bc5e8c762b6f069f5e4493db1c9138b3.ppt

- Количество слайдов: 24

Financial help for those entering full time higher education in 2014

Financial help for those entering full time higher education in 2014

Overview Expenses and financial support whilst at university fall broadly into two categories: Tuition fees Living costs - maintenance grant - maintenance loans

Overview Expenses and financial support whilst at university fall broadly into two categories: Tuition fees Living costs - maintenance grant - maintenance loans

Tuition fees The majority of course fees have been set at: £ 7, 500 to £ 9, 000 Check the university website Fees will vary course to course and university to university May go over £ 9, 000 with inflation

Tuition fees The majority of course fees have been set at: £ 7, 500 to £ 9, 000 Check the university website Fees will vary course to course and university to university May go over £ 9, 000 with inflation

Help with Tuition fees Student loan for fees All Students are eligible for tuition fee loans No income assessment Fees will be paid directly to the university Tuition fee loans will be repayable once students have graduated and are earning more than £ 21, 000 a year

Help with Tuition fees Student loan for fees All Students are eligible for tuition fee loans No income assessment Fees will be paid directly to the university Tuition fee loans will be repayable once students have graduated and are earning more than £ 21, 000 a year

Help with living expenses Includes Maintenance Grant Maintenance Loan Bursaries (may be)

Help with living expenses Includes Maintenance Grant Maintenance Loan Bursaries (may be)

Help with living expenses Maintenance Grant Worth up to £ 3, 387 a year Income assessed – based upon household income Grant paid by instalments Does not have to be paid back

Help with living expenses Maintenance Grant Worth up to £ 3, 387 a year Income assessed – based upon household income Grant paid by instalments Does not have to be paid back

Household income For most school leavers based on: Gross taxable income of one or both adults in the house – parents partners step parents Less some deductions for payments into pension funds etc and £ 1, 130 each for other dependent children in the household Based on tax year 2012 -13

Household income For most school leavers based on: Gross taxable income of one or both adults in the house – parents partners step parents Less some deductions for payments into pension funds etc and £ 1, 130 each for other dependent children in the household Based on tax year 2012 -13

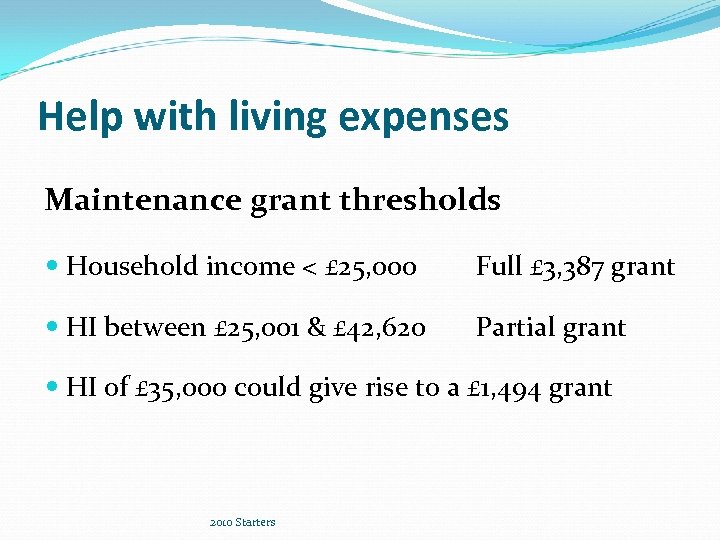

Help with living expenses Maintenance grant thresholds Household income < £ 25, 000 Full £ 3, 387 grant HI between £ 25, 001 & £ 42, 620 Partial grant HI of £ 35, 000 could give rise to a £ 1, 494 grant 2010 Starters

Help with living expenses Maintenance grant thresholds Household income < £ 25, 000 Full £ 3, 387 grant HI between £ 25, 001 & £ 42, 620 Partial grant HI of £ 35, 000 could give rise to a £ 1, 494 grant 2010 Starters

Help with living expenses Maintenance Loans To help with general living costs such as rent, food and books Available to all students Added to the tuition fee loan Re-payable once earning in excess of £ 21, 000

