2f80aceb66a9353e53ff60145dec7899.ppt

- Количество слайдов: 50

Financial Operations and Systems Update Presentation Presented by Mark Preston, Director 14 May 2009 Darlington Centre 1

Agenda 1. 2. 3. 4. 5. 6. 7. Overview of Financial Operations and Systems – Mark Preston (15 mins) Financial Support Services Unit update – Uma Kumar (10 mins) Draft Service Level Agreement (SLA) – Kevin Lacey (15 mins) Expense reimbursement via Spendvision – Krishan Prasad (5 mins) Procure to Pay (P 2 P) – Lean Lee (40 mins) Billing to Cash (B 2 C) – Gemma Gill (5 mins) Questions (15 mins) 2

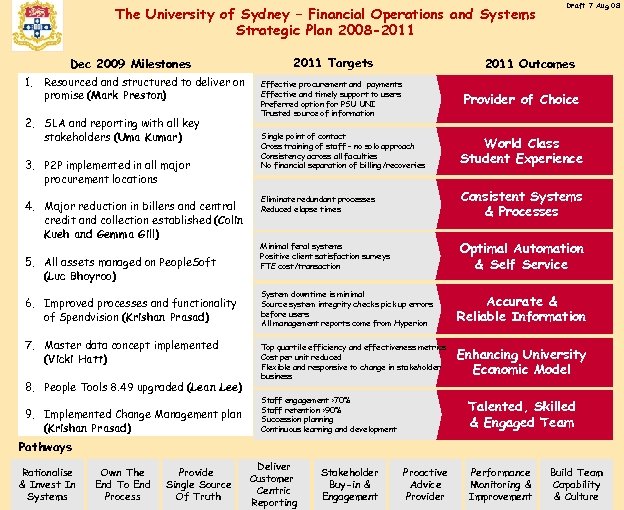

The University of Sydney – Financial Operations and Systems Strategic Plan 2008 -2011 Dec 2009 Milestones 1. Resourced and structured to deliver on promise (Mark Preston) 2. SLA and reporting with all key stakeholders (Uma Kumar) 3. P 2 P implemented in all major procurement locations 4. Major reduction in billers and central credit and collection established (Colin Kueh and Gemma Gill) 5. All assets managed on People. Soft (Luc Bhoyroo) 6. Improved processes and functionality of Spendvision (Krishan Prasad) 7. Master data concept implemented (Vicki Hatt) 8. People Tools 8. 49 upgraded (Lean Lee) 9. Implemented Change Management plan (Krishan Prasad) 2011 Targets Draft 7 Aug 08 2011 Outcomes Effective procurement and payments Effective and timely support to users Preferred option for PSU UNI Trusted source of information Provider of Choice Single point of contact Cross training of staff - no solo approach Consistency across all faculties No financial separation of billing/recoveries World Class Student Experience Eliminate redundant processes Reduced elapse times Consistent Systems & Processes Minimal feral systems Positive client satisfaction surveys FTE cost/transaction Optimal Automation & Self Service System downtime is minimal Source system integrity checks pick up errors before users All management reports come from Hyperion Accurate & Reliable Information Top quartile efficiency and effectiveness metrics Cost per unit reduced Flexible and responsive to change in stakeholder business Enhancing University Economic Model Staff engagement >70% Staff retention >90% Succession planning Continuous learning and development Talented, Skilled & Engaged Team Pathways Rationalise & Invest In Systems Own The End To End Process Provide Single Source Of Truth Deliver Customer Centric Reporting Stakeholder Buy-in & Engagement Proactive Advice Provider Performance Monitoring & Improvement Build Team 3 Capability & Culture

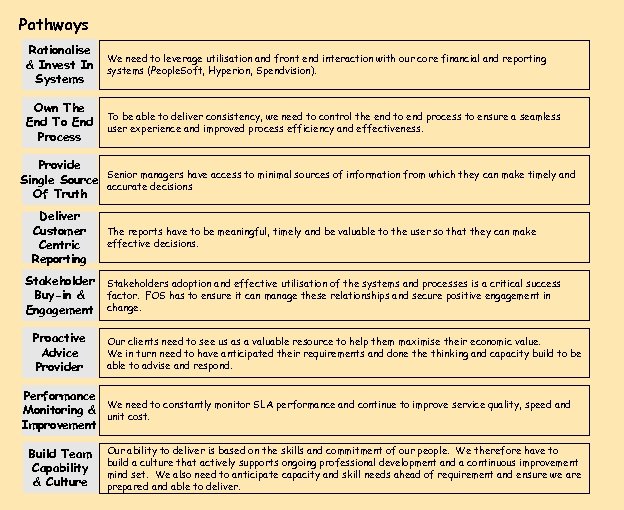

Pathways Rationalise & Invest In Systems We need to leverage utilisation and front end interaction with our core financial and reporting systems (People. Soft, Hyperion, Spendvision). Own The End To End Process To be able to deliver consistency, we need to control the end to end process to ensure a seamless user experience and improved process efficiency and effectiveness. Provide Senior managers have access to minimal sources of information from which they can make timely and Single Source accurate decisions Of Truth Deliver Customer Centric Reporting Stakeholder Buy-in & Engagement Proactive Advice Provider The reports have to be meaningful, timely and be valuable to the user so that they can make effective decisions. Stakeholders adoption and effective utilisation of the systems and processes is a critical success factor. FOS has to ensure it can manage these relationships and secure positive engagement in change. Our clients need to see us as a valuable resource to help them maximise their economic value. We in turn need to have anticipated their requirements and done thinking and capacity build to be able to advise and respond. Performance We need to constantly monitor SLA performance and continue to improve service quality, speed and Monitoring & unit cost. Improvement Build Team Capability & Culture Our ability to deliver is based on the skills and commitment of our people. We therefore have to build a culture that actively supports ongoing professional development and a continuous improvement mind set. We also need to anticipate capacity and skill needs ahead of requirement and ensure we are prepared and able to deliver.

