ce3b50470e5d572a3800ad1b1b2b9b2e.ppt

- Количество слайдов: 89

Financial Risk Management Zvi Wiener 02 -588 -3049 http: //pluto. mscc. huji. ac. il/~mswiener/zvi. html Jan-02 Risk Management

Financial Risk Management Zvi Wiener 02 -588 -3049 http: //pluto. mscc. huji. ac. il/~mswiener/zvi. html Jan-02 Risk Management

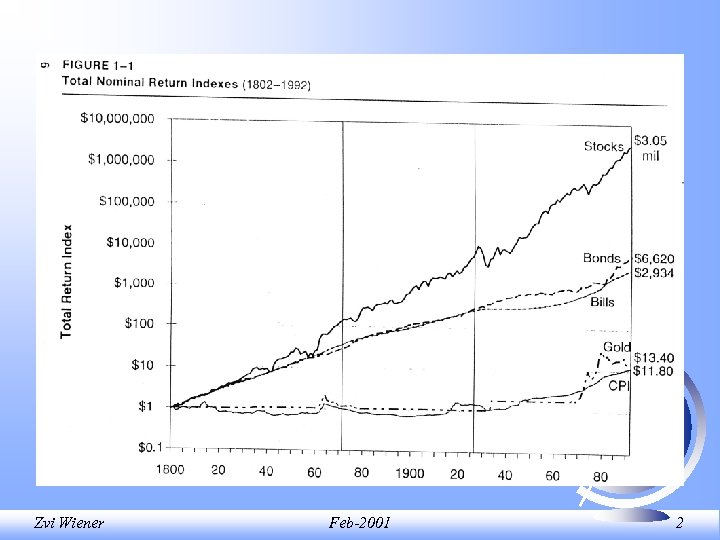

Zvi Wiener Feb-2001 2

Zvi Wiener Feb-2001 2

Risk • Business Risk • Financial Risk – market risk – credit risk – liquidity risk • • Zvi Wiener Operational Risk Legal Risk Feb-2001 3

Risk • Business Risk • Financial Risk – market risk – credit risk – liquidity risk • • Zvi Wiener Operational Risk Legal Risk Feb-2001 3

Risk Management • Examples of good and bad risk management • Good or bad risk management is NOT the same as profits and losses. • There are many examples of good RM that lead to losses and bad RM that lead to gains. Zvi Wiener Feb-2001 4

Risk Management • Examples of good and bad risk management • Good or bad risk management is NOT the same as profits and losses. • There are many examples of good RM that lead to losses and bad RM that lead to gains. Zvi Wiener Feb-2001 4

Barings • • 233 year old bank • 28 year old Nick Leeson • $1, 300, 000 loss • Zvi Wiener February 26, 1995 bought by ING for $1. 5 Feb-2001 5

Barings • • 233 year old bank • 28 year old Nick Leeson • $1, 300, 000 loss • Zvi Wiener February 26, 1995 bought by ING for $1. 5 Feb-2001 5

Metallgesellshaft 14 th largest industrial group • 58, 000 employees • offered long term oil contracts • hedge by long-term forward contracts • short term contracts were used (rolling hedge) • 1993 price fell from $20 to $15 • $1 B margin call in cash • Zvi Wiener Feb-2001 6

Metallgesellshaft 14 th largest industrial group • 58, 000 employees • offered long term oil contracts • hedge by long-term forward contracts • short term contracts were used (rolling hedge) • 1993 price fell from $20 to $15 • $1 B margin call in cash • Zvi Wiener Feb-2001 6

Orange County • Bob Citron, the county treasures • $7. 5 B portfolio (schools, cities) • borrowed $12. 5 B, invested in 5 yr. notes • interest rates increased • reported at cost - big mistake! • realized loss of $1. 64 B Zvi Wiener Feb-2001 7

Orange County • Bob Citron, the county treasures • $7. 5 B portfolio (schools, cities) • borrowed $12. 5 B, invested in 5 yr. notes • interest rates increased • reported at cost - big mistake! • realized loss of $1. 64 B Zvi Wiener Feb-2001 7

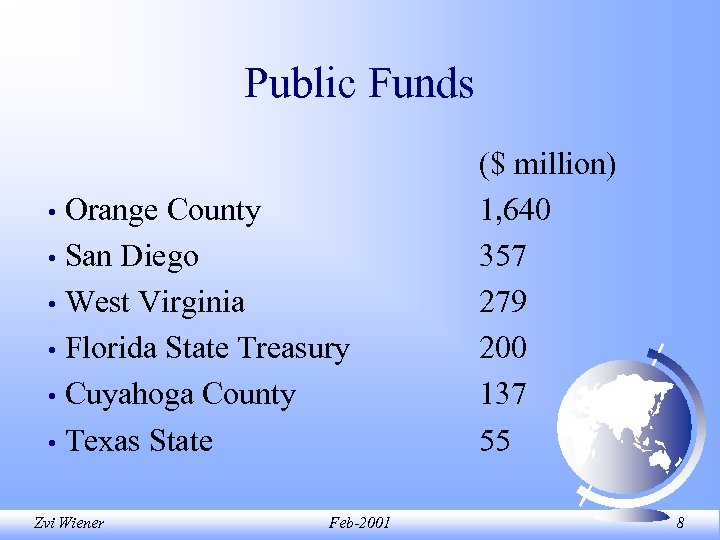

Public Funds Orange County • San Diego • West Virginia • Florida State Treasury • Cuyahoga County • Texas State • Zvi Wiener Feb-2001 ($ million) 1, 640 357 279 200 137 55 8

Public Funds Orange County • San Diego • West Virginia • Florida State Treasury • Cuyahoga County • Texas State • Zvi Wiener Feb-2001 ($ million) 1, 640 357 279 200 137 55 8

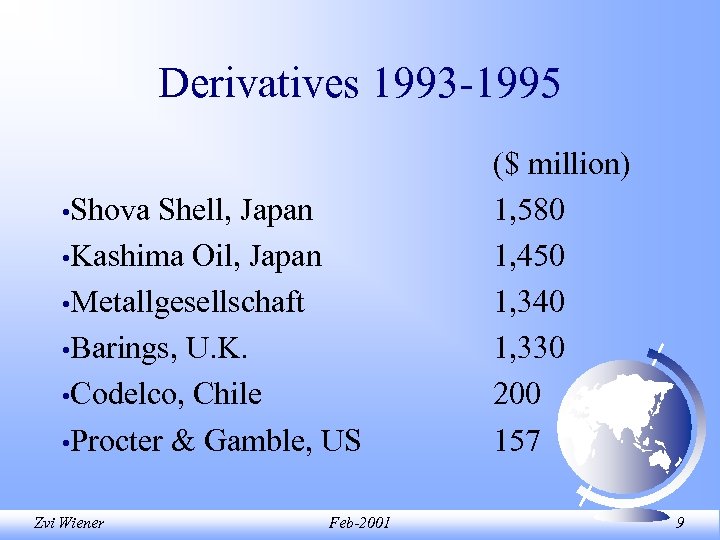

Derivatives 1993 -1995 • Shova Shell, Japan • Kashima Oil, Japan • Metallgesellschaft • Barings, U. K. • Codelco, Chile • Procter & Gamble, US Zvi Wiener Feb-2001 ($ million) 1, 580 1, 450 1, 340 1, 330 200 157 9

