0e8c2848e6d9a5163ca02c4447795622.ppt

- Количество слайдов: 26

Financial Literacy Workshop Develop Program Content Module 3 of 4 DRAFT

Financial Literacy Workshop Develop Program Content Module 3 of 4 DRAFT

Workshop Objectives • Discuss key content of a successful program • • • Planning Budgeting Banking Managing student loans Managing credit Identify resources for valuable program content 2

Workshop Objectives • Discuss key content of a successful program • • • Planning Budgeting Banking Managing student loans Managing credit Identify resources for valuable program content 2

Planning Discuss importance of planning & setting goals Academic • Financial • When setting goals Be realistic • Be specific • Make them measurable! • Have a timeframe • 3

Planning Discuss importance of planning & setting goals Academic • Financial • When setting goals Be realistic • Be specific • Make them measurable! • Have a timeframe • 3

Budgeting Recognize the importance of creating and sticking to a budget • • • 4 Enables you to stay on the path to reach your financial goals Makes it easier to plan and save Reduces stress Helps improve your credit and live within your means Discuss consequences of poor budgeting while in school

Budgeting Recognize the importance of creating and sticking to a budget • • • 4 Enables you to stay on the path to reach your financial goals Makes it easier to plan and save Reduces stress Helps improve your credit and live within your means Discuss consequences of poor budgeting while in school

What is a Budget? Income: money that comes from a job, loans, family, or other sources • Expenses: items and services you spend money on such as bills, tuition, transportation, and entertainment • Budget: the estimate of expected income and expenses • Income – Expenses = Budget 5

What is a Budget? Income: money that comes from a job, loans, family, or other sources • Expenses: items and services you spend money on such as bills, tuition, transportation, and entertainment • Budget: the estimate of expected income and expenses • Income – Expenses = Budget 5

Expenses Monthly and recurring expenses • • 6 Tuition and fees Books Food (meal plan may be included in tuition) Housing (dorm may be included in tuition) Utilities (phone, internet, electric, gas, etc. ) Transportation Insurance – Health and Auto Others

Expenses Monthly and recurring expenses • • 6 Tuition and fees Books Food (meal plan may be included in tuition) Housing (dorm may be included in tuition) Utilities (phone, internet, electric, gas, etc. ) Transportation Insurance – Health and Auto Others

Needs Vs. Wants in a Budget Differentiate between things you want and things you need when creating a budget: • • • 7 Eating out vs. dining hall or cooking New phone vs. current serviceable phone Size of data usage plan for cell phone/tablet Going to movie vs. renting movies Spring break trip vs. staying in place Expensive clothes & shoes vs. sale shopping

Needs Vs. Wants in a Budget Differentiate between things you want and things you need when creating a budget: • • • 7 Eating out vs. dining hall or cooking New phone vs. current serviceable phone Size of data usage plan for cell phone/tablet Going to movie vs. renting movies Spring break trip vs. staying in place Expensive clothes & shoes vs. sale shopping

Living Within Your Means Track your daily spending • Determine your monthly expenses • Estimate your monthly income • FSA Budget Calculator Expenses > Income = Living Over Your Means • 8

Living Within Your Means Track your daily spending • Determine your monthly expenses • Estimate your monthly income • FSA Budget Calculator Expenses > Income = Living Over Your Means • 8

Benefits of Using Financial Institutions Convenience • Safety • Cost • Financial future • 9

Benefits of Using Financial Institutions Convenience • Safety • Cost • Financial future • 9

Detriments of Being Unbanked • • • 10 High transaction fees to access money Inconvenient to cash checks – takes time & energy to access your own money Inability to earn interest on money saved No easy access to cash in emergency Diminished opportunity to manage money, build investments, and plan for future financial success

Detriments of Being Unbanked • • • 10 High transaction fees to access money Inconvenient to cash checks – takes time & energy to access your own money Inability to earn interest on money saved No easy access to cash in emergency Diminished opportunity to manage money, build investments, and plan for future financial success

Financial Institutions • Types of institutions • • • Types of accounts • • Checking Savings Emergency funds Fees & requirements • • Bank Credit Union Minimum balances Service fees Overdraft fees Detriments of being unbanked 11

