fe8f63397766f6f76eead0b2e9cda739.ppt

- Количество слайдов: 17

Financial Inclusion July 27, 2013

Financial Inclusion July 27, 2013

Agenda ICICI Bank’s Financial Inclusion Plan ICICI Bank in Madhya Pradesh Creating Reach : Gramin Branches, CSPs and SHGs Awards and Recognition

Agenda ICICI Bank’s Financial Inclusion Plan ICICI Bank in Madhya Pradesh Creating Reach : Gramin Branches, CSPs and SHGs Awards and Recognition

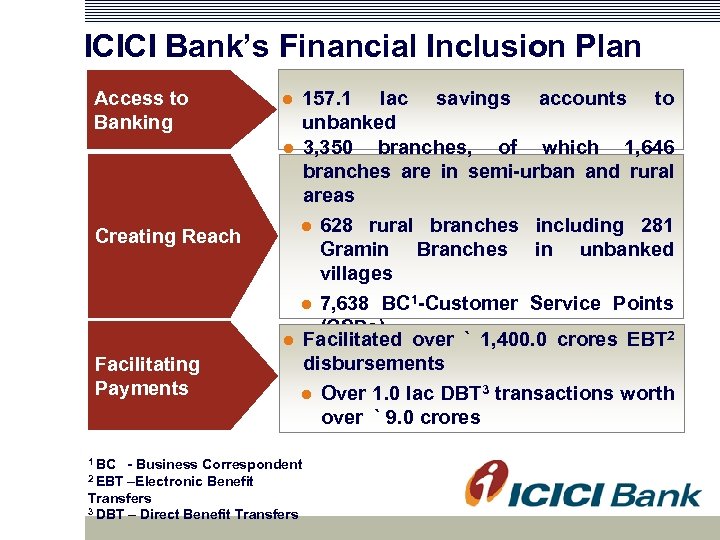

ICICI Bank’s Financial Inclusion Plan Access to Banking Creating Reach Facilitating Payments 1 BC 157. 1 lac savings accounts to unbanked 3, 350 branches, of which 1, 646 branches are in semi-urban and rural areas 628 rural branches including 281 Gramin Branches in unbanked villages 7, 638 BC 1 -Customer Service Points (CSPs) Facilitated over ` 1, 400. 0 crores EBT 2 disbursements - Business Correspondent –Electronic Benefit Transfers 3 DBT – Direct Benefit Transfers 2 EBT Over 1. 0 lac DBT 3 transactions worth over ` 9. 0 crores

ICICI Bank’s Financial Inclusion Plan Access to Banking Creating Reach Facilitating Payments 1 BC 157. 1 lac savings accounts to unbanked 3, 350 branches, of which 1, 646 branches are in semi-urban and rural areas 628 rural branches including 281 Gramin Branches in unbanked villages 7, 638 BC 1 -Customer Service Points (CSPs) Facilitated over ` 1, 400. 0 crores EBT 2 disbursements - Business Correspondent –Electronic Benefit Transfers 3 DBT – Direct Benefit Transfers 2 EBT Over 1. 0 lac DBT 3 transactions worth over ` 9. 0 crores