Derivatives 1993 -1995 • Shova Shell, Japan • Kashima Oil, Japan • Metallgesellschaft • Barings, U. K. • Codelco, Chile • Procter & Gamble, US Zvi Wiener Feb-2001 ($ million) 1, 580 1, 450 1, 340 1, 330 200 157 9

Investec Clali, Jan-01 Client bought put options without sufficient funds. Loss is 8 -15 M NIS. Zvi Wiener Feb-2001 10

Investec Clali, Jan-01 Client bought put options without sufficient funds. Loss is 8 -15 M NIS. Zvi Wiener Feb-2001 10

Financial Losses Barings • Bank Negara, Malaysia 92 • Banesto, Spain • Credit Lyonnais • S&L, U. S. A. • Japan • Zvi Wiener Feb-2001 $1. 3 B $4. 7 B $10 B $150 B $500 B 11

Financial Losses Barings • Bank Negara, Malaysia 92 • Banesto, Spain • Credit Lyonnais • S&L, U. S. A. • Japan • Zvi Wiener Feb-2001 $1. 3 B $4. 7 B $10 B $150 B $500 B 11

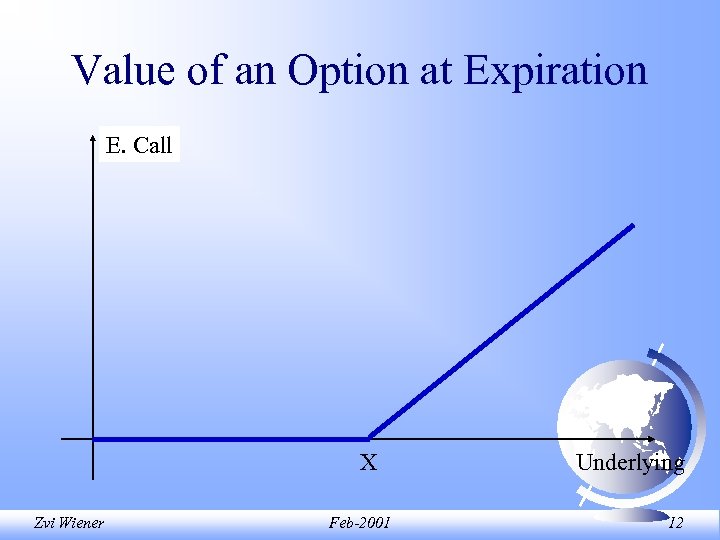

Value of an Option at Expiration E. Call X Zvi Wiener Feb-2001 Underlying 12

Value of an Option at Expiration E. Call X Zvi Wiener Feb-2001 Underlying 12

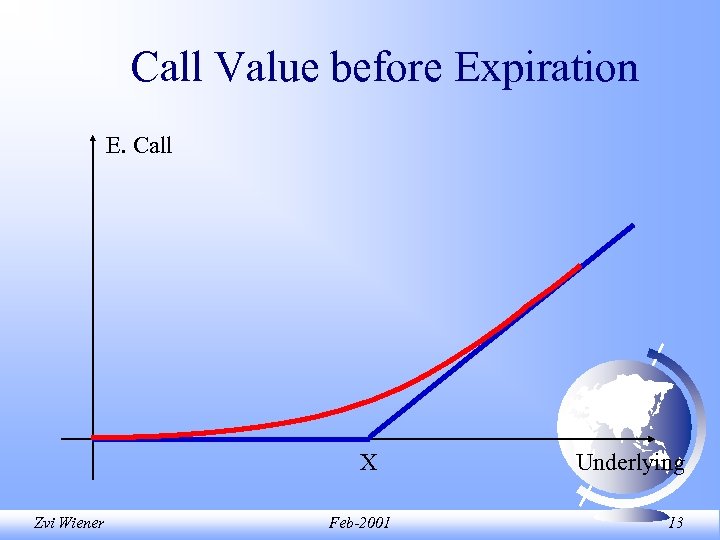

Call Value before Expiration E. Call X Zvi Wiener Feb-2001 Underlying 13

Call Value before Expiration E. Call X Zvi Wiener Feb-2001 Underlying 13

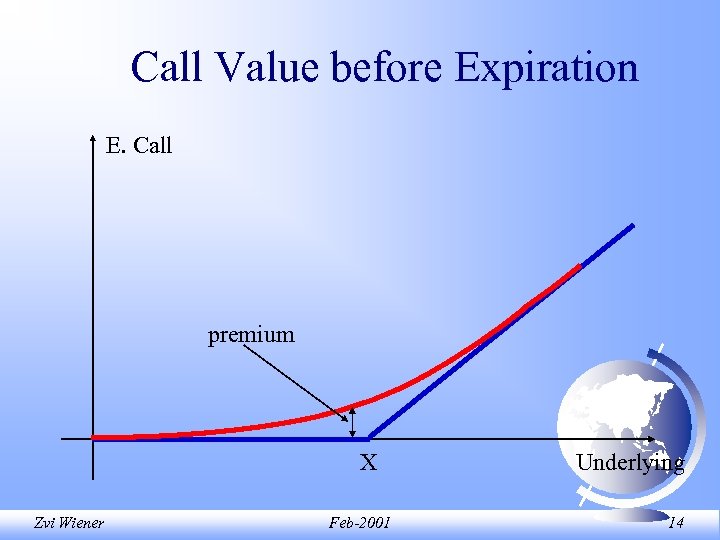

Call Value before Expiration E. Call premium X Zvi Wiener Feb-2001 Underlying 14

Call Value before Expiration E. Call premium X Zvi Wiener Feb-2001 Underlying 14

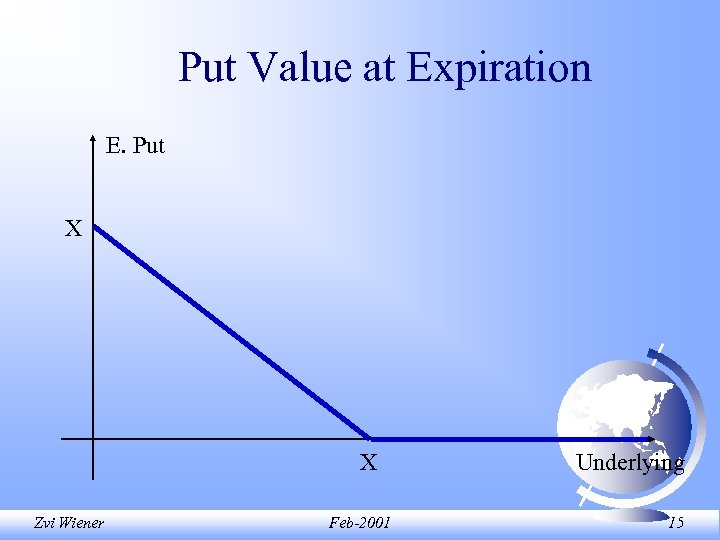

Put Value at Expiration E. Put X X Zvi Wiener Feb-2001 Underlying 15

Put Value at Expiration E. Put X X Zvi Wiener Feb-2001 Underlying 15

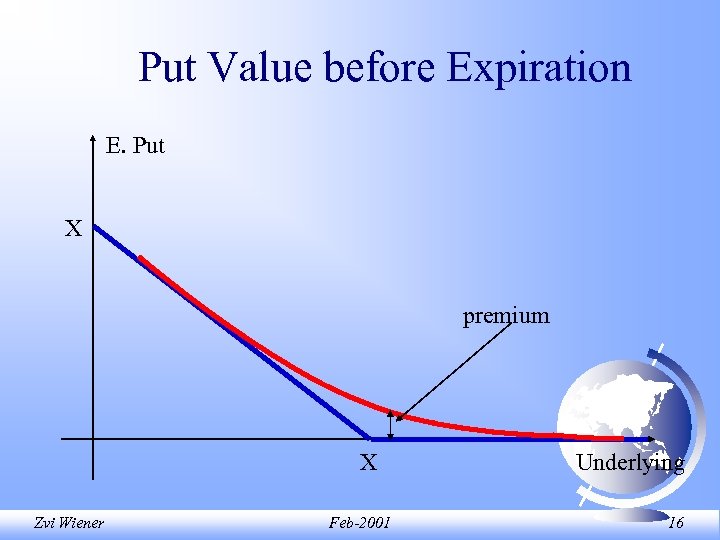

Put Value before Expiration E. Put X premium X Zvi Wiener Feb-2001 Underlying 16

Put Value before Expiration E. Put X premium X Zvi Wiener Feb-2001 Underlying 16

Collar • Firm B has shares of firm C of value $200 M They do not want to sell the shares, but need money. • Moreover they would like to decrease the exposure to financial risk. • • How to get it done? Zvi Wiener Feb-2001 17

Collar • Firm B has shares of firm C of value $200 M They do not want to sell the shares, but need money. • Moreover they would like to decrease the exposure to financial risk. • • How to get it done? Zvi Wiener Feb-2001 17

