Financial Management in Foreign Companies Lecture 1: « Kick-off »

Financial Management in Foreign Companies Lecture 1: « Kick-off »

TABLE OF CONTENTS I. The business language II. III. Methodology IV. Limits of scope V. Your expectations ? VI. Tentative content VII. November 2013 My background Prerequisites 2

TABLE OF CONTENTS I. The business language II. III. Methodology IV. Limits of scope V. Your expectations ? VI. Tentative content VII. November 2013 My background Prerequisites 2

I- The Business Language English in business is like globalization of economy: INELUCTABLE !!! November 2013 3

I- The Business Language English in business is like globalization of economy: INELUCTABLE !!! November 2013 3

II- My Background French passport, German dialect for mother tongue, 50 years old, working in Russia since 2000 and living in Lipetsk since 2005. Son, grand-son, and grand-son of coal miners. First generation in my family to attend university. Engineer in mechanics and MBA from INSEAD (ranking top 5 worldwide). Work experience: - Technical project manager in French nuclear missile industry (5 years); Investment banker and partner in an LBO fund (Lazard Frères) (8 years); Entrepreneur in Russia (13 years). My business: November 2013 - Small group of companies in the swine industry (300 employees); - Land farming, pig breeding, slaughtering, genetic trading, equipment manufacturing; - Strong growth (+50 persons in 2014 and + 500 within 5 years); - Differentiation thru technical excellence and innovation. 4

II- My Background French passport, German dialect for mother tongue, 50 years old, working in Russia since 2000 and living in Lipetsk since 2005. Son, grand-son, and grand-son of coal miners. First generation in my family to attend university. Engineer in mechanics and MBA from INSEAD (ranking top 5 worldwide). Work experience: - Technical project manager in French nuclear missile industry (5 years); Investment banker and partner in an LBO fund (Lazard Frères) (8 years); Entrepreneur in Russia (13 years). My business: November 2013 - Small group of companies in the swine industry (300 employees); - Land farming, pig breeding, slaughtering, genetic trading, equipment manufacturing; - Strong growth (+50 persons in 2014 and + 500 within 5 years); - Differentiation thru technical excellence and innovation. 4

III- Methodology The aim: Exposure to strategic and financial management of a foreign company in Russia. The read thread: The swine industry. The way of doing: - Dialog vs. monolog; - You will get out what you put in; - Diversity as an asset. November 2013 5

III- Methodology The aim: Exposure to strategic and financial management of a foreign company in Russia. The read thread: The swine industry. The way of doing: - Dialog vs. monolog; - You will get out what you put in; - Diversity as an asset. November 2013 5

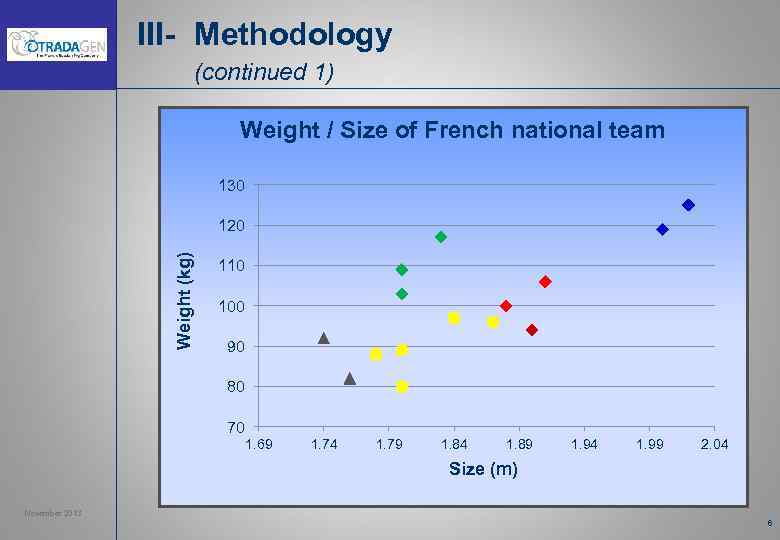

III- Methodology (continued 1) Weight / Size of French national team 130 Weight (kg) 120 110 100 90 80 70 1. 69 1. 74 1. 79 1. 84 1. 89 1. 94 1. 99 2. 04 Size (m) November 2013 6

III- Methodology (continued 1) Weight / Size of French national team 130 Weight (kg) 120 110 100 90 80 70 1. 69 1. 74 1. 79 1. 84 1. 89 1. 94 1. 99 2. 04 Size (m) November 2013 6

III- Methodology (continued 2) Haka !!! November 2013 7

III- Methodology (continued 2) Haka !!! November 2013 7

IV- Limits of scope What you can get out of this set of lectures: The view of a general practitioner, How basic economic and financial theories can help you being a better manager, How to use accounting and finance to genuinely manage a company, An inside view into a foreign company operating in Russia. What you shall not wait for: November 2013 Detailed theory about finance and economics, Brilliant breakthroughs. 8

IV- Limits of scope What you can get out of this set of lectures: The view of a general practitioner, How basic economic and financial theories can help you being a better manager, How to use accounting and finance to genuinely manage a company, An inside view into a foreign company operating in Russia. What you shall not wait for: November 2013 Detailed theory about finance and economics, Brilliant breakthroughs. 8

V- Your expectations ? Your turn: 123 Etc. November 2013 9

V- Your expectations ? Your turn: 123 Etc. November 2013 9

VI- Tentative content Financial management guidelines (2) Cash management Cost structure and decision making Performance monitoring Risk hedging Fund raising. November 2013 10

VI- Tentative content Financial management guidelines (2) Cash management Cost structure and decision making Performance monitoring Risk hedging Fund raising. November 2013 10

VII- Prerequisites Economics (value added-chain, Porter’s 5 forces diagram, supply & demand diagrams), Accounting (basics about P&L, balance sheet and cash-flow statements, cost accounting), Finance (basics about financial ratios, exchange rates), Envy to learn. November 2013 11

VII- Prerequisites Economics (value added-chain, Porter’s 5 forces diagram, supply & demand diagrams), Accounting (basics about P&L, balance sheet and cash-flow statements, cost accounting), Finance (basics about financial ratios, exchange rates), Envy to learn. November 2013 11