66c1f6ec8fd70d7a05164e1f4c573b36.ppt

- Количество слайдов: 17

Financial Instruments Chapter 2 Mc. Graw-Hill/Irwin Copyright © 2005 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

Financial Instruments Chapter 2 Mc. Graw-Hill/Irwin Copyright © 2005 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

Major Types of Securities Debt Money market instruments (up to 1 year) Bonds (1 year or greater maturity) Common stock (perpetual security) Preferred stock (perpetual security) Derivative securities (various maturities) 2 -2

Major Types of Securities Debt Money market instruments (up to 1 year) Bonds (1 year or greater maturity) Common stock (perpetual security) Preferred stock (perpetual security) Derivative securities (various maturities) 2 -2

Markets and Instruments Money Market (less than one year) Debt Instruments Typically $100, 000 plus Bought at a discount, redeemed at par Derivatives Capital Market (one year and longer) Bonds Equity Derivatives 2 -3

Markets and Instruments Money Market (less than one year) Debt Instruments Typically $100, 000 plus Bought at a discount, redeemed at par Derivatives Capital Market (one year and longer) Bonds Equity Derivatives 2 -3

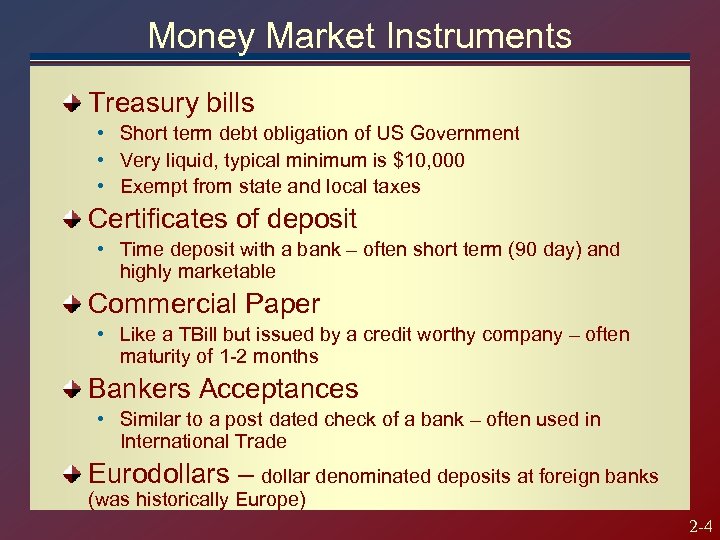

Money Market Instruments Treasury bills • Short term debt obligation of US Government • Very liquid, typical minimum is $10, 000 • Exempt from state and local taxes Certificates of deposit • Time deposit with a bank – often short term (90 day) and highly marketable Commercial Paper • Like a TBill but issued by a credit worthy company – often maturity of 1 -2 months Bankers Acceptances • Similar to a post dated check of a bank – often used in International Trade Eurodollars – dollar denominated deposits at foreign banks (was historically Europe) 2 -4

Money Market Instruments Treasury bills • Short term debt obligation of US Government • Very liquid, typical minimum is $10, 000 • Exempt from state and local taxes Certificates of deposit • Time deposit with a bank – often short term (90 day) and highly marketable Commercial Paper • Like a TBill but issued by a credit worthy company – often maturity of 1 -2 months Bankers Acceptances • Similar to a post dated check of a bank – often used in International Trade Eurodollars – dollar denominated deposits at foreign banks (was historically Europe) 2 -4

Money Market Instruments (Cont. ) Repurchase Agreements (RPs) and Reverse RPs – a form of short term, usually overnight borrowing Federal Funds – Funds in a banks reserve account which are need to meet reserve requirement Brokers’ Calls – Brokers borrowed money for margin loans – usually about 1% above short term TBill LIBOR Market – London Interbank Offered Rate – the rate large banks in London lend money among themselves on dollar denominated loans 2 -5

Money Market Instruments (Cont. ) Repurchase Agreements (RPs) and Reverse RPs – a form of short term, usually overnight borrowing Federal Funds – Funds in a banks reserve account which are need to meet reserve requirement Brokers’ Calls – Brokers borrowed money for margin loans – usually about 1% above short term TBill LIBOR Market – London Interbank Offered Rate – the rate large banks in London lend money among themselves on dollar denominated loans 2 -5

Bond Markets (often called Fixed Income) US Treasury Bonds and Notes Agency Issues (Fed Gov, e. g. FNMA) International Bonds Municipal Bonds (Non Federal) Corporate Bonds Mortgage-Backed Securities 2 -6

