e12f85ea4ea0a256c752712afd1a7a9d.ppt

- Количество слайдов: 30

Financial Opportunities in MENA – One Belt One Road Agricultural Bank of China, DIFC Branch Hui Shao 2016/04/25

Contents I. Brief introduction of OBOR II. The economic and trade cooperations between China and main MENA countries III. Financial opportunities to be increased IV. Financial cooperations with MENA banks 22

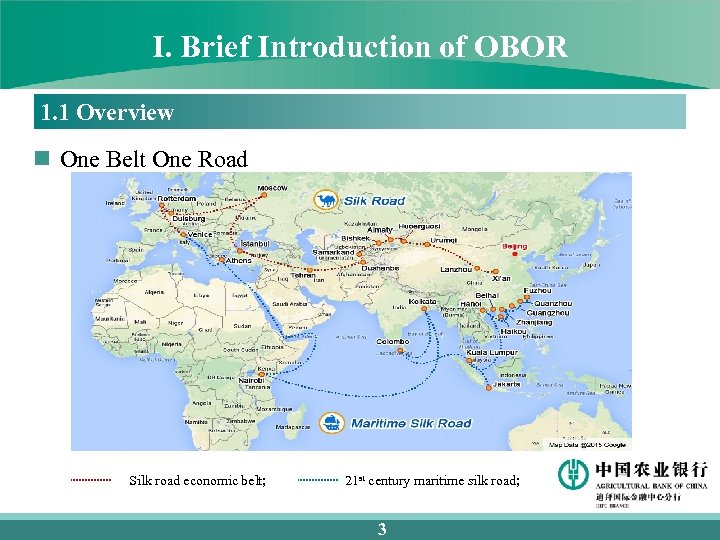

I. Brief Introduction of OBOR 1. 1 Overview n One Belt One Road Silk road economic belt; 21 st century maritime silk road; 33

I. Brief Introduction of OBOR 1. 2 Five Objectives of OBOR n Policy Coordination n Facilities Connectivity n Unimpeded Trade n Financial Integration n People to People Bond 44

II. The economic and trade cooperations between China and main MENA countries 2. 1 Bilateral relations between China and main countries in MENA n China upgraded bilateral relations with Egypt, Algeria, Qatar and Jordan over the last two years. n China upgraded its relationship with both Saudi Arabia and Iran to a comprehensive strategic partnership during President Xi’s three nation visit January this year. 55

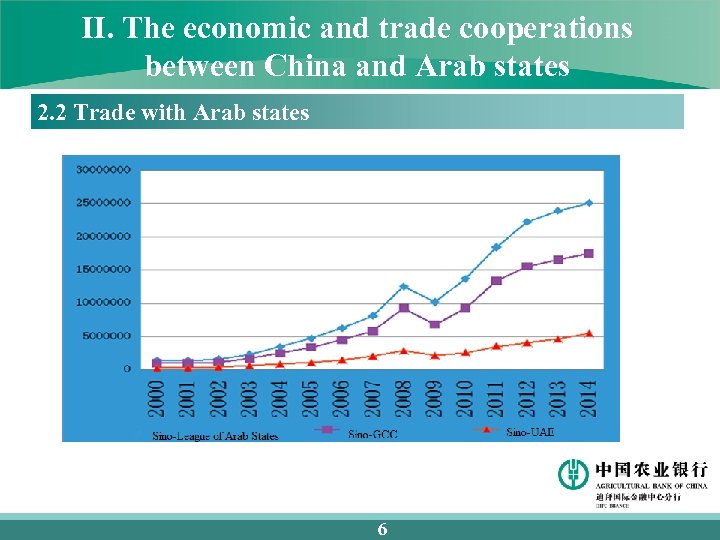

II. The economic and trade cooperations between China and Arab states 2. 2 Trade with Arab states 66

II. The economic and trade cooperations between China and Arab states 2. 2 Trade with Arab states n China became the second largest trading partner of Arab States last year. n China became the Largest trading partner of 9 countries, including Saudi Araba, Oman, Algeria, etc. 77