Collar 1. Buy a protective Put option (3 y to maturity, strike = 90% of spot). 2. Sell an out-the-money Call option (3 y to maturity, strike above spot). 3. Take a “cheap” loan at 90% of the current value. Zvi Wiener Feb-2001 18

Collar 1. Buy a protective Put option (3 y to maturity, strike = 90% of spot). 2. Sell an out-the-money Call option (3 y to maturity, strike above spot). 3. Take a “cheap” loan at 90% of the current value. Zvi Wiener Feb-2001 18

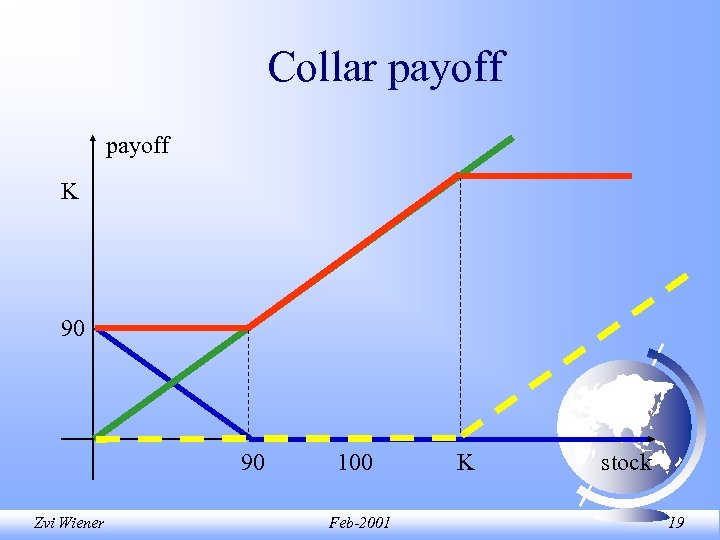

Collar payoff K 90 90 Zvi Wiener 100 Feb-2001 K stock 19

Collar payoff K 90 90 Zvi Wiener 100 Feb-2001 K stock 19

Options in Hi Tech Many firms give options as a part of compensation. There is a vesting period and then there is a longer time to expiration. Most employees exercise the options at vesting with same-day-sale (because of tax). How this can be improved? Zvi Wiener Feb-2001 20

Options in Hi Tech Many firms give options as a part of compensation. There is a vesting period and then there is a longer time to expiration. Most employees exercise the options at vesting with same-day-sale (because of tax). How this can be improved? Zvi Wiener Feb-2001 20

Long term options payoff Your option K Result 50 k Zvi Wiener K Feb-2001 Sell a call stock 21

Long term options payoff Your option K Result 50 k Zvi Wiener K Feb-2001 Sell a call stock 21

Example You have 10, 000 vested options for 10 years with strike $5, while the stock is traded at $10. An immediate exercise will give you $50, 000 before tax. Selling a (covered) call with strike $15 will give you $60, 000 now (assuming interest rate 6% and 50% volatility) and additional profit at the end of the period! Zvi Wiener Feb-2001 22

Example You have 10, 000 vested options for 10 years with strike $5, while the stock is traded at $10. An immediate exercise will give you $50, 000 before tax. Selling a (covered) call with strike $15 will give you $60, 000 now (assuming interest rate 6% and 50% volatility) and additional profit at the end of the period! Zvi Wiener Feb-2001 22

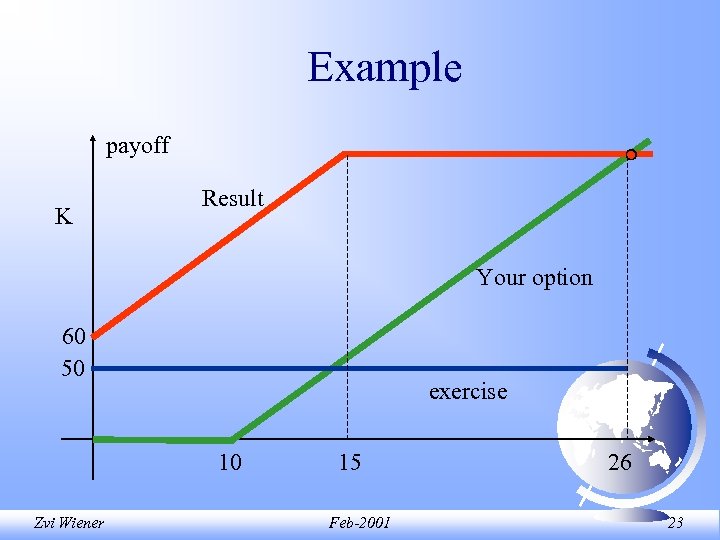

Example payoff K Result Your option 60 50 exercise 10 Zvi Wiener 15 Feb-2001 26 23

Example payoff K Result Your option 60 50 exercise 10 Zvi Wiener 15 Feb-2001 26 23