Role of Financial Support Services (FSS) Presentation to Faculty Finance Team Presented by Uma Kumar 14 May 2009

1. Mandate by Senate in 2006 to implement a Shared Service Model Key aspects of approach taken are: a) Data collection & analysis conducted, between May to September 2007 b) Findings from data analysis conducted split work into: i. iii. iv. v. Financial Transactional Processes Financial Non Transactional Processes Human Resources Processes Administration Processes Student Services 6

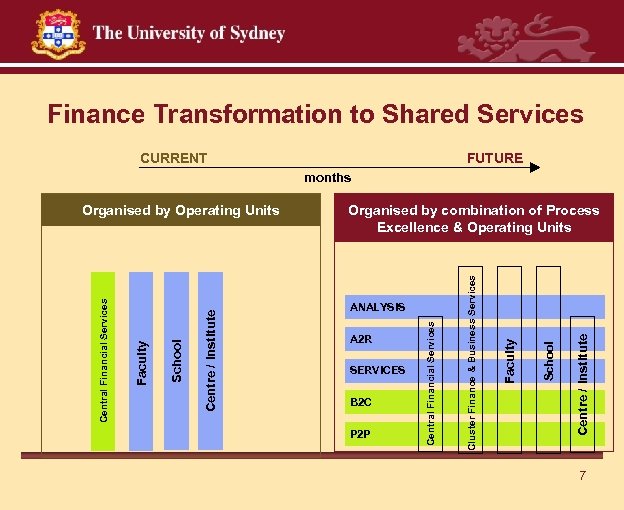

Finance Transformation to Shared Services CURRENT FUTURE months B 2 C P 2 P Centre / Institute SERVICES School A 2 R Faculty ANALYSIS Cluster Finance & Business Services Organised by combination of Process Excellence & Operating Units Central Financial Services Centre / Institute School Faculty Central Financial Services Organised by Operating Units 7

2. Supporting objectives are: a) Enhance quality of service b) Productive utilization of resources c) Ensure compliance & regulatory 3. Broad Objective include: a) Consolidation & consistency of Financial transactional processes b) Improve customer service c) Economies of scale through cost optimization 8

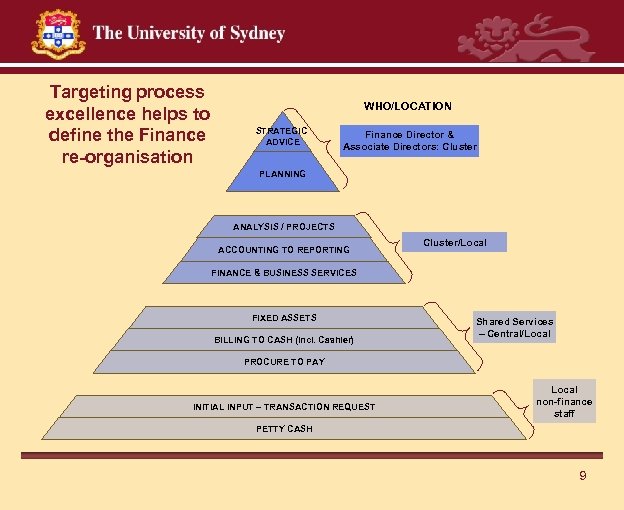

Targeting process excellence helps to define the Finance re-organisation WHO/LOCATION STRATEGIC ADVICE Finance Director & Associate Directors: Cluster PLANNING ANALYSIS / PROJECTS ACCOUNTING TO REPORTING Cluster/Local FINANCE & BUSINESS SERVICES FIXED ASSETS BILLING TO CASH (incl. Cashier) Shared Services – Central/Local PROCURE TO PAY INITIAL INPUT – TRANSACTION REQUEST Local non-finance staff PETTY CASH 9

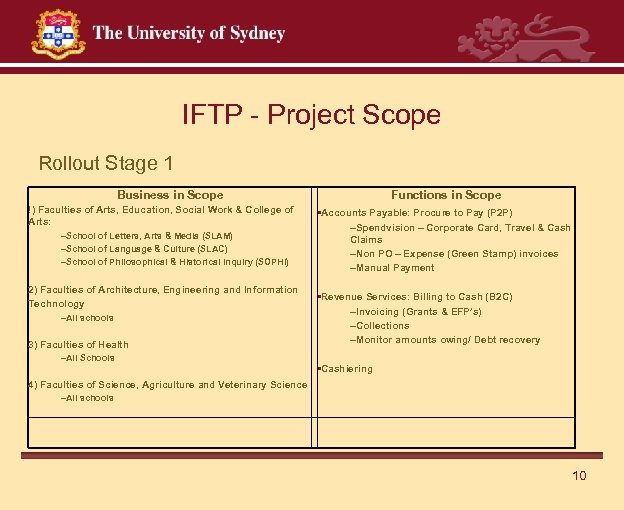

IFTP - Project Scope Rollout Stage 1 Business in Scope !) Faculties of Arts, Education, Social Work & College of Arts: –School of Letters, Arts & Media (SLAM) –School of Language & Culture (SLAC) –School of Philosophical & Historical Inquiry (SOPHI) 2) Faculties of Architecture, Engineering and Information Technology –All schools 3) Faculties of Health –All Schools Functions in Scope • Accounts Payable: Procure to Pay (P 2 P) –Spendvision – Corporate Card, Travel & Cash Claims –Non PO – Expense (Green Stamp) invoices –Manual Payment • Revenue Services: Billing to Cash (B 2 C) –Invoicing (Grants & EFP’s) –Collections –Monitor amounts owing/ Debt recovery • Cashiering 4) Faculties of Science, Agriculture and Veterinary Science –All schools 10

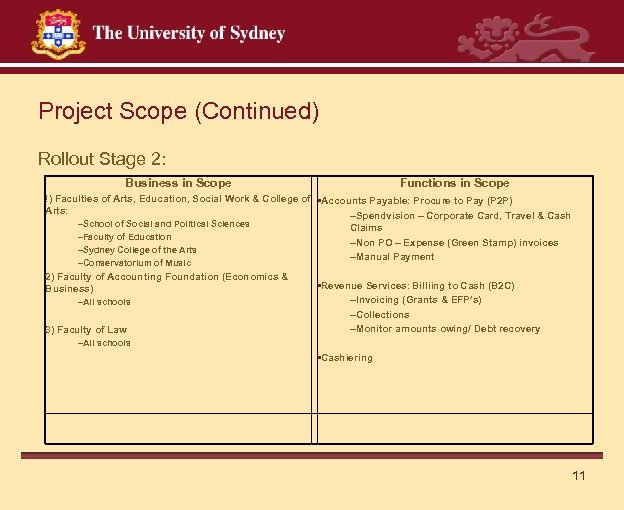

Project Scope (Continued) Rollout Stage 2: Business in Scope Functions in Scope !) Faculties of Arts, Education, Social Work & College of • Accounts Payable: Procure to Pay (P 2 P) Arts: –Spendvision – Corporate Card, Travel & Cash –School of Social and Political Sciences Claims –Faculty of Education –Non PO – Expense (Green Stamp) invoices –Sydney College of the Arts –Manual Payment –Conservatorium of Music 2) Faculty of Accounting Foundation (Economics & Business) –All schools 3) Faculty of Law • Revenue Services: Billiing to Cash (B 2 C) –Invoicing (Grants & EFP’s) –Collections –Monitor amounts owing/ Debt recovery –All schools • Cashiering 11

