ce080a4ef751a8f6cebdf5859f4a3734.ppt

- Количество слайдов: 40

Financial Management CAIIB MODULE D Presentation by Prof. S. D. Bargir Joint Director, IIBF

Module D topics o o Marginal Costing Capital Budgeting Cash Budget Working Capital

COSTING o o Cost accounting system provides information about cost Aim : best use of resources and maximization of returns cost = amount of expenditure incurred( actual+ notional) Purposes +profit from each job/product, division, segment+pricingdecision+control+profit planning +inter firm comparison

Marginal costing o o Marginal costing distinguishes between fixed cost and variable cost Marginal cost is nothing bust variable cost of additional unit Marginal cost= variable cost MC= Direct Material + Direct Labour +Direct expenses

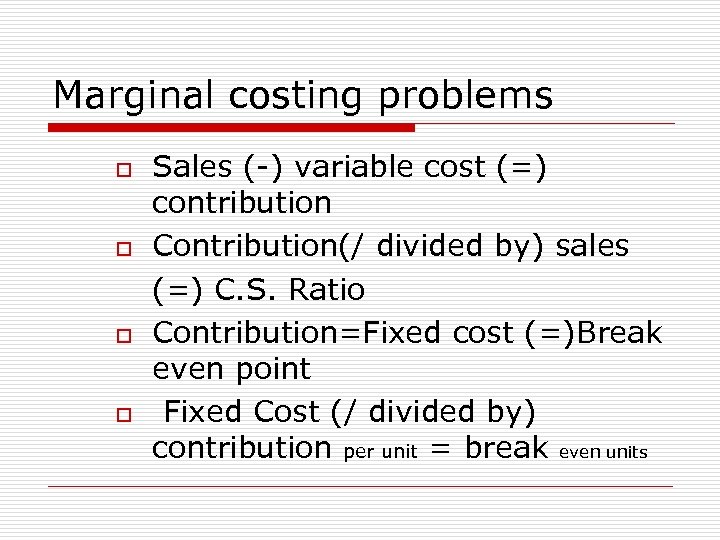

Marginal costing problems o o Sales (-) variable cost (=) contribution Contribution(/ divided by) sales (=) C. S. Ratio Contribution=Fixed cost (=)Break even point Fixed Cost (/ divided by) contribution per unit = break even units

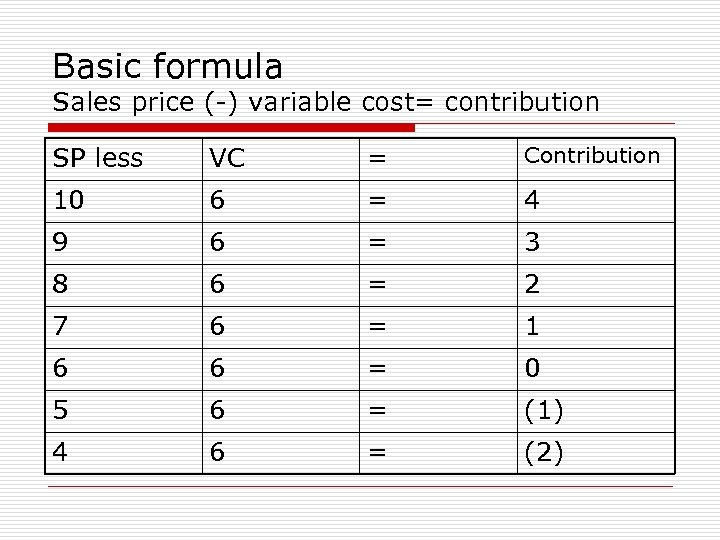

Basic formula Sales price (-) variable cost= contribution SP less VC = Contribution 10 6 = 4 9 6 = 3 8 6 = 2 7 6 = 1 6 6 = 0 5 6 = (1) 4 6 = (2)

