33f59d2aa419dd8ebca364985fb2befc.ppt

- Количество слайдов: 16

Financial Inclusion Andhra Bank’s Experience

Challenges! • • • Enrollment of large numbers Wide geographic spread High maintenance costs for accounts Small ticket size of transaction Illiteracy and use of vernacular Product & service pricing Trust and acceptance Lack of electricity Poor telecommunications

Financial Inclusion through Smartcard Bank’s role in AP • Schemes covered so far • Social Security Pensions (SSPs) • Wages under NREG Scheme • SHG Linkage (Pilot) • Geographic scope – Indentified mandals in • Warangal, Karimnagar, Medak, Mahaboobnagar, Chittoor, East Godavari – One- district-one-bank • Srikakulam and Guntur

Our Technology Partners • A Little World Pvt Ltd – Pilot project in Geesukonda Mandal – Warangal district • Access Development Services (BC) & Atyati Technologies – Districts of East Godavari, Srikakulam, Karimnagar, Mahaboobnagar, Medak, Chittoor, Guntur • Fino Ltd. – SHG Linkage – Pilot - in East Godavari

Pilot Project – AP Govt - 2007 • Andhra Bank was allotted 25 villages in Geesukonda Mandal (Warangal district). • Government has extended financial assistance – of Rs. 90/- per card – Rs. 10, 000 per hand held device – Service charges of 2% of the volume of cash disbursed.

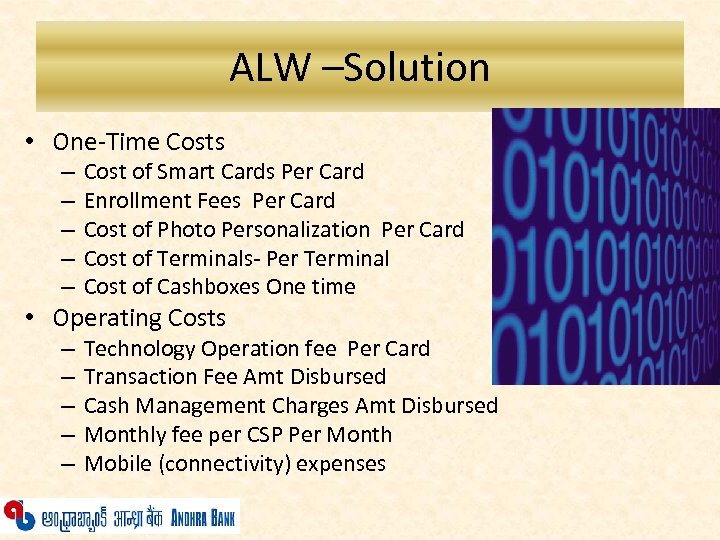

ALW –Solution • One-Time Costs – – – Cost of Smart Cards Per Card Enrollment Fees Per Card Cost of Photo Personalization Per Card Cost of Terminals- Per Terminal Cost of Cashboxes One time • Operating Costs – – – Technology Operation fee Per Card Transaction Fee Amt Disbursed Cash Management Charges Amt Disbursed Monthly fee per CSP Per Month Mobile (connectivity) expenses

Salient aspects of our RFP • • • Proven Technology Scalable and interoperable system Contact or Contactless smartcards Fingerprint image acquisition as per RBI norms End-to-end Solution (technology and banking services)

