08f239ac8fa95dc34f732e7defb825cc.ppt

- Количество слайдов: 60

Financial Instrument for Doing Business in China Corso Executive “Mercati ed opportunità di business: Far East” 29. 04. 2011 Corso di Alta Formazione per l’Internazionalizzazione d’impresa A. A. 2010/2011

Financial Instrument for Doing Business in China Basic Knowledge Foreign Exchange Account Payment Instruments Means of international settlement International Trade Finance Corso di Alta Formazione per l’Internazionalizzazione d’impresa A. A. 2010/2011

1、Basic Knowledge 1. 1 Banking System A number of effective measure have been adopted since China’s access to the WTO in 2001 and a diversified and competitive banking system has been gradually developed. Besides the central bank, the People’s Bank of China, there are 3 policy banks, 5 state-owned commercial banks, 12 joint-equity commercial banks, 149 urban commercial banks, 43 rural commercial banks, 1 postal savings bank, and 37 foreign banks in China. www. pbc. gov. cn www. cbrc. gov. cn Corso di Alta Formazione per l’Internazionalizzazione d’impresa A. A. 2010/2011

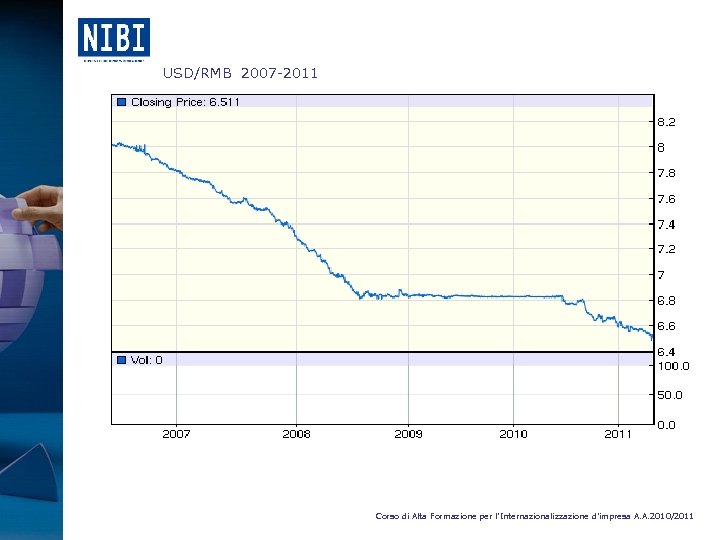

1、Basic Knowledge 1. 2 Foreign Exchange System The regulator is SAFE – State Administration of Foreign Exchange. On July 21, 2005, RMB exchange rate regime changed to a managed floating system with a reference to a basket of currencies. Since then, RMB has kept appreciating from 1 USD: 8. 11 RMB in July 2005 to 1 USD: 6. 53 RMB in April 2011. The quotation forward transaction in 12 month is 1: 6. 37, which means further appreciation of RMB is still being expected. www. safe. gov. cn Corso di Alta Formazione per l’Internazionalizzazione d’impresa A. A. 2010/2011

1、Basic Knowledge 1. 3 Main relevant parties involved Exporter + exporter’s bank Importer + importer’s bank Shipping company Insurance company Custom Government Corso di Alta Formazione per l’Internazionalizzazione d’impresa A. A. 2010/2011

1、Basic Knowledge 1. 4 normal procedures to do international business: Contract Settlement Preparation of export goods Shipping Corso di Alta Formazione per l’Internazionalizzazione d’impresa A. A. 2010/2011

2. Foreign Exchange Account 2. 1 Current Account and capital account Items under current account:import & export settlement interest and dividends Items under capital account: investment funds Corso di Alta Formazione per l’Internazionalizzazione d’impresa A. A. 2010/2011

