Equity Valuation, Part 3 (2).pptx

- Количество слайдов: 32

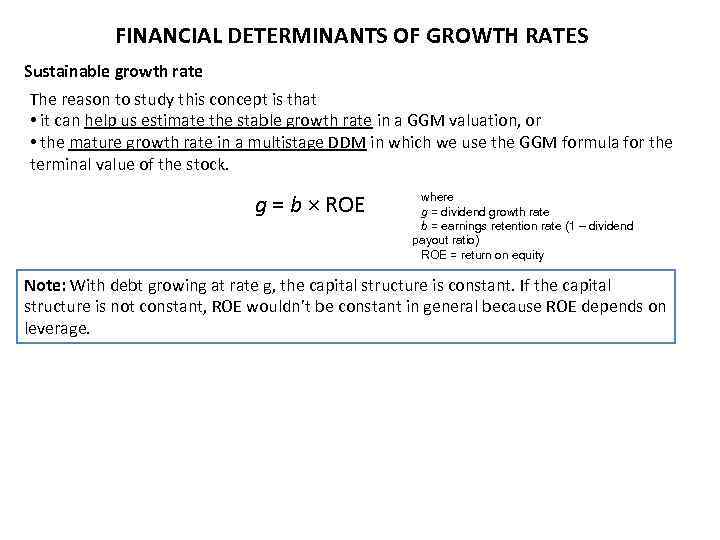

FINANCIAL DETERMINANTS OF GROWTH RATES Sustainable growth rate The reason to study this concept is that • it can help us estimate the stable growth rate in a GGM valuation, or • the mature growth rate in a multistage DDM in which we use the GGM formula for the terminal value of the stock. g = b × ROE where g = dividend growth rate b = earnings retention rate (1 – dividend payout ratio) ROE = return on equity Note: With debt growing at rate g, the capital structure is constant. If the capital structure is not constant, ROE wouldn’t be constant in general because ROE depends on leverage.

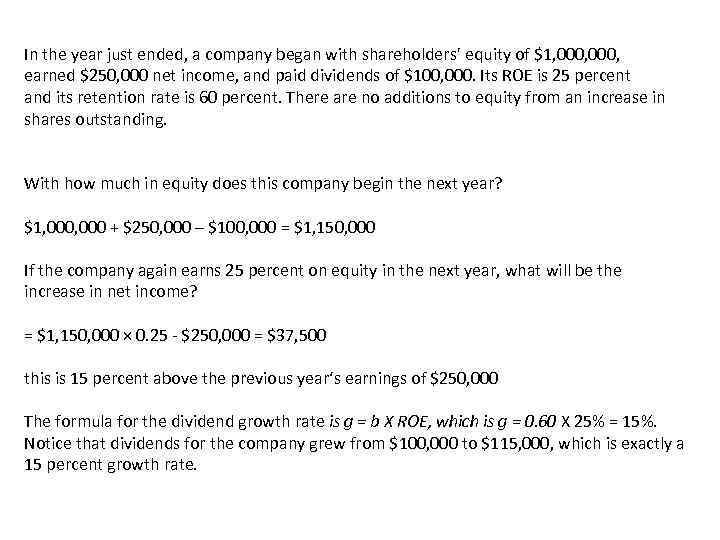

In the year just ended, a company began with shareholders' equity of $1, 000, earned $250, 000 net income, and paid dividends of $100, 000. Its ROE is 25 percent and its retention rate is 60 percent. There are no additions to equity from an increase in shares outstanding. With how much in equity does this company begin the next year? $1, 000 + $250, 000 – $100, 000 = $1, 150, 000 If the company again earns 25 percent on equity in the next year, what will be the increase in net income? = $1, 150, 000 × 0. 25 - $250, 000 = $37, 500 this is 15 percent above the previous year‘s earnings of $250, 000 The formula for the dividend growth rate is g = b X ROE, which is g = 0. 60 X 25% = 15%. Notice that dividends for the company grew from $100, 000 to $115, 000, which is exactly a 15 percent growth rate.

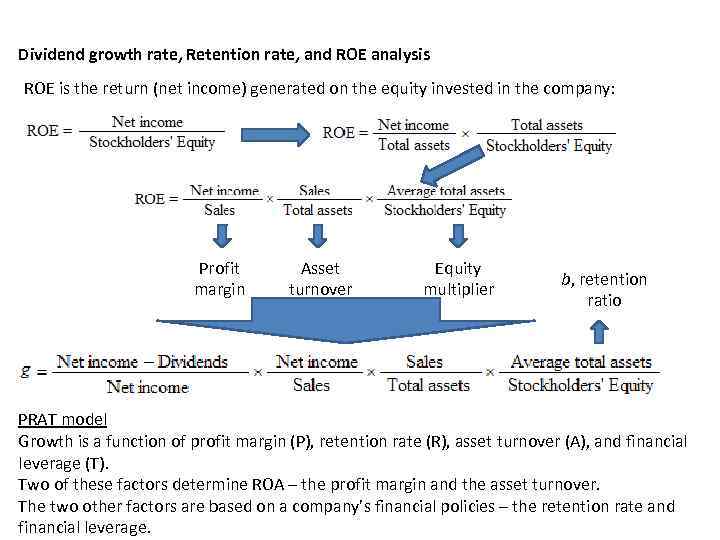

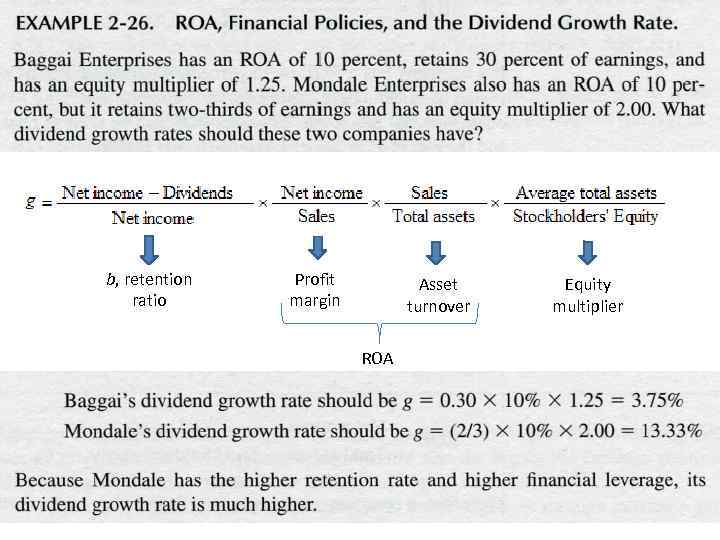

Dividend growth rate, Retention rate, and ROE analysis ROE is the return (net income) generated on the equity invested in the company: Profit margin Asset turnover Equity multiplier b, retention ratio PRAT model Growth is a function of profit margin (P), retention rate (R), asset turnover (A), and financial leverage (T). Two of these factors determine ROA – the profit margin and the asset turnover. The two other factors are based on a company’s financial policies – the retention rate and financial leverage.