How much can we lose? Everything correct, but useless answer. How much can we lose realistically? Zvi Wiener Feb-2001 24

How much can we lose? Everything correct, but useless answer. How much can we lose realistically? Zvi Wiener Feb-2001 24

What is the current Risk? Bonds • Stocks • Options • Credit • Forex • Total • Zvi Wiener duration, convexity volatility delta, gamma, vega rating target zone ? Feb-2001 25

What is the current Risk? Bonds • Stocks • Options • Credit • Forex • Total • Zvi Wiener duration, convexity volatility delta, gamma, vega rating target zone ? Feb-2001 25

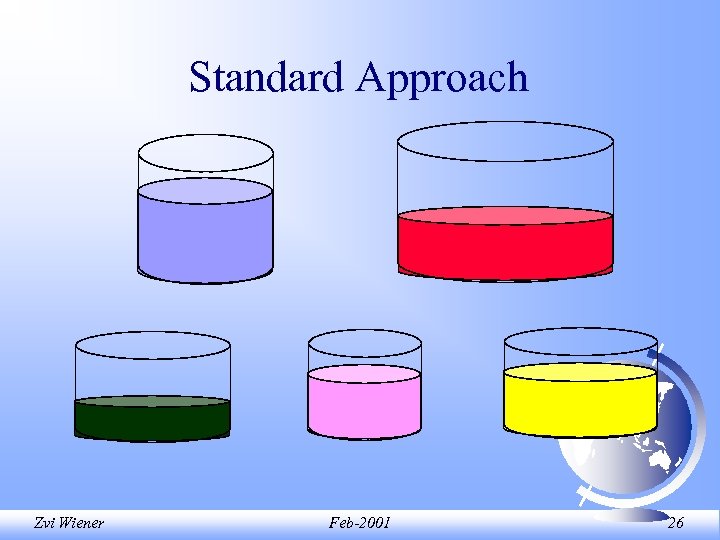

Standard Approach Zvi Wiener Feb-2001 26

Standard Approach Zvi Wiener Feb-2001 26

Modern Approach Financial Institution Zvi Wiener Feb-2001 27

Modern Approach Financial Institution Zvi Wiener Feb-2001 27

Risk Management • • Reporting to board • Limits monitoring • Diversification, reinsurance • Vetting • Reporting to regulators • Zvi Wiener Risk measurement Decision making based on risk Feb-2001 28

Risk Management • • Reporting to board • Limits monitoring • Diversification, reinsurance • Vetting • Reporting to regulators • Zvi Wiener Risk measurement Decision making based on risk Feb-2001 28

Who manages risk? Citibank AIG Nike Bank of England General Re Sony CIBC Swiss Re Dell Computers J. P. Morgan Aetna Philip Morris Bankers Trust Zurich Ford Motor Zvi Wiener Feb-2001 29

Who manages risk? Citibank AIG Nike Bank of England General Re Sony CIBC Swiss Re Dell Computers J. P. Morgan Aetna Philip Morris Bankers Trust Zurich Ford Motor Zvi Wiener Feb-2001 29

Regulators • • FSA • SEC • ISDA • FASB • Bank of Israel • Zvi Wiener BIS Galai’s committee Feb-2001 30

Regulators • • FSA • SEC • ISDA • FASB • Bank of Israel • Zvi Wiener BIS Galai’s committee Feb-2001 30

Basic Steps in RM process • • Data base (market + position) • Risk measurement • Regulators • Risk Management • Reporting • Zvi Wiener Identify risks Strategic decisions Feb-2001 31

Basic Steps in RM process • • Data base (market + position) • Risk measurement • Regulators • Risk Management • Reporting • Zvi Wiener Identify risks Strategic decisions Feb-2001 31

Building a RM system • • Decision, Risk Manager • Risk measurement system • Responsibilities and structure • Testing • Active Risk Management • Zvi Wiener Initial study of risks Staff training and maintenance Feb-2001 32

Building a RM system • • Decision, Risk Manager • Risk measurement system • Responsibilities and structure • Testing • Active Risk Management • Zvi Wiener Initial study of risks Staff training and maintenance Feb-2001 32

Risk Management and Risk Measurement Zvi Wiener Feb-2001 33

Risk Management and Risk Measurement Zvi Wiener Feb-2001 33

Risk Management System Can NOT Predict future • Identify business opportunities • Be always right! • Risk Management System Can Predict loss, given event • Identify most dangerous scenarios • Recommend how to change risk profile • Zvi Wiener Feb-2001 34

Risk Management System Can NOT Predict future • Identify business opportunities • Be always right! • Risk Management System Can Predict loss, given event • Identify most dangerous scenarios • Recommend how to change risk profile • Zvi Wiener Feb-2001 34

Tool, not rule! Limits, Duration, ALM, DFA, Va. R Zvi Wiener Feb-2001 35

Tool, not rule! Limits, Duration, ALM, DFA, Va. R Zvi Wiener Feb-2001 35

Definition Va. R is defined as the predicted worst-case loss at a specific confidence level (e. g. 99%) over a certain period of time. Zvi Wiener Feb-2001 36

Definition Va. R is defined as the predicted worst-case loss at a specific confidence level (e. g. 99%) over a certain period of time. Zvi Wiener Feb-2001 36

