9734f9faf28f2ecde08c2a4e2ec84d66.ppt

- Количество слайдов: 30

Financial Reporting Theory Week 6 Presentation Dennis Chow Ivan Chan Rita Lam

Financial Reporting Theory Week 6 Presentation Dennis Chow Ivan Chan Rita Lam

All new disclosure should appear in the Management Discussion & Analysis Statement Mandatory? All?

All new disclosure should appear in the Management Discussion & Analysis Statement Mandatory? All?

What is a Management Discussion and Analysis Statement (MD&A)? Purpose: • information relevant to an assessment of the financial condition • results of operations of the company

What is a Management Discussion and Analysis Statement (MD&A)? Purpose: • information relevant to an assessment of the financial condition • results of operations of the company

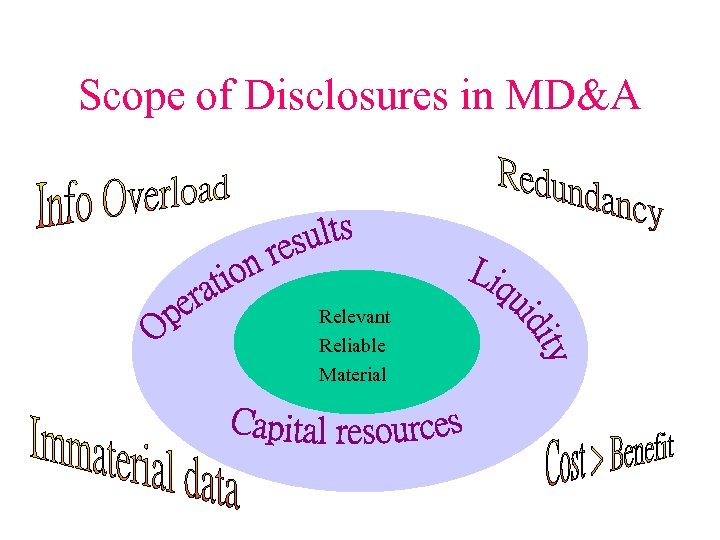

Scope of Disclosures in MD&A Relevant Reliable Material

Scope of Disclosures in MD&A Relevant Reliable Material

Material defined by SEC: • “those matters which there is substantial likelihood that a reasonable investor would attach importance in determining whether to buy or sell the securities registered” • Certainty -- Determined by MGT or evaluated objectively for the consequences

Material defined by SEC: • “those matters which there is substantial likelihood that a reasonable investor would attach importance in determining whether to buy or sell the securities registered” • Certainty -- Determined by MGT or evaluated objectively for the consequences

Talking with CEOs • Mr Richard Li • Chief Executive Officer of Pacific Century Cyber. Works Limited (PCCW)

Talking with CEOs • Mr Richard Li • Chief Executive Officer of Pacific Century Cyber. Works Limited (PCCW)

Talking with CEOs • Mr Steven A. Ballmer • Chief Executive Officer of Microsoft Incorporation

Talking with CEOs • Mr Steven A. Ballmer • Chief Executive Officer of Microsoft Incorporation

Present Application of MD&A Voluntary !!! In Hong Kong, • Reference for Disclosures in Annual Report of Hong Kong Exchange and Clearing Ltd – may disclose (Not restricted) e. g. : • description of the business done and intended to be done • general development of last 5 years • Corporate government practice

Present Application of MD&A Voluntary !!! In Hong Kong, • Reference for Disclosures in Annual Report of Hong Kong Exchange and Clearing Ltd – may disclose (Not restricted) e. g. : • description of the business done and intended to be done • general development of last 5 years • Corporate government practice

Present Application of MD&A In United States, • SEC Regulation S-K – Required three aspects for disclosure: Basic Information Covered: i) Liquidity ii) Capital Resources iii) Results of Operation