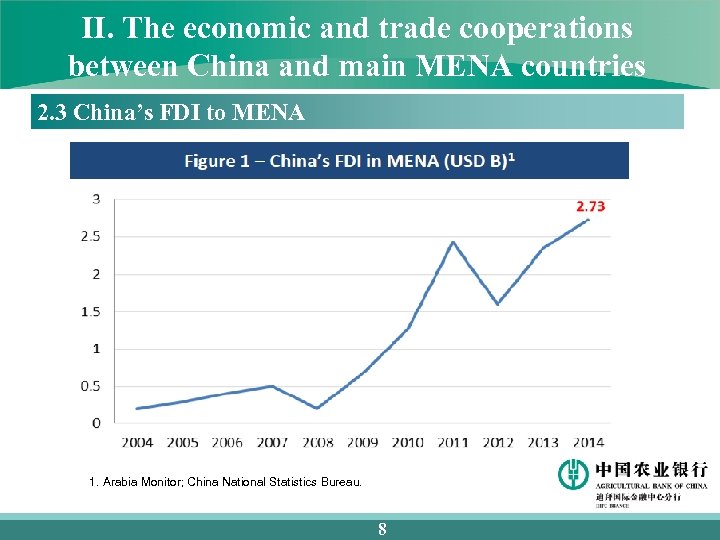

II. The economic and trade cooperations between China and main MENA countries 2. 3 China’s FDI to MENA 1. Arabia Monitor; China National Statistics Bureau. 88

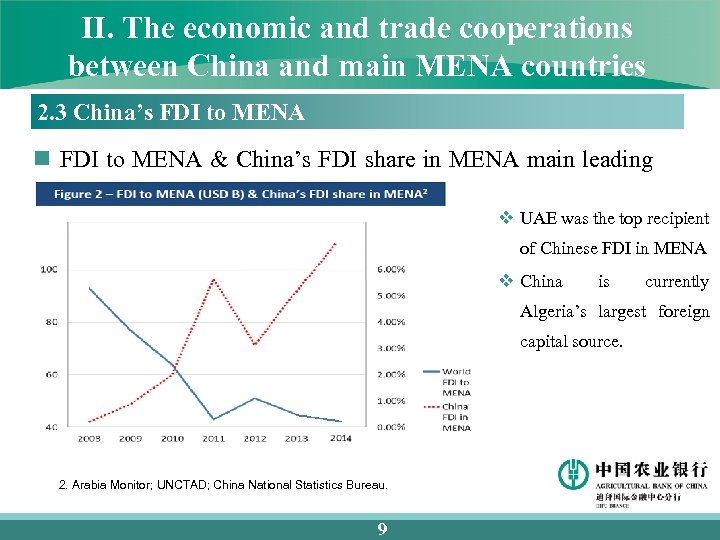

II. The economic and trade cooperations between China and main MENA countries 2. 3 China’s FDI to MENA n FDI to MENA & China’s FDI share in MENA main leading countries v UAE was the top recipient of Chinese FDI in MENA v China is currently Algeria’s largest foreign capital source. 2. Arabia Monitor; UNCTAD; China National Statistics Bureau. 99

II. The economic and trade cooperations between China and main MENA countries 2. 4 Expectation of the future development n USD 55 billion investment has been pledged to MENA by President Xi, among which USD 10 billion would be commercial loans. n Trade value could exceed USD 600 B at the end of 2025, forecasted by Chinese Authority n China will be expected to be the GCC's most important economic partner by 2020, according to a new report by the Economist Intelligence Unit (EIU). 10 10

III. Financial Opportunities n Trade Finance n RQFII(RMB Qualified Foreign Institutional Investors ) Invest in Chinese Market UAE:CNY 50 B, Qatar:CNY 30 B n RMB Settlement and Dealing n Projects Finance n Islamic Banking Development in China 11 11

IV. Financial Cooperations with MENA Banks n 4. 1 RMB Clearing n 4. 2 Finance Cooperation n 4. 3 Financial Market n 4. 4 Trade Innovation 12 12

