3fa2f6b164a6650014394d1279f31f55.ppt

- Количество слайдов: 20

FINANCIAL PLANNING The National Economics Department Financial Freedom Campaign NAACP

FINANCIAL PLANNING The National Economics Department Financial Freedom Campaign NAACP

What Is Financial Planning? v Financial Planning is the process of meeting your life goals through the proper management of your finances. v. Financial Planning consists of a series of steps that help you see your financial “big picture”.

What Is Financial Planning? v Financial Planning is the process of meeting your life goals through the proper management of your finances. v. Financial Planning consists of a series of steps that help you see your financial “big picture”.

v Financial Planning provides direction and meaning to your financial decisions. It allows you to understand how each financial decision you make affects other areas of your finances. v By viewing each financial decision as part of a whole, you can consider its short and long term effects on your life goals. You can also adapt easily to life changes and feel more secure that your goals are on track

v Financial Planning provides direction and meaning to your financial decisions. It allows you to understand how each financial decision you make affects other areas of your finances. v By viewing each financial decision as part of a whole, you can consider its short and long term effects on your life goals. You can also adapt easily to life changes and feel more secure that your goals are on track

The Financial Guide to handling life’s Milestones v Ever wonder how to spend or properly use your money on the milestones that most of us experience at some point in our lives? v Why are milestones so important? – Because, they truly change your financial picture!

The Financial Guide to handling life’s Milestones v Ever wonder how to spend or properly use your money on the milestones that most of us experience at some point in our lives? v Why are milestones so important? – Because, they truly change your financial picture!

Life’s Major Milestones q. Higher Education q. Getting Married q. Birth of a child q. A new Job q. Buying a House q. Loss of a parent

Life’s Major Milestones q. Higher Education q. Getting Married q. Birth of a child q. A new Job q. Buying a House q. Loss of a parent

Higher Education Planning q Before tackling the task of funding college for your children, first make sure it’s worth the money and the effort. Not everyone wants, needs or is qualified to go to college. q However, a college graduate earns an annual average of over 62 percent more than a high school graduate, according to the U. S. Census Bureau.

Higher Education Planning q Before tackling the task of funding college for your children, first make sure it’s worth the money and the effort. Not everyone wants, needs or is qualified to go to college. q However, a college graduate earns an annual average of over 62 percent more than a high school graduate, according to the U. S. Census Bureau.

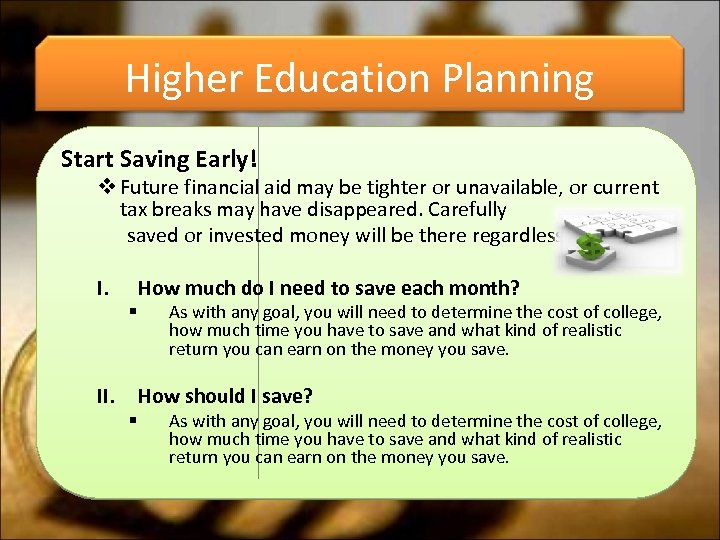

Higher Education Planning Start Saving Early! v Future financial aid may be tighter or unavailable, or current tax breaks may have disappeared. Carefully saved or invested money will be there regardless. I. II. How much do I need to save each month? § As with any goal, you will need to determine the cost of college, how much time you have to save and what kind of realistic return you can earn on the money you save. How should I save? § As with any goal, you will need to determine the cost of college, how much time you have to save and what kind of realistic return you can earn on the money you save.