Present Application of MD&A In United States, • SEC Regulation S-K – Required three aspects for disclosure: Basic Information Covered: i) Liquidity ii) Capital Resources iii) Results of Operation

Our Standpoint Oppose Voluntary disclosure besides basic requirements in MD&A I) Redundancy II) Expose the virtues and evade from the bad III) Cost & Benefit

Our Standpoint Oppose Voluntary disclosure besides basic requirements in MD&A I) Redundancy II) Expose the virtues and evade from the bad III) Cost & Benefit

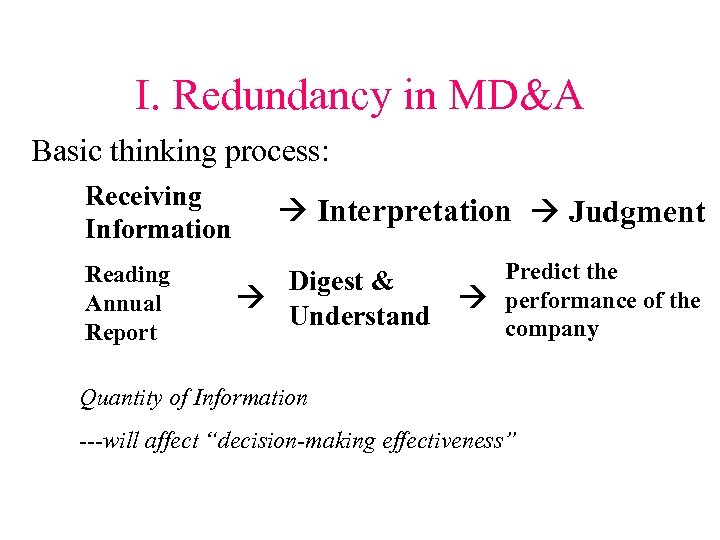

I. Redundancy in MD&A Basic thinking process: Receiving Information Reading Annual Report Interpretation Judgment Predict the Digest & performance of the Understand company Quantity of Information ---will affect “decision-making effectiveness”

I. Redundancy in MD&A Basic thinking process: Receiving Information Reading Annual Report Interpretation Judgment Predict the Digest & performance of the Understand company Quantity of Information ---will affect “decision-making effectiveness”

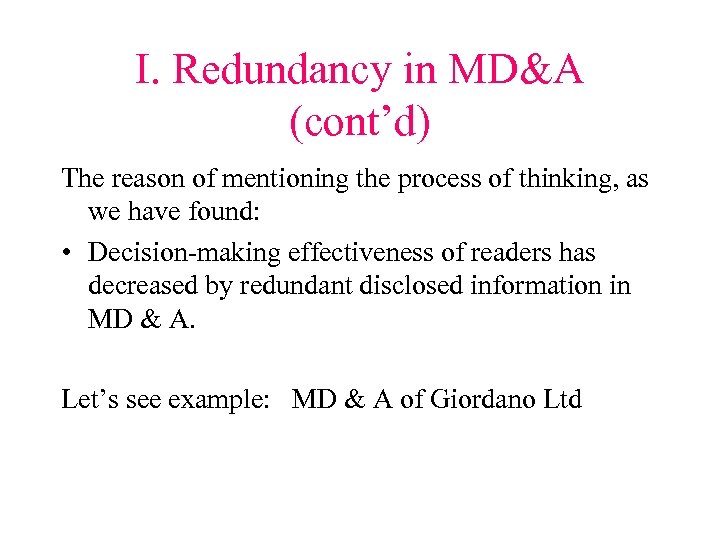

I. Redundancy in MD&A (cont’d) The reason of mentioning the process of thinking, as we have found: • Decision-making effectiveness of readers has decreased by redundant disclosed information in MD & A. Let’s see example: MD & A of Giordano Ltd

I. Redundancy in MD&A (cont’d) The reason of mentioning the process of thinking, as we have found: • Decision-making effectiveness of readers has decreased by redundant disclosed information in MD & A. Let’s see example: MD & A of Giordano Ltd

