18eb6322bace6cb4bcafb419f7aee2c4.ppt

- Количество слайдов: 16

FINANCIAL CRISES Lessons and Prospects Guillermo Calvo Columbia University November 12, 2007

Outline I. RUSSIA VS. SUBPRIME II. LOOKING FORWARD

I. RUSSIA VS. SUBPRIME

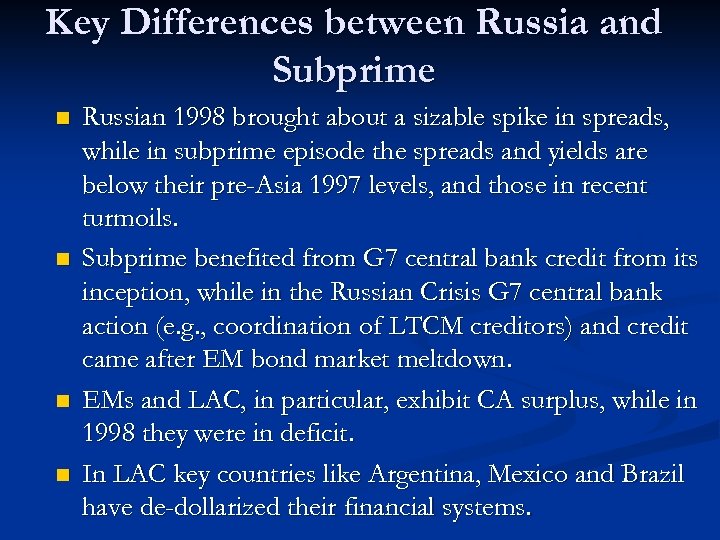

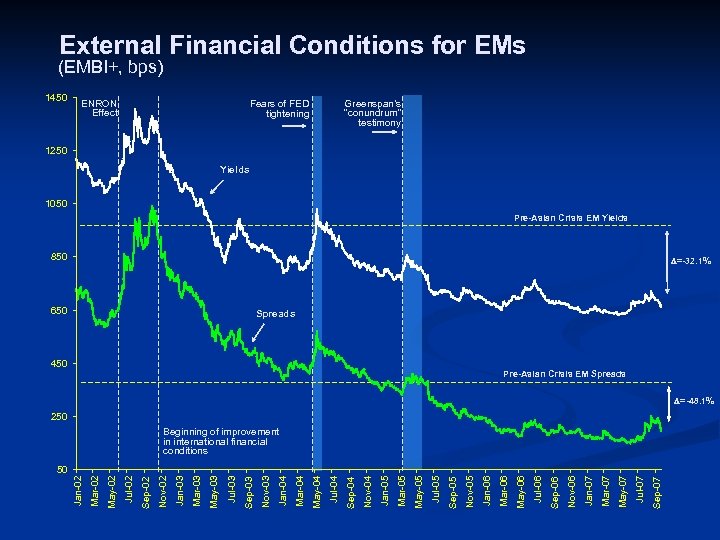

Key Differences between Russia and Subprime n n Russian 1998 brought about a sizable spike in spreads, while in subprime episode the spreads and yields are below their pre-Asia 1997 levels, and those in recent turmoils. Subprime benefited from G 7 central bank credit from its inception, while in the Russian Crisis G 7 central bank action (e. g. , coordination of LTCM creditors) and credit came after EM bond market meltdown. EMs and LAC, in particular, exhibit CA surplus, while in 1998 they were in deficit. In LAC key countries like Argentina, Mexico and Brazil have de-dollarized their financial systems.