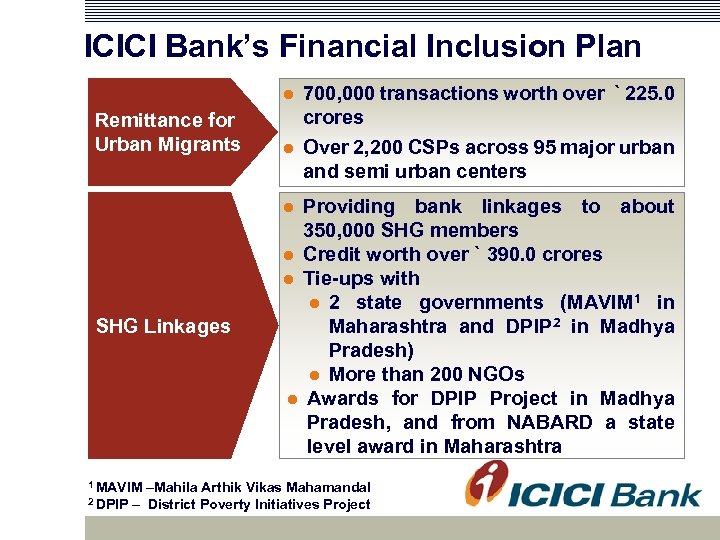

ICICI Bank’s Financial Inclusion Plan Remittance for Urban Migrants 700, 000 transactions worth over ` 225. 0 crores Over 2, 200 CSPs across 95 major urban and semi urban centers Providing bank linkages to about 350, 000 SHG members Credit worth over ` 390. 0 crores Tie-ups with 2 state governments (MAVIM 1 in Maharashtra and DPIP 2 in Madhya Pradesh) More than 200 NGOs Awards for DPIP Project in Madhya Pradesh, and from NABARD a state level award in Maharashtra SHG Linkages 1 MAVIM –Mahila Arthik Vikas Mahamandal 2 DPIP – District Poverty Initiatives Project

ICICI Bank’s Financial Inclusion Plan Remittance for Urban Migrants 700, 000 transactions worth over ` 225. 0 crores Over 2, 200 CSPs across 95 major urban and semi urban centers Providing bank linkages to about 350, 000 SHG members Credit worth over ` 390. 0 crores Tie-ups with 2 state governments (MAVIM 1 in Maharashtra and DPIP 2 in Madhya Pradesh) More than 200 NGOs Awards for DPIP Project in Madhya Pradesh, and from NABARD a state level award in Maharashtra SHG Linkages 1 MAVIM –Mahila Arthik Vikas Mahamandal 2 DPIP – District Poverty Initiatives Project

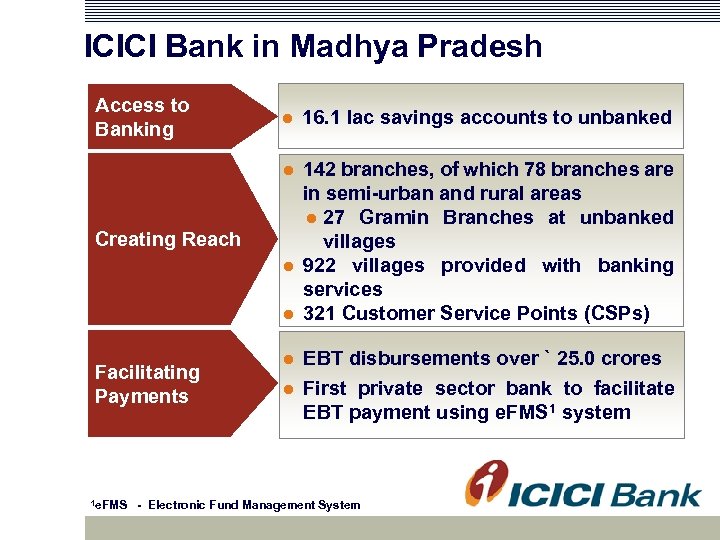

ICICI Bank in Madhya Pradesh Access to Banking 16. 1 lac savings accounts to unbanked 142 branches, of which 78 branches are in semi-urban and rural areas 27 Gramin Branches at unbanked villages 922 villages provided with banking services 321 Customer Service Points (CSPs) Creating Reach Facilitating Payments 1 e. FMS EBT disbursements over ` 25. 0 crores First private sector bank to facilitate EBT payment using e. FMS 1 system - Electronic Fund Management System

ICICI Bank in Madhya Pradesh Access to Banking 16. 1 lac savings accounts to unbanked 142 branches, of which 78 branches are in semi-urban and rural areas 27 Gramin Branches at unbanked villages 922 villages provided with banking services 321 Customer Service Points (CSPs) Creating Reach Facilitating Payments 1 e. FMS EBT disbursements over ` 25. 0 crores First private sector bank to facilitate EBT payment using e. FMS 1 system - Electronic Fund Management System