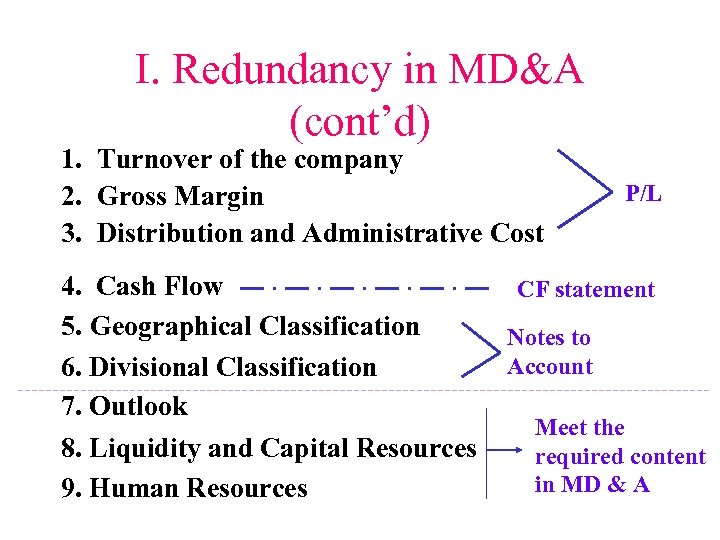

I. Redundancy in MD&A (cont’d) 1. Turnover of the company 2. Gross Margin 3. Distribution and Administrative Cost 4. Cash Flow 5. Geographical Classification 6. Divisional Classification 7. Outlook 8. Liquidity and Capital Resources 9. Human Resources P/L CF statement Notes to Account Meet the required content in MD & A

I. Redundancy in MD&A (cont’d) 1. Turnover of the company 2. Gross Margin 3. Distribution and Administrative Cost 4. Cash Flow 5. Geographical Classification 6. Divisional Classification 7. Outlook 8. Liquidity and Capital Resources 9. Human Resources P/L CF statement Notes to Account Meet the required content in MD & A

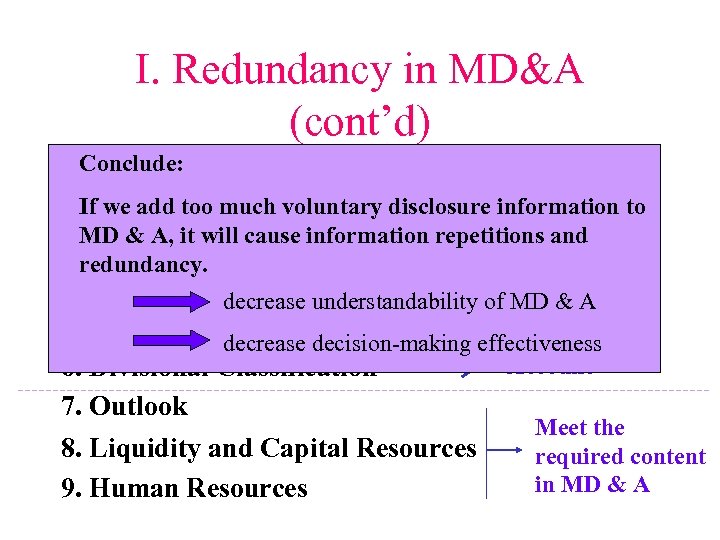

I. Redundancy in MD&A (cont’d) 1. Conclude: of the company Turnover 2. If. Gross Margin voluntary disclosure information P/L we add too much to 3. MD & A, it will cause Administrative Cost and Distribution and information repetitions redundancy. 4. Cash Flow CF statement decrease understandability of MD & A 5. Geographical Classification Notes to decrease decision-making effectiveness Account 6. Divisional Classification 7. Outlook 8. Liquidity and Capital Resources 9. Human Resources Meet the required content in MD & A

