f299ac61b170acd0cffeee72a3f5a0e0.ppt

- Количество слайдов: 17

Financial Development and Patterns of International Capital Flows Jürgen von Hagen (University of Bonn) and Haiping Zhang (Singapore Management University) ES North American Summer Meeting, Boston, 4 -7 June 2009

Financial Development and Patterns of International Capital Flows Jürgen von Hagen (University of Bonn) and Haiping Zhang (Singapore Management University) ES North American Summer Meeting, Boston, 4 -7 June 2009

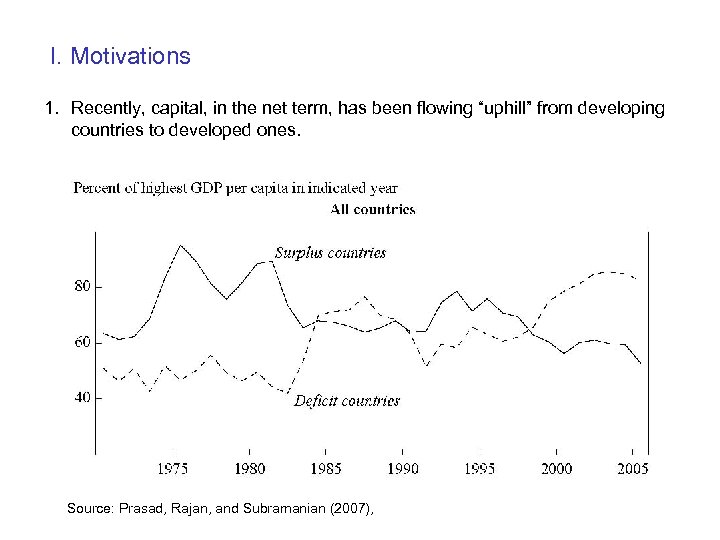

I. Motivations 1. Recently, capital, in the net term, has been flowing “uphill” from developing countries to developed ones. Source: Prasad, Rajan, and Subramanian (2007),

I. Motivations 1. Recently, capital, in the net term, has been flowing “uphill” from developing countries to developed ones. Source: Prasad, Rajan, and Subramanian (2007),

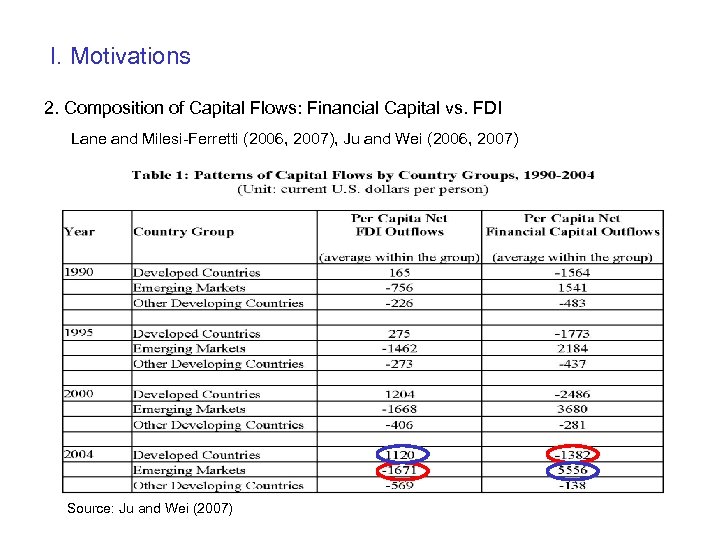

I. Motivations 2. Composition of Capital Flows: Financial Capital vs. FDI Lane and Milesi-Ferretti (2006, 2007), Ju and Wei (2006, 2007) Source: Ju and Wei (2007)

I. Motivations 2. Composition of Capital Flows: Financial Capital vs. FDI Lane and Milesi-Ferretti (2006, 2007), Ju and Wei (2006, 2007) Source: Ju and Wei (2007)

