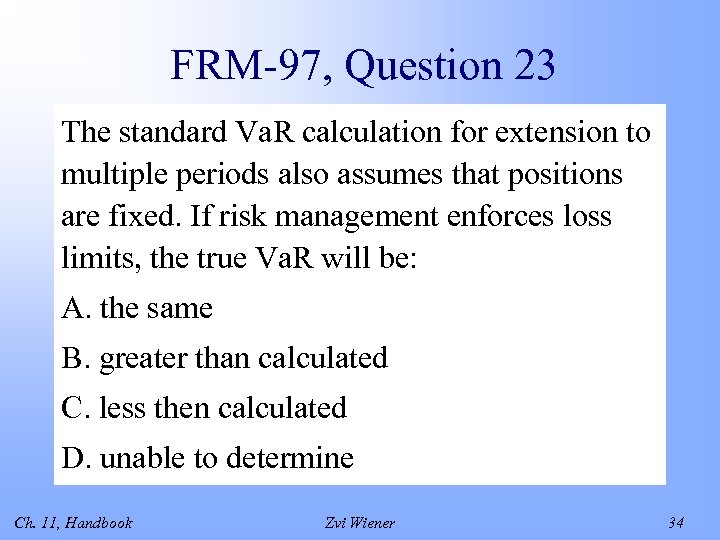

FRM-97, Question 23 The standard Va. R calculation for extension to multiple periods also assumes that positions are fixed. If risk management enforces loss limits, the true Va. R will be: A. the same B. greater than calculated C. less then calculated D. unable to determine Ch. 11, Handbook Zvi Wiener 34

FRM-97, Question 23 The standard Va. R calculation for extension to multiple periods also assumes that positions are fixed. If risk management enforces loss limits, the true Va. R will be: A. the same B. greater than calculated C. less then calculated D. unable to determine Ch. 11, Handbook Zvi Wiener 34

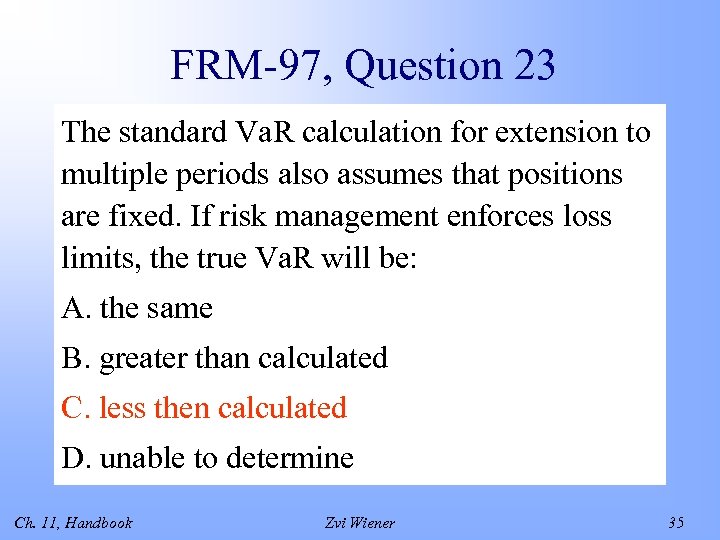

FRM-97, Question 23 The standard Va. R calculation for extension to multiple periods also assumes that positions are fixed. If risk management enforces loss limits, the true Va. R will be: A. the same B. greater than calculated C. less then calculated D. unable to determine Ch. 11, Handbook Zvi Wiener 35

FRM-97, Question 23 The standard Va. R calculation for extension to multiple periods also assumes that positions are fixed. If risk management enforces loss limits, the true Va. R will be: A. the same B. greater than calculated C. less then calculated D. unable to determine Ch. 11, Handbook Zvi Wiener 35

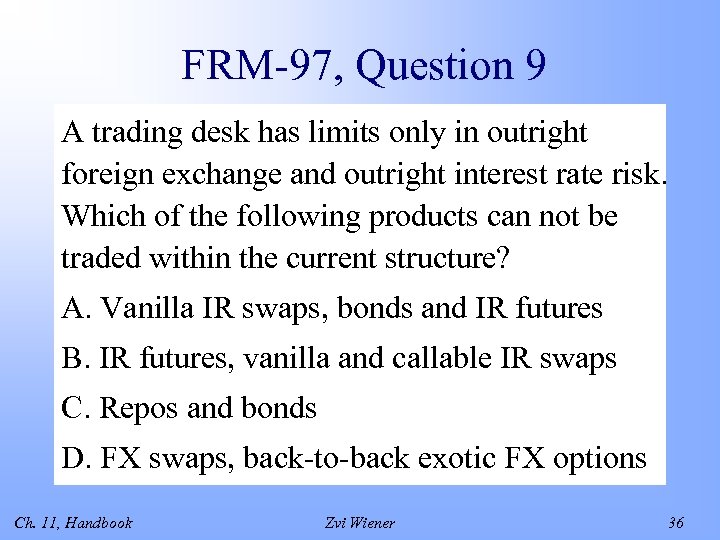

FRM-97, Question 9 A trading desk has limits only in outright foreign exchange and outright interest rate risk. Which of the following products can not be traded within the current structure? A. Vanilla IR swaps, bonds and IR futures B. IR futures, vanilla and callable IR swaps C. Repos and bonds D. FX swaps, back-to-back exotic FX options Ch. 11, Handbook Zvi Wiener 36

