b0bd1670df1a8eb49f452c11421ccc7c.ppt

- Количество слайдов: 61

Financial Reporting for Saccos Tax Planning & Management Julius Mwatu CFO – Indigo Telecom, Member – Taxation Workgroup

Financial Reporting for Saccos Tax Planning & Management Julius Mwatu CFO – Indigo Telecom, Member – Taxation Workgroup

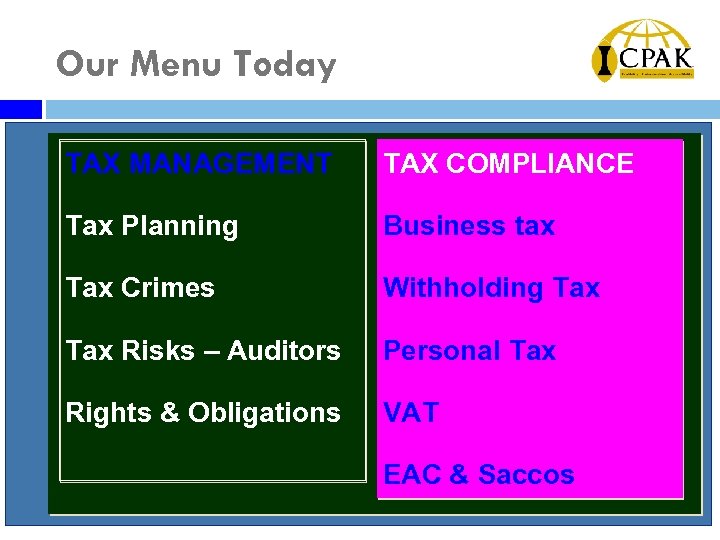

Our Menu Today TAX MANAGEMENT TAX COMPLIANCE Tax Planning Business tax Tax Crimes Withholding Tax Risks – Auditors Personal Tax Rights & Obligations VAT EAC & Saccos

Our Menu Today TAX MANAGEMENT TAX COMPLIANCE Tax Planning Business tax Tax Crimes Withholding Tax Risks – Auditors Personal Tax Rights & Obligations VAT EAC & Saccos

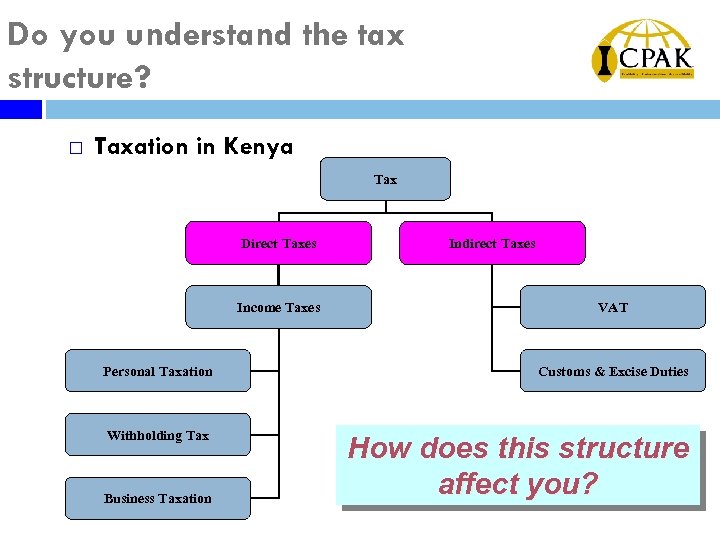

Do you understand the tax structure? ¨ Taxation in Kenya Tax Direct Taxes Income Taxes Indirect Taxes VAT Personal Taxation Customs & Excise Duties Withholding Tax How does this structure affect you? Business Taxation

Do you understand the tax structure? ¨ Taxation in Kenya Tax Direct Taxes Income Taxes Indirect Taxes VAT Personal Taxation Customs & Excise Duties Withholding Tax How does this structure affect you? Business Taxation

Tax…

Tax…

It’s a BIG risk!

It’s a BIG risk!

Personal Taxation

Personal Taxation

Are Management committee members employees or consultants?

Are Management committee members employees or consultants?

What is taxable? ¨ All income of a person which accrued in or was derived from Kenya ¨ Applies to both resident or non-resident persons ¨ It could be cash or/and non-cash ¨ The tax year for individuals runs from 1 January to 31 December

What is taxable? ¨ All income of a person which accrued in or was derived from Kenya ¨ Applies to both resident or non-resident persons ¨ It could be cash or/and non-cash ¨ The tax year for individuals runs from 1 January to 31 December

Withholding Tax

Withholding Tax

Withholding tax ¨ Withholding tax is deductible upon payment of a taxable amount. ¨ Tax point … “Payment” is deemed to include the date of accrual/ crediting of the amount payable. ¨ Whose responsibility?

Withholding tax ¨ Withholding tax is deductible upon payment of a taxable amount. ¨ Tax point … “Payment” is deemed to include the date of accrual/ crediting of the amount payable. ¨ Whose responsibility?