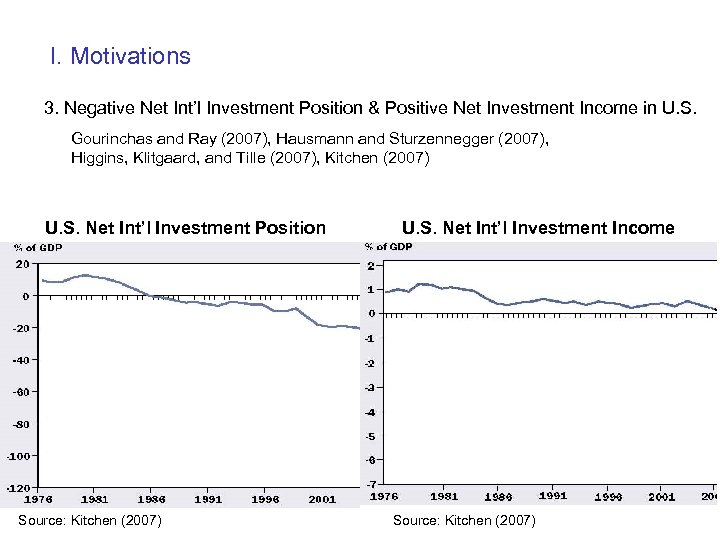

I. Motivations 3. Negative Net Int’l Investment Position & Positive Net Investment Income in U. S. Gourinchas and Ray (2007), Hausmann and Sturzennegger (2007), Higgins, Klitgaard, and Tille (2007), Kitchen (2007) U. S. Net Int’l Investment Position Source: Kitchen (2007) U. S. Net Int’l Investment Income Source: Kitchen (2007)

I. Motivations 3. Negative Net Int’l Investment Position & Positive Net Investment Income in U. S. Gourinchas and Ray (2007), Hausmann and Sturzennegger (2007), Higgins, Klitgaard, and Tille (2007), Kitchen (2007) U. S. Net Int’l Investment Position Source: Kitchen (2007) U. S. Net Int’l Investment Income Source: Kitchen (2007)

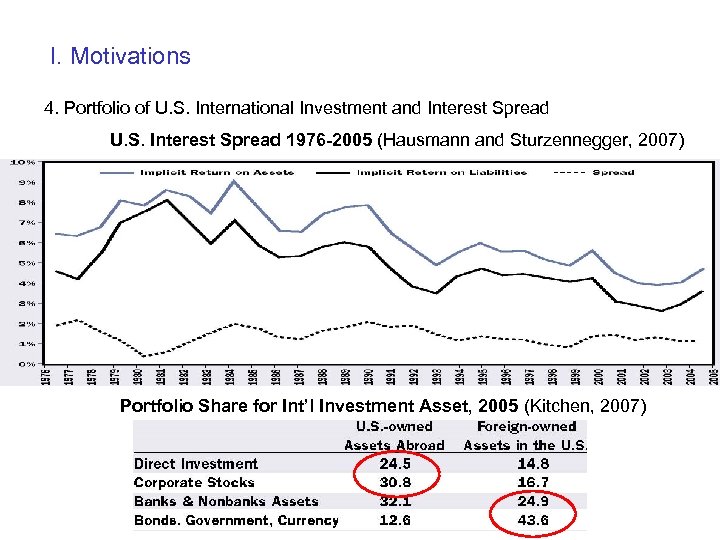

I. Motivations 4. Portfolio of U. S. International Investment and Interest Spread U. S. Interest Spread 1976 -2005 (Hausmann and Sturzennegger, 2007) Portfolio Share for Int’l Investment Asset, 2005 (Kitchen, 2007)

I. Motivations 4. Portfolio of U. S. International Investment and Interest Spread U. S. Interest Spread 1976 -2005 (Hausmann and Sturzennegger, 2007) Portfolio Share for Int’l Investment Asset, 2005 (Kitchen, 2007)

I. Related Literature 1. Many models focus on portfolio capital flows but neglect FDI. 2. Boyd and Smith (1997), Tille (2005), Tille and van Wincoop (2008), Caballero, Farhi, and Gourinchas (2008), Antràs, Desai, and Foley (2009) 3. 2. Two-Way Capital Flows Mendoza, Quadrini, and Rios-Rull (2007), Caballero, Farhi, and Gourinchas (2008), Devereux and Sutherland (2009), Ju and Wei (2006, 2007),