Bond Markets (often called Fixed Income) US Treasury Bonds and Notes Agency Issues (Fed Gov, e. g. FNMA) International Bonds Municipal Bonds (Non Federal) Corporate Bonds Mortgage-Backed Securities 2 -6

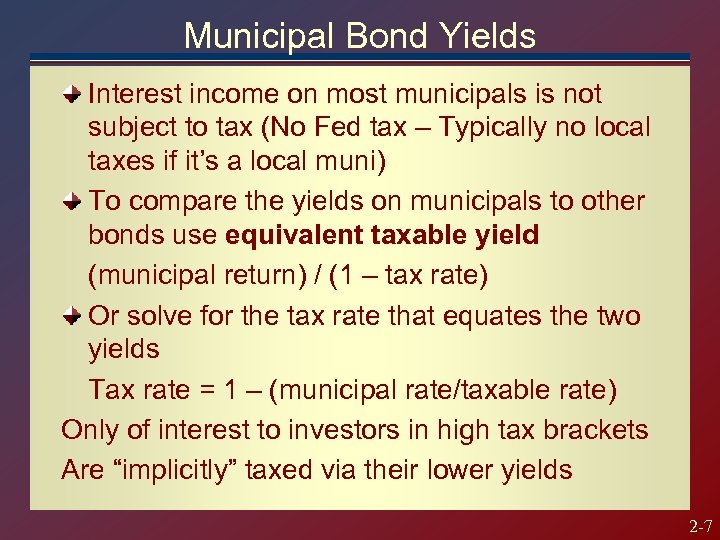

Municipal Bond Yields Interest income on most municipals is not subject to tax (No Fed tax – Typically no local taxes if it’s a local muni) To compare the yields on municipals to other bonds use equivalent taxable yield (municipal return) / (1 – tax rate) Or solve for the tax rate that equates the two yields Tax rate = 1 – (municipal rate/taxable rate) Only of interest to investors in high tax brackets Are “implicitly” taxed via their lower yields 2 -7

Municipal Bond Yields Interest income on most municipals is not subject to tax (No Fed tax – Typically no local taxes if it’s a local muni) To compare the yields on municipals to other bonds use equivalent taxable yield (municipal return) / (1 – tax rate) Or solve for the tax rate that equates the two yields Tax rate = 1 – (municipal rate/taxable rate) Only of interest to investors in high tax brackets Are “implicitly” taxed via their lower yields 2 -7

Capital Market - Equity Common stock Have voting rights (typically) Residual claim Limited liability Preferred stock No voting rights Fixed dividends - limited Priority over common Tax treatment – Corporate tax exclusion (70%) makes preferreds favored by corporations, driving down their yields 2 -8

Capital Market - Equity Common stock Have voting rights (typically) Residual claim Limited liability Preferred stock No voting rights Fixed dividends - limited Priority over common Tax treatment – Corporate tax exclusion (70%) makes preferreds favored by corporations, driving down their yields 2 -8

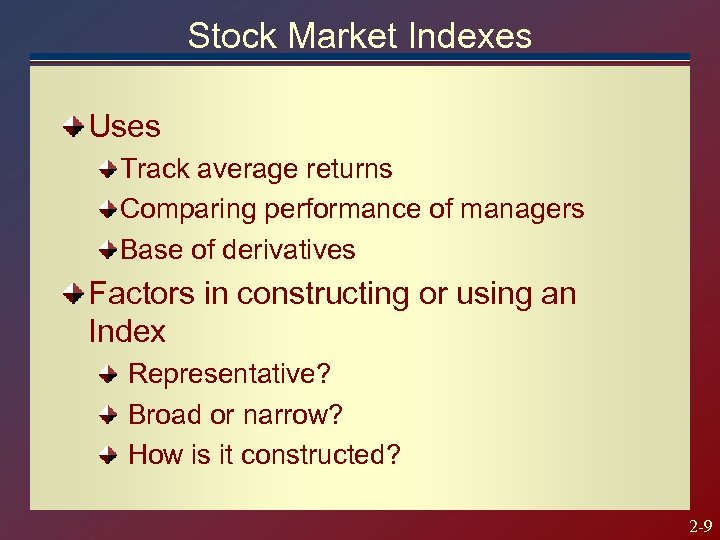

Stock Market Indexes Uses Track average returns Comparing performance of managers Base of derivatives Factors in constructing or using an Index Representative? Broad or narrow? How is it constructed? 2 -9