Help with living expenses Maintenance Loans To help with general living costs such as rent, food and books Available to all students Added to the tuition fee loan Re-payable once earning in excess of £ 21, 000

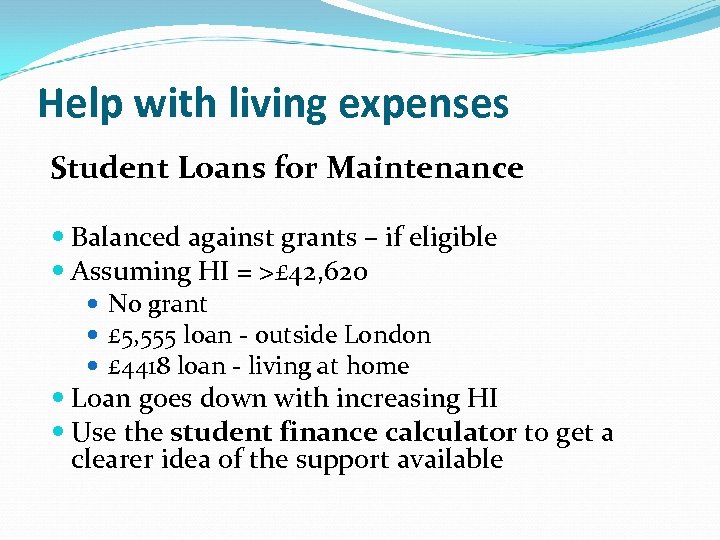

Help with living expenses Student Loans for Maintenance Balanced against grants – if eligible Assuming HI = >£ 42, 620 No grant £ 5, 555 loan - outside London £ 4418 loan - living at home Loan goes down with increasing HI Use the student finance calculator to get a clearer idea of the support available

Help with living expenses Student Loans for Maintenance Balanced against grants – if eligible Assuming HI = >£ 42, 620 No grant £ 5, 555 loan - outside London £ 4418 loan - living at home Loan goes down with increasing HI Use the student finance calculator to get a clearer idea of the support available

