e8b3e6d6984dd36a82529144db356718.ppt

- Количество слайдов: 9

Financial Management Lecture 1 Introduction to Financial Management

Financial Management Lecture 1 Introduction to Financial Management

Financial Management (F. M. ) • What is FM? FM is the management of financial resources – how best to find and use investments and financing opportunities in an ever-changing and increasingly complex environment. • Why should CS majors study FM? – Core Life Skill – need to understand finance to manage your business & personal life. – “Money Makes the World Go Round” – even healthy companies and good CEO’s “die” because of poor FM – MIS and IT are just a part of the overall corporate strategy which runs on financing, the major resource. – Financial Engineering is an upcoming field that requires people with CS, math/science, and finance background Copyright: M. S. Humayun

Financial Management (F. M. ) • What is FM? FM is the management of financial resources – how best to find and use investments and financing opportunities in an ever-changing and increasingly complex environment. • Why should CS majors study FM? – Core Life Skill – need to understand finance to manage your business & personal life. – “Money Makes the World Go Round” – even healthy companies and good CEO’s “die” because of poor FM – MIS and IT are just a part of the overall corporate strategy which runs on financing, the major resource. – Financial Engineering is an upcoming field that requires people with CS, math/science, and finance background Copyright: M. S. Humayun

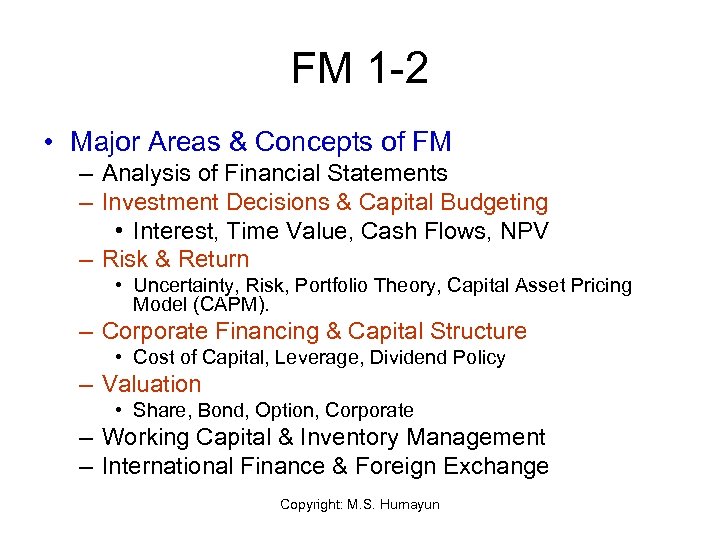

FM 1 -2 • Major Areas & Concepts of FM – Analysis of Financial Statements – Investment Decisions & Capital Budgeting • Interest, Time Value, Cash Flows, NPV – Risk & Return • Uncertainty, Risk, Portfolio Theory, Capital Asset Pricing Model (CAPM). – Corporate Financing & Capital Structure • Cost of Capital, Leverage, Dividend Policy – Valuation • Share, Bond, Option, Corporate – Working Capital & Inventory Management – International Finance & Foreign Exchange Copyright: M. S. Humayun

FM 1 -2 • Major Areas & Concepts of FM – Analysis of Financial Statements – Investment Decisions & Capital Budgeting • Interest, Time Value, Cash Flows, NPV – Risk & Return • Uncertainty, Risk, Portfolio Theory, Capital Asset Pricing Model (CAPM). – Corporate Financing & Capital Structure • Cost of Capital, Leverage, Dividend Policy – Valuation • Share, Bond, Option, Corporate – Working Capital & Inventory Management – International Finance & Foreign Exchange Copyright: M. S. Humayun