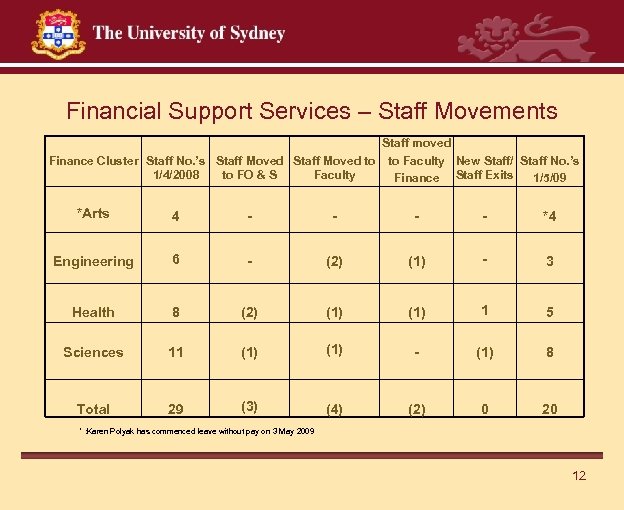

Financial Support Services – Staff Movements Staff moved Finance Cluster Staff No. ’s Staff Moved to to Faculty New Staff/ Staff No. ’s 1/4/2008 to FO & S Faculty Finance Staff Exits 1/5/09 *Arts 4 - - *4 Engineering 6 - (2) (1) - 3 Health 8 (2) (1) 1 5 Sciences 11 (1) - (1) 8 Total 29 (3) (4) (2) 0 20 * : Karen Polyak has commenced leave without pay on 3 May 2009 12

Service Level Agreement for Services from Financial Operations & Systems Presented by Kevin Lacey, Consultant 14 May 2009 13

Service Level Agreement “An agreement between the service provider and its customer quantifying the minimum acceptable service of the customer” 14

Key Aspects of Service Level Agreement Ø Supports Shared Service Model Ø Quantifies minimum service levels in Key Processes Ø Measurement of efficiency & effectiveness in outcomes of Key Processes Ø Two way measurement (end to end) & reporting on Key Processes Ø Review current processes to identify key aspects that can be improved Ø Enable more productive utilisation of resources 15

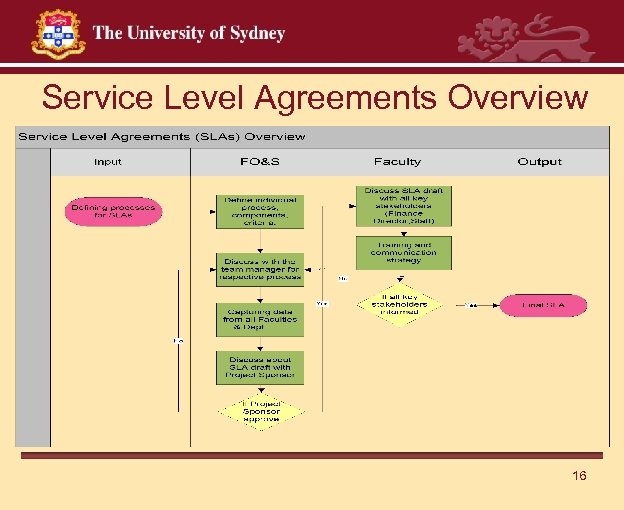

Service Level Agreements Overview 16

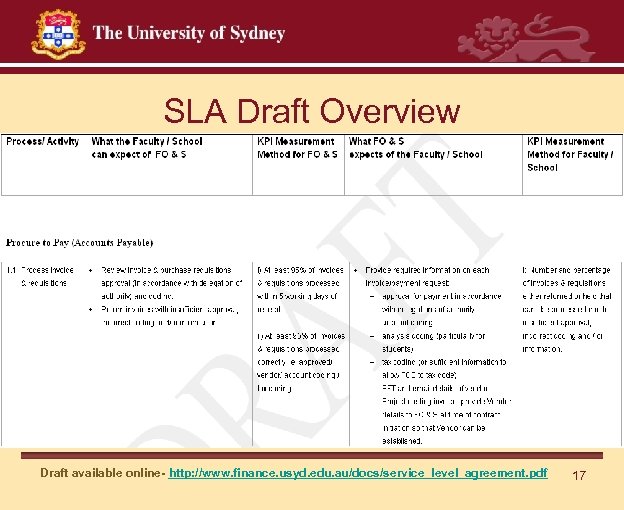

SLA Draft Overview Draft available online- http: //www. finance. usyd. edu. au/docs/service_level_agreement. pdf 17