I. Related Literature 1. Many models focus on portfolio capital flows but neglect FDI. 2. Boyd and Smith (1997), Tille (2005), Tille and van Wincoop (2008), Caballero, Farhi, and Gourinchas (2008), Antràs, Desai, and Foley (2009) 3. 2. Two-Way Capital Flows Mendoza, Quadrini, and Rios-Rull (2007), Caballero, Farhi, and Gourinchas (2008), Devereux and Sutherland (2009), Ju and Wei (2006, 2007),

I. Main Results 1. Cross-country difference in financial development can explain the three empirical facts: the two-way capital flows, “uphill” net capital flow, and the coexistence of negative net international investment position and positive net investment income of the rich country. 2. Intuitively, financial frictions distort the rates of return to external capital (loan) and internal capital (equity). Cross-country difference in financial development leads to cross-country difference in the loan rate as well as in the equity rate, which then drive international flows of financial capital and equity capital (FDI). 3. International capital flows may have opposite welfare implications to different individuals within the same generation as well as across different generations.

I. Main Results 1. Cross-country difference in financial development can explain the three empirical facts: the two-way capital flows, “uphill” net capital flow, and the coexistence of negative net international investment position and positive net investment income of the rich country. 2. Intuitively, financial frictions distort the rates of return to external capital (loan) and internal capital (equity). Cross-country difference in financial development leads to cross-country difference in the loan rate as well as in the equity rate, which then drive international flows of financial capital and equity capital (FDI). 3. International capital flows may have opposite welfare implications to different individuals within the same generation as well as across different generations.

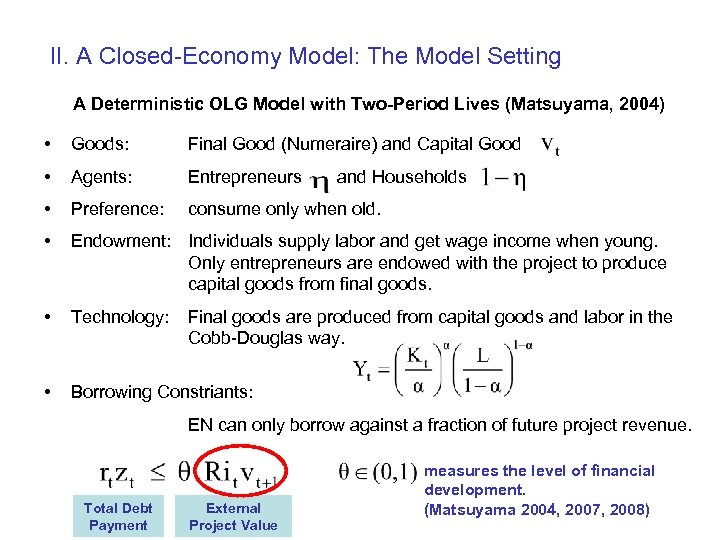

II. A Closed-Economy Model: The Model Setting A Deterministic OLG Model with Two-Period Lives (Matsuyama, 2004) • Goods: Final Good (Numeraire) and Capital Good • Agents: Entrepreneurs • Preference: consume only when old. • Endowment: Individuals supply labor and get wage income when young. Only entrepreneurs are endowed with the project to produce capital goods from final goods. • Technology: • Borrowing Constriants: and Households Final goods are produced from capital goods and labor in the Cobb-Douglas way. EN can only borrow against a fraction of future project revenue. Total Debt Payment External Project Value measures the level of financial development. (Matsuyama 2004, 2007, 2008)