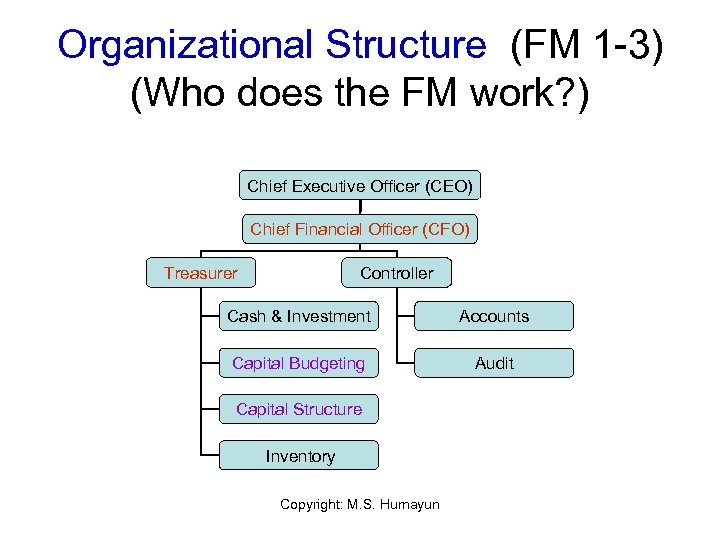

Organizational Structure (FM 1 -3) (Who does the FM work? ) Chief Executive Officer (CEO) Chief Financial Officer (CFO) Treasurer Controller Cash & Investment Accounts Capital Budgeting Audit Capital Structure Inventory Copyright: M. S. Humayun

Organizational Structure (FM 1 -3) (Who does the FM work? ) Chief Executive Officer (CEO) Chief Financial Officer (CFO) Treasurer Controller Cash & Investment Accounts Capital Budgeting Audit Capital Structure Inventory Copyright: M. S. Humayun