2. Foreign Exchange Account 2. 2 procedures to open the current account in a bank: Get the business license (issued by SAIC – State Administration for Industry and Commerce) Get the certificate of organizational code (issued by TSA – Technology Supervision Agency) Get registered in SAFE ID card of legal representative Application form for opening foreign exchange account www. saic. gov. cn Corso di Alta Formazione per l’Internazionalizzazione d’impresa A. A. 2010/2011

2. Foreign Exchange Account 2. 2 Procedures to open the capital account in a bank: 2. 2. 1 Documents needed to get the capital item permission from SAFE - Application report to open capital account Business license Certificate of organizational code ID card of legal representative Contract Charter Get registered in SAFE and get the IC card Corso di Alta Formazione per l’Internazionalizzazione d’impresa A. A. 2010/2011

2. Foreign Exchange Account 2. 2 Procedures to open the capital account in a bank: 2. 2. 2 Documents needed to open capital account in a bank - Capital item permission issued by SAFE - Application form for opening foreign exchange account - Business license - Certificate of organizational code - ID card of legal representative Corso di Alta Formazione per l’Internazionalizzazione d’impresa A. A. 2010/2011

3 payment instruments 3. 1 categories: Financial instrument: - Bill of exchange - Promissory note - Check Commercial instruments : - Invoice - Transport documents - Insurance policy - Certificate of origin, etc. Corso di Alta Formazione per l’Internazionalizzazione d’impresa A. A. 2010/2011

3 payment instruments 3. 2. 1 Bill of Exchange A bill of exchange is an unconditional order in writing, addressed by one person to another, signed by the person giving it, requiring the person to whom it is addressed to pay on demand , or at a fixed or determinable future time, a sum certain in money, to or to the order of a specified person, or to the bearer. Demand bills Term bills Corso di Alta Formazione per l’Internazionalizzazione d’impresa A. A. 2010/2011

3 payment instruments 3. 2. 2 Checks An conditional order in writing, addressed by one person to a bank, signed by the person making it, requiring the bank to pay on demand a sum certain in money to or to the order of a specified person or to the bearer. Corso di Alta Formazione per l’Internazionalizzazione d’impresa A. A. 2010/2011

3 payment instruments 3. 2. 3 promissory notes A written, dated and signed two-party instrument containing an unconditional promise by the maker to pay a definite sum of money to a payee on demand or at a specified future date. The only difference between a promissory note and a bill of exchange is that the maker of a note pays the payee personally, rather than ordering a third party to do so. Corso di Alta Formazione per l’Internazionalizzazione d’impresa A. A. 2010/2011

3 payment instruments 3. 3. 1 commercial invoice Details of payment and delivery terms Details of the goods A detailed breakdown of monetary amounts due Corso di Alta Formazione per l’Internazionalizzazione d’impresa A. A. 2010/2011

3 payment instruments 3. 3. 2 Transport documents Bill of lading (B/L) Main functions i. Evidence of contract for carriage ii. Receipt of goods iii. Quasi negotiable documents iv. Documents of title Corso di Alta Formazione per l’Internazionalizzazione d’impresa A. A. 2010/2011

3 payment instruments 3. 3. 3 Insurance documents Insurance policy Risks covered by an Insurance policy i. Standard clauses of Institute of London Underwriters ii. (Institute Cargo Clause, ICC) iii. 1) F. P. A. – free from particular average iv. 2) W. A. – with particular average v. 3) All risks vi. ii. China Insurance Clause, CIC clause Corso di Alta Formazione per l’Internazionalizzazione d’impresa A. A. 2010/2011

3 payment instruments 3. 3. 4 Other documents Certificate of Origin Third-Party Inspection Certificate Packing List/Weight List Corso di Alta Formazione per l’Internazionalizzazione d’impresa A. A. 2010/2011