II. A Closed-Economy Model: The Model Setting A Deterministic OLG Model with Two-Period Lives (Matsuyama, 2004) • Goods: Final Good (Numeraire) and Capital Good • Agents: Entrepreneurs • Preference: consume only when old. • Endowment: Individuals supply labor and get wage income when young. Only entrepreneurs are endowed with the project to produce capital goods from final goods. • Technology: • Borrowing Constriants: and Households Final goods are produced from capital goods and labor in the Cobb-Douglas way. EN can only borrow against a fraction of future project revenue. Total Debt Payment External Project Value measures the level of financial development. (Matsuyama 2004, 2007, 2008)

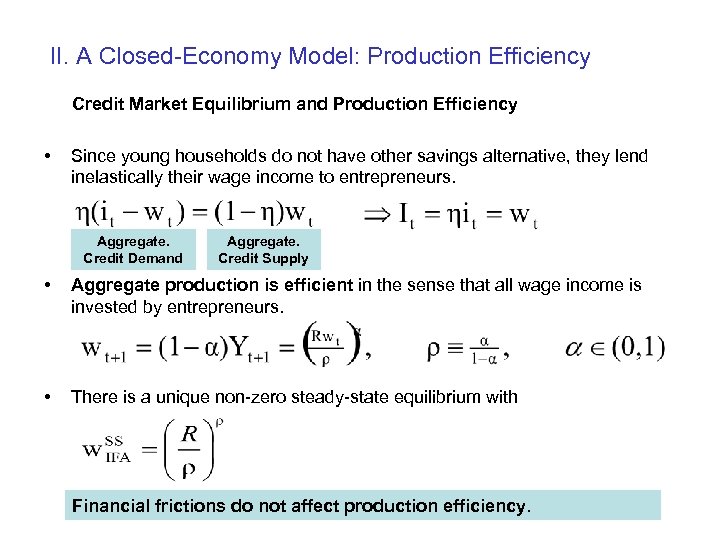

II. A Closed-Economy Model: Production Efficiency Credit Market Equilibrium and Production Efficiency • Since young households do not have other savings alternative, they lend inelastically their wage income to entrepreneurs. Aggregate. Credit Demand Aggregate. Credit Supply • Aggregate production is efficient in the sense that all wage income is invested by entrepreneurs. • There is a unique non-zero steady-state equilibrium with Financial frictions do not affect production efficiency.

II. A Closed-Economy Model: Production Efficiency Credit Market Equilibrium and Production Efficiency • Since young households do not have other savings alternative, they lend inelastically their wage income to entrepreneurs. Aggregate. Credit Demand Aggregate. Credit Supply • Aggregate production is efficient in the sense that all wage income is invested by entrepreneurs. • There is a unique non-zero steady-state equilibrium with Financial frictions do not affect production efficiency.

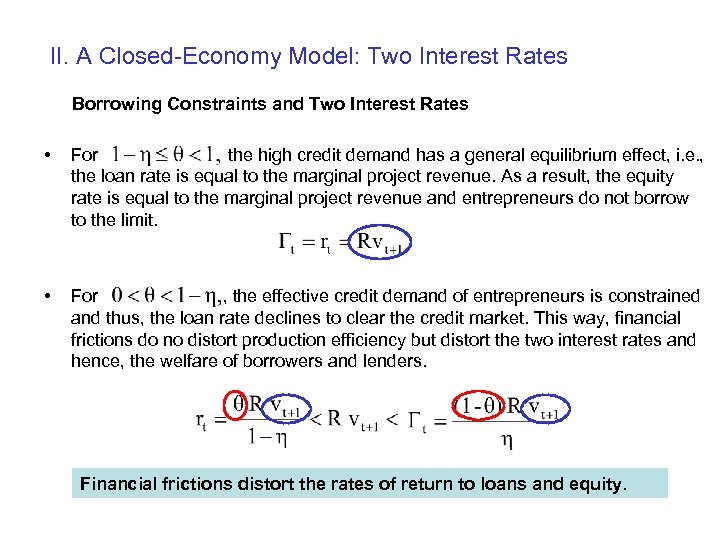

II. A Closed-Economy Model: Two Interest Rates Borrowing Constraints and Two Interest Rates • For the high credit demand has a general equilibrium effect, i. e. , the loan rate is equal to the marginal project revenue. As a result, the equity rate is equal to the marginal project revenue and entrepreneurs do not borrow to the limit. • For , the effective credit demand of entrepreneurs is constrained and thus, the loan rate declines to clear the credit market. This way, financial frictions do no distort production efficiency but distort the two interest rates and hence, the welfare of borrowers and lenders. Financial frictions distort the rates of return to loans and equity.