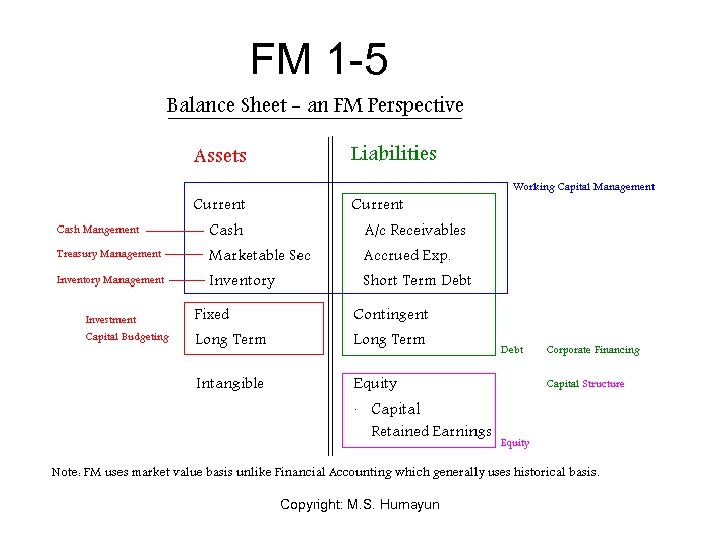

FM 1 -5 Copyright: M. S. Humayun

FM 1 -5 Copyright: M. S. Humayun

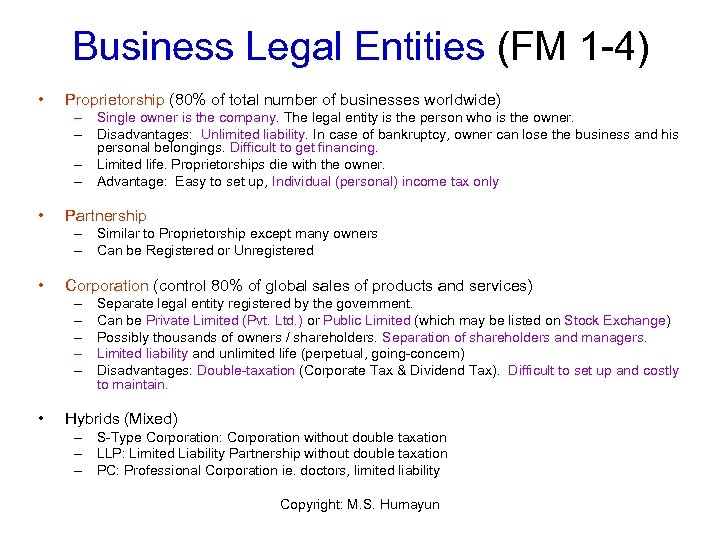

Business Legal Entities (FM 1 -4) • Proprietorship (80% of total number of businesses worldwide) – Single owner is the company. The legal entity is the person who is the owner. – Disadvantages: Unlimited liability. In case of bankruptcy, owner can lose the business and his personal belongings. Difficult to get financing. – Limited life. Proprietorships die with the owner. – Advantage: Easy to set up, Individual (personal) income tax only • Partnership – Similar to Proprietorship except many owners – Can be Registered or Unregistered • Corporation (control 80% of global sales of products and services) – – – • Separate legal entity registered by the government. Can be Private Limited (Pvt. Ltd. ) or Public Limited (which may be listed on Stock Exchange) Possibly thousands of owners / shareholders. Separation of shareholders and managers. Limited liability and unlimited life (perpetual, going-concern) Disadvantages: Double-taxation (Corporate Tax & Dividend Tax). Difficult to set up and costly to maintain. Hybrids (Mixed) – S-Type Corporation: Corporation without double taxation – LLP: Limited Liability Partnership without double taxation – PC: Professional Corporation ie. doctors, limited liability Copyright: M. S. Humayun

Business Legal Entities (FM 1 -4) • Proprietorship (80% of total number of businesses worldwide) – Single owner is the company. The legal entity is the person who is the owner. – Disadvantages: Unlimited liability. In case of bankruptcy, owner can lose the business and his personal belongings. Difficult to get financing. – Limited life. Proprietorships die with the owner. – Advantage: Easy to set up, Individual (personal) income tax only • Partnership – Similar to Proprietorship except many owners – Can be Registered or Unregistered • Corporation (control 80% of global sales of products and services) – – – • Separate legal entity registered by the government. Can be Private Limited (Pvt. Ltd. ) or Public Limited (which may be listed on Stock Exchange) Possibly thousands of owners / shareholders. Separation of shareholders and managers. Limited liability and unlimited life (perpetual, going-concern) Disadvantages: Double-taxation (Corporate Tax & Dividend Tax). Difficult to set up and costly to maintain. Hybrids (Mixed) – S-Type Corporation: Corporation without double taxation – LLP: Limited Liability Partnership without double taxation – PC: Professional Corporation ie. doctors, limited liability Copyright: M. S. Humayun