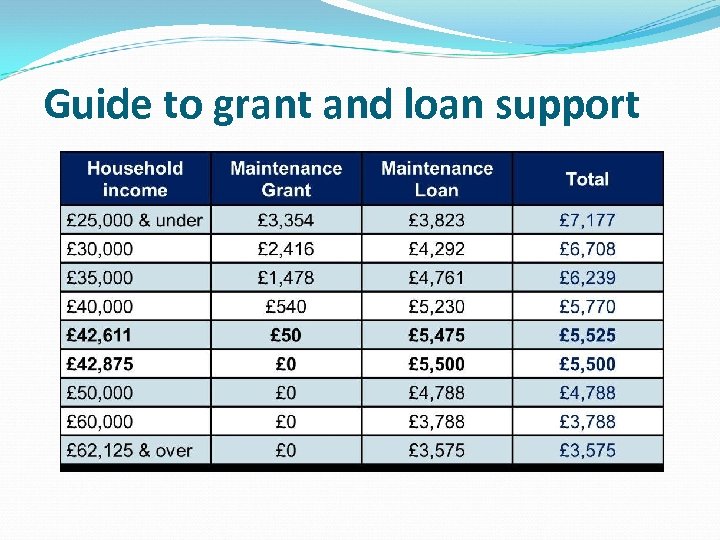

Guide to grant and loan support

Guide to grant and loan support

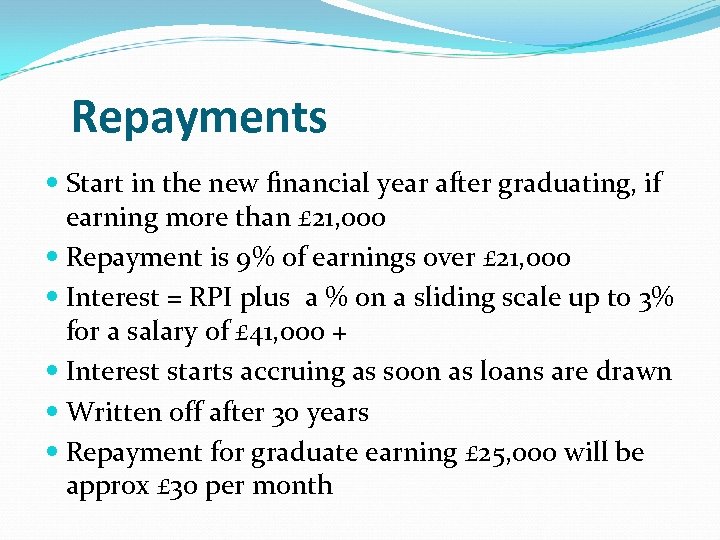

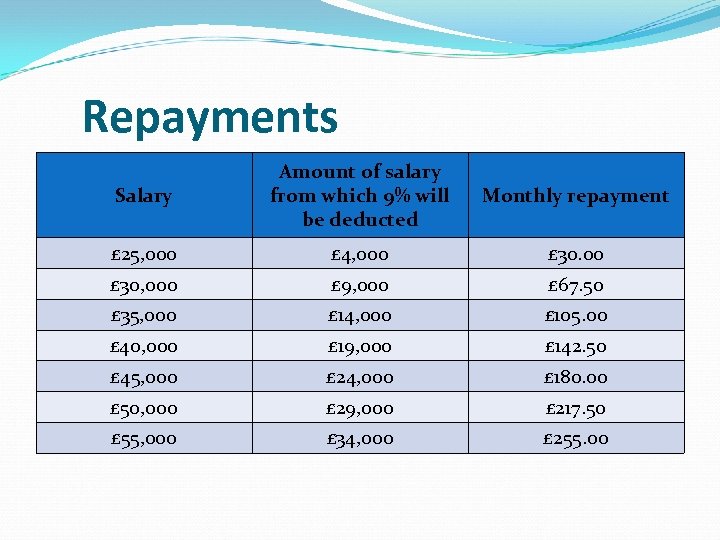

Repayments Start in the new financial year after graduating, if earning more than £ 21, 000 Repayment is 9% of earnings over £ 21, 000 Interest = RPI plus a % on a sliding scale up to 3% for a salary of £ 41, 000 + Interest starts accruing as soon as loans are drawn Written off after 30 years Repayment for graduate earning £ 25, 000 will be approx £ 30 per month

Repayments Start in the new financial year after graduating, if earning more than £ 21, 000 Repayment is 9% of earnings over £ 21, 000 Interest = RPI plus a % on a sliding scale up to 3% for a salary of £ 41, 000 + Interest starts accruing as soon as loans are drawn Written off after 30 years Repayment for graduate earning £ 25, 000 will be approx £ 30 per month

Repayments Salary Amount of salary from which 9% will be deducted Monthly repayment £ 25, 000 £ 4, 000 £ 30, 000 £ 9, 000 £ 67. 50 £ 35, 000 £ 14, 000 £ 105. 00 £ 40, 000 £ 19, 000 £ 142. 50 £ 45, 000 £ 24, 000 £ 180. 00 £ 50, 000 £ 29, 000 £ 217. 50 £ 55, 000 £ 34, 000 £ 255. 00

Repayments Salary Amount of salary from which 9% will be deducted Monthly repayment £ 25, 000 £ 4, 000 £ 30, 000 £ 9, 000 £ 67. 50 £ 35, 000 £ 14, 000 £ 105. 00 £ 40, 000 £ 19, 000 £ 142. 50 £ 45, 000 £ 24, 000 £ 180. 00 £ 50, 000 £ 29, 000 £ 217. 50 £ 55, 000 £ 34, 000 £ 255. 00

