2acd9243c621df2b67625f7aa3ef6f47.ppt

- Количество слайдов: 50

Financial Management - A short and concrete introduction -

Financial Management - A short and concrete introduction -

Runar Knudsen • 27 years • Master in Science of Business from University of Nordland in 2009 • Special field; investments and financing • 21 months in a regional trainee program • Experience from bank, venture capital and consulting • Started in Rapp Marine May 2011 – financial advisor • Main tasks in Rapp Marine: liquidity control, accounting, currency and interest handling • Off work activities: training, movies, fishing, friends and real estate

Runar Knudsen • 27 years • Master in Science of Business from University of Nordland in 2009 • Special field; investments and financing • 21 months in a regional trainee program • Experience from bank, venture capital and consulting • Started in Rapp Marine May 2011 – financial advisor • Main tasks in Rapp Marine: liquidity control, accounting, currency and interest handling • Off work activities: training, movies, fishing, friends and real estate

Objective in presentation • To create awareness and stimulate to further learning • To understand that everything hangs together • Better knowledge of the group; economic situation and risk factors • To see financial management in accordance with AX (ERP system) • To develop an ability to plan and control the cash flow • To create contact points – RM can help with financial management

Objective in presentation • To create awareness and stimulate to further learning • To understand that everything hangs together • Better knowledge of the group; economic situation and risk factors • To see financial management in accordance with AX (ERP system) • To develop an ability to plan and control the cash flow • To create contact points – RM can help with financial management

Financial management – definition and facts! “It is the art and science of managing money/resources” • The most essential requirement of any organized business or activity • An important risk control and guidance tool • Interdependence with other areas of management • Important to maximize the value of the firm

Financial management – definition and facts! “It is the art and science of managing money/resources” • The most essential requirement of any organized business or activity • An important risk control and guidance tool • Interdependence with other areas of management • Important to maximize the value of the firm

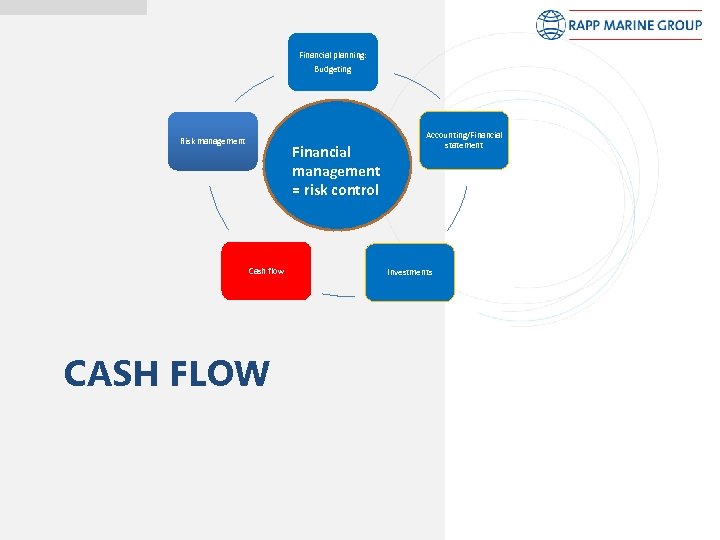

Financial planning: Budget Risk management Financial management = risk control Cash flow Accounting/Financial statement Investments FINANCIAL MANAGEMENT INSTRUMENTS

Financial planning: Budget Risk management Financial management = risk control Cash flow Accounting/Financial statement Investments FINANCIAL MANAGEMENT INSTRUMENTS

Financial planning: Budgeting Risk management Financial management = risk control Cash flow Accounting/Financial statement Investments FINANCIAL PLANNING BUDGETING

Financial planning: Budgeting Risk management Financial management = risk control Cash flow Accounting/Financial statement Investments FINANCIAL PLANNING BUDGETING

Budget «An estimate of cost, revenues and resources over a specific period, reflecting a reading of future financial conditions and goals” • An important instrument of the financial management used as a tool in planning and control • Setting targets for revenue and expenditure • Setting targets for efficiency and equity • A reference point for the management, board and owners • Is all about allocating resources In practice: • We are budgeting both P&L statement and the balance sheet

Budget «An estimate of cost, revenues and resources over a specific period, reflecting a reading of future financial conditions and goals” • An important instrument of the financial management used as a tool in planning and control • Setting targets for revenue and expenditure • Setting targets for efficiency and equity • A reference point for the management, board and owners • Is all about allocating resources In practice: • We are budgeting both P&L statement and the balance sheet

Importance of a good budget process • Budget is the foundation in our financial management system! • Budget process can be a useful review of the business processes, and give a understanding of what creates results • Starting point of action and allocation of resources • Lays the foundation for financing and measures • Should be a good control and plan tool • Can give a good motivation for employees Effect on bad financial management: - We are sailing a ship without compass. - Warning lamps comes on to late

Importance of a good budget process • Budget is the foundation in our financial management system! • Budget process can be a useful review of the business processes, and give a understanding of what creates results • Starting point of action and allocation of resources • Lays the foundation for financing and measures • Should be a good control and plan tool • Can give a good motivation for employees Effect on bad financial management: - We are sailing a ship without compass. - Warning lamps comes on to late

Types of budget 1. Operating budget- related to volume of work anticipated and recurring expenditures for operation and maintenance of services e. g. salaries and wages, supplies, support utilities, maintenance 2. Departmental budget 3. Project budget : probable expenditure and likely revenue for a specific project 4. Capital budget ( non recurrent ): meant for growth ( new facilities), replacement of obsolete. 5. Cash budget : provision for anticipated cash expenditures , for planning the cash flow e. g. salaries, bills etc. budget

Types of budget 1. Operating budget- related to volume of work anticipated and recurring expenditures for operation and maintenance of services e. g. salaries and wages, supplies, support utilities, maintenance 2. Departmental budget 3. Project budget : probable expenditure and likely revenue for a specific project 4. Capital budget ( non recurrent ): meant for growth ( new facilities), replacement of obsolete. 5. Cash budget : provision for anticipated cash expenditures , for planning the cash flow e. g. salaries, bills etc. budget

