1151ade1e53bfe1f646fb293504f6f55.ppt

- Количество слайдов: 66

financial management i chap 03 analysis of financial statements

financial management i chap 03 analysis of financial statements

ratio analysis n n Financial statements report Both on a firm’s position at a point in time & on its operations over some past period. Real Value of Financial Statements? Usefulness of Financial Statement Analysis? Ratio Analysis?

ratio analysis n n Financial statements report Both on a firm’s position at a point in time & on its operations over some past period. Real Value of Financial Statements? Usefulness of Financial Statement Analysis? Ratio Analysis?

ratio analysis 1. 2. 3. 4. 5. 6. Liquidity Ratios Asset Management Ratios Debt Management Ratios Profitability Ratios Market Value Ratios Du. Pont Analysis

ratio analysis 1. 2. 3. 4. 5. 6. Liquidity Ratios Asset Management Ratios Debt Management Ratios Profitability Ratios Market Value Ratios Du. Pont Analysis

liquidity ratios n n A liquid Asset is one that can be converted to cash quickly without having to reduce the Asset’s price very much. Liquidity Ratios are ratios that show the relationship of a firm’s cash & other Current Assets to its liabilities. Usefulness of Liquidity Ratios? Most Commonly Used liquidity Ratios?

liquidity ratios n n A liquid Asset is one that can be converted to cash quickly without having to reduce the Asset’s price very much. Liquidity Ratios are ratios that show the relationship of a firm’s cash & other Current Assets to its liabilities. Usefulness of Liquidity Ratios? Most Commonly Used liquidity Ratios?

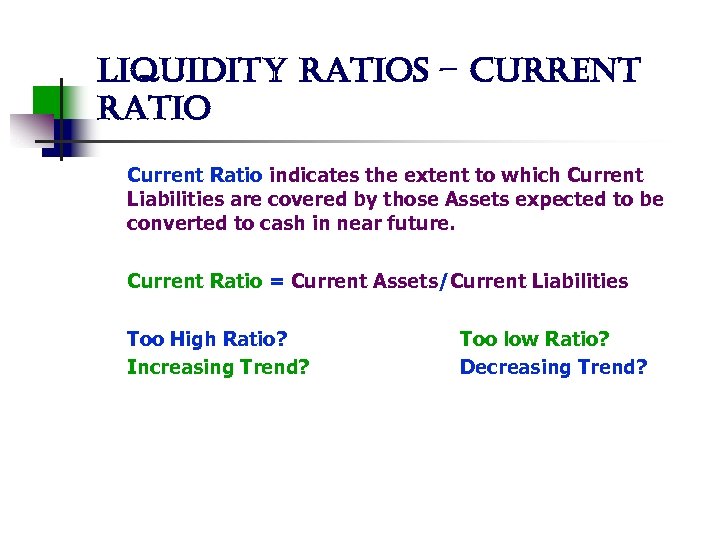

liquidity ratios – current ratio Current Ratio indicates the extent to which Current Liabilities are covered by those Assets expected to be converted to cash in near future. Current Ratio = Current Assets/Current Liabilities Too High Ratio? Increasing Trend? Too low Ratio? Decreasing Trend?

liquidity ratios – current ratio Current Ratio indicates the extent to which Current Liabilities are covered by those Assets expected to be converted to cash in near future. Current Ratio = Current Assets/Current Liabilities Too High Ratio? Increasing Trend? Too low Ratio? Decreasing Trend?

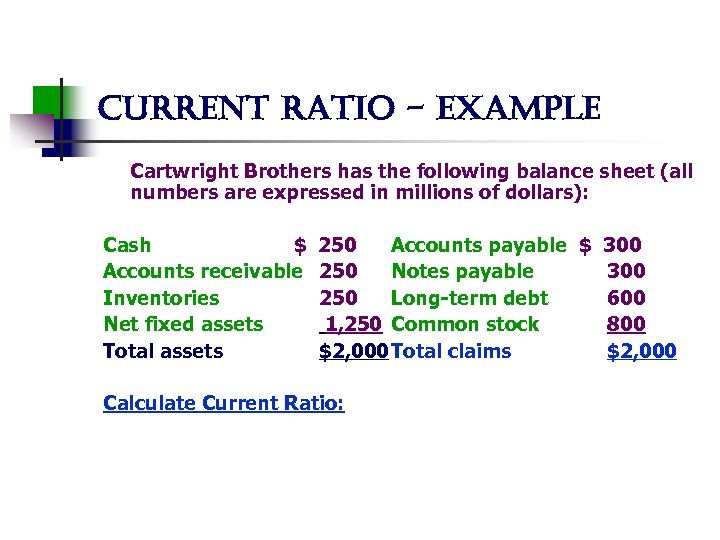

current ratio - example Cartwright Brothers has the following balance sheet (all numbers are expressed in millions of dollars): Cash $ Accounts receivable Inventories Net fixed assets Total assets 250 Accounts payable $ 300 250 Notes payable 300 250 Long-term debt 600 1, 250 Common stock 800 $2, 000 Total claims $2, 000 Calculate Current Ratio:

current ratio - example Cartwright Brothers has the following balance sheet (all numbers are expressed in millions of dollars): Cash $ Accounts receivable Inventories Net fixed assets Total assets 250 Accounts payable $ 300 250 Notes payable 300 250 Long-term debt 600 1, 250 Common stock 800 $2, 000 Total claims $2, 000 Calculate Current Ratio:

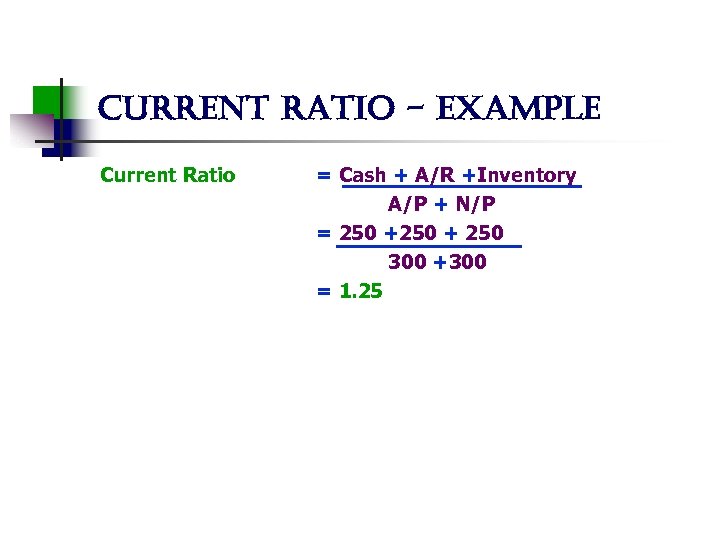

current ratio - example Current Ratio = Cash + A/R +Inventory A/P + N/P = 250 + 250 300 +300 = 1. 25

current ratio - example Current Ratio = Cash + A/R +Inventory A/P + N/P = 250 + 250 300 +300 = 1. 25

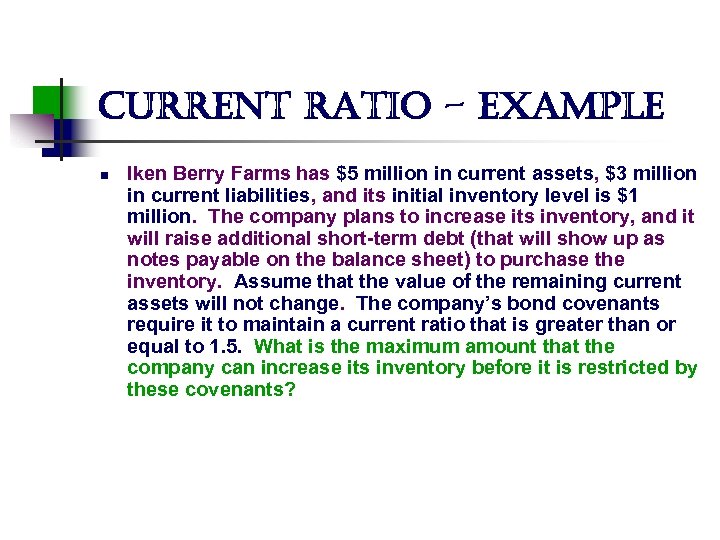

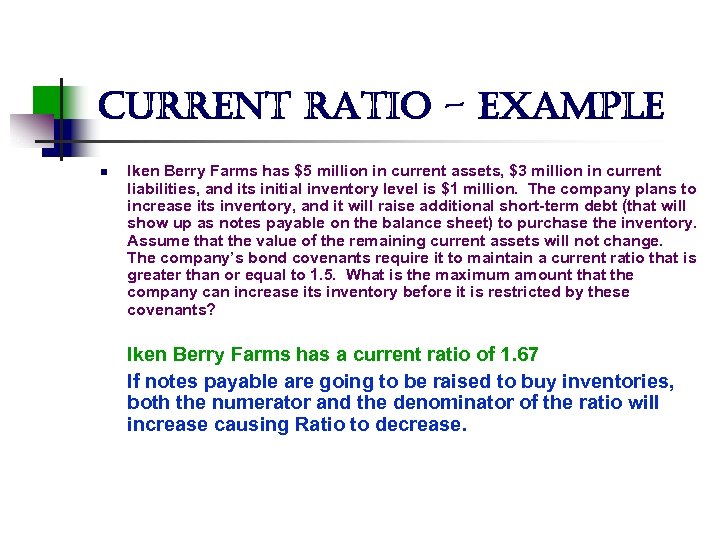

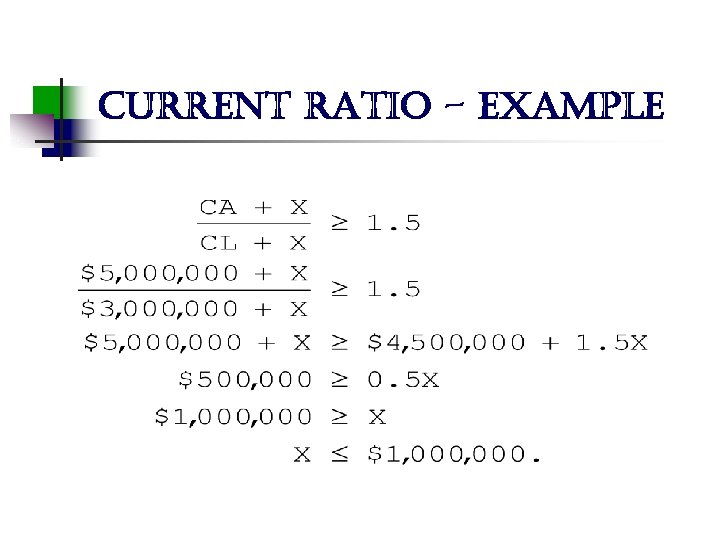

current ratio - example n Iken Berry Farms has $5 million in current assets, $3 million in current liabilities, and its initial inventory level is $1 million. The company plans to increase its inventory, and it will raise additional short-term debt (that will show up as notes payable on the balance sheet) to purchase the inventory. Assume that the value of the remaining current assets will not change. The company’s bond covenants require it to maintain a current ratio that is greater than or equal to 1. 5. What is the maximum amount that the company can increase its inventory before it is restricted by these covenants?

current ratio - example n Iken Berry Farms has $5 million in current assets, $3 million in current liabilities, and its initial inventory level is $1 million. The company plans to increase its inventory, and it will raise additional short-term debt (that will show up as notes payable on the balance sheet) to purchase the inventory. Assume that the value of the remaining current assets will not change. The company’s bond covenants require it to maintain a current ratio that is greater than or equal to 1. 5. What is the maximum amount that the company can increase its inventory before it is restricted by these covenants?

