2.+Financial+markets+and+instruments.pptx

- Количество слайдов: 53

Financial Markets and Instruments Module: Introduction to Finance

Financial Markets and Instruments Module: Introduction to Finance

What is a market? • A market is a venue where goods and services are exchanged. • A financial market is a place where individuals and organizations wanting to borrow funds are brought together with those having a surplus of funds. Module: Introduction to Finance

What is a market? • A market is a venue where goods and services are exchanged. • A financial market is a place where individuals and organizations wanting to borrow funds are brought together with those having a surplus of funds. Module: Introduction to Finance

Overview of Financial Markets Financial Market: a market in which financial assets (securities) such as stocks and bonds can be purchased or sold • Financial markets provide for financial intermediation-financial savings (Surplus Units) to investment (Deficit Units) • Financial markets provide payments system • Financial markets provide means to manage risk Module: Introduction to Finance

Overview of Financial Markets Financial Market: a market in which financial assets (securities) such as stocks and bonds can be purchased or sold • Financial markets provide for financial intermediation-financial savings (Surplus Units) to investment (Deficit Units) • Financial markets provide payments system • Financial markets provide means to manage risk Module: Introduction to Finance

Overview of Financial Instruments • “Securities” is a name that commonly refers to financial instruments that are traded on financial markets. • A security (financial instrument) is a formal obligation that entitles one party to receive payments and/or a share of assets from another party; e. g. , loans, stocks, bonds. • Even an ordinary bank loan is a financial instrument. Module: Introduction to Finance

Overview of Financial Instruments • “Securities” is a name that commonly refers to financial instruments that are traded on financial markets. • A security (financial instrument) is a formal obligation that entitles one party to receive payments and/or a share of assets from another party; e. g. , loans, stocks, bonds. • Even an ordinary bank loan is a financial instrument. Module: Introduction to Finance

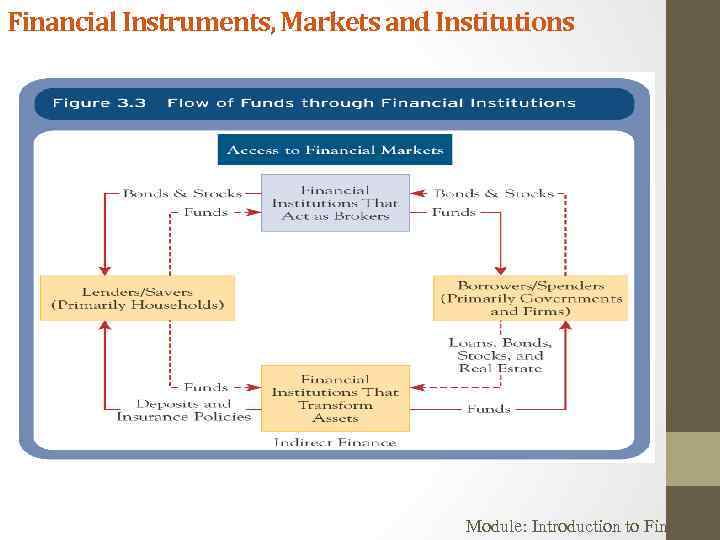

Financial Instruments, Markets and Institutions: Types of Finance Indirect Finance • An Institution, such as a bank, stands between lender and borrower. • Involves asset transformation. Direct Finance • Borrowers and lenders deal directly with each other. Borrowers sell securities directly to lenders in financial markets. Module: Introduction to Finance

Financial Instruments, Markets and Institutions: Types of Finance Indirect Finance • An Institution, such as a bank, stands between lender and borrower. • Involves asset transformation. Direct Finance • Borrowers and lenders deal directly with each other. Borrowers sell securities directly to lenders in financial markets. Module: Introduction to Finance

The Financial System Overview • The household is the primary provider of funds to businesses and government. • Households must accumulate financial resources throughout their working life times to have enough savings (pension) to live on in their retirement years • Financial intermediaries transform the nature of the securities they issue and invest in • Banks, trust companies, credit unions, insurance firms, mutual funds • Market intermediaries simply help make markets work • Investment dealers • Brokers Module: Introduction to Finance

The Financial System Overview • The household is the primary provider of funds to businesses and government. • Households must accumulate financial resources throughout their working life times to have enough savings (pension) to live on in their retirement years • Financial intermediaries transform the nature of the securities they issue and invest in • Banks, trust companies, credit unions, insurance firms, mutual funds • Market intermediaries simply help make markets work • Investment dealers • Brokers Module: Introduction to Finance

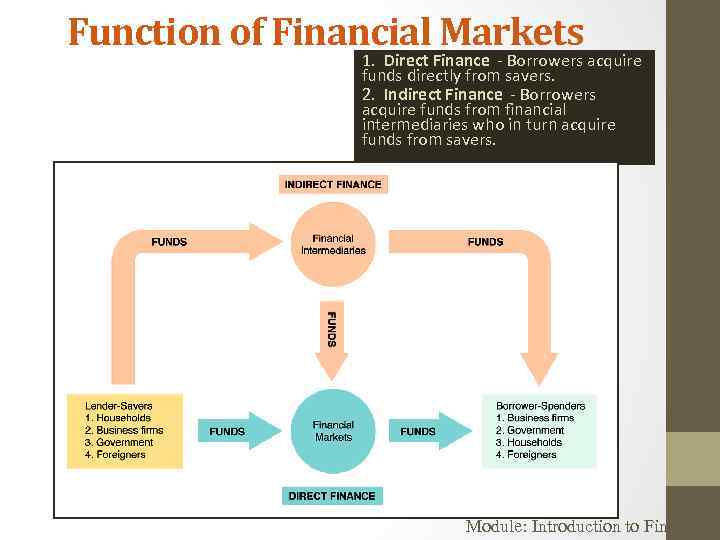

Function of Financial Markets 1. Direct Finance - Borrowers acquire funds directly from savers. 2. Indirect Finance - Borrowers acquire funds from financial intermediaries who in turn acquire funds from savers. Module: Introduction to Finance

