11125e06e4b0b65dd8cd4b147ded7cba.ppt

- Количество слайдов: 48

Financial Projections For Start-ups Thomas Hellmann © 2014

Financial Projections For Start-ups Thomas Hellmann © 2014

Objectives • Give investors what they ask for? – Yes, but why do they want it? • Determine profitability of venture? – Impossible to predict future accurately – FP input for current valuation and/or future exit value • Assess viability of venture? – What assumptions required for venture to be feasible? – Breakeven analysis – Scenario analysis

Objectives • Give investors what they ask for? – Yes, but why do they want it? • Determine profitability of venture? – Impossible to predict future accurately – FP input for current valuation and/or future exit value • Assess viability of venture? – What assumptions required for venture to be feasible? – Breakeven analysis – Scenario analysis

Objectives (continued) • Determine financial needs? – – How much funding is required? For what? When do I need it? How long will it last? • Develop deeper understanding of business? – – FP reflect entrepreneur’s perspective on industry Comparison with industry averages revealing Define operating metrics and business milestones Scenario analysis (again) • FP spreadsheets not suitable as an accounting system

Objectives (continued) • Determine financial needs? – – How much funding is required? For what? When do I need it? How long will it last? • Develop deeper understanding of business? – – FP reflect entrepreneur’s perspective on industry Comparison with industry averages revealing Define operating metrics and business milestones Scenario analysis (again) • FP spreadsheets not suitable as an accounting system

REVENUE PROJECTIONS

REVENUE PROJECTIONS

Revenue Projections • Revenues = Price * Volume • Price determination – Strategy – Competitive forces – Industry price dynamics • Four approaches for estimating volume – – Top-down Bottom-up Copy-cat More-of-the-same • In practice, use combination – E. g. Top-down for where you are going (5 years ahead) but bottom-up for where you are (year 1)

Revenue Projections • Revenues = Price * Volume • Price determination – Strategy – Competitive forces – Industry price dynamics • Four approaches for estimating volume – – Top-down Bottom-up Copy-cat More-of-the-same • In practice, use combination – E. g. Top-down for where you are going (5 years ahead) but bottom-up for where you are (year 1)

Top down revenue projections

Top down revenue projections

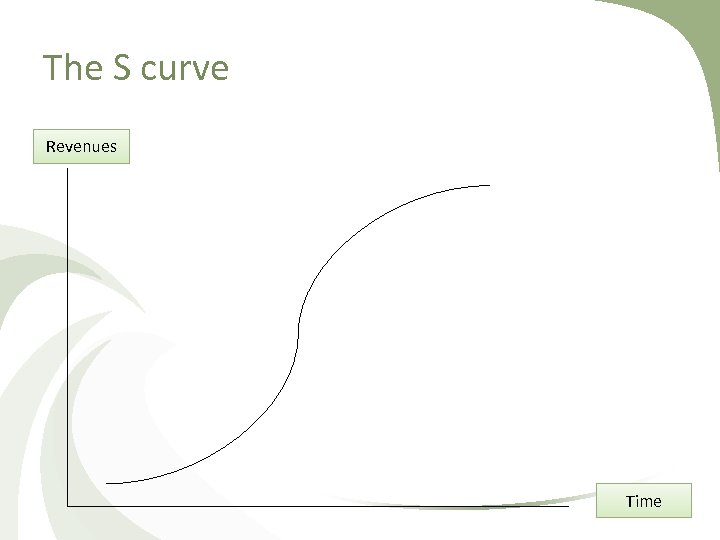

Top down revenue projections • Define relevant market segment – Detailed segmentation key • Existing markets: – Look up current market revenues – Project market growth rate – Estimate obtainable market share • (Hopefully) Emerging markets: – Estimate potential market size – Estimate market adoption curve (S-curve) – Estimate obtainable market share • Classical mistakes: – “Everybody in China will buy our product” – “We only need 1% of a $1 Billion market”

Top down revenue projections • Define relevant market segment – Detailed segmentation key • Existing markets: – Look up current market revenues – Project market growth rate – Estimate obtainable market share • (Hopefully) Emerging markets: – Estimate potential market size – Estimate market adoption curve (S-curve) – Estimate obtainable market share • Classical mistakes: – “Everybody in China will buy our product” – “We only need 1% of a $1 Billion market”

Top down revenue projections Recipe: Use two pounds of fresh primary market research Mix in a cup of secondary market data Lightly sprinkle some theoretical reasoning Decorate subtly with wishful thinking Serve hot

Top down revenue projections Recipe: Use two pounds of fresh primary market research Mix in a cup of secondary market data Lightly sprinkle some theoretical reasoning Decorate subtly with wishful thinking Serve hot

The S curve Revenues Time

The S curve Revenues Time

Bottom-up revenue projections

Bottom-up revenue projections

Bottom-up revenue projections • Basic idea: – – Define basic unit of product / service Estimate customers purchasing units Multiply by average price Estimate customer growth over time • Focuses on ability to deliver • Assumes customers available • Top-down focused outside & demand driven • Bottom-up is focused inside & supply driven • Combination of top-down and bottom more powerful

Bottom-up revenue projections • Basic idea: – – Define basic unit of product / service Estimate customers purchasing units Multiply by average price Estimate customer growth over time • Focuses on ability to deliver • Assumes customers available • Top-down focused outside & demand driven • Bottom-up is focused inside & supply driven • Combination of top-down and bottom more powerful

Copy-Cats and More-of-the-same

Copy-Cats and More-of-the-same

Copy-Cats and More-of-the-same • Industry comparables • Competitor comparables • For established businesses, use recent growth rates • Obvious caveat: past performance is not a reliable indicator of future performance • Better fundamental: Industry or firm S-curve

Copy-Cats and More-of-the-same • Industry comparables • Competitor comparables • For established businesses, use recent growth rates • Obvious caveat: past performance is not a reliable indicator of future performance • Better fundamental: Industry or firm S-curve