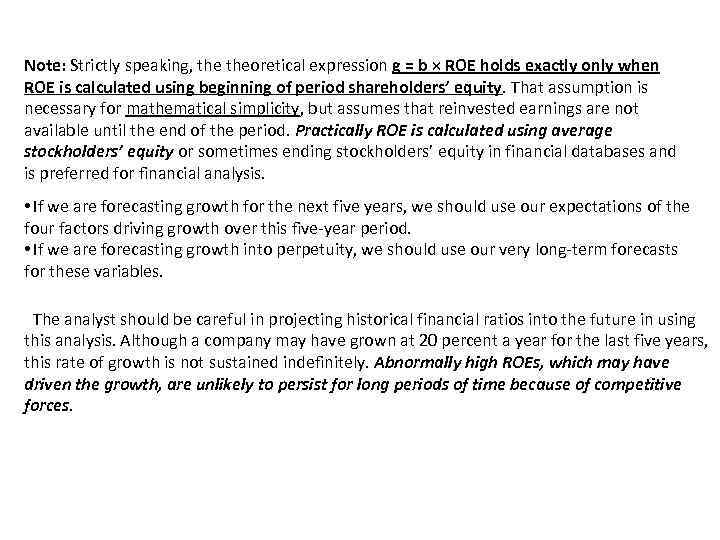

Note: Strictly speaking, theoretical expression g = b × ROE holds exactly only when ROE is calculated using beginning of period shareholders’ equity. That assumption is necessary for mathematical simplicity, but assumes that reinvested earnings are not available until the end of the period. Practically ROE is calculated using average stockholders’ equity or sometimes ending stockholders’ equity in financial databases and is preferred for financial analysis. • If we are forecasting growth for the next five years, we should use our expectations of the four factors driving growth over this five-year period. • If we are forecasting growth into perpetuity, we should use our very long-term forecasts for these variables. The analyst should be careful in projecting historical financial ratios into the future in using this analysis. Although a company may have grown at 20 percent a year for the last five years, this rate of growth is not sustained indefinitely. Abnormally high ROEs, which may have driven the growth, are unlikely to persist for long periods of time because of competitive forces.

b, retention ratio Profit margin Asset turnover ROA Equity multiplier

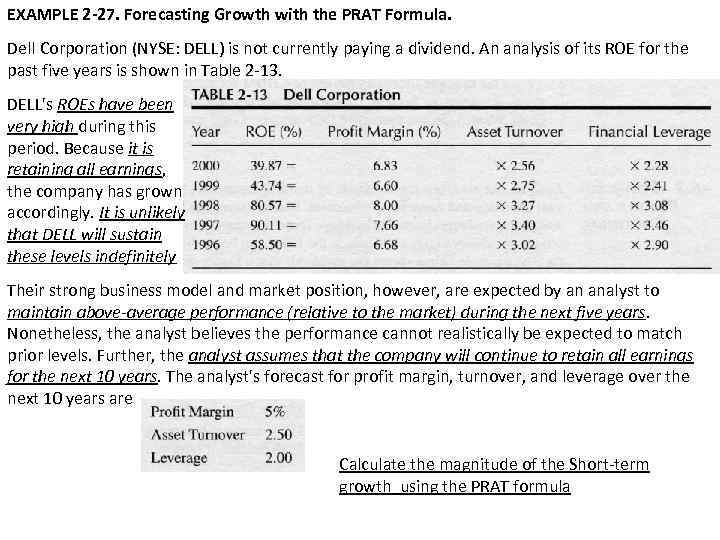

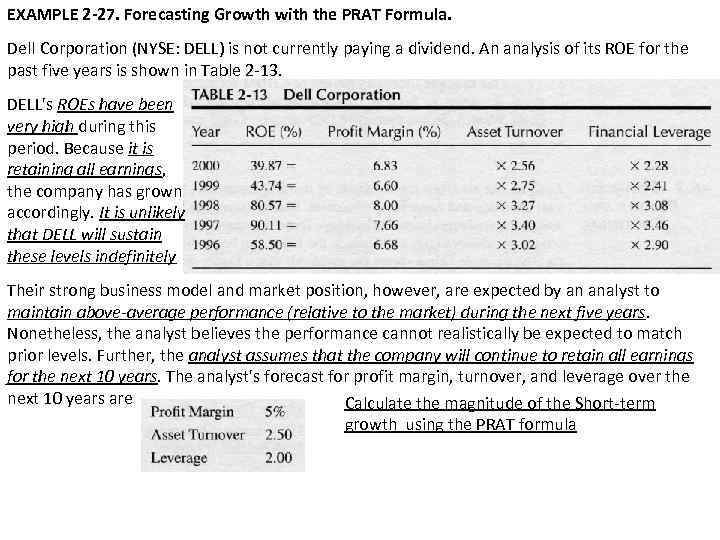

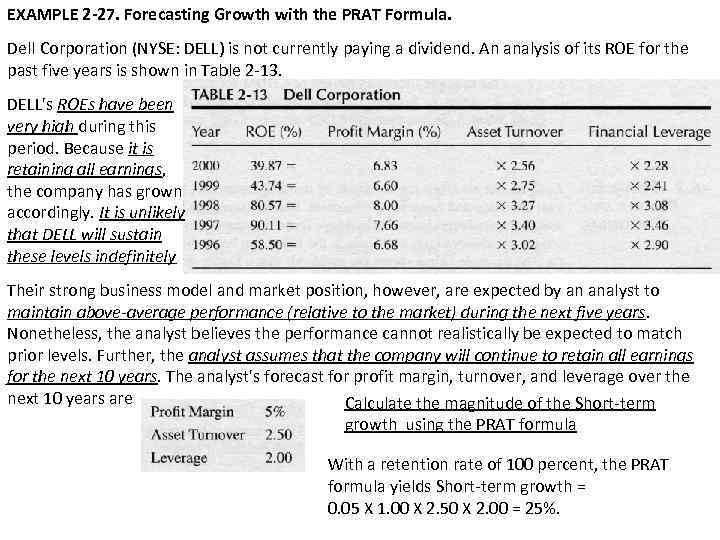

EXAMPLE 2 -27. Forecasting Growth with the PRAT Formula. Dell Corporation (NYSE: DELL) is not currently paying a dividend. An analysis of its ROE for the past five years is shown in Table 2 -13. DELL's ROEs have been very high during this period. Because it is retaining all earnings, the company has grown accordingly. It is unlikely that DELL will sustain these levels indefinitely Their strong business model and market position, however, are expected by an analyst to maintain above-average performance (relative to the market) during the next five years. Nonetheless, the analyst believes the performance cannot realistically be expected to match prior levels. Further, the analyst assumes that the company will continue to retain all earnings for the next 10 years. The analyst's forecast for profit margin, turnover, and leverage over the next 10 years are Calculate the magnitude of the Short-term growth using the PRAT formula