I. Redundancy in MD&A (cont’d) 1. Conclude: of the company Turnover 2. If. Gross Margin voluntary disclosure information P/L we add too much to 3. MD & A, it will cause Administrative Cost and Distribution and information repetitions redundancy. 4. Cash Flow CF statement decrease understandability of MD & A 5. Geographical Classification Notes to decrease decision-making effectiveness Account 6. Divisional Classification 7. Outlook 8. Liquidity and Capital Resources 9. Human Resources Meet the required content in MD & A

I. Redundancy in MD&A (cont’d) • Chairman of Ernst & Young, US, NJ. Groves conducted a survey in 1994 • Try to quantify the excessive disclosures in annual report.

I. Redundancy in MD&A (cont’d) • Chairman of Ernst & Young, US, NJ. Groves conducted a survey in 1994 • Try to quantify the excessive disclosures in annual report.

I. Redundancy in MD&A (cont’d) Collect & measure the total no of pages -- annual report, footnotes, MD&A of 25 companies in USA. e. g. AT&T, Coca-Cola, IBM, etc Basic assumption: • Not all information disclosed is useful. Increasing total reflect the increasing redundancy problem no of pages

I. Redundancy in MD&A (cont’d) Collect & measure the total no of pages -- annual report, footnotes, MD&A of 25 companies in USA. e. g. AT&T, Coca-Cola, IBM, etc Basic assumption: • Not all information disclosed is useful. Increasing total reflect the increasing redundancy problem no of pages

I. Redundancy in MD&A (cont’d) Collect & measure the total no of pages -- annual report, footnotes, MD&A of 25 companies in USA. Conclusion: e. g. AT&T, Coca-Cola, IBM, etc The redundancy problem in MD & A become Basic assumption: serious as the new disclosure increase from year to year • Not all information disclosed is useful. Increasing total reflect the increasing redundancy problem no of pages

I. Redundancy in MD&A (cont’d) Collect & measure the total no of pages -- annual report, footnotes, MD&A of 25 companies in USA. Conclusion: e. g. AT&T, Coca-Cola, IBM, etc The redundancy problem in MD & A become Basic assumption: serious as the new disclosure increase from year to year • Not all information disclosed is useful. Increasing total reflect the increasing redundancy problem no of pages

II. Expose the virtues and evade from the bad • Focus of MD&A – focus specifically on MATERIAL events and uncertainties known to management – would cause reported financial information not to be necessarily indicative of future operating results or of future financial condition

II. Expose the virtues and evade from the bad • Focus of MD&A – focus specifically on MATERIAL events and uncertainties known to management – would cause reported financial information not to be necessarily indicative of future operating results or of future financial condition

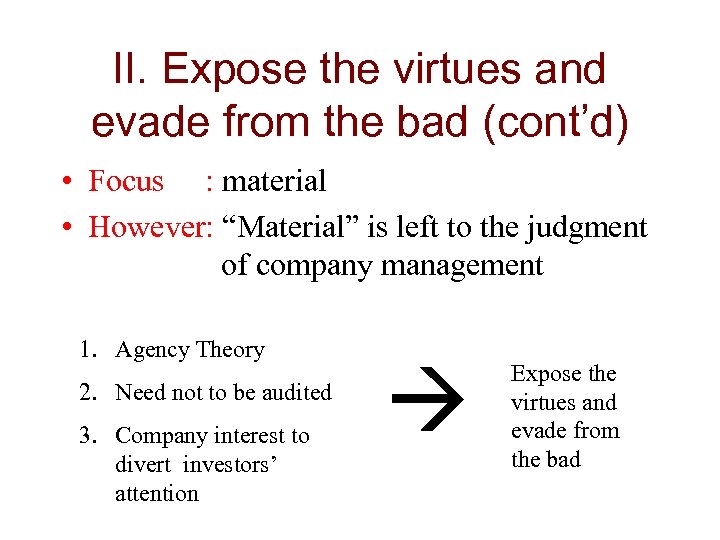

II. Expose the virtues and evade from the bad (cont’d) • Focus : material • However: “Material” is left to the judgment of company management 1. Agency Theory 2. Need not to be audited 3. Company interest to divert investors’ attention Expose the virtues and evade from the bad