FRM-97, Question 9 A trading desk has limits only in outright foreign exchange and outright interest rate risk. Which of the following products can not be traded within the current structure? A. Vanilla IR swaps, bonds and IR futures B. IR futures, vanilla and callable IR swaps C. Repos and bonds D. FX swaps, back-to-back exotic FX options Ch. 11, Handbook Zvi Wiener 36

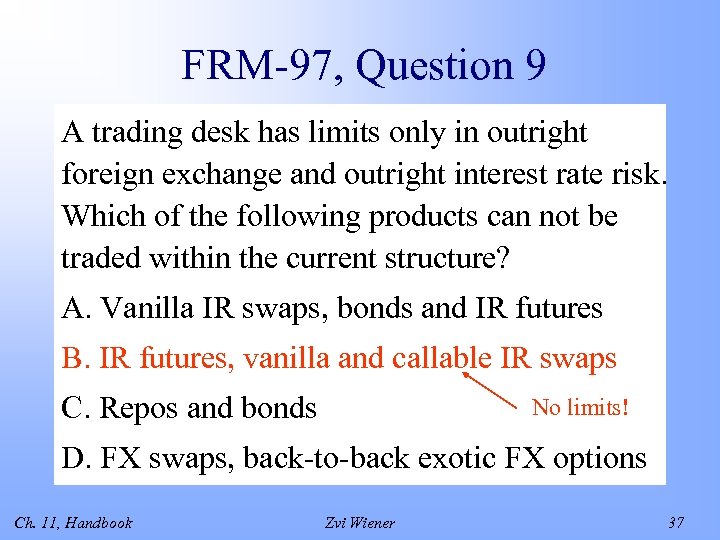

FRM-97, Question 9 A trading desk has limits only in outright foreign exchange and outright interest rate risk. Which of the following products can not be traded within the current structure? A. Vanilla IR swaps, bonds and IR futures B. IR futures, vanilla and callable IR swaps C. Repos and bonds No limits! D. FX swaps, back-to-back exotic FX options Ch. 11, Handbook Zvi Wiener 37

FRM-97, Question 9 A trading desk has limits only in outright foreign exchange and outright interest rate risk. Which of the following products can not be traded within the current structure? A. Vanilla IR swaps, bonds and IR futures B. IR futures, vanilla and callable IR swaps C. Repos and bonds No limits! D. FX swaps, back-to-back exotic FX options Ch. 11, Handbook Zvi Wiener 37

Stress-testing • scenario analysis • stressing models, volatilities and correlations • developing policy responses Ch. 11, Handbook Zvi Wiener 38

Stress-testing • scenario analysis • stressing models, volatilities and correlations • developing policy responses Ch. 11, Handbook Zvi Wiener 38

Scenario Analysis • Moving key variables one at a time • Using historical scenarios • Creating prospective scenarios The goal is to identify areas of potential vulnerability. Ch. 11, Handbook Zvi Wiener 39

Scenario Analysis • Moving key variables one at a time • Using historical scenarios • Creating prospective scenarios The goal is to identify areas of potential vulnerability. Ch. 11, Handbook Zvi Wiener 39

FRM-97, Question 4 The use of scenario analysis allows one to: A. assess the behavior of portfolios under large moves B. research market shocks which occurred in the past C. analyze the distribution of historical P&L D. perform effective back-testing Ch. 11, Handbook Zvi Wiener 40

FRM-97, Question 4 The use of scenario analysis allows one to: A. assess the behavior of portfolios under large moves B. research market shocks which occurred in the past C. analyze the distribution of historical P&L D. perform effective back-testing Ch. 11, Handbook Zvi Wiener 40

FRM-98, Question 20 Va. R measure should be supplemented by portfolio stress-testing because: A. Va. R measures indicate that the minimum is Va. R, they do not indicate the actual loss B. stress testing provides a precise maximum loss level C. Va. R measures are correct only 95% of time D. stress testing scenarios incorporate reasonably probable events. Ch. 11, Handbook Zvi Wiener 41

FRM-98, Question 20 Va. R measure should be supplemented by portfolio stress-testing because: A. Va. R measures indicate that the minimum is Va. R, they do not indicate the actual loss B. stress testing provides a precise maximum loss level C. Va. R measures are correct only 95% of time D. stress testing scenarios incorporate reasonably probable events. Ch. 11, Handbook Zvi Wiener 41

FRM-00, Question 105 Va. R analysis should be complemented by stress -testing because stress-testing: A. Provides a maximum loss in dollars. B. Summarizes the expected loss over a target horizon within a minimum confidence interval. C. Assesses the behavior of portfolio at a 99% confidence level. D. Identifies losses that go beyond the normal losses measured by Va. R. Ch. 11, Handbook Zvi Wiener 42

FRM-00, Question 105 Va. R analysis should be complemented by stress -testing because stress-testing: A. Provides a maximum loss in dollars. B. Summarizes the expected loss over a target horizon within a minimum confidence interval. C. Assesses the behavior of portfolio at a 99% confidence level. D. Identifies losses that go beyond the normal losses measured by Va. R. Ch. 11, Handbook Zvi Wiener 42