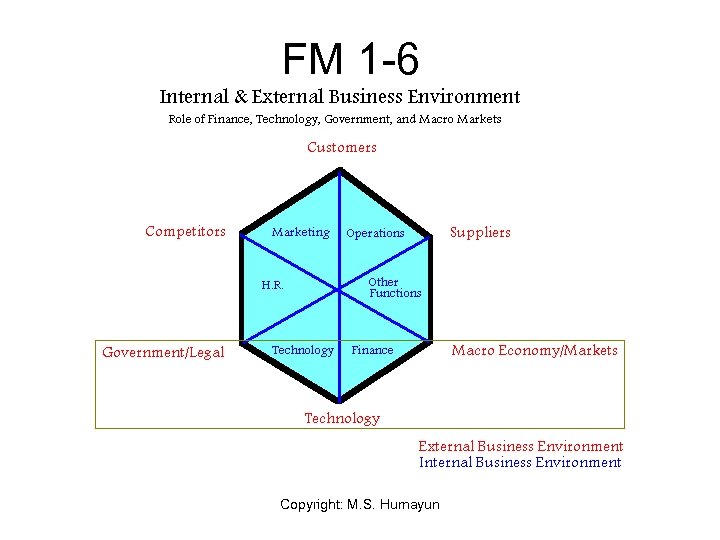

FM 1 -6 Copyright: M. S. Humayun

FM 1 -6 Copyright: M. S. Humayun

Financial Markets (FM 1 -7) • Capital Markets – Stock Exchange (listed shares, unit trusts, TFC) • Money Markets – Bonds • Government of Pakistan: FIB, T-Bill • Private Sector: Corporate Bonds, Debentures – Call Money, Inter-bank short-term and overnight lending – Loans, Leases, Insurance policies, Certificate of Deposits (CD’s) – Badlah (money lending against shares), Road-side money lenders • Real Assets Markets – Cotton Exchange, Gold Market, Kapra Market – Property (land, house, apartment, warehouse) – Computer hardware, Used Cars, Wheat, Sugar, Vegetables, etc. Copyright: M. S. Humayun

Financial Markets (FM 1 -7) • Capital Markets – Stock Exchange (listed shares, unit trusts, TFC) • Money Markets – Bonds • Government of Pakistan: FIB, T-Bill • Private Sector: Corporate Bonds, Debentures – Call Money, Inter-bank short-term and overnight lending – Loans, Leases, Insurance policies, Certificate of Deposits (CD’s) – Badlah (money lending against shares), Road-side money lenders • Real Assets Markets – Cotton Exchange, Gold Market, Kapra Market – Property (land, house, apartment, warehouse) – Computer hardware, Used Cars, Wheat, Sugar, Vegetables, etc. Copyright: M. S. Humayun

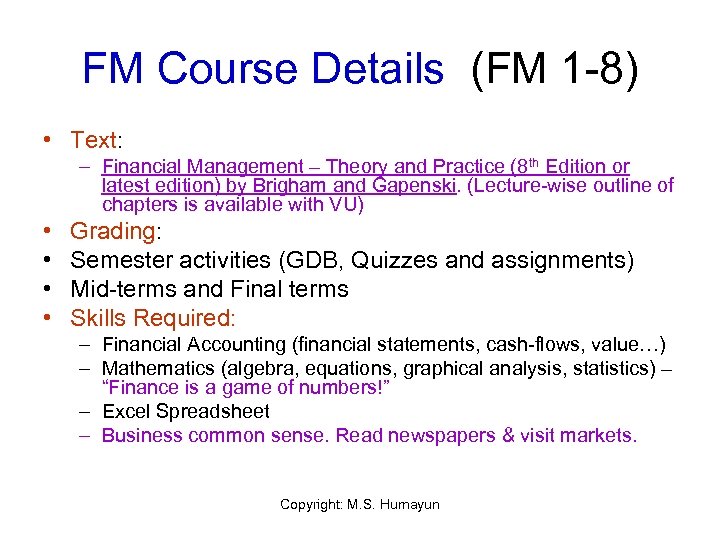

FM Course Details (FM 1 -8) • Text: – Financial Management – Theory and Practice (8 th Edition or latest edition) by Brigham and Gapenski. (Lecture-wise outline of chapters is available with VU) • • Grading: Semester activities (GDB, Quizzes and assignments) Mid-terms and Final terms Skills Required: – Financial Accounting (financial statements, cash-flows, value…) – Mathematics (algebra, equations, graphical analysis, statistics) – “Finance is a game of numbers!” – Excel Spreadsheet – Business common sense. Read newspapers & visit markets. Copyright: M. S. Humayun

FM Course Details (FM 1 -8) • Text: – Financial Management – Theory and Practice (8 th Edition or latest edition) by Brigham and Gapenski. (Lecture-wise outline of chapters is available with VU) • • Grading: Semester activities (GDB, Quizzes and assignments) Mid-terms and Final terms Skills Required: – Financial Accounting (financial statements, cash-flows, value…) – Mathematics (algebra, equations, graphical analysis, statistics) – “Finance is a game of numbers!” – Excel Spreadsheet – Business common sense. Read newspapers & visit markets. Copyright: M. S. Humayun