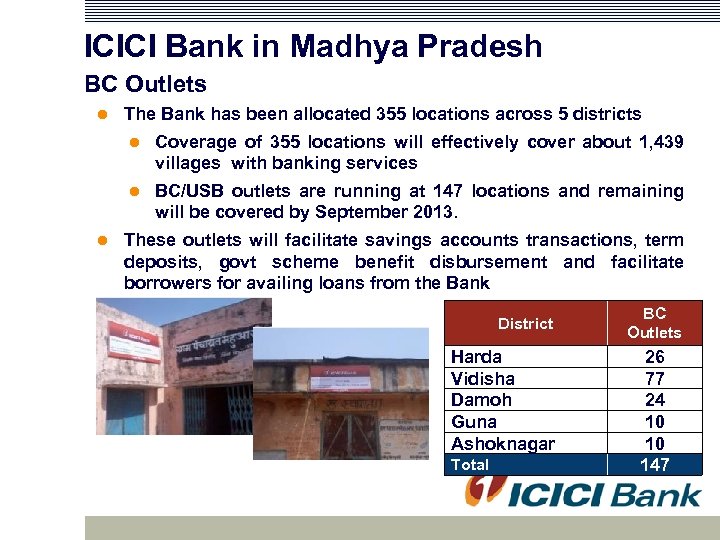

ICICI Bank in Madhya Pradesh BC Outlets The Bank has been allocated 355 locations across 5 districts Coverage of 355 locations will effectively cover about 1, 439 villages with banking services BC/USB outlets are running at 147 locations and remaining will be covered by September 2013. These outlets will facilitate savings accounts transactions, term deposits, govt scheme benefit disbursement and facilitate borrowers for availing loans from the Bank District Harda Vidisha Damoh Guna Ashoknagar Total BC Outlets 26 77 24 10 10 147

ICICI Bank in Madhya Pradesh BC Outlets The Bank has been allocated 355 locations across 5 districts Coverage of 355 locations will effectively cover about 1, 439 villages with banking services BC/USB outlets are running at 147 locations and remaining will be covered by September 2013. These outlets will facilitate savings accounts transactions, term deposits, govt scheme benefit disbursement and facilitate borrowers for availing loans from the Bank District Harda Vidisha Damoh Guna Ashoknagar Total BC Outlets 26 77 24 10 10 147

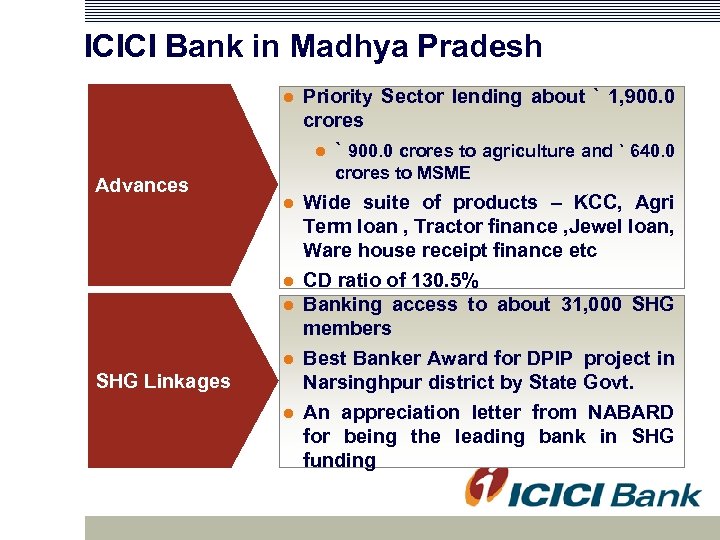

ICICI Bank in Madhya Pradesh Priority Sector lending about ` 1, 900. 0 crores Advances ` 900. 0 crores to agriculture and ` 640. 0 crores to MSME SHG Linkages Wide suite of products – KCC, Agri Term loan , Tractor finance , Jewel loan, Ware house receipt finance etc CD ratio of 130. 5% Banking access to about 31, 000 SHG members Best Banker Award for DPIP project in Narsinghpur district by State Govt. An appreciation letter from NABARD for being the leading bank in SHG funding

ICICI Bank in Madhya Pradesh Priority Sector lending about ` 1, 900. 0 crores Advances ` 900. 0 crores to agriculture and ` 640. 0 crores to MSME SHG Linkages Wide suite of products – KCC, Agri Term loan , Tractor finance , Jewel loan, Ware house receipt finance etc CD ratio of 130. 5% Banking access to about 31, 000 SHG members Best Banker Award for DPIP project in Narsinghpur district by State Govt. An appreciation letter from NABARD for being the leading bank in SHG funding