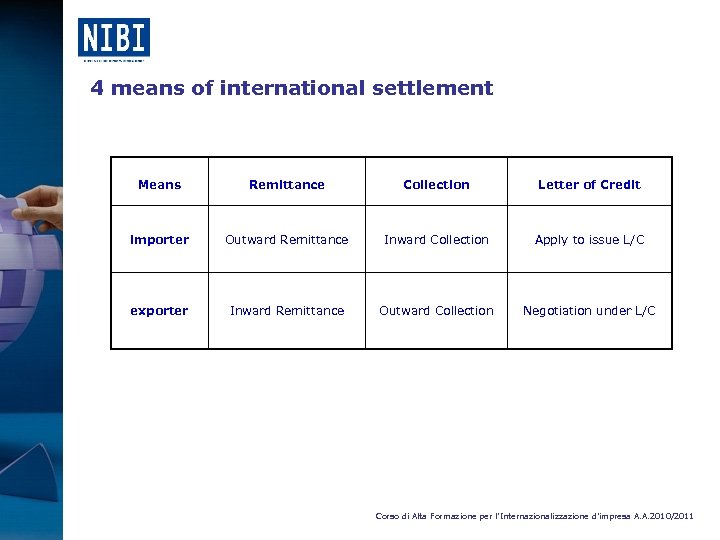

4 means of international settlement Means Remittance Collection Letter of Credit importer Outward Remittance Inward Collection Apply to issue L/C exporter Inward Remittance Outward Collection Negotiation under L/C Corso di Alta Formazione per l’Internazionalizzazione d’impresa A. A. 2010/2011

4. 1 Remittance 4. 1. 1 means of remittance T/T Telegraphic Transfer M/T Mail Transfer D/D Demand Draft SWIFT Society for Worldwide Inter-Bank Financial Telecommunication S. C. - ICBC ICBKCNBJ BOC BKCHCNBJ ABC ABOCCNBJ CCB PCBCCNBJ BComm COMMCNBJ Corso di Alta Formazione per l’Internazionalizzazione d’impresa A. A. 2010/2011

4. 1 Remittance 4. 1. 2 Advantage and disadvantage to use remittance Advantage: convenient, fast, cheap, simple procedure, lower cost Disadvantage: commercial credit Better to use remittance between parent company and subsidiaries or branches or customers that know well with each other Corso di Alta Formazione per l’Internazionalizzazione d’impresa A. A. 2010/2011

4. 1 Remittance 4. 1. 3 open A/C and Payment in Advance 4. 1. 3. 1 Open A. C Delivery of goods before payment Be beneficial to buyer 4. 1. 3. 2 Payment in advance Payment prior to shipment of goods or provision of services Be beneficial to seller Corso di Alta Formazione per l’Internazionalizzazione d’impresa A. A. 2010/2011

4. 1 Remittance 4. 1. 4 parties involved Remitter (payer) Remitting bank Payee Receiving bank Corso di Alta Formazione per l’Internazionalizzazione d’impresa A. A. 2010/2011

4. 1 Remittance 4. 1. 5 Banking fees Inward Remittance (to China) have account in the receiving bank - NIL transfer to other domestic banks - USD 10 intra city - USD 20 intercity Outward Remittance (from China) 1‰ of the remittance amount RMB 50 -1000 Corso di Alta Formazione per l’Internazionalizzazione d’impresa A. A. 2010/2011

4. 2 Collection 4. 2. 1 Definition Bank in the importer’s country acts on behalf of an exporter for collecting and remitting payment for a shipment. Parties involved: - Principal (exporter) - Collecting Bank - Presenting Bank - Drawee (importer) Corso di Alta Formazione per l’Internazionalizzazione d’impresa A. A. 2010/2011

4. 2 Collection 4. 2. 2 categories of collection Clean Collection Only the financial documents (bill of exchange)is sent through the banks without the commercial documents (bill of lading etc. ) Documentary Collection The exporter present financial documents and commercial documents or only commercial documents to the collecting bank. Corso di Alta Formazione per l’Internazionalizzazione d’impresa A. A. 2010/2011

4. 2 Collection 4. 2. 3 categories of documentary collection Document against Payment,D/P at sight Document against Acceptance, D/A Corso di Alta Formazione per l’Internazionalizzazione d’impresa A. A. 2010/2011