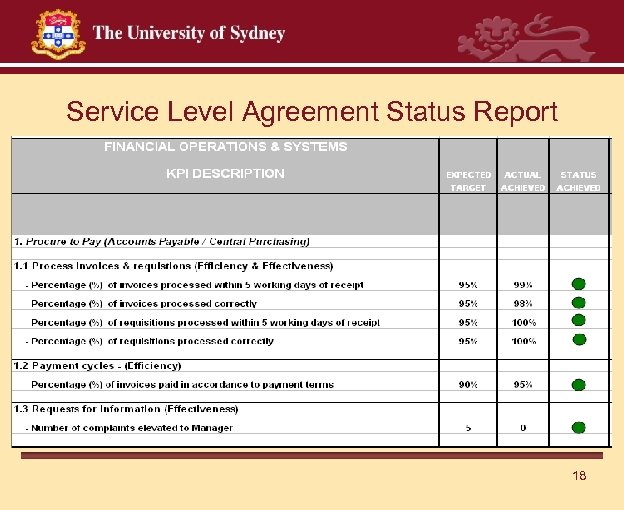

Service Level Agreement Status Report 18

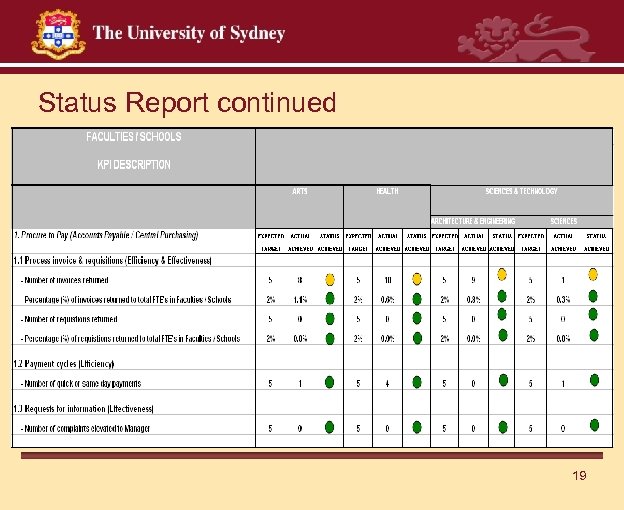

Status Report continued 19

Spendvision Projects Presented by Krishan Prasad 14 May 2009 20

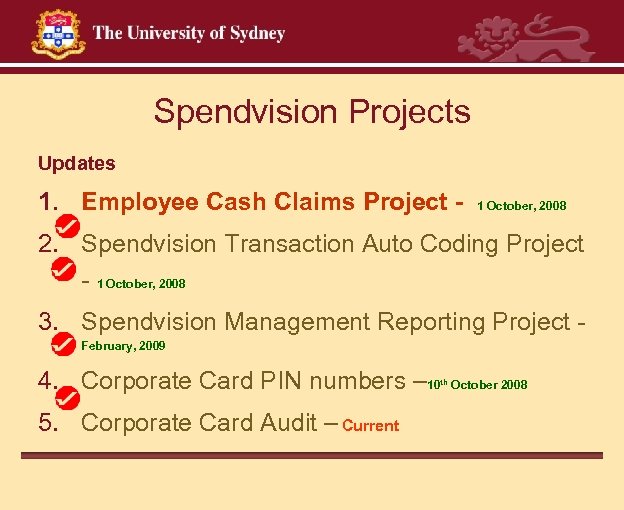

Spendvision Projects Updates 1. Employee Cash Claims Project - 1 October, 2008 2. Spendvision Transaction Auto Coding Project - 1 October, 2008 3. Spendvision Management Reporting Project - February, 2009 4. Corporate Card PIN numbers – 10 th 5. Corporate Card Audit – Current October 2008

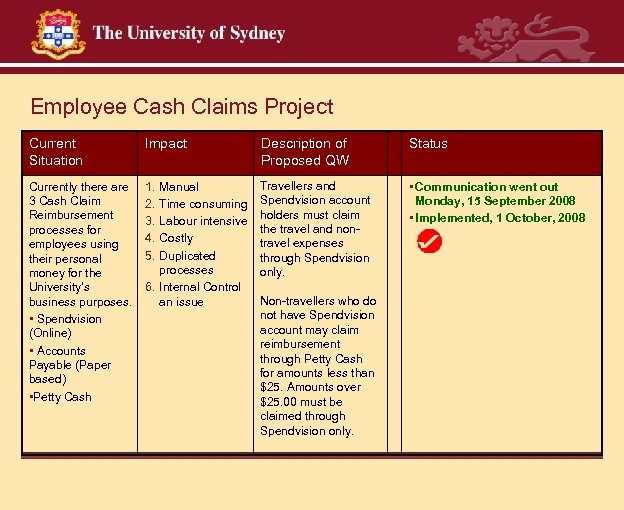

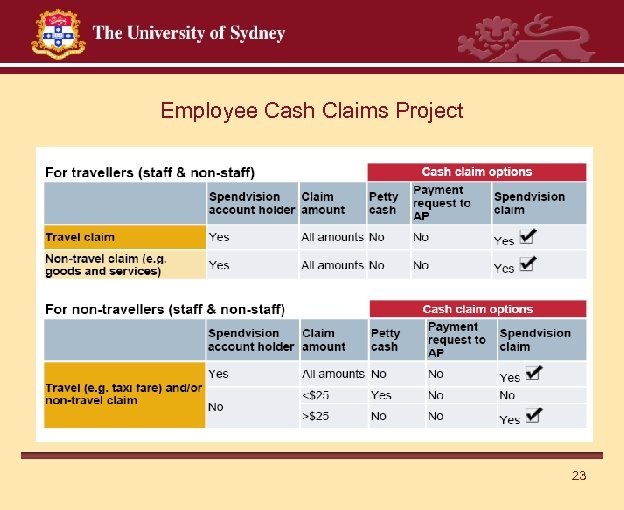

Employee Cash Claims Project Current Situation Impact Description of Proposed QW Status Currently there are 3 Cash Claim Reimbursement processes for employees using their personal money for the University’s business purposes. • Spendvision (Online) • Accounts Payable (Paper based) • Petty Cash 1. 2. 3. 4. 5. Travellers and Spendvision account holders must claim the travel and nontravel expenses through Spendvision only. • Communication went out Monday, 15 September 2008 • Implemented, 1 October, 2008 Manual Time consuming Labour intensive Costly Duplicated processes 6. Internal Control an issue Non-travellers who do not have Spendvision account may claim reimbursement through Petty Cash for amounts less than $25. Amounts over $25. 00 must be claimed through Spendvision only.