Function of Financial Markets 1. Direct Finance - Borrowers acquire funds directly from savers. 2. Indirect Finance - Borrowers acquire funds from financial intermediaries who in turn acquire funds from savers. Module: Introduction to Finance

Financial Instruments, Markets and Institutions Module: Introduction to Finance

Financial Instruments, Markets and Institutions Module: Introduction to Finance

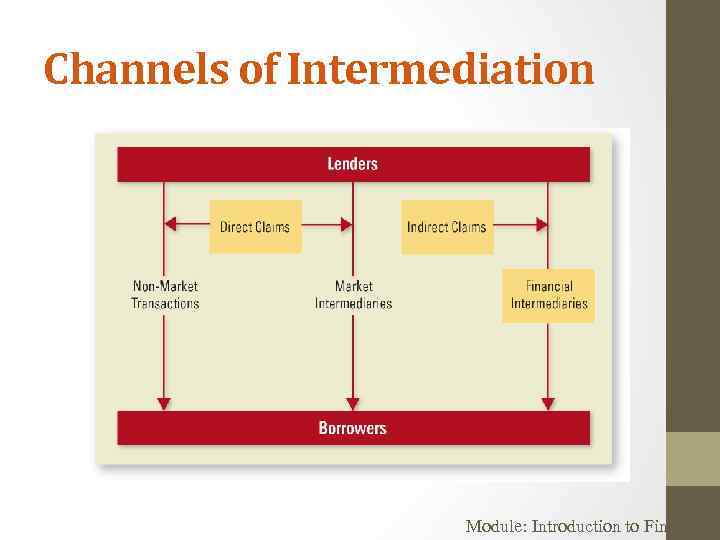

The Financial System Channels of Intermediation • Funds can be channeled from the saver to the borrower in three ways: • Direct intermediation (direct transfer from saver to borrower – a non-market transaction) • Direct intermediation (a market-based transaction usually through a market intermediary such as a broker) • Indirect claims through a financial intermediary (where the financial intermediary such as a bank offers deposit-taking services and ultimately lends those deposits out as mortgages or loans) Module: Introduction to Finance

The Financial System Channels of Intermediation • Funds can be channeled from the saver to the borrower in three ways: • Direct intermediation (direct transfer from saver to borrower – a non-market transaction) • Direct intermediation (a market-based transaction usually through a market intermediary such as a broker) • Indirect claims through a financial intermediary (where the financial intermediary such as a bank offers deposit-taking services and ultimately lends those deposits out as mortgages or loans) Module: Introduction to Finance

Channels of Intermediation Module: Introduction to Finance

Channels of Intermediation Module: Introduction to Finance

The Role of Financial Markets Financial markets perform two exceedingly important functions: • They transfer funds from savers into investments and • They transfer title of ownership of existing securities from sellers to buyers. Module: Introduction to Finance

The Role of Financial Markets Financial markets perform two exceedingly important functions: • They transfer funds from savers into investments and • They transfer title of ownership of existing securities from sellers to buyers. Module: Introduction to Finance

The Role of Financial Markets (Cont’d) • Financial markets are the mechanism to transfer the savings to productive uses. • The process of transferring savings into investments, is a primary and perhaps the most important function of the financial system. • This process leads to creation of financial claims such stock and debt instruments such as bonds. as Module: Introduction to Finance

The Role of Financial Markets (Cont’d) • Financial markets are the mechanism to transfer the savings to productive uses. • The process of transferring savings into investments, is a primary and perhaps the most important function of the financial system. • This process leads to creation of financial claims such stock and debt instruments such as bonds. as Module: Introduction to Finance

The Role of Financial Markets (Cont’d) • A second important purpose of the financial markets is the creation of markets in existing securities. • These “secondary” markets, however, do not transfer funds to users of funds; they transfer the ownership of securities among various investors. Module: Introduction to Finance

The Role of Financial Markets (Cont’d) • A second important purpose of the financial markets is the creation of markets in existing securities. • These “secondary” markets, however, do not transfer funds to users of funds; they transfer the ownership of securities among various investors. Module: Introduction to Finance

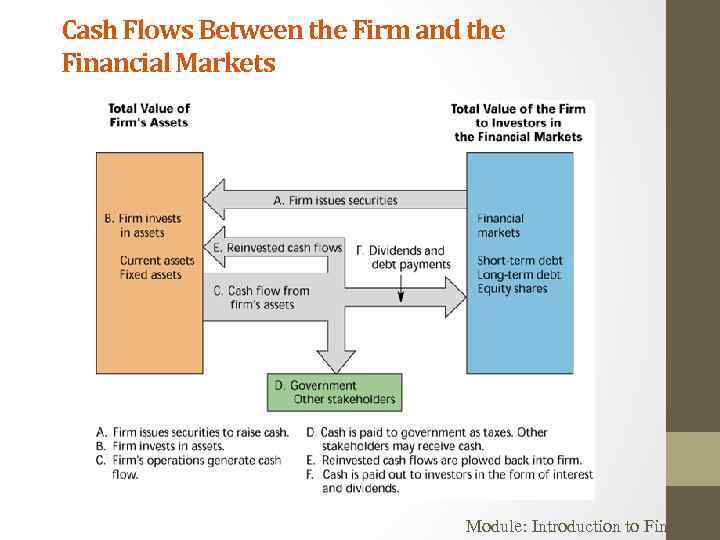

Cash Flows Between the Firm and the Financial Markets Module: Introduction to Finance