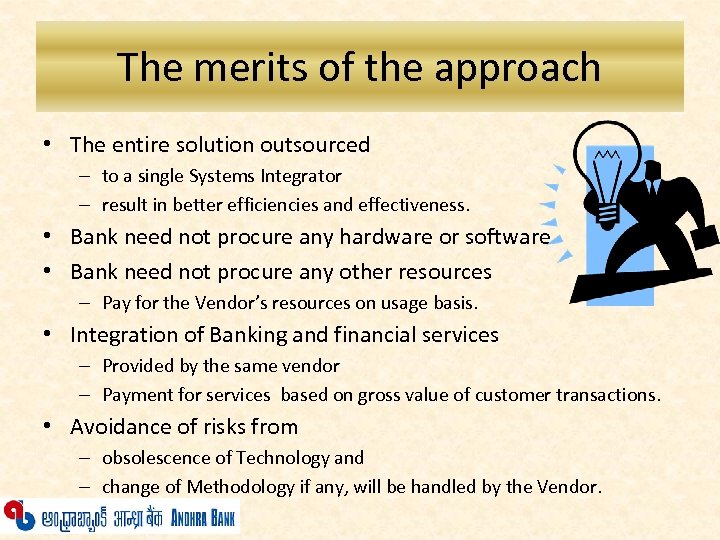

The merits of the approach • The entire solution outsourced – to a single Systems Integrator – result in better efficiencies and effectiveness. • Bank need not procure any hardware or software • Bank need not procure any other resources – Pay for the Vendor’s resources on usage basis. • Integration of Banking and financial services – Provided by the same vendor – Payment for services based on gross value of customer transactions. • Avoidance of risks from – obsolescence of Technology and – change of Methodology if any, will be handled by the Vendor.

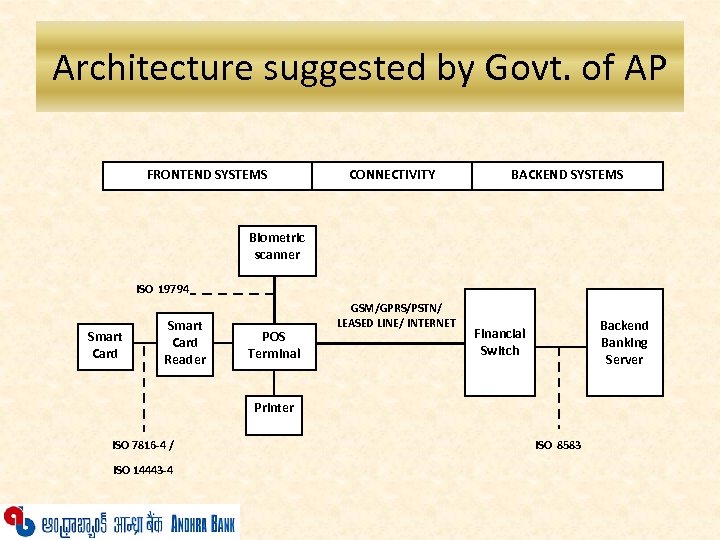

Architecture suggested by Govt. of AP FRONTEND SYSTEMS CONNECTIVITY BACKEND SYSTEMS Biometric scanner ISO 19794 Smart Card Reader POS Terminal GSM/GPRS/PSTN/ LEASED LINE/ INTERNET Backend Banking Server Financial Switch Printer ISO 7816 -4 / ISO 14443 -4 ISO 8583

Technical Specifications - RFP • Smartcard – ISO 14443 / ISO 7816 – EMV Compliant – 32 K EEPROM memory – Standard dimension PVC / Polycarbonate Card – DES/3 DES (key length 1024/2048) – Hold User Certificates, Smartcard OS, Applications, etc

Technical Specification - RFP • Handheld devices – Integrated system or 2/3 components – ISO 14443 / ISO 7816 and ISO 18092 for read and write operations – Built-in PKI support – EMV Compliant – Multilingual support – Online & Offline capability – Secured storage and communication – Long hours of battery support

Technical Specifications - RFP • Fingerprint Scanner – – – Image acquisition at setting level 31 of ISO/IEC 19794 -4 Contact area 1 x 1 sq. inch Min. capture-size 13 mm wide x 17 mm high Pixel density 500 ppi with + 5 ppi Pixel depth 8 bits 200 grey levels (dynamic range of scanned image) Sense live-scan plain finger impression Strong anti-spoofing features Protection from ambient light, residual images Standard for Data-Interchange - ANSI-378 Encrypt fingerprint minutiae with 3 DES Scanner surface to be resistant to dust, humidity, shocks, electronic discharge, ambient light, extreme temperatures, etc