EXAMPLE 2 -27. Forecasting Growth with the PRAT Formula. Dell Corporation (NYSE: DELL) is not currently paying a dividend. An analysis of its ROE for the past five years is shown in Table 2 -13. DELL's ROEs have been very high during this period. Because it is retaining all earnings, the company has grown accordingly. It is unlikely that DELL will sustain these levels indefinitely Their strong business model and market position, however, are expected by an analyst to maintain above-average performance (relative to the market) during the next five years. Nonetheless, the analyst believes the performance cannot realistically be expected to match prior levels. Further, the analyst assumes that the company will continue to retain all earnings for the next 10 years. The analyst's forecast for profit margin, turnover, and leverage over the next 10 years are Calculate the magnitude of the Short-term growth using the PRAT formula

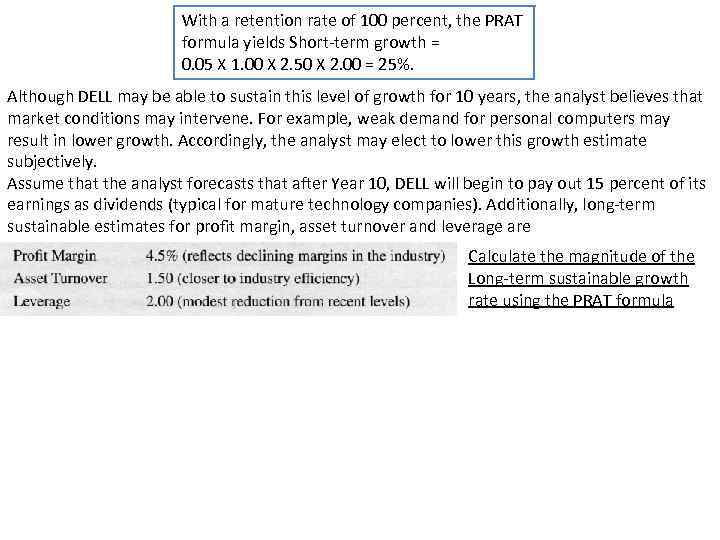

EXAMPLE 2 -27. Forecasting Growth with the PRAT Formula. Dell Corporation (NYSE: DELL) is not currently paying a dividend. An analysis of its ROE for the past five years is shown in Table 2 -13. DELL's ROEs have been very high during this period. Because it is retaining all earnings, the company has grown accordingly. It is unlikely that DELL will sustain these levels indefinitely Their strong business model and market position, however, are expected by an analyst to maintain above-average performance (relative to the market) during the next five years. Nonetheless, the analyst believes the performance cannot realistically be expected to match prior levels. Further, the analyst assumes that the company will continue to retain all earnings for the next 10 years. The analyst's forecast for profit margin, turnover, and leverage over the next 10 years are Calculate the magnitude of the Short-term growth using the PRAT formula With a retention rate of 100 percent, the PRAT formula yields Short-term growth = 0. 05 X 1. 00 X 2. 50 X 2. 00 = 25%.

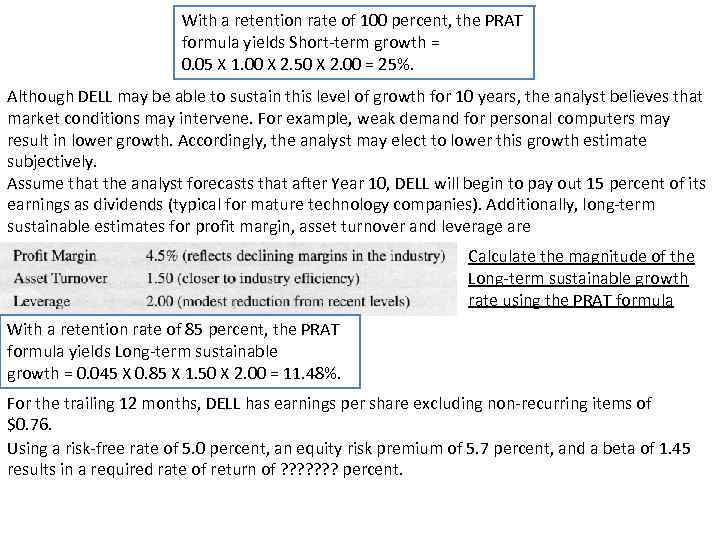

With a retention rate of 100 percent, the PRAT formula yields Short-term growth = 0. 05 X 1. 00 X 2. 50 X 2. 00 = 25%. Although DELL may be able to sustain this level of growth for 10 years, the analyst believes that market conditions may intervene. For example, weak demand for personal computers may result in lower growth. Accordingly, the analyst may elect to lower this growth estimate subjectively. Assume that the analyst forecasts that after Year 10, DELL will begin to pay out 15 percent of its earnings as dividends (typical for mature technology companies). Additionally, long-term sustainable estimates for profit margin, asset turnover and leverage are Calculate the magnitude of the Long-term sustainable growth rate using the PRAT formula

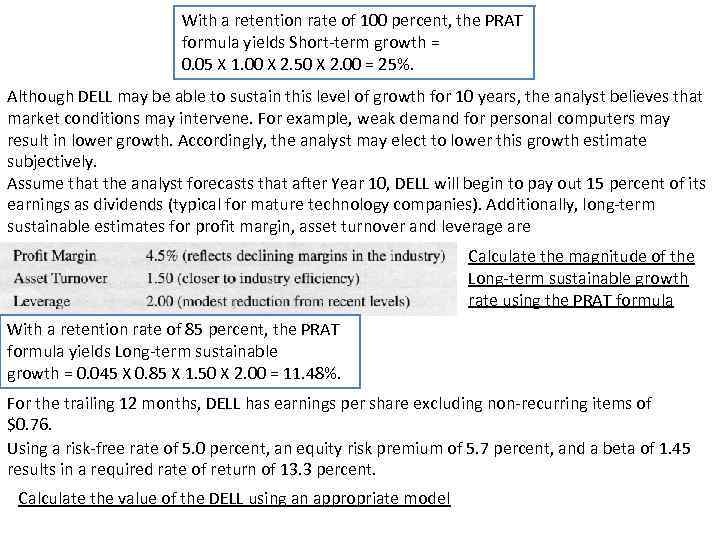

With a retention rate of 100 percent, the PRAT formula yields Short-term growth = 0. 05 X 1. 00 X 2. 50 X 2. 00 = 25%. Although DELL may be able to sustain this level of growth for 10 years, the analyst believes that market conditions may intervene. For example, weak demand for personal computers may result in lower growth. Accordingly, the analyst may elect to lower this growth estimate subjectively. Assume that the analyst forecasts that after Year 10, DELL will begin to pay out 15 percent of its earnings as dividends (typical for mature technology companies). Additionally, long-term sustainable estimates for profit margin, asset turnover and leverage are Calculate the magnitude of the Long-term sustainable growth rate using the PRAT formula With a retention rate of 85 percent, the PRAT formula yields Long-term sustainable growth = 0. 045 X 0. 85 X 1. 50 X 2. 00 = 11. 48%. For the trailing 12 months, DELL has earnings per share excluding non-recurring items of $0. 76. Using a risk-free rate of 5. 0 percent, an equity risk premium of 5. 7 percent, and a beta of 1. 45 results in a required rate of return of ? ? ? ? percent.