Employee Cash Claims Project 23

Financial Operations and Systems Update Procure to Pay (P 2 P) Presentation by Lean Lee May 2009 24

Agenda • Current Status of P 2 P Project • Key Benefits Delivered • External Purchase Requisition (EPR) Rollout to Financial Support Services (FSS) staff • “To Be” P 2 P Process for EPR Walkthrough • Quick System Demo – Raise Requisition – Receiving 25

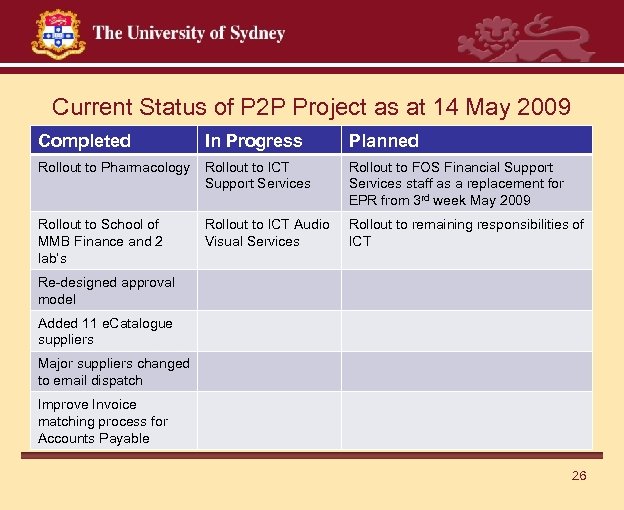

Current Status of P 2 P Project as at 14 May 2009 Completed In Progress Planned Rollout to Pharmacology Rollout to ICT Support Services Rollout to FOS Financial Support Services staff as a replacement for EPR from 3 rd week May 2009 Rollout to School of MMB Finance and 2 lab’s Rollout to ICT Audio Visual Services Rollout to remaining responsibilities of ICT Re-designed approval model Added 11 e. Catalogue suppliers Major suppliers changed to email dispatch Improve Invoice matching process for Accounts Payable 26

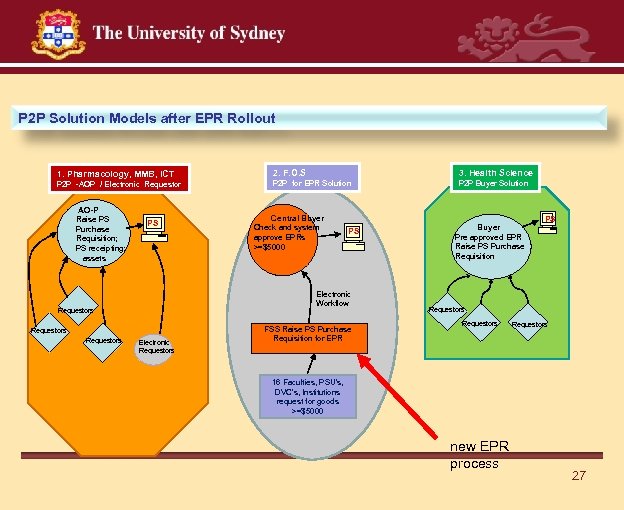

P 2 P Solution Models after EPR Rollout 1. Pharmacology, MMB, ICT P 2 P -AOP / Electronic Requestor AO-P Raise PS Purchase Requisition; PS receipting; assets PS 3. Health Science P 2 P for EPR Solution P 2 P Buyer Solution Central Buyer Check and system approve EPRs >=$5000 PS Electronic Workflow Requestors 2. F. O. S Electronic Requestors FSS Raise PS Purchase Requisition for EPR Buyer Pre approved EPR Raise PS Purchase Requisition PS Requestors 16 Faculties, PSU’s, DVC’s, Institutions request for goods >=$5000 new EPR process 27

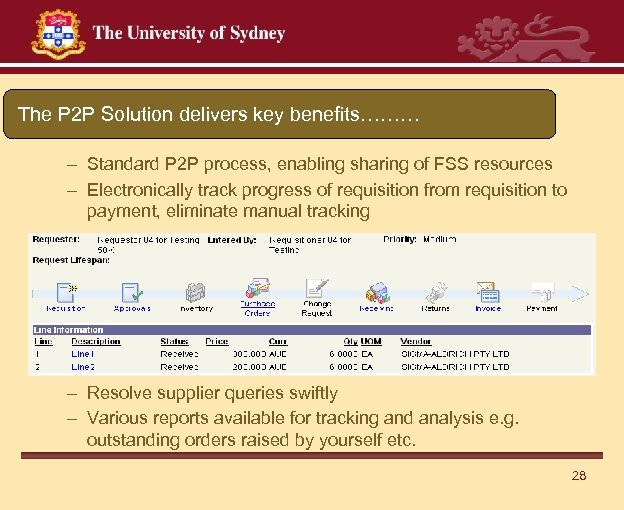

The P 2 P Solution delivers key benefits……… – Standard P 2 P process, enabling sharing of FSS resources – Electronically track progress of requisition from requisition to payment, eliminate manual tracking – Resolve supplier queries swiftly – Various reports available for tracking and analysis e. g. outstanding orders raised by yourself etc. 28

P 2 P Solution delivers key benefits……… – Encourage adherence to the University Purchasing Policy – Eliminate activities that have no ‘value add’ e. g. no more paper requisitions to be completed and forwarded to Central Purchasing – Documents can be attached to requisition, either to be sent to the suppliers or for internal use only – User-friendly web-based access – Provide transactional integrity, reduce data entry with defaults, improve data accuracy – PO’s are emailed to suppliers where emails are available – Reduces workloads of users, no green-stamp – replaced by electronic receiving – Speedy end-to-end procure-to-pay – Visibility of purchase $$ commitments immediately 29

Additional benefits if e. Catalogue Solution is used…… • Access to the ‘best-in-class’ suppliers for goods/services – – Eliminates work on multiple quotations Central Buyer approval not required. Transact with suppliers via B 2 B connection Quickest method of ordering goods (Pharmacology experiences requisition to order cycle of 12 minutes) – Minimal price variances – e. Catalouge suppliers are managed by Procurement Services 30