Dividends ¨ Dividends could be cash, stock, redeemable preference shares, debentures, or payments during winding up ¨ Classified as exempt, qualifying or non-qualifying ¨ Qualifying – WHT is final, non-qualifying – WHT not final ¨ Rates – 5% (Residents); 10% (Non-residents) ¨ Exempt dividends – Paid to exempt persons listed on 1 st Schedule or those received by a resident co. controlling >12. 5% - S 7(2) ¨ Non-qualifying dividends – Paid by a designated co-op society (Taxed under section 19 A) - S 2 ¨ Qualifying dividends – All the others

Dividends ¨ Dividends could be cash, stock, redeemable preference shares, debentures, or payments during winding up ¨ Classified as exempt, qualifying or non-qualifying ¨ Qualifying – WHT is final, non-qualifying – WHT not final ¨ Rates – 5% (Residents); 10% (Non-residents) ¨ Exempt dividends – Paid to exempt persons listed on 1 st Schedule or those received by a resident co. controlling >12. 5% - S 7(2) ¨ Non-qualifying dividends – Paid by a designated co-op society (Taxed under section 19 A) - S 2 ¨ Qualifying dividends – All the others

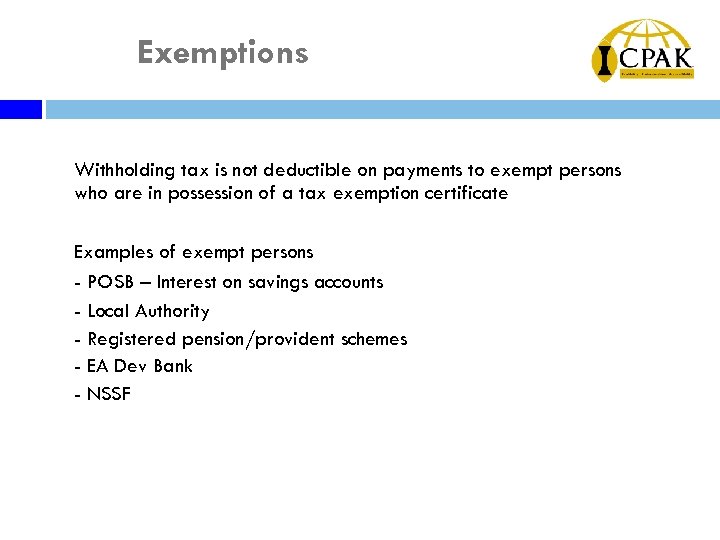

Exemptions ¨ Withholding tax is not deductible on payments to exempt persons who are in possession of a tax exemption certificate ¨ Examples of exempt persons - POSB – Interest on savings accounts - Local Authority - Registered pension/provident schemes - EA Dev Bank - NSSF

Exemptions ¨ Withholding tax is not deductible on payments to exempt persons who are in possession of a tax exemption certificate ¨ Examples of exempt persons - POSB – Interest on savings accounts - Local Authority - Registered pension/provident schemes - EA Dev Bank - NSSF

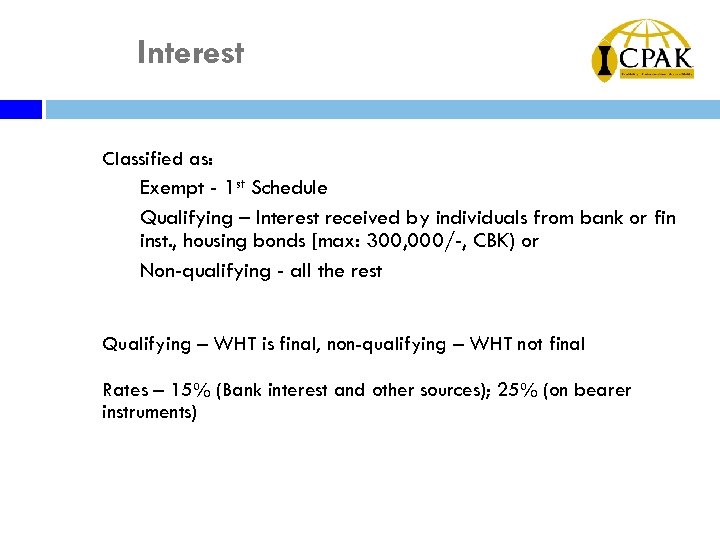

Interest ¨ Classified as: - Exempt - 1 st Schedule - Qualifying – Interest received by individuals from bank or fin inst. , housing bonds [max: 300, 000/-, CBK) or - Non-qualifying - all the rest ¨ Qualifying – WHT is final, non-qualifying – WHT not final ¨ Rates – 15% (Bank interest and other sources); 25% (on bearer instruments)

Interest ¨ Classified as: - Exempt - 1 st Schedule - Qualifying – Interest received by individuals from bank or fin inst. , housing bonds [max: 300, 000/-, CBK) or - Non-qualifying - all the rest ¨ Qualifying – WHT is final, non-qualifying – WHT not final ¨ Rates – 15% (Bank interest and other sources); 25% (on bearer instruments)

