041d09595cd632b6be2d347afb2f4d93.ppt

- Количество слайдов: 54

Financial Planning and the ® CFP Marks: A World View Presented by: Noel Maye, CEO Financial Planning Standards Board Ltd. CIFPs National Conference, 12 June 2007 1 © 2007, Financial Planning Standards Board Ltd.

Financial Planning and the ® CFP Marks: A World View Presented by: Noel Maye, CEO Financial Planning Standards Board Ltd. CIFPs National Conference, 12 June 2007 1 © 2007, Financial Planning Standards Board Ltd.

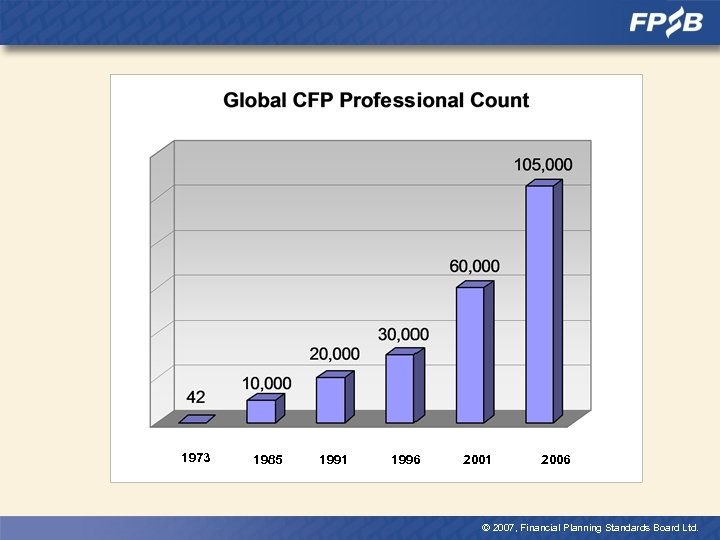

1973 1985 1991 1996 2001 2006 © 2007, Financial Planning Standards Board Ltd.

1973 1985 1991 1996 2001 2006 © 2007, Financial Planning Standards Board Ltd.

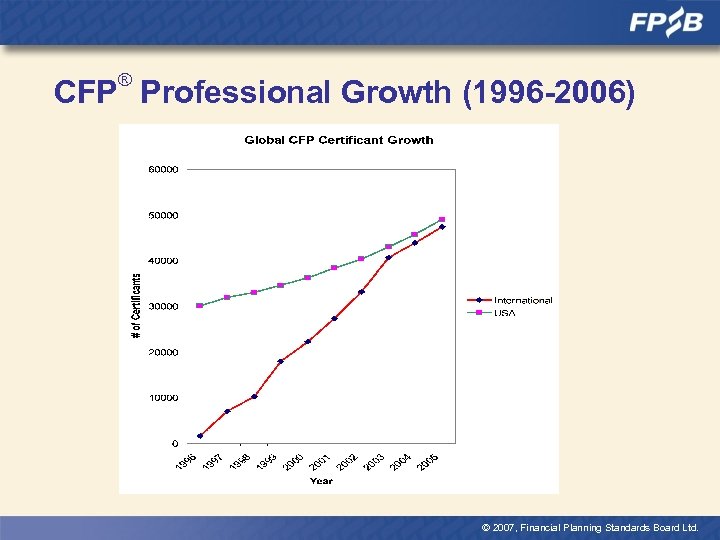

® CFP Professional Growth (1996 -2006) © 2007, Financial Planning Standards Board Ltd.

® CFP Professional Growth (1996 -2006) © 2007, Financial Planning Standards Board Ltd.

PC_fpsb_final. exe © 2007, Financial Planning Standards Board Ltd.

PC_fpsb_final. exe © 2007, Financial Planning Standards Board Ltd.

FPSB Mission To benefit and protect the global community by establishing, upholding and promoting worldwide professional standards in financial planning. Our commitment to excellence is represented by the marks of professional distinction – PC_fpsb_final. exe © 2007, Financial Planning Standards Board Ltd.

FPSB Mission To benefit and protect the global community by establishing, upholding and promoting worldwide professional standards in financial planning. Our commitment to excellence is represented by the marks of professional distinction – PC_fpsb_final. exe © 2007, Financial Planning Standards Board Ltd.

FPSB Affiliate Organizations Asia Pacific § § § Australia Chinese Taipei Hong Kong India Indonesia Japan Malaysia New Zealand Rep. Korea Singapore Europe North America § § § Austria France Germany Switzerland U. K. Canada South America § Brazil Africa § South Africa © 2007, Financial Planning Standards Board Ltd.