Stock Market Indexes Uses Track average returns Comparing performance of managers Base of derivatives Factors in constructing or using an Index Representative? Broad or narrow? How is it constructed? 2 -9

Examples of Indexes - Domestic Dow Jones Industrial Average (30 “Blue Chip” Stocks, since 1896) Standard & Poor’s 500 Composite NASDAQ Composite NYSE Composite Wilshire 5000 (about 7000 stocks currently tracked) Indexes track capital gains over time – i. e. they ignore the dividends 2 -10

Examples of Indexes - Domestic Dow Jones Industrial Average (30 “Blue Chip” Stocks, since 1896) Standard & Poor’s 500 Composite NASDAQ Composite NYSE Composite Wilshire 5000 (about 7000 stocks currently tracked) Indexes track capital gains over time – i. e. they ignore the dividends 2 -10

Examples of Indexes - International Nikkei 225 & Nikkei 300 FTSE (Financial Times of London) Dax Region and Country Indexes EAFE Far East United Kingdom 2 -11

Examples of Indexes - International Nikkei 225 & Nikkei 300 FTSE (Financial Times of London) Dax Region and Country Indexes EAFE Far East United Kingdom 2 -11

Bond Indexes Lehman Brothers Merrill Lynch Salomon Brothers Specialized Indexes Merrill Lynch Mortgage Bond Index Problem Bonds are often purchased and held, rather than actively traded, making it difficult to determine their price each day 2 -12

Bond Indexes Lehman Brothers Merrill Lynch Salomon Brothers Specialized Indexes Merrill Lynch Mortgage Bond Index Problem Bonds are often purchased and held, rather than actively traded, making it difficult to determine their price each day 2 -12

Construction of Indexes How are stocks weighted? Price weighted (DJIA) Market-value weighted (S&P 500, NASDAQ) Equally weighted (Value Line Index) How returns are averaged? Arithmetic (DJIA and S&P 500) Geometric (Value Line Index) Effective of Stock Splits? Change the divisor for DJIA no effect on others 2 -13

Construction of Indexes How are stocks weighted? Price weighted (DJIA) Market-value weighted (S&P 500, NASDAQ) Equally weighted (Value Line Index) How returns are averaged? Arithmetic (DJIA and S&P 500) Geometric (Value Line Index) Effective of Stock Splits? Change the divisor for DJIA no effect on others 2 -13

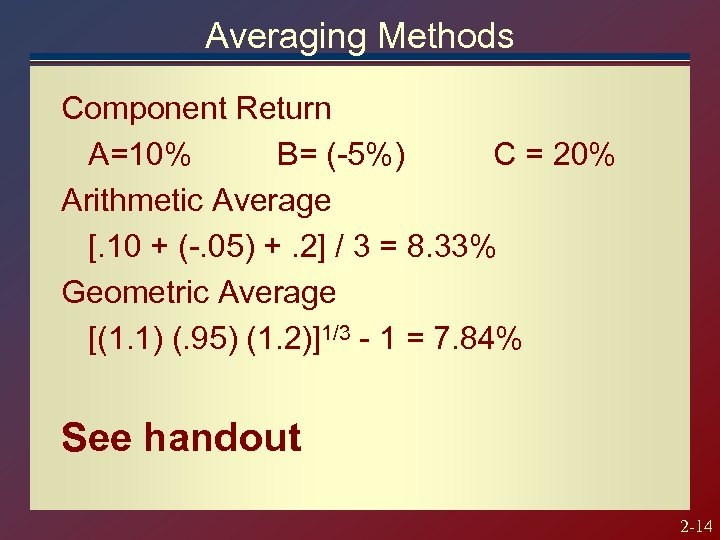

Averaging Methods Component Return A=10% B= (-5%) C = 20% Arithmetic Average [. 10 + (-. 05) +. 2] / 3 = 8. 33% Geometric Average [(1. 1) (. 95) (1. 2)]1/3 - 1 = 7. 84% See handout 2 -14

Averaging Methods Component Return A=10% B= (-5%) C = 20% Arithmetic Average [. 10 + (-. 05) +. 2] / 3 = 8. 33% Geometric Average [(1. 1) (. 95) (1. 2)]1/3 - 1 = 7. 84% See handout 2 -14