4. 2 Collection 4. 2. 3 categories of documentary collection Document against Payment,D/P at sight Document against Acceptance, D/A Corso di Alta Formazione per l’Internazionalizzazione d’impresa A. A. 2010/2011

4. 2 Collection 4. 2. 4 International practice Subject to The Uniform Rules for Collection, (ICC Publication No. 522), i. e. URC 522。 Corso di Alta Formazione per l’Internazionalizzazione d’impresa A. A. 2010/2011

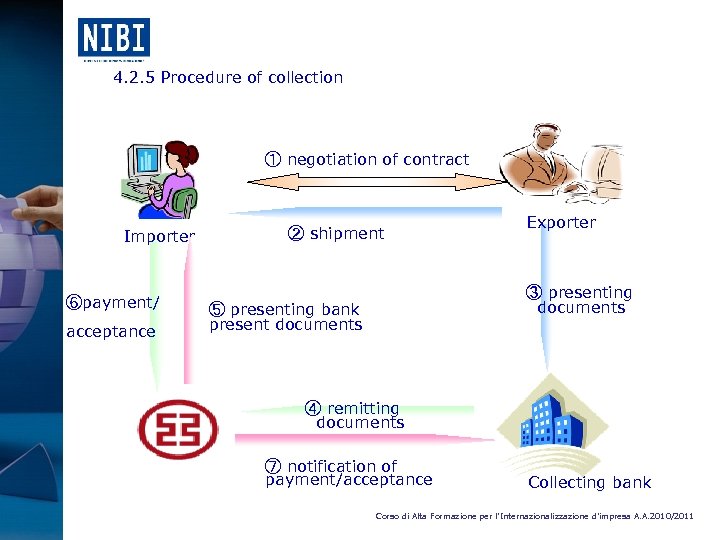

4. 2. 5 Procedure of collection ① negotiation of contract Importer ⑥payment/ acceptance ② shipment Exporter ③ presenting documents ⑤ presenting bank present documents ④ remitting documents ⑦ notification of payment/acceptance Collecting bank Corso di Alta Formazione per l’Internazionalizzazione d’impresa A. A. 2010/2011

4. 2 Collection 4. 2. 6 Banking fees Clean collection: 1‰,RMB 100 --1000/transaction Documentary collection: 1‰,starting from RMB 100 Corso di Alta Formazione per l’Internazionalizzazione d’impresa A. A. 2010/2011

4. 3 letter of credit 4. 3. 1 definition Letter of Credit means any arrangement, that is irrevocable and thereby constitutes a definite undertaking of the issuing bank to honour a complying presentation. Banking credit separate transaction from the sale or other contract on which it may be based on documents irrevocable. Corso di Alta Formazione per l’Internazionalizzazione d’impresa A. A. 2010/2011

4. 3 letter of credit 4. 3. 2 categories of letter of credit Payment credit: pay the sight drafts Deferred payment credit: no draft, guarantgee to pay at fixed or determinable future time Negotiation crfedit: freely negotiable sight/tenor Acceptance credit: credit for term draft, pay at maturity Corso di Alta Formazione per l’Internazionalizzazione d’impresa A. A. 2010/2011

4. 3 letter of credit 4. 3. 2 categories of letter of credit Confirmed L/C Confirmation means a definite undertaking of the confirming bank, in addition to that of the issuing bank, to honour or negotiate a complying presentation. Confirming bank means the bank that adds its confirmation to a credit upon the issuing bank’s authorization or request. Corso di Alta Formazione per l’Internazionalizzazione d’impresa A. A. 2010/2011

4. 3 letter of credit 4. 3. 3 parties involved Applicant (importer) - request fo rissuing L/C Issuing Bank (importer’s bank)- issuing L/C in favor of beneficiary Beneficiary (Exporter)- entitled to have its complying presentation honored Advising Bank (exporter’s bank)- notifies, or requests to notify the beneficiary of L/C Negotiating Bank- the issuing bank desingates or authorizes to pay, accept, negotiate or reimburse. Corso di Alta Formazione per l’Internazionalizzazione d’impresa A. A. 2010/2011

