f09f7e1dedad38075d59d8615dc433c4.ppt

- Количество слайдов: 26

Financial Markets Overview IEMS 326

Financial Markets Overview IEMS 326

Why this Lecture? o Goals: n n o financial literacy financial numeracy Will this be on the exam? n n n Yes. Know definitions Primary vs. Secondary markets Stocks vs. Flows vs. Trades Know orders of magnitude, relative sizes. Market functions

Why this Lecture? o Goals: n n o financial literacy financial numeracy Will this be on the exam? n n n Yes. Know definitions Primary vs. Secondary markets Stocks vs. Flows vs. Trades Know orders of magnitude, relative sizes. Market functions

Debt versus Budget o What’s bigger, the debt or deficit of the US? n n o U. S. federal debt: over $11 T U. S. federal deficit 2009: about $1½T In general, distinguish among 3 things: n n n stocks—e. g. how much has been invested? flows—an increase or decrease in stocks trades—exchanges of ownership o (may not affect the real economy)

Debt versus Budget o What’s bigger, the debt or deficit of the US? n n o U. S. federal debt: over $11 T U. S. federal deficit 2009: about $1½T In general, distinguish among 3 things: n n n stocks—e. g. how much has been invested? flows—an increase or decrease in stocks trades—exchanges of ownership o (may not affect the real economy)

Debt, Deficit, Bonds o The U. S. federal debt is a… n o The U. S. federal deficit is a… n o stock—total amount borrowed flow—this year’s increase in the debt When I buy a U. S. Treasury bond, it’s a… n n trade—if I buy it from you flow—if I buy it from the U. S. Treasury

Debt, Deficit, Bonds o The U. S. federal debt is a… n o The U. S. federal deficit is a… n o stock—total amount borrowed flow—this year’s increase in the debt When I buy a U. S. Treasury bond, it’s a… n n trade—if I buy it from you flow—if I buy it from the U. S. Treasury

Budgets o The U. S. federal budget is… n n n o about $3 T about twice the U. S. federal deficit about $10 K person (population ~300 M) Illinois has population ~13 M and its state budget is… n n about $50 B about $4 K person

Budgets o The U. S. federal budget is… n n n o about $3 T about twice the U. S. federal deficit about $10 K person (population ~300 M) Illinois has population ~13 M and its state budget is… n n about $50 B about $4 K person

Budgets o The City of Evanston’s budget is… n n o $191 M about $2. 5 K person (population ~75 K) Northwestern’s budget is… n n $1. 6 B about $100 K per student (~16 K students)

Budgets o The City of Evanston’s budget is… n n o $191 M about $2. 5 K person (population ~75 K) Northwestern’s budget is… n n $1. 6 B about $100 K per student (~16 K students)

Values of Investments o o o What’s worth more, American Airlines or Northwestern’s endowment? Our endowment: about $6 B (~$400 K/student) American Airlines (AMR): n n n market capitalization $830 M = (# shares of stock)*(price of a share) = 335 M shares * $2. 48/share

Values of Investments o o o What’s worth more, American Airlines or Northwestern’s endowment? Our endowment: about $6 B (~$400 K/student) American Airlines (AMR): n n n market capitalization $830 M = (# shares of stock)*(price of a share) = 335 M shares * $2. 48/share

Groupon IPO Reuters “Groupon Inc raised $700 million after increasing the size of its initial public offering, becoming the largest IPO by a U. S. Internet company since Google Inc raised $1. 7 billion in 2004. The global leader in "daily deals" is now valued at almost $13 billion after saying it increased the offering by 5 million shares to 35 million in total and pricing them at $20 each, above an initial range of $16 to $18. ”

Groupon IPO Reuters “Groupon Inc raised $700 million after increasing the size of its initial public offering, becoming the largest IPO by a U. S. Internet company since Google Inc raised $1. 7 billion in 2004. The global leader in "daily deals" is now valued at almost $13 billion after saying it increased the offering by 5 million shares to 35 million in total and pricing them at $20 each, above an initial range of $16 to $18. ”

Typical share prices o o From $1 to $100 s Not too low… n o (penny stocks) …or too high! n Berkshire Hathaway

Typical share prices o o From $1 to $100 s Not too low… n o (penny stocks) …or too high! n Berkshire Hathaway

How to make money in stocks o o buy low sell high n o When the share price goes up, (trade) n n o …or collect dividends the company is more expensive shareholders are happy real economy vs. financial trades

How to make money in stocks o o buy low sell high n o When the share price goes up, (trade) n n o …or collect dividends the company is more expensive shareholders are happy real economy vs. financial trades