current ratio - example n Iken Berry Farms has $5 million in current assets, $3 million in current liabilities, and its initial inventory level is $1 million. The company plans to increase its inventory, and it will raise additional short-term debt (that will show up as notes payable on the balance sheet) to purchase the inventory. Assume that the value of the remaining current assets will not change. The company’s bond covenants require it to maintain a current ratio that is greater than or equal to 1. 5. What is the maximum amount that the company can increase its inventory before it is restricted by these covenants? Iken Berry Farms has a current ratio of 1. 67 If notes payable are going to be raised to buy inventories, both the numerator and the denominator of the ratio will increase causing Ratio to decrease.

current ratio - example n Iken Berry Farms has $5 million in current assets, $3 million in current liabilities, and its initial inventory level is $1 million. The company plans to increase its inventory, and it will raise additional short-term debt (that will show up as notes payable on the balance sheet) to purchase the inventory. Assume that the value of the remaining current assets will not change. The company’s bond covenants require it to maintain a current ratio that is greater than or equal to 1. 5. What is the maximum amount that the company can increase its inventory before it is restricted by these covenants? Iken Berry Farms has a current ratio of 1. 67 If notes payable are going to be raised to buy inventories, both the numerator and the denominator of the ratio will increase causing Ratio to decrease.

current ratio - example

current ratio - example

asset management ratios n n n Asset Management ratios is a set of ratios that measure how effectively a firm is managing its assets Problem with having too many Assets? Or, too less Assets? Most Commonly used Asset Management Ratios?

asset management ratios n n n Asset Management ratios is a set of ratios that measure how effectively a firm is managing its assets Problem with having too many Assets? Or, too less Assets? Most Commonly used Asset Management Ratios?

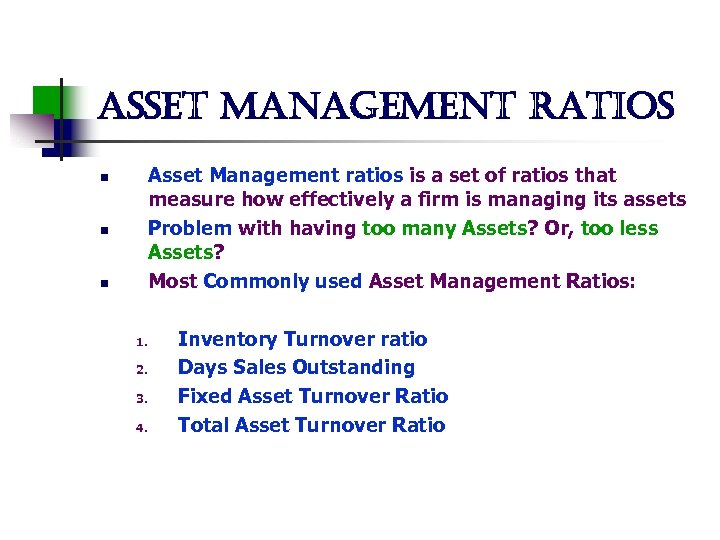

asset management ratios Asset Management ratios is a set of ratios that measure how effectively a firm is managing its assets Problem with having too many Assets? Or, too less Assets? Most Commonly used Asset Management Ratios: n n n 1. 2. 3. 4. Inventory Turnover ratio Days Sales Outstanding Fixed Asset Turnover Ratio Total Asset Turnover Ratio

asset management ratios Asset Management ratios is a set of ratios that measure how effectively a firm is managing its assets Problem with having too many Assets? Or, too less Assets? Most Commonly used Asset Management Ratios: n n n 1. 2. 3. 4. Inventory Turnover ratio Days Sales Outstanding Fixed Asset Turnover Ratio Total Asset Turnover Ratio

asset management ratios – inventory turnover ratio Inventory Turnover is an approximation indicating how many times in a year, a company’s inventory is sold out or converted to sales. Inventory T. O = Sales / Inventory Too high Ratio? Increasing Trend? Too Low ratio? Decreasing Trend?

asset management ratios – inventory turnover ratio Inventory Turnover is an approximation indicating how many times in a year, a company’s inventory is sold out or converted to sales. Inventory T. O = Sales / Inventory Too high Ratio? Increasing Trend? Too Low ratio? Decreasing Trend?

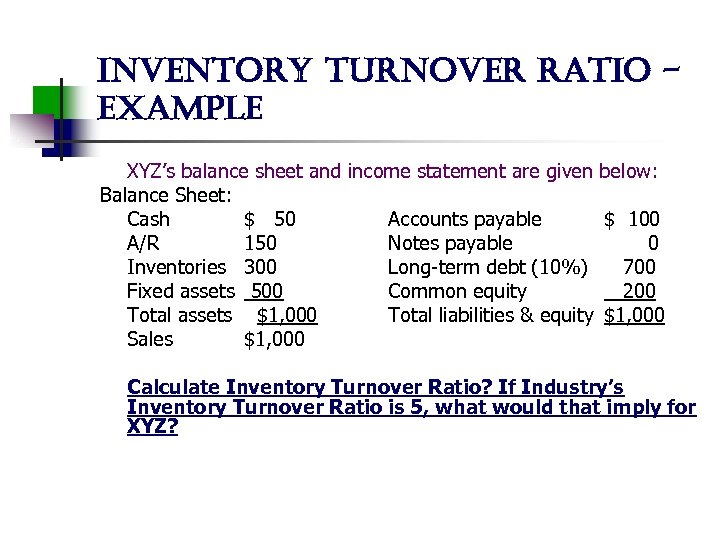

inventory turnover ratio example XYZ’s balance sheet and income statement are given below: Balance Sheet: Cash $ 50 Accounts payable $ 100 A/R 150 Notes payable 0 Inventories 300 Long-term debt (10%) 700 Fixed assets 500 Common equity 200 Total assets $1, 000 Total liabilities & equity $1, 000 Sales $1, 000 Calculate Inventory Turnover Ratio? If Industry’s Inventory Turnover Ratio is 5, what would that imply for XYZ?

inventory turnover ratio example XYZ’s balance sheet and income statement are given below: Balance Sheet: Cash $ 50 Accounts payable $ 100 A/R 150 Notes payable 0 Inventories 300 Long-term debt (10%) 700 Fixed assets 500 Common equity 200 Total assets $1, 000 Total liabilities & equity $1, 000 Sales $1, 000 Calculate Inventory Turnover Ratio? If Industry’s Inventory Turnover Ratio is 5, what would that imply for XYZ?

inventory turnover ratio example Inventory Turnover Ratio = 1000/ 300 = 3. 33

inventory turnover ratio example Inventory Turnover Ratio = 1000/ 300 = 3. 33

asset management ratios – days sales outstanding Days Sales outstanding (DSO), also called the collection period, indicates the average length of time the firm must wait after making a sale before it receives cash. DSO = Receivables / Average Sales Per Day = Receivables / (Annual Sales/ 365) Should be compared with the terms on which the firm sells its goods!!

asset management ratios – days sales outstanding Days Sales outstanding (DSO), also called the collection period, indicates the average length of time the firm must wait after making a sale before it receives cash. DSO = Receivables / Average Sales Per Day = Receivables / (Annual Sales/ 365) Should be compared with the terms on which the firm sells its goods!!

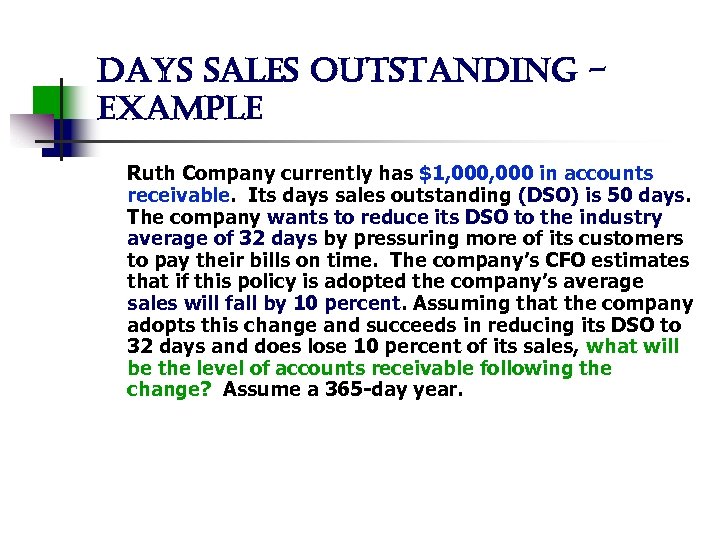

days sales outstanding example Ruth Company currently has $1, 000 in accounts receivable. Its days sales outstanding (DSO) is 50 days. The company wants to reduce its DSO to the industry average of 32 days by pressuring more of its customers to pay their bills on time. The company’s CFO estimates that if this policy is adopted the company’s average sales will fall by 10 percent. Assuming that the company adopts this change and succeeds in reducing its DSO to 32 days and does lose 10 percent of its sales, what will be the level of accounts receivable following the change? Assume a 365 -day year.

days sales outstanding example Ruth Company currently has $1, 000 in accounts receivable. Its days sales outstanding (DSO) is 50 days. The company wants to reduce its DSO to the industry average of 32 days by pressuring more of its customers to pay their bills on time. The company’s CFO estimates that if this policy is adopted the company’s average sales will fall by 10 percent. Assuming that the company adopts this change and succeeds in reducing its DSO to 32 days and does lose 10 percent of its sales, what will be the level of accounts receivable following the change? Assume a 365 -day year.

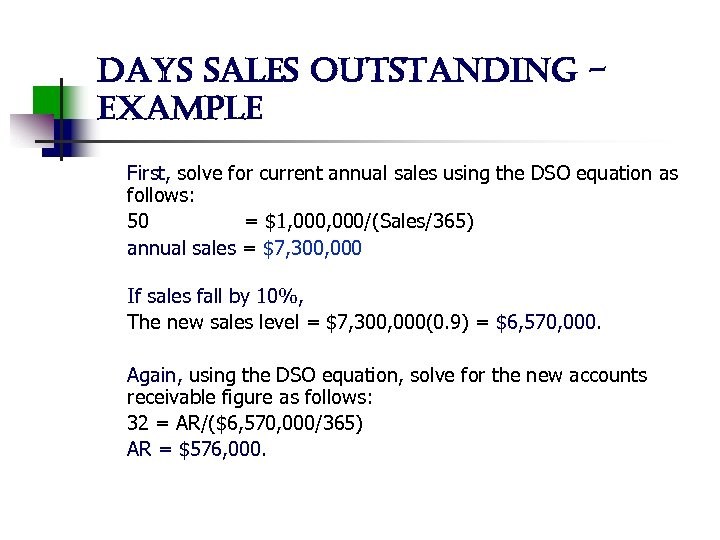

days sales outstanding example First, solve for current annual sales using the DSO equation as follows: 50 = $1, 000/(Sales/365) annual sales = $7, 300, 000 If sales fall by 10%, The new sales level = $7, 300, 000(0. 9) = $6, 570, 000. Again, using the DSO equation, solve for the new accounts receivable figure as follows: 32 = AR/($6, 570, 000/365) AR = $576, 000.

days sales outstanding example First, solve for current annual sales using the DSO equation as follows: 50 = $1, 000/(Sales/365) annual sales = $7, 300, 000 If sales fall by 10%, The new sales level = $7, 300, 000(0. 9) = $6, 570, 000. Again, using the DSO equation, solve for the new accounts receivable figure as follows: 32 = AR/($6, 570, 000/365) AR = $576, 000.