II. Expose the virtues and evade from the bad (cont’d) • Focus : material • However: “Material” is left to the judgment of company management 1. Agency Theory 2. Need not to be audited 3. Company interest to divert investors’ attention Expose the virtues and evade from the bad

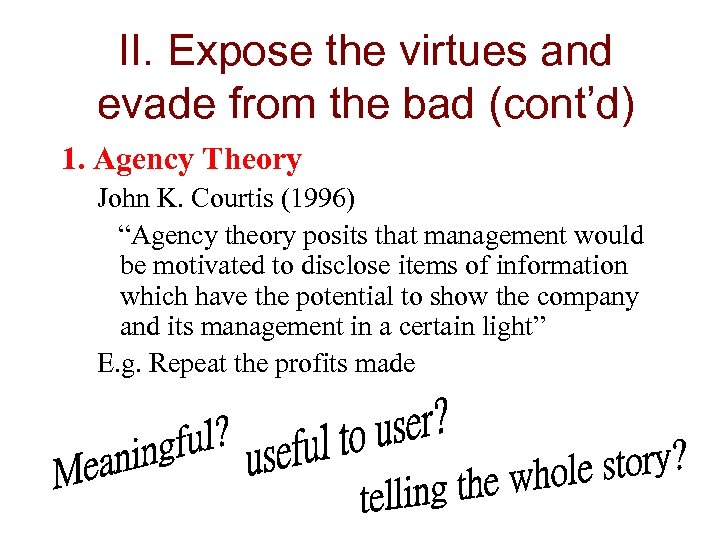

II. Expose the virtues and evade from the bad (cont’d) 1. Agency Theory John K. Courtis (1996) “Agency theory posits that management would be motivated to disclose items of information which have the potential to show the company and its management in a certain light” E. g. Repeat the profits made

II. Expose the virtues and evade from the bad (cont’d) 1. Agency Theory John K. Courtis (1996) “Agency theory posits that management would be motivated to disclose items of information which have the potential to show the company and its management in a certain light” E. g. Repeat the profits made

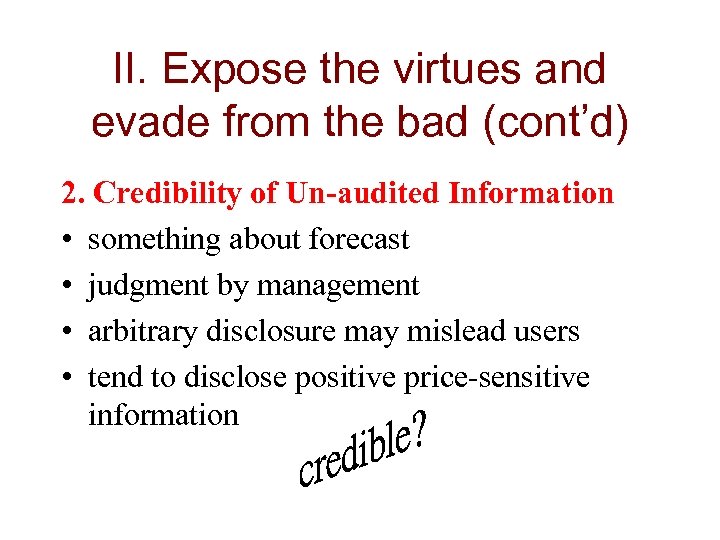

II. Expose the virtues and evade from the bad (cont’d) 2. Credibility of Un-audited Information • something about forecast • judgment by management • arbitrary disclosure may mislead users • tend to disclose positive price-sensitive information