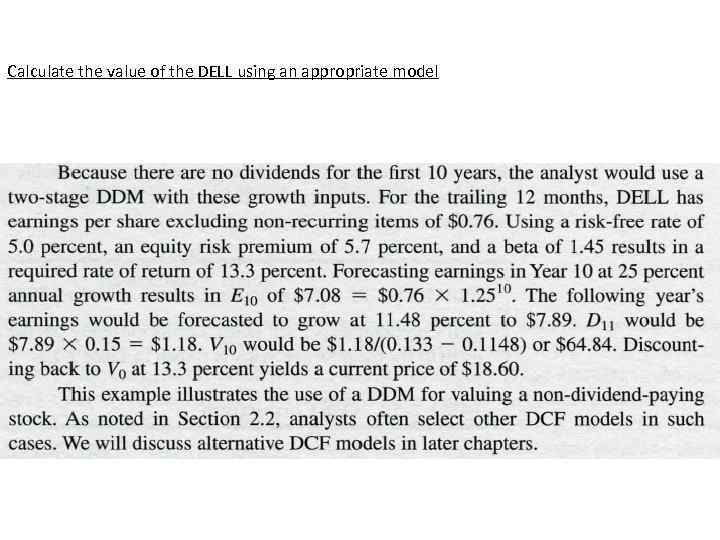

With a retention rate of 100 percent, the PRAT formula yields Short-term growth = 0. 05 X 1. 00 X 2. 50 X 2. 00 = 25%. Although DELL may be able to sustain this level of growth for 10 years, the analyst believes that market conditions may intervene. For example, weak demand for personal computers may result in lower growth. Accordingly, the analyst may elect to lower this growth estimate subjectively. Assume that the analyst forecasts that after Year 10, DELL will begin to pay out 15 percent of its earnings as dividends (typical for mature technology companies). Additionally, long-term sustainable estimates for profit margin, asset turnover and leverage are Calculate the magnitude of the Long-term sustainable growth rate using the PRAT formula With a retention rate of 85 percent, the PRAT formula yields Long-term sustainable growth = 0. 045 X 0. 85 X 1. 50 X 2. 00 = 11. 48%. For the trailing 12 months, DELL has earnings per share excluding non-recurring items of $0. 76. Using a risk-free rate of 5. 0 percent, an equity risk premium of 5. 7 percent, and a beta of 1. 45 results in a required rate of return of 13. 3 percent. Calculate the value of the DELL using an appropriate model

Calculate the value of the DELL using an appropriate model

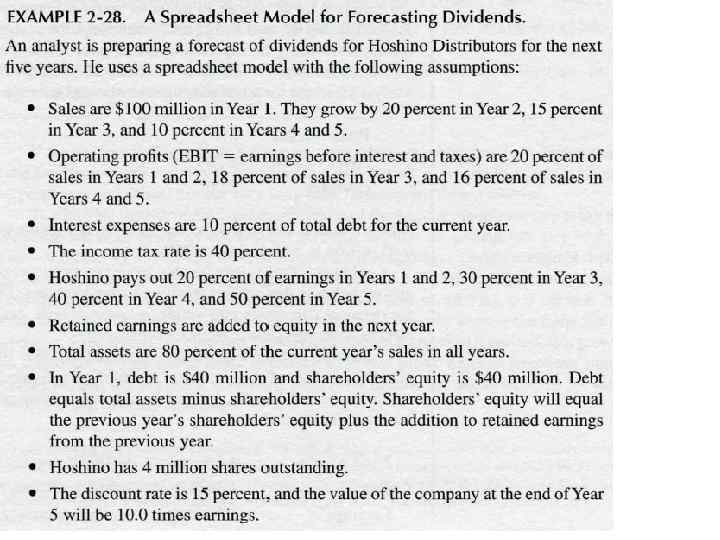

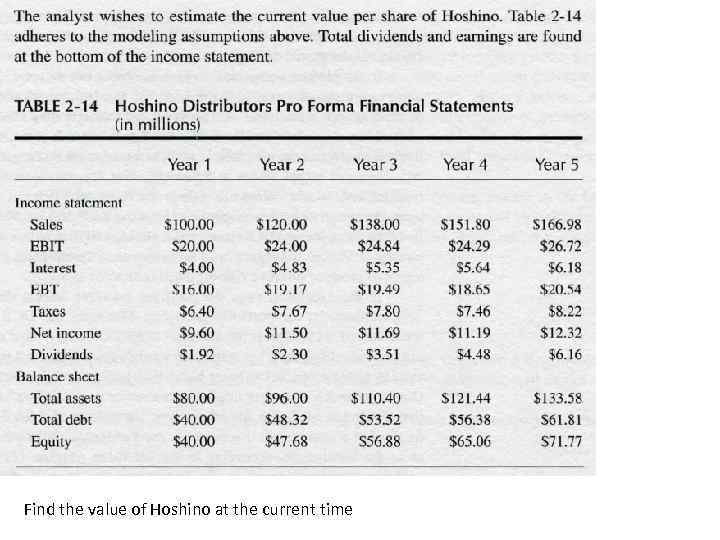

Find the value of Hoshino at the current time

Find the value of Hoshino at the current time

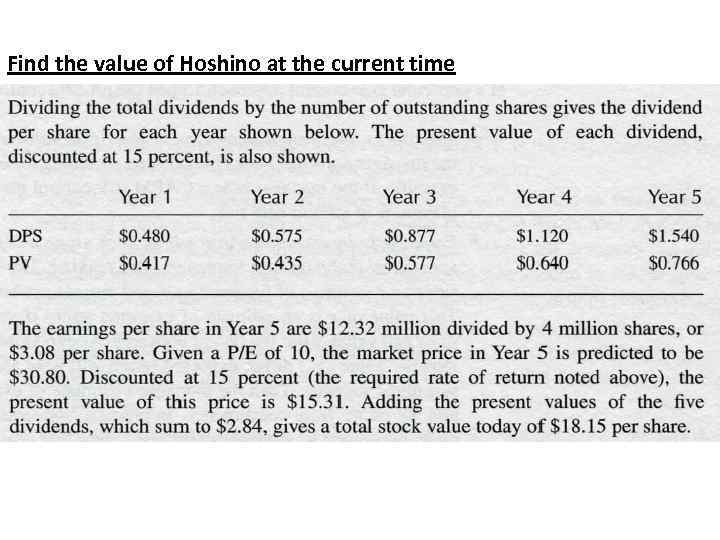

FREE CASH FLOW VALUATION Free cash flow to the firm is the cash flow available to the company’s suppliers of capital after all operating expenses (including taxes) have been paid and necessary investments in working capital and fixed capital have been made. FCFF is the cash flow from operations minus capital expenditures. FCFF = Net income available to shareholders Plus: Net noncash charges Plus: Interest expense × (1 – Tax rate) Less: Investment in fixed capital (in the specific period for which FCFF is calculated) Less: Investment in working capital (in the specific period for which FCFF is calculated) FCFF = NI + NCC + Int(1 – Tax rate) – FCInv – WCInv