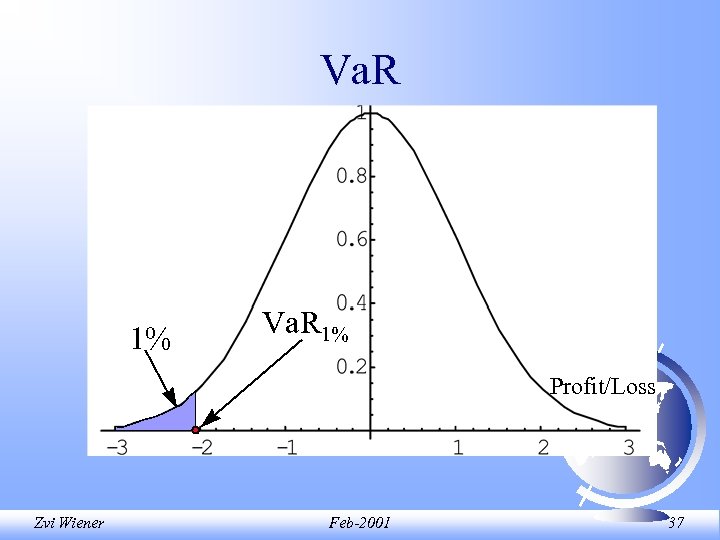

Va. R 1% Profit/Loss Zvi Wiener Feb-2001 37

Va. R 1% Profit/Loss Zvi Wiener Feb-2001 37

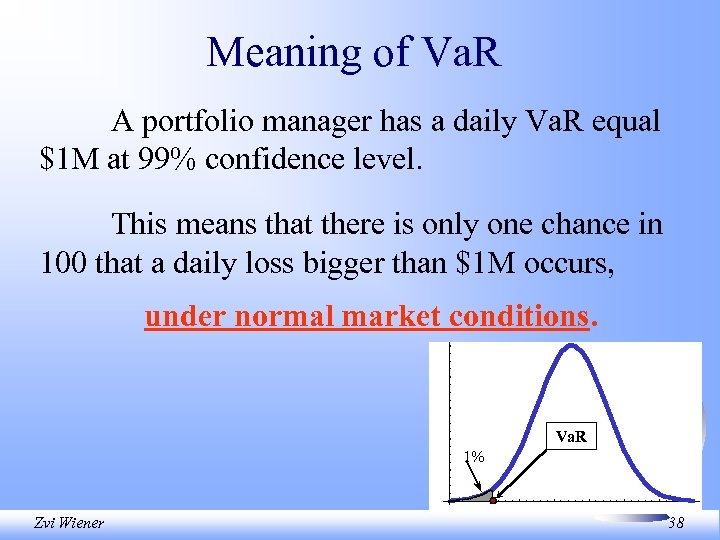

Meaning of Va. R A portfolio manager has a daily Va. R equal $1 M at 99% confidence level. This means that there is only one chance in 100 that a daily loss bigger than $1 M occurs, under normal market conditions. Va. R 1% Zvi Wiener 38

Meaning of Va. R A portfolio manager has a daily Va. R equal $1 M at 99% confidence level. This means that there is only one chance in 100 that a daily loss bigger than $1 M occurs, under normal market conditions. Va. R 1% Zvi Wiener 38

History of Va. R • 80’s - major US banks - proprietary • 93 G-30 recommendations • 94 - Risk. Metrics by J. P. Morgan • 98 - Basel • SEC, FSA, ISDA, pension funds, dealers • Widely used and misused! Zvi Wiener Feb-2001 39

History of Va. R • 80’s - major US banks - proprietary • 93 G-30 recommendations • 94 - Risk. Metrics by J. P. Morgan • 98 - Basel • SEC, FSA, ISDA, pension funds, dealers • Widely used and misused! Zvi Wiener Feb-2001 39

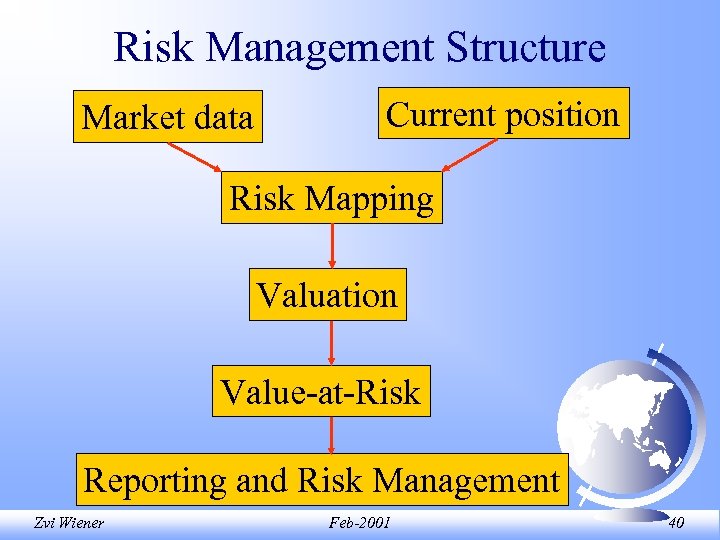

Risk Management Structure Market data Current position Risk Mapping Valuation Value-at-Risk Reporting and Risk Management Zvi Wiener Feb-2001 40

Risk Management Structure Market data Current position Risk Mapping Valuation Value-at-Risk Reporting and Risk Management Zvi Wiener Feb-2001 40

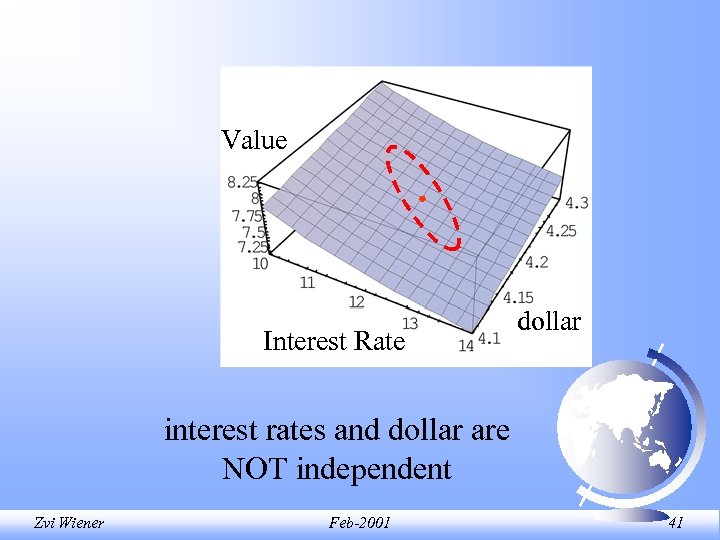

Value Interest Rate dollar interest rates and dollar are NOT independent Zvi Wiener Feb-2001 41

Value Interest Rate dollar interest rates and dollar are NOT independent Zvi Wiener Feb-2001 41

Risk Measuring Software CATS, CARMA • Algorithmics, Risk Watch • Infinity • J. P. Morgan, Four. Fifteen • FEA, Outlook • Reuters, Sailfish • Kamacura • Bankers Trust, RAROC • INSSINC, Orchestra • Zvi Wiener Feb-2001 42

Risk Measuring Software CATS, CARMA • Algorithmics, Risk Watch • Infinity • J. P. Morgan, Four. Fifteen • FEA, Outlook • Reuters, Sailfish • Kamacura • Bankers Trust, RAROC • INSSINC, Orchestra • Zvi Wiener Feb-2001 42

Qualitative Requirements An independent risk management unit • Board of directors involvement • Internal model as an integral part • Internal controller and risk model • Backtesting • Stress test • Zvi Wiener Feb-2001 43

Qualitative Requirements An independent risk management unit • Board of directors involvement • Internal model as an integral part • Internal controller and risk model • Backtesting • Stress test • Zvi Wiener Feb-2001 43

Quantitative Requirements 99% confidence interval • 10 business days horizon • At least one year of historic data • Data base revised at least every quarter • All types of risk exposure • Derivatives • Zvi Wiener Feb-2001 44

Quantitative Requirements 99% confidence interval • 10 business days horizon • At least one year of historic data • Data base revised at least every quarter • All types of risk exposure • Derivatives • Zvi Wiener Feb-2001 44

Types of Assets and Risks • Real projects - cashflow versus financing • Fixed Income • Optionality • Credit exposure • Legal, operational, authorities Zvi Wiener Feb-2001 45

Types of Assets and Risks • Real projects - cashflow versus financing • Fixed Income • Optionality • Credit exposure • Legal, operational, authorities Zvi Wiener Feb-2001 45

Risk Factors There are many bonds, stocks and currencies. The idea is to choose a small set of relevant economic factors and to map everything on these factors. • Exchange rates • Interest rates (for each maturity and indexation) • Spreads • Stock indices Zvi Wiener Feb-2001 46