Higher Education Planning Start Saving Early! v Future financial aid may be tighter or unavailable, or current tax breaks may have disappeared. Carefully saved or invested money will be there regardless. I. II. How much do I need to save each month? § As with any goal, you will need to determine the cost of college, how much time you have to save and what kind of realistic return you can earn on the money you save. How should I save? § As with any goal, you will need to determine the cost of college, how much time you have to save and what kind of realistic return you can earn on the money you save.

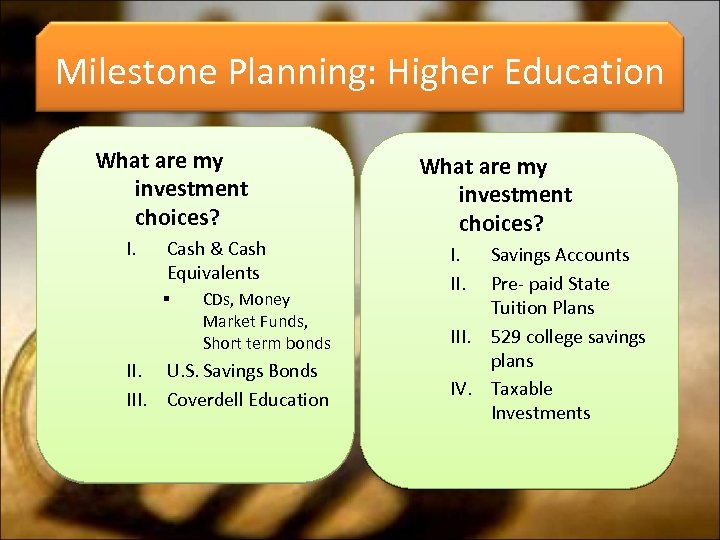

Milestone Planning: Higher Education What are my investment choices? I. Cash & Cash Equivalents § CDs, Money Market Funds, Short term bonds II. U. S. Savings Bonds III. Coverdell Education What are my investment choices? I. II. Savings Accounts Pre- paid State Tuition Plans III. 529 college savings plans IV. Taxable Investments

Milestone Planning: Higher Education What are my investment choices? I. Cash & Cash Equivalents § CDs, Money Market Funds, Short term bonds II. U. S. Savings Bonds III. Coverdell Education What are my investment choices? I. II. Savings Accounts Pre- paid State Tuition Plans III. 529 college savings plans IV. Taxable Investments

Marriage Planning Tips Stop paying for services twice – These are the ways two can live more cheaply than one • Sharing cell phone minutes (saving aprox. $300 a year, more if you join a plan that lest you to each other for free) • Internet and Cable Service (another $500 a year) • Commute together- limit or stop using a car if you’re going in the same direction

Marriage Planning Tips Stop paying for services twice – These are the ways two can live more cheaply than one • Sharing cell phone minutes (saving aprox. $300 a year, more if you join a plan that lest you to each other for free) • Internet and Cable Service (another $500 a year) • Commute together- limit or stop using a car if you’re going in the same direction

Marriage Planning Tips Do a benefits audit – Does it make sense to swap your singles health plan for family care? – It may, if your spouse works in a place where the employee contribution is very small. Weigh the costs of two single plans against family coverage

Marriage Planning Tips Do a benefits audit – Does it make sense to swap your singles health plan for family care? – It may, if your spouse works in a place where the employee contribution is very small. Weigh the costs of two single plans against family coverage

Marriage Planning Tips File jointly § When you’re married and still file your taxes separately you loose some big tax benefits. Often times, filing jointly can help you pay less in taxes. § Example: If one spouse earns $75 k and the other $15 k, filing jointly can help you save about $1, 500 in taxes a year. § If you are not sure about your particular case, ask your accountant or use a tax software program like Turbo tax)

Marriage Planning Tips File jointly § When you’re married and still file your taxes separately you loose some big tax benefits. Often times, filing jointly can help you pay less in taxes. § Example: If one spouse earns $75 k and the other $15 k, filing jointly can help you save about $1, 500 in taxes a year. § If you are not sure about your particular case, ask your accountant or use a tax software program like Turbo tax)

Child Birth Planning Tips Ø Put a set amount away in an IRA monthly – Allows you to pay for retirement and/or college • Remember: there is no financial aid for retirement but there are lots of financial aid for college Ø Open an Upromise account – Deposits a percentage of your purchases into a 529 account to pay for college Ø Name Guardians – If you already have a will, now you have to name guardians of that child. To ensure that if something happens to you, getting guardianship can cost hundreds of dollars if the proceeding is NOT contested.