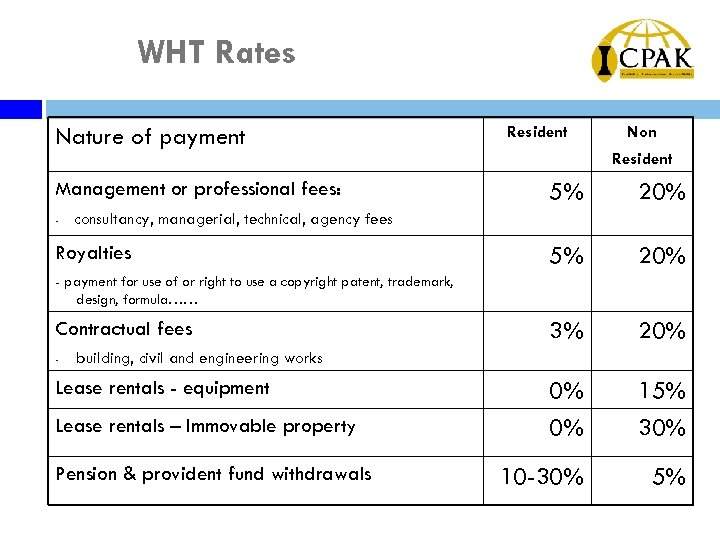

WHT Rates Nature of payment Management or professional fees: - Resident Non Resident 5% 20% 3% 20% 0% 0% 15% 30% 10 -30% 5% consultancy, managerial, technical, agency fees Royalties - payment for use of or right to use a copyright patent, trademark, design, formula…… Contractual fees - building, civil and engineering works Lease rentals - equipment Lease rentals – Immovable property Pension & provident fund withdrawals

WHT Rates Nature of payment Management or professional fees: - Resident Non Resident 5% 20% 3% 20% 0% 0% 15% 30% 10 -30% 5% consultancy, managerial, technical, agency fees Royalties - payment for use of or right to use a copyright patent, trademark, design, formula…… Contractual fees - building, civil and engineering works Lease rentals - equipment Lease rentals – Immovable property Pension & provident fund withdrawals

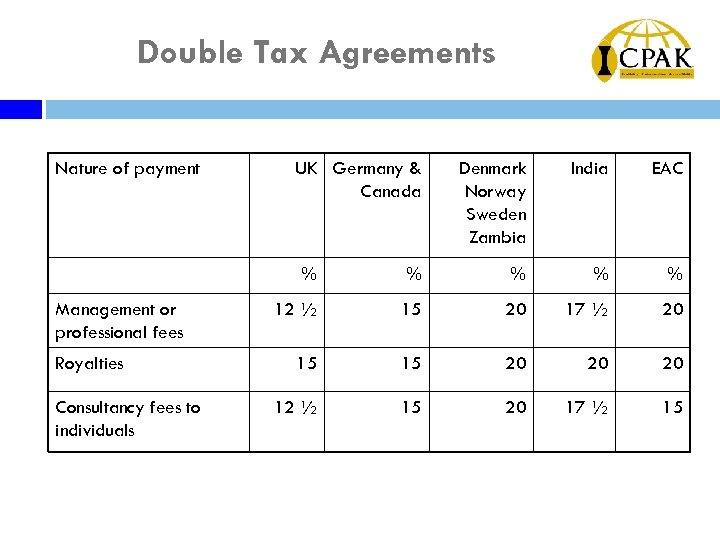

Double Tax Agreements Nature of payment UK Germany & Canada Denmark Norway Sweden Zambia India EAC % Management or professional fees Royalties Consultancy fees to individuals % % 12 ½ 15 20 17 ½ 20 15 15 20 20 20 12 ½ 15 20 17 ½ 15

Double Tax Agreements Nature of payment UK Germany & Canada Denmark Norway Sweden Zambia India EAC % Management or professional fees Royalties Consultancy fees to individuals % % 12 ½ 15 20 17 ½ 20 15 15 20 20 20 12 ½ 15 20 17 ½ 15

Penalties ¨ ¨ 10% penalty (subject to a maximum of KShs 1 million) for failure to withhold or remit tax to KRA Interest charged at 2% per month or part thereof, on the principal WHT

Penalties ¨ ¨ 10% penalty (subject to a maximum of KShs 1 million) for failure to withhold or remit tax to KRA Interest charged at 2% per month or part thereof, on the principal WHT

Employees or consultants?

Employees or consultants?

Business Tax

Business Tax

Gains or profits from business ¨ “Business” is defined to include any - trade, - profession or vocation - manufacture, - adventure and - concern in the nature of trade but does not include employment.

Gains or profits from business ¨ “Business” is defined to include any - trade, - profession or vocation - manufacture, - adventure and - concern in the nature of trade but does not include employment.