Primary&Secondary Equity Market o primary equity market: (flow) n n o e. g. initial public offering (IPO) Google issued new shares sold them to investors for $30 B invested $30 B in cool stuff secondary equity market (exchanges): (trade) n n n $36. 6 T total shares and $$ change hands brokers get ¢ (~0. 1% of value)

Primary&Secondary Equity Market o primary equity market: (flow) n n o e. g. initial public offering (IPO) Google issued new shares sold them to investors for $30 B invested $30 B in cool stuff secondary equity market (exchanges): (trade) n n n $36. 6 T total shares and $$ change hands brokers get ¢ (~0. 1% of value)

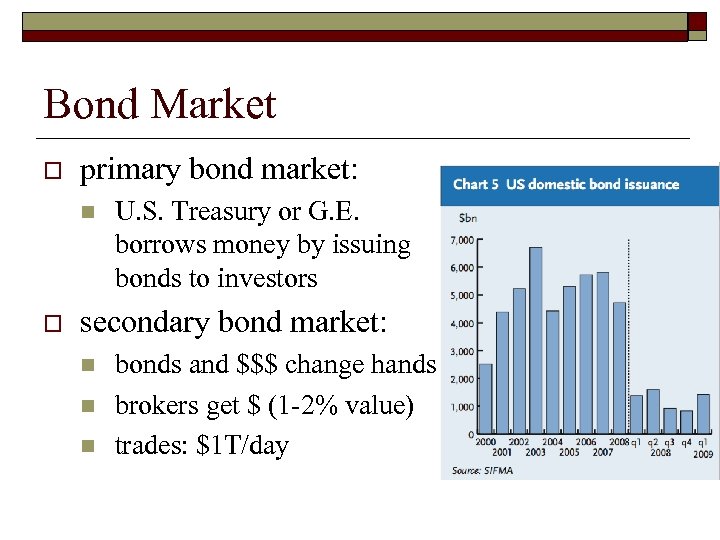

Bond Market o primary bond market: n o U. S. Treasury or G. E. borrows money by issuing bonds to investors secondary bond market: n n n bonds and $$$ change hands brokers get $ (1 -2% value) trades: $1 T/day

Bond Market o primary bond market: n o U. S. Treasury or G. E. borrows money by issuing bonds to investors secondary bond market: n n n bonds and $$$ change hands brokers get $ (1 -2% value) trades: $1 T/day