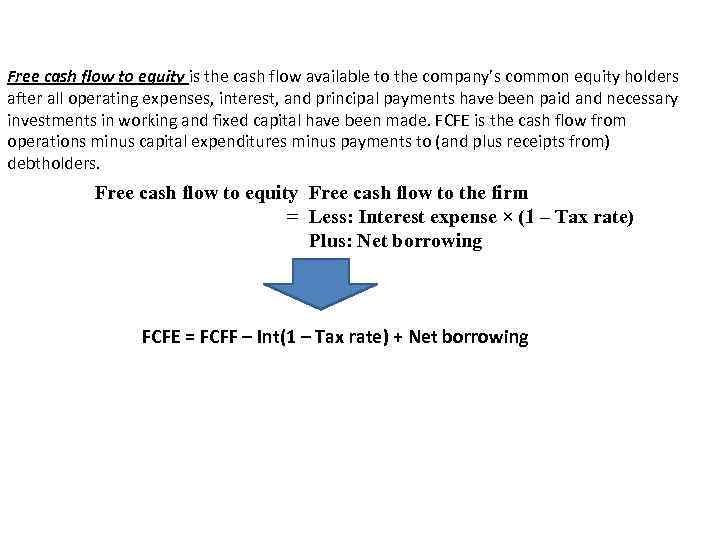

Free cash flow to equity is the cash flow available to the company’s common equity holders after all operating expenses, interest, and principal payments have been paid and necessary investments in working and fixed capital have been made. FCFE is the cash flow from operations minus capital expenditures minus payments to (and plus receipts from) debtholders. Free cash flow to equity Free cash flow to the firm = Less: Interest expense × (1 – Tax rate) Plus: Net borrowing FCFE = FCFF – Int(1 – Tax rate) + Net borrowing

Analysts like to use free cash flow as return (either FCFF or FCFE) whenever one or more of the following conditions is present: • The company is not dividend paying; • The company is dividend paying but dividends differ significantly from the company’s capacity to pay dividends; • Free cash flow align with profitability within a reasonable forecast period with which the analyst is comfortable; or The investor takes a control perspective. Depending on the company being analyzed, an analyst may have reasons to prefer using FCFF or FCFE. • If the company’s capital structure is relatively stable, FCFE is more direct and simpler to use than FCFF. • In the case of levered company with negative FCFE, however, working with FCFF to value stock may be easier. The analyst would discount FCFF to find the present value of operating assets, add cash and marketable securities to get total firm value and then subtract the market value of debt to find the intrinsic value of equity. • If a company has had a history of leverage changes in the past, a growth rate in FCFF may be more meaningful than an ever-changing growth pattern in FCFE.

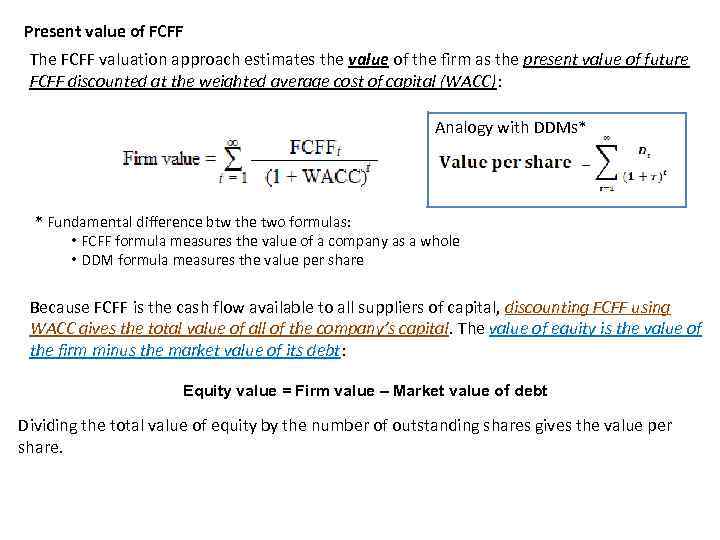

Present value of FCFF The FCFF valuation approach estimates the value of the firm as the present value of future FCFF discounted at the weighted average cost of capital (WACC): Analogy with DDMs* * Fundamental difference btw the two formulas: • FCFF formula measures the value of a company as a whole • DDM formula measures the value per share Because FCFF is the cash flow available to all suppliers of capital, discounting FCFF using WACC gives the total value of all of the company’s capital. The value of equity is the value of the firm minus the market value of its debt: Equity value = Firm value – Market value of debt Dividing the total value of equity by the number of outstanding shares gives the value per share.

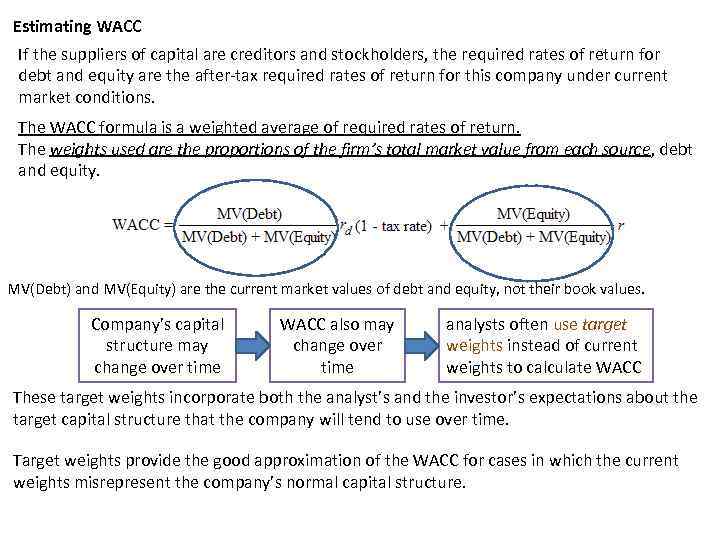

Estimating WACC If the suppliers of capital are creditors and stockholders, the required rates of return for debt and equity are the after-tax required rates of return for this company under current market conditions. The WACC formula is a weighted average of required rates of return. The weights used are the proportions of the firm’s total market value from each source, debt and equity. MV(Debt) and MV(Equity) are the current market values of debt and equity, not their book values. Company’s capital structure may change over time WACC also may change over time analysts often use target weights instead of current weights to calculate WACC These target weights incorporate both the analyst’s and the investor’s expectations about the target capital structure that the company will tend to use over time. Target weights provide the good approximation of the WACC for cases in which the current weights misrepresent the company’s normal capital structure.