![Options A call [put] option gives it buyer the right to purchase [sell] an Options A call [put] option gives it buyer the right to purchase [sell] an](https://present5.com/presentation/66c1f6ec8fd70d7a05164e1f4c573b36/image-15.jpg) Options A call [put] option gives it buyer the right to purchase [sell] an asset for a specified price (called the exercise or strike price) on or before the specified expiration date Intrinsic value: Put: Max (Strike Price – Asset Price, 0) Call: Max (Asset Price – Strike Price, 0) Seller of option must respond to buyer 2 -15

Options A call [put] option gives it buyer the right to purchase [sell] an asset for a specified price (called the exercise or strike price) on or before the specified expiration date Intrinsic value: Put: Max (Strike Price – Asset Price, 0) Call: Max (Asset Price – Strike Price, 0) Seller of option must respond to buyer 2 -15

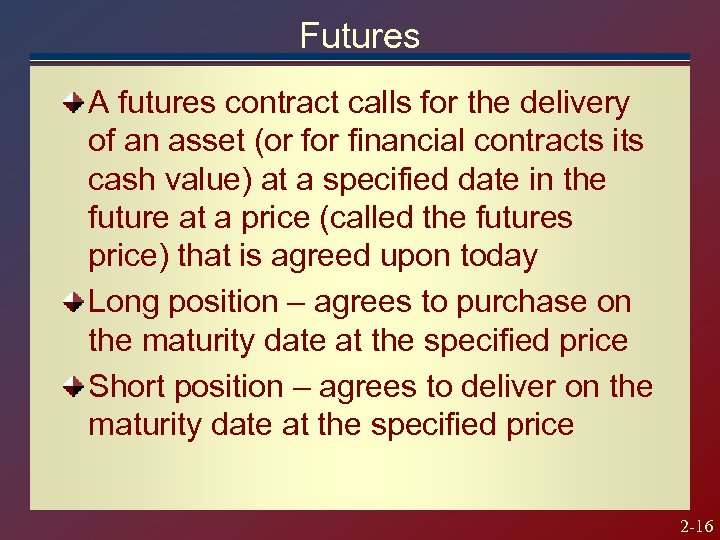

Futures A futures contract calls for the delivery of an asset (or financial contracts its cash value) at a specified date in the future at a price (called the futures price) that is agreed upon today Long position – agrees to purchase on the maturity date at the specified price Short position – agrees to deliver on the maturity date at the specified price 2 -16

Futures A futures contract calls for the delivery of an asset (or financial contracts its cash value) at a specified date in the future at a price (called the futures price) that is agreed upon today Long position – agrees to purchase on the maturity date at the specified price Short position – agrees to deliver on the maturity date at the specified price 2 -16

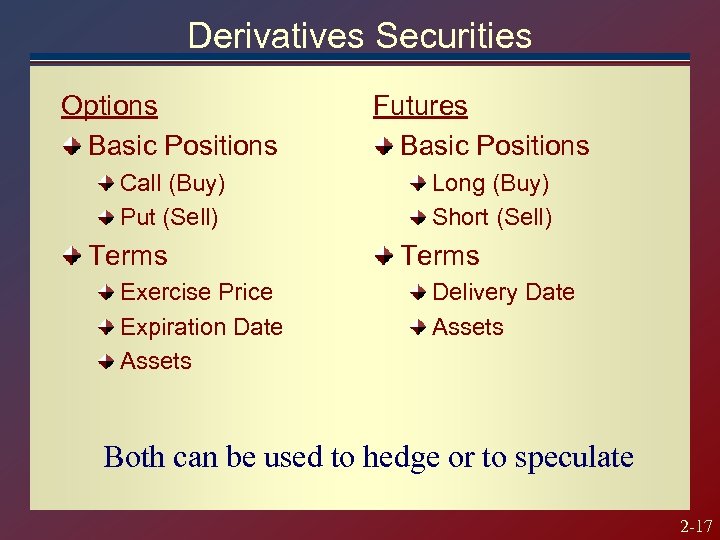

Derivatives Securities Options Basic Positions Call (Buy) Put (Sell) Terms Exercise Price Expiration Date Assets Futures Basic Positions Long (Buy) Short (Sell) Terms Delivery Date Assets Both can be used to hedge or to speculate 2 -17

Derivatives Securities Options Basic Positions Call (Buy) Put (Sell) Terms Exercise Price Expiration Date Assets Futures Basic Positions Long (Buy) Short (Sell) Terms Delivery Date Assets Both can be used to hedge or to speculate 2 -17