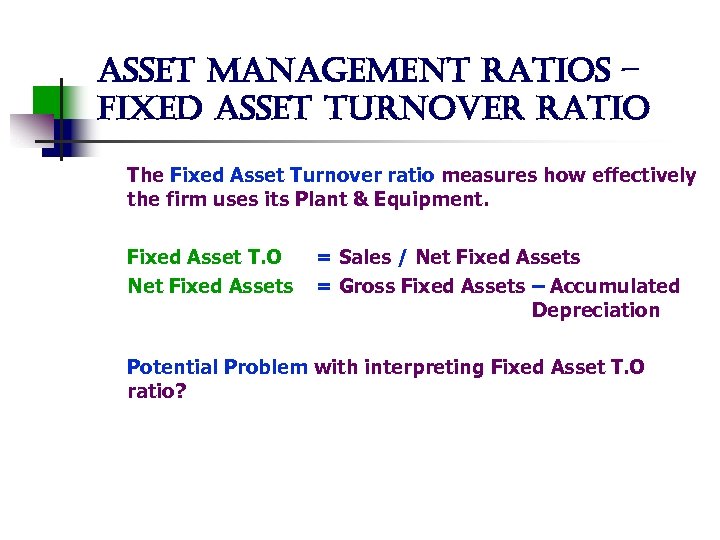

asset management ratios – fixed asset turnover ratio The Fixed Asset Turnover ratio measures how effectively the firm uses its Plant & Equipment. Fixed Asset T. O Net Fixed Assets = Sales / Net Fixed Assets = Gross Fixed Assets – Accumulated Depreciation Potential Problem with interpreting Fixed Asset T. O ratio?

asset management ratios – fixed asset turnover ratio The Fixed Asset Turnover ratio measures how effectively the firm uses its Plant & Equipment. Fixed Asset T. O Net Fixed Assets = Sales / Net Fixed Assets = Gross Fixed Assets – Accumulated Depreciation Potential Problem with interpreting Fixed Asset T. O ratio?

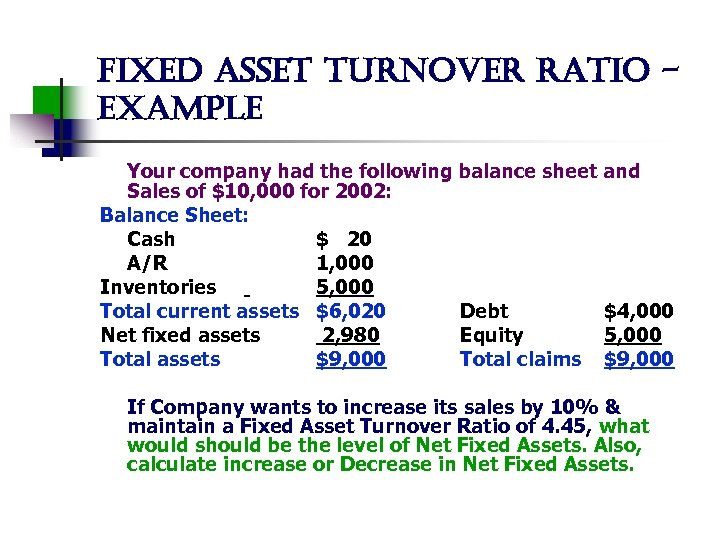

fixed asset turnover ratio example Your company had the following balance sheet and Sales of $10, 000 for 2002: Balance Sheet: Cash $ 20 A/R 1, 000 Inventories 5, 000 Total current assets $6, 020 Debt $4, 000 Net fixed assets 2, 980 Equity 5, 000 Total assets $9, 000 Total claims $9, 000 If Company wants to increase its sales by 10% & maintain a Fixed Asset Turnover Ratio of 4. 45, what would should be the level of Net Fixed Assets. Also, calculate increase or Decrease in Net Fixed Assets.

fixed asset turnover ratio example Your company had the following balance sheet and Sales of $10, 000 for 2002: Balance Sheet: Cash $ 20 A/R 1, 000 Inventories 5, 000 Total current assets $6, 020 Debt $4, 000 Net fixed assets 2, 980 Equity 5, 000 Total assets $9, 000 Total claims $9, 000 If Company wants to increase its sales by 10% & maintain a Fixed Asset Turnover Ratio of 4. 45, what would should be the level of Net Fixed Assets. Also, calculate increase or Decrease in Net Fixed Assets.

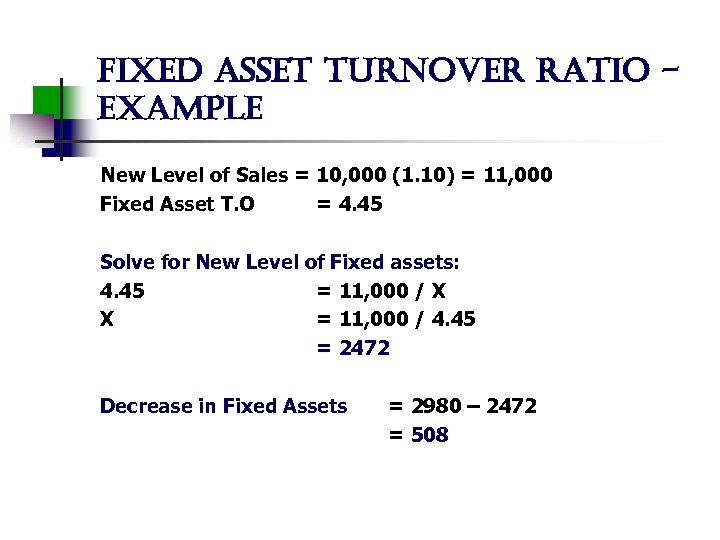

fixed asset turnover ratio example New Level of Sales = 10, 000 (1. 10) = 11, 000 Fixed Asset T. O = 4. 45 Solve for New Level of Fixed assets: 4. 45 = 11, 000 / X X = 11, 000 / 4. 45 = 2472 Decrease in Fixed Assets = 2980 – 2472 = 508

fixed asset turnover ratio example New Level of Sales = 10, 000 (1. 10) = 11, 000 Fixed Asset T. O = 4. 45 Solve for New Level of Fixed assets: 4. 45 = 11, 000 / X X = 11, 000 / 4. 45 = 2472 Decrease in Fixed Assets = 2980 – 2472 = 508

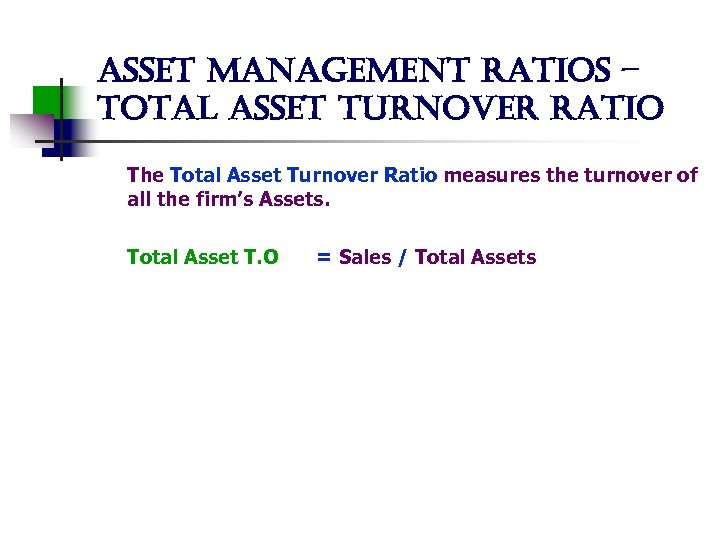

asset management ratios – total asset turnover ratio The Total Asset Turnover Ratio measures the turnover of all the firm’s Assets. Total Asset T. O = Sales / Total Assets

asset management ratios – total asset turnover ratio The Total Asset Turnover Ratio measures the turnover of all the firm’s Assets. Total Asset T. O = Sales / Total Assets

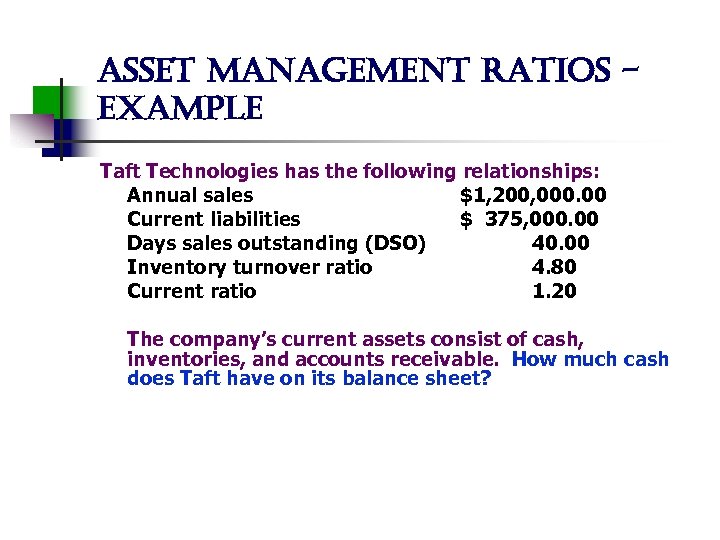

asset management ratios example Taft Technologies has the following relationships: Annual sales $1, 200, 000. 00 Current liabilities $ 375, 000. 00 Days sales outstanding (DSO) 40. 00 Inventory turnover ratio 4. 80 Current ratio 1. 20 The company’s current assets consist of cash, inventories, and accounts receivable. How much cash does Taft have on its balance sheet?

asset management ratios example Taft Technologies has the following relationships: Annual sales $1, 200, 000. 00 Current liabilities $ 375, 000. 00 Days sales outstanding (DSO) 40. 00 Inventory turnover ratio 4. 80 Current ratio 1. 20 The company’s current assets consist of cash, inventories, and accounts receivable. How much cash does Taft have on its balance sheet?

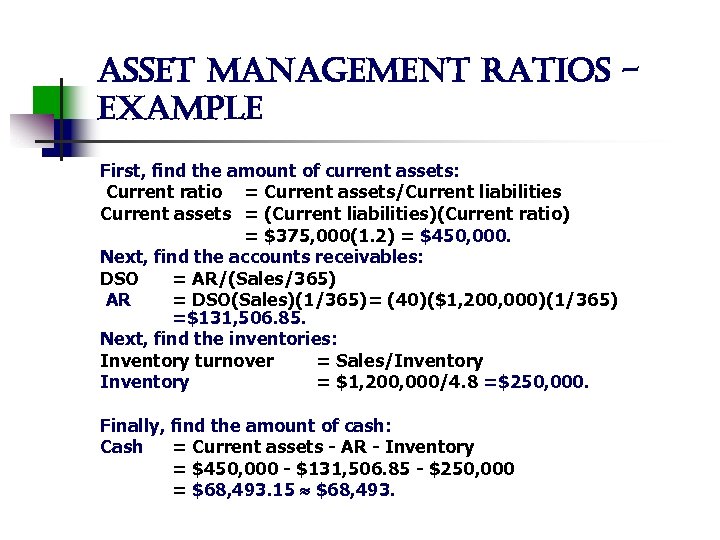

asset management ratios example First, find the amount of current assets: Current ratio = Current assets/Current liabilities Current assets = (Current liabilities)(Current ratio) = $375, 000(1. 2) = $450, 000. Next, find the accounts receivables: DSO = AR/(Sales/365) AR = DSO(Sales)(1/365)= (40)($1, 200, 000)(1/365) =$131, 506. 85. Next, find the inventories: Inventory turnover = Sales/Inventory = $1, 200, 000/4. 8 =$250, 000. Finally, find the amount of cash: Cash = Current assets - AR - Inventory = $450, 000 - $131, 506. 85 - $250, 000 = $68, 493. 15 $68, 493.

asset management ratios example First, find the amount of current assets: Current ratio = Current assets/Current liabilities Current assets = (Current liabilities)(Current ratio) = $375, 000(1. 2) = $450, 000. Next, find the accounts receivables: DSO = AR/(Sales/365) AR = DSO(Sales)(1/365)= (40)($1, 200, 000)(1/365) =$131, 506. 85. Next, find the inventories: Inventory turnover = Sales/Inventory = $1, 200, 000/4. 8 =$250, 000. Finally, find the amount of cash: Cash = Current assets - AR - Inventory = $450, 000 - $131, 506. 85 - $250, 000 = $68, 493. 15 $68, 493.