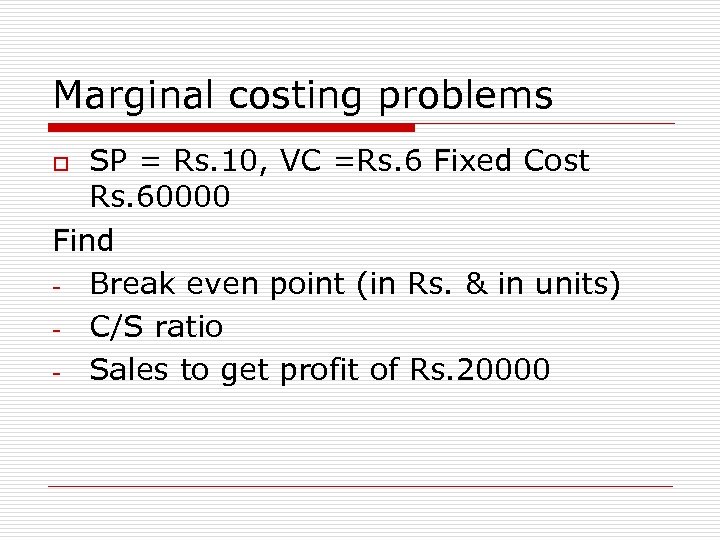

Marginal costing problems SP = Rs. 10, VC =Rs. 6 Fixed Cost Rs. 60000 Find - Break even point (in Rs. & in units) - C/S ratio - Sales to get profit of Rs. 20000 o

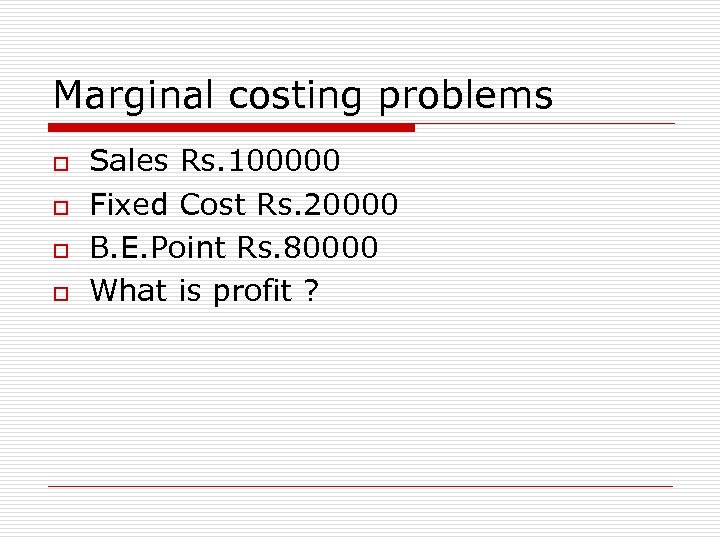

Marginal costing problems o o Sales Rs. 100000 Fixed Cost Rs. 20000 B. E. Point Rs. 80000 What is profit ?

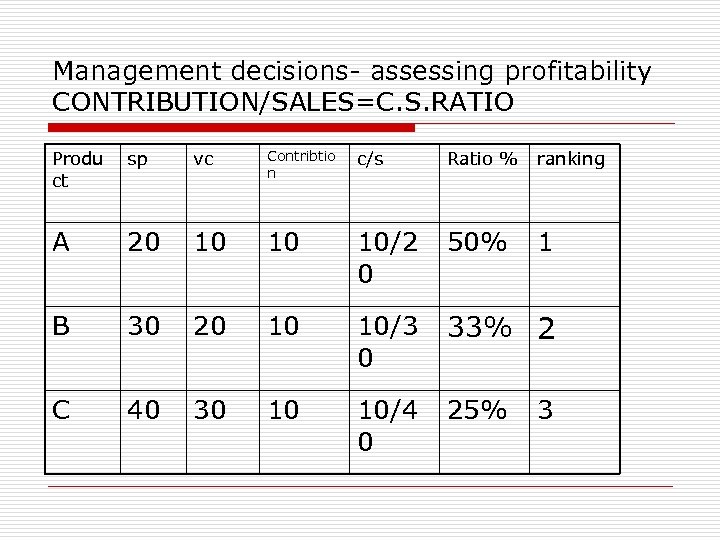

Management decisions- assessing profitability CONTRIBUTION/SALES=C. S. RATIO Produ ct sp vc Contribtio n c/s Ratio % ranking A 20 10 10 10/2 0 50% 1 B 30 20 10 10/3 0 33% 2 C 40 30 10 10/4 0 25% 3