Cash Flows Between the Firm and the Financial Markets Module: Introduction to Finance

Overview of Financial Markets • Broad Classifications of Financial Markets Money versus Capital Markets Primary versus Secondary Markets Organized versus Over-the-Counter Markets Module: Introduction to Finance

Overview of Financial Markets • Broad Classifications of Financial Markets Money versus Capital Markets Primary versus Secondary Markets Organized versus Over-the-Counter Markets Module: Introduction to Finance

Financial Markets Money Primary OTC Markets Secondary Markets Module: Introduction to Finance

Financial Markets Money Primary OTC Markets Secondary Markets Module: Introduction to Finance

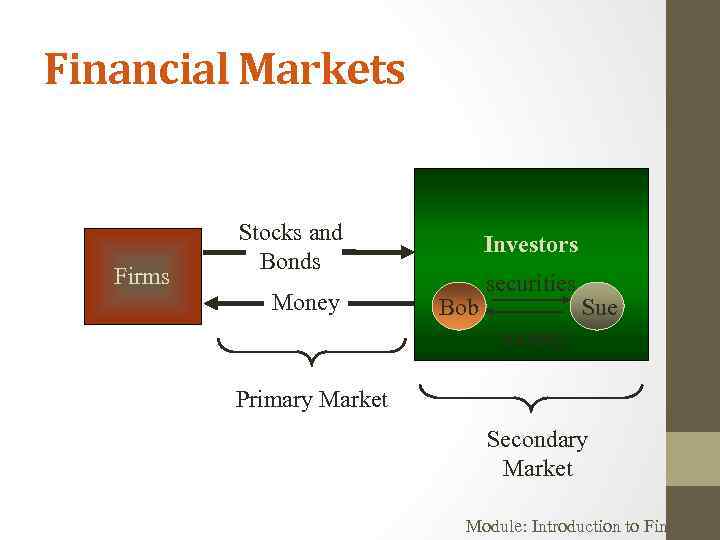

Financial Markets • Primary Market • Markets that involve the issue of new securities by the borrower in return for cash from the investors (Capital formation occurs) • Secondary Market • Markets that involve buyers and sellers of existing securities. Funds flow from buyer to seller. Seller becomes the new owner of the security. (No capital formation occurs) Module: Introduction to Finance

Financial Markets • Primary Market • Markets that involve the issue of new securities by the borrower in return for cash from the investors (Capital formation occurs) • Secondary Market • Markets that involve buyers and sellers of existing securities. Funds flow from buyer to seller. Seller becomes the new owner of the security. (No capital formation occurs) Module: Introduction to Finance

Financial Markets Firms Stocks and Bonds Money Investors Bob securities Sue money Primary Market Secondary Market Module: Introduction to Finance

Financial Markets Firms Stocks and Bonds Money Investors Bob securities Sue money Primary Market Secondary Market Module: Introduction to Finance

Primary vs. Secondary Markets • PRIMARY • New Issue of Securities • SECONDARY • Trading Previously Issued Securities • Exchange of Funds for Financial Claim • No New Funds for Issuer • Funds for Borrower; an IOU for Lender • Provides Liquidity for Seller Module: Introduction to Finance

Primary vs. Secondary Markets • PRIMARY • New Issue of Securities • SECONDARY • Trading Previously Issued Securities • Exchange of Funds for Financial Claim • No New Funds for Issuer • Funds for Borrower; an IOU for Lender • Provides Liquidity for Seller Module: Introduction to Finance

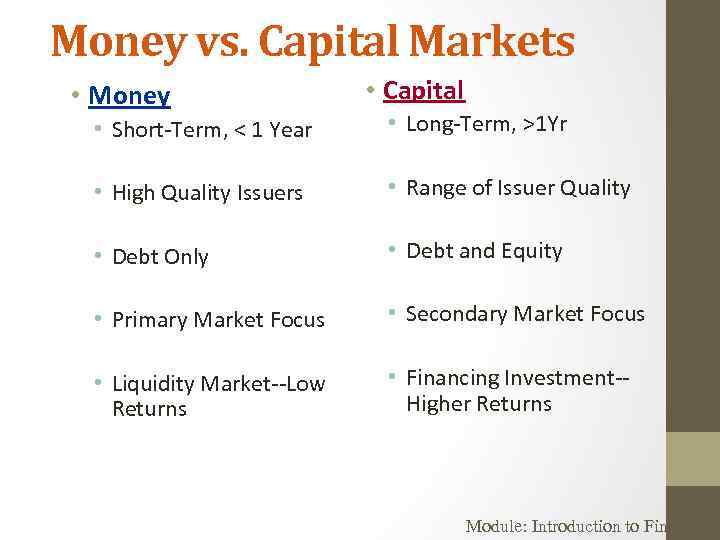

Money vs. Capital Markets • Money Market – Short-term, high quality debt securities are traded here. These securities carry little or no default risk and have very little price risk due to their short maturities. • Capital Market – Long-term securities trade in the capital markets. These securities are subject to significant price risk, default risk, purchasing power risk, etc. due to their longer maturities. Module: Introduction to Finance