4. 3 letter of credit 4. 3. 4 commercial instruments involved Transport documents - Marine/Ocean Bill of Lading Non-Negotiable Sea Way Bill Charter Party Bill of Lading MTD Multimodal Transport Document AWB Airway Bill Road, Rail, Inland Waterway Transport Documents Post Receipt Corso di Alta Formazione per l’Internazionalizzazione d’impresa A. A. 2010/2011

4. 3 letter of credit 4. 3. 4 commercial instruments involved Other related documents - Bill of Exchange Commercial Invoice Insurance Document Certificate of Origin Corso di Alta Formazione per l’Internazionalizzazione d’impresa A. A. 2010/2011

4. 3 letter of credit 4. 3. 5 international practice Uniform Customs and Practice for Documentary Credits ICC Publication No. 600, i. e. UCP 600 International Standard Banking Practice for the Examination of Documents under Documentary credits (ISBP) Corso di Alta Formazione per l’Internazionalizzazione d’impresa A. A. 2010/2011

4. 3 letter of credit 4. 3. 6 issue letter of credit Different banks have different terms and conditions to issue L/C. General speaking, banks would issue L/C for customers with good rating without asking for guarantee or security. For those customers with not good enough rating, certain amount of guarantee and/or security would be required to issued the L/C. Corso di Alta Formazione per l’Internazionalizzazione d’impresa A. A. 2010/2011

4. 3 letter of credit 4. 3. 7 Banking fees - Issuing fee 0. 15% starting from RMB 30 Amendment fee RMB 200元/transaction Acceptance fee 0. 1% starting from RMB 200 Swift telecommunication fee RMB 100元/transaction Discrepancy fee starting from USD 50/transaction Export documents checking fee: 0. 125%,starting from RMB 300/transaction Corso di Alta Formazione per l’Internazionalizzazione d’impresa A. A. 2010/2011

4. 4 letter of guarantee (bond) 4. 4. 1 definition Letter of Guarantee (bond) is a guarantee to the beneficiary that the principal will fulfill his contractual obligation. Corso di Alta Formazione per l’Internazionalizzazione d’impresa A. A. 2010/2011

4. 4 letter of guarantee (bond) 4. 4. 2 categories of bonds Tender or bid bond – 2% to 5%of contract value, guarantee that the principal will take up contract if it is awarded Performance bond – 10% of contract value, guarantee that goods or services will of be required standard and a stated penalty is payable if not Advance payment bond – undertake to refuse any advance payment if good or services unsatisfactory Warranty or maintenance bond – undertake that the exporter will maintain the equipment for a period of time Retention bond – Guarantee the return to the buyer of these retention money in case of non-performance or post-completion Corso di Alta Formazione per l’Internazionalizzazione d’impresa A. A. 2010/2011

4. 4 letter of guarantee (bond) 4. 4. 2 categories of bonds On Demand Bond – unconditional bonds, at sole discretion of beneficiary Conditional bond - requiring documentary evidence – maximum protection to principal - No requiring documentary evidence Corso di Alta Formazione per l’Internazionalizzazione d’impresa A. A. 2010/2011

4. 4 letter of guarantee (bond) 4. 4. 3 banking fees Most of the banks apply 0. 8‰ to 1. 5‰ per quarter depending on different kinds of bond. Corso di Alta Formazione per l’Internazionalizzazione d’impresa A. A. 2010/2011

5 international trade finance Trade finance for importer Trade finance for exporter Corso di Alta Formazione per l’Internazionalizzazione d’impresa A. A. 2010/2011