II. Expose the virtues and evade from the bad (cont’d) 2. Credibility of Un-audited Information • something about forecast • judgment by management • arbitrary disclosure may mislead users • tend to disclose positive price-sensitive information

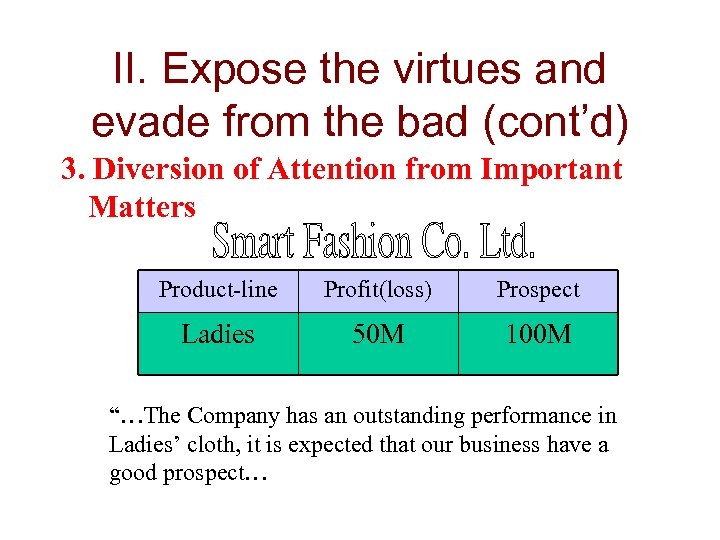

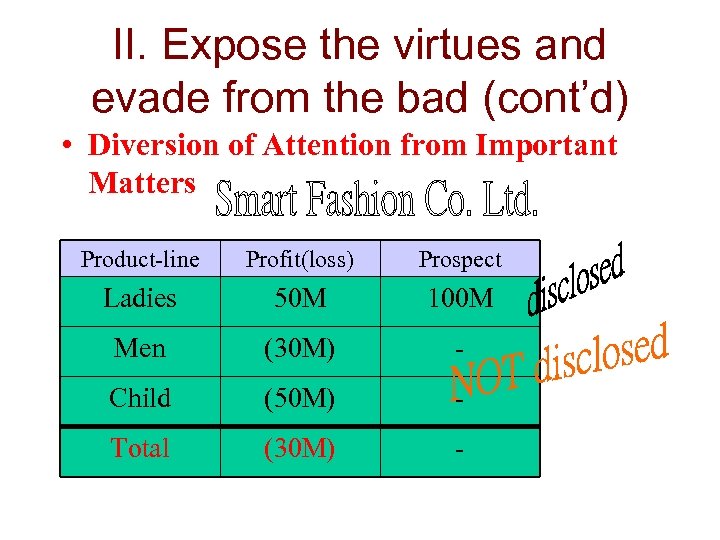

II. Expose the virtues and evade from the bad (cont’d) 3. Diversion of Attention from Important Matters Product-line Profit(loss) Prospect Ladies 50 M 100 M “…The Company has an outstanding performance in Ladies’ cloth, it is expected that our business have a good prospect…

II. Expose the virtues and evade from the bad (cont’d) 3. Diversion of Attention from Important Matters Product-line Profit(loss) Prospect Ladies 50 M 100 M “…The Company has an outstanding performance in Ladies’ cloth, it is expected that our business have a good prospect…

II. Expose the virtues and evade from the bad (cont’d) • Diversion of Attention from Important Matters Product-line Profit(loss) Prospect Ladies 50 M 100 M Men (30 M) - Child (50 M) - Total (30 M) -

II. Expose the virtues and evade from the bad (cont’d) • Diversion of Attention from Important Matters Product-line Profit(loss) Prospect Ladies 50 M 100 M Men (30 M) - Child (50 M) - Total (30 M) -