Money vs. Capital Markets • Money Market – Short-term, high quality debt securities are traded here. These securities carry little or no default risk and have very little price risk due to their short maturities. • Capital Market – Long-term securities trade in the capital markets. These securities are subject to significant price risk, default risk, purchasing power risk, etc. due to their longer maturities. Module: Introduction to Finance

Money vs. Capital Markets • Money • Capital • Short-Term, < 1 Year • Long-Term, >1 Yr • High Quality Issuers • Range of Issuer Quality • Debt Only • Debt and Equity • Primary Market Focus • Secondary Market Focus • Liquidity Market--Low Returns • Financing Investment-Higher Returns Module: Introduction to Finance

Money vs. Capital Markets • Money • Capital • Short-Term, < 1 Year • Long-Term, >1 Yr • High Quality Issuers • Range of Issuer Quality • Debt Only • Debt and Equity • Primary Market Focus • Secondary Market Focus • Liquidity Market--Low Returns • Financing Investment-Higher Returns Module: Introduction to Finance

Organized vs. Over-the. Counter Markets • Organized • Visible Marketplace • Members Trade • Securities Listed • New York Stock Exchange • OTC • Wired Network of Dealers • No Central, Physical Location • All Securities Traded off the Exchanges Module: Introduction to Finance

Organized vs. Over-the. Counter Markets • Organized • Visible Marketplace • Members Trade • Securities Listed • New York Stock Exchange • OTC • Wired Network of Dealers • No Central, Physical Location • All Securities Traded off the Exchanges Module: Introduction to Finance

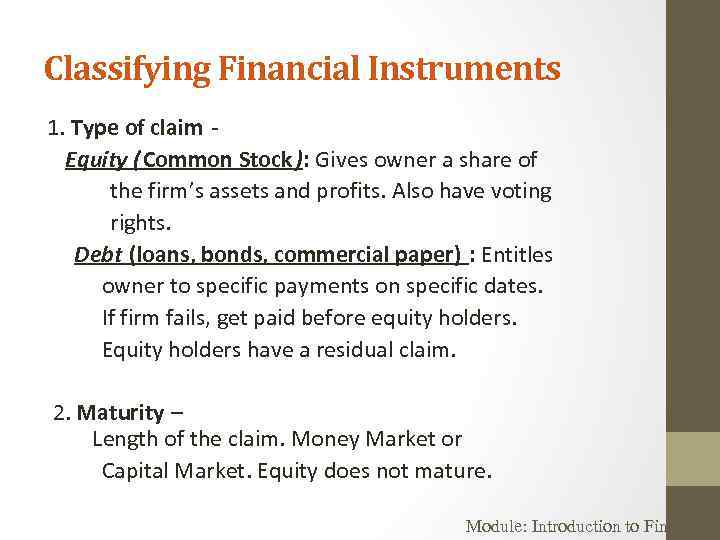

Classifying Financial Instruments 1. Type of claim Equity (Common Stock ): Gives owner a share of the firm’s assets and profits. Also have voting rights. Debt (loans, bonds, commercial paper) : Entitles owner to specific payments on specific dates. If firm fails, get paid before equity holders. Equity holders have a residual claim. 2. Maturity – Length of the claim. Money Market or Capital Market. Equity does not mature. Module: Introduction to Finance

Classifying Financial Instruments 1. Type of claim Equity (Common Stock ): Gives owner a share of the firm’s assets and profits. Also have voting rights. Debt (loans, bonds, commercial paper) : Entitles owner to specific payments on specific dates. If firm fails, get paid before equity holders. Equity holders have a residual claim. 2. Maturity – Length of the claim. Money Market or Capital Market. Equity does not mature. Module: Introduction to Finance

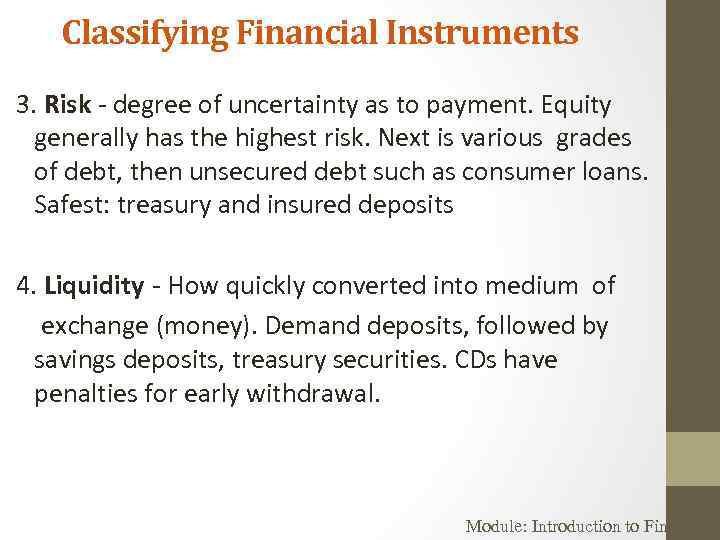

Classifying Financial Instruments 3. Risk - degree of uncertainty as to payment. Equity generally has the highest risk. Next is various grades of debt, then unsecured debt such as consumer loans. Safest: treasury and insured deposits 4. Liquidity - How quickly converted into medium of exchange (money). Demand deposits, followed by savings deposits, treasury securities. CDs have penalties for early withdrawal. Module: Introduction to Finance