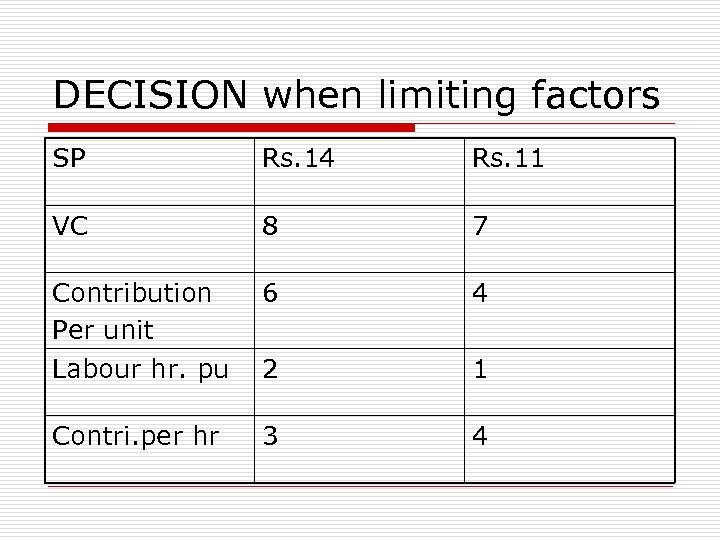

DECISION when limiting factors SP Rs. 14 Rs. 11 VC 8 7 Contribution Per unit Labour hr. pu 6 4 2 1 Contri. per hr 3 4

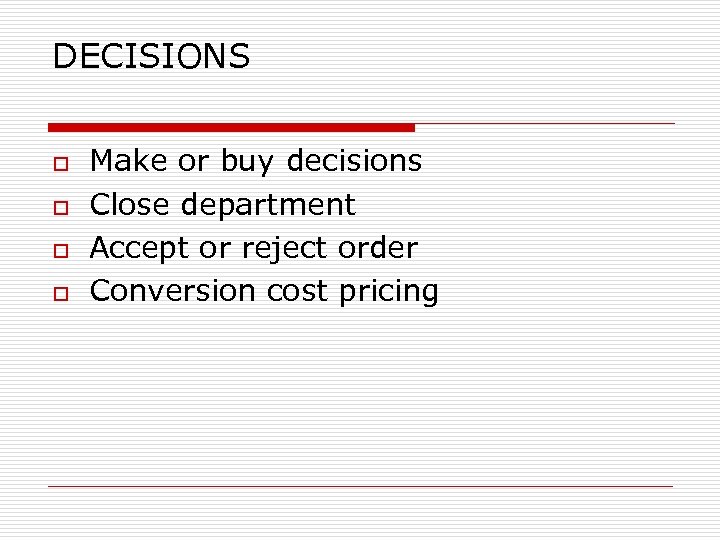

DECISIONS o o Make or buy decisions Close department Accept or reject order Conversion cost pricing

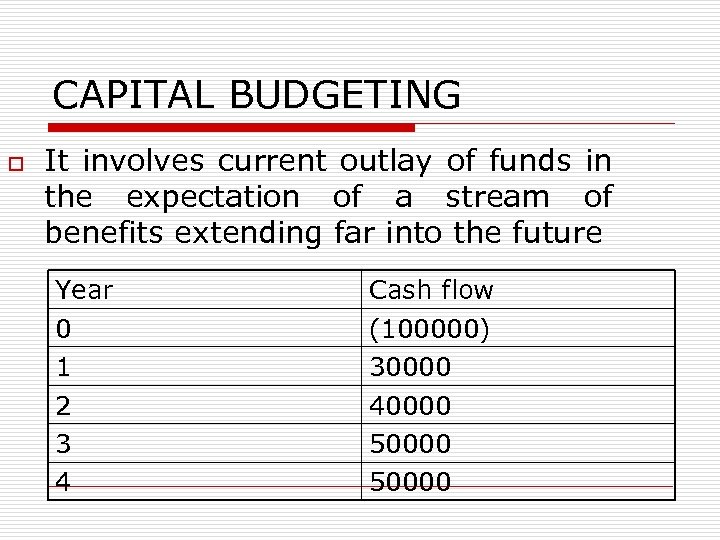

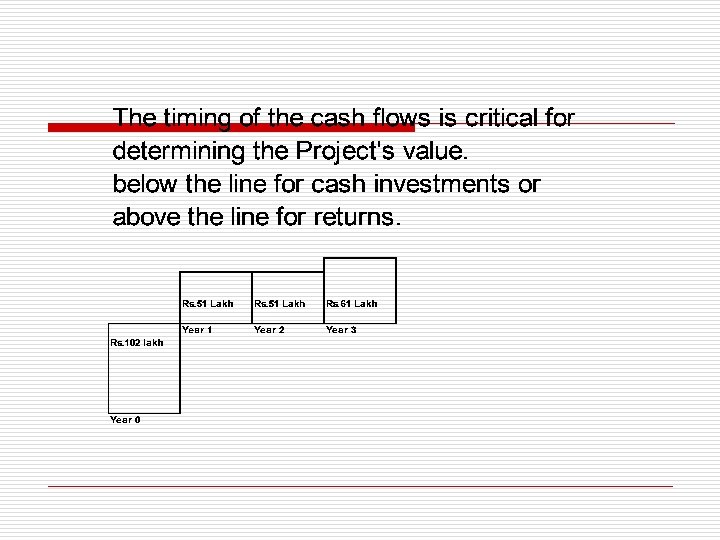

CAPITAL BUDGETING o It involves current outlay of funds in the expectation of a stream of benefits extending far into the future Year 0 1 2 3 4 Cash flow (100000) 30000 40000 50000