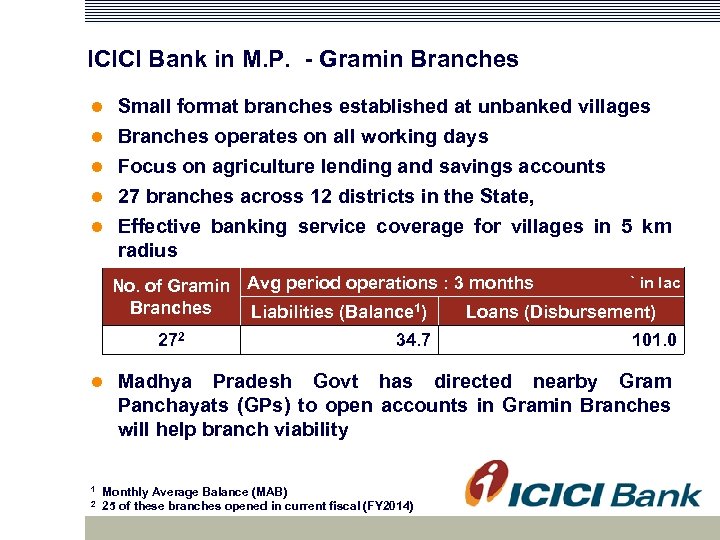

ICICI Bank in M. P. - Gramin Branches Small format branches established at unbanked villages Branches operates on all working days Focus on agriculture lending and savings accounts 27 branches across 12 districts in the State, Effective banking service coverage for villages in 5 km radius ` in lac No. of Gramin Avg period operations : 3 months Branches Liabilities (Balance 1) Loans (Disbursement) 272 1 2 34. 7 101. 0 Madhya Pradesh Govt has directed nearby Gram Panchayats (GPs) to open accounts in Gramin Branches will help branch viability Monthly Average Balance (MAB) 25 of these branches opened in current fiscal (FY 2014)

ICICI Bank in M. P. - Gramin Branches Small format branches established at unbanked villages Branches operates on all working days Focus on agriculture lending and savings accounts 27 branches across 12 districts in the State, Effective banking service coverage for villages in 5 km radius ` in lac No. of Gramin Avg period operations : 3 months Branches Liabilities (Balance 1) Loans (Disbursement) 272 1 2 34. 7 101. 0 Madhya Pradesh Govt has directed nearby Gram Panchayats (GPs) to open accounts in Gramin Branches will help branch viability Monthly Average Balance (MAB) 25 of these branches opened in current fiscal (FY 2014)

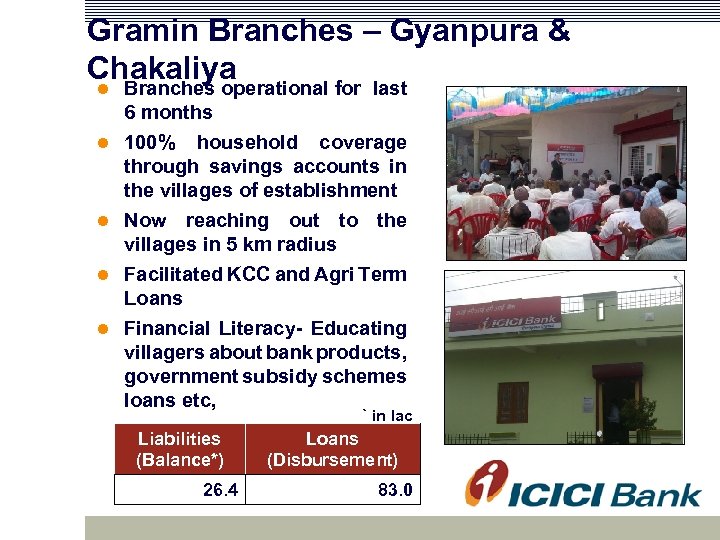

Gramin Branches – Gyanpura & Chakaliya Branches operational for last 6 months 100% household coverage through savings accounts in the villages of establishment Now reaching out to the villages in 5 km radius Facilitated KCC and Agri Term Loans Financial Literacy- Educating villagers about bank products, government subsidy schemes loans etc, ` in lac Liabilities (Balance*) 26. 4 Loans (Disbursement) 83. 0