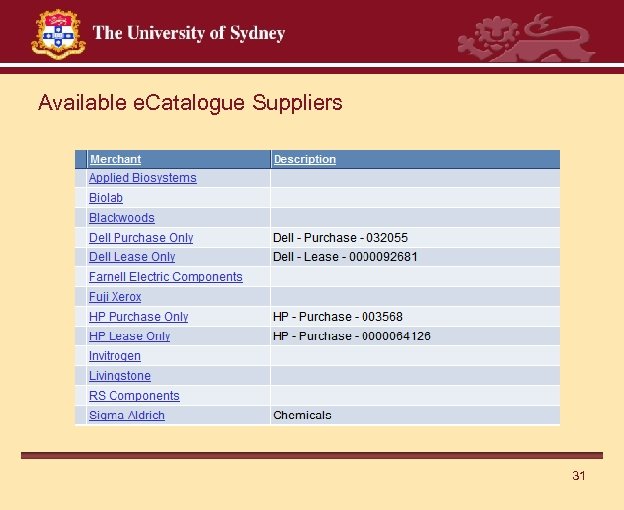

Available e. Catalogue Suppliers 31

Reasons for EPR Replacement Rollout to FSS Staff instead of a full rollout • • Transparent to the academic community Least disruption to the departmental processes Brief introduction of FSS staff to the P 2 P solution Current EPR is the most inefficient requisitioning process for goods and services – slow and too much paper works • Staff has direct reporting line to FOS • Quick wins 32

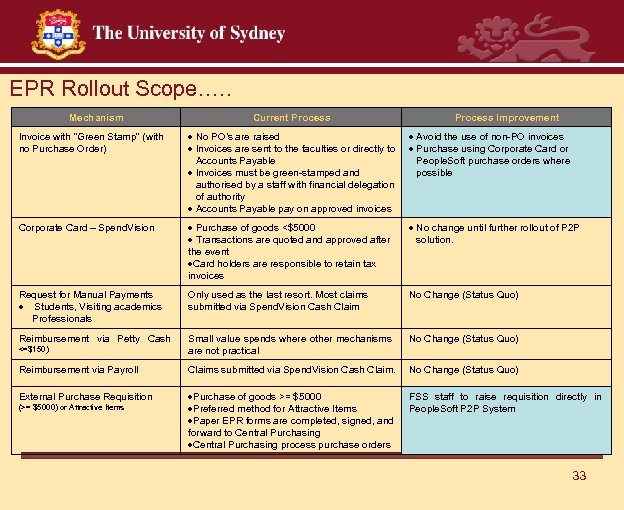

EPR Rollout Scope…. . Mechanism Current Process Improvement Invoice with “Green Stamp” (with no Purchase Order) No PO’s are raised Invoices are sent to the faculties or directly to Accounts Payable Invoices must be green-stamped and authorised by a staff with financial delegation of authority Accounts Payable pay on approved invoices Avoid the use of non-PO invoices Purchase using Corporate Card or People. Soft purchase orders where possible Corporate Card – Spend. Vision Purchase of goods <$5000 Transactions are quoted and approved after the event Card holders are responsible to retain tax invoices No change until further rollout of P 2 P solution. Request for Manual Payments Students, Visiting academics Professionals Only used as the last resort. Most claims submitted via Spend. Vision Cash Claim No Change (Status Quo) Reimbursement via Petty Cash Small value spends where other mechanisms are not practical No Change (Status Quo) <=$150) Reimbursement via Payroll Claims submitted via Spend. Vision Cash Claim. No Change (Status Quo) External Purchase Requisition Purchase of goods >= $5000 Preferred method for Attractive Items Paper EPR forms are completed, signed, and forward to Central Purchasing process purchase orders FSS staff to raise requisition directly in People. Soft P 2 P System (>= $5000) or Attractive Items 33

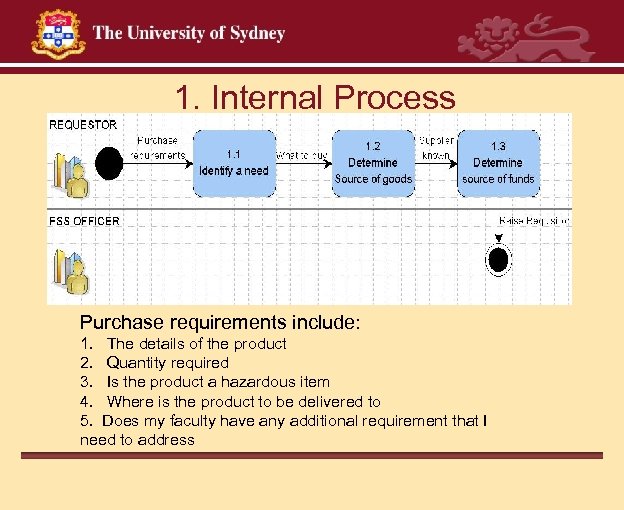

1. Internal Process Purchase requirements include: 1. The details of the product 2. Quantity required 3. Is the product a hazardous item 4. Where is the product to be delivered to 5. Does my faculty have any additional requirement that I need to address