Risk Factors There are many bonds, stocks and currencies. The idea is to choose a small set of relevant economic factors and to map everything on these factors. • Exchange rates • Interest rates (for each maturity and indexation) • Spreads • Stock indices Zvi Wiener Feb-2001 46

How to measure Va. R • • Variance-Covariance • Monte Carlo • Zvi Wiener Historical Simulations Analytical Methods Feb-2001 47

How to measure Va. R • • Variance-Covariance • Monte Carlo • Zvi Wiener Historical Simulations Analytical Methods Feb-2001 47

Historical Simulations • Fix current portfolio. • Pretend that market changes are similar to those observed in the past. • • Zvi Wiener Calculate P&L (profit-loss). Find the lowest quantile. Feb-2001 48

Historical Simulations • Fix current portfolio. • Pretend that market changes are similar to those observed in the past. • • Zvi Wiener Calculate P&L (profit-loss). Find the lowest quantile. Feb-2001 48

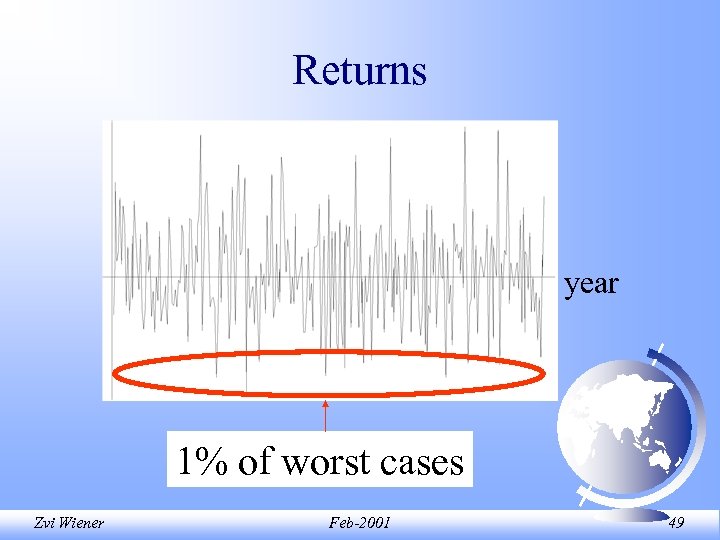

Returns year 1% of worst cases Zvi Wiener Feb-2001 49

Returns year 1% of worst cases Zvi Wiener Feb-2001 49

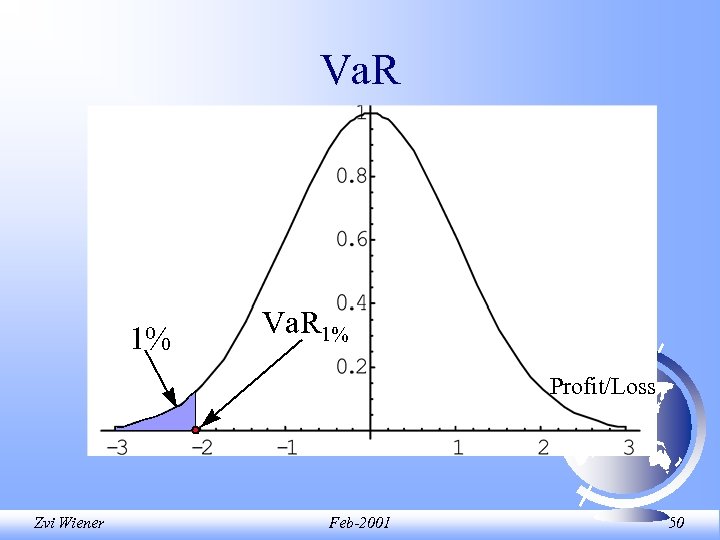

Va. R 1% Profit/Loss Zvi Wiener Feb-2001 50

Va. R 1% Profit/Loss Zvi Wiener Feb-2001 50

Weights Since old observations can be less relevant, there is a technique that assigns decreasing weights to older observations. Typically the decrease is exponential. See Risk. Metrics Technical Document for details. Zvi Wiener Feb-2001 51

Weights Since old observations can be less relevant, there is a technique that assigns decreasing weights to older observations. Typically the decrease is exponential. See Risk. Metrics Technical Document for details. Zvi Wiener Feb-2001 51

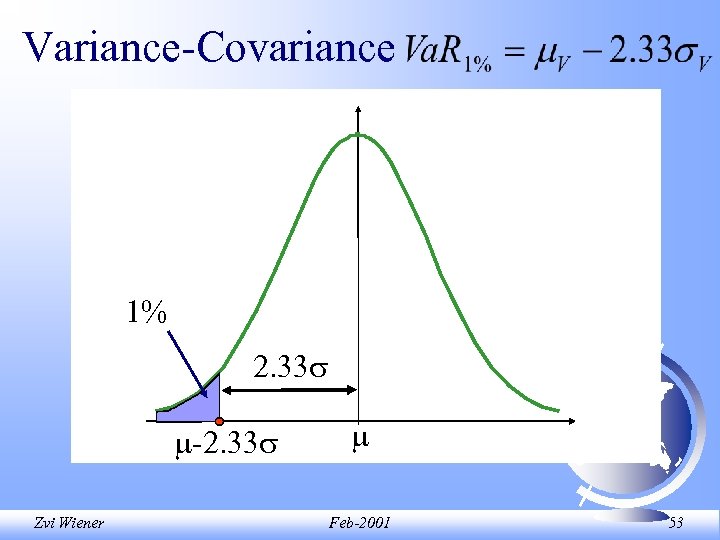

Variance Covariance • Means and covariances of market factors • Mean and standard deviation of the portfolio • Delta or Delta-Gamma approximation • Va. R 1%= P – 2. 33 P • Based on the normality assumption! Zvi Wiener Feb-2001 52

Variance Covariance • Means and covariances of market factors • Mean and standard deviation of the portfolio • Delta or Delta-Gamma approximation • Va. R 1%= P – 2. 33 P • Based on the normality assumption! Zvi Wiener Feb-2001 52

Variance-Covariance 1% 2. 33 -2. 33 Zvi Wiener Feb-2001 53

Variance-Covariance 1% 2. 33 -2. 33 Zvi Wiener Feb-2001 53

Monte Carlo Zvi Wiener Feb-2001 54

Monte Carlo Zvi Wiener Feb-2001 54

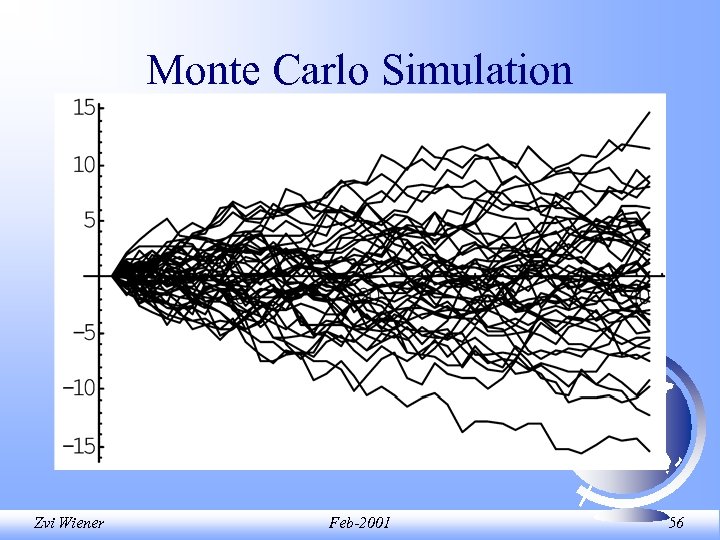

Monte Carlo • • Simulation of a large number of events • P&L for each scenario • Order the results • Zvi Wiener Distribution of market factors Va. R = lowest quantile Feb-2001 55