Gramin Branches – Gyanpura & Chakaliya Branches operational for last 6 months 100% household coverage through savings accounts in the villages of establishment Now reaching out to the villages in 5 km radius Facilitated KCC and Agri Term Loans Financial Literacy- Educating villagers about bank products, government subsidy schemes loans etc, ` in lac Liabilities (Balance*) 26. 4 Loans (Disbursement) 83. 0

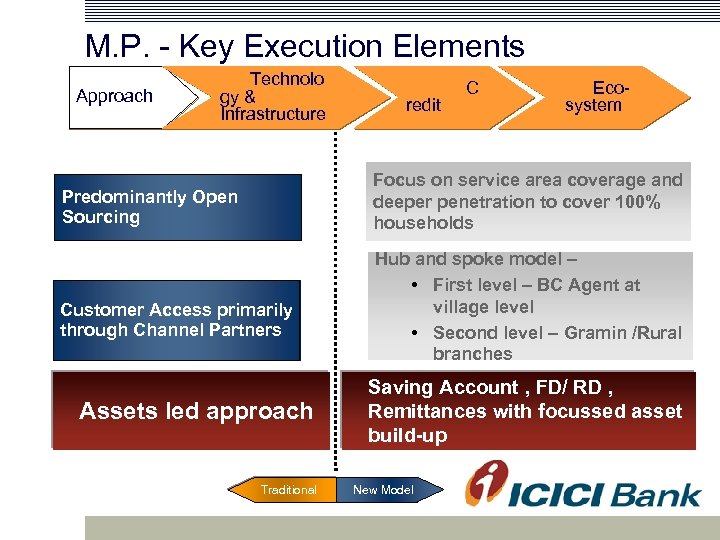

M. P. - Key Execution Elements Approach Technolo gy & Infrastructure redit C Ecosystem Focus on service area coverage and deeper penetration to cover 100% households Predominantly Open Sourcing Customer Access primarily through Channel Partners Assets led approach Traditional Hub and spoke model – • First level – BC Agent at village level • Second level – Gramin /Rural branches Saving Account , FD/ RD , Remittances with focussed asset build-up New Model

M. P. - Key Execution Elements Approach Technolo gy & Infrastructure redit C Ecosystem Focus on service area coverage and deeper penetration to cover 100% households Predominantly Open Sourcing Customer Access primarily through Channel Partners Assets led approach Traditional Hub and spoke model – • First level – BC Agent at village level • Second level – Gramin /Rural branches Saving Account , FD/ RD , Remittances with focussed asset build-up New Model

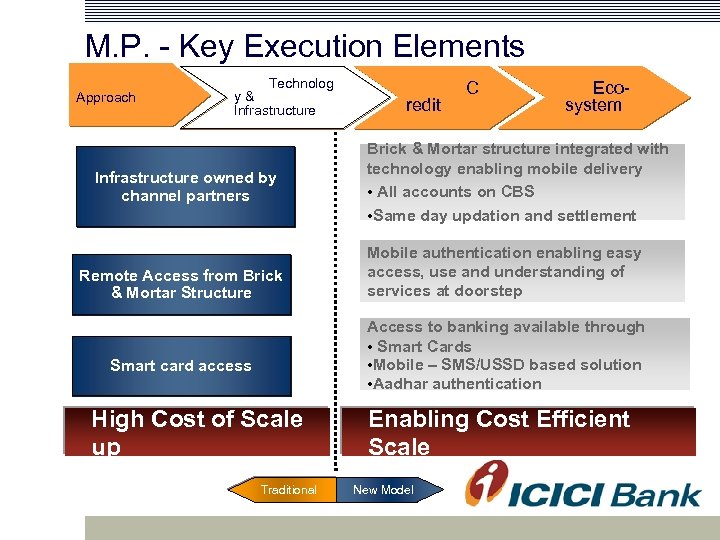

M. P. - Key Execution Elements Approach Technolog y& Infrastructure owned by channel partners Remote Access from Brick & Mortar Structure redit C Ecosystem Brick & Mortar structure integrated with technology enabling mobile delivery • All accounts on CBS • Same day updation and settlement Mobile authentication enabling easy access, use and understanding of services at doorstep Access to banking available through • Smart Cards • Mobile – SMS/USSD based solution • Aadhar authentication Smart card access High Cost of Scale up Traditional Enabling Cost Efficient Scale New Model