REVENUES AND CHANNEL STRATEGY

REVENUES AND CHANNEL STRATEGY

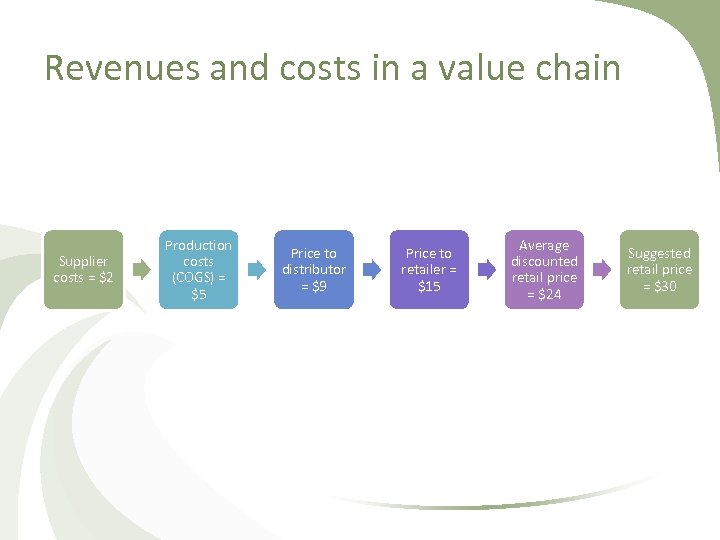

Revenues and costs in a value chain Supplier costs = $2 Production costs (COGS) = $5 Price to distributor = $9 Price to retailer = $15 Average discounted retail price = $24 Suggested retail price = $30

Revenues and costs in a value chain Supplier costs = $2 Production costs (COGS) = $5 Price to distributor = $9 Price to retailer = $15 Average discounted retail price = $24 Suggested retail price = $30

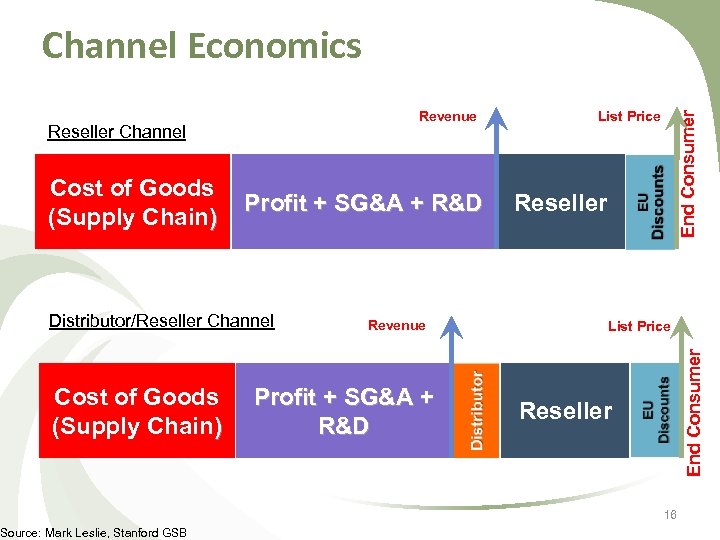

Channel Economics Cost of Goods (Supply Chain) Profit + SG&A + R&D Distributor/Reseller Channel Cost of Goods (Supply Chain) Source: Mark Leslie, Stanford GSB Revenue Profit + SG&A + R&D End Consumer Reseller Channel List Price Reseller List Price End Consumer Revenue Reseller 16

Channel Economics Cost of Goods (Supply Chain) Profit + SG&A + R&D Distributor/Reseller Channel Cost of Goods (Supply Chain) Source: Mark Leslie, Stanford GSB Revenue Profit + SG&A + R&D End Consumer Reseller Channel List Price Reseller List Price End Consumer Revenue Reseller 16

Classroom Exercise • Identify two concrete channels (direct or indirect) of how to reach a customer, and then ask them to map out: • What type of final customer is reached with that channel? • What is the unit of goods sold? • What is the average price paid by the customers? • What is the average price received by the company? • Are there different prices for different customers? • How much revenue do you expect for each channel – Focus on the first year! – We will not ask them about costs now! • Based on this analysis, which channel should you pursue?

Classroom Exercise • Identify two concrete channels (direct or indirect) of how to reach a customer, and then ask them to map out: • What type of final customer is reached with that channel? • What is the unit of goods sold? • What is the average price paid by the customers? • What is the average price received by the company? • Are there different prices for different customers? • How much revenue do you expect for each channel – Focus on the first year! – We will not ask them about costs now! • Based on this analysis, which channel should you pursue?