FPSB Affiliate Organizations Asia Pacific § § § Australia Chinese Taipei Hong Kong India Indonesia Japan Malaysia New Zealand Rep. Korea Singapore Europe North America § § § Austria France Germany Switzerland U. K. Canada South America § Brazil Africa § South Africa © 2007, Financial Planning Standards Board Ltd.

Potential Growth Areas Asia Pacific Middle East § Thailand § Brunei § Philippines § Caribbean § Bermuda Egypt § Israel § Saudi Arabia § U. A. E South/Central America § Argentina § § Chile Colombia Uruguay Mexico Europe § § § Belgium Bulgaria Greece Hungary Ireland Italy Netherlands Poland Romania Spain Sweden Turkey © 2007, Financial Planning Standards Board Ltd.

Potential Growth Areas Asia Pacific Middle East § Thailand § Brunei § Philippines § Caribbean § Bermuda Egypt § Israel § Saudi Arabia § U. A. E South/Central America § Argentina § § Chile Colombia Uruguay Mexico Europe § § § Belgium Bulgaria Greece Hungary Ireland Italy Netherlands Poland Romania Spain Sweden Turkey © 2007, Financial Planning Standards Board Ltd.

What We Have in Common 8 © 2007, Financial Planning Standards Board Ltd.

What We Have in Common 8 © 2007, Financial Planning Standards Board Ltd.

(1) Our Understanding of What Financial Planning Is 9 © 2007, Financial Planning Standards Board Ltd.

(1) Our Understanding of What Financial Planning Is 9 © 2007, Financial Planning Standards Board Ltd.

Financial Planning Definition § Financial planning is the process of developing strategies to help clients manage their financial affairs to meet life goals. § all relevant aspects of a client’s situation § inter-relationships among often conflicting objectives § across a large breadth of financial planning activities. © 2007, Financial Planning Standards Board Ltd.

Financial Planning Definition § Financial planning is the process of developing strategies to help clients manage their financial affairs to meet life goals. § all relevant aspects of a client’s situation § inter-relationships among often conflicting objectives § across a large breadth of financial planning activities. © 2007, Financial Planning Standards Board Ltd.

Financial Planning Process 1. Establishing and defining the client-planner relationship. 2. Gathering client data including goals. 3. Analyzing and evaluating the client’s financial status. 4. Developing and presenting financial planning. recommendations and/or alternatives. 5. Implementing the financial planning recommendations 6. Monitoring the financial planning recommendations. © 2007, Financial Planning Standards Board Ltd.

Financial Planning Process 1. Establishing and defining the client-planner relationship. 2. Gathering client data including goals. 3. Analyzing and evaluating the client’s financial status. 4. Developing and presenting financial planning. recommendations and/or alternatives. 5. Implementing the financial planning recommendations 6. Monitoring the financial planning recommendations. © 2007, Financial Planning Standards Board Ltd.

(2) Drivers of Financial Planning 12 © 2007, Financial Planning Standards Board Ltd.

(2) Drivers of Financial Planning 12 © 2007, Financial Planning Standards Board Ltd.

1. Consumer Demand § § § Shrinking pensions More personal responsibility People living longer Less savings/more debt Complicated products © 2007, Financial Planning Standards Board Ltd.

1. Consumer Demand § § § Shrinking pensions More personal responsibility People living longer Less savings/more debt Complicated products © 2007, Financial Planning Standards Board Ltd.

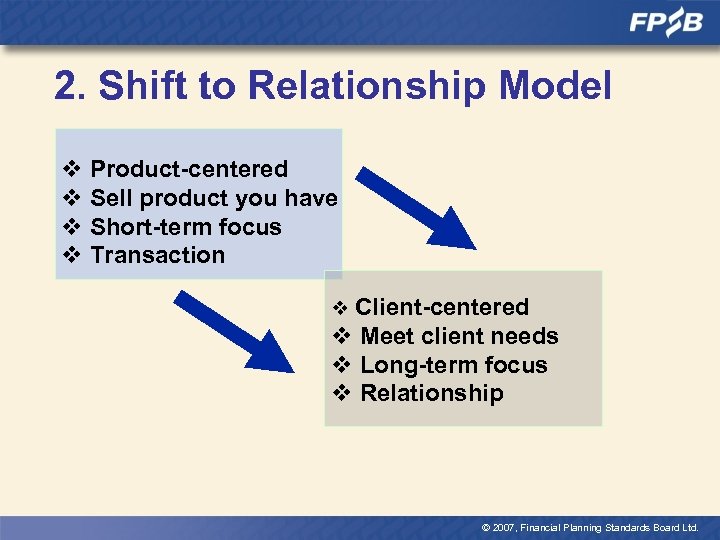

2. Shift to Relationship Model v Product-centered v Sell product you have v Short-term focus v Transaction v Client-centered v Meet client needs v Long-term focus v Relationship © 2007, Financial Planning Standards Board Ltd.