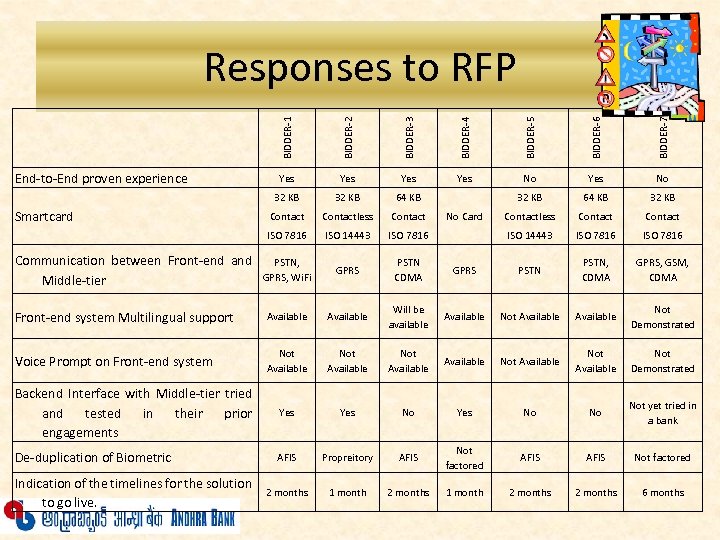

32 KB 64 KB Contactless Contact ISO 7816 ISO 14443 ISO 7816 PSTN, GPRS, Wi. Fi GPRS PSTN CDMA Front-end system Multilingual support Available Voice Prompt on Front-end system Not Available Backend Interface with Middle-tier tried and tested in their prior engagements De-duplication of Biometric Indication of the timelines for the solution to go live. BIDDER-7 Yes Communication between Front-end and Middle-tier BIDDER-6 BIDDER-3 Yes Smartcard BIDDER-5 BIDDER-2 Yes End-to-End proven experience BIDDER-4 BIDDER-1 Responses to RFP Yes No 32 KB 64 KB 32 KB Contactless Contact ISO 14443 ISO 7816 GPRS PSTN, CDMA GPRS, GSM, CDMA Will be available Available Not Demonstrated Not Available Not Available Not Demonstrated Yes No Not yet tried in a bank AFIS Propreitory AFIS Not factored 2 months 1 month 2 months 6 months No Card

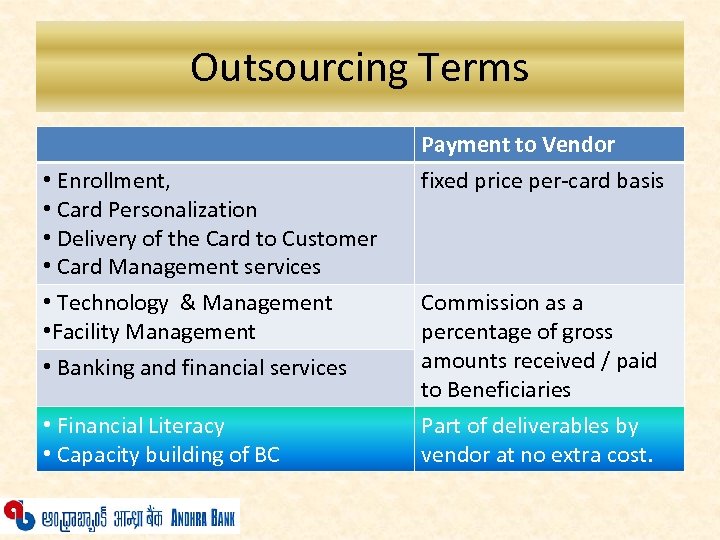

Outsourcing Terms • Enrollment, • Card Personalization • Delivery of the Card to Customer • Card Management services • Technology & Management • Facility Management • Banking and financial services • Financial Literacy • Capacity building of BC Payment to Vendor fixed price per-card basis Commission as a percentage of gross amounts received / paid to Beneficiaries Part of deliverables by vendor at no extra cost.

Progress in coverage • Beneficiaries covered so far in AP – Warangal District (pilot) 14, 000 – East Godavari District (enrolled) 150, 000 – Srikakulam District 20, 000

33f59d2aa419dd8ebca364985fb2befc.ppt