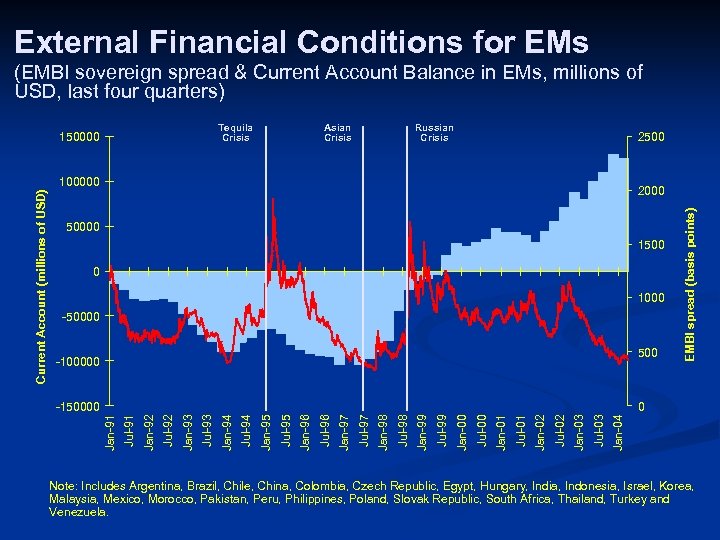

External Financial Conditions for EMs (EMBI sovereign spread & Current Account Balance in EMs, millions of USD, last four quarters) Tequila Crisis 150000 Asian Crisis Russian Crisis 2500 50000 1500 0 1000 -50000 500 -100000 -150000 EMBI spread (basis points) 2000 Jan-04 Jul-03 Jan-03 Jul-02 Jan-02 Jul-01 Jan-01 Jul-00 Jan-00 Jul-99 Jan-99 Jul-98 Jan-98 Jul-97 Jan-97 Jul-96 Jan-96 Jul-95 Jan-95 Jul-94 Jan-94 Jul-93 Jan-93 Jul-92 Jan-92 Jul-91 0 Jan-91 Current Account (millions of USD) 100000 Note: Includes Argentina, Brazil, Chile, China, Colombia, Czech Republic, Egypt, Hungary, India, Indonesia, Israel, Korea, Malaysia, Mexico, Morocco, Pakistan, Peru, Philippines, Poland, Slovak Republic, South Africa, Thailand, Turkey and Venezuela.

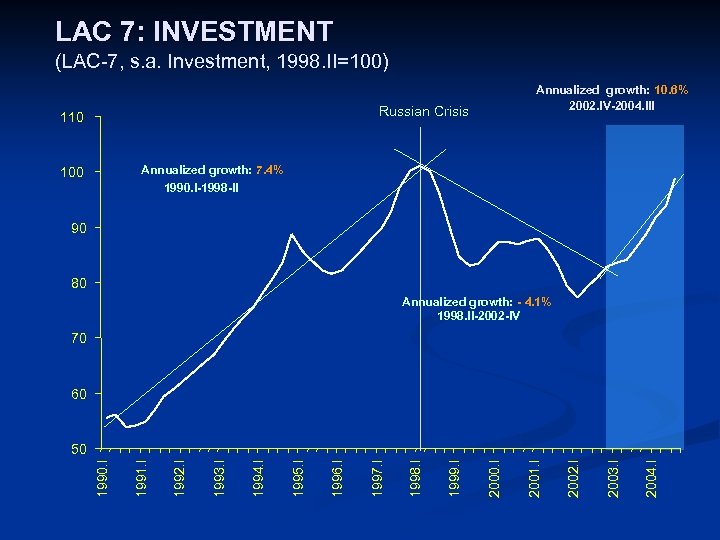

LAC 7: INVESTMENT (LAC-7, s. a. Investment, 1998. II=100) Annualized growth: 10. 6% 2002. IV-2004. III Russian Crisis 110 Annualized growth: 7. 4% 1990. I-1998 -II 100 90 80 Annualized growth: - 4. 1% 1998. II-2002 -IV 70 60 2004. I 2003. I 2002. I 2001. I 2000. I 1999. I 1998. I 1997. I 1996. I 1995. I 1994. I 1993. I 1992. I 1991. I 1990. I 50

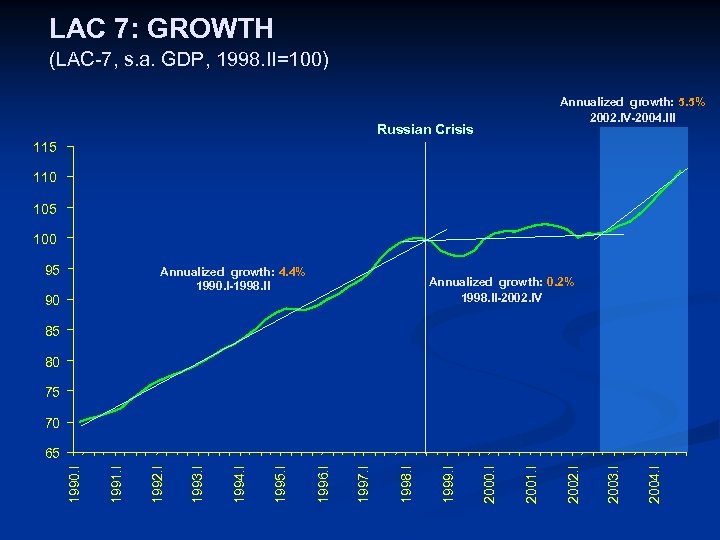

LAC 7: GROWTH (LAC-7, s. a. GDP, 1998. II=100) Annualized growth: 5. 5% 2002. IV-2004. III Russian Crisis 115 110 105 100 95 Annualized growth: 4. 4% 1990. I-1998. II Annualized growth: 0. 2% 1998. II-2002. IV 90 85 80 75 70 2004. I 2003. I 2002. I 2001. I 2000. I 1999. I 1998. I 1997. I 1996. I 1995. I 1994. I 1993. I 1992. I 1991. I 1990. I 65