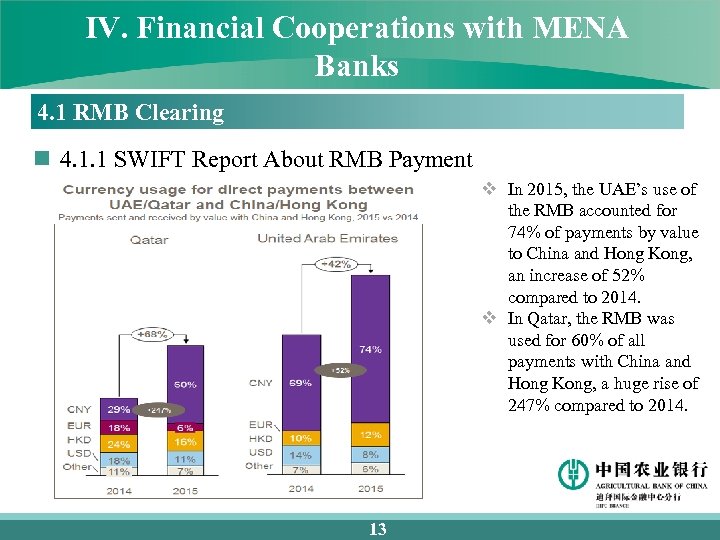

IV. Financial Cooperations with MENA Banks 4. 1 RMB Clearing n 4. 1. 1 SWIFT Report About RMB Payment v In 2015, the UAE’s use of the RMB accounted for 74% of payments by value to China and Hong Kong, an increase of 52% compared to 2014. v In Qatar, the RMB was used for 60% of all payments with China and Hong Kong, a huge rise of 247% compared to 2014. 13 13

IV. Financial Cooperations with MENA Banks 4. 1 RMB Clearing n 4. 1. 2 Clearing Advantages v Largest Physical network in China--23, 670 Branches and Outlets v largest Customer Base in China: Corporate Customers: 3. 64 million; Retail Customers: 474 million v Largest Card Issuer in China--- 871. 38 million Cards Issued v Efficient v Same Time Zone Service 14 14

IV. Financial Cooperations with MENA Banks 4. 2 Finance Cooperation n Trade Finance Cooperation n Syndication 15 15

IV. Financial Cooperations with MENA Banks 4. 3 Finance Market n Money Market: borrowing and lending in multi-currencies, including USD, CNH, EUR and JPY, etc; n FX Market: spot, forward and swap trade in multi-currencies, including CNH, USD, EUR and JPY, etc; n Bond Market: providing investment banking services for MTN and CDs issuance; Assisting banks and other financial institutions to invest in China Bond Market and issue Panda Bond within China mainland 16 16

IV. Financial Cooperations with MENA Banks 4. 4 Trade Finance Innovation n 4. 4. 1 Investment Composition percentage of investment under OBOR is: v Infrastructure/energy infrastructure 52% v Trade finance occupied 30% v Financial industry is 13% 17 17