Planning & preparing budget • Well in advance. “Rush” work can hurt the organization • An opportunity to plan expansion or improving services , hence involve staff and all departments • Standardized solutions through AX and Excel. Makes a complex process simpler. • Plans must be realistic

Planning & preparing budget • Well in advance. “Rush” work can hurt the organization • An opportunity to plan expansion or improving services , hence involve staff and all departments • Standardized solutions through AX and Excel. Makes a complex process simpler. • Plans must be realistic

Advantages 1)Quantitative expression of the planning 2 )Evaluation of financial performance in accordance with plans 3 ) Controlling costs 4 ) Optimizing the use of resources 5) Directing the total efforts in to the most profitable channels

Advantages 1)Quantitative expression of the planning 2 )Evaluation of financial performance in accordance with plans 3 ) Controlling costs 4 ) Optimizing the use of resources 5) Directing the total efforts in to the most profitable channels

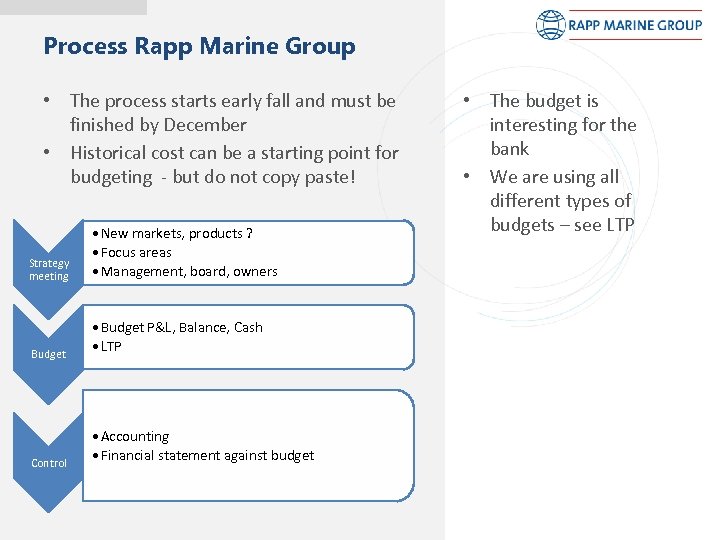

Process Rapp Marine Group • The process starts early fall and must be finished by December • Historical cost can be a starting point for budgeting - but do not copy paste! Strategy meeting • New markets, products ? • Focus areas • Management, board, owners Budget • Budget P&L, Balance, Cash • LTP Control • Accounting • Financial statement against budget • The budget is interesting for the bank • We are using all different types of budgets – see LTP

Process Rapp Marine Group • The process starts early fall and must be finished by December • Historical cost can be a starting point for budgeting - but do not copy paste! Strategy meeting • New markets, products ? • Focus areas • Management, board, owners Budget • Budget P&L, Balance, Cash • LTP Control • Accounting • Financial statement against budget • The budget is interesting for the bank • We are using all different types of budgets – see LTP

Budget and AX (ERP system) • Complete budget is implemented in AX • We can: - easy check budget against real numbers - Better stock control - Every department can check how they are doing - Linking against bank and invoice, makes the system adequate to have solid follow ups - Projects can also be followed up in AX (stock handling, payments and so on) We are using the AX system as an integrated part of our budget and control focus! Both in administration and in each department.

Budget and AX (ERP system) • Complete budget is implemented in AX • We can: - easy check budget against real numbers - Better stock control - Every department can check how they are doing - Linking against bank and invoice, makes the system adequate to have solid follow ups - Projects can also be followed up in AX (stock handling, payments and so on) We are using the AX system as an integrated part of our budget and control focus! Both in administration and in each department.

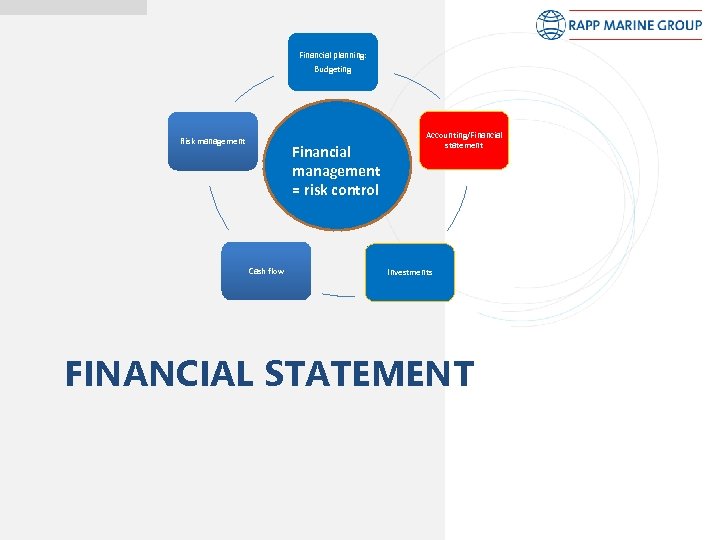

Financial planning: Budgeting Risk management Financial management = risk control Cash flow Accounting/Financial statement Investments FINANCIAL STATEMENT

Financial planning: Budgeting Risk management Financial management = risk control Cash flow Accounting/Financial statement Investments FINANCIAL STATEMENT

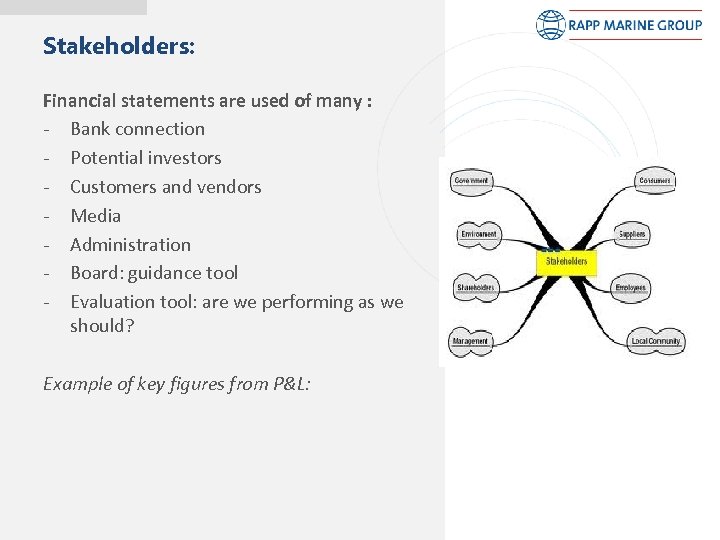

Stakeholders: Financial statements are used of many : - Bank connection - Potential investors - Customers and vendors - Media - Administration - Board: guidance tool - Evaluation tool: are we performing as we should? Example of key figures from P&L:

Stakeholders: Financial statements are used of many : - Bank connection - Potential investors - Customers and vendors - Media - Administration - Board: guidance tool - Evaluation tool: are we performing as we should? Example of key figures from P&L:

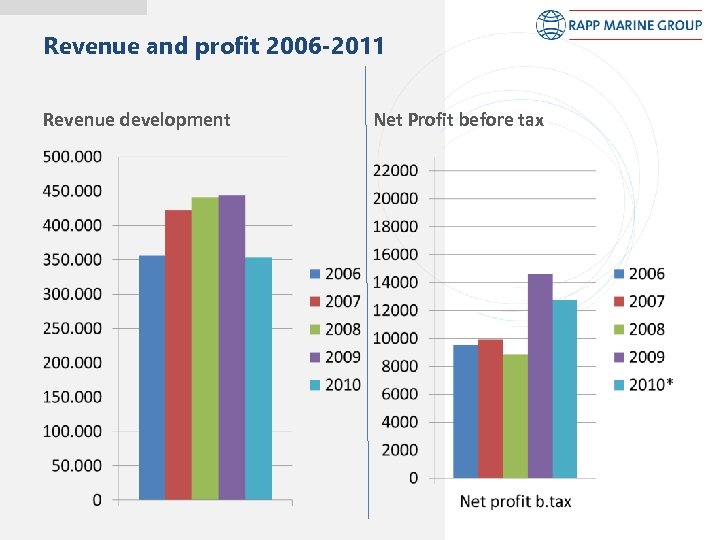

Revenue and profit 2006 -2011 Revenue development Net Profit before tax

Revenue and profit 2006 -2011 Revenue development Net Profit before tax

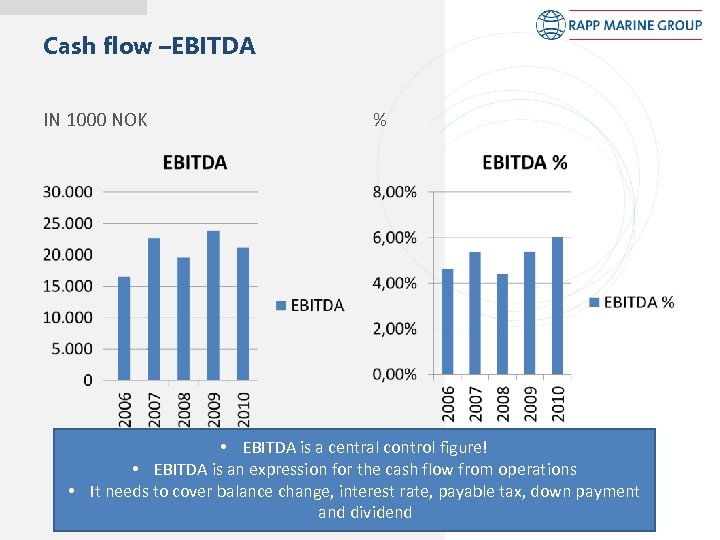

Cash flow –EBITDA IN 1000 NOK % • EBITDA is a central control figure! • EBITDA is an expression for the cash flow from operations • It needs to cover balance change, interest rate, payable tax, down payment and dividend

Cash flow –EBITDA IN 1000 NOK % • EBITDA is a central control figure! • EBITDA is an expression for the cash flow from operations • It needs to cover balance change, interest rate, payable tax, down payment and dividend

Accounting • An art of recording , classifying and summarizing data in a significant manner and interpreting the results • Data may be in form of money transactions and events which are, in part at least , of a financial character • Is done to keep track of cost. All costs need to be linked to an account and an department/project • With an ERP system, cost check is just “two” clicks away

Accounting • An art of recording , classifying and summarizing data in a significant manner and interpreting the results • Data may be in form of money transactions and events which are, in part at least , of a financial character • Is done to keep track of cost. All costs need to be linked to an account and an department/project • With an ERP system, cost check is just “two” clicks away

Types of accounting 1. Financial accounting: documentation of facts - daily transactions 2. Cost accounting : expenditure for a particular service/product/project 3. Management accounting : Analysis and interpretation of financial information for management purpose

Types of accounting 1. Financial accounting: documentation of facts - daily transactions 2. Cost accounting : expenditure for a particular service/product/project 3. Management accounting : Analysis and interpretation of financial information for management purpose

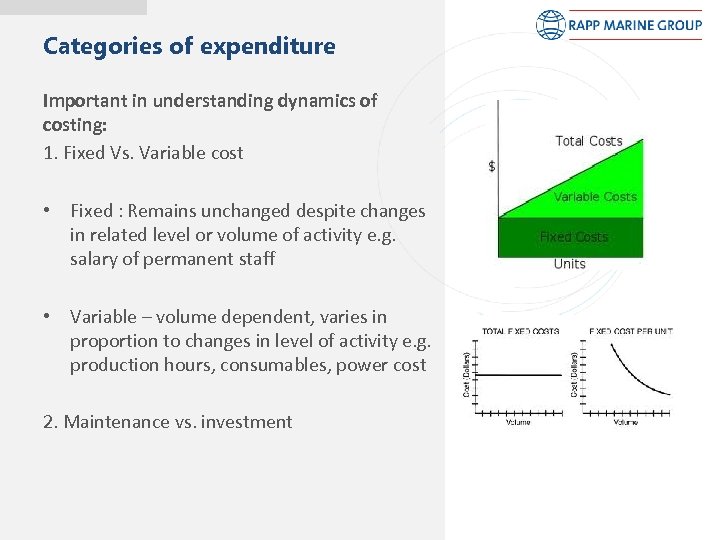

Categories of expenditure Important in understanding dynamics of costing: 1. Fixed Vs. Variable cost • Fixed : Remains unchanged despite changes in related level or volume of activity e. g. salary of permanent staff • Variable – volume dependent, varies in proportion to changes in level of activity e. g. production hours, consumables, power cost 2. Maintenance vs. investment