5 international trade finance 5. 1 Trust receipt is the notice of the release merchandise to a buyer from a bank, with the bank retaining the ownership title to the release assets. In an arrangement involving a trust receipt under L/C, the bank remains the owner of the merchandise, but the buyer is allowed to hold the merchandise in trust for the bank, for manufacturing or sales purposes and the bank effect payment under L/C, the buyer repay the bank at due date agreed with the bank. Terms: 4 -6 months Rate: Libor+ Corso di Alta Formazione per l’Internazionalizzazione d’impresa A. A. 2010/2011

5 international trade finance 5. 2 export trade finance Packing loan Negotiation Discount Forfeiting Factoring Corso di Alta Formazione per l’Internazionalizzazione d’impresa A. A. 2010/2011

5 international trade finance 5. 2 export trade finance Packing loan This is a short term financing facility extended to exporters prior to shipment of goods. This facility enables the exporter to enjoy pre-export financing for the purchase of the goods provided a firm order is secured by the exporter. The application has to be supported by a Letter of Credit in his favour or a Confirmed Purchase Order. The loan granted will only cover the costs of goods for export or a percentage of the LC submitted. Corso di Alta Formazione per l’Internazionalizzazione d’impresa A. A. 2010/2011

5 international trade finance 5. 2 export trade finance Negotiation – Negotiation of bills of exchange drawn under L/C Discount – Acceptance and discount of draft under L/C Corso di Alta Formazione per l’Internazionalizzazione d’impresa A. A. 2010/2011

5 international trade finance 5. 2 export trade finance Forfeiting - The purchasing of an exporter's receivables (the amount importers owe the exporter) at a discount by paying cash. The forfaiter, the purchaser of the receivables, becomes the entity to whom the importer is obliged to pay its debt. Usually under settlement means of L/C By purchasing these receivables - which are usually guaranteed by the importer's bank - the forfaiter frees the exporter from credit and from the risk of not receiving payment from the importer who purchased the goods on credit. The receivables, becoming a form of debt instrument that can be sold on the secondary market, are represented by bills of exchange or promissory notes, which are unconditional and easily transferred debt instruments. Corso di Alta Formazione per l’Internazionalizzazione d’impresa A. A. 2010/2011

5 international trade finance 5. 2 export trade finance Factoring – A financial transaction whereby a business unit sells its accounts receivable (i. e. , invoices) to a third party (the factor) at a discount in exchange for immediate money with which to finance continued business. Usually under settlement means of O/A or D/A Factoring is different from forfaiting in the sense that forfaiting is a transaction-based operation involving exporters in which the firm sells one of its transactions, while factoring is a financial transaction that involves the Sale of any portion of the firm's receivables Corso di Alta Formazione per l’Internazionalizzazione d’impresa A. A. 2010/2011

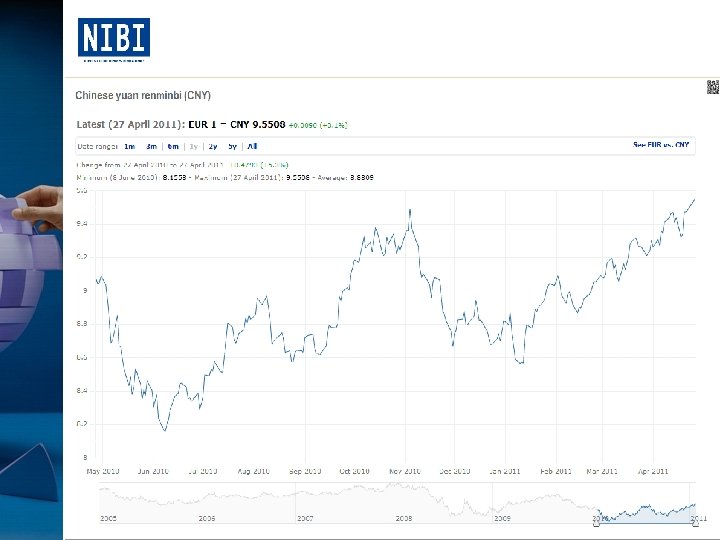

5 international trade finance 5. 3 hot topic To pay in RMB in international trade settlement Corso di Alta Formazione per l’Internazionalizzazione d’impresa A. A. 2010/2011