M. P. - Key Execution Elements Approach Technolog y& Infrastructure owned by channel partners Remote Access from Brick & Mortar Structure redit C Ecosystem Brick & Mortar structure integrated with technology enabling mobile delivery • All accounts on CBS • Same day updation and settlement Mobile authentication enabling easy access, use and understanding of services at doorstep Access to banking available through • Smart Cards • Mobile – SMS/USSD based solution • Aadhar authentication Smart card access High Cost of Scale up Traditional Enabling Cost Efficient Scale New Model

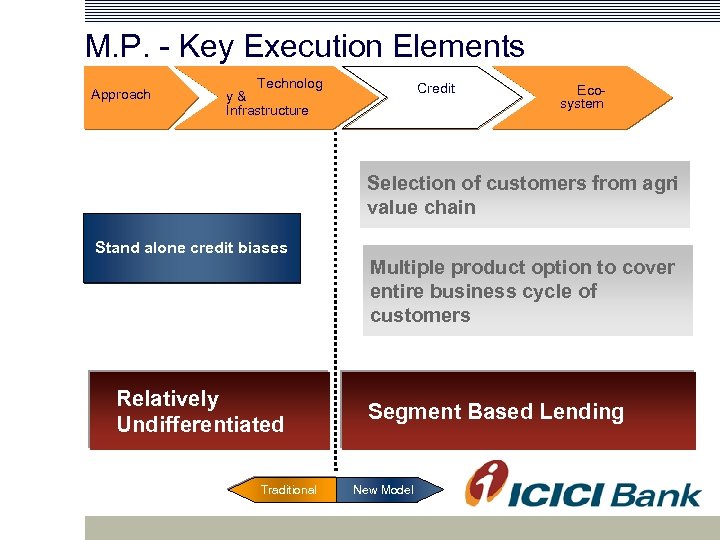

M. P. - Key Execution Elements Approach Technolog Credit y& Infrastructure Ecosystem Selection of customers from agri value chain Stand alone credit biases Relatively Undifferentiated Traditional Multiple product option to cover entire business cycle of customers Segment Based Lending New Model

M. P. - Key Execution Elements Approach Technolog Credit y& Infrastructure Ecosystem Selection of customers from agri value chain Stand alone credit biases Relatively Undifferentiated Traditional Multiple product option to cover entire business cycle of customers Segment Based Lending New Model

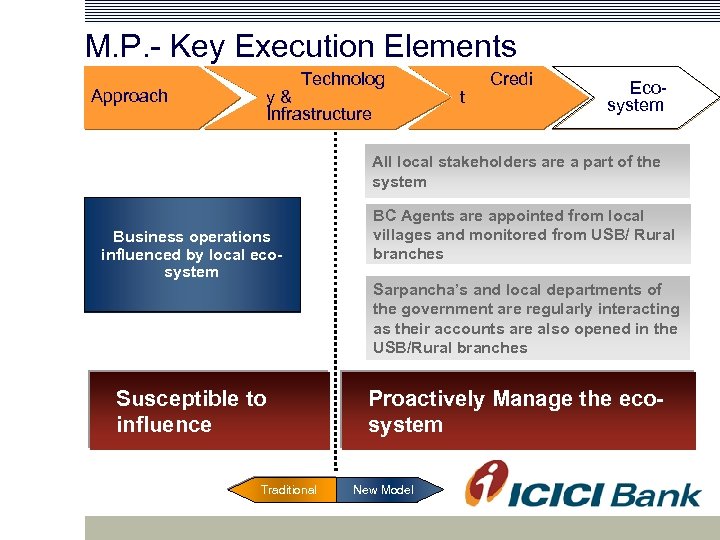

M. P. - Key Execution Elements Approach Technolog y& Infrastructure t Credi Ecosystem All local stakeholders are a part of the system Business operations influenced by local ecosystem BC Agents are appointed from local villages and monitored from USB/ Rural branches Sarpancha’s and local departments of the government are regularly interacting as their accounts are also opened in the USB/Rural branches Susceptible to influence Traditional Proactively Manage the ecosystem New Model

M. P. - Key Execution Elements Approach Technolog y& Infrastructure t Credi Ecosystem All local stakeholders are a part of the system Business operations influenced by local ecosystem BC Agents are appointed from local villages and monitored from USB/ Rural branches Sarpancha’s and local departments of the government are regularly interacting as their accounts are also opened in the USB/Rural branches Susceptible to influence Traditional Proactively Manage the ecosystem New Model