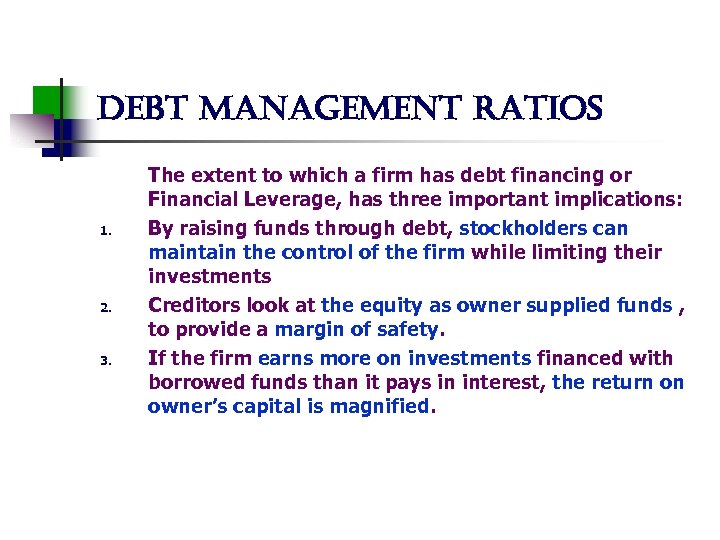

debt management ratios 1. 2. 3. The extent to which a firm has debt financing or Financial Leverage, has three important implications: By raising funds through debt, stockholders can maintain the control of the firm while limiting their investments Creditors look at the equity as owner supplied funds , to provide a margin of safety. If the firm earns more on investments financed with borrowed funds than it pays in interest, the return on owner’s capital is magnified.

debt management ratios 1. 2. 3. The extent to which a firm has debt financing or Financial Leverage, has three important implications: By raising funds through debt, stockholders can maintain the control of the firm while limiting their investments Creditors look at the equity as owner supplied funds , to provide a margin of safety. If the firm earns more on investments financed with borrowed funds than it pays in interest, the return on owner’s capital is magnified.

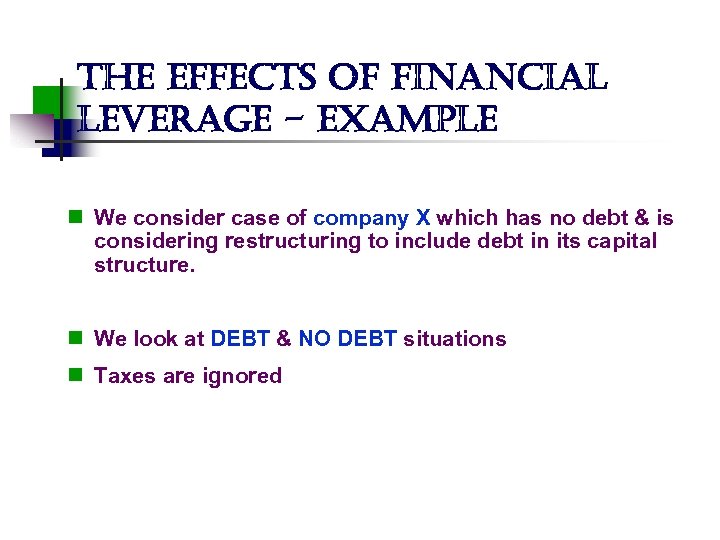

the effects of financial leverage - example n We consider case of company X which has no debt & is considering restructuring to include debt in its capital structure. n We look at DEBT & NO DEBT situations n Taxes are ignored

the effects of financial leverage - example n We consider case of company X which has no debt & is considering restructuring to include debt in its capital structure. n We look at DEBT & NO DEBT situations n Taxes are ignored

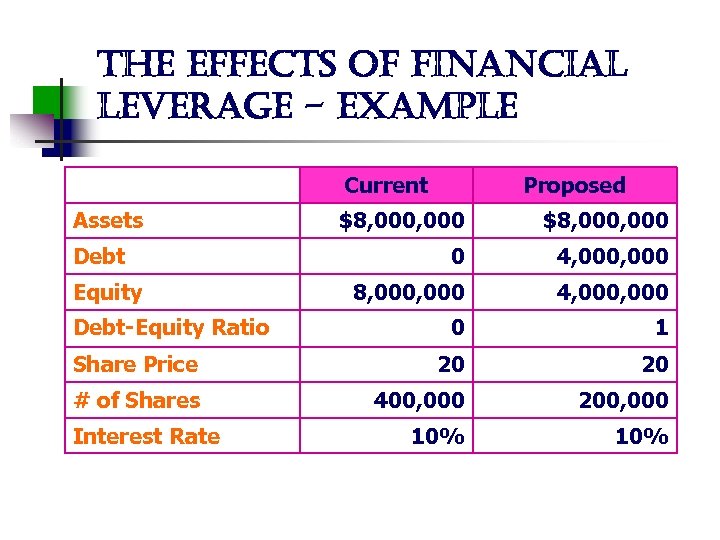

the effects of financial leverage - example Current Assets Proposed $8, 000, 000 0 4, 000 8, 000 4, 000 0 1 Share Price 20 20 # of Shares 400, 000 200, 000 10% Debt Equity Debt-Equity Ratio Interest Rate

the effects of financial leverage - example Current Assets Proposed $8, 000, 000 0 4, 000 8, 000 4, 000 0 1 Share Price 20 20 # of Shares 400, 000 200, 000 10% Debt Equity Debt-Equity Ratio Interest Rate

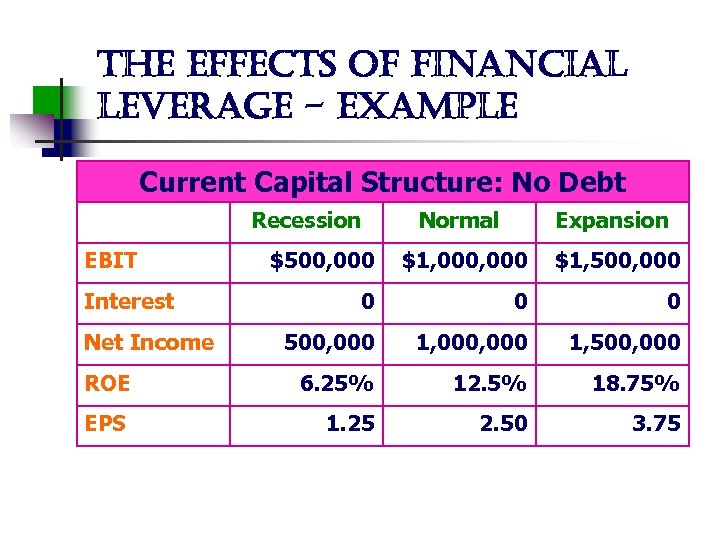

the effects of financial leverage - example Current Capital Structure: No Debt Recession Normal Expansion $500, 000 $1, 500, 000 0 500, 000 1, 500, 000 ROE 6. 25% 12. 5% 18. 75% EPS 1. 25 2. 50 3. 75 EBIT Interest Net Income

the effects of financial leverage - example Current Capital Structure: No Debt Recession Normal Expansion $500, 000 $1, 500, 000 0 500, 000 1, 500, 000 ROE 6. 25% 12. 5% 18. 75% EPS 1. 25 2. 50 3. 75 EBIT Interest Net Income

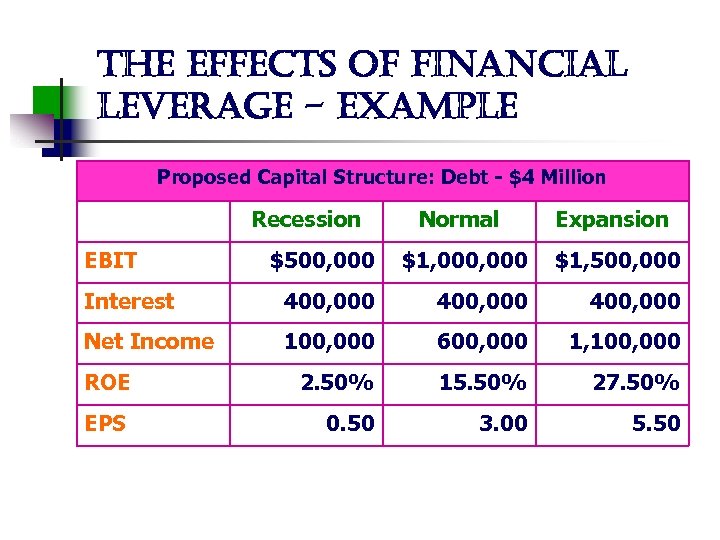

the effects of financial leverage - example Proposed Capital Structure: Debt - $4 Million Recession Normal Expansion $500, 000 $1, 500, 000 Interest 400, 000 Net Income 100, 000 600, 000 1, 100, 000 ROE 2. 50% 15. 50% 27. 50% EPS 0. 50 3. 00 5. 50 EBIT

the effects of financial leverage - example Proposed Capital Structure: Debt - $4 Million Recession Normal Expansion $500, 000 $1, 500, 000 Interest 400, 000 Net Income 100, 000 600, 000 1, 100, 000 ROE 2. 50% 15. 50% 27. 50% EPS 0. 50 3. 00 5. 50 EBIT

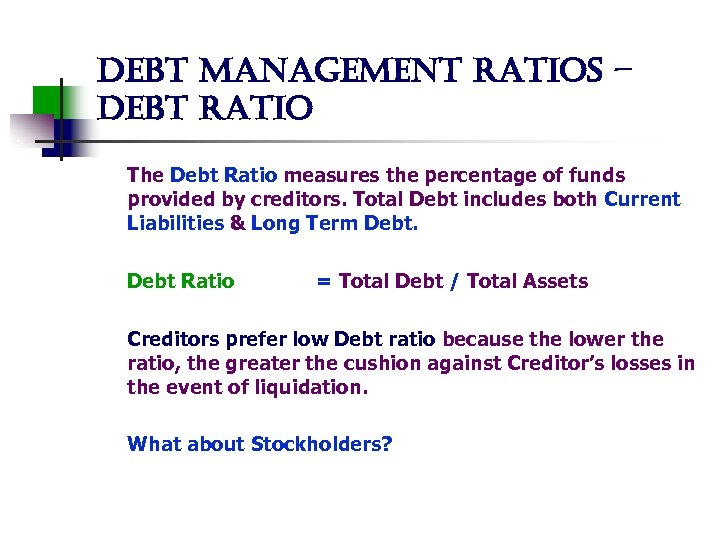

debt management ratios – debt ratio The Debt Ratio measures the percentage of funds provided by creditors. Total Debt includes both Current Liabilities & Long Term Debt Ratio = Total Debt / Total Assets Creditors prefer low Debt ratio because the lower the ratio, the greater the cushion against Creditor’s losses in the event of liquidation. What about Stockholders?

debt management ratios – debt ratio The Debt Ratio measures the percentage of funds provided by creditors. Total Debt includes both Current Liabilities & Long Term Debt Ratio = Total Debt / Total Assets Creditors prefer low Debt ratio because the lower the ratio, the greater the cushion against Creditor’s losses in the event of liquidation. What about Stockholders?