2. Shift to Relationship Model v Product-centered v Sell product you have v Short-term focus v Transaction v Client-centered v Meet client needs v Long-term focus v Relationship © 2007, Financial Planning Standards Board Ltd.

3. Government Regulation § § Fairness to client Disclosure Ethical behavior Certification body / regulator partnerships © 2007, Financial Planning Standards Board Ltd.

3. Government Regulation § § Fairness to client Disclosure Ethical behavior Certification body / regulator partnerships © 2007, Financial Planning Standards Board Ltd.

4. Globalization § § All clients are ‘international’ Multi-national firms need standard approach Portable qualifications Convergence © 2007, Financial Planning Standards Board Ltd.

4. Globalization § § All clients are ‘international’ Multi-national firms need standard approach Portable qualifications Convergence © 2007, Financial Planning Standards Board Ltd.

(3) Global Mark of Excellence 17 © 2007, Financial Planning Standards Board Ltd.

(3) Global Mark of Excellence 17 © 2007, Financial Planning Standards Board Ltd.

© 2007, Financial Planning Standards Board Ltd.

© 2007, Financial Planning Standards Board Ltd.

© 2007, Financial Planning Standards Board Ltd.

© 2007, Financial Planning Standards Board Ltd.

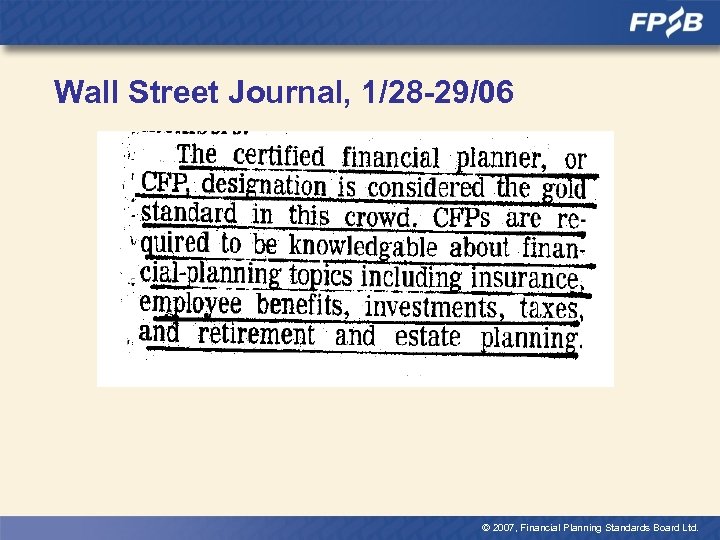

Wall Street Journal, 1/28 -29/06 © 2007, Financial Planning Standards Board Ltd.

Wall Street Journal, 1/28 -29/06 © 2007, Financial Planning Standards Board Ltd.

Business Week, Feb. 26, 2007 “Of all the financial planning designations, the one that carries the most clout is Certified Financial Planner. . ” © 2007, Financial Planning Standards Board Ltd.

Business Week, Feb. 26, 2007 “Of all the financial planning designations, the one that carries the most clout is Certified Financial Planner. . ” © 2007, Financial Planning Standards Board Ltd.

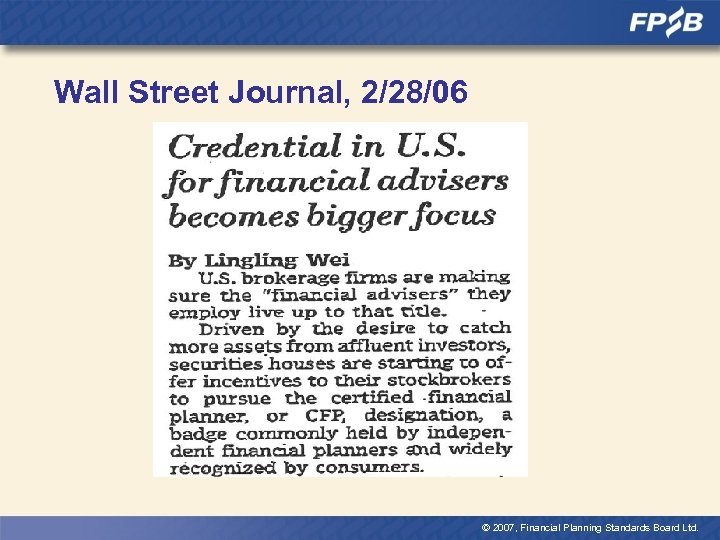

Wall Street Journal, 2/28/06 © 2007, Financial Planning Standards Board Ltd.