USD/RMB 2007 -2011 Corso di Alta Formazione per l’Internazionalizzazione d’impresa A. A. 2010/2011

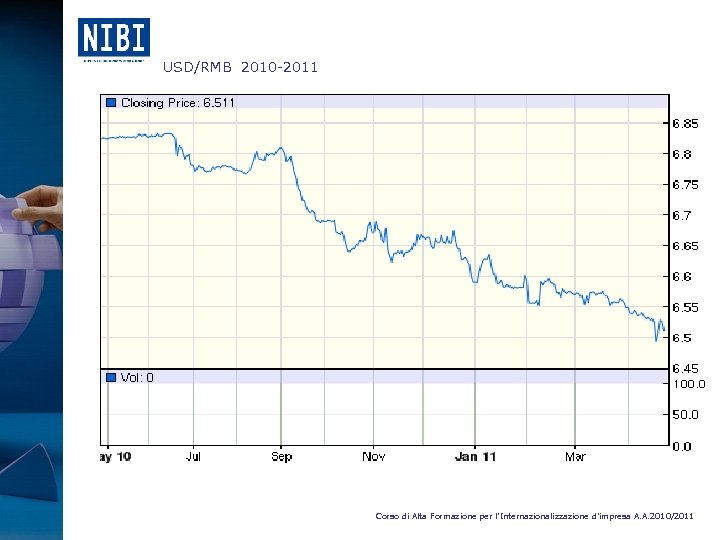

USD/RMB 2010 -2011 Corso di Alta Formazione per l’Internazionalizzazione d’impresa A. A. 2010/2011