II. A Closed-Economy Model: Two Interest Rates Borrowing Constraints and Two Interest Rates • For the high credit demand has a general equilibrium effect, i. e. , the loan rate is equal to the marginal project revenue. As a result, the equity rate is equal to the marginal project revenue and entrepreneurs do not borrow to the limit. • For , the effective credit demand of entrepreneurs is constrained and thus, the loan rate declines to clear the credit market. This way, financial frictions do no distort production efficiency but distort the two interest rates and hence, the welfare of borrowers and lenders. Financial frictions distort the rates of return to loans and equity.

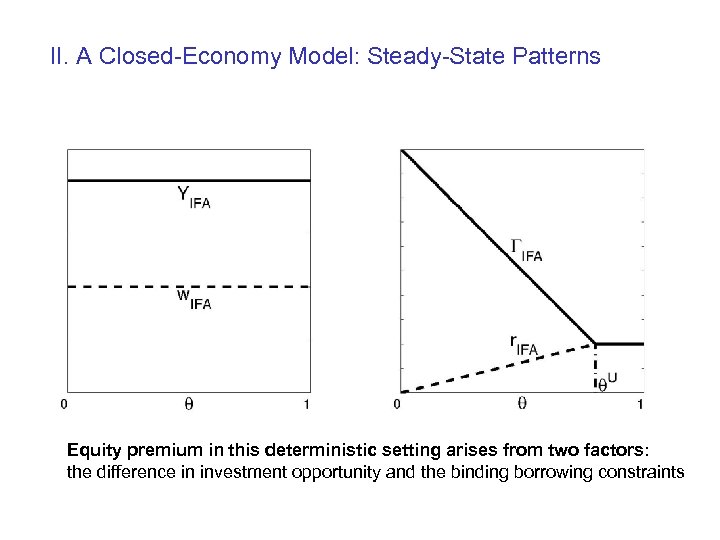

II. A Closed-Economy Model: Steady-State Patterns Equity premium in this deterministic setting arises from two factors: the difference in investment opportunity and the binding borrowing constraints

II. A Closed-Economy Model: Steady-State Patterns Equity premium in this deterministic setting arises from two factors: the difference in investment opportunity and the binding borrowing constraints

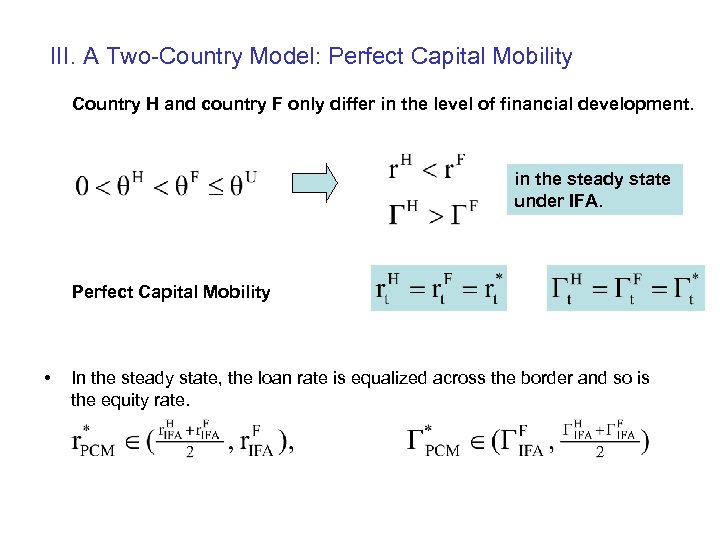

III. A Two-Country Model: Perfect Capital Mobility Country H and country F only differ in the level of financial development. in the steady state under IFA. Perfect Capital Mobility • In the steady state, the loan rate is equalized across the border and so is the equity rate.