COST PROJECTIONS

COST PROJECTIONS

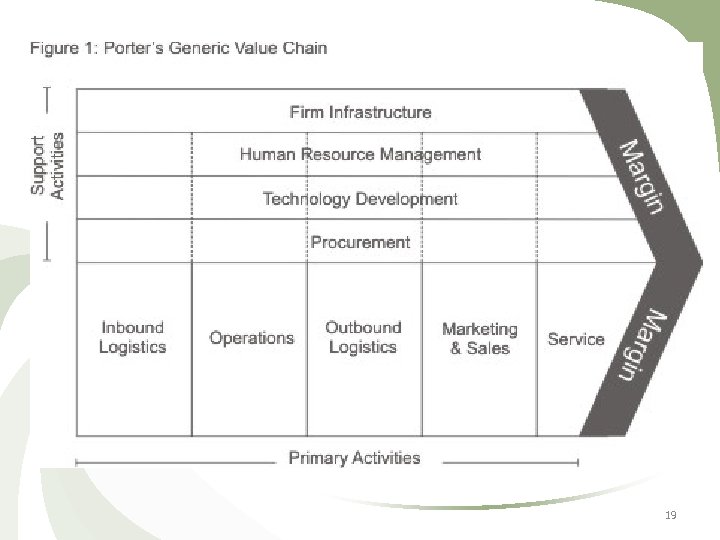

19

19

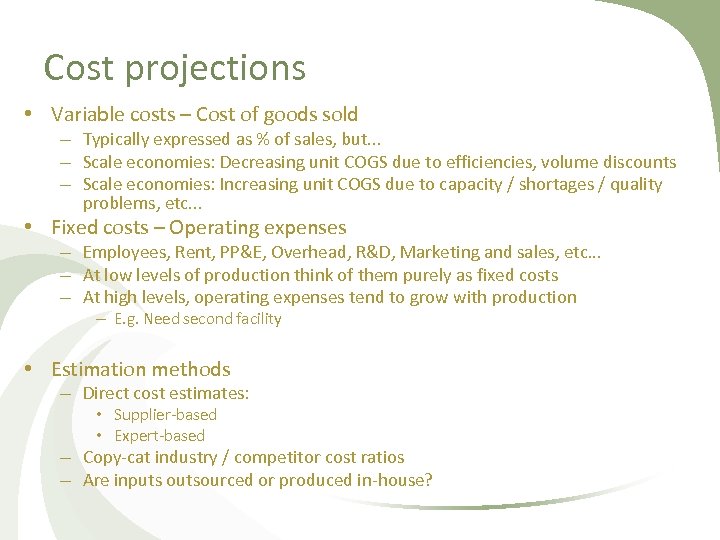

Cost projections • Variable costs – Cost of goods sold – Typically expressed as % of sales, but. . . – Scale economies: Decreasing unit COGS due to efficiencies, volume discounts – Scale economies: Increasing unit COGS due to capacity / shortages / quality problems, etc. . . • Fixed costs – Operating expenses – Employees, Rent, PP&E, Overhead, R&D, Marketing and sales, etc. . . – At low levels of production think of them purely as fixed costs – At high levels, operating expenses tend to grow with production – E. g. Need second facility • Estimation methods – Direct cost estimates: • Supplier-based • Expert-based – Copy-cat industry / competitor cost ratios – Are inputs outsourced or produced in-house?

Cost projections • Variable costs – Cost of goods sold – Typically expressed as % of sales, but. . . – Scale economies: Decreasing unit COGS due to efficiencies, volume discounts – Scale economies: Increasing unit COGS due to capacity / shortages / quality problems, etc. . . • Fixed costs – Operating expenses – Employees, Rent, PP&E, Overhead, R&D, Marketing and sales, etc. . . – At low levels of production think of them purely as fixed costs – At high levels, operating expenses tend to grow with production – E. g. Need second facility • Estimation methods – Direct cost estimates: • Supplier-based • Expert-based – Copy-cat industry / competitor cost ratios – Are inputs outsourced or produced in-house?

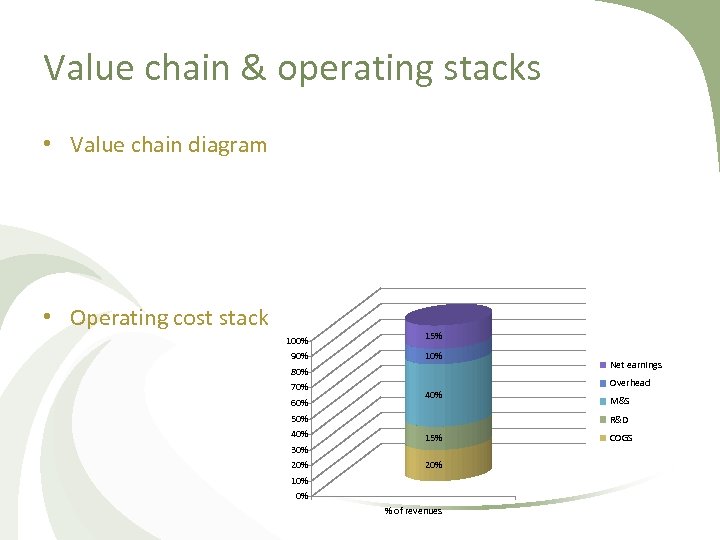

Value chain & operating stacks • Value chain diagram • Operating cost stack 100% 90% 80% 70% 60% 50% 40% 30% 20% 15% 10% 40% Net earnings Overhead M&S R&D 15% 20% 10% 0% % of revenues COGS

Value chain & operating stacks • Value chain diagram • Operating cost stack 100% 90% 80% 70% 60% 50% 40% 30% 20% 15% 10% 40% Net earnings Overhead M&S R&D 15% 20% 10% 0% % of revenues COGS

Development cost projections • Business set-up costs – Legal, Licenses, Office space, Basics • Develop research plan – Timed activity plan – Define priorities • Estimate research costs – Employees – Equipment – Licensing in technology • Define milestones – Define demonstrable progress markers • Prototype, Beta customers, etc… – Milestones be used for financial contracting • Planning of grants – Preference for non-dilutive funding!

Development cost projections • Business set-up costs – Legal, Licenses, Office space, Basics • Develop research plan – Timed activity plan – Define priorities • Estimate research costs – Employees – Equipment – Licensing in technology • Define milestones – Define demonstrable progress markers • Prototype, Beta customers, etc… – Milestones be used for financial contracting • Planning of grants – Preference for non-dilutive funding!

Budget for founder salaries? • Before outside financing, founder salaries largely meaningless • Outside investors not too fond of paying high salaries in early stages • Founders need to set expectations that one day they want to eat something better than Ramen soup! – Write employment agreement – Define founder salary – Take reduced salary for initial years

Budget for founder salaries? • Before outside financing, founder salaries largely meaningless • Outside investors not too fond of paying high salaries in early stages • Founders need to set expectations that one day they want to eat something better than Ramen soup! – Write employment agreement – Define founder salary – Take reduced salary for initial years

INTEGRATED PROJECTIONS

INTEGRATED PROJECTIONS

Useful links • Stanford Technology Venture Formation http: //www. stanford. edu/class/msande 273/resources. html – Peter Kent’s financial model (too complex) – Jeff Kuhn’s model (too simple) – Jeff Kuhn’s video on understanding balance sheets and income statements (probably unnecessary for MBAs) • Hellmann Model http: //strategy. sauder. ubc. ca/hellmann/ – Goldilocks says: (Just right) • WWW – Lots of models freely available

Useful links • Stanford Technology Venture Formation http: //www. stanford. edu/class/msande 273/resources. html – Peter Kent’s financial model (too complex) – Jeff Kuhn’s model (too simple) – Jeff Kuhn’s video on understanding balance sheets and income statements (probably unnecessary for MBAs) • Hellmann Model http: //strategy. sauder. ubc. ca/hellmann/ – Goldilocks says: (Just right) • WWW – Lots of models freely available