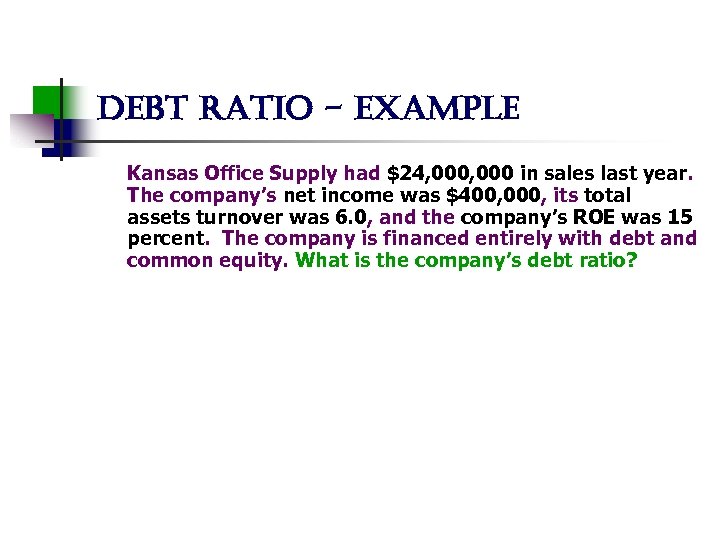

debt ratio - example Kansas Office Supply had $24, 000 in sales last year. The company’s net income was $400, 000, its total assets turnover was 6. 0, and the company’s ROE was 15 percent. The company is financed entirely with debt and common equity. What is the company’s debt ratio?

debt ratio - example Kansas Office Supply had $24, 000 in sales last year. The company’s net income was $400, 000, its total assets turnover was 6. 0, and the company’s ROE was 15 percent. The company is financed entirely with debt and common equity. What is the company’s debt ratio?

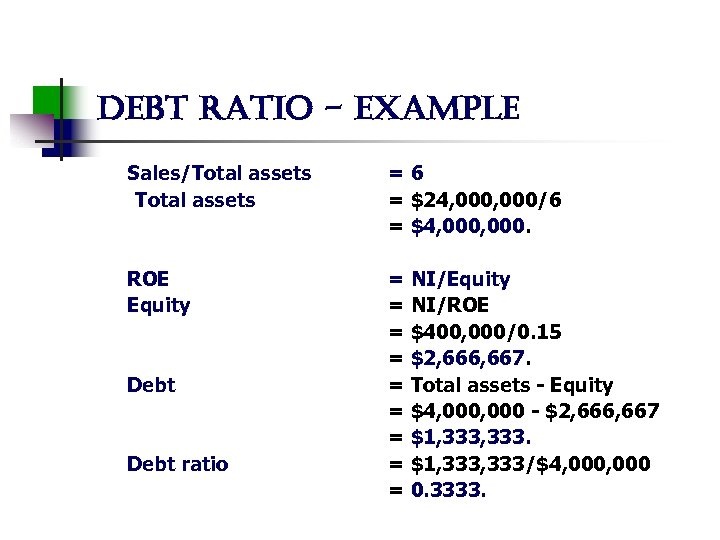

debt ratio - example Sales/Total assets =6 = $24, 000/6 = $4, 000. ROE Equity = NI/ROE = $400, 000/0. 15 = $2, 666, 667. = Total assets - Equity = $4, 000 - $2, 666, 667 = $1, 333/$4, 000 = 0. 3333. Debt ratio

debt ratio - example Sales/Total assets =6 = $24, 000/6 = $4, 000. ROE Equity = NI/ROE = $400, 000/0. 15 = $2, 666, 667. = Total assets - Equity = $4, 000 - $2, 666, 667 = $1, 333/$4, 000 = 0. 3333. Debt ratio

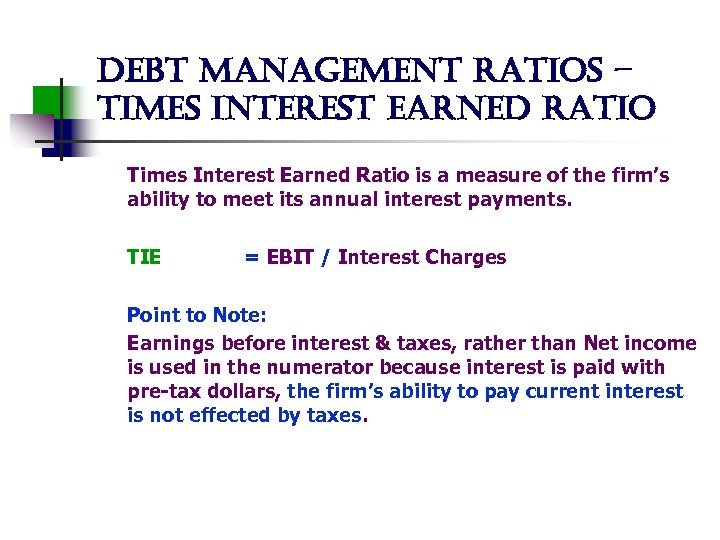

debt management ratios – times interest earned ratio Times Interest Earned Ratio is a measure of the firm’s ability to meet its annual interest payments. TIE = EBIT / Interest Charges Point to Note: Earnings before interest & taxes, rather than Net income is used in the numerator because interest is paid with pre-tax dollars, the firm’s ability to pay current interest is not effected by taxes.

debt management ratios – times interest earned ratio Times Interest Earned Ratio is a measure of the firm’s ability to meet its annual interest payments. TIE = EBIT / Interest Charges Point to Note: Earnings before interest & taxes, rather than Net income is used in the numerator because interest is paid with pre-tax dollars, the firm’s ability to pay current interest is not effected by taxes.

times interest earned ratio example Culver Inc. has earnings after interest but before taxes of $300. The company’s times interest earned ratio is 7. 00. Calculate the company’s interest charges.

times interest earned ratio example Culver Inc. has earnings after interest but before taxes of $300. The company’s times interest earned ratio is 7. 00. Calculate the company’s interest charges.

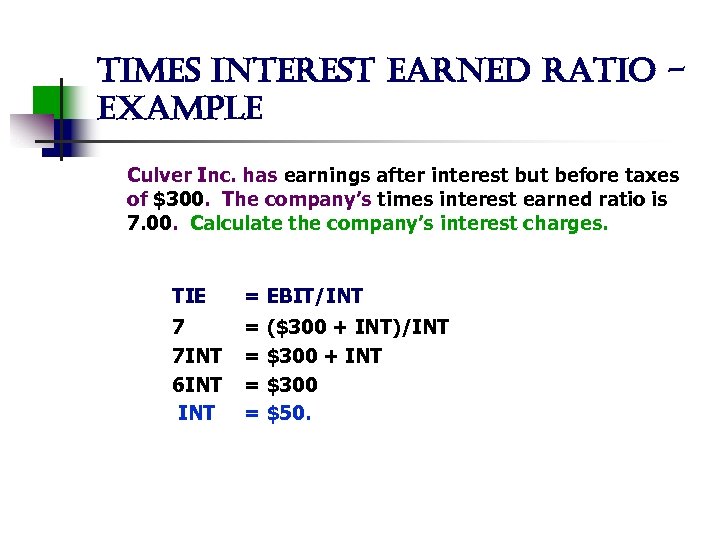

times interest earned ratio example Culver Inc. has earnings after interest but before taxes of $300. The company’s times interest earned ratio is 7. 00. Calculate the company’s interest charges. TIE = EBIT/INT 7 7 INT 6 INT = ($300 + INT)/INT = $300 + INT = $300 = $50.

times interest earned ratio example Culver Inc. has earnings after interest but before taxes of $300. The company’s times interest earned ratio is 7. 00. Calculate the company’s interest charges. TIE = EBIT/INT 7 7 INT 6 INT = ($300 + INT)/INT = $300 + INT = $300 = $50.

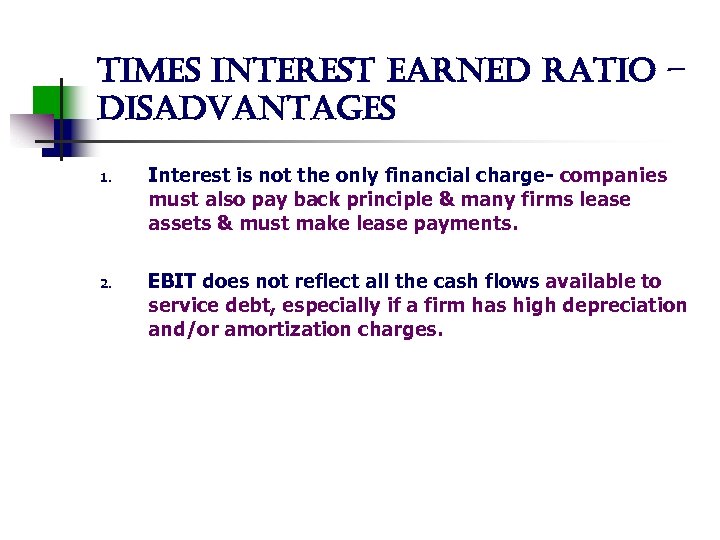

times interest earned ratio – disadvantages 1. 2. Interest is not the only financial charge- companies must also pay back principle & many firms lease assets & must make lease payments. EBIT does not reflect all the cash flows available to service debt, especially if a firm has high depreciation and/or amortization charges.

times interest earned ratio – disadvantages 1. 2. Interest is not the only financial charge- companies must also pay back principle & many firms lease assets & must make lease payments. EBIT does not reflect all the cash flows available to service debt, especially if a firm has high depreciation and/or amortization charges.

debt management ratios – ebitda coverage ratio The EBITDA coverage ratio is most useful for relatively short term lenders as over a relatively short period, depreciation generated funds can be used to service debt. EBITDA Coverage Ratio: EBITDA + lease Payments Interest +Principal Payment +Lease Payments

debt management ratios – ebitda coverage ratio The EBITDA coverage ratio is most useful for relatively short term lenders as over a relatively short period, depreciation generated funds can be used to service debt. EBITDA Coverage Ratio: EBITDA + lease Payments Interest +Principal Payment +Lease Payments

profitability ratios Profitability ratios include a group of ratios that show the combined effect of liquidity, asset management & debt on operating results. Profitability ratios constitute of: 1. 2. 3. 4. Profit Margin on Sales Basic Earning Power (BEP) Return on Total Assets (ROA) Return on Common Equity (ROE)

profitability ratios Profitability ratios include a group of ratios that show the combined effect of liquidity, asset management & debt on operating results. Profitability ratios constitute of: 1. 2. 3. 4. Profit Margin on Sales Basic Earning Power (BEP) Return on Total Assets (ROA) Return on Common Equity (ROE)

profitability ratios – profit margin on sales Profit Margin Ratio measures Net Income per dollar of Sales. Profit Margin on Sales = Net Income / Sales Special Case of Financial Leverage!!

profitability ratios – profit margin on sales Profit Margin Ratio measures Net Income per dollar of Sales. Profit Margin on Sales = Net Income / Sales Special Case of Financial Leverage!!

profitability ratios - basic earning power The BEP ratio indicates the ability of the firm’s Assets to generate operating Income. BEP = EBIT / Total Assets This ratio shows the raw earning power of the firm’s Assets, before the influence of taxes & leverage, and it is useful for comparing firms with different tax situations & different degrees of financial leverage.

profitability ratios - basic earning power The BEP ratio indicates the ability of the firm’s Assets to generate operating Income. BEP = EBIT / Total Assets This ratio shows the raw earning power of the firm’s Assets, before the influence of taxes & leverage, and it is useful for comparing firms with different tax situations & different degrees of financial leverage.