Wall Street Journal, 2/28/06 © 2007, Financial Planning Standards Board Ltd.

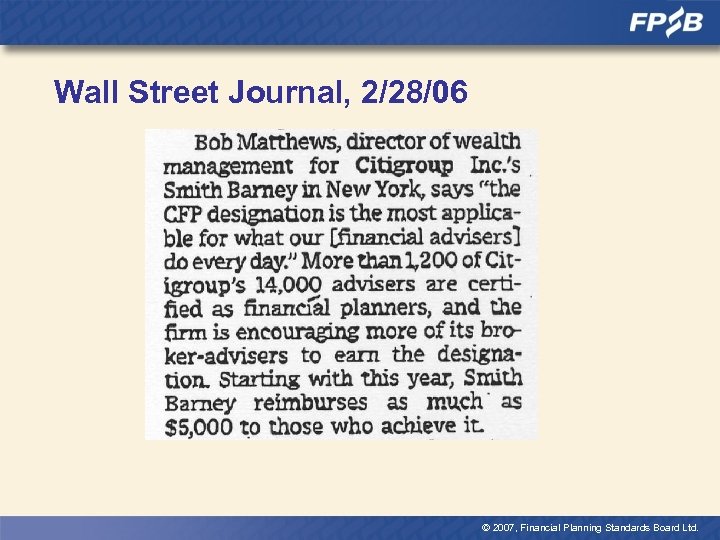

Wall Street Journal, 2/28/06 © 2007, Financial Planning Standards Board Ltd.

Wall Street Journal, 2/28/06 © 2007, Financial Planning Standards Board Ltd.

Ameriprise Financial “With over 2. 5 million clients, more CERTIFIED FINANCIAL PLANNERTM practitioners than any other firm, strong asset management capabilities, … and a robust insurance and annuities business, Ameriprise Financial will be a leader in the industry. ” Jim Cracchiolo, chairman and CEO of AEFA announcing the launch of Ameriprise Financial © 2007, Financial Planning Standards Board Ltd.

Ameriprise Financial “With over 2. 5 million clients, more CERTIFIED FINANCIAL PLANNERTM practitioners than any other firm, strong asset management capabilities, … and a robust insurance and annuities business, Ameriprise Financial will be a leader in the industry. ” Jim Cracchiolo, chairman and CEO of AEFA announcing the launch of Ameriprise Financial © 2007, Financial Planning Standards Board Ltd.

Bangkok Post April 2007 “There has been great demand for CFP professionals, particularly among financial institutions. ” © 2007, Financial Planning Standards Board Ltd.

Bangkok Post April 2007 “There has been great demand for CFP professionals, particularly among financial institutions. ” © 2007, Financial Planning Standards Board Ltd.

![Financial Planner Success Aspects of Financial Planner Success [Scale of 1– 4] (1) People/Communication Financial Planner Success Aspects of Financial Planner Success [Scale of 1– 4] (1) People/Communication](https://present5.com/presentation/041d09595cd632b6be2d347afb2f4d93/image-26.jpg) Financial Planner Success Aspects of Financial Planner Success [Scale of 1– 4] (1) People/Communication Skills 3. 79 (2) Referrals from Clients 3. 68 ® (3) Having the CFP Certification 3. 54 (4) Educational Background 3. 39 (5) Keeping up with CE/CPD 3. 32 (6) Specialization 2. 93 2007 Survey of Trends in Financial Planning, College for Financial Planning © 2007, Financial Planning Standards Board Ltd.

Financial Planner Success Aspects of Financial Planner Success [Scale of 1– 4] (1) People/Communication Skills 3. 79 (2) Referrals from Clients 3. 68 ® (3) Having the CFP Certification 3. 54 (4) Educational Background 3. 39 (5) Keeping up with CE/CPD 3. 32 (6) Specialization 2. 93 2007 Survey of Trends in Financial Planning, College for Financial Planning © 2007, Financial Planning Standards Board Ltd.