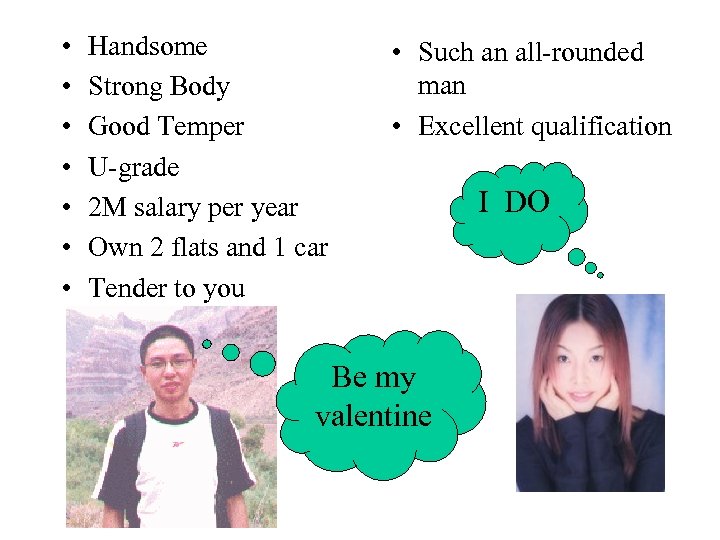

• • Handsome Strong Body Good Temper U-grade 2 M salary per year Own 2 flats and 1 car Tender to you • Such an all-rounded man • Excellent qualification Be my valentine I DO

• • Handsome Strong Body Good Temper U-grade 2 M salary per year Own 2 flats and 1 car Tender to you • Such an all-rounded man • Excellent qualification Be my valentine I DO

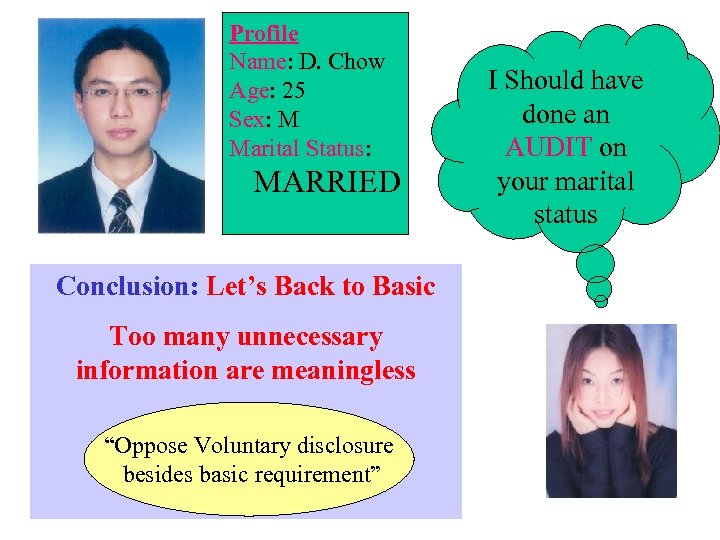

Profile Name: D. Chow Age: 25 Sex: M Marital Status: MARRIED Conclusion: Let’s Back to Basic Too many unnecessary information are meaningless “Oppose Voluntary disclosure besides basic requirement” I Should have done an AUDIT on your marital status

Profile Name: D. Chow Age: 25 Sex: M Marital Status: MARRIED Conclusion: Let’s Back to Basic Too many unnecessary information are meaningless “Oppose Voluntary disclosure besides basic requirement” I Should have done an AUDIT on your marital status