Child Birth Planning Tips Ø Put a set amount away in an IRA monthly – Allows you to pay for retirement and/or college • Remember: there is no financial aid for retirement but there are lots of financial aid for college Ø Open an Upromise account – Deposits a percentage of your purchases into a 529 account to pay for college Ø Name Guardians – If you already have a will, now you have to name guardians of that child. To ensure that if something happens to you, getting guardianship can cost hundreds of dollars if the proceeding is NOT contested.

New Job Planning Tips • Collect 401 k matching dollars – The average company these days will match 50% of 401(k) contributions up to 6% of your salary • Deduct job-Hunting expenses – If you itemize your taxes, remember that job-hunting expenses can be deducted. This is a deduction not a credit. But it can include the cost of outplacement or headhunting services, travel expenses if your traveled to an interview, mileage added to your car as you drove around looking for a job.

New Job Planning Tips • Collect 401 k matching dollars – The average company these days will match 50% of 401(k) contributions up to 6% of your salary • Deduct job-Hunting expenses – If you itemize your taxes, remember that job-hunting expenses can be deducted. This is a deduction not a credit. But it can include the cost of outplacement or headhunting services, travel expenses if your traveled to an interview, mileage added to your car as you drove around looking for a job.

Buying a House Tips Make one extra mortgage payment a year (if possible) – Will reduce the term of a 30 -year mortgage and save you a bundle on interest alone Raise the deductable on your homeowners policy – Going with a $1, 000 deductable rather than a $500 deductable can save you 25% on your premiums each year. On a policy that costs $1, 000, that’s a savings of $250 a year.

Buying a House Tips Make one extra mortgage payment a year (if possible) – Will reduce the term of a 30 -year mortgage and save you a bundle on interest alone Raise the deductable on your homeowners policy – Going with a $1, 000 deductable rather than a $500 deductable can save you 25% on your premiums each year. On a policy that costs $1, 000, that’s a savings of $250 a year.

Buying a House Tips Do an energy audit – Go through the house yourself ( or hire a professional) to find areas where air is leaking, insulation is not working or needed or windows needing caulking can save 5 to 30% off the costs of your heating bills each are.

Buying a House Tips Do an energy audit – Go through the house yourself ( or hire a professional) to find areas where air is leaking, insulation is not working or needed or windows needing caulking can save 5 to 30% off the costs of your heating bills each are.

The Loss of a Parent Get essential paperwork in order – You’ll want 5 -6 copies of the death certificate so that you can apply for life insurance benefits or financial accounts. – Let an employer or pension provider or Social Security now of the death within a few days (mandated by law) – Get an Accountant on board sooner rather than later to start working on the final tax return.

The Loss of a Parent Get essential paperwork in order – You’ll want 5 -6 copies of the death certificate so that you can apply for life insurance benefits or financial accounts. – Let an employer or pension provider or Social Security now of the death within a few days (mandated by law) – Get an Accountant on board sooner rather than later to start working on the final tax return.