Types of capital investments o o o New unit Expansion Diversification Replacement Research & Development

Significance of capital budgeting o o Huge outlay Long term effects Irreversibility Problems in measuring future cash flows

Facets of project analysis o o o Market analysis Technical analysis Financial analysis Economic analysis Managerial analysis Ecological analysis

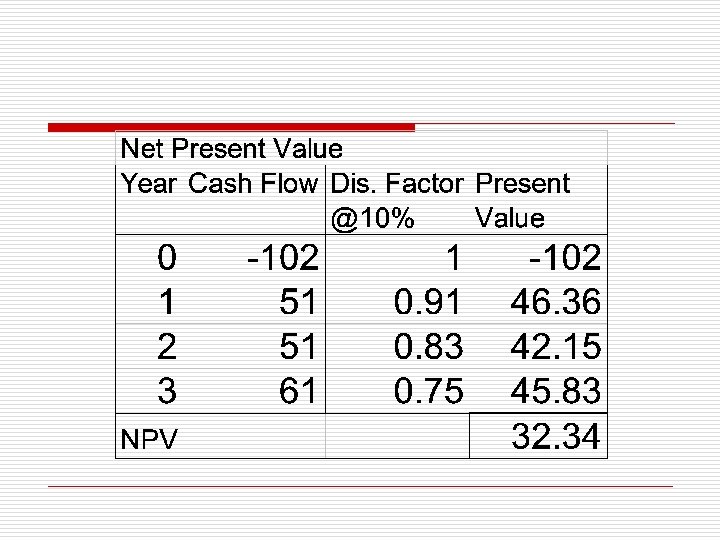

Financial analysis o o o Cost of project Means of finance Cost of capital Projected profitability Cash flows of the projects Project appraisal