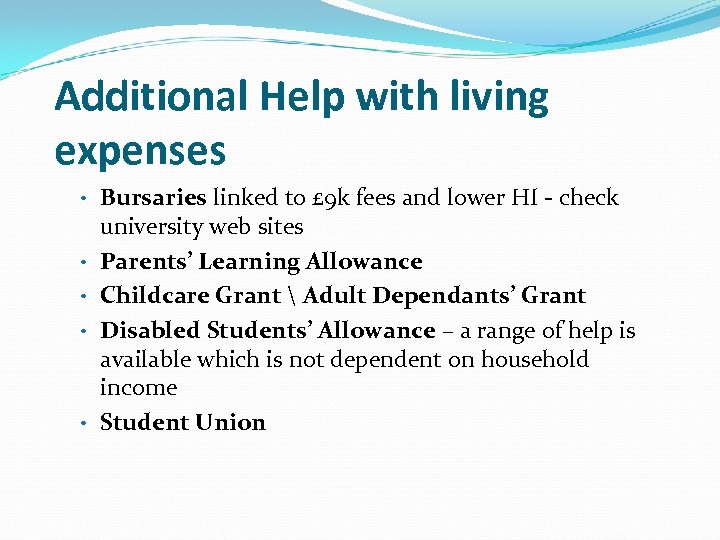

Additional Help with living expenses • Bursaries linked to £ 9 k fees and lower HI - check • • university web sites Parents’ Learning Allowance Childcare Grant Adult Dependants’ Grant Disabled Students’ Allowance – a range of help is available which is not dependent on household income Student Union

Additional Help with living expenses • Bursaries linked to £ 9 k fees and lower HI - check • • university web sites Parents’ Learning Allowance Childcare Grant Adult Dependants’ Grant Disabled Students’ Allowance – a range of help is available which is not dependent on household income Student Union

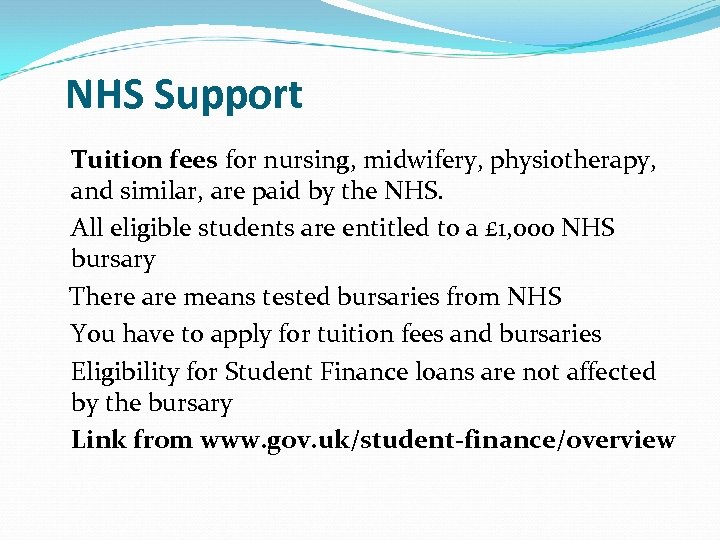

NHS Support Tuition fees for nursing, midwifery, physiotherapy, and similar, are paid by the NHS. All eligible students are entitled to a £ 1, 000 NHS bursary There are means tested bursaries from NHS You have to apply for tuition fees and bursaries Eligibility for Student Finance loans are not affected by the bursary Link from www. gov. uk/student-finance/overview

NHS Support Tuition fees for nursing, midwifery, physiotherapy, and similar, are paid by the NHS. All eligible students are entitled to a £ 1, 000 NHS bursary There are means tested bursaries from NHS You have to apply for tuition fees and bursaries Eligibility for Student Finance loans are not affected by the bursary Link from www. gov. uk/student-finance/overview

All the information you need Google “student finance” and go to: www. gov. uk/student-finance/overview

All the information you need Google “student finance” and go to: www. gov. uk/student-finance/overview

Some Good News HECSU’s What Do Graduates Do? Report, the average salary for UK graduates in full-time employment six months after graduation range between £ 18, 000 - £ 24, 000 www. graduates. co. uk Website also shows average salaries by sector

Some Good News HECSU’s What Do Graduates Do? Report, the average salary for UK graduates in full-time employment six months after graduation range between £ 18, 000 - £ 24, 000 www. graduates. co. uk Website also shows average salaries by sector