Classifying Financial Instruments 3. Risk - degree of uncertainty as to payment. Equity generally has the highest risk. Next is various grades of debt, then unsecured debt such as consumer loans. Safest: treasury and insured deposits 4. Liquidity - How quickly converted into medium of exchange (money). Demand deposits, followed by savings deposits, treasury securities. CDs have penalties for early withdrawal. Module: Introduction to Finance

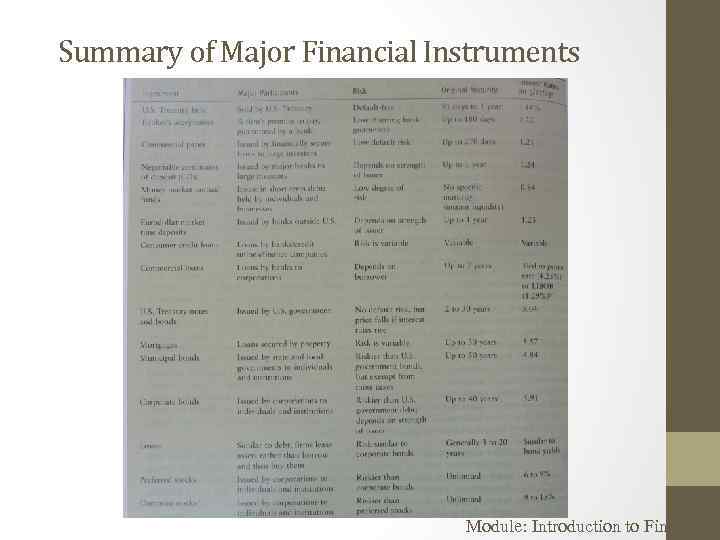

Classifying Financial Instruments 5. Expected Returns – As shown on the next slide, returns are typically higher for riskier, less liquid and longer-maturity assets. Highest risk is equities, followed by junk bonds. Lowest risk – Treasury bills, demand deposits. Module: Introduction to Finance

Classifying Financial Instruments 5. Expected Returns – As shown on the next slide, returns are typically higher for riskier, less liquid and longer-maturity assets. Highest risk is equities, followed by junk bonds. Lowest risk – Treasury bills, demand deposits. Module: Introduction to Finance

Summary of Major Financial Instruments Module: Introduction to Finance

Summary of Major Financial Instruments Module: Introduction to Finance

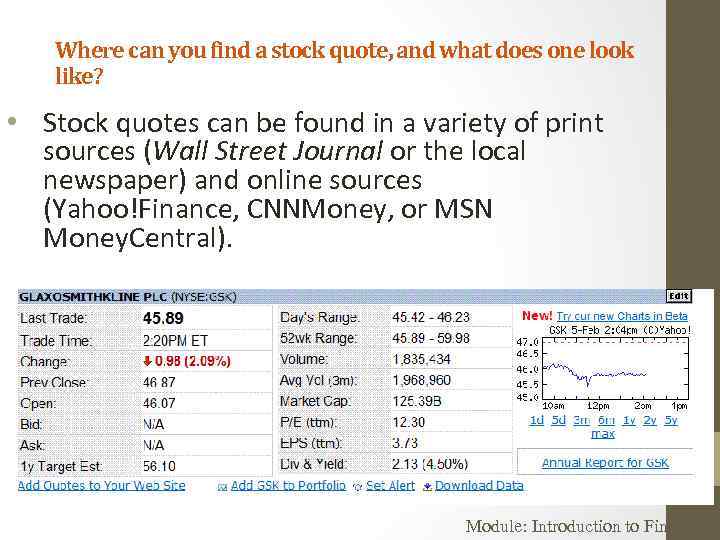

Where can you find a stock quote, and what does one look like? • Stock quotes can be found in a variety of print sources (Wall Street Journal or the local newspaper) and online sources (Yahoo!Finance, CNNMoney, or MSN Money. Central). Module: Introduction to Finance

Where can you find a stock quote, and what does one look like? • Stock quotes can be found in a variety of print sources (Wall Street Journal or the local newspaper) and online sources (Yahoo!Finance, CNNMoney, or MSN Money. Central). Module: Introduction to Finance

Stock Market Transactions • Apple Computer decides to issue additional stock with the assistance of its investment banker. An investor purchases some of the newly issued shares. Is this a primary market transaction or a secondary market transaction? • Since new shares of stock are being issued, this is a primary market transaction. • What if instead an investor buys existing shares of Apple stock in the open market – is this a primary or secondary market transaction? • Since no new shares are created, this is a secondary market transaction. Module: Introduction to Finance

Stock Market Transactions • Apple Computer decides to issue additional stock with the assistance of its investment banker. An investor purchases some of the newly issued shares. Is this a primary market transaction or a secondary market transaction? • Since new shares of stock are being issued, this is a primary market transaction. • What if instead an investor buys existing shares of Apple stock in the open market – is this a primary or secondary market transaction? • Since no new shares are created, this is a secondary market transaction. Module: Introduction to Finance

The Role of Investment Bankers • Initial sale of the of a security is executed with the assistance of investment bankers • Investment banker serve as a “middleman” • They are often not bankers, and generally do not invest • • Ex. Goldman, Sachs & Co. , Montgomery Securities They do not buy newly issued securities in their own accounts for investment purposes Module: Introduction to Finance

The Role of Investment Bankers • Initial sale of the of a security is executed with the assistance of investment bankers • Investment banker serve as a “middleman” • They are often not bankers, and generally do not invest • • Ex. Goldman, Sachs & Co. , Montgomery Securities They do not buy newly issued securities in their own accounts for investment purposes Module: Introduction to Finance