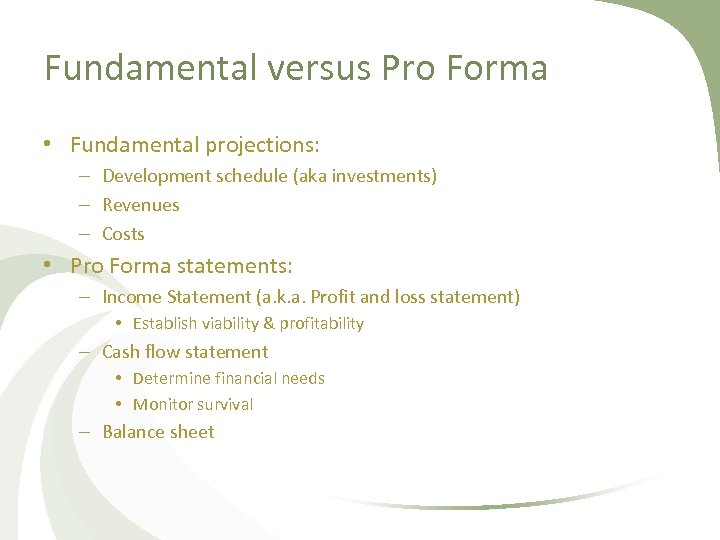

Fundamental versus Pro Forma • Fundamental projections: – Development schedule (aka investments) – Revenues – Costs • Pro Forma statements: – Income Statement (a. k. a. Profit and loss statement) • Establish viability & profitability – Cash flow statement • Determine financial needs • Monitor survival – Balance sheet

Fundamental versus Pro Forma • Fundamental projections: – Development schedule (aka investments) – Revenues – Costs • Pro Forma statements: – Income Statement (a. k. a. Profit and loss statement) • Establish viability & profitability – Cash flow statement • Determine financial needs • Monitor survival – Balance sheet

How long, how often, how detailed? • Length – Minimum 1 -2 years; typical 3 -5 years; maximum ? ? ? – Depends on industry and development cycle • Retail: a few months • Software: a few years • Biotech / Cleantech: a few decades • Frequency – Monthly: “only the paranoid survive” – Quarterly: “balanced approach”; still captures seasonality – Yearly: “big picture” • Detail – I n a presentation only shows highlights • Revenue projections • Investment / Costs highlights • Income / cash flows (“The ubiquitous hockey stick”) – Be ready for justifying each number!

How long, how often, how detailed? • Length – Minimum 1 -2 years; typical 3 -5 years; maximum ? ? ? – Depends on industry and development cycle • Retail: a few months • Software: a few years • Biotech / Cleantech: a few decades • Frequency – Monthly: “only the paranoid survive” – Quarterly: “balanced approach”; still captures seasonality – Yearly: “big picture” • Detail – I n a presentation only shows highlights • Revenue projections • Investment / Costs highlights • Income / cash flows (“The ubiquitous hockey stick”) – Be ready for justifying each number!

PRESENTATION EXAMPLE #1

PRESENTATION EXAMPLE #1

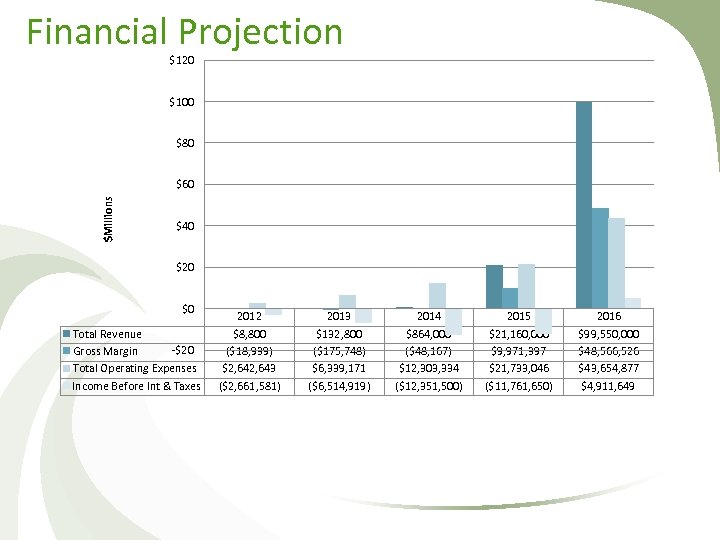

Financial Projection $120 $100 $80 $Millions $60 $40 $20 $0 Total Revenue -$20 Gross Margin Total Operating Expenses Income Before Int & Taxes 2012 $8, 800 ($18, 939) $2, 643 ($2, 661, 581) 2013 $132, 800 ($175, 748) $6, 339, 171 ($6, 514, 919) 2014 $864, 000 ($48, 167) $12, 303, 334 ($12, 351, 500) 2015 $21, 160, 000 $9, 971, 397 $21, 733, 046 ($11, 761, 650) 2016 $99, 550, 000 $48, 566, 526 $43, 654, 877 $4, 911, 649

Financial Projection $120 $100 $80 $Millions $60 $40 $20 $0 Total Revenue -$20 Gross Margin Total Operating Expenses Income Before Int & Taxes 2012 $8, 800 ($18, 939) $2, 643 ($2, 661, 581) 2013 $132, 800 ($175, 748) $6, 339, 171 ($6, 514, 919) 2014 $864, 000 ($48, 167) $12, 303, 334 ($12, 351, 500) 2015 $21, 160, 000 $9, 971, 397 $21, 733, 046 ($11, 761, 650) 2016 $99, 550, 000 $48, 566, 526 $43, 654, 877 $4, 911, 649