Categories of expenditure Important in understanding dynamics of costing: 1. Fixed Vs. Variable cost • Fixed : Remains unchanged despite changes in related level or volume of activity e. g. salary of permanent staff • Variable – volume dependent, varies in proportion to changes in level of activity e. g. production hours, consumables, power cost 2. Maintenance vs. investment

P&L statement «is the number 1 guidance for stakeholders» • The board of directors will use the report in there decisions • Important for management and for each department • Are most often measured against budget numbers • A big negative deviation between P&L makes need for action • Measures share of fixed cost • Alert! The P&L statement doesn`t give a complete picture if the business is healthy or not!

P&L statement «is the number 1 guidance for stakeholders» • The board of directors will use the report in there decisions • Important for management and for each department • Are most often measured against budget numbers • A big negative deviation between P&L makes need for action • Measures share of fixed cost • Alert! The P&L statement doesn`t give a complete picture if the business is healthy or not!

Balance sheet - introduction • A financial statement that summarizes a company's assets, liabilities and shareholders' equity at a specific point in time. • It's called a balance sheet because the two sides balance out. This makes sense: a company has to pay for all the things it has (assets) by either borrowing money (liabilities) or getting it from shareholders (shareholders' equity). • Assets= Liabilities + Equity

Balance sheet - introduction • A financial statement that summarizes a company's assets, liabilities and shareholders' equity at a specific point in time. • It's called a balance sheet because the two sides balance out. This makes sense: a company has to pay for all the things it has (assets) by either borrowing money (liabilities) or getting it from shareholders (shareholders' equity). • Assets= Liabilities + Equity

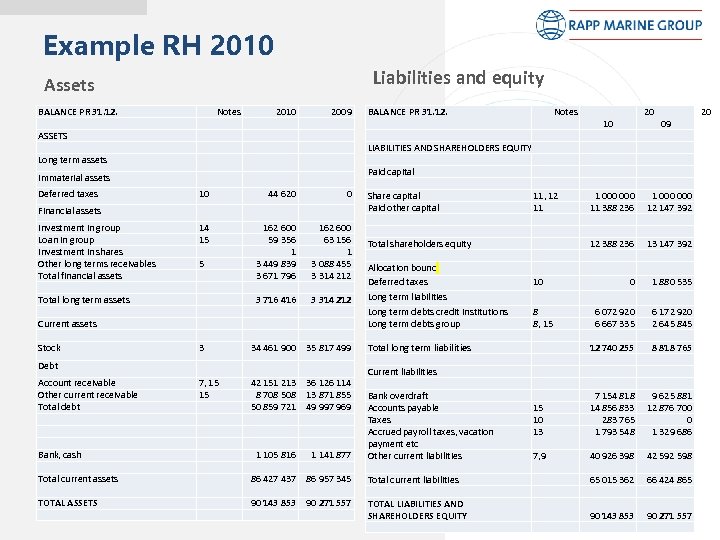

Example RH 2010 Liabilities and equity Assets BALANCE PR 31. 12. ASSETS Long term assets Immaterial assets Deferred taxes 10 Financial assets Investment in group Loan in group Investment in shares Other long terms receivables Total financial assets Total long term assets Current assets Stock 14 15 5 3 Debt Account receivable Other current receivable Total debt Bank, cash Total current assets TOTAL ASSETS 2010 2009 44 620 0 162 600 59 356 1 3 449 839 3 671 796 3 716 416 34 461 900 162 600 63 156 1 3 088 455 3 314 212 35 817 499 7, 15 15 42 151 213 8 708 50 859 721 1 105 816 86 427 437 36 126 114 13 871 855 49 997 969 1 141 877 86 957 345 90 143 853 90 271 557 Notes BALANCE PR 31. 12. Notes LIABILITIES AND SHAREHOLDERS EQUITY Paid capital Share capital 11, 12 Paid other capital 11 Total shareholders equity Allocation bound Deferred taxes 10 Long term liabilities Long term debts credit institutions 8 Long term debts group 8, 15 Total long term liabilities Current liabilities Bank overdraft Accounts payable 15 Taxes 10 Accrued payroll taxes, vacation 13 payment etc Other current liabilities 7, 9 Total current liabilities TOTAL LIABILITIES AND SHAREHOLDERS EQUITY 20 10 09 1 000 000 11 388 236 12 147 392 12 388 236 13 147 392 0 1 880 535 6 072 920 6 172 920 6 667 335 2 645 845 12 740 255 8 818 765 7 154 818 9 625 881 14 856 833 12 876 700 283 765 0 1 793 548 1 329 686 40 926 398 42 598 65 015 362 90 143 853 66 424 865 90 271 557