Monte Carlo • • Simulation of a large number of events • P&L for each scenario • Order the results • Zvi Wiener Distribution of market factors Va. R = lowest quantile Feb-2001 55

Monte Carlo Simulation Zvi Wiener Feb-2001 56

Monte Carlo Simulation Zvi Wiener Feb-2001 56

Real Projects Most daily returns are invisible. Proper financing should be based on risk exposure of each specific project. Note that accounting standards not always reflect financial risk properly. Zvi Wiener Feb-2001 57

Real Projects Most daily returns are invisible. Proper financing should be based on risk exposure of each specific project. Note that accounting standards not always reflect financial risk properly. Zvi Wiener Feb-2001 57

Example • You are going to invest in Japan. • Take a loan in Yen. Financial statements will reflect your investment according to the exchange rate at the day of investment and your liability will be linked to yen. • • Zvi Wiener Actually there is no currency risk. Feb-2001 58

Example • You are going to invest in Japan. • Take a loan in Yen. Financial statements will reflect your investment according to the exchange rate at the day of investment and your liability will be linked to yen. • • Zvi Wiener Actually there is no currency risk. Feb-2001 58

Airline company fuel - oil prices and $ • purchasing airplanes - $ and Euro • salaries - NIS, some $ • tickets $ • marketing - different currencies • payments to airports for services • Zvi Wiener Feb-2001 59

Airline company fuel - oil prices and $ • purchasing airplanes - $ and Euro • salaries - NIS, some $ • tickets $ • marketing - different currencies • payments to airports for services • Zvi Wiener Feb-2001 59

Airline company • • equity • Zvi Wiener loans callable bonds Feb-2001 60

Airline company • • equity • Zvi Wiener loans callable bonds Feb-2001 60

Airline company Base currency - by major stockholder. Time horizon - by time of possible price change. Earnings at risk, not value at risk, since there is too much optionality in setting prices. One can create a one year cashflow forecast and measure its sensitivity to different market events. Zvi Wiener Feb-2001 61

Airline company Base currency - by major stockholder. Time horizon - by time of possible price change. Earnings at risk, not value at risk, since there is too much optionality in setting prices. One can create a one year cashflow forecast and measure its sensitivity to different market events. Zvi Wiener Feb-2001 61

Reporting Division of Va. R by business units, areas of activity, counterparty, currency. Performance measurement - RAROC (Risk Adjusted Return On Capital). Zvi Wiener Feb-2001 62

Reporting Division of Va. R by business units, areas of activity, counterparty, currency. Performance measurement - RAROC (Risk Adjusted Return On Capital). Zvi Wiener Feb-2001 62

How Va. R is used • Internal Risk Management • Reporting • Regulators Zvi Wiener Feb-2001 63

How Va. R is used • Internal Risk Management • Reporting • Regulators Zvi Wiener Feb-2001 63

Backtesting Verification of Risk Management models. Comparison if the model’s forecast Va. R with the actual outcome - P&L. Exception occurs when actual loss exceeds Va. R. After exception - explanation and action. Zvi Wiener Feb-2001 64

Backtesting Verification of Risk Management models. Comparison if the model’s forecast Va. R with the actual outcome - P&L. Exception occurs when actual loss exceeds Va. R. After exception - explanation and action. Zvi Wiener Feb-2001 64

Backtesting Green zone - up to 4 exceptions OK Yellow zone - 5 -9 exceptions increasing k Red zone - 10 exceptions or more intervention Zvi Wiener Feb-2001 65

Backtesting Green zone - up to 4 exceptions OK Yellow zone - 5 -9 exceptions increasing k Red zone - 10 exceptions or more intervention Zvi Wiener Feb-2001 65

Stress Designed to estimate potential losses in abnormal markets. Extreme events Fat tails Central questions: How much we can lose in a certain scenario? What event could cause a big loss? Zvi Wiener Feb-2001 66

Stress Designed to estimate potential losses in abnormal markets. Extreme events Fat tails Central questions: How much we can lose in a certain scenario? What event could cause a big loss? Zvi Wiener Feb-2001 66

Unifying Approach • • Based on Statistics • Portfolio Theory • Verification • Widely Accepted • Zvi Wiener One number Easy Comparison Feb-2001 67

Unifying Approach • • Based on Statistics • Portfolio Theory • Verification • Widely Accepted • Zvi Wiener One number Easy Comparison Feb-2001 67

Board of Directors (Basle, September 1998) periodic discussions with management concerning the effectiveness of the internal control system • a timely review of evaluations of internal controls made by management, internal and external auditors • periodic efforts to ensure that management has promptly followed up on recommendations and concerns expressed by auditors and supervisory authorities on internal control weaknesses • a periodic review of the appropriateness of the bank’s strategy and risk limits. • Zvi Wiener Feb-2001 68

Board of Directors (Basle, September 1998) periodic discussions with management concerning the effectiveness of the internal control system • a timely review of evaluations of internal controls made by management, internal and external auditors • periodic efforts to ensure that management has promptly followed up on recommendations and concerns expressed by auditors and supervisory authorities on internal control weaknesses • a periodic review of the appropriateness of the bank’s strategy and risk limits. • Zvi Wiener Feb-2001 68

Open Questions • • Non-traded assets • Credit information • Global Database • Zvi Wiener Risks related to cashflow Liquidity problem Feb-2001 69

Open Questions • • Non-traded assets • Credit information • Global Database • Zvi Wiener Risks related to cashflow Liquidity problem Feb-2001 69

Issues Specific to Israel • • Exchange Band • Zvi Wiener Indexation Shallow Markets Feb-2001 70

Issues Specific to Israel • • Exchange Band • Zvi Wiener Indexation Shallow Markets Feb-2001 70

pluto. mscc. huji. ac. il/~mswiener/ Risk Management resources • Useful Internet sites • Regulators • Insurance Companies • Risk Management in SEC reports Zvi Wiener Feb-2001 71

pluto. mscc. huji. ac. il/~mswiener/ Risk Management resources • Useful Internet sites • Regulators • Insurance Companies • Risk Management in SEC reports Zvi Wiener Feb-2001 71