Pertinent issues q Turnover tax regime q Taxation of partnerships q Taxation of Individuals

Pertinent issues q Turnover tax regime q Taxation of partnerships q Taxation of Individuals

Specified sources of income ¨ ¨ ¨ Business income Employment income Investment income Farming income Rental income Any other

Specified sources of income ¨ ¨ ¨ Business income Employment income Investment income Farming income Rental income Any other

Taxation of Saccos ¨ ¨ Interest income from members – Exempt Other non-mutual incomes – 30% of 50% of income

Taxation of Saccos ¨ ¨ Interest income from members – Exempt Other non-mutual incomes – 30% of 50% of income

Value Added Tax

Value Added Tax

Value Added Tax (VAT)? ¨ VAT is a general consumption tax assessed on the value added to goods and services. The Kenya VAT Act was enacted in 1989, and commenced on 1 January 1990 Replaced Sales Tax It is a general tax that applies, in principle, to all commercial activities involving the production and distribution of goods and the provision of services. It is a consumption tax - Its borne ultimately by the final consumer

Value Added Tax (VAT)? ¨ VAT is a general consumption tax assessed on the value added to goods and services. The Kenya VAT Act was enacted in 1989, and commenced on 1 January 1990 Replaced Sales Tax It is a general tax that applies, in principle, to all commercial activities involving the production and distribution of goods and the provision of services. It is a consumption tax - Its borne ultimately by the final consumer

VAT Registration ¨ ¨ Registration is now online – KRA online A taxpayer should register for VAT if His business has supplied taxable goods or taxable services or expects to supply taxable goods or taxable services or both, the value of which is KShs. 5 Million or more in a period of 12 months (taxable person) To register within 30 days Deregistration – if turnover falls below KShs. 5 Million

VAT Registration ¨ ¨ Registration is now online – KRA online A taxpayer should register for VAT if His business has supplied taxable goods or taxable services or expects to supply taxable goods or taxable services or both, the value of which is KShs. 5 Million or more in a period of 12 months (taxable person) To register within 30 days Deregistration – if turnover falls below KShs. 5 Million

Tax point for VAT q Once registered for VAT, a company should charge VAT at every point of sale q The tax point is the earlier of: q date of supply; q date of invoice/certificate; q date of payment

Tax point for VAT q Once registered for VAT, a company should charge VAT at every point of sale q The tax point is the earlier of: q date of supply; q date of invoice/certificate; q date of payment

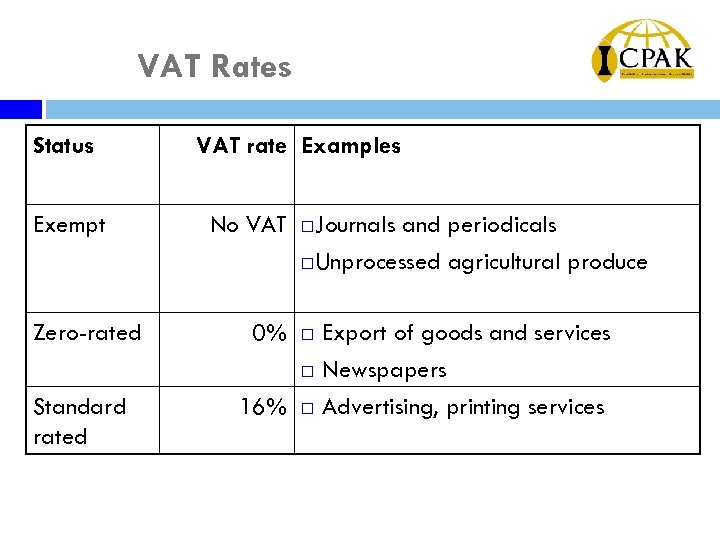

VAT Rates Status Exempt Zero-rated Standard rated VAT rate Examples No VAT ¨ Journals and periodicals ¨Unprocessed agricultural produce 0% ¨ Export of goods and services ¨ Newspapers 16% ¨ Advertising, printing services

VAT Rates Status Exempt Zero-rated Standard rated VAT rate Examples No VAT ¨ Journals and periodicals ¨Unprocessed agricultural produce 0% ¨ Export of goods and services ¨ Newspapers 16% ¨ Advertising, printing services

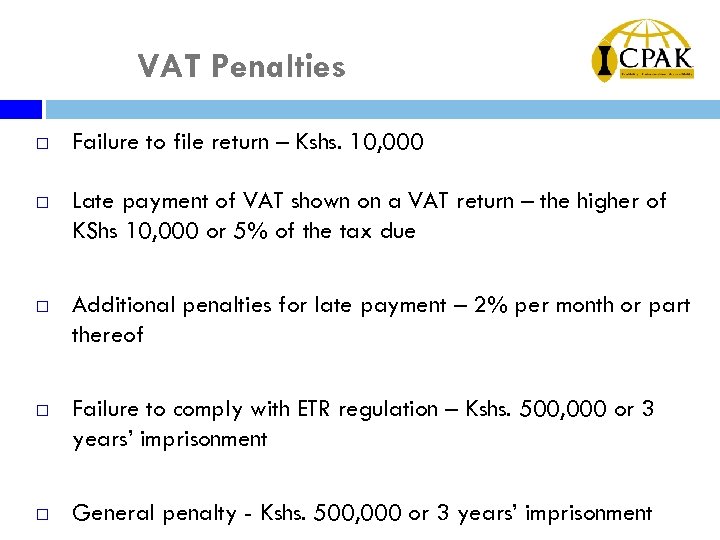

VAT Penalties ¨ Failure to file return – Kshs. 10, 000 ¨ Late payment of VAT shown on a VAT return – the higher of KShs 10, 000 or 5% of the tax due ¨ Additional penalties for late payment – 2% per month or part thereof ¨ Failure to comply with ETR regulation – Kshs. 500, 000 or 3 years’ imprisonment ¨ General penalty - Kshs. 500, 000 or 3 years’ imprisonment