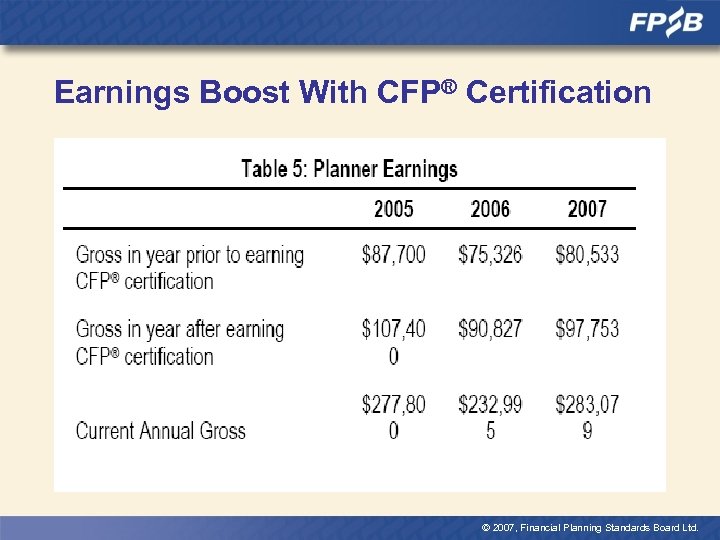

Earnings Boost With CFP® Certification © 2007, Financial Planning Standards Board Ltd.

Earnings Boost With CFP® Certification © 2007, Financial Planning Standards Board Ltd.

Smart Magazine (Chinese Taipei) (1 January 2007) Top Seven Credentials With Pay Increment Potential – Go For Quality Not Quantity § Test of English for International Communication (TOEIC) § IT credentials such Linux, Cisco, and Oracle, § CFP certification § CFA credential § Securities analyst credential © 2007, Financial Planning Standards Board Ltd.

Smart Magazine (Chinese Taipei) (1 January 2007) Top Seven Credentials With Pay Increment Potential – Go For Quality Not Quantity § Test of English for International Communication (TOEIC) § IT credentials such Linux, Cisco, and Oracle, § CFP certification § CFA credential § Securities analyst credential © 2007, Financial Planning Standards Board Ltd.

(4) Global Platform for Certification Standards 29 © 2007, Financial Planning Standards Board Ltd.

(4) Global Platform for Certification Standards 29 © 2007, Financial Planning Standards Board Ltd.

® CFP Certification Standards Initial Certification Standards § Education § Examination § Experience § Ethics Ongoing Certification Standards § Continuing education § Practice Standards and ethical review © 2007, Financial Planning Standards Board Ltd.

® CFP Certification Standards Initial Certification Standards § Education § Examination § Experience § Ethics Ongoing Certification Standards § Continuing education § Practice Standards and ethical review © 2007, Financial Planning Standards Board Ltd.

Where We Are Distinct 31 © 2007, Financial Planning Standards Board Ltd.

Where We Are Distinct 31 © 2007, Financial Planning Standards Board Ltd.

(1) Recognition of Financial Planning, CFP Marks 32 © 2007, Financial Planning Standards Board Ltd.

(1) Recognition of Financial Planning, CFP Marks 32 © 2007, Financial Planning Standards Board Ltd.

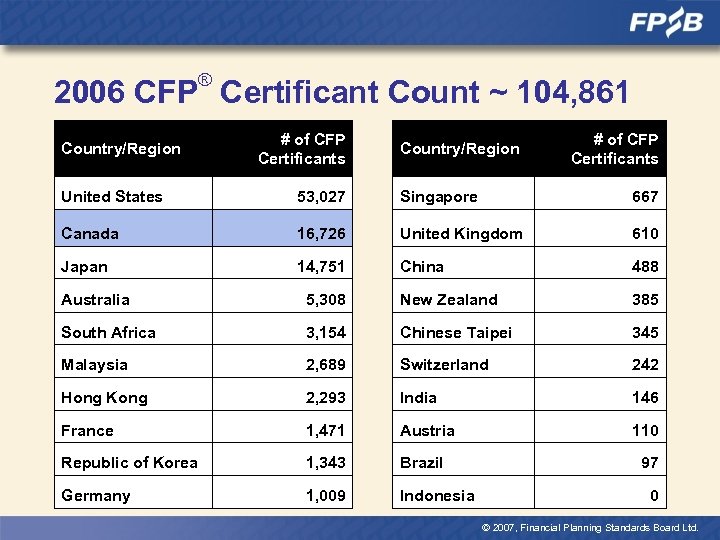

® 2006 CFP Certificant Count ~ 104, 861 Country/Region # of CFP Certificants United States 53, 027 Singapore 667 Canada 16, 726 United Kingdom 610 Japan 14, 751 China 488 Australia 5, 308 New Zealand 385 South Africa 3, 154 Chinese Taipei 345 Malaysia 2, 689 Switzerland 242 Hong Kong 2, 293 India 146 France 1, 471 Austria 110 Republic of Korea 1, 343 Brazil Germany 1, 009 Indonesia 97 0 © 2007, Financial Planning Standards Board Ltd.