Example RH 2010 Liabilities and equity Assets BALANCE PR 31. 12. ASSETS Long term assets Immaterial assets Deferred taxes 10 Financial assets Investment in group Loan in group Investment in shares Other long terms receivables Total financial assets Total long term assets Current assets Stock 14 15 5 3 Debt Account receivable Other current receivable Total debt Bank, cash Total current assets TOTAL ASSETS 2010 2009 44 620 0 162 600 59 356 1 3 449 839 3 671 796 3 716 416 34 461 900 162 600 63 156 1 3 088 455 3 314 212 35 817 499 7, 15 15 42 151 213 8 708 50 859 721 1 105 816 86 427 437 36 126 114 13 871 855 49 997 969 1 141 877 86 957 345 90 143 853 90 271 557 Notes BALANCE PR 31. 12. Notes LIABILITIES AND SHAREHOLDERS EQUITY Paid capital Share capital 11, 12 Paid other capital 11 Total shareholders equity Allocation bound Deferred taxes 10 Long term liabilities Long term debts credit institutions 8 Long term debts group 8, 15 Total long term liabilities Current liabilities Bank overdraft Accounts payable 15 Taxes 10 Accrued payroll taxes, vacation 13 payment etc Other current liabilities 7, 9 Total current liabilities TOTAL LIABILITIES AND SHAREHOLDERS EQUITY 20 10 09 1 000 000 11 388 236 12 147 392 12 388 236 13 147 392 0 1 880 535 6 072 920 6 172 920 6 667 335 2 645 845 12 740 255 8 818 765 7 154 818 9 625 881 14 856 833 12 876 700 283 765 0 1 793 548 1 329 686 40 926 398 42 598 65 015 362 90 143 853 66 424 865 90 271 557

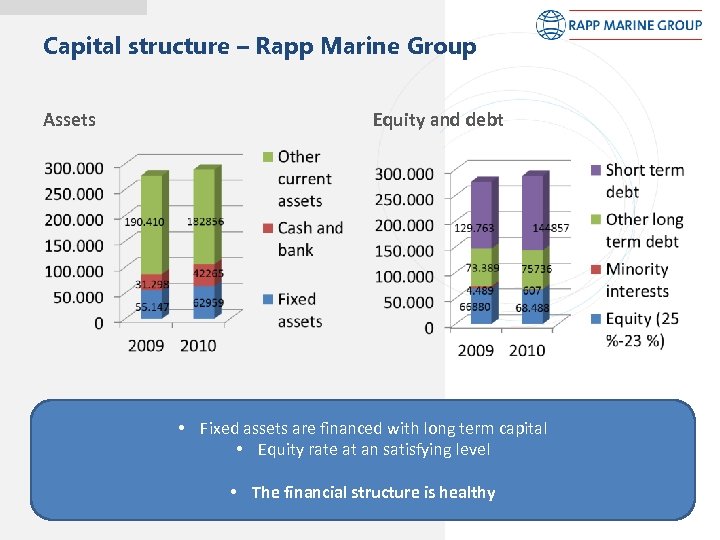

Capital structure – Rapp Marine Group Assets Equity and debt • Fixed assets are financed with long term capital • Equity rate at an satisfying level • The financial structure is healthy

Capital structure – Rapp Marine Group Assets Equity and debt • Fixed assets are financed with long term capital • Equity rate at an satisfying level • The financial structure is healthy

Financial planning: Budgeting Risk management Financial management = risk control Cash flow INVESTMENTS Accounting/Financial statement Investments

Financial planning: Budgeting Risk management Financial management = risk control Cash flow INVESTMENTS Accounting/Financial statement Investments

Investments • Investments is a long term obligation for the business and needs to be well analyzed • A bad investment will follow the business for many years • A long term commitment needs to be financed long term – matching of cash flows • A general guidance is to have a positive NPV – net present value. • Of course some investment are based on other factors like public regulation or safety matters.

Investments • Investments is a long term obligation for the business and needs to be well analyzed • A bad investment will follow the business for many years • A long term commitment needs to be financed long term – matching of cash flows • A general guidance is to have a positive NPV – net present value. • Of course some investment are based on other factors like public regulation or safety matters.

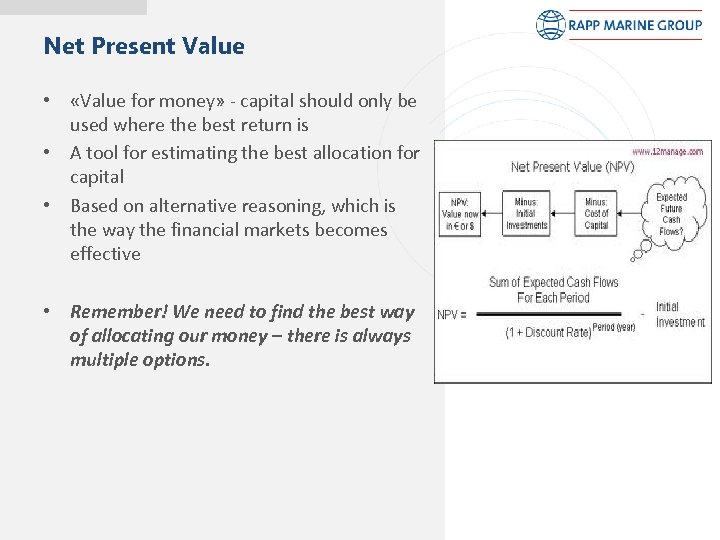

Net Present Value • «Value for money» - capital should only be used where the best return is • A tool for estimating the best allocation for capital • Based on alternative reasoning, which is the way the financial markets becomes effective • Remember! We need to find the best way of allocating our money – there is always multiple options.

Net Present Value • «Value for money» - capital should only be used where the best return is • A tool for estimating the best allocation for capital • Based on alternative reasoning, which is the way the financial markets becomes effective • Remember! We need to find the best way of allocating our money – there is always multiple options.

Financial planning: Budgeting Risk management Financial management = risk control Cash flow CASH FLOW Accounting/Financial statement Investments

Financial planning: Budgeting Risk management Financial management = risk control Cash flow CASH FLOW Accounting/Financial statement Investments

«CASH IS STILL KING!» “The cash flow shows the amount of cash generated and used by a company in a given period. “ • Is the number 1 most important figure • Is crucial for a business survival • Is a product of both the P&L, balance sheet and investments (financial, operations and investing). • Without adequate amount of cash your business is finished. • Cash flow can be attributed to a specific project, or to a business as a whole.

«CASH IS STILL KING!» “The cash flow shows the amount of cash generated and used by a company in a given period. “ • Is the number 1 most important figure • Is crucial for a business survival • Is a product of both the P&L, balance sheet and investments (financial, operations and investing). • Without adequate amount of cash your business is finished. • Cash flow can be attributed to a specific project, or to a business as a whole.