VAT Penalties ¨ Failure to file return – Kshs. 10, 000 ¨ Late payment of VAT shown on a VAT return – the higher of KShs 10, 000 or 5% of the tax due ¨ Additional penalties for late payment – 2% per month or part thereof ¨ Failure to comply with ETR regulation – Kshs. 500, 000 or 3 years’ imprisonment ¨ General penalty - Kshs. 500, 000 or 3 years’ imprisonment

Tax Planning & Strategy

Tax Planning & Strategy

Do you have a tax strategy…?

Do you have a tax strategy…?

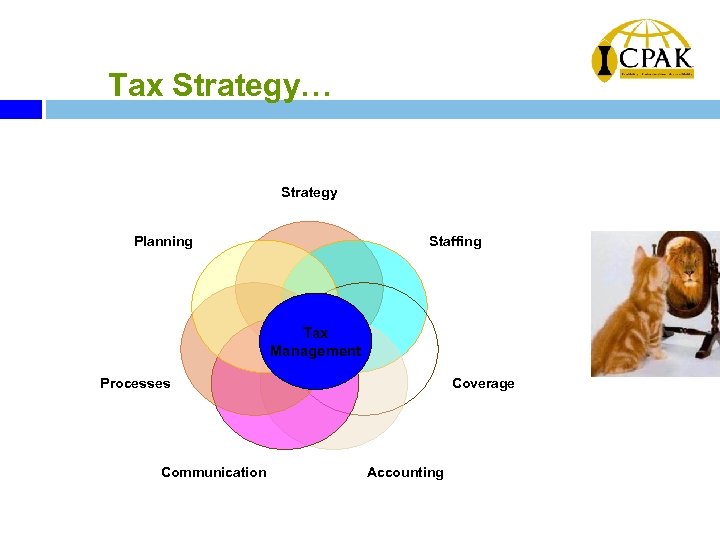

Tax Strategy… Strategy Planning Staffing Tax Management Processes Communication Coverage Accounting

Tax Strategy… Strategy Planning Staffing Tax Management Processes Communication Coverage Accounting

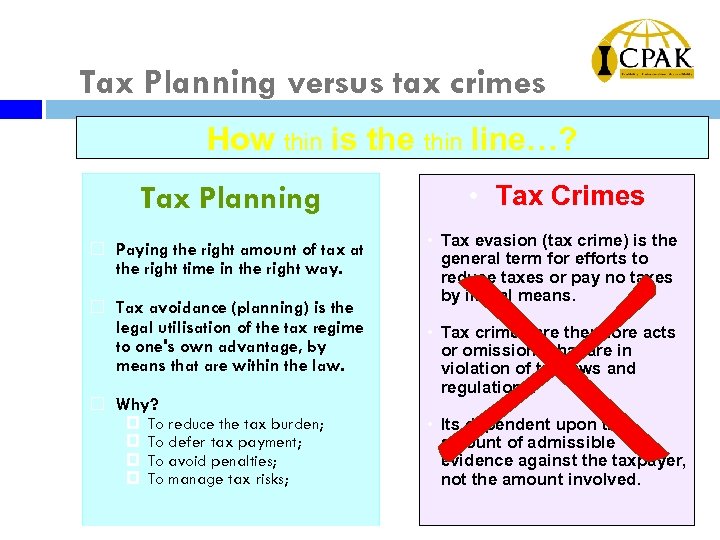

Tax Planning versus tax crimes How thin is the thin line…? Tax Planning • Tax Crimes ¨ Paying the right amount of tax at the right time in the right way. • Tax evasion (tax crime) is the general term for efforts to reduce taxes or pay no taxes by illegal means. ¨ Tax avoidance (planning) is the legal utilisation of the tax regime to one's own advantage, by means that are within the law. ¨ Why? To reduce the tax burden; To defer tax payment; To avoid penalties; To manage tax risks; • Tax crimes are therefore acts or omissions that are in violation of tax laws and regulations. • Its dependent upon the amount of admissible evidence against the taxpayer, not the amount involved.

Tax Planning versus tax crimes How thin is the thin line…? Tax Planning • Tax Crimes ¨ Paying the right amount of tax at the right time in the right way. • Tax evasion (tax crime) is the general term for efforts to reduce taxes or pay no taxes by illegal means. ¨ Tax avoidance (planning) is the legal utilisation of the tax regime to one's own advantage, by means that are within the law. ¨ Why? To reduce the tax burden; To defer tax payment; To avoid penalties; To manage tax risks; • Tax crimes are therefore acts or omissions that are in violation of tax laws and regulations. • Its dependent upon the amount of admissible evidence against the taxpayer, not the amount involved.