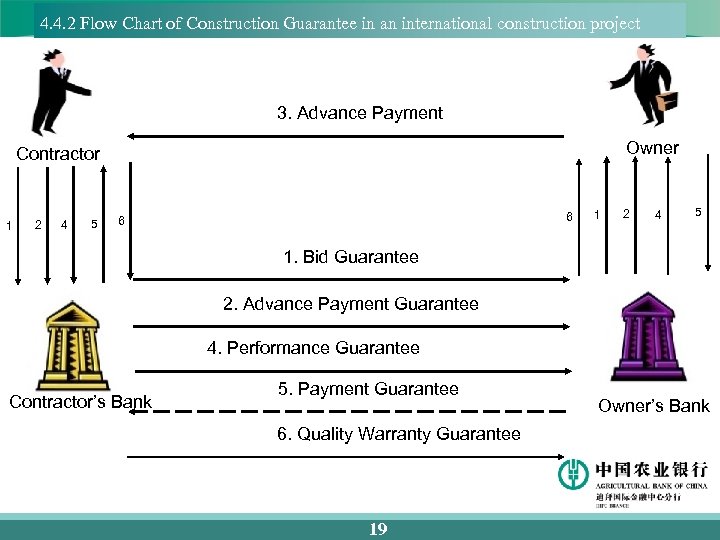

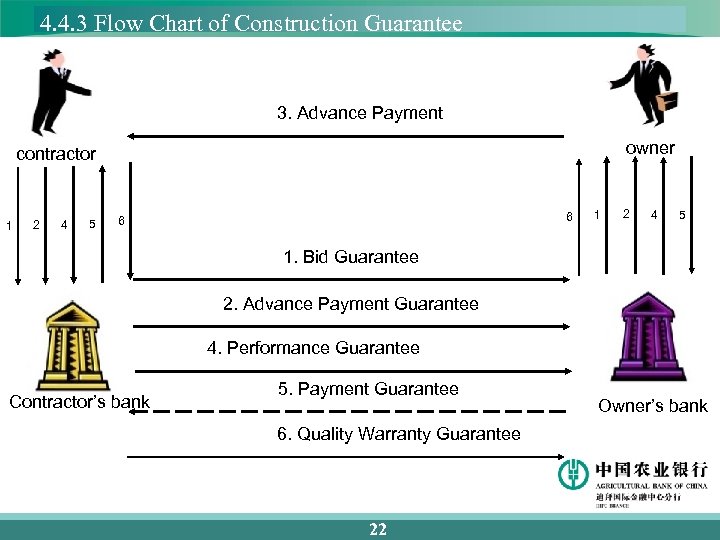

IV. Financial Cooperations with MENA Banks 4. 4 Trade Finance Innovation n 4. 4. 2 Guarantees Involved in Construction Project v Bid Guarantee v Advance Payment Guarantee v Performance Guarantee v Payment Guarantee v Quality Warranty Guarantee 18 18

4. 4. 2 Flow Chart of Construction Guarantee in an international construction project 3. Advance Payment Owner Contractor 1 2 4 5 6 6 1 2 4 5 1. Bid Guarantee 2. Advance Payment Guarantee 4. Performance Guarantee Contractor’s Bank 5. Payment Guarantee 6. Quality Warranty Guarantee 19 19 Owner’s Bank

IV. Financial Cooperations with MENA Banks 4. 4 Trade Finance Innovation n 4. 4. 3 Why is difficult for contractor to get finance? v Contractors usually do not have any assets here as collateral v Particularly impacted by cyclical and seasonal fluctuation of economy v The failure of subcontractor v Labor problems 20 20

IV. Financial Cooperations with MENA Banks 4. 4 Trade Finance Innovation n 4. 4. 3 Example v Contractor: Stimes Fabric and Steel Structure FZE. 10 years in Dubai v Project: IMG Theme Park The largest indoor theme park in the world The biggest steel structure unit in the world 21 21

4. 4. 3 Flow Chart of Construction Guarantee 3. Advance Payment owner contractor 1 2 4 5 6 6 1 2 4 5 1. Bid Guarantee 2. Advance Payment Guarantee 4. Performance Guarantee Contractor’s bank 5. Payment Guarantee 6. Quality Warranty Guarantee 22 22 Owner’s bank

IV. Financial Cooperations with MENA Banks 4. 4 Trade Finance Innovation n 4. 4. 4 How to Change? Separate the trade in goods from the project 23 23