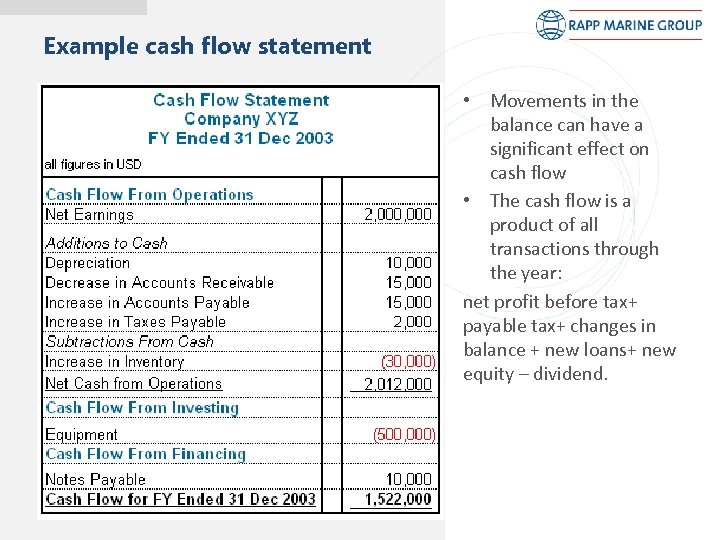

Example cash flow statement • Movements in the balance can have a significant effect on cash flow • The cash flow is a product of all transactions through the year: net profit before tax+ payable tax+ changes in balance + new loans+ new equity – dividend.

Example cash flow statement • Movements in the balance can have a significant effect on cash flow • The cash flow is a product of all transactions through the year: net profit before tax+ payable tax+ changes in balance + new loans+ new equity – dividend.

Focus areas to have a healthy cash flow: • Cash flow statement on a weekly and quarter basis • Awareness around credit times both to vendors and customers • Capital binding in stock • Reasonable bank conditions – interest + down payment period • A company can use a cash flow statement to predict future cash flow, which helps with matters in budgeting • Risk management tools revolving currency and interest

Focus areas to have a healthy cash flow: • Cash flow statement on a weekly and quarter basis • Awareness around credit times both to vendors and customers • Capital binding in stock • Reasonable bank conditions – interest + down payment period • A company can use a cash flow statement to predict future cash flow, which helps with matters in budgeting • Risk management tools revolving currency and interest

Growth and cash flow • In a growth period the cost comes before the profit • Bad liquidity control is the number 1 reason for insolvency • Growth increases the risk, so we need to take down the volatility in the cash flow with measures in front • An example will illustrate the need for a close focus on cash flow, especially in expansion periods:

Growth and cash flow • In a growth period the cost comes before the profit • Bad liquidity control is the number 1 reason for insolvency • Growth increases the risk, so we need to take down the volatility in the cash flow with measures in front • An example will illustrate the need for a close focus on cash flow, especially in expansion periods:

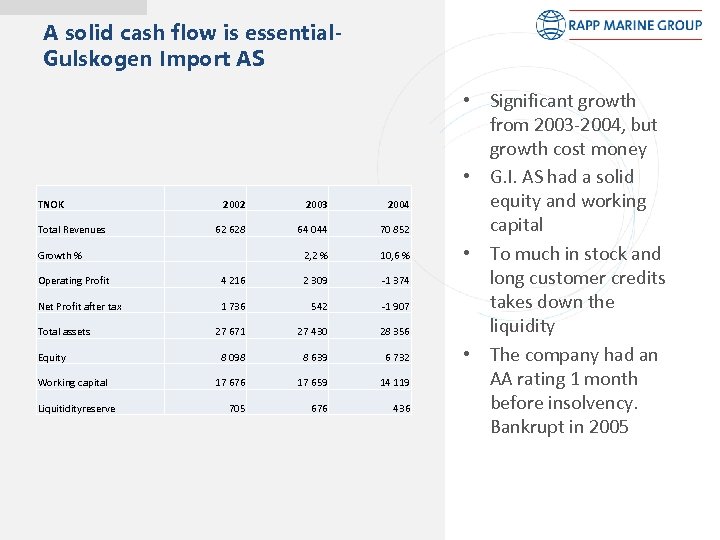

A solid cash flow is essential. Gulskogen Import AS TNOK Total Revenues 2002 2003 2004 62 628 64 044 70 852 2, 2 % 10, 6 % Growth % Operating Profit 4 216 2 309 -1 374 Net Profit after tax 1 736 542 -1 907 27 671 27 430 28 356 8 098 8 639 6 732 17 676 17 659 14 119 705 676 436 Total assets Equity Working capital Liquitidityreserve • Significant growth from 2003 -2004, but growth cost money • G. I. AS had a solid equity and working capital • To much in stock and long customer credits takes down the liquidity • The company had an AA rating 1 month before insolvency. Bankrupt in 2005

A solid cash flow is essential. Gulskogen Import AS TNOK Total Revenues 2002 2003 2004 62 628 64 044 70 852 2, 2 % 10, 6 % Growth % Operating Profit 4 216 2 309 -1 374 Net Profit after tax 1 736 542 -1 907 27 671 27 430 28 356 8 098 8 639 6 732 17 676 17 659 14 119 705 676 436 Total assets Equity Working capital Liquitidityreserve • Significant growth from 2003 -2004, but growth cost money • G. I. AS had a solid equity and working capital • To much in stock and long customer credits takes down the liquidity • The company had an AA rating 1 month before insolvency. Bankrupt in 2005

What to learn from this example? Main objective: cash flow “It’s only when the tide goes out that you discover who’s been swimming naked. ” • In a growing period cash flow is extra essential • We can do means in own business to take down the risk – growth leaves the business more vulnerable to an economic downturn. • The financial crisis underlines the need for a strong focus on cash flow • We must be proactive in good times - stock - credit strategy - purchase - efficiency in production - finance including currency handling

What to learn from this example? Main objective: cash flow “It’s only when the tide goes out that you discover who’s been swimming naked. ” • In a growing period cash flow is extra essential • We can do means in own business to take down the risk – growth leaves the business more vulnerable to an economic downturn. • The financial crisis underlines the need for a strong focus on cash flow • We must be proactive in good times - stock - credit strategy - purchase - efficiency in production - finance including currency handling