Personal Taxation ¨ ¨ ¨ ¨ School fees Medical benefits Loans to employees Pensions/Provident Funds Mortgage Home Ownership Savings Scheme Benefits in kind Insurance relief 1

Personal Taxation ¨ ¨ ¨ ¨ School fees Medical benefits Loans to employees Pensions/Provident Funds Mortgage Home Ownership Savings Scheme Benefits in kind Insurance relief 1

Personal Taxation ¨ ¨ ¨ Staff training and development Staff party expenses Study leave Home leave passages Telephone benefit 1

Personal Taxation ¨ ¨ ¨ Staff training and development Staff party expenses Study leave Home leave passages Telephone benefit 1

Tax Crimes

Tax Crimes

Why do we commit tax crimes

Why do we commit tax crimes

Why do we commit tax crimes? ¨ Lack of effective tax planning measures ¨ Inadequate knowledge of taxation ¨ Unrealistic tax regimes (perceived? ) ¨ Inefficient tax authorities ¨ Self – discipline ¨ Payback (perceived? )

Why do we commit tax crimes? ¨ Lack of effective tax planning measures ¨ Inadequate knowledge of taxation ¨ Unrealistic tax regimes (perceived? ) ¨ Inefficient tax authorities ¨ Self – discipline ¨ Payback (perceived? )

When do you become a tax criminal? ¨ ¨ Failure to file tax returns Filing false tax returns Conspiracy to impede/defeat the collection of tax (Tax planning? ? ) Keeping two sets of books

When do you become a tax criminal? ¨ ¨ Failure to file tax returns Filing false tax returns Conspiracy to impede/defeat the collection of tax (Tax planning? ? ) Keeping two sets of books

Rights & Obligations

Rights & Obligations

The Balancing Act. . . Your rights & Obligations ¨ Taxpayers Charter Balanced? ? Yes/No The right (s) has nothing right Perceptions ce n ‘Su sta b ov rf e m’ or Obligations Rights

The Balancing Act. . . Your rights & Obligations ¨ Taxpayers Charter Balanced? ? Yes/No The right (s) has nothing right Perceptions ce n ‘Su sta b ov rf e m’ or Obligations Rights

Tax Risks…

Tax Risks…

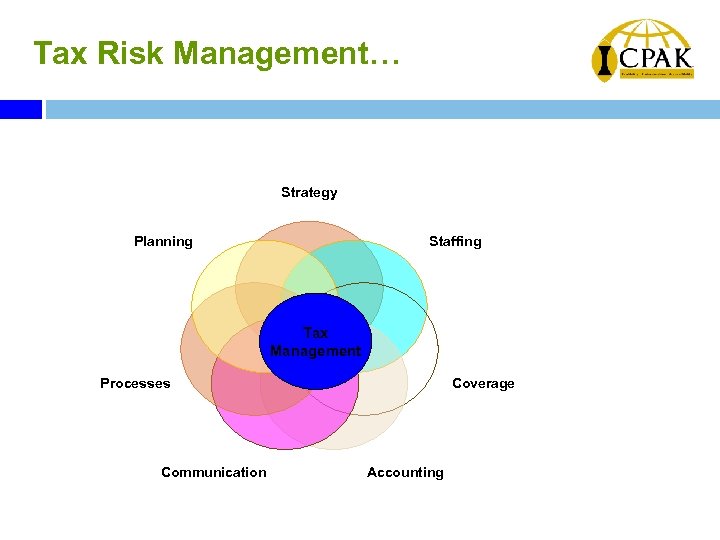

Tax Risk Management… Strategy Planning Staffing Tax Management Processes Communication Coverage Accounting

Tax Risk Management… Strategy Planning Staffing Tax Management Processes Communication Coverage Accounting