III. A Two-Country Model: Perfect Capital Mobility Country H and country F only differ in the level of financial development. in the steady state under IFA. Perfect Capital Mobility • In the steady state, the loan rate is equalized across the border and so is the equity rate.

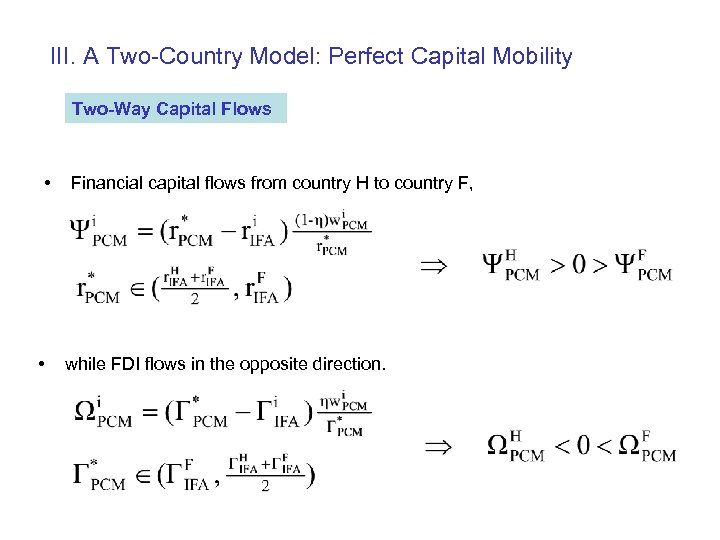

III. A Two-Country Model: Perfect Capital Mobility Two-Way Capital Flows • • Financial capital flows from country H to country F, while FDI flows in the opposite direction.

III. A Two-Country Model: Perfect Capital Mobility Two-Way Capital Flows • • Financial capital flows from country H to country F, while FDI flows in the opposite direction.

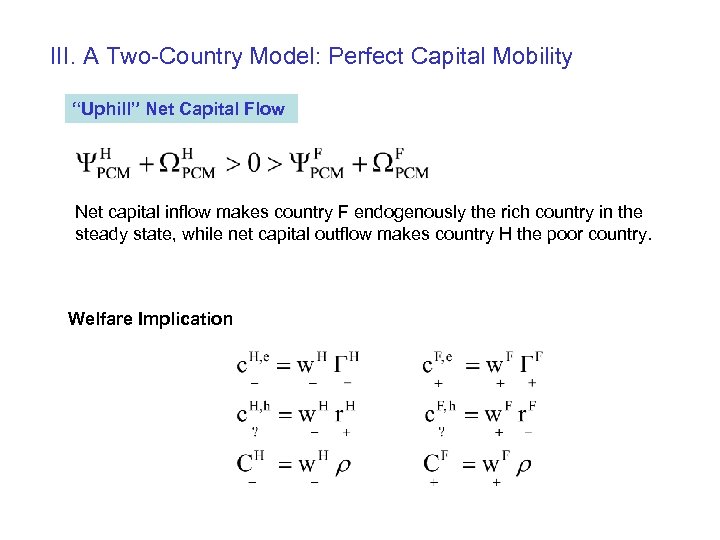

III. A Two-Country Model: Perfect Capital Mobility “Uphill” Net Capital Flow Net capital inflow makes country F endogenously the rich country in the steady state, while net capital outflow makes country H the poor country. Welfare Implication

III. A Two-Country Model: Perfect Capital Mobility “Uphill” Net Capital Flow Net capital inflow makes country F endogenously the rich country in the steady state, while net capital outflow makes country H the poor country. Welfare Implication