® 2006 CFP Certificant Count ~ 104, 861 Country/Region # of CFP Certificants United States 53, 027 Singapore 667 Canada 16, 726 United Kingdom 610 Japan 14, 751 China 488 Australia 5, 308 New Zealand 385 South Africa 3, 154 Chinese Taipei 345 Malaysia 2, 689 Switzerland 242 Hong Kong 2, 293 India 146 France 1, 471 Austria 110 Republic of Korea 1, 343 Brazil Germany 1, 009 Indonesia 97 0 © 2007, Financial Planning Standards Board Ltd.

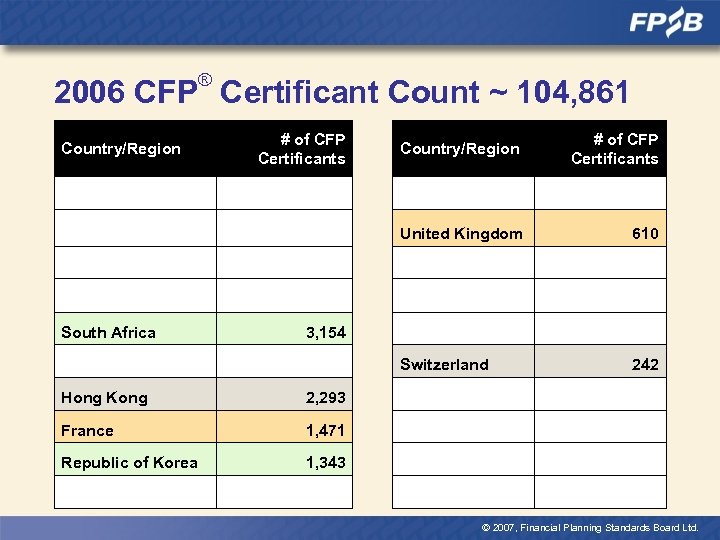

® 2006 CFP Certificant Count ~ 104, 861 # of CFP Certificants 610 Switzerland South Africa # of CFP Certificants Country/Region United Kingdom Country/Region 242 3, 154 Hong Kong 2, 293 France 1, 471 Republic of Korea 1, 343 © 2007, Financial Planning Standards Board Ltd.

® 2006 CFP Certificant Count ~ 104, 861 # of CFP Certificants 610 Switzerland South Africa # of CFP Certificants Country/Region United Kingdom Country/Region 242 3, 154 Hong Kong 2, 293 France 1, 471 Republic of Korea 1, 343 © 2007, Financial Planning Standards Board Ltd.

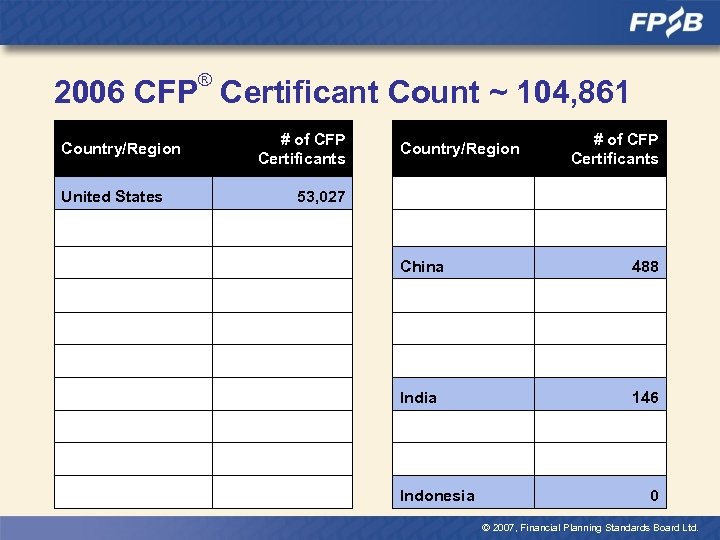

® 2006 CFP Certificant Count ~ 104, 861 Country/Region United States # of CFP Certificants Country/Region # of CFP Certificants 53, 027 China 488 India 146 Indonesia 0 © 2007, Financial Planning Standards Board Ltd.

® 2006 CFP Certificant Count ~ 104, 861 Country/Region United States # of CFP Certificants Country/Region # of CFP Certificants 53, 027 China 488 India 146 Indonesia 0 © 2007, Financial Planning Standards Board Ltd.

(2) Dominant Delivery Mode, Compensation Method 36 © 2007, Financial Planning Standards Board Ltd.

(2) Dominant Delivery Mode, Compensation Method 36 © 2007, Financial Planning Standards Board Ltd.

Channel/Pricing for Financial Planning § Financial services firms (insurance, banks, asset management, etc. ) § Solo / boutique practitioners § Planning and/or implementation § Commission-only § Commission and fees § Fee-only © 2007, Financial Planning Standards Board Ltd.