The Role of Investment Bankers • Investment banker facilitates initial sale • Security brokers and secondary markets facilitate subsequent sales • Investment bankers, brokers, and security exchanges do not create claims on themselves Module: Introduction to Finance

The Role of Investment Bankers • Investment banker facilitates initial sale • Security brokers and secondary markets facilitate subsequent sales • Investment bankers, brokers, and security exchanges do not create claims on themselves Module: Introduction to Finance

Investment Bankers • When securities are sold into the primary market, firms enlist the services of investment bankers. • Investment bankers provide three basic services to companies: • Advice and counsel (before and after the sale) • Underwriting • Distribution Module: Introduction to Finance

Investment Bankers • When securities are sold into the primary market, firms enlist the services of investment bankers. • Investment bankers provide three basic services to companies: • Advice and counsel (before and after the sale) • Underwriting • Distribution Module: Introduction to Finance

Investment Banking Functions: Advice and Counsel • Investment bankers provide important advice on security issues, such as: • • • Pricing Size of the offering Timing of the offering Type of security (debt or equity) Special features (callability, convertibility, coupon rate, etc) • Additionally, investment bankers often consult on issues of corporate governance, such as mergers. Module: Introduction to Finance

Investment Banking Functions: Advice and Counsel • Investment bankers provide important advice on security issues, such as: • • • Pricing Size of the offering Timing of the offering Type of security (debt or equity) Special features (callability, convertibility, coupon rate, etc) • Additionally, investment bankers often consult on issues of corporate governance, such as mergers. Module: Introduction to Finance

Investment Banking Functions: Underwriting • Once the company and investment banker agree as to the type of security, pricing, etc. the issue is ready to market. • The investment banker may either: • Underwrite the issue – here the investment banker purchases the issue and hopes to sell it at a higher price to the public (assumes price risk). This is also known as a “firm commitment. ” • Act as an agent – Also known as a “best efforts” offering, the investment banker does not purchase the securities and merely markets them to the public. • Typically only small, relatively unknown firms agree to a best efforts offering. Module: Introduction to Finance

Investment Banking Functions: Underwriting • Once the company and investment banker agree as to the type of security, pricing, etc. the issue is ready to market. • The investment banker may either: • Underwrite the issue – here the investment banker purchases the issue and hopes to sell it at a higher price to the public (assumes price risk). This is also known as a “firm commitment. ” • Act as an agent – Also known as a “best efforts” offering, the investment banker does not purchase the securities and merely markets them to the public. • Typically only small, relatively unknown firms agree to a best efforts offering. Module: Introduction to Finance

Investment Banking Functions: Distribution • The final role of the investment banker is to actually sell the securities. • Typically, the originating investment banking firm will form an underwriting group (syndicate) to spread the price risk. • Next, a selling group consisting of the underwriting group and, perhaps, other brokerage firms is formed to sell the security. Each member of the selling group is given an allocation for which it is responsible. • The selling group then allocates its share of the securities among interested customers. Module: Introduction to Finance

Investment Banking Functions: Distribution • The final role of the investment banker is to actually sell the securities. • Typically, the originating investment banking firm will form an underwriting group (syndicate) to spread the price risk. • Next, a selling group consisting of the underwriting group and, perhaps, other brokerage firms is formed to sell the security. Each member of the selling group is given an allocation for which it is responsible. • The selling group then allocates its share of the securities among interested customers. Module: Introduction to Finance

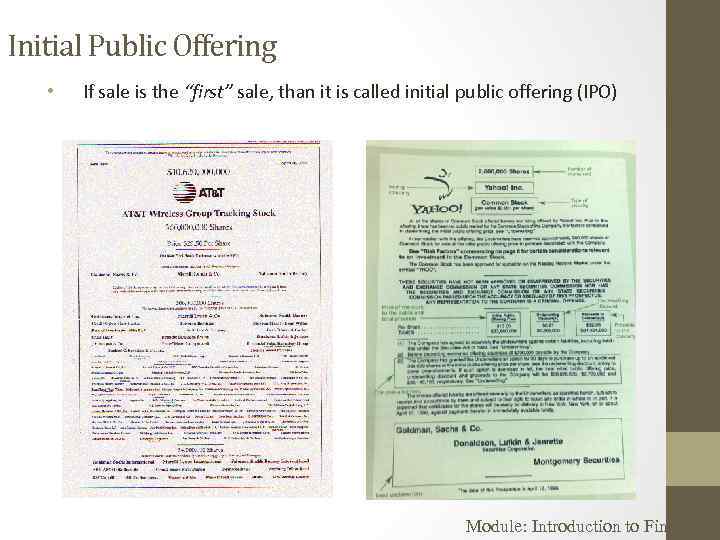

Initial Public Offering • If sale is the “first” sale, than it is called initial public offering (IPO) Module: Introduction to Finance

Initial Public Offering • If sale is the “first” sale, than it is called initial public offering (IPO) Module: Introduction to Finance

Major Types of Financial Intermediaries • Commercial banks • Thrift institutions • Life insurance companies • Pension plans • Mutual funds Module: Introduction to Finance

Major Types of Financial Intermediaries • Commercial banks • Thrift institutions • Life insurance companies • Pension plans • Mutual funds Module: Introduction to Finance