Financial Institutions • Types of institutions • • • Types of accounts • • Checking Savings Emergency funds Fees & requirements • • Bank Credit Union Minimum balances Service fees Overdraft fees Detriments of being unbanked 11

Types of Institutions Bank: Make loans, pay checks, accept deposits and provide other financial services • Anyone can use their services • Subject to federal and state laws to protect consumers • Credit Union: Same services as bank • Non-profit owned by people who have something in common • Must be a member of the credit union to use services • 12

Types of Institutions Bank: Make loans, pay checks, accept deposits and provide other financial services • Anyone can use their services • Subject to federal and state laws to protect consumers • Credit Union: Same services as bank • Non-profit owned by people who have something in common • Must be a member of the credit union to use services • 12

Types of Accounts Checking • • • Allows you to pay bills and buy goods with the money you have deposited Pay for things using a check, an ATM or debit card, on online banking Money spent comes directly from your account Savings • • • 13 Often earns interest Usually no used like a checking account May allow use of an ATM or debit card

Types of Accounts Checking • • • Allows you to pay bills and buy goods with the money you have deposited Pay for things using a check, an ATM or debit card, on online banking Money spent comes directly from your account Savings • • • 13 Often earns interest Usually no used like a checking account May allow use of an ATM or debit card

Emergency Fund Savings should be used for short-term and longterm goals • Emergency funds should be a separate amount used for unexpected expenses, such as: • • 14 Car and home repairs Loss of job Other unexpected expenses or accidents

Emergency Fund Savings should be used for short-term and longterm goals • Emergency funds should be a separate amount used for unexpected expenses, such as: • • 14 Car and home repairs Loss of job Other unexpected expenses or accidents

Fees and Requirements Some accounts may have: Monthly maintenance fees • Penalty fees • Overdraft fees • Required to open an account: Prove your identity (driver’s license or ID card) • Provide Social Security number • 15

Fees and Requirements Some accounts may have: Monthly maintenance fees • Penalty fees • Overdraft fees • Required to open an account: Prove your identity (driver’s license or ID card) • Provide Social Security number • 15

Things to Know About the Bank • What are the fees and what options are free? • • • ATM and debit cards Withdrawal limits per month Requirements for opening & maintaining account? Overdraft protection and low balance alerts? Are the locations, hours and ATMs convenient? Is it insured by FDIC/NCUA? Mobile/online banking options? Annual percentage yield (APY)? Do the employees speak my language? 16

Things to Know About the Bank • What are the fees and what options are free? • • • ATM and debit cards Withdrawal limits per month Requirements for opening & maintaining account? Overdraft protection and low balance alerts? Are the locations, hours and ATMs convenient? Is it insured by FDIC/NCUA? Mobile/online banking options? Annual percentage yield (APY)? Do the employees speak my language? 16

Sources of Funding for Education Grants • Scholarships • Loans • Family contributions • Employment • • Work study • Private 17

Sources of Funding for Education Grants • Scholarships • Loans • Family contributions • Employment • • Work study • Private 17

Managing Student Loans • Loan Terminology • • • Principal Interest rate – fixed vs. variable Grace period Identify types of loans & pros and cons of each • Understanding Financial Aid Award letters • Impact of paying interest while in school • 18

Managing Student Loans • Loan Terminology • • • Principal Interest rate – fixed vs. variable Grace period Identify types of loans & pros and cons of each • Understanding Financial Aid Award letters • Impact of paying interest while in school • 18

Managing Student Loans, Continued Describe repayment process: • Grace period actions • How to contact servicer • What to do if you have difficulty repaying • Loan consolidation • Repayment options • Consequences of default 19

Managing Student Loans, Continued Describe repayment process: • Grace period actions • How to contact servicer • What to do if you have difficulty repaying • Loan consolidation • Repayment options • Consequences of default 19

FSA Loan Counseling Resources • Office of Federal Student Aid counseling resources • • • 20 Entrance Counseling PLUS Counseling Financial Awareness Counseling Exit Counseling Student. Loans. gov provides ALL Federal Student Aid electronic loan counseling, in one location.

FSA Loan Counseling Resources • Office of Federal Student Aid counseling resources • • • 20 Entrance Counseling PLUS Counseling Financial Awareness Counseling Exit Counseling Student. Loans. gov provides ALL Federal Student Aid electronic loan counseling, in one location.

