0df966b9ccf339959b5f966b35b5927b.ppt

- Количество слайдов: 22

Financial Leverage and Capital Structure Policy

Financial Leverage and Capital Structure Policy

Financial Leverage and Capital Structure Policy n Topic Organization n The Capital Structure Question n The Effect of Financial Leverage on Firm Value and Cost of Capital n M&M Propositions I and II: u without Corporate Taxes u with Bankruptcy Costs n Optimal Capital Structure Vassil Mihov

Financial Leverage and Capital Structure Policy n Topic Organization n The Capital Structure Question n The Effect of Financial Leverage on Firm Value and Cost of Capital n M&M Propositions I and II: u without Corporate Taxes u with Bankruptcy Costs n Optimal Capital Structure Vassil Mihov

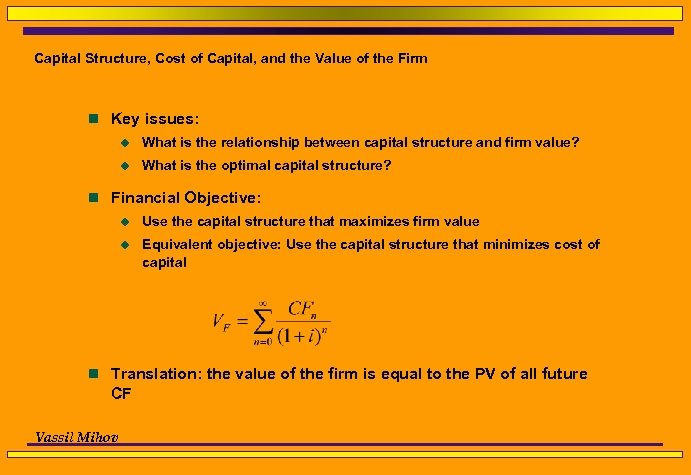

Capital Structure, Cost of Capital, and the Value of the Firm n Key issues: u What is the relationship between capital structure and firm value? u What is the optimal capital structure? n Financial Objective: u Use the capital structure that maximizes firm value u Equivalent objective: Use the capital structure that minimizes cost of capital n Translation: the value of the firm is equal to the PV of all future CF Vassil Mihov

Capital Structure, Cost of Capital, and the Value of the Firm n Key issues: u What is the relationship between capital structure and firm value? u What is the optimal capital structure? n Financial Objective: u Use the capital structure that maximizes firm value u Equivalent objective: Use the capital structure that minimizes cost of capital n Translation: the value of the firm is equal to the PV of all future CF Vassil Mihov

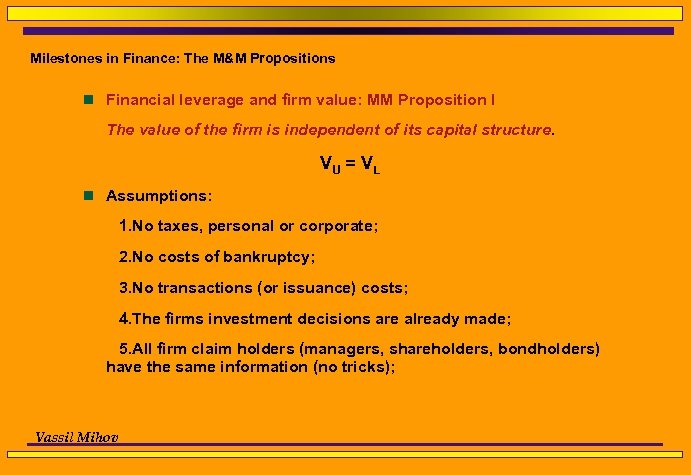

Milestones in Finance: The M&M Propositions n Financial leverage and firm value: MM Proposition I The value of the firm is independent of its capital structure. VU = V L n Assumptions: 1. No taxes, personal or corporate; 2. No costs of bankruptcy; 3. No transactions (or issuance) costs; 4. The firms investment decisions are already made; 5. All firm claim holders (managers, shareholders, bondholders) have the same information (no tricks); Vassil Mihov