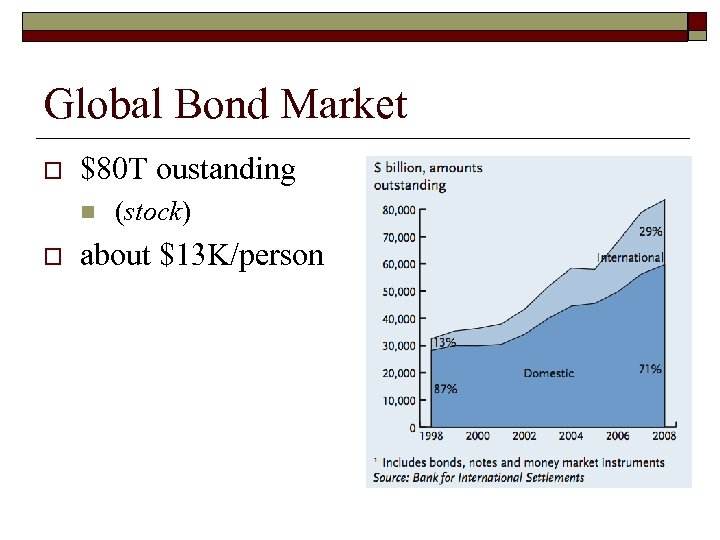

Global Bond Market o $80 T oustanding n o (stock) about $13 K/person

Global Bond Market o $80 T oustanding n o (stock) about $13 K/person

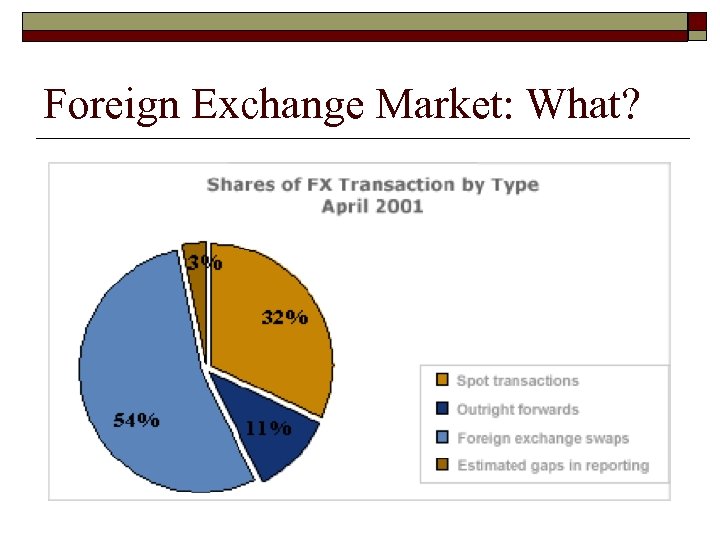

Foreign Exchange Market o currency: trade $ for euros n o trades: about $3 T/day n n o open 24/7 about $500/person/day about $200 K/person/year purposes: n n n international trade hedging speculation

Foreign Exchange Market o currency: trade $ for euros n o trades: about $3 T/day n n o open 24/7 about $500/person/day about $200 K/person/year purposes: n n n international trade hedging speculation

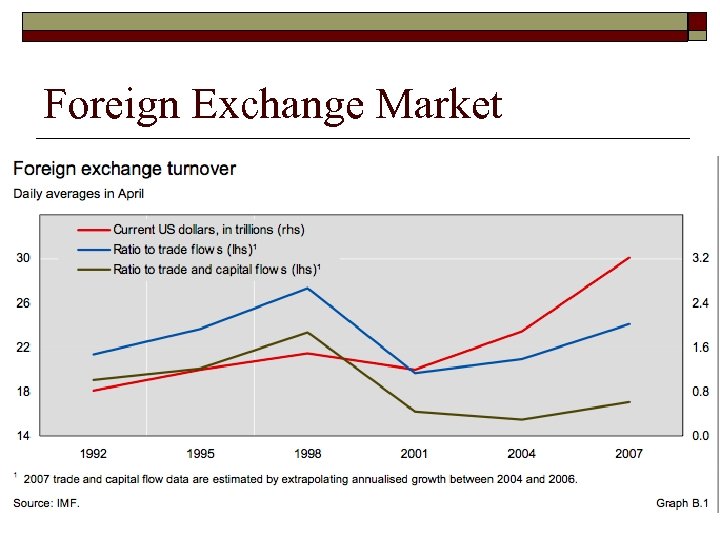

Foreign Exchange Market

Foreign Exchange Market

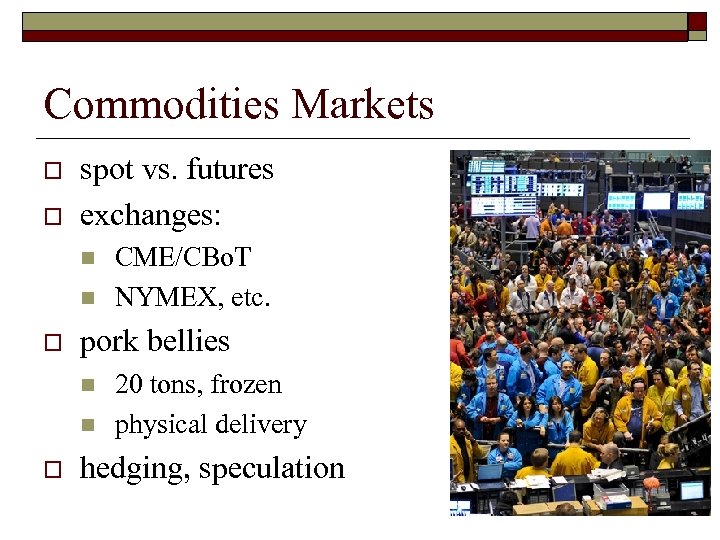

Commodities Markets o o spot vs. futures exchanges: n n o pork bellies n n o CME/CBo. T NYMEX, etc. 20 tons, frozen physical delivery hedging, speculation

Commodities Markets o o spot vs. futures exchanges: n n o pork bellies n n o CME/CBo. T NYMEX, etc. 20 tons, frozen physical delivery hedging, speculation