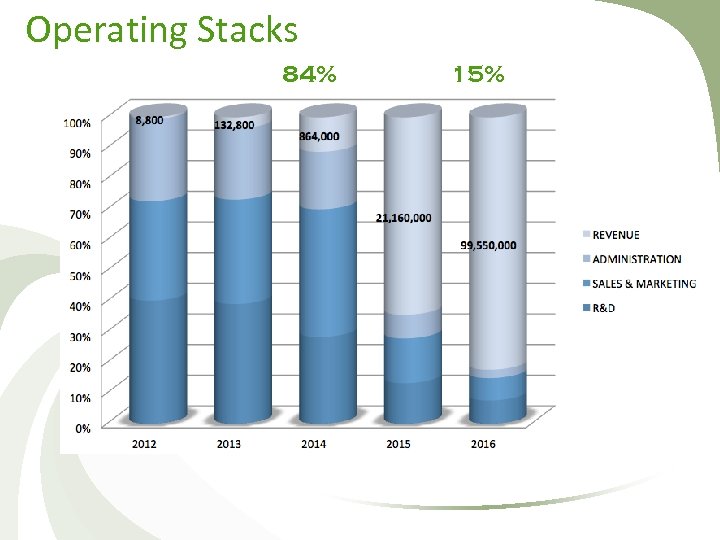

Operating Stacks 84% 15%

Operating Stacks 84% 15%

PRESENTATION EXAMPLE #2

PRESENTATION EXAMPLE #2

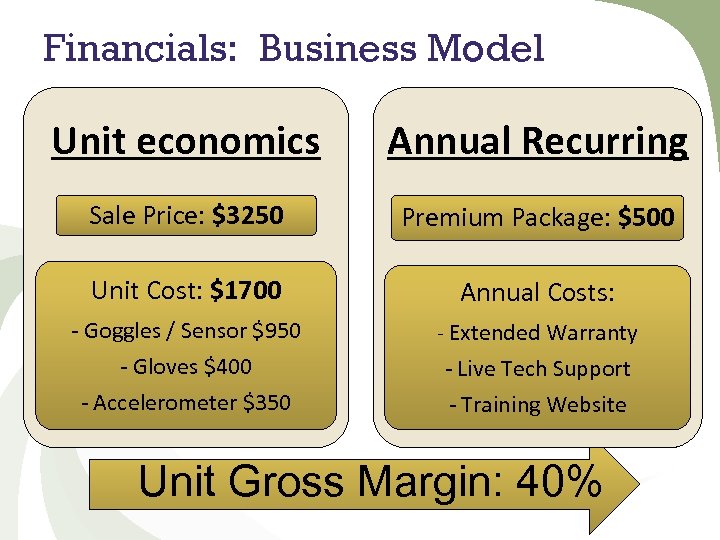

Financials: Business Model Unit economics Annual Recurring Sale Price: $3250 Premium Package: $500 Unit Cost: $1700 Annual Costs: - Goggles / Sensor $950 - Gloves $400 - Accelerometer $350 - Extended Warranty - Live Tech Support - Training Website Unit Gross Margin: 40%

Financials: Business Model Unit economics Annual Recurring Sale Price: $3250 Premium Package: $500 Unit Cost: $1700 Annual Costs: - Goggles / Sensor $950 - Gloves $400 - Accelerometer $350 - Extended Warranty - Live Tech Support - Training Website Unit Gross Margin: 40%

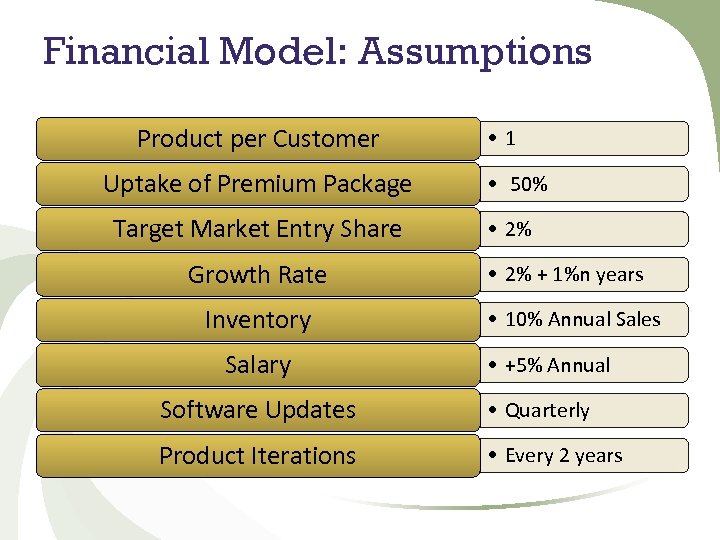

Financial Model: Assumptions Product per Customer • 1 • 50% Uptake of Premium Package • 2% Target Market Entry Share Growth Rate • 2% + 1%n years Inventory • 10% Annual Sales Salary • +5% Annual Software Updates • Quarterly Product Iterations • Every 2 years

Financial Model: Assumptions Product per Customer • 1 • 50% Uptake of Premium Package • 2% Target Market Entry Share Growth Rate • 2% + 1%n years Inventory • 10% Annual Sales Salary • +5% Annual Software Updates • Quarterly Product Iterations • Every 2 years

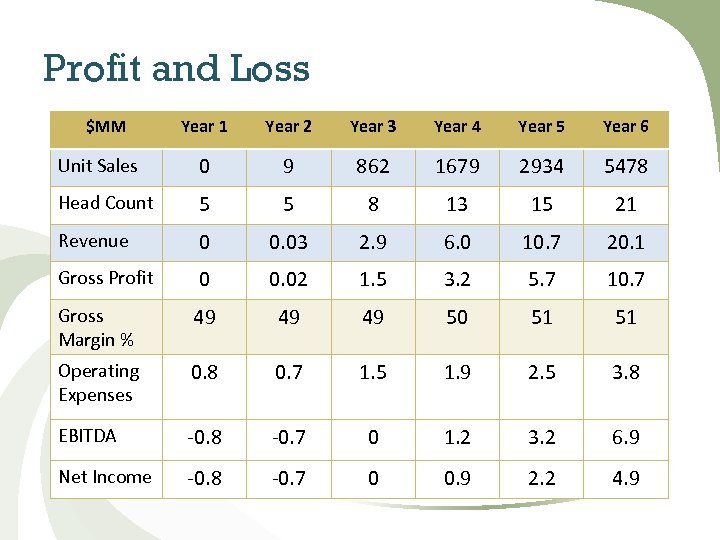

Profit and Loss $MM Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Unit Sales 0 9 862 1679 2934 5478 Head Count 5 5 8 13 15 21 Revenue 0 0. 03 2. 9 6. 0 10. 7 20. 1 Gross Profit 0 0. 02 1. 5 3. 2 5. 7 10. 7 Gross Margin % 49 49 49 50 51 51 Operating Expenses 0. 8 0. 7 1. 5 1. 9 2. 5 3. 8 EBITDA -0. 8 -0. 7 0 1. 2 3. 2 6. 9 Net Income -0. 8 -0. 7 0 0. 9 2. 2 4. 9