Milestones in Finance: The M&M Propositions n Financial leverage and firm value: MM Proposition I The value of the firm is independent of its capital structure. VU = V L n Assumptions: 1. No taxes, personal or corporate; 2. No costs of bankruptcy; 3. No transactions (or issuance) costs; 4. The firms investment decisions are already made; 5. All firm claim holders (managers, shareholders, bondholders) have the same information (no tricks); Vassil Mihov

n Intuition: The value of the firm is the PV of all future CF to all security holders (shareholders and bondholders). The debt/equity decision simply re-allocates those CF between debt holders and equity holders, it does not change the total. n Example: If you buy a pizza, you can split it with your roommate, or eat it by yourself. Either way, the size of the pizza does not change. Vassil Mihov

n Intuition: The value of the firm is the PV of all future CF to all security holders (shareholders and bondholders). The debt/equity decision simply re-allocates those CF between debt holders and equity holders, it does not change the total. n Example: If you buy a pizza, you can split it with your roommate, or eat it by yourself. Either way, the size of the pizza does not change. Vassil Mihov

n Further, an investor in an unlevered (all-equity) firm can replicate the payoff to the equity of the levered firm, and vice-versa, using "homemade leverage". Thus, if one of the two firms is not priced fairly in the market, knowledgeable investors can borrow / lend on personal account and buy shares of the undervalued firm / sell shares of the overvalued firm. This is called arbitrage. Vassil Mihov

n Further, an investor in an unlevered (all-equity) firm can replicate the payoff to the equity of the levered firm, and vice-versa, using "homemade leverage". Thus, if one of the two firms is not priced fairly in the market, knowledgeable investors can borrow / lend on personal account and buy shares of the undervalued firm / sell shares of the overvalued firm. This is called arbitrage. Vassil Mihov

n Example: Suppose you have two firms: Unlevered Corp. and Levered Corp. They are identical in every way except for their capital structures. Unlevered Corp. is an all-equity firm, and has 5, 000 shares outstanding, each selling for $20. Levered Corp. uses debt, worth $25, 000, in its capital structure. The cost of debt is 12%. EBIT for both firms is expected to be 35, 000. n According to M&M proposition I, what is u 1. The value of Unlevered Corp. and Levered Corp. ? u 2. The value of Unlevered stock and Levered stock? n Construct a strategy for investment in Unlevered stock that replicates the return on investment of 20% in Levered stock. Vassil Mihov

n Example: Suppose you have two firms: Unlevered Corp. and Levered Corp. They are identical in every way except for their capital structures. Unlevered Corp. is an all-equity firm, and has 5, 000 shares outstanding, each selling for $20. Levered Corp. uses debt, worth $25, 000, in its capital structure. The cost of debt is 12%. EBIT for both firms is expected to be 35, 000. n According to M&M proposition I, what is u 1. The value of Unlevered Corp. and Levered Corp. ? u 2. The value of Unlevered stock and Levered stock? n Construct a strategy for investment in Unlevered stock that replicates the return on investment of 20% in Levered stock. Vassil Mihov

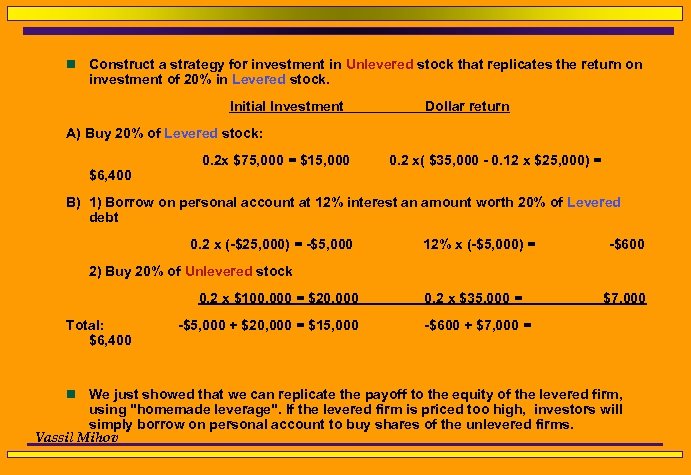

n Construct a strategy for investment in Unlevered stock that replicates the return on investment of 20% in Levered stock. Initial Investment Dollar return A) Buy 20% of Levered stock: $6, 400 0. 2 x $75, 000 = $15, 000 0. 2 x( $35, 000 - 0. 12 x $25, 000) = B) 1) Borrow on personal account at 12% interest an amount worth 20% of Levered debt 0. 2 x (-$25, 000) = -$5, 000 12% x (-$5, 000) = -$600 2) Buy 20% of Unlevered stock 0. 2 x $100, 000 = $20, 000 Total: $6, 400 -$5, 000 + $20, 000 = $15, 000 0. 2 x $35, 000 = $7, 000 -$600 + $7, 000 = n We just showed that we can replicate the payoff to the equity of the levered firm, using "homemade leverage". If the levered firm is priced too high, investors will simply borrow on personal account to buy shares of the unlevered firms. Vassil Mihov