Channel/Pricing for Financial Planning § Financial services firms (insurance, banks, asset management, etc. ) § Solo / boutique practitioners § Planning and/or implementation § Commission-only § Commission and fees § Fee-only © 2007, Financial Planning Standards Board Ltd.

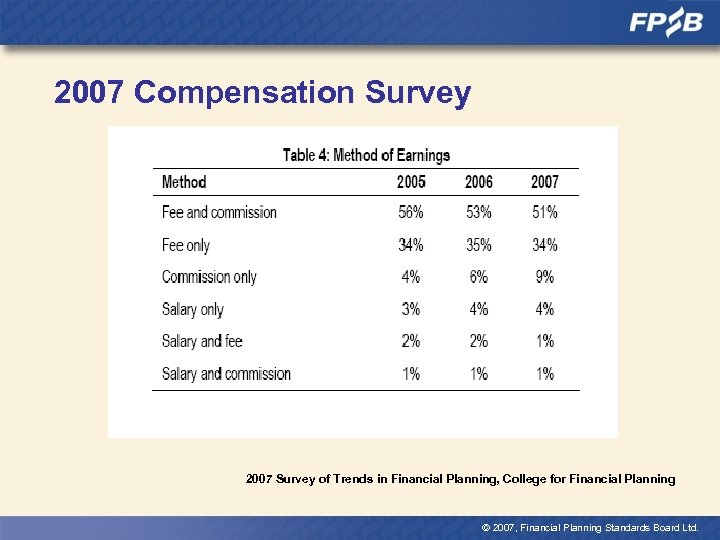

2007 Compensation Survey 2007 Survey of Trends in Financial Planning, College for Financial Planning © 2007, Financial Planning Standards Board Ltd.

2007 Compensation Survey 2007 Survey of Trends in Financial Planning, College for Financial Planning © 2007, Financial Planning Standards Board Ltd.

(3) Localized Content, Application 39 © 2007, Financial Planning Standards Board Ltd.

(3) Localized Content, Application 39 © 2007, Financial Planning Standards Board Ltd.

Global Framework, Local Program § Four Es localized to academic / regulatory / marketplace needs § Education § Examination § Experience § Ethics © 2007, Financial Planning Standards Board Ltd.

Global Framework, Local Program § Four Es localized to academic / regulatory / marketplace needs § Education § Examination § Experience § Ethics © 2007, Financial Planning Standards Board Ltd.

(4) Readiness for Financial Planning 41 © 2007, Financial Planning Standards Board Ltd.

(4) Readiness for Financial Planning 41 © 2007, Financial Planning Standards Board Ltd.

Readiness for Financial Planning § Client awareness, value § Financial services firm structure, reward scheme § Regulatory environment § Social network © 2007, Financial Planning Standards Board Ltd.

Readiness for Financial Planning § Client awareness, value § Financial services firm structure, reward scheme § Regulatory environment § Social network © 2007, Financial Planning Standards Board Ltd.

FPSB Goals 43 © 2007, Financial Planning Standards Board Ltd.

FPSB Goals 43 © 2007, Financial Planning Standards Board Ltd.

FPSB Goals § Establish Financial Planning as a Global Profession § Establish CFP certification as the mark of the professional financial planner © 2007, Financial Planning Standards Board Ltd.

FPSB Goals § Establish Financial Planning as a Global Profession § Establish CFP certification as the mark of the professional financial planner © 2007, Financial Planning Standards Board Ltd.

Characteristics of a Profession § Specialized body of knowledge § Recognized formal education process § Standard of professional qualifications for admission § Standards of conduct § Recognition of status § Acceptance of social responsibility § Organization to advance group’s social responsibility © 2007, Financial Planning Standards Board Ltd.

Characteristics of a Profession § Specialized body of knowledge § Recognized formal education process § Standard of professional qualifications for admission § Standards of conduct § Recognition of status § Acceptance of social responsibility § Organization to advance group’s social responsibility © 2007, Financial Planning Standards Board Ltd.

FPSB Goals 1. Uniformity of competency, ethics and practice standards globally (80: 20 approach) § what is possible? § What is desirable? © 2007, Financial Planning Standards Board Ltd.

FPSB Goals 1. Uniformity of competency, ethics and practice standards globally (80: 20 approach) § what is possible? § What is desirable? © 2007, Financial Planning Standards Board Ltd.

FPSB Goals 1. Uniformity of standards globally (80: 20 rule) 2. Core financial planning curriculum/exam § Global “Call for Papers” on ways to deliver global financial planning curriculum § Education Advisory Panel § Education and Assessment Working Groups © 2007, Financial Planning Standards Board Ltd.