External Financial Conditions for EMs (EMBI+, bps) 1450 ENRON Effect Greenspan’s “conundrum” testimony Fears of FED tightening 1250 Yields 1050 Pre-Asian Crisis EM Yields 850 =-32. 1% 650 Spreads 450 Pre-Asian Crisis EM Spreads =-48. 1% 250 Sep-07 Jul-07 May-07 Mar-07 Jan-07 Nov-06 Sep-06 Jul-06 May-06 Mar-06 Jan-06 Nov-05 Sep-05 Jul-05 May-05 Mar-05 Jan-05 Nov-04 Sep-04 Jul-04 May-04 Mar-04 Jan-04 Nov-03 Sep-03 Jul-03 May-03 Mar-03 Jan-03 Nov-02 Sep-02 Jul-02 May-02 Jan-02 50 Mar-02 Beginning of improvement in international financial conditions

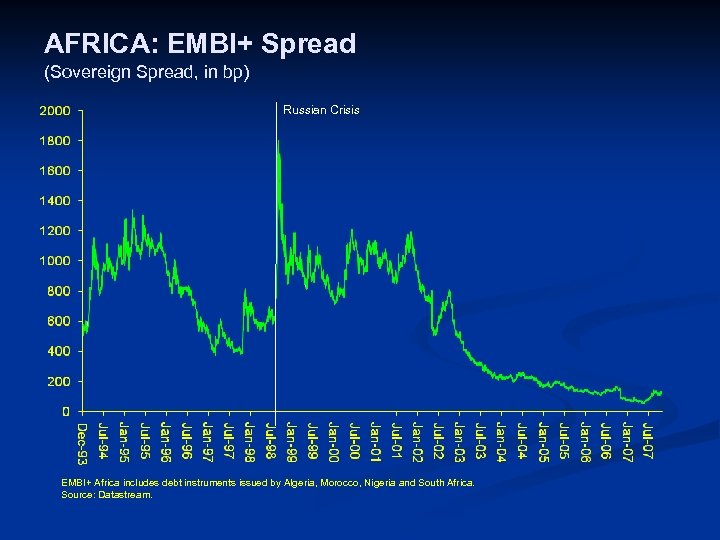

AFRICA: EMBI+ Spread (Sovereign Spread, in bp) Russian Crisis EMBI+ Africa includes debt instruments issued by Algeria, Morocco, Nigeria and South Africa. Source: Datastream.

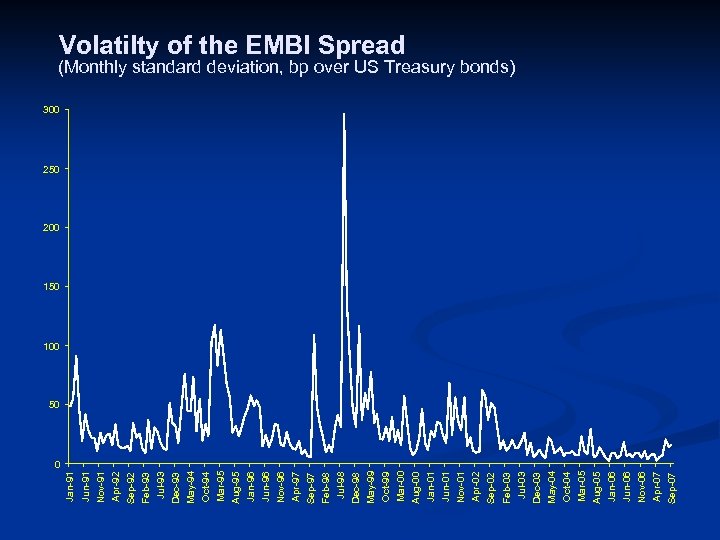

Sep-07 Jan-06 Jun-06 Nov-06 Apr-07 Oct-04 Mar-05 Aug-05 May-04 Feb-03 Jul-03 Dec-03 Apr-02 Sep-02 Jun-01 Nov-01 Jan-01 Oct-99 Mar-00 Aug-00 May-99 Feb-98 Jul-98 Dec-98 Nov-96 Apr-97 Sep-97 Jun-96 Jan-96 Oct-94 Mar-95 Aug-95 Dec-93 May-94 Feb-93 Jul-93 Jun-91 Nov-91 Apr-92 Sep-92 Jan-91 Volatilty of the EMBI Spread (Monthly standard deviation, bp over US Treasury bonds) 300 250 200 150 100 50 0