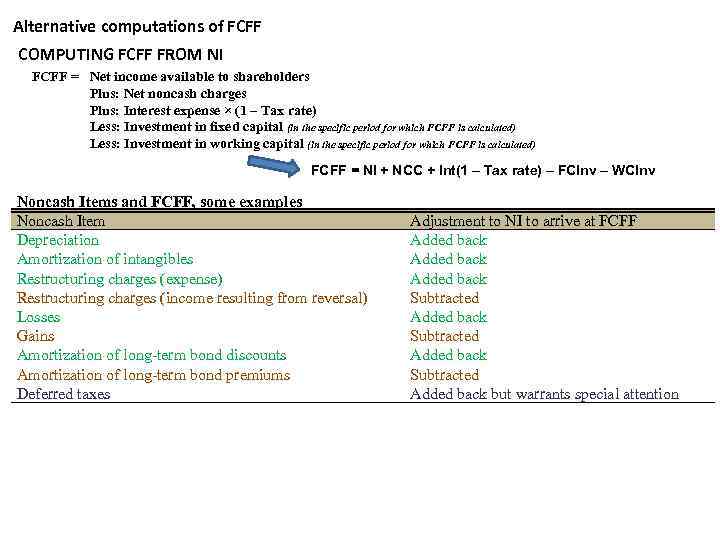

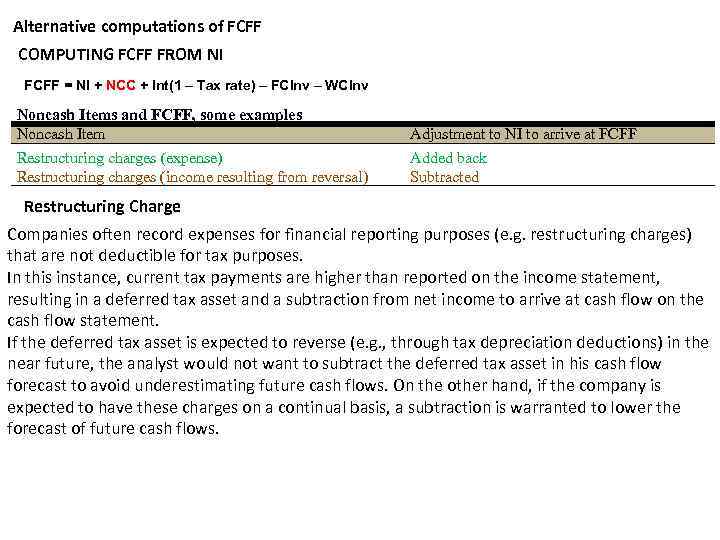

Alternative computations of FCFF COMPUTING FCFF FROM NI FCFF = Net income available to shareholders Plus: Net noncash charges Plus: Interest expense × (1 – Tax rate) Less: Investment in fixed capital (in the specific period for which FCFF is calculated) Less: Investment in working capital (in the specific period for which FCFF is calculated) FCFF = NI + NCC + Int(1 – Tax rate) – FCInv – WCInv Noncash Items and FCFF, some examples Noncash Item Depreciation Amortization of intangibles Restructuring charges (expense) Restructuring charges (income resulting from reversal) Losses Gains Amortization of long-term bond discounts Amortization of long-term bond premiums Deferred taxes Adjustment to NI to arrive at FCFF Added back Subtracted Added back but warrants special attention

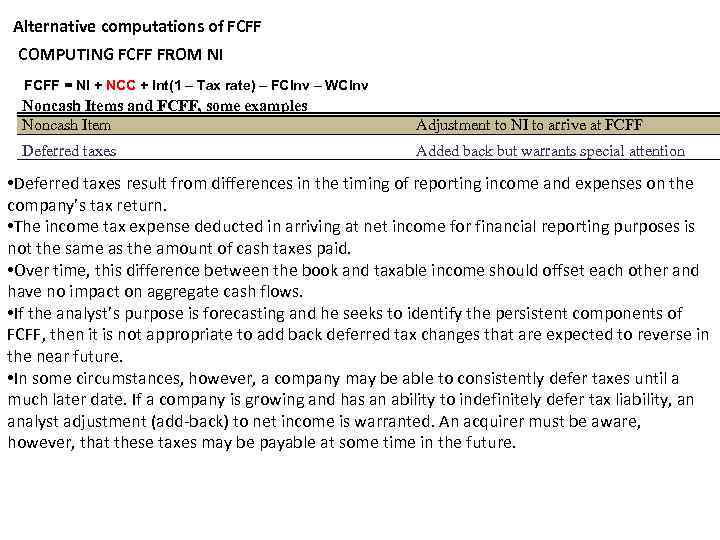

Alternative computations of FCFF COMPUTING FCFF FROM NI FCFF = NI + NCC + Int(1 – Tax rate) – FCInv – WCInv Noncash Items and FCFF, some examples Noncash Item Adjustment to NI to arrive at FCFF Deferred taxes Added back but warrants special attention • Deferred taxes result from differences in the timing of reporting income and expenses on the company’s tax return. • The income tax expense deducted in arriving at net income for financial reporting purposes is not the same as the amount of cash taxes paid. • Over time, this difference between the book and taxable income should offset each other and have no impact on aggregate cash flows. • If the analyst’s purpose is forecasting and he seeks to identify the persistent components of FCFF, then it is not appropriate to add back deferred tax changes that are expected to reverse in the near future. • In some circumstances, however, a company may be able to consistently defer taxes until a much later date. If a company is growing and has an ability to indefinitely defer tax liability, an analyst adjustment (add-back) to net income is warranted. An acquirer must be aware, however, that these taxes may be payable at some time in the future.

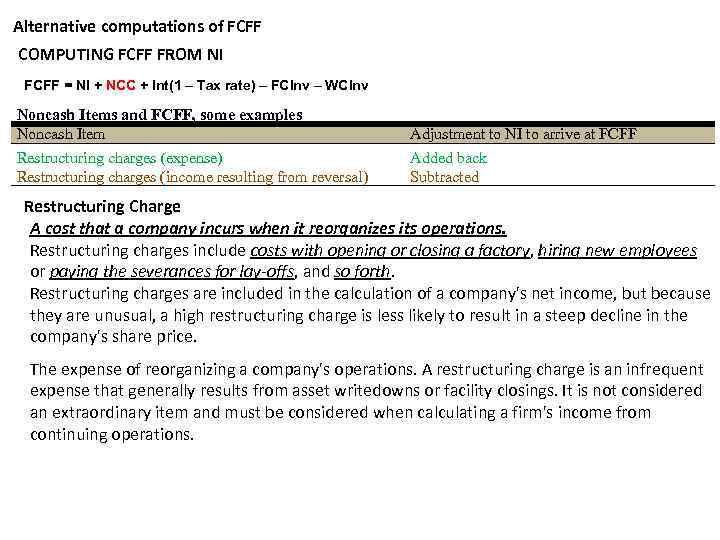

Alternative computations of FCFF COMPUTING FCFF FROM NI FCFF = NI + NCC + Int(1 – Tax rate) – FCInv – WCInv Noncash Items and FCFF, some examples Noncash Item Restructuring charges (expense) Restructuring charges (income resulting from reversal) Adjustment to NI to arrive at FCFF Added back Subtracted Restructuring Charge A cost that a company incurs when it reorganizes its operations. Restructuring charges include costs with opening or closing a factory, hiring new employees or paying the severances for lay-offs, and so forth. Restructuring charges are included in the calculation of a company's net income, but because they are unusual, a high restructuring charge is less likely to result in a steep decline in the company's share price. The expense of reorganizing a company's operations. A restructuring charge is an infrequent expense that generally results from asset writedowns or facility closings. It is not considered an extraordinary item and must be considered when calculating a firm's income from continuing operations.