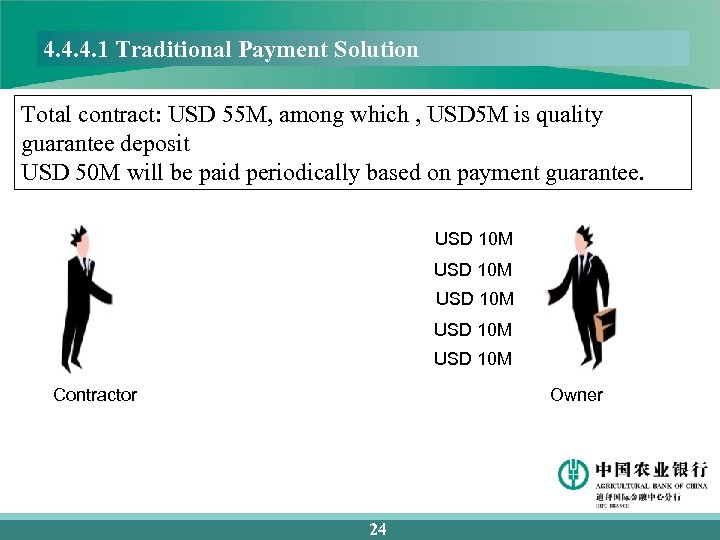

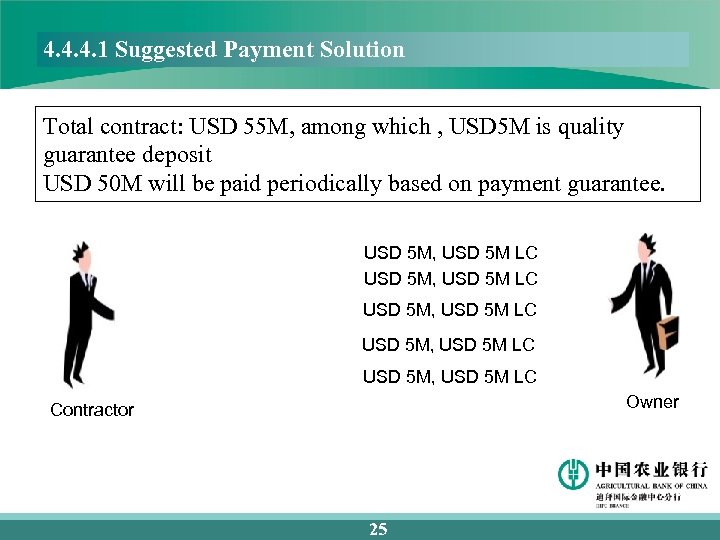

4. 4. 4. 1 Traditional Payment Solution Total contract: USD 55 M, among which , USD 5 M is quality guarantee deposit USD 50 M will be paid periodically based on payment guarantee. USD 10 M USD 10 M Contractor Owner 24 24

4. 4. 4. 1 Suggested Payment Solution Total contract: USD 55 M, among which , USD 5 M is quality guarantee deposit USD 50 M will be paid periodically based on payment guarantee. USD 5 M, USD 5 M LC USD 5 M, USD 5 M LC Owner Contractor 25 25

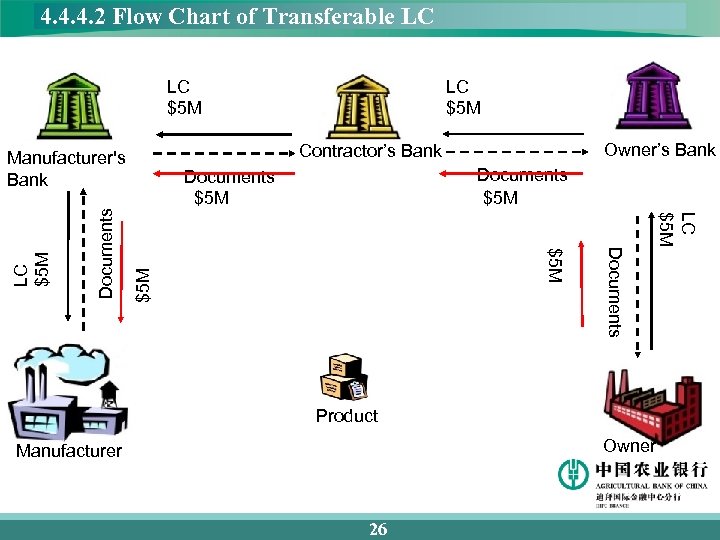

4. 4. 4. 2 Flow Chart of Transferable LC LC $5 M Documents $5 M Product Owner Manufacturer 26 26 LC $5 M Documents Owner’s Bank Contractor’s Bank Manufacturer's Bank LC $5 M

IV. Financial Cooperations with MENA Banks 4. 4 Trade Finance Innovation n 4. 4. 5 Owner’s main risk of the change v How can he know the price of materials v Is it possible that contractor only sale goods to owner? v Did the owner take more risk? v Does the owner need more credit lines form the bank? 27 27

IV. Financial Cooperations with MENA Banks 4. 4 Trade Finance Innovation n 4. 4. 6 Benefits of the Contractor v Solve his finance problem. He can take advantage of owner’s credit to buy the materials. v Reduce the financial expense. He needs not get a loan and pay the interest 28 28

IV. Financial Cooperations with MENA Banks 4. 4 Trade Finance Innovation n 4. 4. 7 Benefits of the Owner v Assure the project finished on time v Control the quality of material during the proceeding v May share the benefits of the constructor's saved financial expenses 29 29

Thank you! For inquiries, please contact the following: Corporate Department: Chu Zhang +97145676989 zhangchuae@abchina. com Treasury Department: Sam Liu +97145676968 liuxiaofeiae@abchina. com 30 30

e12f85ea4ea0a256c752712afd1a7a9d.ppt