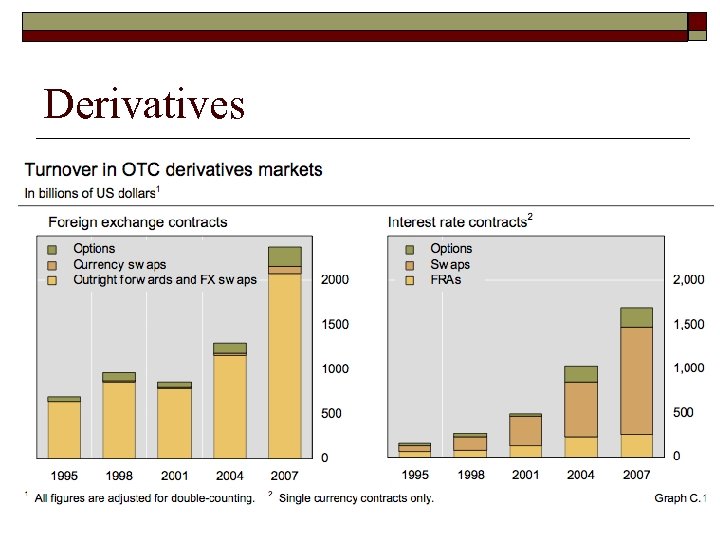

Derivatives

Derivatives

Backup slides

Backup slides

How companies make money o successful business projects… n n n o create positive earnings increase book value make it possible to pay higher dividends real economy vs. financial trades

How companies make money o successful business projects… n n n o create positive earnings increase book value make it possible to pay higher dividends real economy vs. financial trades