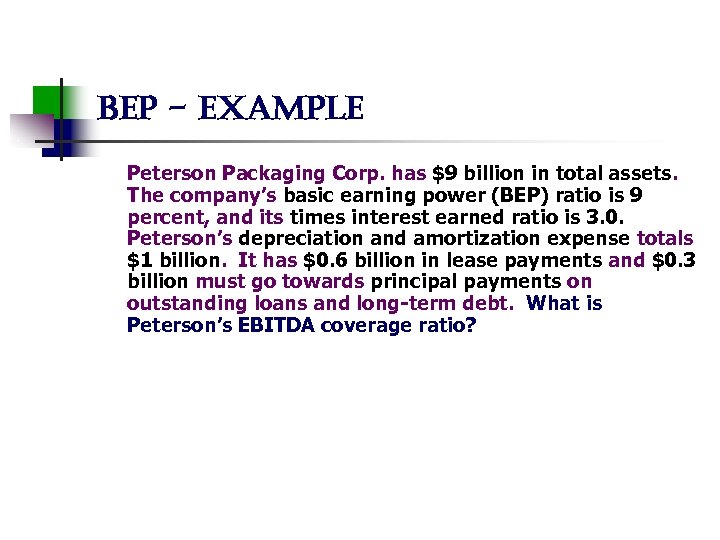

bep - example Peterson Packaging Corp. has $9 billion in total assets. The company’s basic earning power (BEP) ratio is 9 percent, and its times interest earned ratio is 3. 0. Peterson’s depreciation and amortization expense totals $1 billion. It has $0. 6 billion in lease payments and $0. 3 billion must go towards principal payments on outstanding loans and long-term debt. What is Peterson’s EBITDA coverage ratio?

bep - example Peterson Packaging Corp. has $9 billion in total assets. The company’s basic earning power (BEP) ratio is 9 percent, and its times interest earned ratio is 3. 0. Peterson’s depreciation and amortization expense totals $1 billion. It has $0. 6 billion in lease payments and $0. 3 billion must go towards principal payments on outstanding loans and long-term debt. What is Peterson’s EBITDA coverage ratio?

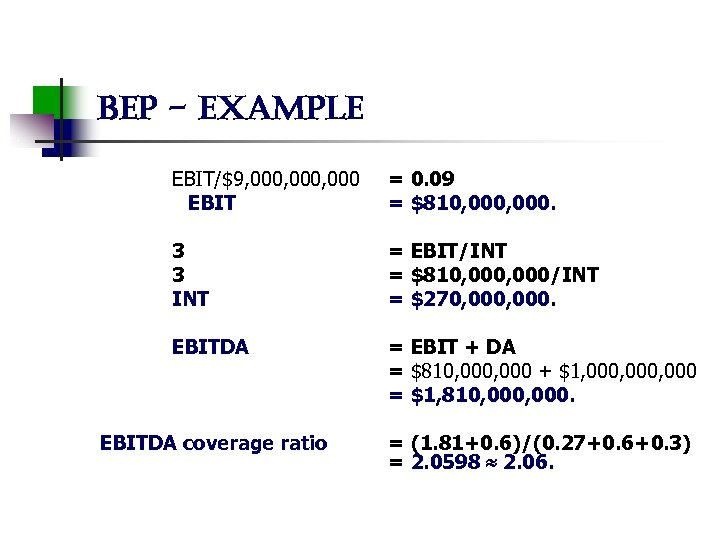

bep - example EBIT/$9, 000, 000 EBIT = 0. 09 = $810, 000. 3 3 INT = EBIT/INT = $810, 000/INT = $270, 000. EBITDA = EBIT + DA = $810, 000 + $1, 000, 000 = $1, 810, 000. EBITDA coverage ratio = (1. 81+0. 6)/(0. 27+0. 6+0. 3) = 2. 0598 2. 06.

bep - example EBIT/$9, 000, 000 EBIT = 0. 09 = $810, 000. 3 3 INT = EBIT/INT = $810, 000/INT = $270, 000. EBITDA = EBIT + DA = $810, 000 + $1, 000, 000 = $1, 810, 000. EBITDA coverage ratio = (1. 81+0. 6)/(0. 27+0. 6+0. 3) = 2. 0598 2. 06.

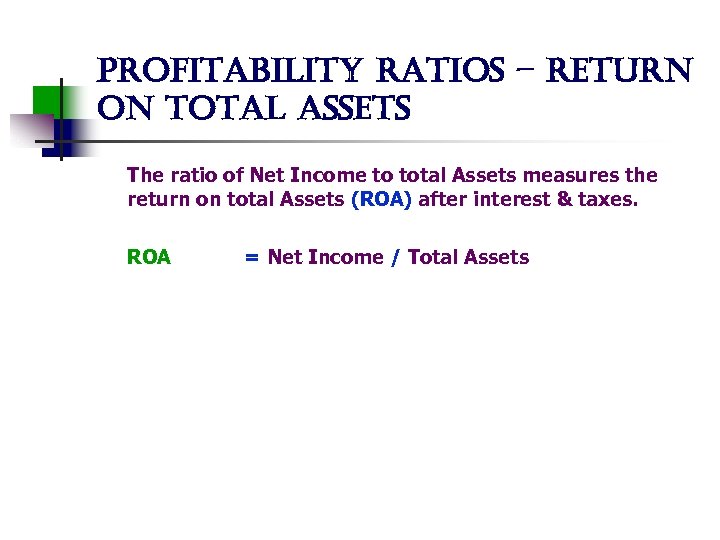

profitability ratios – return on total assets The ratio of Net Income to total Assets measures the return on total Assets (ROA) after interest & taxes. ROA = Net Income / Total Assets

profitability ratios – return on total assets The ratio of Net Income to total Assets measures the return on total Assets (ROA) after interest & taxes. ROA = Net Income / Total Assets

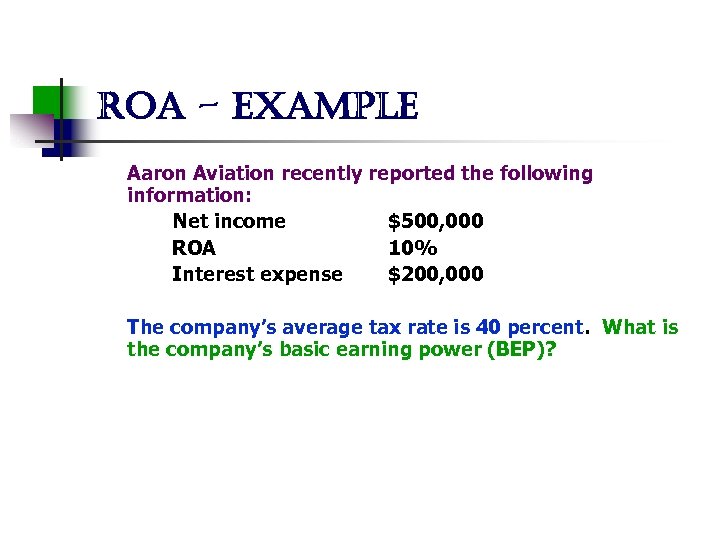

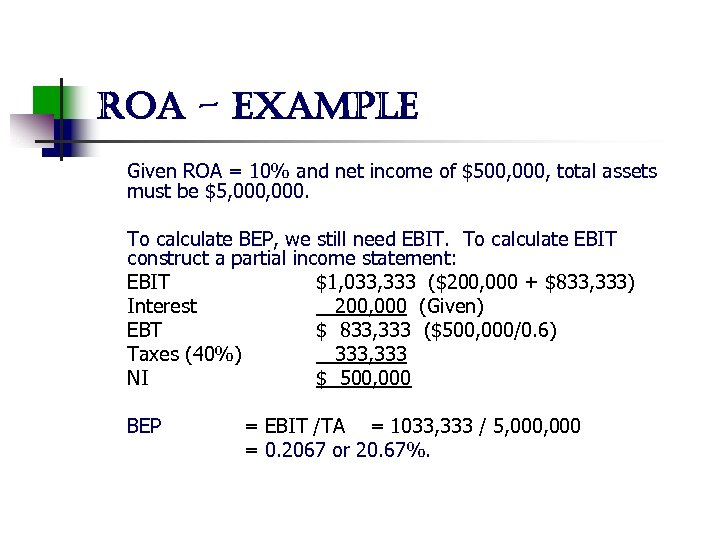

roa - example Aaron Aviation recently reported the following information: Net income $500, 000 ROA 10% Interest expense $200, 000 The company’s average tax rate is 40 percent. What is the company’s basic earning power (BEP)?

roa - example Aaron Aviation recently reported the following information: Net income $500, 000 ROA 10% Interest expense $200, 000 The company’s average tax rate is 40 percent. What is the company’s basic earning power (BEP)?

roa - example Given ROA = 10% and net income of $500, 000, total assets must be $5, 000. To calculate BEP, we still need EBIT. To calculate EBIT construct a partial income statement: EBIT $1, 033, 333 ($200, 000 + $833, 333) Interest 200, 000 (Given) EBT $ 833, 333 ($500, 000/0. 6) Taxes (40%) 333, 333 NI $ 500, 000 BEP = EBIT /TA = 1033, 333 / 5, 000 = 0. 2067 or 20. 67%.

roa - example Given ROA = 10% and net income of $500, 000, total assets must be $5, 000. To calculate BEP, we still need EBIT. To calculate EBIT construct a partial income statement: EBIT $1, 033, 333 ($200, 000 + $833, 333) Interest 200, 000 (Given) EBT $ 833, 333 ($500, 000/0. 6) Taxes (40%) 333, 333 NI $ 500, 000 BEP = EBIT /TA = 1033, 333 / 5, 000 = 0. 2067 or 20. 67%.

profitability ratios – return on common equity The Return on Common Equity Ratio measures the Return on Common Stockholders’ investments. ROE = Net Income / Common Equity

profitability ratios – return on common equity The Return on Common Equity Ratio measures the Return on Common Stockholders’ investments. ROE = Net Income / Common Equity

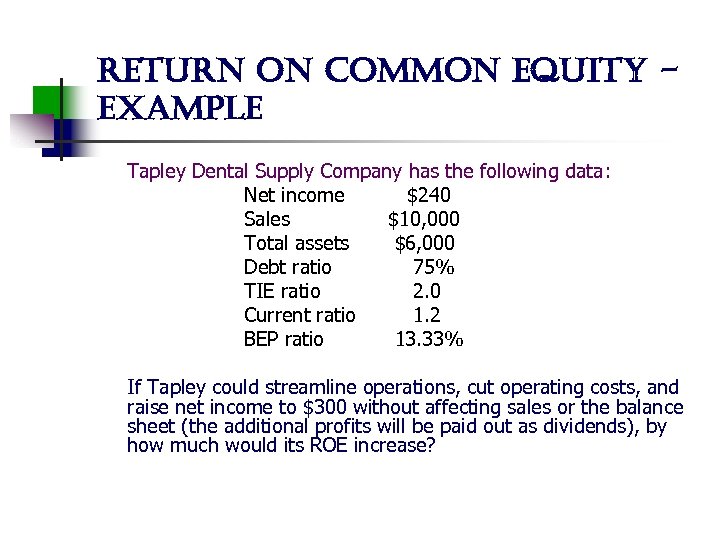

return on common equity example Tapley Dental Supply Company has the following data: Net income $240 Sales $10, 000 Total assets $6, 000 Debt ratio 75% TIE ratio 2. 0 Current ratio 1. 2 BEP ratio 13. 33% If Tapley could streamline operations, cut operating costs, and raise net income to $300 without affecting sales or the balance sheet (the additional profits will be paid out as dividends), by how much would its ROE increase?

return on common equity example Tapley Dental Supply Company has the following data: Net income $240 Sales $10, 000 Total assets $6, 000 Debt ratio 75% TIE ratio 2. 0 Current ratio 1. 2 BEP ratio 13. 33% If Tapley could streamline operations, cut operating costs, and raise net income to $300 without affecting sales or the balance sheet (the additional profits will be paid out as dividends), by how much would its ROE increase?