…where the buck stops… Introduction

…where the buck stops… Introduction

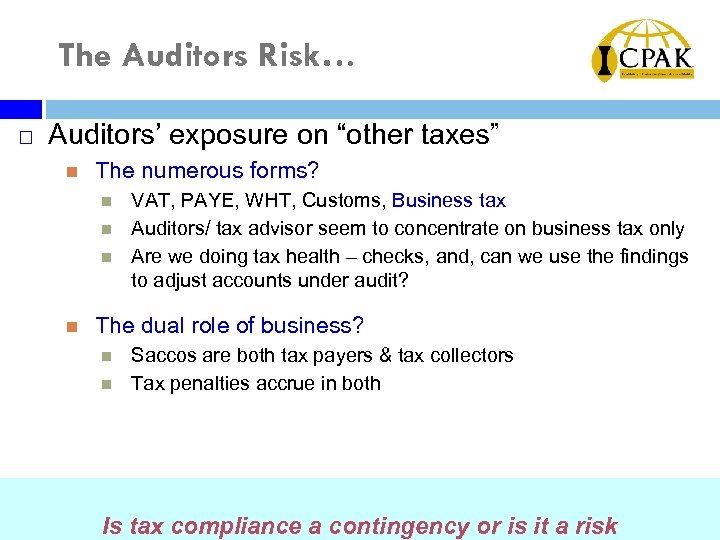

The Auditors Risk… ¨ Auditors’ exposure on “other taxes” The numerous forms? VAT, PAYE, WHT, Customs, Business tax Auditors/ tax advisor seem to concentrate on business tax only Are we doing tax health – checks, and, can we use the findings to adjust accounts under audit? The dual role of business? Saccos are both tax payers & tax collectors Tax penalties accrue in both Is tax compliance a contingency or is it a risk

The Auditors Risk… ¨ Auditors’ exposure on “other taxes” The numerous forms? VAT, PAYE, WHT, Customs, Business tax Auditors/ tax advisor seem to concentrate on business tax only Are we doing tax health – checks, and, can we use the findings to adjust accounts under audit? The dual role of business? Saccos are both tax payers & tax collectors Tax penalties accrue in both Is tax compliance a contingency or is it a risk

Tax on Investments…

Tax on Investments…

Invest wisely… ¨ Land stamp Rates ¨ duty - Collected by KRA - Leasehold Buildings Transfer ¨ - commercial or non-commercial Shares & Unit trusts

Invest wisely… ¨ Land stamp Rates ¨ duty - Collected by KRA - Leasehold Buildings Transfer ¨ - commercial or non-commercial Shares & Unit trusts

Buildings cont. . . Tax Incentives Use of Pension as collateral You can assign up to 60% of the accrued benefits as security for mortgages

Buildings cont. . . Tax Incentives Use of Pension as collateral You can assign up to 60% of the accrued benefits as security for mortgages

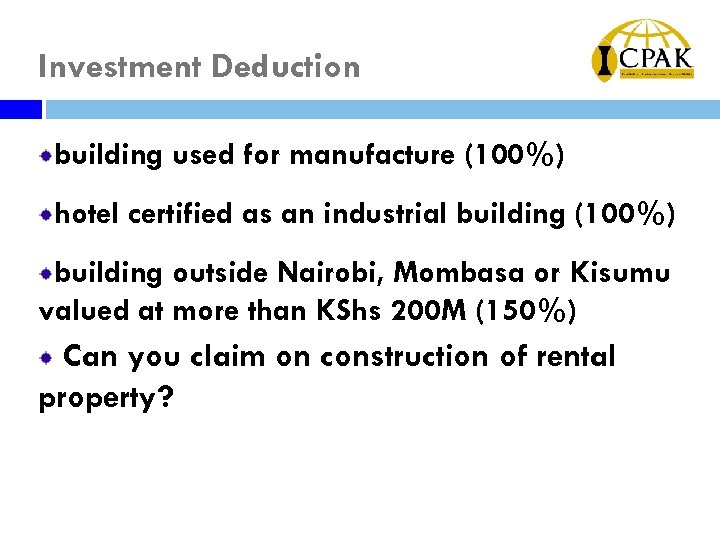

Investment Deduction building used for manufacture (100%) hotel certified as an industrial building (100%) building outside Nairobi, Mombasa or Kisumu valued at more than KShs 200 M (150%) Can you claim on construction of rental property?

Investment Deduction building used for manufacture (100%) hotel certified as an industrial building (100%) building outside Nairobi, Mombasa or Kisumu valued at more than KShs 200 M (150%) Can you claim on construction of rental property?

Tax on Buildings Investment deduction VAT 5 claim

Tax on Buildings Investment deduction VAT 5 claim

East Africa & the EAC…

East Africa & the EAC…

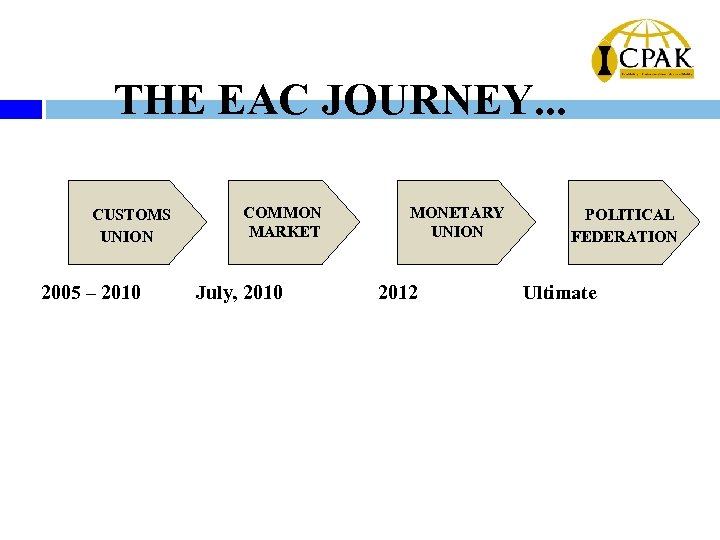

THE EAC JOURNEY. . . CUSTOMS UNION 2005 – 2010 COMMON MARKET July, 2010 MONETARY UNION 2012 POLITICAL FEDERATION Ultimate