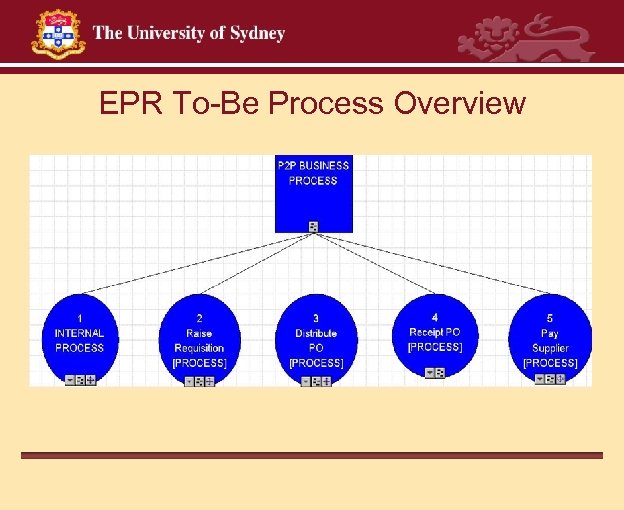

EPR To-Be Process Overview

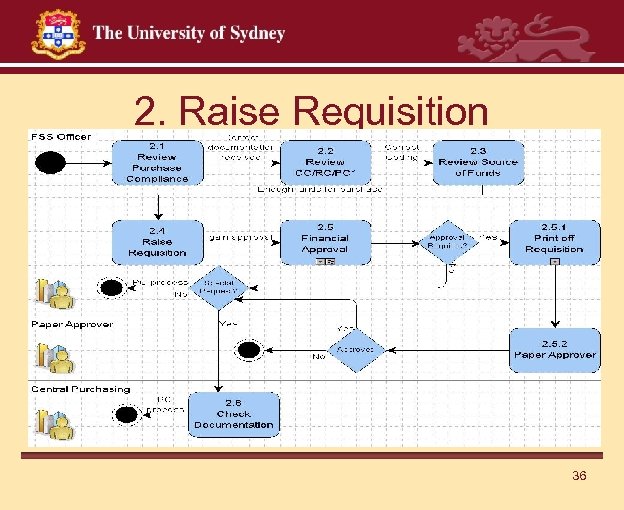

2. Raise Requisition 36

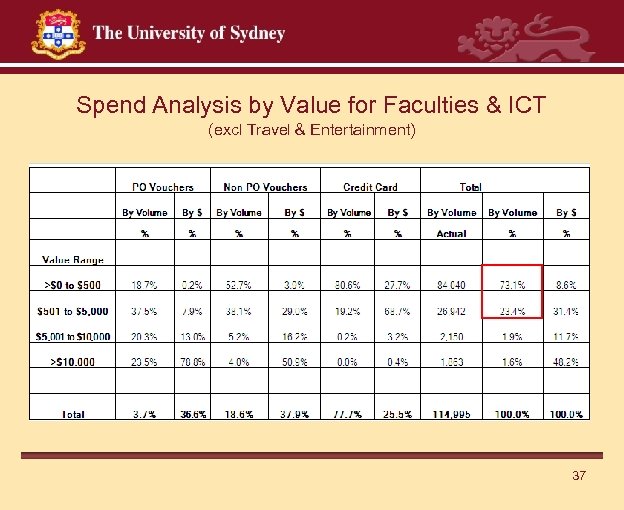

Spend Analysis by Value for Faculties & ICT (excl Travel & Entertainment) 37

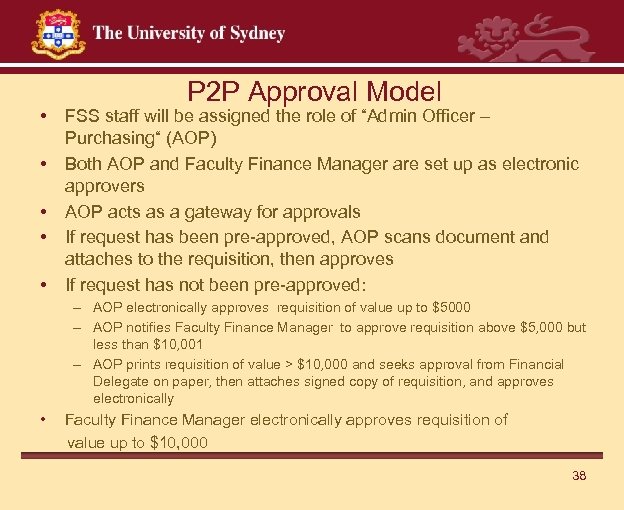

P 2 P Approval Model • FSS staff will be assigned the role of “Admin Officer – Purchasing“ (AOP) • Both AOP and Faculty Finance Manager are set up as electronic approvers • AOP acts as a gateway for approvals • If request has been pre-approved, AOP scans document and attaches to the requisition, then approves • If request has not been pre-approved: – AOP electronically approves requisition of value up to $5000 – AOP notifies Faculty Finance Manager to approve requisition above $5, 000 but less than $10, 001 – AOP prints requisition of value > $10, 000 and seeks approval from Financial Delegate on paper, then attaches signed copy of requisition, and approves electronically • Faculty Finance Manager electronically approves requisition of value up to $10, 000 38

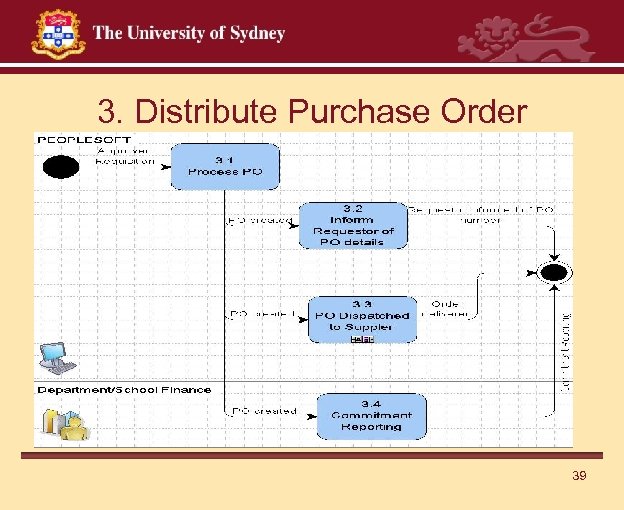

3. Distribute Purchase Order 39

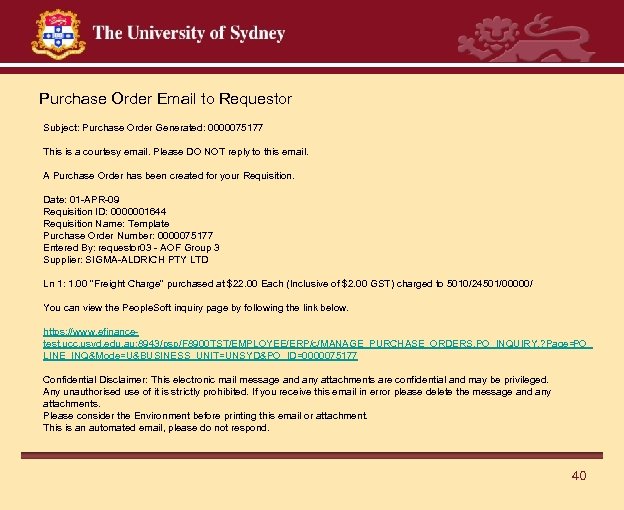

Purchase Order Email to Requestor Subject: Purchase Order Generated: 0000075177 This is a courtesy email. Please DO NOT reply to this email. A Purchase Order has been created for your Requisition. Date: 01 -APR-09 Requisition ID: 0000001644 Requisition Name: Template Purchase Order Number: 0000075177 Entered By: requestor 03 - AOF Group 3 Supplier: SIGMA-ALDRICH PTY LTD Ln 1: 1. 00 "Freight Charge" purchased at $22. 00 Each (Inclusive of $2. 00 GST) charged to 5010/24501/00000/ You can view the People. Soft inquiry page by following the link below. https: //www. efinancetest. ucc. usyd. edu. au: 8943/psp/F 8900 TST/EMPLOYEE/ERP/c/MANAGE_PURCHASE_ORDERS. PO_INQUIRY. ? Page= PO_ LINE_INQ&Mode=U&BUSINESS_UNIT=UNSYD&PO_ID=0000075177 Confidential Disclaimer: This electronic mail message and any attachments are confidential and may be privileged. Any unauthorised use of it is strictly prohibited. If you receive this email in error please delete the message and any attachments. Please consider the Environment before printing this email or attachment. This is an automated email, please do not respond. 40