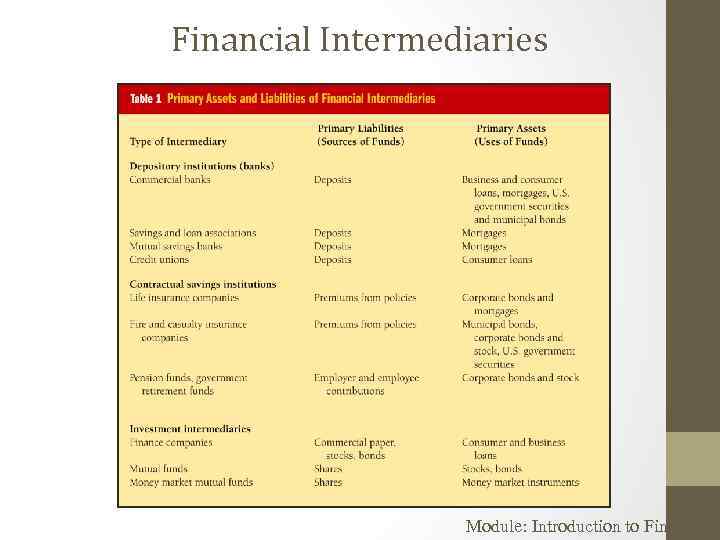

Financial Intermediaries Module: Introduction to Finance

Financial Intermediaries Module: Introduction to Finance

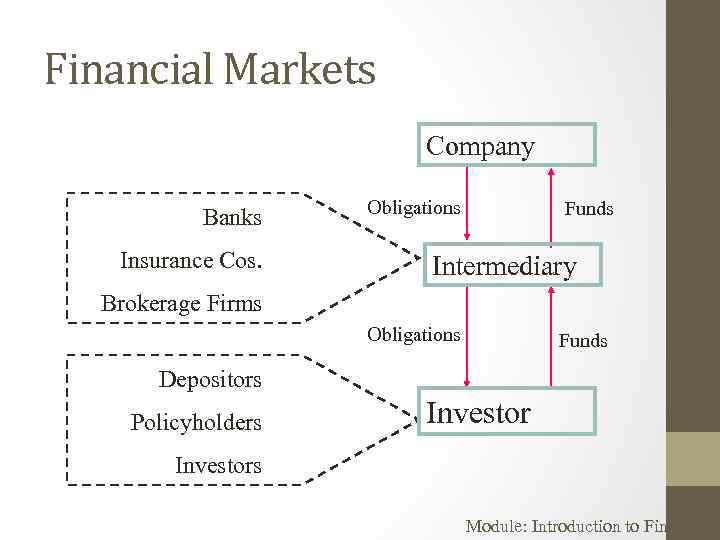

Financial Markets Company Banks Insurance Cos. Obligations Funds Intermediary Brokerage Firms Obligations Funds Depositors Policyholders Investors Module: Introduction to Finance

Financial Markets Company Banks Insurance Cos. Obligations Funds Intermediary Brokerage Firms Obligations Funds Depositors Policyholders Investors Module: Introduction to Finance

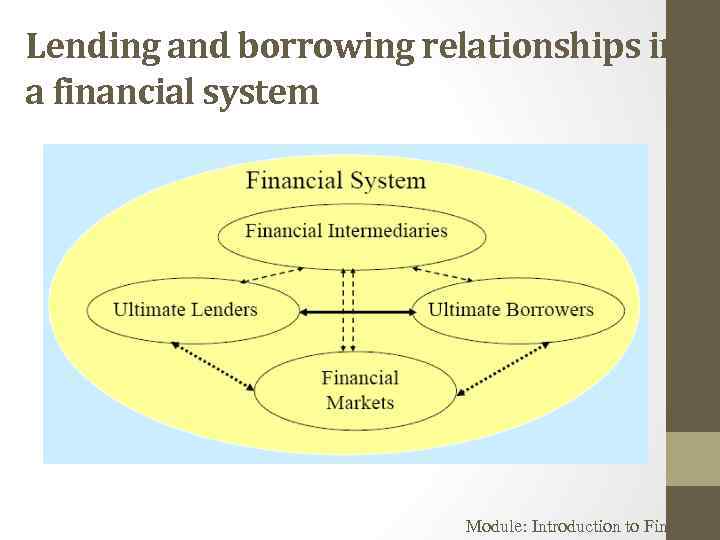

Lending and borrowing relationships in a financial system Module: Introduction to Finance

Lending and borrowing relationships in a financial system Module: Introduction to Finance

Financial system participants The Financial System provides the environment in which the individual investors and companies operate. Financial system participants: – Individuals. – Companies. – Financial institutions, private and public organizations. – Governments. Module: Introduction to Finance

Financial system participants The Financial System provides the environment in which the individual investors and companies operate. Financial system participants: – Individuals. – Companies. – Financial institutions, private and public organizations. – Governments. Module: Introduction to Finance

Financial Intermediaries • Financial Intermediaries (FI) are companies that act as mediators between surplus and deficit economic agents. • Financial Intermediaries: – Deposit takers. • Banks – Non-deposit takers • Contractual Saving Institutions • Investment Intermediaries Module: Introduction to Finance

Financial Intermediaries • Financial Intermediaries (FI) are companies that act as mediators between surplus and deficit economic agents. • Financial Intermediaries: – Deposit takers. • Banks – Non-deposit takers • Contractual Saving Institutions • Investment Intermediaries Module: Introduction to Finance

The Bond Market and Interest Rates • A security (financial instrument) is a claim on the issuer’s future income or assets • A bond is a debt security that promises to make payments periodically for a specified period of time • An interest rate is the cost of borrowing or the price paid for the rental of fund Module: Introduction to Finance