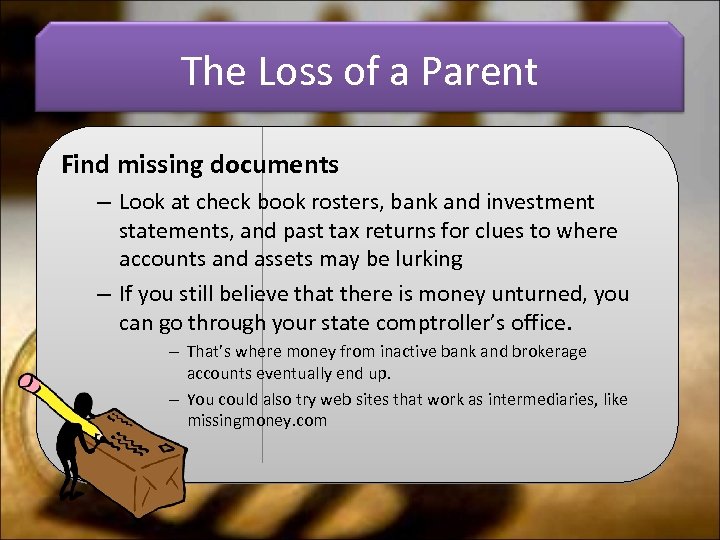

The Loss of a Parent Find missing documents – Look at check book rosters, bank and investment statements, and past tax returns for clues to where accounts and assets may be lurking – If you still believe that there is money unturned, you can go through your state comptroller’s office. – That’s where money from inactive bank and brokerage accounts eventually end up. – You could also try web sites that work as intermediaries, like missingmoney. com

The Loss of a Parent Find missing documents – Look at check book rosters, bank and investment statements, and past tax returns for clues to where accounts and assets may be lurking – If you still believe that there is money unturned, you can go through your state comptroller’s office. – That’s where money from inactive bank and brokerage accounts eventually end up. – You could also try web sites that work as intermediaries, like missingmoney. com

The Financial Planning Profession Ø A Financial Planner is a professional who helps determine how you will meet you life’s goals. Ø In addition to being qualified to provide you with general financial planning services, many financial planners are also registered investment advisors or hold insure or securities licenses that allow them to buy or sell products.

The Financial Planning Profession Ø A Financial Planner is a professional who helps determine how you will meet you life’s goals. Ø In addition to being qualified to provide you with general financial planning services, many financial planners are also registered investment advisors or hold insure or securities licenses that allow them to buy or sell products.

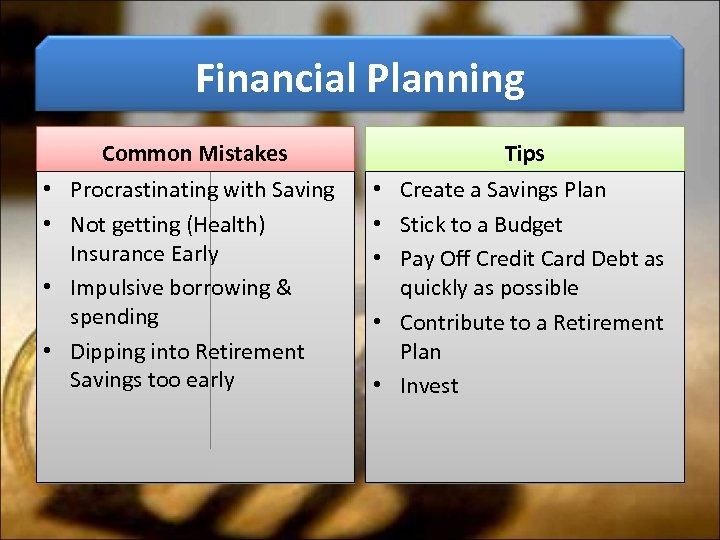

Financial Planning Common Mistakes Tips • Procrastinating with Saving • Not getting (Health) Insurance Early • Impulsive borrowing & spending • Dipping into Retirement Savings too early • Create a Savings Plan • Stick to a Budget • Pay Off Credit Card Debt as quickly as possible • Contribute to a Retirement Plan • Invest

Financial Planning Common Mistakes Tips • Procrastinating with Saving • Not getting (Health) Insurance Early • Impulsive borrowing & spending • Dipping into Retirement Savings too early • Create a Savings Plan • Stick to a Budget • Pay Off Credit Card Debt as quickly as possible • Contribute to a Retirement Plan • Invest

Resources • Financial Planners Association www. fpanet. org/ • Certified Financial Planners Board of Standards www. cfp. net • Association of Financial Counseling Planning Education www. cpe. org

Resources • Financial Planners Association www. fpanet. org/ • Certified Financial Planners Board of Standards www. cfp. net • Association of Financial Counseling Planning Education www. cpe. org