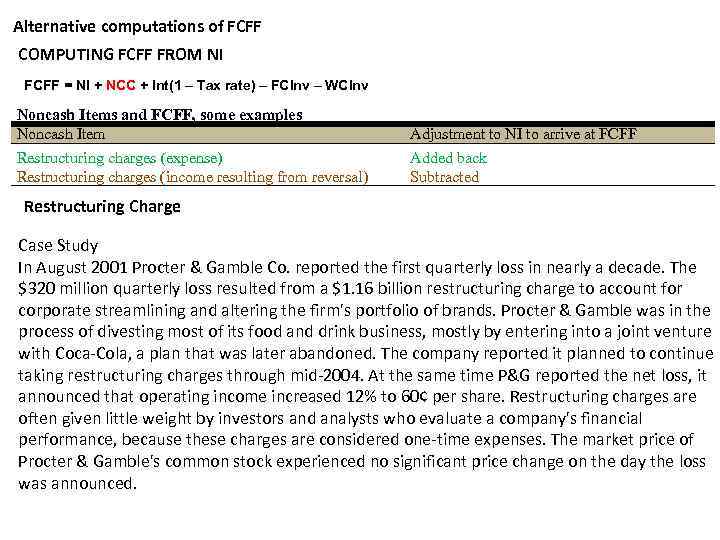

Alternative computations of FCFF COMPUTING FCFF FROM NI FCFF = NI + NCC + Int(1 – Tax rate) – FCInv – WCInv Noncash Items and FCFF, some examples Noncash Item Restructuring charges (expense) Restructuring charges (income resulting from reversal) Adjustment to NI to arrive at FCFF Added back Subtracted Restructuring Charge Case Study In August 2001 Procter & Gamble Co. reported the first quarterly loss in nearly a decade. The $320 million quarterly loss resulted from a $1. 16 billion restructuring charge to account for corporate streamlining and altering the firm's portfolio of brands. Procter & Gamble was in the process of divesting most of its food and drink business, mostly by entering into a joint venture with Coca-Cola, a plan that was later abandoned. The company reported it planned to continue taking restructuring charges through mid-2004. At the same time P&G reported the net loss, it announced that operating income increased 12% to 60¢ per share. Restructuring charges are often given little weight by investors and analysts who evaluate a company's financial performance, because these charges are considered one-time expenses. The market price of Procter & Gamble's common stock experienced no significant price change on the day the loss was announced.

Alternative computations of FCFF COMPUTING FCFF FROM NI FCFF = NI + NCC + Int(1 – Tax rate) – FCInv – WCInv Noncash Items and FCFF, some examples Noncash Item Restructuring charges (expense) Restructuring charges (income resulting from reversal) Adjustment to NI to arrive at FCFF Added back Subtracted Restructuring Charge Companies often record expenses for financial reporting purposes (e. g. restructuring charges) that are not deductible for tax purposes. In this instance, current tax payments are higher than reported on the income statement, resulting in a deferred tax asset and a subtraction from net income to arrive at cash flow on the cash flow statement. If the deferred tax asset is expected to reverse (e. g. , through tax depreciation deductions) in the near future, the analyst would not want to subtract the deferred tax asset in his cash flow forecast to avoid underestimating future cash flows. On the other hand, if the company is expected to have these charges on a continual basis, a subtraction is warranted to lower the forecast of future cash flows.

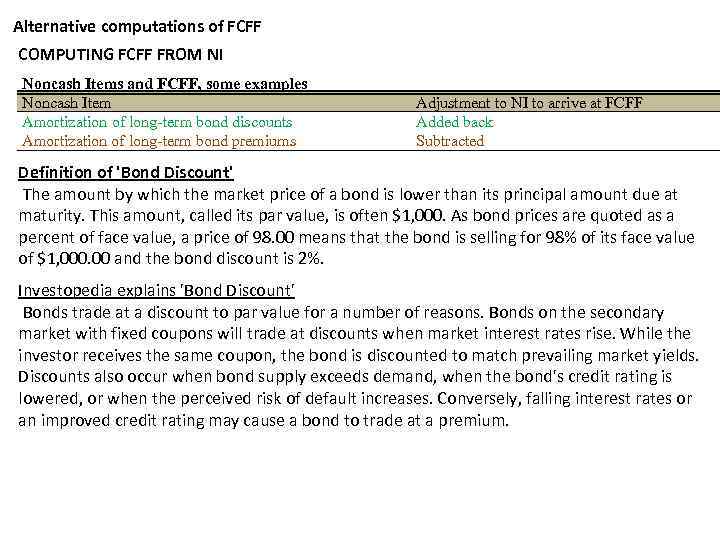

Alternative computations of FCFF COMPUTING FCFF FROM NI Noncash Items and FCFF, some examples Noncash Item Amortization of long-term bond discounts Amortization of long-term bond premiums Adjustment to NI to arrive at FCFF Added back Subtracted Definition of 'Bond Discount' The amount by which the market price of a bond is lower than its principal amount due at maturity. This amount, called its par value, is often $1, 000. As bond prices are quoted as a percent of face value, a price of 98. 00 means that the bond is selling for 98% of its face value of $1, 000. 00 and the bond discount is 2%. Investopedia explains 'Bond Discount' Bonds trade at a discount to par value for a number of reasons. Bonds on the secondary market with fixed coupons will trade at discounts when market interest rates rise. While the investor receives the same coupon, the bond is discounted to match prevailing market yields. Discounts also occur when bond supply exceeds demand, when the bond's credit rating is lowered, or when the perceived risk of default increases. Conversely, falling interest rates or an improved credit rating may cause a bond to trade at a premium.