The Bond Market and Interest Rates • A security (financial instrument) is a claim on the issuer’s future income or assets • A bond is a debt security that promises to make payments periodically for a specified period of time • An interest rate is the cost of borrowing or the price paid for the rental of fund Module: Introduction to Finance

The Stock Market • Common stock represents a share of ownership in a corporation • A share of stock is a claim on the earnings and assets of the corporation Module: Introduction to Finance

The Stock Market • Common stock represents a share of ownership in a corporation • A share of stock is a claim on the earnings and assets of the corporation Module: Introduction to Finance

Banking and Financial Institutions • Financial Intermediaries—institutions that borrow funds from people who have saved and make loans to other people • Banks—institutions that accept deposits and make loans • Other Financial Institutions—insurance companies, finance companies, pension funds, mutual funds and investment banks • Financial Innovation—in particular, the advent of the information age and e-finance Module: Introduction to Finance

Banking and Financial Institutions • Financial Intermediaries—institutions that borrow funds from people who have saved and make loans to other people • Banks—institutions that accept deposits and make loans • Other Financial Institutions—insurance companies, finance companies, pension funds, mutual funds and investment banks • Financial Innovation—in particular, the advent of the information age and e-finance Module: Introduction to Finance

Commercial Banks • The most important depository institutions in terms of size • Important source of finance to businesses (11. 7%) and individual consumers (8. 7%) • Most loans are for short term • Primary liabilities are their deposits (8. 2%) and savings and time deposits (58. 1%) Module: Introduction to Finance

Commercial Banks • The most important depository institutions in terms of size • Important source of finance to businesses (11. 7%) and individual consumers (8. 7%) • Most loans are for short term • Primary liabilities are their deposits (8. 2%) and savings and time deposits (58. 1%) Module: Introduction to Finance

Commercial Banks • Demand deposits are payable on demand • Saving accounts, money market accounts and certificates of deposit bear interest • Large denominations CDs in excess of $100, 000 are called negotiable CDs Module: Introduction to Finance

Commercial Banks • Demand deposits are payable on demand • Saving accounts, money market accounts and certificates of deposit bear interest • Large denominations CDs in excess of $100, 000 are called negotiable CDs Module: Introduction to Finance

Thrift Institutions • A place for savers • Two types: • Mutual savings banks • Savings and Loan Associations (S&Ls) • Mutual savings bank is owned by its depositors • Owners may readily withdraw funds Module: Introduction to Finance

Thrift Institutions • A place for savers • Two types: • Mutual savings banks • Savings and Loan Associations (S&Ls) • Mutual savings bank is owned by its depositors • Owners may readily withdraw funds Module: Introduction to Finance

Thrift Institutions • • Historically S&Ls acted as a source of mortgage loans Members are owners of the S&Ls When all borrowed funds were repaid associations dissolved Today S&Ls accept deposit from anyone and make variety of loans, but still more emphasis on mortgage loans Module: Introduction to Finance

Thrift Institutions • • Historically S&Ls acted as a source of mortgage loans Members are owners of the S&Ls When all borrowed funds were repaid associations dissolved Today S&Ls accept deposit from anyone and make variety of loans, but still more emphasis on mortgage loans Module: Introduction to Finance

Regulation of Commercial banks and Thrift Institutions • They are regulated by government in order to prevent losses by depositors • Both federal and state banking authorities regulate banks • Banks must keep funds in reserve against their deposit liabilities Module: Introduction to Finance

Regulation of Commercial banks and Thrift Institutions • They are regulated by government in order to prevent losses by depositors • Both federal and state banking authorities regulate banks • Banks must keep funds in reserve against their deposit liabilities Module: Introduction to Finance

Reserves • Reserves may be in two forms: • Cash in the vault • Deposit with another bank, especially the Federal Reserve • Only the excess reserves may be lent out Module: Introduction to Finance

Reserves • Reserves may be in two forms: • Cash in the vault • Deposit with another bank, especially the Federal Reserve • Only the excess reserves may be lent out Module: Introduction to Finance

Life Insurance Companies • They receive the funds of savers and lend the fund to borrowers • They provide more than insurance against premature death • Insurance • Savings plan • They invest in longer term assets unlike banks Module: Introduction to Finance

Life Insurance Companies • They receive the funds of savers and lend the fund to borrowers • They provide more than insurance against premature death • Insurance • Savings plan • They invest in longer term assets unlike banks Module: Introduction to Finance

Pension Plans • They exist to accumulate assets for workers so they will have funds for retirement • Periodic payments into the pension plan by saver or employer • Not all pension plans are financial intermediaries Module: Introduction to Finance

Pension Plans • They exist to accumulate assets for workers so they will have funds for retirement • Periodic payments into the pension plan by saver or employer • Not all pension plans are financial intermediaries Module: Introduction to Finance

Money Market Mutual Funds • Mutual funds invest on behalf of individuals • Money Market Mutual Funds acquire short-term securities • • • U. S. Treasury bills (T-bills) Commercial paper Repurchase agreements (repo) Banker’s acceptances Tax anticipation notes Module: Introduction to Finance

Money Market Mutual Funds • Mutual funds invest on behalf of individuals • Money Market Mutual Funds acquire short-term securities • • • U. S. Treasury bills (T-bills) Commercial paper Repurchase agreements (repo) Banker’s acceptances Tax anticipation notes Module: Introduction to Finance