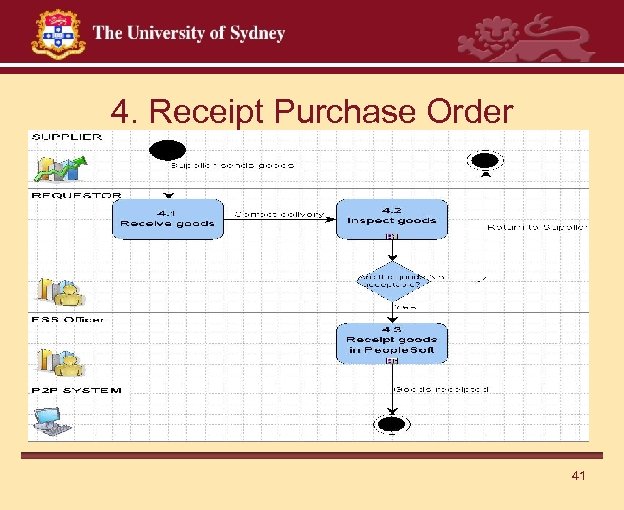

4. Receipt Purchase Order 41

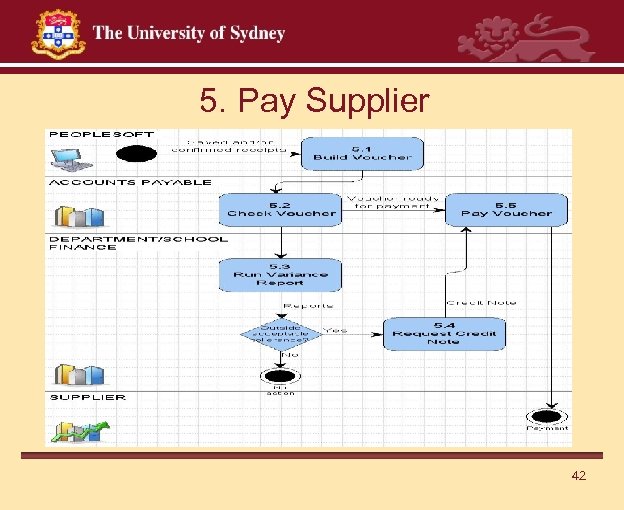

5. Pay Supplier 42

System Demo 43

Financial Operations & Systems Update Order to Collect Project General Update Presentation by Gemma Gill - Project Manager O 2 C 14 May 2009

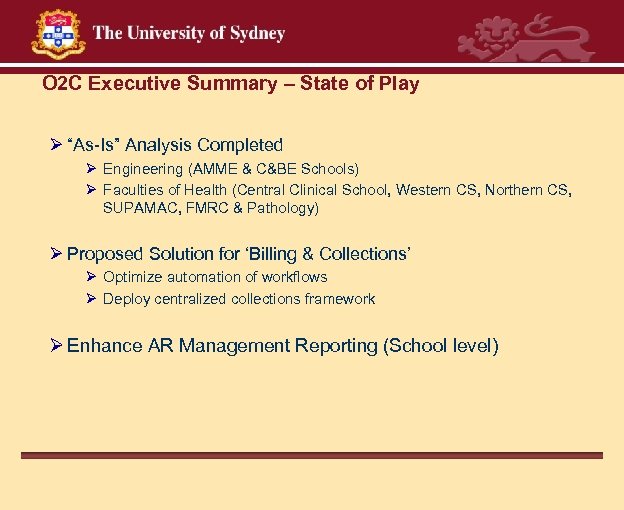

O 2 C Executive Summary – State of Play Ø “As-Is” Analysis Completed Ø Engineering (AMME & C&BE Schools) Ø Faculties of Health (Central Clinical School, Western CS, Northern CS, SUPAMAC, FMRC & Pathology) Ø Proposed Solution for ‘Billing & Collections’ Ø Optimize automation of workflows Ø Deploy centralized collections framework Ø Enhance AR Management Reporting (School level)

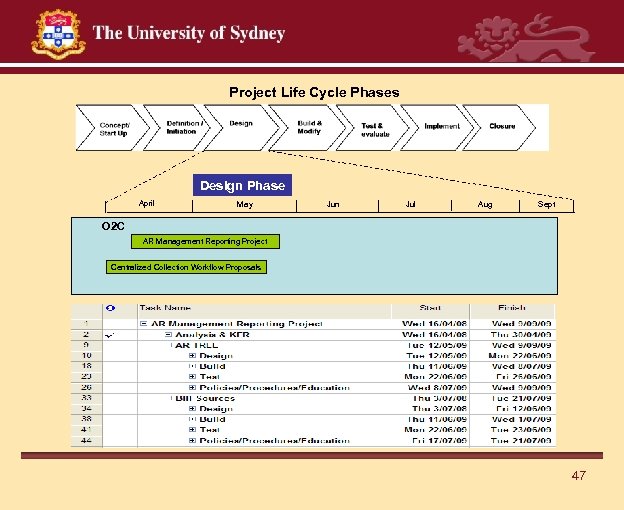

Project Life Cycle Phases Design Phase April May Jun Jul Aug Sept O 2 C AR Management Reporting Project Centralized Collection Workflow Proposals 47

O 2 C – Quick Win Summary Financial Operations and Systems 48

Questions ? 49

Contacts 1. Financial Operations and Systems – Mark Preston 2. Financial Support Services Unit update – Uma Kumar 3. Draft Service Level Agreement (SLA) – Kevin Lacey 4. Expense reimbursement via Spendvision – Krishan Prasad 5. Procure to Pay (P 2 P) – Lean Lee 6. Billing to Cash (B 2 C) – Gemma Gill 50

Thank You 51

2f80aceb66a9353e53ff60145dec7899.ppt