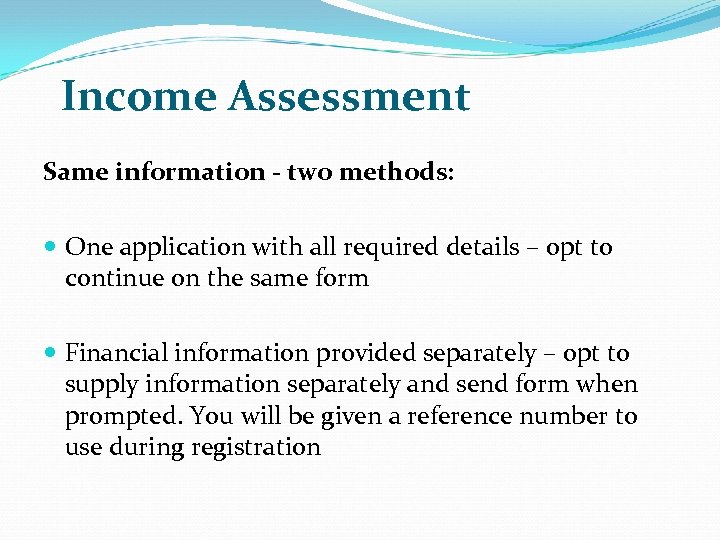

Income Assessment Same information - two methods: One application with all required details – opt to continue on the same form Financial information provided separately – opt to supply information separately and send form when prompted. You will be given a reference number to use during registration

Income Assessment Same information - two methods: One application with all required details – opt to continue on the same form Financial information provided separately – opt to supply information separately and send form when prompted. You will be given a reference number to use during registration

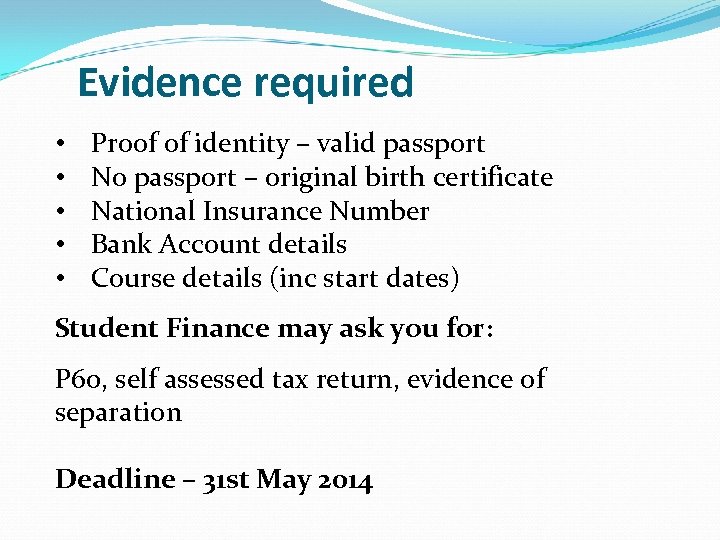

Evidence required • • • Proof of identity – valid passport No passport – original birth certificate National Insurance Number Bank Account details Course details (inc start dates) Student Finance may ask you for: P 60, self assessed tax return, evidence of separation Deadline – 31 st May 2014

Evidence required • • • Proof of identity – valid passport No passport – original birth certificate National Insurance Number Bank Account details Course details (inc start dates) Student Finance may ask you for: P 60, self assessed tax return, evidence of separation Deadline – 31 st May 2014

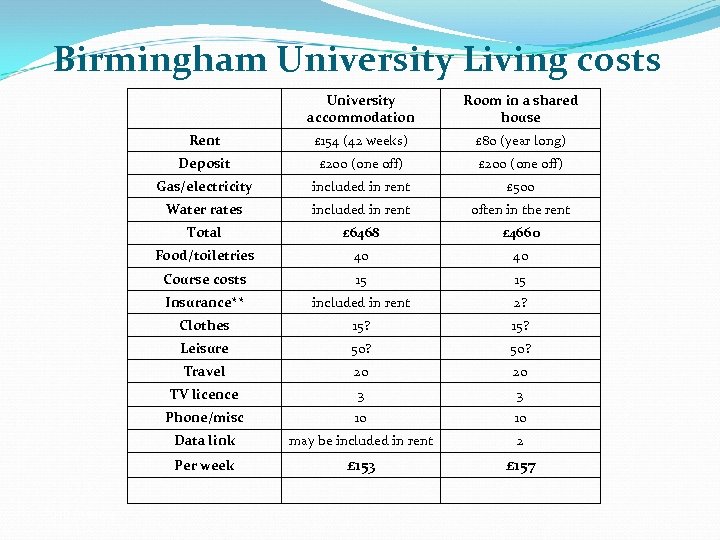

Birmingham University Living costs University accommodation Rent £ 154 (42 weeks) £ 80 (year long) Deposit £ 200 (one off) Gas/electricity included in rent £ 500 Water rates included in rent often in the rent Total £ 6468 £ 4660 Food/toiletries 40 40 Course costs 15 15 Insurance** included in rent 2? Clothes 15? Leisure 50? Travel 20 20 TV licence 3 3 Phone/misc 10 10 Data link may be included in rent 2 Per week 2010 Starters Room in a shared house £ 153 £ 157