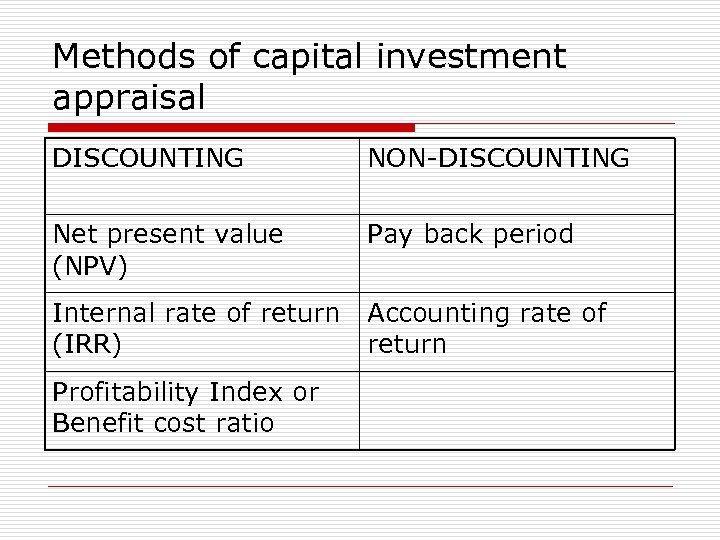

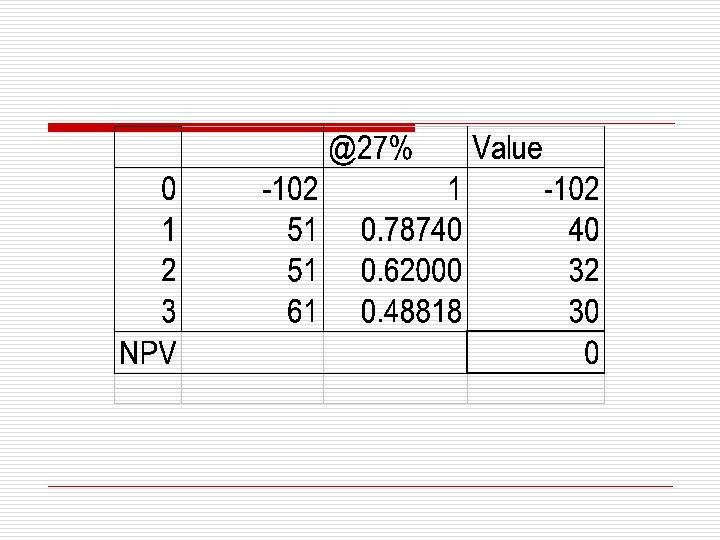

Methods of capital investment appraisal DISCOUNTING NON-DISCOUNTING Net present value (NPV) Pay back period Internal rate of return (IRR) Accounting rate of return Profitability Index or Benefit cost ratio

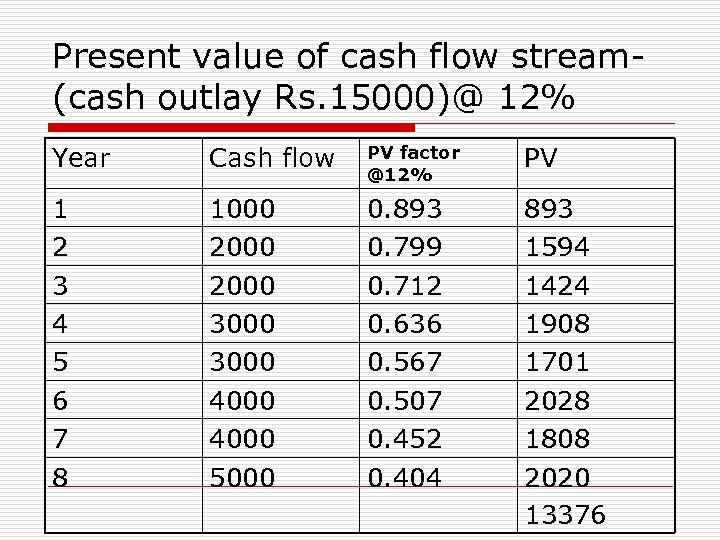

Present value of cash flow stream(cash outlay Rs. 15000)@ 12% Year Cash flow PV factor @12% PV 1 2 3 4 5 6 7 8 1000 2000 3000 4000 5000 0. 893 0. 799 0. 712 0. 636 0. 567 0. 507 0. 452 0. 404 893 1594 1424 1908 1701 2028 1808 2020 13376

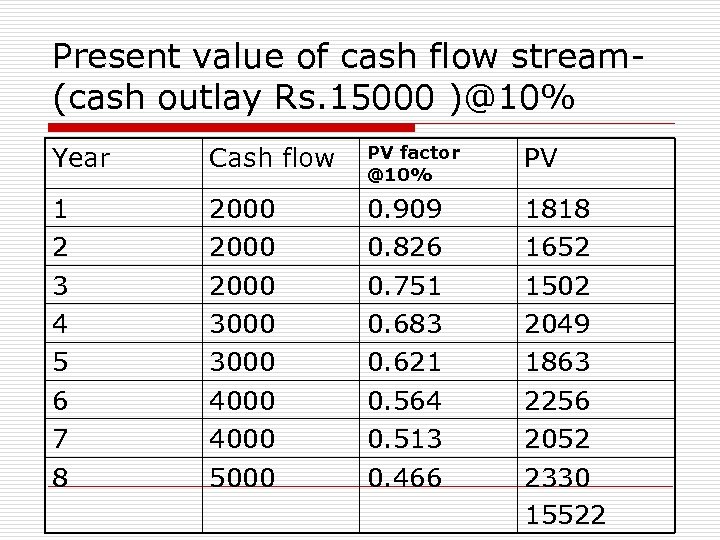

Present value of cash flow stream(cash outlay Rs. 15000 )@10% Year Cash flow PV factor @10% PV 1 2 3 4 5 6 7 8 2000 3000 4000 5000 0. 909 0. 826 0. 751 0. 683 0. 621 0. 564 0. 513 0. 466 1818 1652 1502 2049 1863 2256 2052 2330 15522