n Construct a strategy for investment in Unlevered stock that replicates the return on investment of 20% in Levered stock. Initial Investment Dollar return A) Buy 20% of Levered stock: $6, 400 0. 2 x $75, 000 = $15, 000 0. 2 x( $35, 000 - 0. 12 x $25, 000) = B) 1) Borrow on personal account at 12% interest an amount worth 20% of Levered debt 0. 2 x (-$25, 000) = -$5, 000 12% x (-$5, 000) = -$600 2) Buy 20% of Unlevered stock 0. 2 x $100, 000 = $20, 000 Total: $6, 400 -$5, 000 + $20, 000 = $15, 000 0. 2 x $35, 000 = $7, 000 -$600 + $7, 000 = n We just showed that we can replicate the payoff to the equity of the levered firm, using "homemade leverage". If the levered firm is priced too high, investors will simply borrow on personal account to buy shares of the unlevered firms. Vassil Mihov

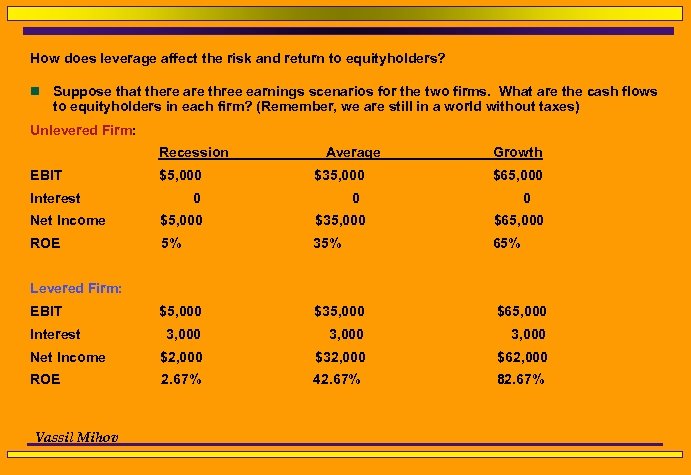

How does leverage affect the risk and return to equityholders? n Suppose that there are three earnings scenarios for the two firms. What are the cash flows to equityholders in each firm? (Remember, we are still in a world without taxes) Unlevered Firm: Recession EBIT $5, 000 Interest Average $35, 000 0 Growth $65, 000 0 0 Net Income $5, 000 $35, 000 $65, 000 ROE 5% 35% 65% $5, 000 $35, 000 $65, 000 3, 000 Net Income $2, 000 $32, 000 $62, 000 ROE 2. 67% 42. 67% 82. 67% Levered Firm: EBIT Interest Vassil Mihov

How does leverage affect the risk and return to equityholders? n Suppose that there are three earnings scenarios for the two firms. What are the cash flows to equityholders in each firm? (Remember, we are still in a world without taxes) Unlevered Firm: Recession EBIT $5, 000 Interest Average $35, 000 0 Growth $65, 000 0 0 Net Income $5, 000 $35, 000 $65, 000 ROE 5% 35% 65% $5, 000 $35, 000 $65, 000 3, 000 Net Income $2, 000 $32, 000 $62, 000 ROE 2. 67% 42. 67% 82. 67% Levered Firm: EBIT Interest Vassil Mihov