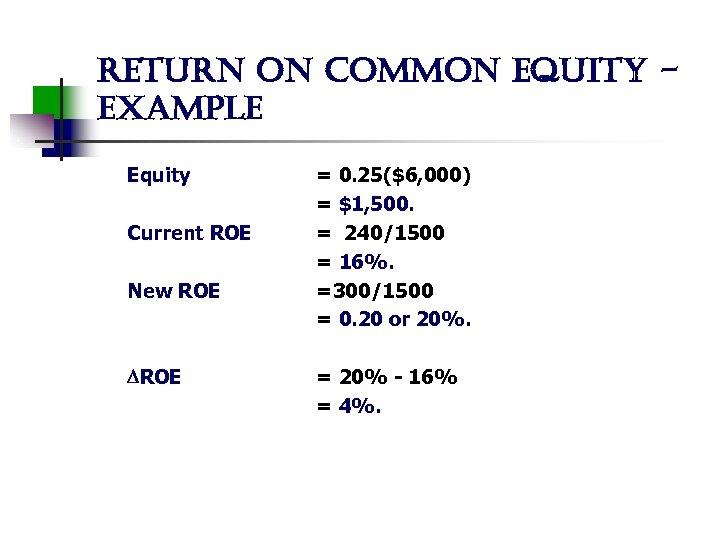

return on common equity example Equity Current ROE New ROE = 0. 25($6, 000) = $1, 500. = 240/1500 = 16%. =300/1500 = 0. 20 or 20%. = 20% - 16% = 4%.

return on common equity example Equity Current ROE New ROE = 0. 25($6, 000) = $1, 500. = 240/1500 = 16%. =300/1500 = 0. 20 or 20%. = 20% - 16% = 4%.

financial management i chap 03 analysis of financial statements

financial management i chap 03 analysis of financial statements

ratio analysis 1. 2. 3. 4. 5. 6. Liquidity Ratios Asset Management Ratios Debt Management Ratios Profitability Ratios Market Value Ratios Du. Pont Analysis

ratio analysis 1. 2. 3. 4. 5. 6. Liquidity Ratios Asset Management Ratios Debt Management Ratios Profitability Ratios Market Value Ratios Du. Pont Analysis

market value ratios Market Value Ratios constitute set of ratios that relate the firm’s stock price to its earnings, cash flows & book value per share: 1. 2. 3. Price/ Earning Ratio Price/ Cash flow ratio Market/Book Value Ratio

market value ratios Market Value Ratios constitute set of ratios that relate the firm’s stock price to its earnings, cash flows & book value per share: 1. 2. 3. Price/ Earning Ratio Price/ Cash flow ratio Market/Book Value Ratio

market value ratios – price/earnings ratio The ratio of Price per Share to earnings per share shows the dollar amount investors will pay for $1 of current earnings. P/E Ratio Purpose? = Price Per Share / Earnings Per Share

market value ratios – price/earnings ratio The ratio of Price per Share to earnings per share shows the dollar amount investors will pay for $1 of current earnings. P/E Ratio Purpose? = Price Per Share / Earnings Per Share

price/earnings ratio example Cleveland Corporation has 100, 000 shares of common stock outstanding, its net income is $750, 000, and its P/E is 8. What is the company’s stock price?

price/earnings ratio example Cleveland Corporation has 100, 000 shares of common stock outstanding, its net income is $750, 000, and its P/E is 8. What is the company’s stock price?

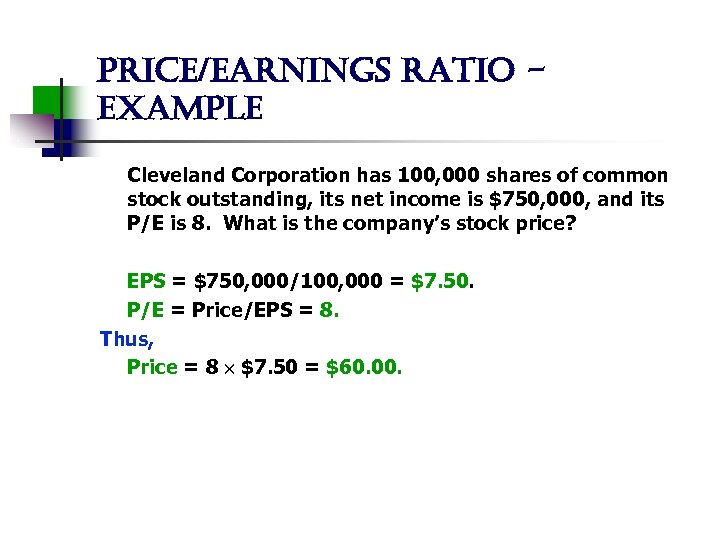

price/earnings ratio example Cleveland Corporation has 100, 000 shares of common stock outstanding, its net income is $750, 000, and its P/E is 8. What is the company’s stock price? EPS = $750, 000/100, 000 = $7. 50. P/E = Price/EPS = 8. Thus, Price = 8 $7. 50 = $60. 00.

price/earnings ratio example Cleveland Corporation has 100, 000 shares of common stock outstanding, its net income is $750, 000, and its P/E is 8. What is the company’s stock price? EPS = $750, 000/100, 000 = $7. 50. P/E = Price/EPS = 8. Thus, Price = 8 $7. 50 = $60. 00.

market value ratios/ price/cash flow ratio The ratio of Price per Share to cash flow per share shows the dollar amount investors will pay for $1 of cash flows. P/CF Ratio = Price Per Share / Cash Flow Per Share Where: CF Purpose? = (NI + Non Cash Charges)

market value ratios/ price/cash flow ratio The ratio of Price per Share to cash flow per share shows the dollar amount investors will pay for $1 of cash flows. P/CF Ratio = Price Per Share / Cash Flow Per Share Where: CF Purpose? = (NI + Non Cash Charges)

market value ratios market/book value ratio The ratio of stock’s Market price to its book value gives another indication of how investors regard the company. Companies with relatively high rates of return on Equity generally sell at higher multiples of book Value than those with low Returns. Market/Book Ratio = Market Price per share Book Value per Share

market value ratios market/book value ratio The ratio of stock’s Market price to its book value gives another indication of how investors regard the company. Companies with relatively high rates of return on Equity generally sell at higher multiples of book Value than those with low Returns. Market/Book Ratio = Market Price per share Book Value per Share

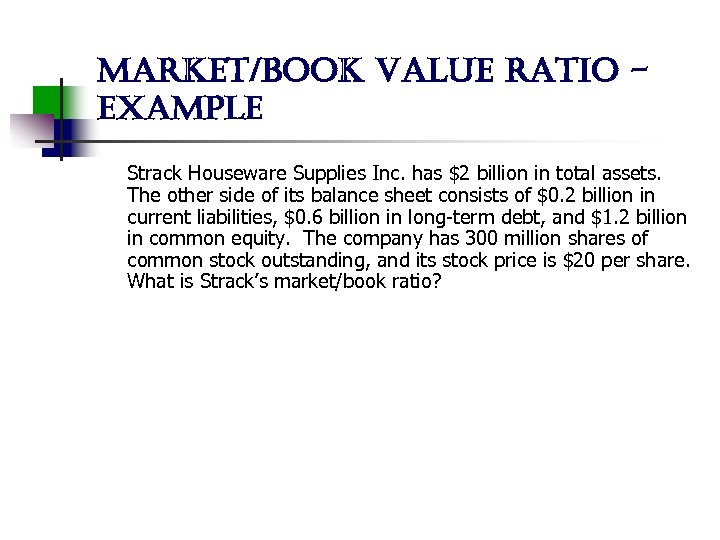

market/book value ratio example Strack Houseware Supplies Inc. has $2 billion in total assets. The other side of its balance sheet consists of $0. 2 billion in current liabilities, $0. 6 billion in long-term debt, and $1. 2 billion in common equity. The company has 300 million shares of common stock outstanding, and its stock price is $20 per share. What is Strack’s market/book ratio?

market/book value ratio example Strack Houseware Supplies Inc. has $2 billion in total assets. The other side of its balance sheet consists of $0. 2 billion in current liabilities, $0. 6 billion in long-term debt, and $1. 2 billion in common equity. The company has 300 million shares of common stock outstanding, and its stock price is $20 per share. What is Strack’s market/book ratio?

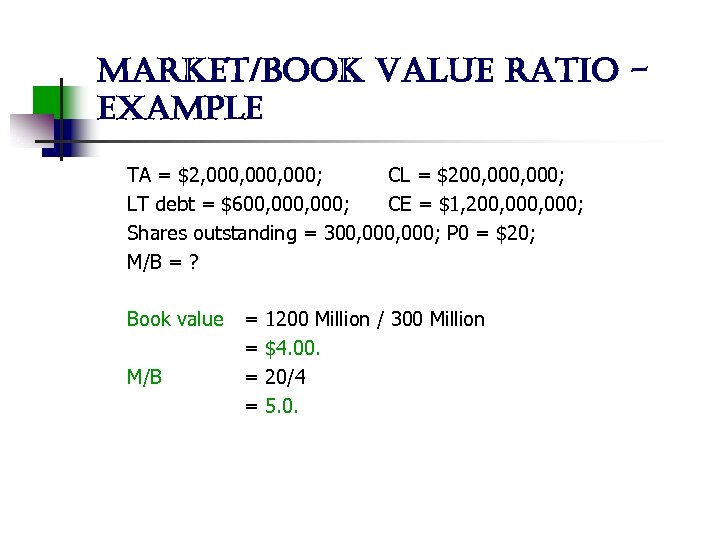

market/book value ratio example TA = $2, 000, 000; CL = $200, 000; LT debt = $600, 000; CE = $1, 200, 000; Shares outstanding = 300, 000; P 0 = $20; M/B = ? Book value M/B = = 1200 Million / 300 Million $4. 00. 20/4 5. 0.

market/book value ratio example TA = $2, 000, 000; CL = $200, 000; LT debt = $600, 000; CE = $1, 200, 000; Shares outstanding = 300, 000; P 0 = $20; M/B = ? Book value M/B = = 1200 Million / 300 Million $4. 00. 20/4 5. 0.