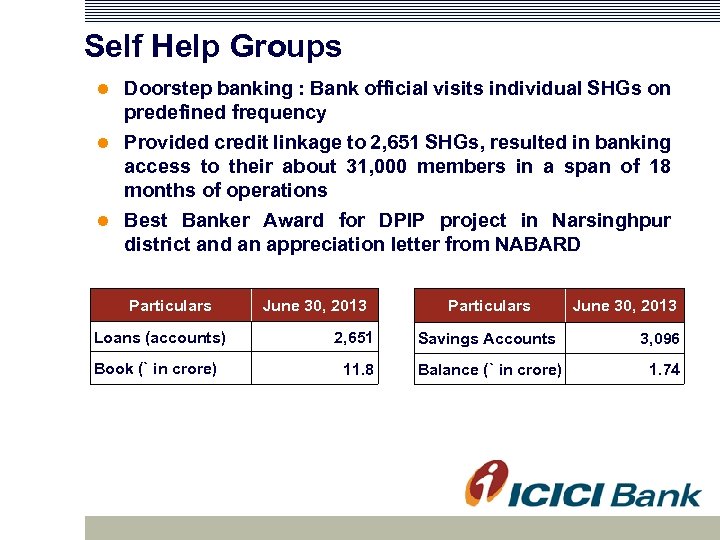

Self Help Groups Doorstep banking : Bank official visits individual SHGs on predefined frequency Provided credit linkage to 2, 651 SHGs, resulted in banking access to their about 31, 000 members in a span of 18 months of operations Best Banker Award for DPIP project in Narsinghpur district and an appreciation letter from NABARD Particulars June 30, 2013 Loans (accounts) 2, 651 Savings Accounts 3, 096 Book (` in crore) 11. 8 Balance (` in crore) 1. 74

Self Help Groups Doorstep banking : Bank official visits individual SHGs on predefined frequency Provided credit linkage to 2, 651 SHGs, resulted in banking access to their about 31, 000 members in a span of 18 months of operations Best Banker Award for DPIP project in Narsinghpur district and an appreciation letter from NABARD Particulars June 30, 2013 Loans (accounts) 2, 651 Savings Accounts 3, 096 Book (` in crore) 11. 8 Balance (` in crore) 1. 74

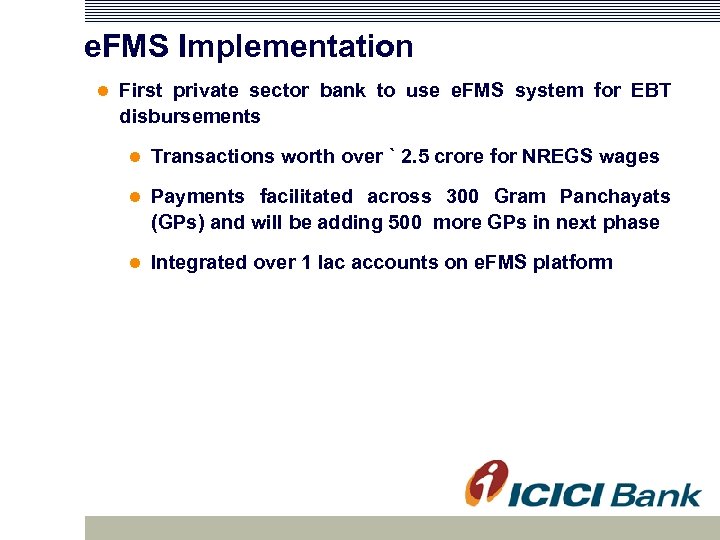

e. FMS Implementation First private sector bank to use e. FMS system for EBT disbursements Transactions worth over ` 2. 5 crore for NREGS wages Payments facilitated across 300 Gram Panchayats (GPs) and will be adding 500 more GPs in next phase Integrated over 1 lac accounts on e. FMS platform

e. FMS Implementation First private sector bank to use e. FMS system for EBT disbursements Transactions worth over ` 2. 5 crore for NREGS wages Payments facilitated across 300 Gram Panchayats (GPs) and will be adding 500 more GPs in next phase Integrated over 1 lac accounts on e. FMS platform

Thank you

Thank you