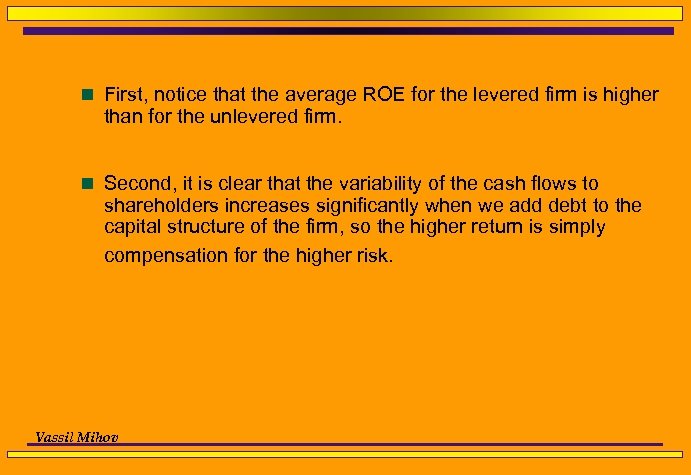

n First, notice that the average ROE for the levered firm is higher than for the unlevered firm. n Second, it is clear that the variability of the cash flows to shareholders increases significantly when we add debt to the capital structure of the firm, so the higher return is simply compensation for the higher risk. Vassil Mihov

n First, notice that the average ROE for the levered firm is higher than for the unlevered firm. n Second, it is clear that the variability of the cash flows to shareholders increases significantly when we add debt to the capital structure of the firm, so the higher return is simply compensation for the higher risk. Vassil Mihov

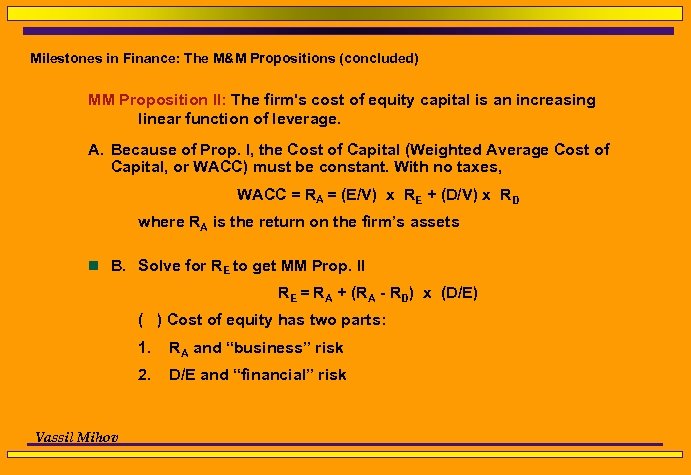

Milestones in Finance: The M&M Propositions (concluded) MM Proposition II: The firm's cost of equity capital is an increasing linear function of leverage. A. Because of Prop. I, the Cost of Capital (Weighted Average Cost of Capital, or WACC) must be constant. With no taxes, WACC = RA = (E/V) x RE + (D/V) x RD where RA is the return on the firm’s assets n B. Solve for RE to get MM Prop. II RE = RA + (RA - RD) x (D/E) ( ) Cost of equity has two parts: 1. 2. Vassil Mihov RA and “business” risk D/E and “financial” risk

Milestones in Finance: The M&M Propositions (concluded) MM Proposition II: The firm's cost of equity capital is an increasing linear function of leverage. A. Because of Prop. I, the Cost of Capital (Weighted Average Cost of Capital, or WACC) must be constant. With no taxes, WACC = RA = (E/V) x RE + (D/V) x RD where RA is the return on the firm’s assets n B. Solve for RE to get MM Prop. II RE = RA + (RA - RD) x (D/E) ( ) Cost of equity has two parts: 1. 2. Vassil Mihov RA and “business” risk D/E and “financial” risk

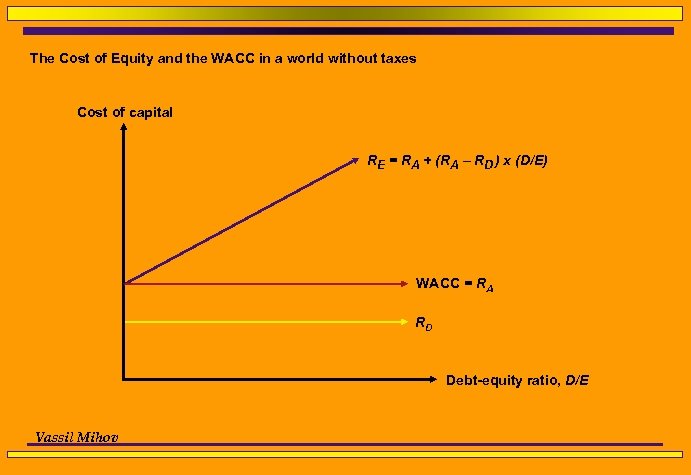

The Cost of Equity and the WACC in a world without taxes Cost of capital RE = RA + (RA – RD ) x (D/E) WACC = RA RD Debt-equity ratio, D/E Vassil Mihov