Follow up liquidity - RM • The board gets a quarter statement every second month - payments - order backlog - purchase Much of this information can be gathered from the AX system. • If a company is in trouble a weekly cash flow is made All of this information comes from the system

Follow up liquidity - RM • The board gets a quarter statement every second month - payments - order backlog - purchase Much of this information can be gathered from the AX system. • If a company is in trouble a weekly cash flow is made All of this information comes from the system

Other things • Constantly supervising the stock to minimize capital binding • Big contracts with milestone payments, must, as far as possible, match our cost of production. Awareness from the sellers are important • Credit time to the customer should be as short as possible, and credit time to vendors as long as possible • It is expensive to keep drawing on the line of credit • The cash situation requires a strong focus from every department in the organization

Other things • Constantly supervising the stock to minimize capital binding • Big contracts with milestone payments, must, as far as possible, match our cost of production. Awareness from the sellers are important • Credit time to the customer should be as short as possible, and credit time to vendors as long as possible • It is expensive to keep drawing on the line of credit • The cash situation requires a strong focus from every department in the organization

Financial planning: Budgeting Risk management Accounting/Financial statement Financial management = risk control Cash flow Investments RISK MANAGEMENT

Financial planning: Budgeting Risk management Accounting/Financial statement Financial management = risk control Cash flow Investments RISK MANAGEMENT

Risk handling • It is vital to keep the fluctuations in cash flow on a moderate level • Interest rates and, especially, currency fluctuations can damage the result, and the cash flow • A stronger RSD will decrease the amount coming in when EUR is sold • There is need for a strategy around currency and interest rates • Which kind of strategy will depend on the business model and liquidity situation • Risk level in the company depends on the economic situation, owners risk willingness and future plans (growth? )

Risk handling • It is vital to keep the fluctuations in cash flow on a moderate level • Interest rates and, especially, currency fluctuations can damage the result, and the cash flow • A stronger RSD will decrease the amount coming in when EUR is sold • There is need for a strategy around currency and interest rates • Which kind of strategy will depend on the business model and liquidity situation • Risk level in the company depends on the economic situation, owners risk willingness and future plans (growth? )

“A form of risk that arises from the change in price of one currency against another. Whenever investors or companies have assets or business operations across national borders, they face currency risk if their positions are not hedged. “ CURRENCY RISK

“A form of risk that arises from the change in price of one currency against another. Whenever investors or companies have assets or business operations across national borders, they face currency risk if their positions are not hedged. “ CURRENCY RISK

Currency risk • When it comes to currency, time can both be our friend and enemy • The economy department and the sellers needs to be linked together • The strategy needed will be affected by the liquidity situation (SAGA story) • It is the net exposure in a currency which is important • Risk level will affect the growth potential of the business, e. g. the expected growth in budget

Currency risk • When it comes to currency, time can both be our friend and enemy • The economy department and the sellers needs to be linked together • The strategy needed will be affected by the liquidity situation (SAGA story) • It is the net exposure in a currency which is important • Risk level will affect the growth potential of the business, e. g. the expected growth in budget

Short about currency strategy • History can tell something about the future • Currency risk can exist both in the balance sheet and P & L. • Sensitivity analysis shows how vulnerable the company are • The financial markets can be used to take down the risk: derivate and options • Based on the risk profile, expected net exposure and liquidity situation, a strategy can be made

Short about currency strategy • History can tell something about the future • Currency risk can exist both in the balance sheet and P & L. • Sensitivity analysis shows how vulnerable the company are • The financial markets can be used to take down the risk: derivate and options • Based on the risk profile, expected net exposure and liquidity situation, a strategy can be made

Currency handling RM • Rapp Marine is the overhead for currency handling • Information from the AX system and from sellers are used • Historical net exposure are found in AX • Dollar is more volatile and needs to be more secured • The risk area is from an offer is made to acceptance • Uses the currency rate in contract as an indicative of what is an good exchange rate • We wish to be proactive to raise competitiveness; sell USD or EUR when the NOK is weak without having an exact order to link it with • Volatility currency EUR/NOK – ca. 7 % USD/NOK- ca. 13 % USD are more essential to secure

Currency handling RM • Rapp Marine is the overhead for currency handling • Information from the AX system and from sellers are used • Historical net exposure are found in AX • Dollar is more volatile and needs to be more secured • The risk area is from an offer is made to acceptance • Uses the currency rate in contract as an indicative of what is an good exchange rate • We wish to be proactive to raise competitiveness; sell USD or EUR when the NOK is weak without having an exact order to link it with • Volatility currency EUR/NOK – ca. 7 % USD/NOK- ca. 13 % USD are more essential to secure

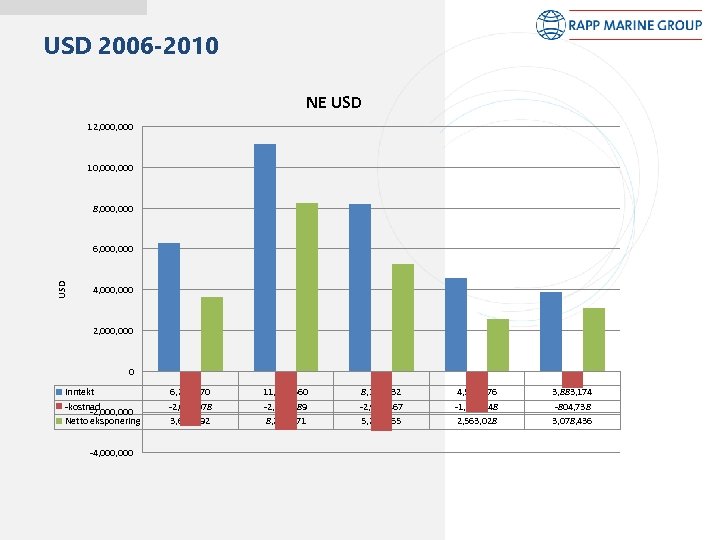

USD 2006 -2010 NE USD 12, 000 10, 000 8, 000 USD 6, 000 4, 000 2, 000 0 Inntekt -kostnad -2, 000 Netto eksponering -4, 000 2006 6, 273, 670 -2, 662, 978 3, 610, 692 2007 11, 108, 360 -2, 874, 889 8, 233, 471 2008 8, 184, 832 -2, 919, 467 5, 265, 365 2009 4, 545, 976 -1, 982, 948 2, 563, 028 2010 3, 883, 174 -804, 738 3, 078, 436