FPSB Goals 1. Uniformity of standards globally (80: 20 rule) 2. Core financial planning curriculum/exam § Global “Call for Papers” on ways to deliver global financial planning curriculum § Education Advisory Panel § Education and Assessment Working Groups © 2007, Financial Planning Standards Board Ltd.

FPSB Goals 1. Uniformity of standards globally (80: 20 rule) 2. Core financial planning curriculum / exam 3. Affiliate assessment/training § 14 completed, four underway (Brazil, Canada, Chinese Taipei) § Identify the gaps in certification program § Train to eliminate deficiencies © 2007, Financial Planning Standards Board Ltd.

FPSB Goals 1. Uniformity of standards globally (80: 20 rule) 2. Core financial planning curriculum / exam 3. Affiliate assessment/training § 14 completed, four underway (Brazil, Canada, Chinese Taipei) § Identify the gaps in certification program § Train to eliminate deficiencies © 2007, Financial Planning Standards Board Ltd.

FPSB Goals 1. 2. 3. 4. Uniformity of standards globally (80: 20 rule) Core financial planning curriculum / exam Affiliate assessment / training Cross-border reciprocity among Affiliates § § § Hong Kong, US four-hour exam Hong Kong, PRC, Chinese Taipei Germany, Austria Australia, New Zealand Commonwealth countries © 2007, Financial Planning Standards Board Ltd.

FPSB Goals 1. 2. 3. 4. Uniformity of standards globally (80: 20 rule) Core financial planning curriculum / exam Affiliate assessment / training Cross-border reciprocity among Affiliates § § § Hong Kong, US four-hour exam Hong Kong, PRC, Chinese Taipei Germany, Austria Australia, New Zealand Commonwealth countries © 2007, Financial Planning Standards Board Ltd.

FPSB Goals 1. 2. 3. 4. 5. Uniformity of standards globally (80: 20 rule) Core financial planning curriculum / exam Affiliate assessment / training Cross-border reciprocity among Affiliates Growth in existing / new markets © 2007, Financial Planning Standards Board Ltd.

FPSB Goals 1. 2. 3. 4. 5. Uniformity of standards globally (80: 20 rule) Core financial planning curriculum / exam Affiliate assessment / training Cross-border reciprocity among Affiliates Growth in existing / new markets © 2007, Financial Planning Standards Board Ltd.

FPSB Goals 1. 2. 3. 4. 5. 6. Uniformity of standards globally (80: 20 rule) Core financial planning curriculum / exam Affiliate assessment / training Cross-border reciprocity among Affiliates Growth in existing / new markets Outreach to regulators / key influencers © 2007, Financial Planning Standards Board Ltd.

FPSB Goals 1. 2. 3. 4. 5. 6. Uniformity of standards globally (80: 20 rule) Core financial planning curriculum / exam Affiliate assessment / training Cross-border reciprocity among Affiliates Growth in existing / new markets Outreach to regulators / key influencers © 2007, Financial Planning Standards Board Ltd.

FPSB Goals 1. 2. 3. 4. 5. 6. 7. Uniformity of standards globally (80: 20 rule) Core financial planning curriculum / exam Affiliate assessment / training Cross-border reciprocity among Affiliates Growth in existing / new markets Outreach to regulators / key influencers Global CFP mark promotional campaign § Same look, feel all over the world § Localization of language, imagery © 2007, Financial Planning Standards Board Ltd.

FPSB Goals 1. 2. 3. 4. 5. 6. 7. Uniformity of standards globally (80: 20 rule) Core financial planning curriculum / exam Affiliate assessment / training Cross-border reciprocity among Affiliates Growth in existing / new markets Outreach to regulators / key influencers Global CFP mark promotional campaign § Same look, feel all over the world § Localization of language, imagery © 2007, Financial Planning Standards Board Ltd.

Global CFP Mark Promotional Campaign § Brand values for “CFP Professional” and “Financial Planning” § Brand DNA (values, personality, proposition) § Brand Guidelines for promotional activities § Template advertisements, body copy, presentations, promotional brochures, etc. , for Affiliates and CFP professionals © 2007, Financial Planning Standards Board Ltd.

Global CFP Mark Promotional Campaign § Brand values for “CFP Professional” and “Financial Planning” § Brand DNA (values, personality, proposition) § Brand Guidelines for promotional activities § Template advertisements, body copy, presentations, promotional brochures, etc. , for Affiliates and CFP professionals © 2007, Financial Planning Standards Board Ltd.

Thank you! www. fpsb. org 54 © 2007, Financial Planning Standards Board Ltd.

Thank you! www. fpsb. org 54 © 2007, Financial Planning Standards Board Ltd.