The Cost of Equity and the WACC in a world without taxes Cost of capital RE = RA + (RA – RD ) x (D/E) WACC = RA RD Debt-equity ratio, D/E Vassil Mihov

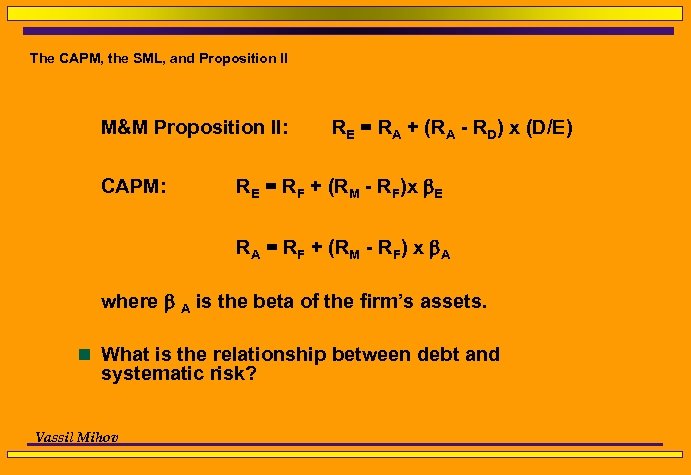

The CAPM, the SML, and Proposition II M&M Proposition II: CAPM: RE = RA + (RA - RD) x (D/E) RE = RF + (RM - RF)x b. E RA = RF + (RM - RF) x b. A where b A is the beta of the firm’s assets. n What is the relationship between debt and systematic risk? Vassil Mihov

The CAPM, the SML, and Proposition II M&M Proposition II: CAPM: RE = RA + (RA - RD) x (D/E) RE = RF + (RM - RF)x b. E RA = RF + (RM - RF) x b. A where b A is the beta of the firm’s assets. n What is the relationship between debt and systematic risk? Vassil Mihov

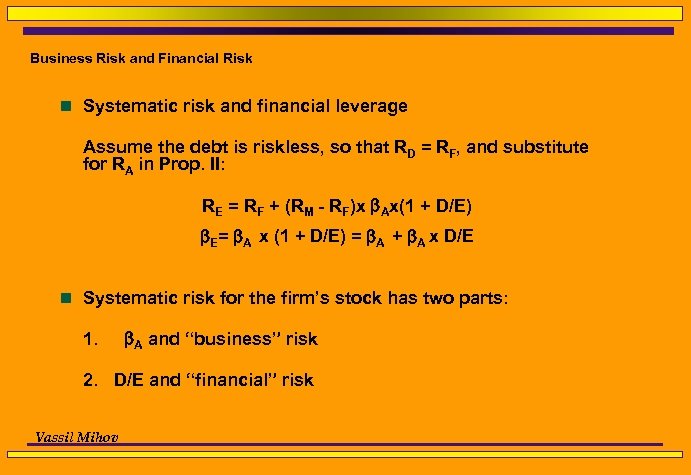

Business Risk and Financial Risk n Systematic risk and financial leverage Assume the debt is riskless, so that RD = RF, and substitute for RA in Prop. II: RE = RF + (RM - RF)x b. Ax(1 + D/E) b. E= b. A x (1 + D/E) = b. A + b. A x D/E n Systematic risk for the firm’s stock has two parts: 1. b. A and “business” risk 2. D/E and “financial” risk Vassil Mihov

Business Risk and Financial Risk n Systematic risk and financial leverage Assume the debt is riskless, so that RD = RF, and substitute for RA in Prop. II: RE = RF + (RM - RF)x b. Ax(1 + D/E) b. E= b. A x (1 + D/E) = b. A + b. A x D/E n Systematic risk for the firm’s stock has two parts: 1. b. A and “business” risk 2. D/E and “financial” risk Vassil Mihov