THE EAC JOURNEY. . . CUSTOMS UNION 2005 – 2010 COMMON MARKET July, 2010 MONETARY UNION 2012 POLITICAL FEDERATION Ultimate

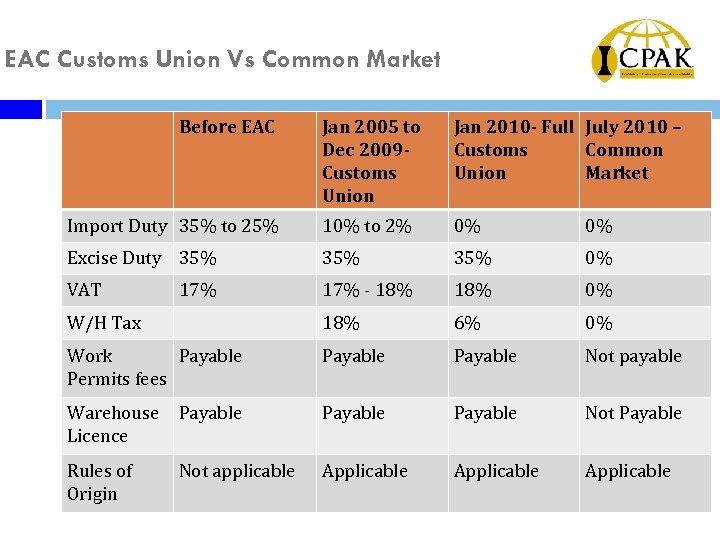

EAC Customs Union Vs Common Market Before EAC Jan 2005 to Dec 2009 Customs Union Jan 2010 - Full July 2010 – Customs Common Union Market Import Duty 35% to 25% 10% to 2% 0% 0% Excise Duty 35% 35% 0% VAT 17% - 18% 0% W/H Tax 18% 6% 0% Work Payable Permits fees Payable Not payable Warehouse Licence Payable Not Payable Rules of Origin Not applicable Applicable 17%

EAC Customs Union Vs Common Market Before EAC Jan 2005 to Dec 2009 Customs Union Jan 2010 - Full July 2010 – Customs Common Union Market Import Duty 35% to 25% 10% to 2% 0% 0% Excise Duty 35% 35% 0% VAT 17% - 18% 0% W/H Tax 18% 6% 0% Work Payable Permits fees Payable Not payable Warehouse Licence Payable Not Payable Rules of Origin Not applicable Applicable 17%

Pertinent Issues

Pertinent Issues

Is it a Change we can believe in? ¨ Need to position ourselves! SWOT Analysis! Lets embrace the Common Market ¨ Other barriers ¨ Our culture

Is it a Change we can believe in? ¨ Need to position ourselves! SWOT Analysis! Lets embrace the Common Market ¨ Other barriers ¨ Our culture

Are we seeing the same “Animal”? ¨ ¨ Do we understand the benefits the same way? We need to anticipate challenges & be proactive? ¨ Implementation ¨ National sovereignty ¨ Non-tariff barriers

Are we seeing the same “Animal”? ¨ ¨ Do we understand the benefits the same way? We need to anticipate challenges & be proactive? ¨ Implementation ¨ National sovereignty ¨ Non-tariff barriers

How does EAC affect our tax policy? ¨ ¨ Tax is a bitter pill Subtle shift towards indirect taxes ¨ Harmonisation likely to tilt the compass ¨ Are we looking at more direct tax measures in future?

How does EAC affect our tax policy? ¨ ¨ Tax is a bitter pill Subtle shift towards indirect taxes ¨ Harmonisation likely to tilt the compass ¨ Are we looking at more direct tax measures in future?

Lets not overload the system ¨ ¨ Free movement of “Everything”? Any anticipated reciprocation?

Lets not overload the system ¨ ¨ Free movement of “Everything”? Any anticipated reciprocation?

We know where we are!…

We know where we are!…

Let us exercise our rights for change! Vote wisely for your Chairman Vote wisely for your ICPAK Representation Accounting Profession is broad… TAXATION is BIG & Deep!

Let us exercise our rights for change! Vote wisely for your Chairman Vote wisely for your ICPAK Representation Accounting Profession is broad… TAXATION is BIG & Deep!

Let us exercise our rights for change! Presenter’s contact details: Julius Mwatu – MBA, BSc. , CPA(K), CPS(K), CFA(EA) Chief Finance Officer – Indigo Telecom Email: julius@indigo. co. ke Telephone: 3876805 -8 / 0728 -888 555

Let us exercise our rights for change! Presenter’s contact details: Julius Mwatu – MBA, BSc. , CPA(K), CPS(K), CFA(EA) Chief Finance Officer – Indigo Telecom Email: julius@indigo. co. ke Telephone: 3876805 -8 / 0728 -888 555

Kwaheri

Kwaheri