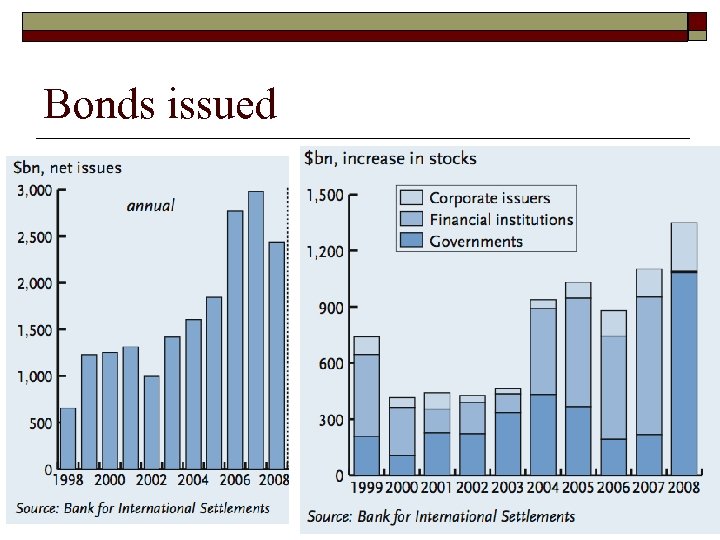

Bonds issued

Bonds issued

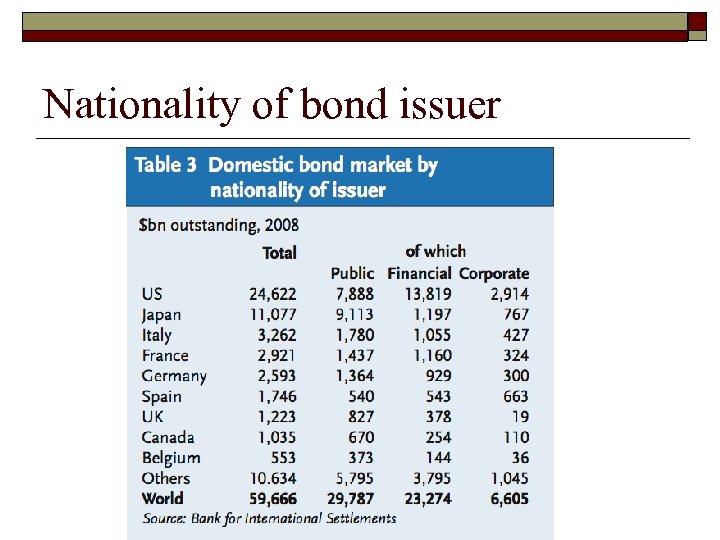

Nationality of bond issuer

Nationality of bond issuer

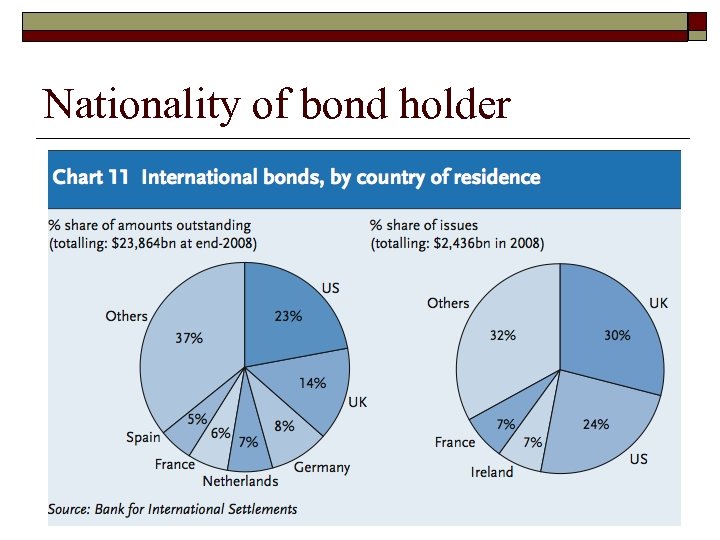

Nationality of bond holder

Nationality of bond holder

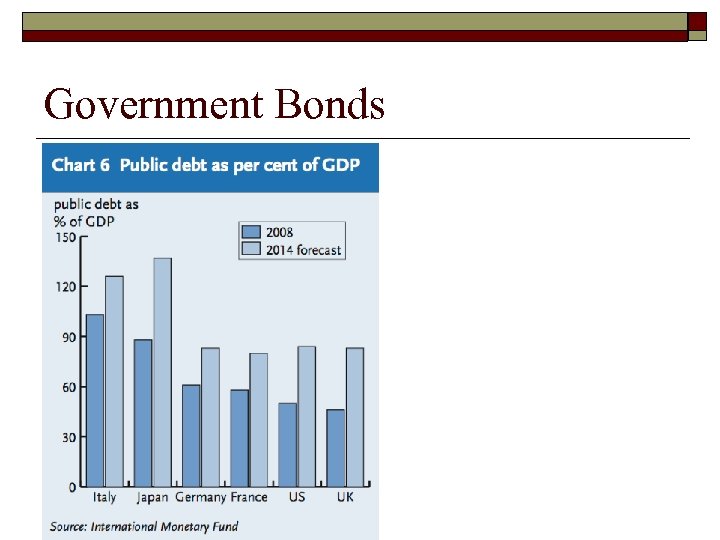

Government Bonds

Government Bonds

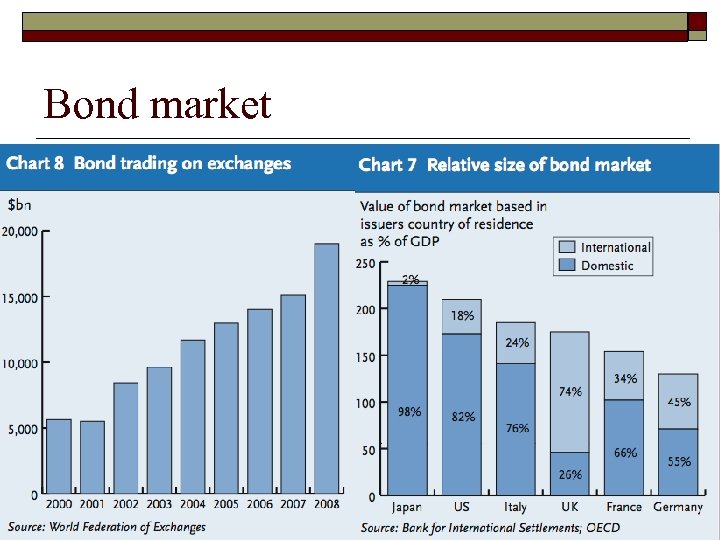

Bond market

Bond market

Foreign Exchange Market: What?

Foreign Exchange Market: What?

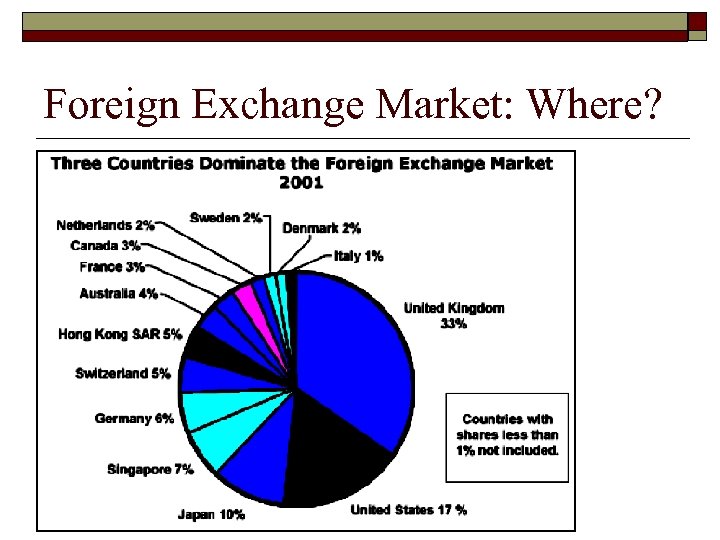

Foreign Exchange Market: Where?

Foreign Exchange Market: Where?