Profit and Loss $MM Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Unit Sales 0 9 862 1679 2934 5478 Head Count 5 5 8 13 15 21 Revenue 0 0. 03 2. 9 6. 0 10. 7 20. 1 Gross Profit 0 0. 02 1. 5 3. 2 5. 7 10. 7 Gross Margin % 49 49 49 50 51 51 Operating Expenses 0. 8 0. 7 1. 5 1. 9 2. 5 3. 8 EBITDA -0. 8 -0. 7 0 1. 2 3. 2 6. 9 Net Income -0. 8 -0. 7 0 0. 9 2. 2 4. 9

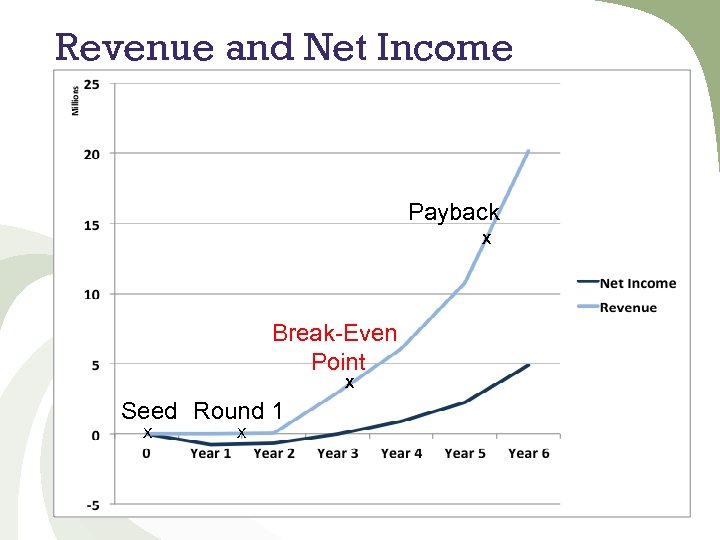

Revenue and Net Income Payback X Break-Even Point X Seed Round 1 X X

Revenue and Net Income Payback X Break-Even Point X Seed Round 1 X X

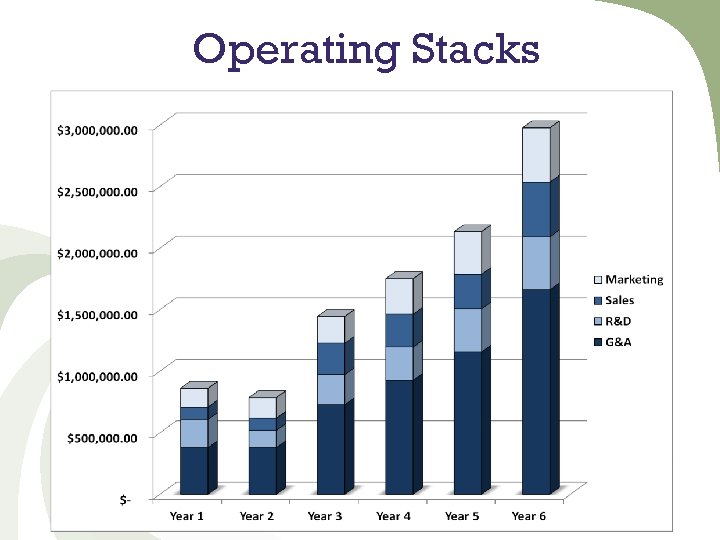

Operating Stacks

Operating Stacks

PRESENTATION EXAMPLE #3

PRESENTATION EXAMPLE #3

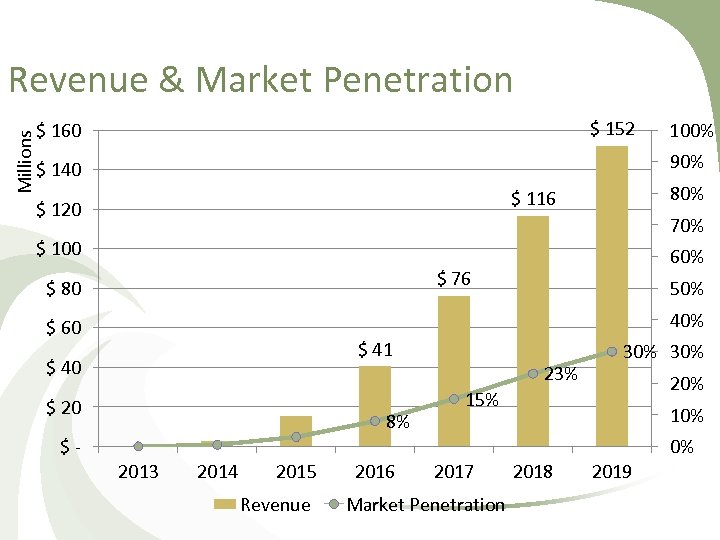

Millions Revenue & Market Penetration $ 152 $ 160 100% 90% $ 140 80% $ 116 $ 120 70% $ 100 60% $ 76 $ 80 50% 40% $ 60 $ 41 $ 40 23% $ 20 8% 30% 20% 15% 10% $ - 0% 2013 2014 2015 Revenue 2016 2017 Market Penetration 2018 2019

Millions Revenue & Market Penetration $ 152 $ 160 100% 90% $ 140 80% $ 116 $ 120 70% $ 100 60% $ 76 $ 80 50% 40% $ 60 $ 41 $ 40 23% $ 20 8% 30% 20% 15% 10% $ - 0% 2013 2014 2015 Revenue 2016 2017 Market Penetration 2018 2019

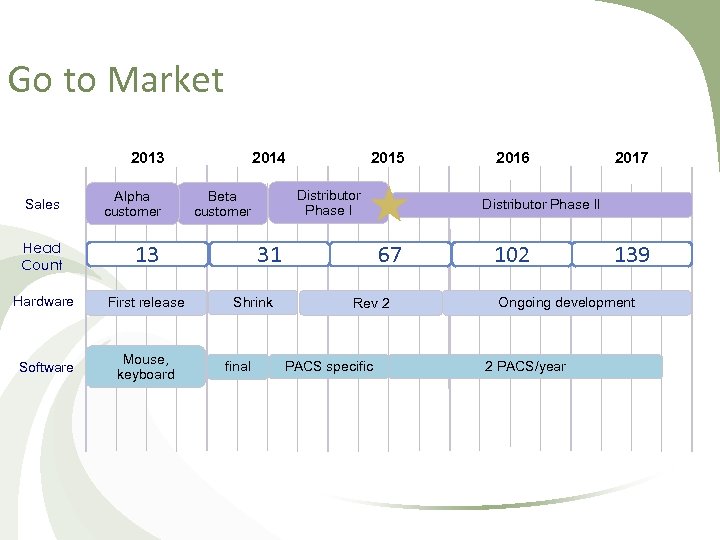

Go to Market 2013 Sales Alpha customer Head Count First release Software Mouse, keyboard 2015 Distributor Phase I Beta customer 13 Hardware 2014 31 Shrink final 2017 Distributor Phase II 67 Rev 2 PACS specific 2016 102 139 Ongoing development 2 PACS/year