Student Loans: Impact on Your Future Demonstrate relationship between graduating on time, minimizing loans and future financial success • Completing school • Strategies for successful transition into workforce • Income-based repayment options • How to avoid scams 21

Student Loans: Impact on Your Future Demonstrate relationship between graduating on time, minimizing loans and future financial success • Completing school • Strategies for successful transition into workforce • Income-based repayment options • How to avoid scams 21

Managing Credit • • Increased debt impacts school performance Borrowing impacts future financial success What is credit Credit score Employers check credit history Poor credit limits your ability to rent and buy housing Debt and worry lead to anxiety and may affect health 22

Managing Credit • • Increased debt impacts school performance Borrowing impacts future financial success What is credit Credit score Employers check credit history Poor credit limits your ability to rent and buy housing Debt and worry lead to anxiety and may affect health 22

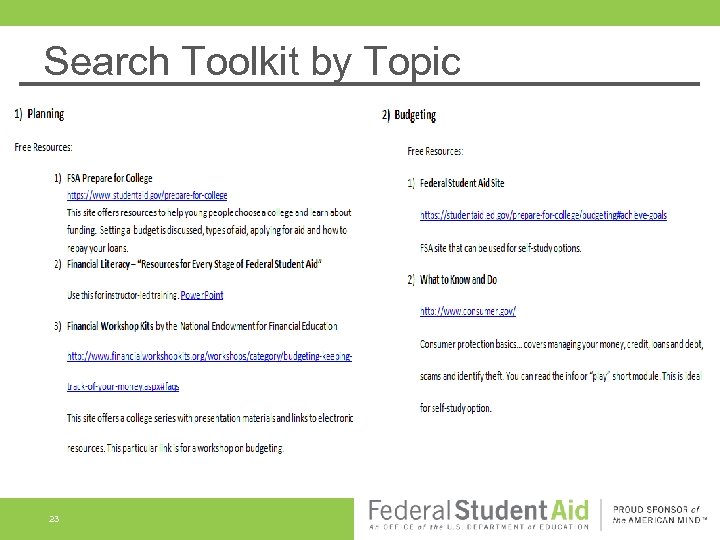

Search Toolkit by Topic 23

Search Toolkit by Topic 23

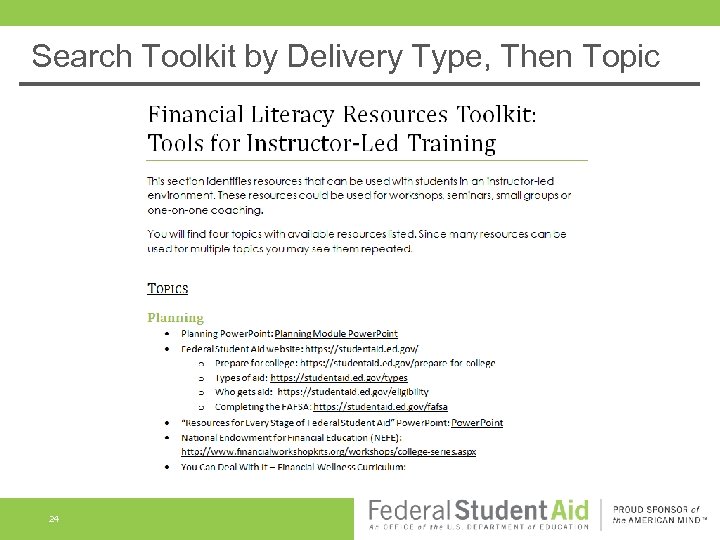

Search Toolkit by Delivery Type, Then Topic 24

Search Toolkit by Delivery Type, Then Topic 24

Summary Students have different needs when it comes to financial literacy • A successful program offers something for each need • Program should discuss: • • • 25 Planning for the financial future Budgeting Managing student loans Managing credit

Summary Students have different needs when it comes to financial literacy • A successful program offers something for each need • Program should discuss: • • • 25 Planning for the financial future Budgeting Managing student loans Managing credit

What to Expect Next The last module will discuss program implementation 26

What to Expect Next The last module will discuss program implementation 26