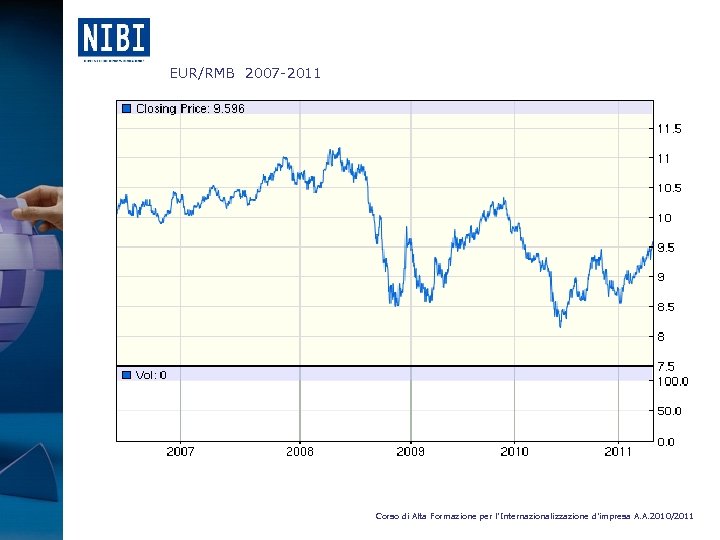

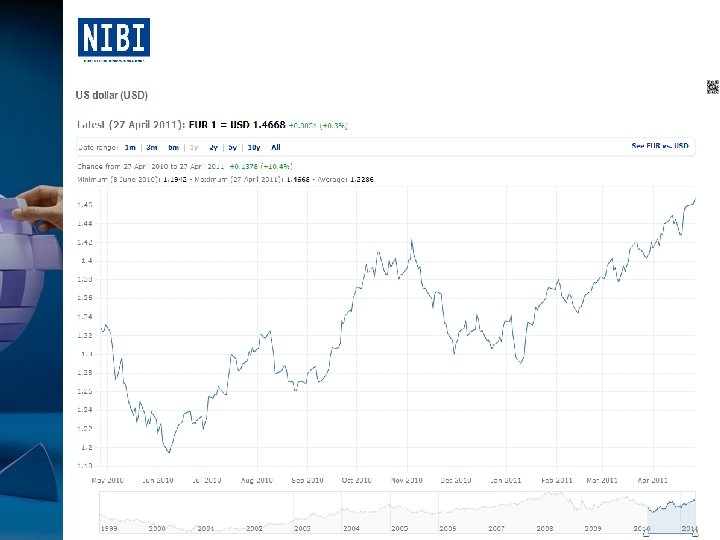

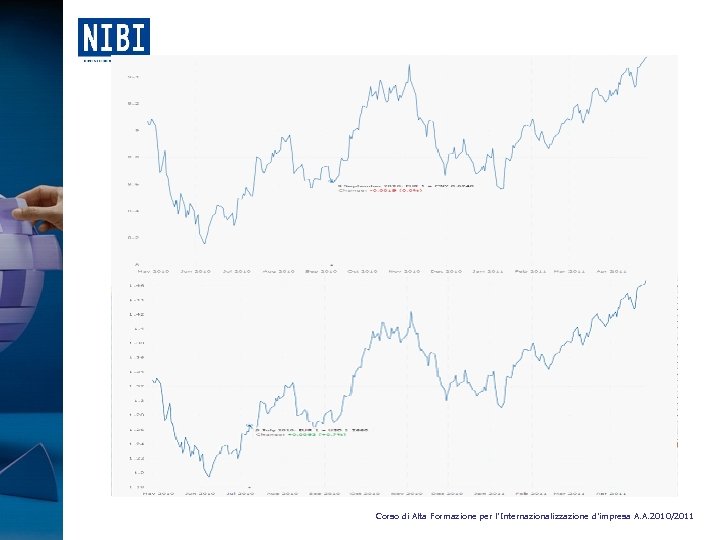

EUR/RMB 2007 -2011 Corso di Alta Formazione per l’Internazionalizzazione d’impresa A. A. 2010/2011

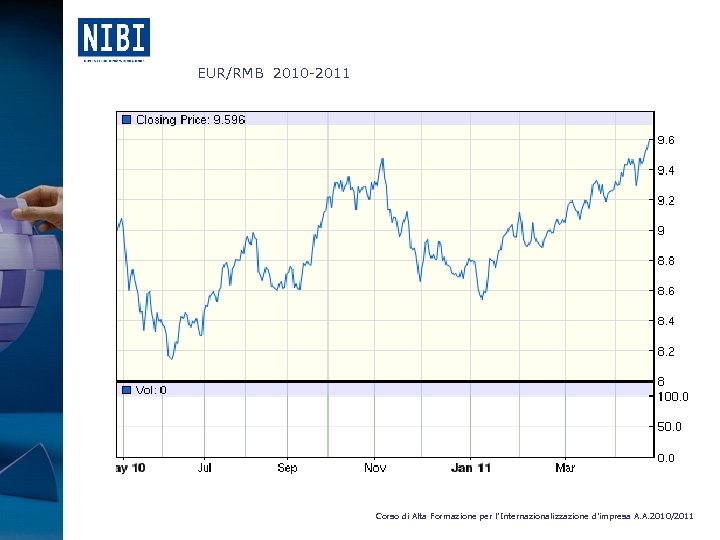

EUR/RMB 2010 -2011 Corso di Alta Formazione per l’Internazionalizzazione d’impresa A. A. 2010/2011

Corso di Alta Formazione per l’Internazionalizzazione d’impresa A. A. 2010/2011

Corso di Alta Formazione per l’Internazionalizzazione d’impresa A. A. 2010/2011

Corso di Alta Formazione per l’Internazionalizzazione d’impresa A. A. 2010/2011

Financial Instrument for Doing Business in China THANK YOU SUN Yanhong Deputy General Manager ICBC Milan Branch sunyanhong@it. icbc. com. cn Tel: 02 0066 8898 Corso di Alta Formazione per l’Internazionalizzazione d’impresa A. A. 2010/2011

08f239ac8fa95dc34f732e7defb825cc.ppt