Go to Market 2013 Sales Alpha customer Head Count First release Software Mouse, keyboard 2015 Distributor Phase I Beta customer 13 Hardware 2014 31 Shrink final 2017 Distributor Phase II 67 Rev 2 PACS specific 2016 102 139 Ongoing development 2 PACS/year

Assumptions 25% of all operations • 50%-75% of operations use imaging. • Half of those are long enough. 33% Distributor Markup • Retail price of $112. 50 • Wholesale price of $75. 00 Slow Medical Market • 15% penetration in 5 years • 30% penetration in 7 years Class I Device • No FDA approval • 90 day pre-market notification Steady Adoption • Growth rate is linear

Assumptions 25% of all operations • 50%-75% of operations use imaging. • Half of those are long enough. 33% Distributor Markup • Retail price of $112. 50 • Wholesale price of $75. 00 Slow Medical Market • 15% penetration in 5 years • 30% penetration in 7 years Class I Device • No FDA approval • 90 day pre-market notification Steady Adoption • Growth rate is linear

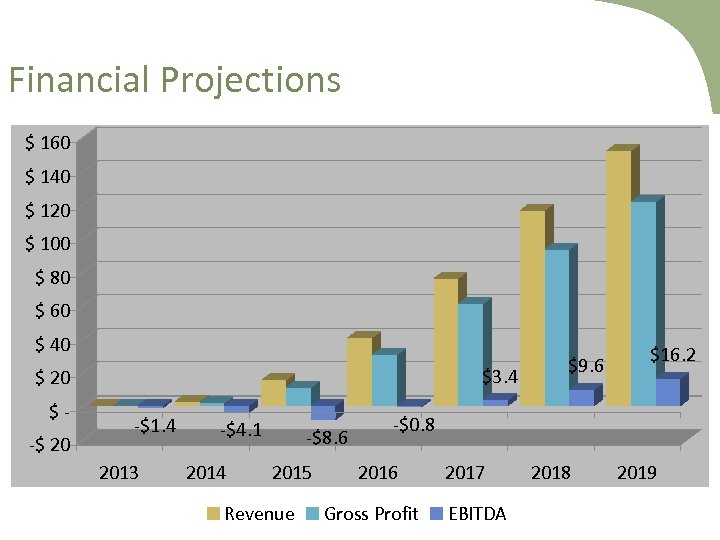

Financial Projections $ 160 $ 140 $ 120 $ 100 $ 80 $ 60 $ 40 $3. 4 $ 20 $ -$ 20 -$1. 4 2013 -$4. 1 2014 -$8. 6 2015 Revenue $9. 6 $16. 2 -$0. 8 2016 Gross Profit 2017 EBITDA 2018 2019

Financial Projections $ 160 $ 140 $ 120 $ 100 $ 80 $ 60 $ 40 $3. 4 $ 20 $ -$ 20 -$1. 4 2013 -$4. 1 2014 -$8. 6 2015 Revenue $9. 6 $16. 2 -$0. 8 2016 Gross Profit 2017 EBITDA 2018 2019

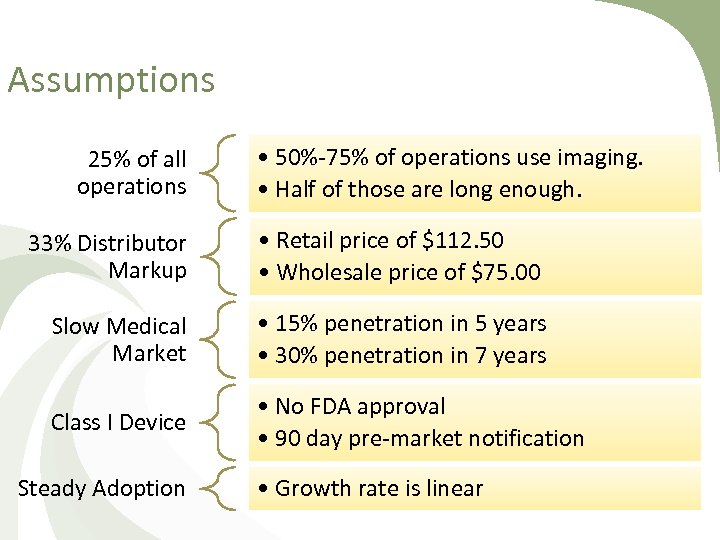

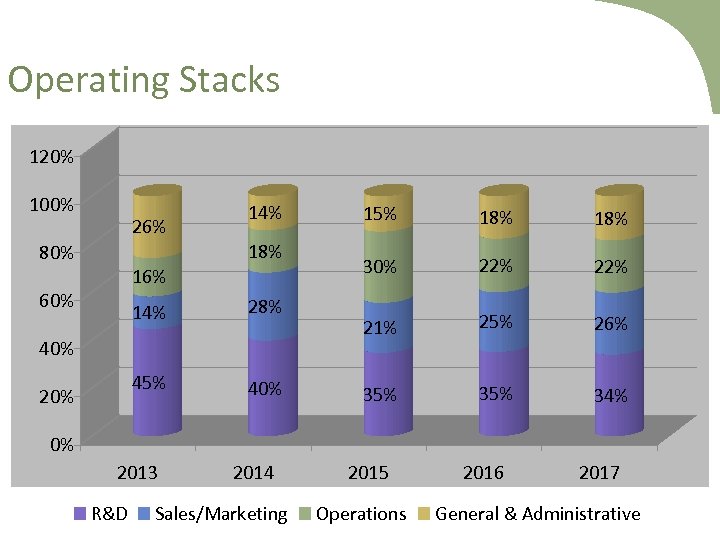

Operating Stacks 120% 100% 26% 14% 18% 80% 16% 60% 14% 28% 45% 40% 20% 15% 18% 30% 22% 21% 25% 26% 35% 34% 0% 2013 R&D 2014 Sales/Marketing 2015 Operations 2016 2017 General & Administrative