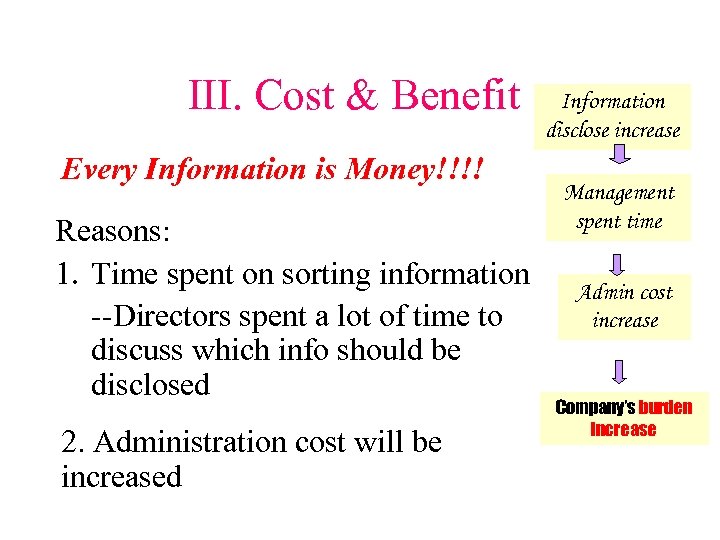

III. Cost & Benefit Every Information is Money!!!! Reasons: 1. Time spent on sorting information --Directors spent a lot of time to discuss which info should be disclosed 2. Administration cost will be increased Information disclose increase Management spent time Admin cost increase Company’s burden increase

III. Cost & Benefit Every Information is Money!!!! Reasons: 1. Time spent on sorting information --Directors spent a lot of time to discuss which info should be disclosed 2. Administration cost will be increased Information disclose increase Management spent time Admin cost increase Company’s burden increase

III. Cost & Benefit (cont’d) But the benefit generated from the increased disclosed info in MD & A is not so great as you think!!!! Example: Boeing --- military aerospace products (e. g helicopters, tanks) manufacturers in US In Boeing’s MD&A --- technical terms---describe the production process in the Research & Development -- Model of the military(e. g F/A-18 Super Honet, F-22 Raptor, AH-64 Apche, V-22 Osprey) -

III. Cost & Benefit (cont’d) But the benefit generated from the increased disclosed info in MD & A is not so great as you think!!!! Example: Boeing --- military aerospace products (e. g helicopters, tanks) manufacturers in US In Boeing’s MD&A --- technical terms---describe the production process in the Research & Development -- Model of the military(e. g F/A-18 Super Honet, F-22 Raptor, AH-64 Apche, V-22 Osprey) -

III. Cost & Benefit (cont’d) But the benefit generated from the increased disclosed info in MD & A is not so great as you think!!!! Example: Boeing --- military aerospace products (e. g helicopters, tanks) manufacturers in US the increased disclosed information In Boeing’s MD&A cannot help investors to predict the --- technical terms---describe the production process in the performance of the company!!!!!!! Research & Development -- Model of the military(e. g F/A-18 Super Honet, F-22 Raptor, AH-64 Apche, V-22 Osprey) -

III. Cost & Benefit (cont’d) But the benefit generated from the increased disclosed info in MD & A is not so great as you think!!!! Example: Boeing --- military aerospace products (e. g helicopters, tanks) manufacturers in US the increased disclosed information In Boeing’s MD&A cannot help investors to predict the --- technical terms---describe the production process in the performance of the company!!!!!!! Research & Development -- Model of the military(e. g F/A-18 Super Honet, F-22 Raptor, AH-64 Apche, V-22 Osprey) -

Conclusion • • MD&A is good But be precise Avoid redundancy Avoid expose the virtues and evade from the bad • Avoid Cost over Benefit Provide information relevant to the assessment for the financial condition and results of operation, and stick to the basic requirement don’t disclose all

Conclusion • • MD&A is good But be precise Avoid redundancy Avoid expose the virtues and evade from the bad • Avoid Cost over Benefit Provide information relevant to the assessment for the financial condition and results of operation, and stick to the basic requirement don’t disclose all

~ The End ~ Thank you ^_^

~ The End ~ Thank you ^_^