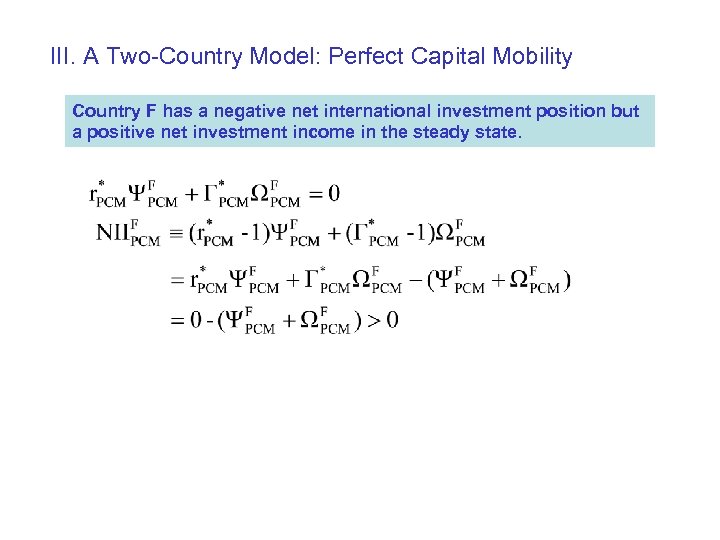

III. A Two-Country Model: Perfect Capital Mobility Country F has a negative net international investment position but a positive net investment income in the steady state.

III. A Two-Country Model: Perfect Capital Mobility Country F has a negative net international investment position but a positive net investment income in the steady state.

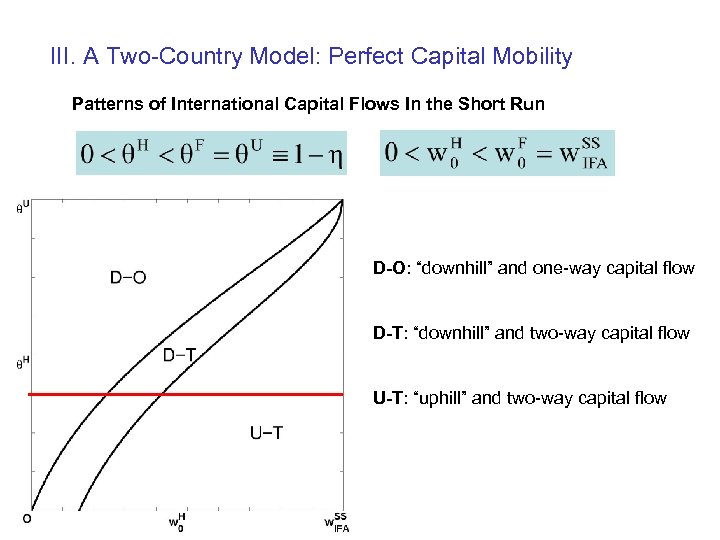

III. A Two-Country Model: Perfect Capital Mobility Patterns of International Capital Flows In the Short Run D-O: “downhill” and one-way capital flow D-T: “downhill” and two-way capital flow U-T: “uphill” and two-way capital flow

III. A Two-Country Model: Perfect Capital Mobility Patterns of International Capital Flows In the Short Run D-O: “downhill” and one-way capital flow D-T: “downhill” and two-way capital flow U-T: “uphill” and two-way capital flow

IV. Summary 1. Cross-country difference in financial development can explain three recent empirical facts: two-way capital flows, “uphill” net capital flow, and the coexistence of negative net international investment position and positive international investment income in U. S. 2. Essentially, this paper is an application of the Heckscher-Ohlin theorem in international finance. Financial development can be considered as an endowment of an economy which does not change in the short run. In the country with more developed financial sector, aggregate (effective) credit demand is higher. Thus, the loan rate tends to be higher while the equity rate lower in the steady state. International capital flows are driven by crosscountry differences in the two interest rates.

IV. Summary 1. Cross-country difference in financial development can explain three recent empirical facts: two-way capital flows, “uphill” net capital flow, and the coexistence of negative net international investment position and positive international investment income in U. S. 2. Essentially, this paper is an application of the Heckscher-Ohlin theorem in international finance. Financial development can be considered as an endowment of an economy which does not change in the short run. In the country with more developed financial sector, aggregate (effective) credit demand is higher. Thus, the loan rate tends to be higher while the equity rate lower in the steady state. International capital flows are driven by crosscountry differences in the two interest rates.