Operating Stacks 120% 100% 26% 14% 18% 80% 16% 60% 14% 28% 45% 40% 20% 15% 18% 30% 22% 21% 25% 26% 35% 34% 0% 2013 R&D 2014 Sales/Marketing 2015 Operations 2016 2017 General & Administrative

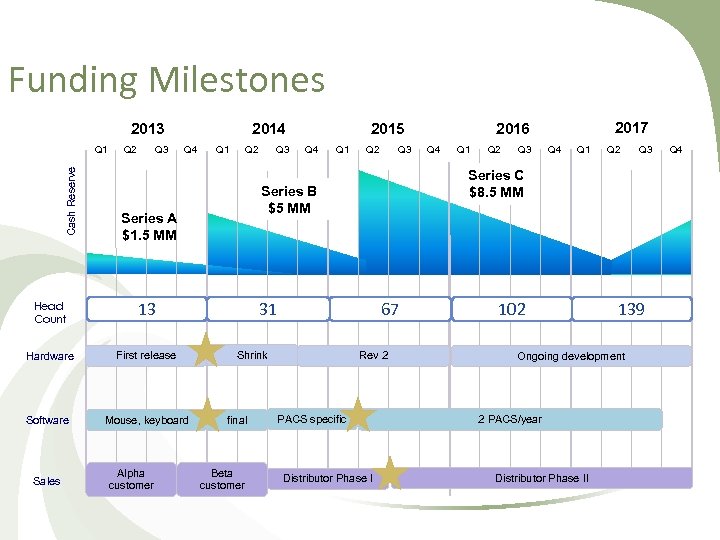

Funding Milestones 2013 Cash Reserve Q 1 Q 2 Q 3 2014 Q 1 Q 2 13 Hardware First release Software Mouse, keyboard Sales Alpha customer Q 4 Q 1 Q 2 Q 3 31 67 Shrink final Beta customer 2017 2016 Q 4 Q 1 Q 2 Q 3 Series C $8. 5 MM Series B $5 MM Series A $1. 5 MM Head Count Q 3 2015 Rev 2 PACS specific Distributor Phase I 102 139 Ongoing development 2 PACS/year Distributor Phase II Q 4

Funding Milestones 2013 Cash Reserve Q 1 Q 2 Q 3 2014 Q 1 Q 2 13 Hardware First release Software Mouse, keyboard Sales Alpha customer Q 4 Q 1 Q 2 Q 3 31 67 Shrink final Beta customer 2017 2016 Q 4 Q 1 Q 2 Q 3 Series C $8. 5 MM Series B $5 MM Series A $1. 5 MM Head Count Q 3 2015 Rev 2 PACS specific Distributor Phase I 102 139 Ongoing development 2 PACS/year Distributor Phase II Q 4

CONCLUDING THOUGHTS

CONCLUDING THOUGHTS

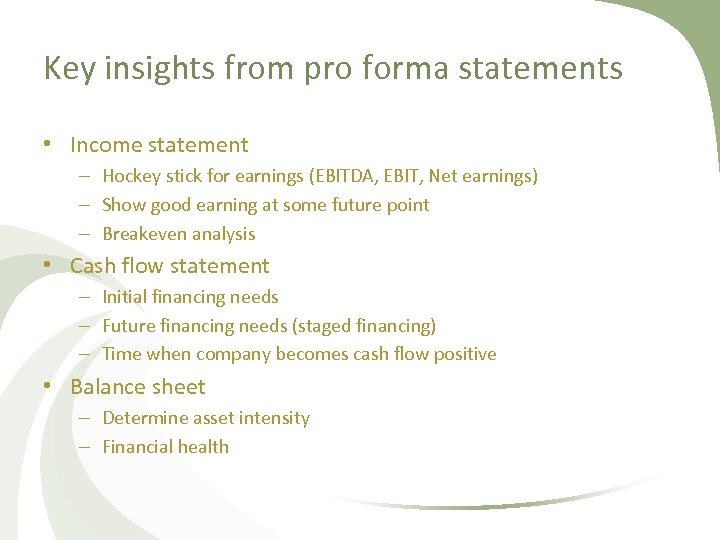

Key insights from pro forma statements • Income statement – Hockey stick for earnings (EBITDA, EBIT, Net earnings) – Show good earning at some future point – Breakeven analysis • Cash flow statement – Initial financing needs – Future financing needs (staged financing) – Time when company becomes cash flow positive • Balance sheet – Determine asset intensity – Financial health

Key insights from pro forma statements • Income statement – Hockey stick for earnings (EBITDA, EBIT, Net earnings) – Show good earning at some future point – Breakeven analysis • Cash flow statement – Initial financing needs – Future financing needs (staged financing) – Time when company becomes cash flow positive • Balance sheet – Determine asset intensity – Financial health

Classic mistakes (I) • Revenues – Overestimate speed of revenues – Unjustifiable revenue spurts – Missing costs of generating sales – Distinguish listed and actual average price • Cost – Forget costs of running business – Plan for underutilization • both revenues % costs) – Full labor costs • including benefits, training, bonuses, etc…

Classic mistakes (I) • Revenues – Overestimate speed of revenues – Unjustifiable revenue spurts – Missing costs of generating sales – Distinguish listed and actual average price • Cost – Forget costs of running business – Plan for underutilization • both revenues % costs) – Full labor costs • including benefits, training, bonuses, etc…

Classic mistakes (II) • Cash flows – Late payments and collection costs – Underestimate true cost of trade credit – Time to raise funding • Overall – Ignore industry ratios – False precision – Level of detail • internal operations vs. external presentation – Mismatch between financials and business plan

Classic mistakes (II) • Cash flows – Late payments and collection costs – Underestimate true cost of trade credit – Time to raise funding • Overall – Ignore industry ratios – False precision – Level of detail • internal operations vs. external presentation – Mismatch between financials and business plan

Final words of wisdom Cash flows are more important than your mommy! C. F. A. M. I. T. Y. M

Final words of wisdom Cash flows are more important than your mommy! C. F. A. M. I. T. Y. M