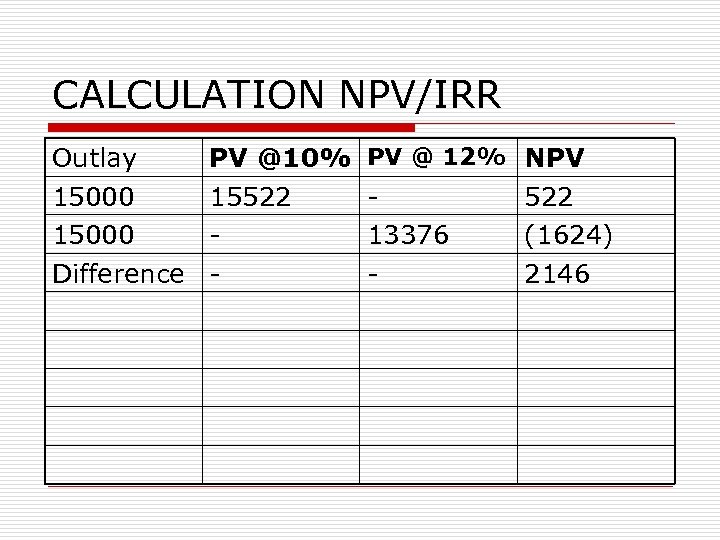

CALCULATION NPV/IRR Outlay 15000 Difference PV @10% 15522 - PV @ 12% NPV 13376 - 522 (1624) 2146

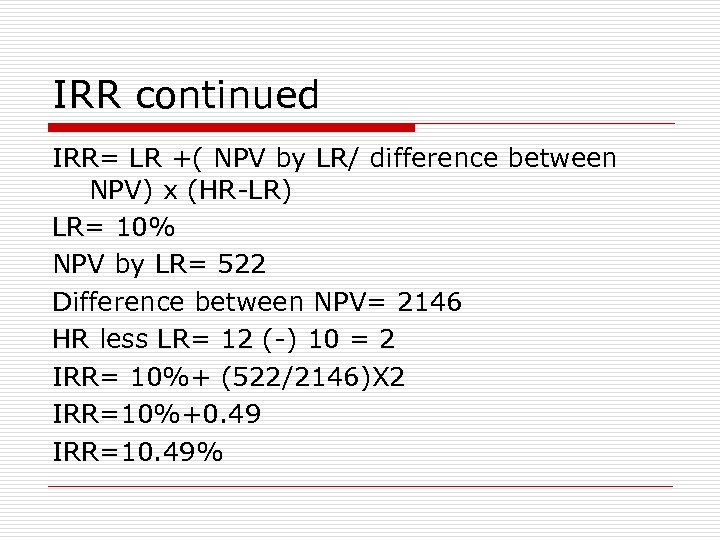

IRR continued IRR= LR +( NPV by LR/ difference between NPV) x (HR-LR) LR= 10% NPV by LR= 522 Difference between NPV= 2146 HR less LR= 12 (-) 10 = 2 IRR= 10%+ (522/2146)X 2 IRR=10%+0. 49 IRR=10. 49%

PRICING DECISIONS o o Full cost pricing Conversion cost pricing Marginal cost pricing Market based pricing

BUDGET o o Quantitative expression of management objective Budgets and standards Budgetary control Cash budget

PROFIT PLANNING o o o Budget & budgetary control Marginal costing CVP and break even point Comparative cost analysis ROCE

PRICING DECISIONS o o Full cost pricing Conversion cost pricing Marginal cost pricing Market based pricing

Operating leverage Financial leverage o o OL= amount of fixed cost in a cost structure. Relationship between sales and op. profit FL= effect of financing decisions on return to owners. Relationship between operating profit and earning available to equity holders (owners)

BUDGET o o Quantitative expression of management objective Budgets and standards Budgetary control Cash budget

PROFIT PLANNING o o o Budget & budgetary control Marginal costing CVP and break even point Comparative cost analysis ROCE

PRICING DECISIONS o o Full cost pricing Conversion cost pricing Marginal cost pricing Market based pricing

Operating leverage Financial leverage o o OL= amount of fixed cost in a cost structure. Relationship between sales and op. profit FL= effect of financing decisions on return to owners. Relationship between operating profit and earning available to equity holders (owners)

Working capital o o Current assets less current liabilities = net working capital or net current assets Permanent working capital vs. variable working capital

Working capital cycle o o cash> Raw material > Work in progress > finished goods > Sales > Debtors > Cash> Operating cycle – it is a length of time between outlay on RM /wages /others AND inflow of cash from the sale of the goods

Examples from book o o o o P-369 P-375 P-377 P-379 P-380 P-385 P-387 P-393

Examples from book o o P-413 P-414 p-415 P-417

*** THANK YOU WISH YOU BEST OF LUCK sudaaba@iibf. org. in ***

ce080a4ef751a8f6cebdf5859f4a3734.ppt