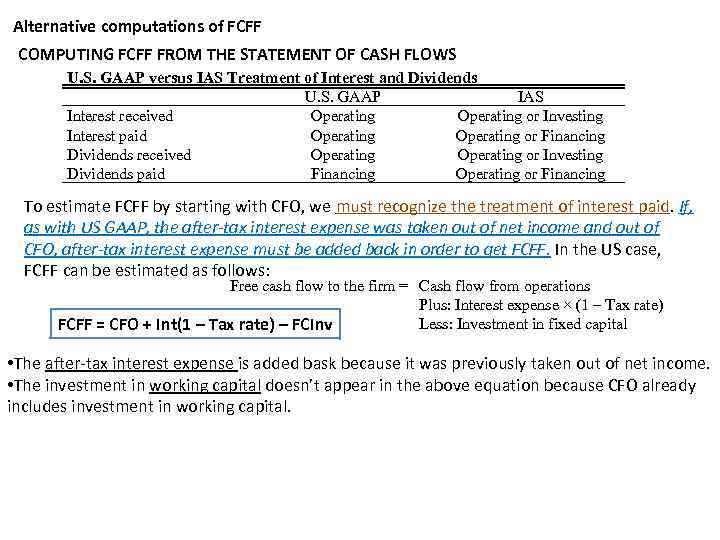

Alternative computations of FCFF COMPUTING FCFF FROM THE STATEMENT OF CASH FLOWS U. S. GAAP versus IAS Treatment of Interest and Dividends U. S. GAAP IAS Interest received Operating or Investing Interest paid Operating or Financing Dividends received Operating or Investing Dividends paid Financing Operating or Financing To estimate FCFF by starting with CFO, we must recognize the treatment of interest paid. If, as with US GAAP, the after-tax interest expense was taken out of net income and out of CFO, after-tax interest expense must be added back in order to get FCFF. In the US case, FCFF can be estimated as follows: Free cash flow to the firm = Cash flow from operations Plus: Interest expense × (1 – Tax rate) Less: Investment in fixed capital FCFF = CFO + Int(1 – Tax rate) – FCInv • The after-tax interest expense is added bask because it was previously taken out of net income. • The investment in working capital doesn’t appear in the above equation because CFO already includes investment in working capital.

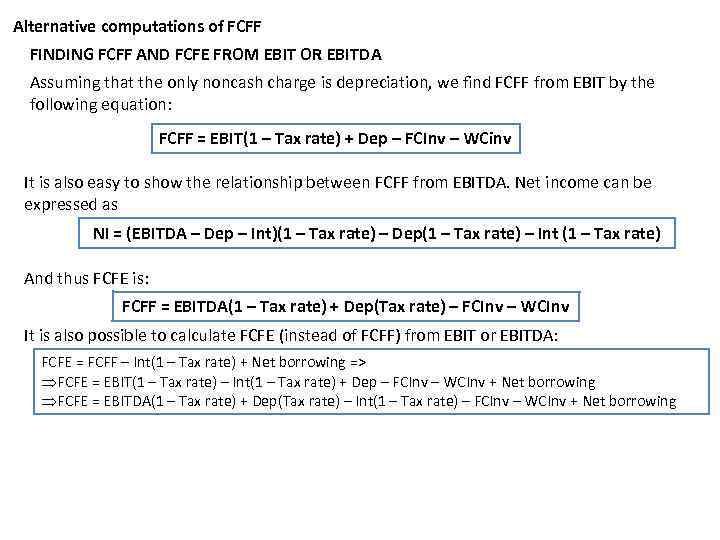

Alternative computations of FCFF FINDING FCFF AND FCFE FROM EBIT OR EBITDA Assuming that the only noncash charge is depreciation, we find FCFF from EBIT by the following equation: FCFF = EBIT(1 – Tax rate) + Dep – FCInv – WCinv It is also easy to show the relationship between FCFF from EBITDA. Net income can be expressed as NI = (EBITDA – Dep – Int)(1 – Tax rate) – Dep(1 – Tax rate) – Int (1 – Tax rate) And thus FCFE is: FCFF = EBITDA(1 – Tax rate) + Dep(Tax rate) – FCInv – WCInv It is also possible to calculate FCFE (instead of FCFF) from EBIT or EBITDA: FCFE = FCFF – Int(1 – Tax rate) + Net borrowing => ÞFCFE = EBIT(1 – Tax rate) – Int(1 – Tax rate) + Dep – FCInv – WCInv + Net borrowing ÞFCFE = EBITDA(1 – Tax rate) + Dep(Tax rate) – Int(1 – Tax rate) – FCInv – WCInv + Net borrowing

Beta VS Unlevered beta Definition of 'Beta' A measure of the volatility, or systematic risk, of a security or a portfolio in comparison to the market as a whole. Beta is used in the capital asset pricing model (CAPM), a model that calculates the expected return of an asset based on its beta and expected market returns. . Investopedia explains 'Beta' Beta is calculated using regression analysis, and you can think of beta as the tendency of a security's returns to respond to swings in the market. A beta of 1 indicates that the security's price will move with the market. A beta of less than 1 means that the security will be less volatile than the market. A beta of greater than 1 indicates that the security's price will be more volatile than the market. For example, if a stock's beta is 1. 2, it's theoretically 20% more volatile than the market. Example: Many utilities stocks have a beta of less than 1. Conversely, most high-tech Nasdaqbased stocks have a beta of greater than 1, offering the possibility of a higher rate of return, but also posing more risk.

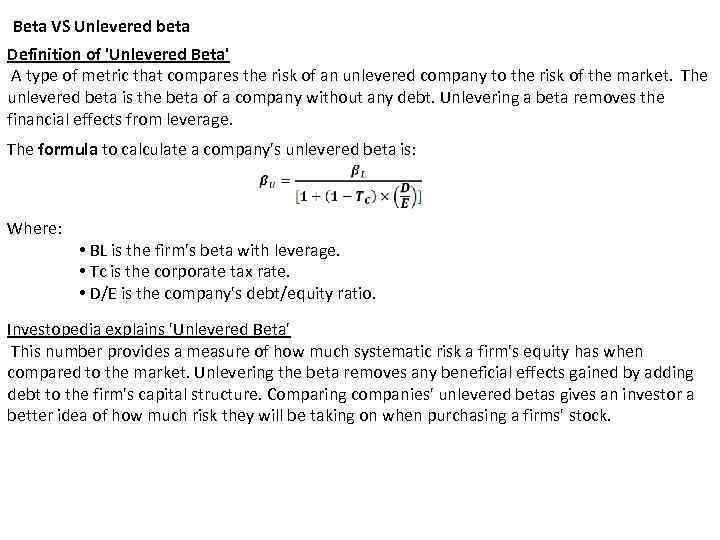

Beta VS Unlevered beta Definition of 'Unlevered Beta' A type of metric that compares the risk of an unlevered company to the risk of the market. The unlevered beta is the beta of a company without any debt. Unlevering a beta removes the financial effects from leverage. The formula to calculate a company's unlevered beta is: Where: • BL is the firm's beta with leverage. • Tc is the corporate tax rate. • D/E is the company's debt/equity ratio. Investopedia explains 'Unlevered Beta' This number provides a measure of how much systematic risk a firm's equity has when compared to the market. Unlevering the beta removes any beneficial effects gained by adding debt to the firm's capital structure. Comparing companies' unlevered betas gives an investor a better idea of how much risk they will be taking on when purchasing a firms' stock.

Equity Valuation, Part 3 (2).pptx