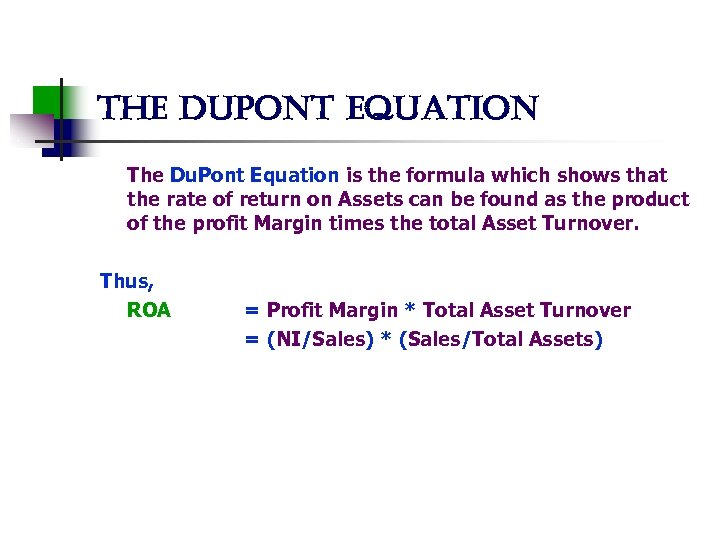

the dupont equation The Du. Pont Equation is the formula which shows that the rate of return on Assets can be found as the product of the profit Margin times the total Asset Turnover. Thus, ROA = Profit Margin * Total Asset Turnover = (NI/Sales) * (Sales/Total Assets)

the dupont equation The Du. Pont Equation is the formula which shows that the rate of return on Assets can be found as the product of the profit Margin times the total Asset Turnover. Thus, ROA = Profit Margin * Total Asset Turnover = (NI/Sales) * (Sales/Total Assets)

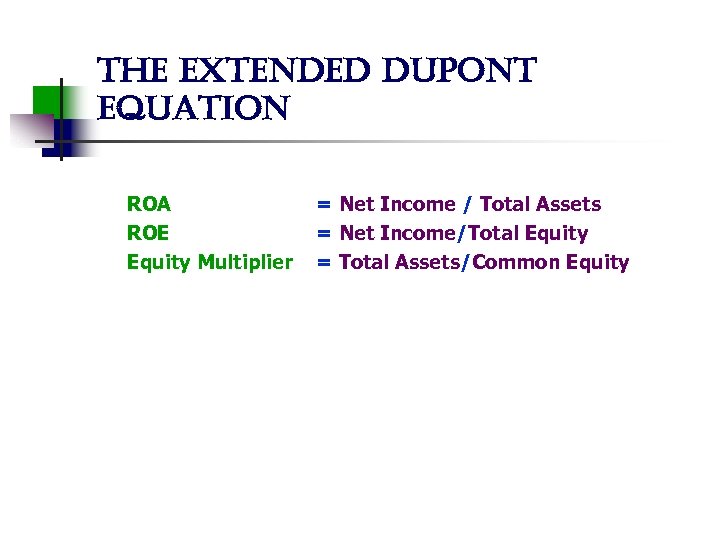

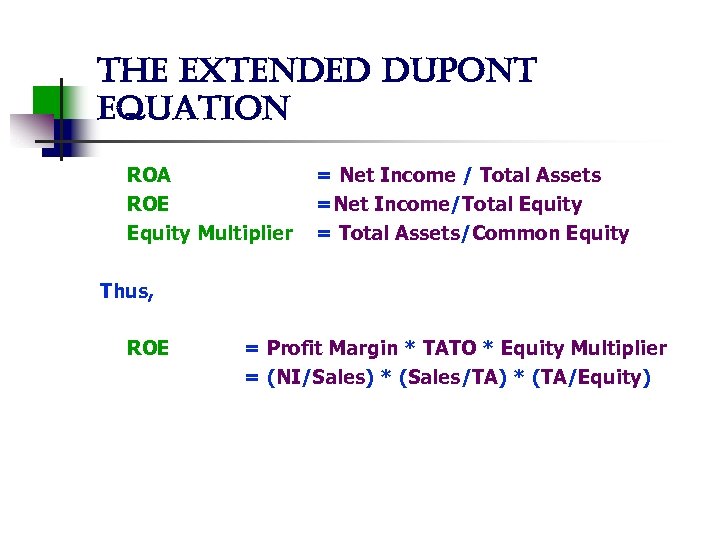

the extended dupont equation ROA ROE Equity Multiplier = Net Income / Total Assets = Net Income/Total Equity = Total Assets/Common Equity

the extended dupont equation ROA ROE Equity Multiplier = Net Income / Total Assets = Net Income/Total Equity = Total Assets/Common Equity

the extended dupont equation ROA ROE Equity Multiplier = Net Income / Total Assets =Net Income/Total Equity = Total Assets/Common Equity Thus, ROE = Profit Margin * TATO * Equity Multiplier = (NI/Sales) * (Sales/TA) * (TA/Equity)

the extended dupont equation ROA ROE Equity Multiplier = Net Income / Total Assets =Net Income/Total Equity = Total Assets/Common Equity Thus, ROE = Profit Margin * TATO * Equity Multiplier = (NI/Sales) * (Sales/TA) * (TA/Equity)

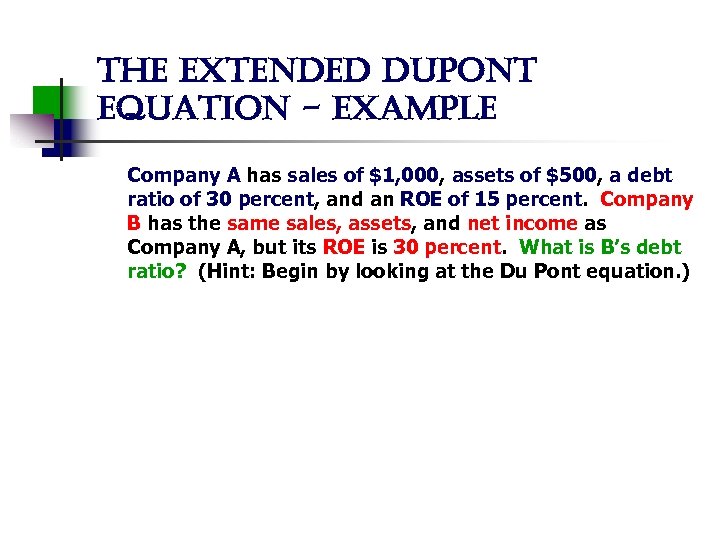

the extended dupont equation - example Company A has sales of $1, 000, assets of $500, a debt ratio of 30 percent, and an ROE of 15 percent. Company B has the same sales, assets, and net income as Company A, but its ROE is 30 percent. What is B’s debt ratio? (Hint: Begin by looking at the Du Pont equation. )

the extended dupont equation - example Company A has sales of $1, 000, assets of $500, a debt ratio of 30 percent, and an ROE of 15 percent. Company B has the same sales, assets, and net income as Company A, but its ROE is 30 percent. What is B’s debt ratio? (Hint: Begin by looking at the Du Pont equation. )

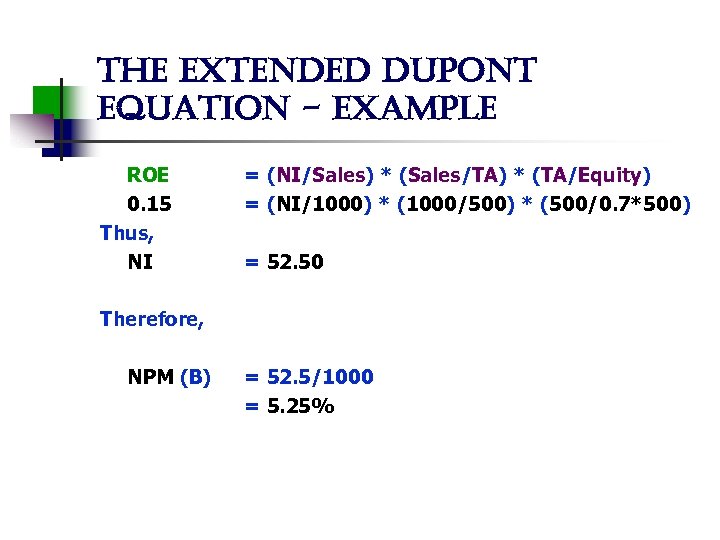

the extended dupont equation - example ROE 0. 15 Thus, NI = (NI/Sales) * (Sales/TA) * (TA/Equity) = (NI/1000) * (1000/500) * (500/0. 7*500) = 52. 50 Therefore, NPM (B) = 52. 5/1000 = 5. 25%

the extended dupont equation - example ROE 0. 15 Thus, NI = (NI/Sales) * (Sales/TA) * (TA/Equity) = (NI/1000) * (1000/500) * (500/0. 7*500) = 52. 50 Therefore, NPM (B) = 52. 5/1000 = 5. 25%

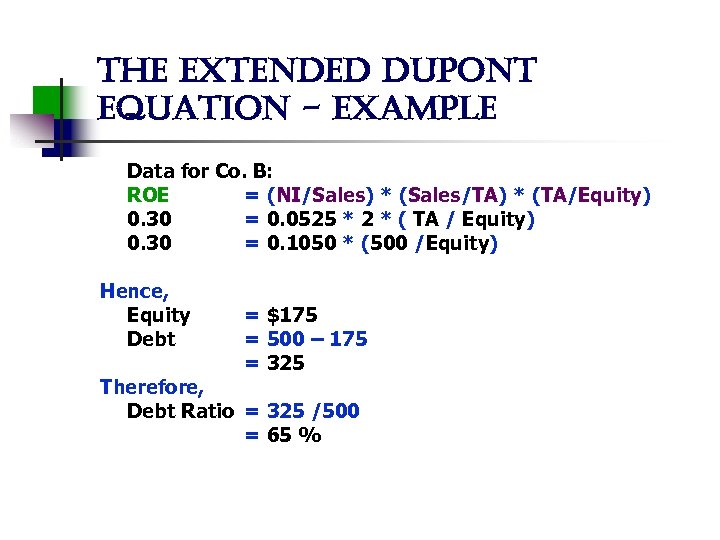

the extended dupont equation - example Data for Co. B: ROE = (NI/Sales) * (Sales/TA) * (TA/Equity) 0. 30 = 0. 0525 * 2 * ( TA / Equity) 0. 30 = 0. 1050 * (500 /Equity) Hence, Equity Debt = $175 = 500 – 175 = 325 Therefore, Debt Ratio = 325 /500 = 65 %

the extended dupont equation - example Data for Co. B: ROE = (NI/Sales) * (Sales/TA) * (TA/Equity) 0. 30 = 0. 0525 * 2 * ( TA / Equity) 0. 30 = 0. 1050 * (500 /Equity) Hence, Equity Debt = $175 = 500 – 175 = 325 Therefore, Debt Ratio = 325 /500 = 65 %

limitations of ratio analysis n n n n Multiple Divisions in different Industries Average Not Enough for Most firms Inflation Seasonal Factors Window Dressing Techniques Different Accounting Practices Difficult to generalize

limitations of ratio analysis n n n n Multiple Divisions in different Industries Average Not Enough for Most firms Inflation Seasonal Factors Window Dressing Techniques Different Accounting Practices Difficult to generalize

thank you for your time & patience

thank you for your time & patience