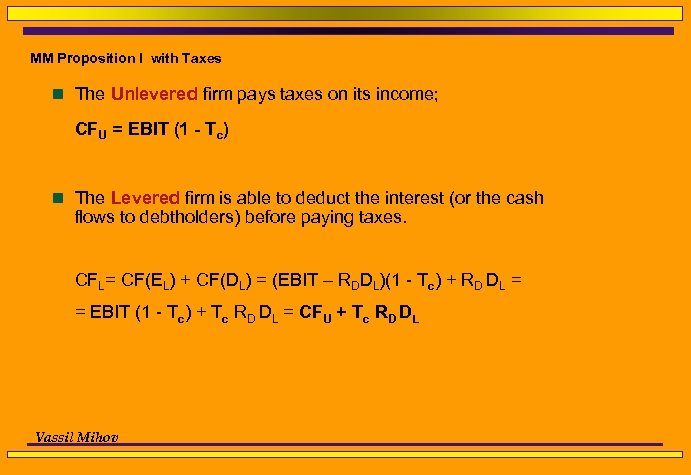

MM Proposition I with Taxes n The Unlevered firm pays taxes on its income; CFU = EBIT (1 - Tc) n The Levered firm is able to deduct the interest (or the cash flows to debtholders) before paying taxes. CFL= CF(EL) + CF(DL) = (EBIT – RDDL)(1 - Tc) + RD DL = = EBIT (1 - Tc) + Tc RD DL = CFU + Tc RD DL Vassil Mihov

MM Proposition I with Taxes n The Unlevered firm pays taxes on its income; CFU = EBIT (1 - Tc) n The Levered firm is able to deduct the interest (or the cash flows to debtholders) before paying taxes. CFL= CF(EL) + CF(DL) = (EBIT – RDDL)(1 - Tc) + RD DL = = EBIT (1 - Tc) + Tc RD DL = CFU + Tc RD DL Vassil Mihov

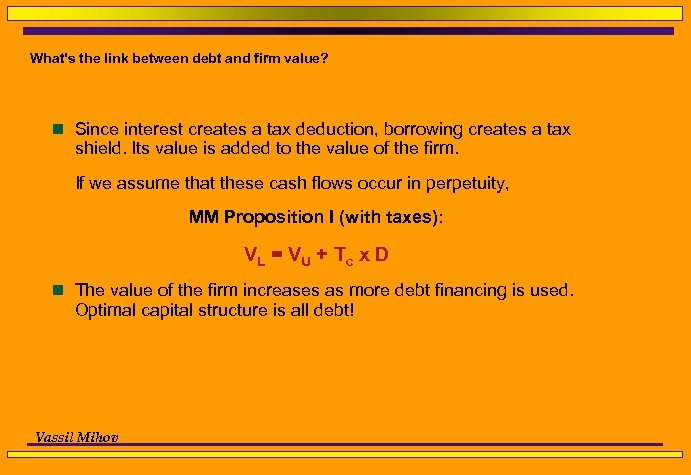

What's the link between debt and firm value? n Since interest creates a tax deduction, borrowing creates a tax shield. Its value is added to the value of the firm. If we assume that these cash flows occur in perpetuity, MM Proposition I (with taxes): VL = V U + T c x D n The value of the firm increases as more debt financing is used. Optimal capital structure is all debt! Vassil Mihov

What's the link between debt and firm value? n Since interest creates a tax deduction, borrowing creates a tax shield. Its value is added to the value of the firm. If we assume that these cash flows occur in perpetuity, MM Proposition I (with taxes): VL = V U + T c x D n The value of the firm increases as more debt financing is used. Optimal capital structure is all debt! Vassil Mihov

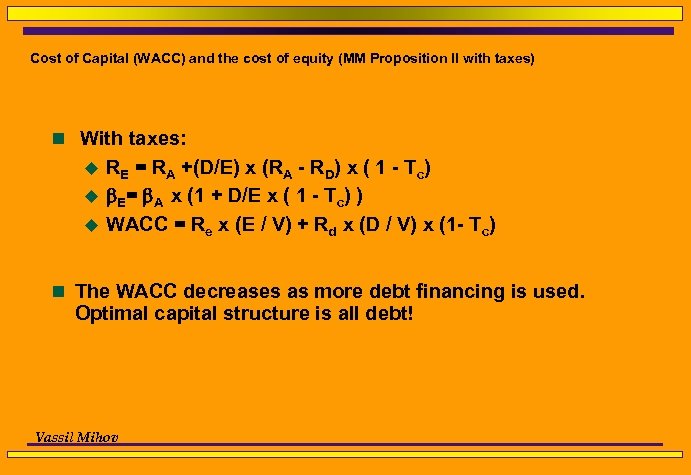

Cost of Capital (WACC) and the cost of equity (MM Proposition II with taxes) n With taxes: u u u RE = RA +(D/E) x (RA - RD) x ( 1 - Tc) b. E= b. A x (1 + D/E x ( 1 - Tc) ) WACC = Re x (E / V) + Rd x (D / V) x (1 - Tc) n The WACC decreases as more debt financing is used. Optimal capital structure is all debt! Vassil Mihov