Birmingham University Living costs University accommodation Rent £ 154 (42 weeks) £ 80 (year long) Deposit £ 200 (one off) Gas/electricity included in rent £ 500 Water rates included in rent often in the rent Total £ 6468 £ 4660 Food/toiletries 40 40 Course costs 15 15 Insurance** included in rent 2? Clothes 15? Leisure 50? Travel 20 20 TV licence 3 3 Phone/misc 10 10 Data link may be included in rent 2 Per week 2010 Starters Room in a shared house £ 153 £ 157

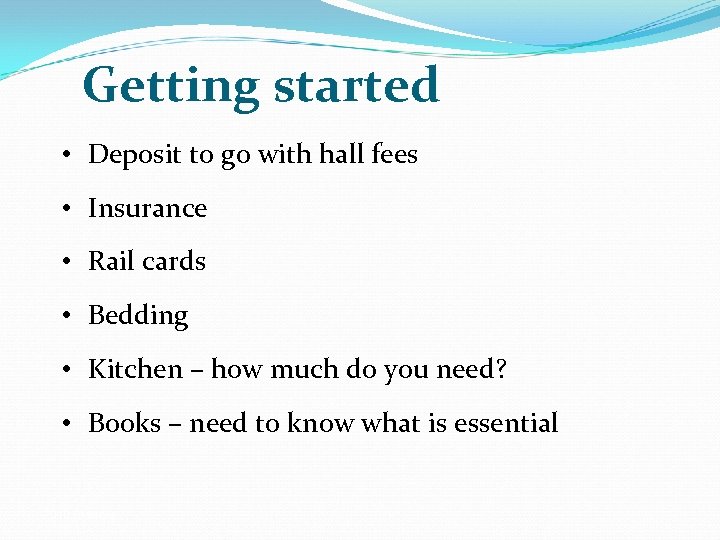

Getting started • Deposit to go with hall fees • Insurance • Rail cards • Bedding • Kitchen – how much do you need? • Books – need to know what is essential 2010 Starters

Getting started • Deposit to go with hall fees • Insurance • Rail cards • Bedding • Kitchen – how much do you need? • Books – need to know what is essential 2010 Starters

Banks • They can offer a lot of money - £ 1, 000 in the first year, going up by £ 250 a year thereafter • Their main aim is to recruit a long term customer • Beware - they will just assume students have graduated and switch to a regular overdraft – with charges! • Banks do write and students ignore the letters because they bank on line! • Use Debit not Credit cards 2010 Starters

Banks • They can offer a lot of money - £ 1, 000 in the first year, going up by £ 250 a year thereafter • Their main aim is to recruit a long term customer • Beware - they will just assume students have graduated and switch to a regular overdraft – with charges! • Banks do write and students ignore the letters because they bank on line! • Use Debit not Credit cards 2010 Starters

Living out in years 2 and 3 • Often sorted out in January of first year • Use student union approved agents • Student union will advise on safe areas and contracts • Often, one student has to be a lead tenant • Bills included v Pay your own bills • Parents may be required to act as guarantor • Agents can no longer hold deposits

Living out in years 2 and 3 • Often sorted out in January of first year • Use student union approved agents • Student union will advise on safe areas and contracts • Often, one student has to be a lead tenant • Bills included v Pay your own bills • Parents may be required to act as guarantor • Agents can no longer hold deposits

Budgeting Advice Martin Lewis student finance at www. moneysavingexpert. com/students/studentguide Most university websites have budget advice

Budgeting Advice Martin Lewis student finance at www. moneysavingexpert. com/students/studentguide Most university websites have budget advice