USD 2006 -2010 NE USD 12, 000 10, 000 8, 000 USD 6, 000 4, 000 2, 000 0 Inntekt -kostnad -2, 000 Netto eksponering -4, 000 2006 6, 273, 670 -2, 662, 978 3, 610, 692 2007 11, 108, 360 -2, 874, 889 8, 233, 471 2008 8, 184, 832 -2, 919, 467 5, 265, 365 2009 4, 545, 976 -1, 982, 948 2, 563, 028 2010 3, 883, 174 -804, 738 3, 078, 436

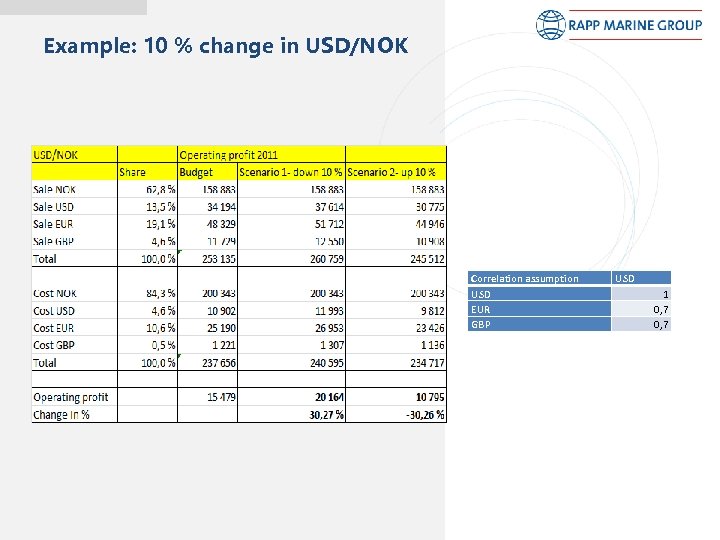

Example: 10 % change in USD/NOK Correlation assumption USD EUR GBP USD 1 0, 7

Example: 10 % change in USD/NOK Correlation assumption USD EUR GBP USD 1 0, 7

Derivate contracts • We are selling/buying something we don`t have – with delivery at a specific date • International currency can be viewed as the same as a product • Example: Company X Has a net exposure of EUR and wants to sell. We then need to: - Borrow EUR to a rate for X months - Exchange and invest in home country for X months - At the end of derivate contract we need to pay back the EUR loan - We get spot as initial sales day+/- interest points - This is handled by an currency broker in the bank •

Derivate contracts • We are selling/buying something we don`t have – with delivery at a specific date • International currency can be viewed as the same as a product • Example: Company X Has a net exposure of EUR and wants to sell. We then need to: - Borrow EUR to a rate for X months - Exchange and invest in home country for X months - At the end of derivate contract we need to pay back the EUR loan - We get spot as initial sales day+/- interest points - This is handled by an currency broker in the bank •

Derivate contracts Case: RH gets a contract worth USD 1 000. 50 % Payment in 6 months – the rest in 1 year. Exchange rate USD/NOK used 5, 7. Spot USD/NOK 5, 75. We want to secure the USD position. What do we do?

Derivate contracts Case: RH gets a contract worth USD 1 000. 50 % Payment in 6 months – the rest in 1 year. Exchange rate USD/NOK used 5, 7. Spot USD/NOK 5, 75. We want to secure the USD position. What do we do?

Handling: • Use historical numbers to evaluate the need for dollars to pay bills – is the future need for dollar different? • Secure the payment by using the financial markets • We are selling something we don`t have: - Borrow dollar for 6 and 12 months. Interest rate USA 2 % - Exchange and invest in secure interest paper in Norway. Interest rate 4 % - We got a future USD/ NOK from spot+ points for interest different - Agio will be about 0, 13 or 130 000 NOK(5, 83 -5, 70) with 100 % sale •

Handling: • Use historical numbers to evaluate the need for dollars to pay bills – is the future need for dollar different? • Secure the payment by using the financial markets • We are selling something we don`t have: - Borrow dollar for 6 and 12 months. Interest rate USA 2 % - Exchange and invest in secure interest paper in Norway. Interest rate 4 % - We got a future USD/ NOK from spot+ points for interest different - Agio will be about 0, 13 or 130 000 NOK(5, 83 -5, 70) with 100 % sale •

Advantages derivate: • No up front payments – liquidity friendly • The contract period can be shortened or enhanced – but this can cost liquidity • An easy tool to understand use • Cost efficient But it can be dangerous to over secure! AX: A ERP system will ease the analysis needed and makes the currency handling more safe. Communication between sellers and economy department is important!

Advantages derivate: • No up front payments – liquidity friendly • The contract period can be shortened or enhanced – but this can cost liquidity • An easy tool to understand use • Cost efficient But it can be dangerous to over secure! AX: A ERP system will ease the analysis needed and makes the currency handling more safe. Communication between sellers and economy department is important!

Conclusion Financial management is about: • Controlling the business • Matching market opportunities with resources within the company • Risk control • Information gathering and analysis • Providing information for board, owners and other stakeholders • Everybody needs to work together to have a satisfying financial management! There are multiple tools available to ease the management – a ERP system will help significant! • “Remember the wheel: everything are linked together. “

Conclusion Financial management is about: • Controlling the business • Matching market opportunities with resources within the company • Risk control • Information gathering and analysis • Providing information for board, owners and other stakeholders • Everybody needs to work together to have a satisfying financial management! There are multiple tools available to ease the management – a ERP system will help significant! • “Remember the wheel: everything are linked together. “