Cost of Capital (WACC) and the cost of equity (MM Proposition II with taxes) n With taxes: u u u RE = RA +(D/E) x (RA - RD) x ( 1 - Tc) b. E= b. A x (1 + D/E x ( 1 - Tc) ) WACC = Re x (E / V) + Rd x (D / V) x (1 - Tc) n The WACC decreases as more debt financing is used. Optimal capital structure is all debt! Vassil Mihov

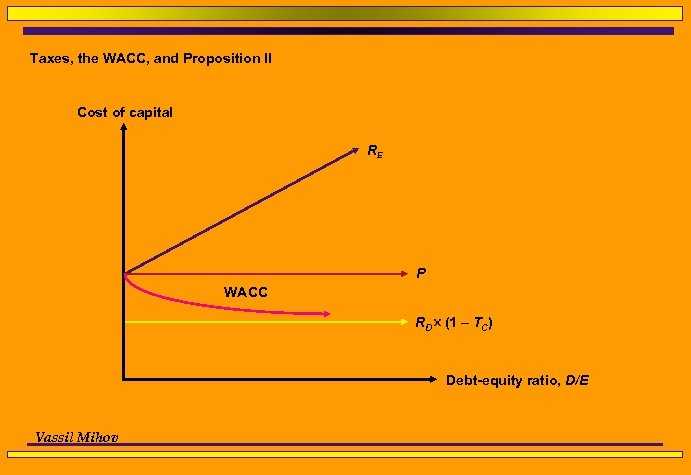

Taxes, the WACC, and Proposition II Cost of capital RE P WACC RD (1 – TC) Debt-equity ratio, D/E Vassil Mihov

Taxes, the WACC, and Proposition II Cost of capital RE P WACC RD (1 – TC) Debt-equity ratio, D/E Vassil Mihov

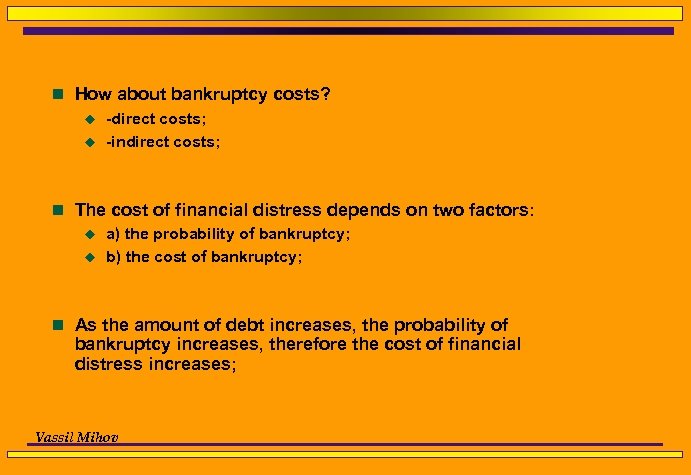

n How about bankruptcy costs? u -direct costs; u -indirect costs; n The cost of financial distress depends on two factors: u a) the probability of bankruptcy; u b) the cost of bankruptcy; n As the amount of debt increases, the probability of bankruptcy increases, therefore the cost of financial distress increases; Vassil Mihov

n How about bankruptcy costs? u -direct costs; u -indirect costs; n The cost of financial distress depends on two factors: u a) the probability of bankruptcy; u b) the cost of bankruptcy; n As the amount of debt increases, the probability of bankruptcy increases, therefore the cost of financial distress increases; Vassil Mihov