Zvi Wiener Feb-2001 72

Zvi Wiener Feb-2001 72

How to hedge financial risk? Static hedge Forwards agreements that fix the price Futures Options static hedge • Dynamic delta or vega hedge, with a variable amount of options held. It is applicable if there is a very liquid market and low transaction costs. • Zvi Wiener Feb-2001 73

How to hedge financial risk? Static hedge Forwards agreements that fix the price Futures Options static hedge • Dynamic delta or vega hedge, with a variable amount of options held. It is applicable if there is a very liquid market and low transaction costs. • Zvi Wiener Feb-2001 73

RMG • http: //www. riskmetrics. com/ • http: //www. pictureofrisk. com/ • http: //www. riskmetrics. com/rm/splash. html • rmgaccess Zvi Wiener Feb-2001 74

RMG • http: //www. riskmetrics. com/ • http: //www. pictureofrisk. com/ • http: //www. riskmetrics. com/rm/splash. html • rmgaccess Zvi Wiener Feb-2001 74

Consulting • • Willis Corroon • Richard Scora • Ernst and Young • Enterprise Advisors • Zvi Wiener Oliver, Wyman and Co. Kamakura Feb-2001 75

Consulting • • Willis Corroon • Richard Scora • Ernst and Young • Enterprise Advisors • Zvi Wiener Oliver, Wyman and Co. Kamakura Feb-2001 75

Examples of Risk Reports http: //www. pictureofrisk. com http: //www. mbrm. com/ http: //www. riskmetrics. com/rm/splash. html Zvi Wiener Feb-2001 76

Examples of Risk Reports http: //www. pictureofrisk. com http: //www. mbrm. com/ http: //www. riskmetrics. com/rm/splash. html Zvi Wiener Feb-2001 76

Regulators • • • BIS G-30 FSA SEC market risk disclosure rules market risk reporting FED, FRB our GARP report Swiss Central Bank Financial Accounting Standards Board Zvi Wiener Feb-2001 77

Regulators • • • BIS G-30 FSA SEC market risk disclosure rules market risk reporting FED, FRB our GARP report Swiss Central Bank Financial Accounting Standards Board Zvi Wiener Feb-2001 77

SEC reports • Edgar • Yahoo – find symbol – profile – raw SEC reports § Zvi Wiener market risk in 10 K 7 A Feb-2001 78

SEC reports • Edgar • Yahoo – find symbol – profile – raw SEC reports § Zvi Wiener market risk in 10 K 7 A Feb-2001 78

3 methods • Sensitivity – requires a deep understanding of positions • Tabular – when there are 1 -2 major risk factors • Value-at-Risk – for active risk management Zvi Wiener Feb-2001 79

3 methods • Sensitivity – requires a deep understanding of positions • Tabular – when there are 1 -2 major risk factors • Value-at-Risk – for active risk management Zvi Wiener Feb-2001 79

KPMG report Survey of disclosures: SEC Market Risk, 1999 SEC: http: //www. sec. gov/smbus/forms/regsk. htm#quan http: //www. sec. gov/rules/othern/derivfaq. htm GARP http: //www. garp. com/ Zvi Wiener Feb-2001 80

KPMG report Survey of disclosures: SEC Market Risk, 1999 SEC: http: //www. sec. gov/smbus/forms/regsk. htm#quan http: //www. sec. gov/rules/othern/derivfaq. htm GARP http: //www. garp. com/ Zvi Wiener Feb-2001 80

World Experience • Bankers Trust, J. P. Morgan, investment banks • Bank regulators, commercial banks • Insurance, dealers • Investment funds (LTCM) • Real companies • Investors learn to read risk information! Zvi Wiener Feb-2001 81

World Experience • Bankers Trust, J. P. Morgan, investment banks • Bank regulators, commercial banks • Insurance, dealers • Investment funds (LTCM) • Real companies • Investors learn to read risk information! Zvi Wiener Feb-2001 81

Agriculture www. cfonet. com/html/Articles/CFO/1999/99 APkita. html 1998 revenues $1. 25 B consulting Willis Corroon Zvi Wiener Feb-2001 82

Agriculture www. cfonet. com/html/Articles/CFO/1999/99 APkita. html 1998 revenues $1. 25 B consulting Willis Corroon Zvi Wiener Feb-2001 82

Nike • Salaries are paid in Asia • Shoes are sold worldwide • Financing comes from USA • Marketing, storing, shipping worldwide use Va. R since 1998. Zvi Wiener Feb-2001 83

Nike • Salaries are paid in Asia • Shoes are sold worldwide • Financing comes from USA • Marketing, storing, shipping worldwide use Va. R since 1998. Zvi Wiener Feb-2001 83

Merck http: //www. palisade-europe. com/html/Articles/merck. html http: //www. sec. gov/Archives/edgar/data/64978/00009501 23 -99 -005573 -index. html see “sensitivity” Zvi Wiener Feb-2001 84

Merck http: //www. palisade-europe. com/html/Articles/merck. html http: //www. sec. gov/Archives/edgar/data/64978/00009501 23 -99 -005573 -index. html see “sensitivity” Zvi Wiener Feb-2001 84

Articles Value at Risk as a Diagnostic Tool for Corporates: The Airline Industry http: //netec. mcc. ac. uk/Wo. PEc/data/Papers/dgruvati n 19990023. html Agricultural Applications of Value-at-Risk Analysis: A Perspective http: //netec. mcc. ac. uk/Wo. PEc/data/Papers/wpawu wpfi 9805002. html Zvi Wiener Feb-2001 85

Articles Value at Risk as a Diagnostic Tool for Corporates: The Airline Industry http: //netec. mcc. ac. uk/Wo. PEc/data/Papers/dgruvati n 19990023. html Agricultural Applications of Value-at-Risk Analysis: A Perspective http: //netec. mcc. ac. uk/Wo. PEc/data/Papers/wpawu wpfi 9805002. html Zvi Wiener Feb-2001 85

Publications “The New Risk Management: the Good, the Bad, and the Ugly”, P. Dybvig, W. Marshall http: //dybfin. olin. wustl. edu/research/papers/riskma n_fed. pdf Association for Investment Management and Research http: //www. aimr. org/ Zvi Wiener Feb-2001 86

Publications “The New Risk Management: the Good, the Bad, and the Ugly”, P. Dybvig, W. Marshall http: //dybfin. olin. wustl. edu/research/papers/riskma n_fed. pdf Association for Investment Management and Research http: //www. aimr. org/ Zvi Wiener Feb-2001 86

Web tour ZW, students, Va. R and risk management • Gloriamundy • GARP • SEC reports • Google • Zvi Wiener Feb-2001 87

Web tour ZW, students, Va. R and risk management • Gloriamundy • GARP • SEC reports • Google • Zvi Wiener Feb-2001 87

What is more risky and why? A. 1 year bond B. 10 year bond Zvi Wiener Feb-2001 88

What is more risky and why? A. 1 year bond B. 10 year bond Zvi Wiener Feb-2001 88

What is more risky and why? A. An in-the-money option? B. An out-of-the-money option? Zvi Wiener Feb-2001 89

What is more risky and why? A. An in-the-money option? B. An out-of-the-money option? Zvi Wiener Feb-2001 89