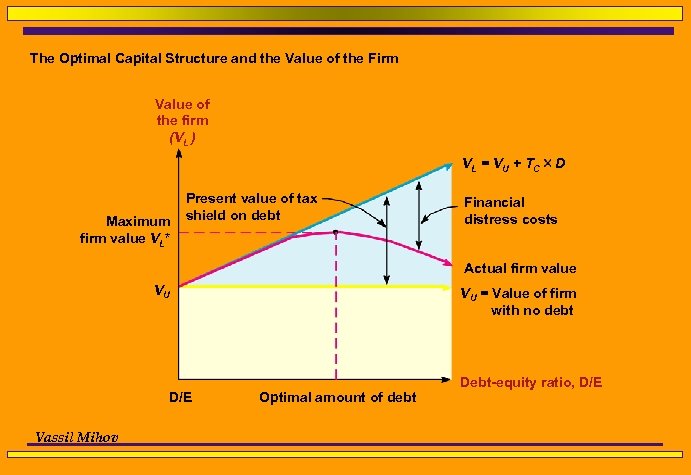

The Optimal Capital Structure and the Value of the Firm Value of the firm (VL ) VL = VU + TC Maximum firm value VL* Present value of tax shield on debt D Financial distress costs Actual firm value VU D/E Vassil Mihov VU = Value of firm with no debt Optimal amount of debt Debt-equity ratio, D/E

The Optimal Capital Structure and the Value of the Firm Value of the firm (VL ) VL = VU + TC Maximum firm value VL* Present value of tax shield on debt D Financial distress costs Actual firm value VU D/E Vassil Mihov VU = Value of firm with no debt Optimal amount of debt Debt-equity ratio, D/E

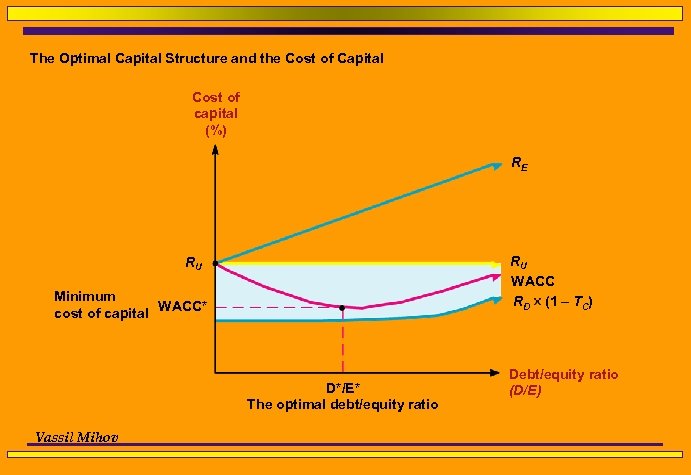

The Optimal Capital Structure and the Cost of Capital Cost of capital (%) RE RU WACC RD (1 – TC) RU Minimum cost of capital WACC* D*/E* The optimal debt/equity ratio Vassil Mihov Debt/equity ratio (D/E)

The Optimal Capital Structure and the Cost of Capital Cost of capital (%) RE RU WACC RD (1 – TC) RU Minimum cost of capital WACC* D*/E* The optimal debt/equity ratio Vassil Mihov Debt/equity ratio (D/E)

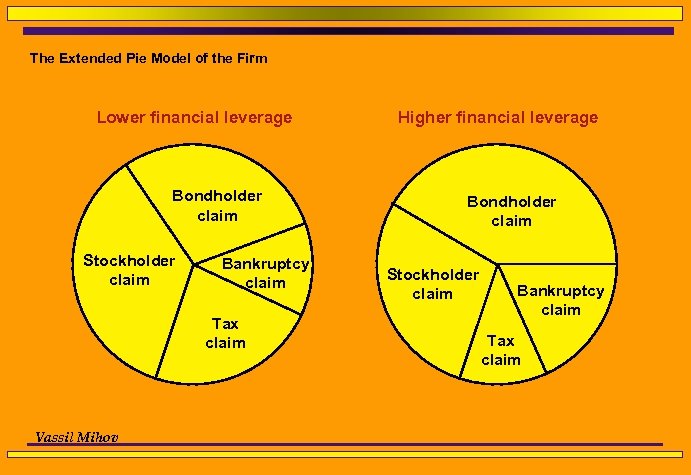

The Extended Pie Model of the Firm Lower financial leverage Bondholder claim Stockholder claim Bankruptcy claim Tax claim Vassil Mihov Higher financial leverage Bondholder claim Stockholder claim Bankruptcy claim Tax claim

The Extended Pie Model of the Firm Lower financial leverage Bondholder claim Stockholder claim Bankruptcy claim Tax claim Vassil Mihov Higher financial leverage Bondholder claim Stockholder claim Bankruptcy claim Tax claim