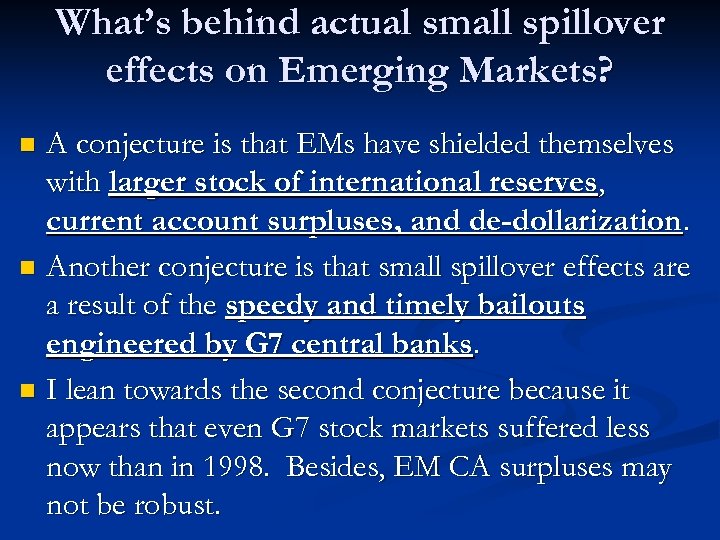

What’s behind actual small spillover effects on Emerging Markets? A conjecture is that EMs have shielded themselves with larger stock of international reserves, current account surpluses, and de-dollarization. n Another conjecture is that small spillover effects are a result of the speedy and timely bailouts engineered by G 7 central banks. n I lean towards the second conjecture because it appears that even G 7 stock markets suffered less now than in 1998. Besides, EM CA surpluses may not be robust. n

II. LOOKING FORWARD

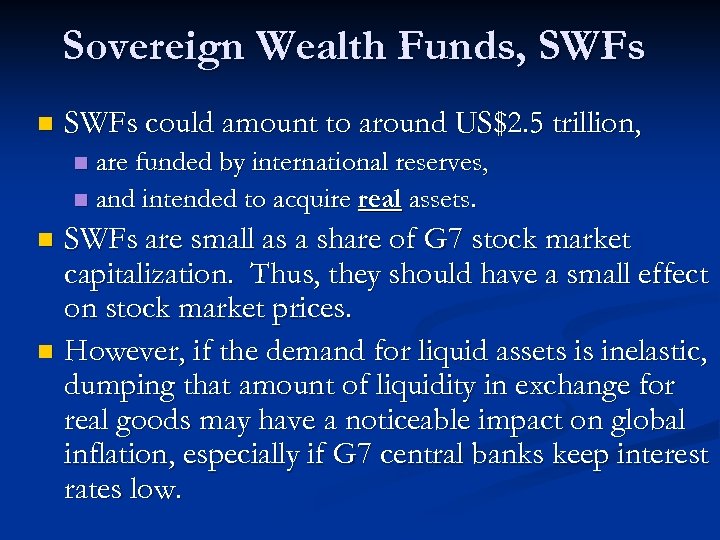

Sovereign Wealth Funds, SWFs n SWFs could amount to around US$2. 5 trillion, are funded by international reserves, n and intended to acquire real assets. n SWFs are small as a share of G 7 stock market capitalization. Thus, they should have a small effect on stock market prices. n However, if the demand for liquid assets is inelastic, dumping that amount of liquidity in exchange for real goods may have a noticeable impact on global inflation, especially if G 7 central banks keep interest rates low. n

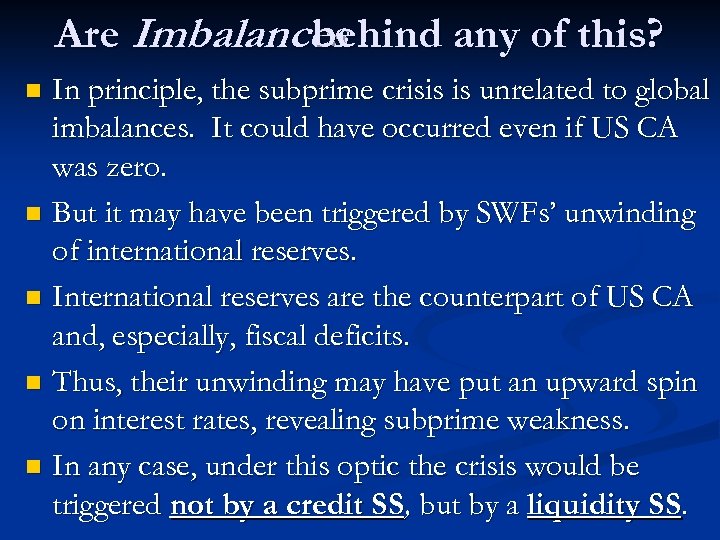

Are Imbalances behind any of this? In principle, the subprime crisis is unrelated to global imbalances. It could have occurred even if US CA was zero. n But it may have been triggered by SWFs’ unwinding of international reserves. n International reserves are the counterpart of US CA and, especially, fiscal deficits. n Thus, their unwinding may have put an upward spin on interest rates, revealing subprime weakness. n In any case, under this optic the crisis would be triggered not by a credit SS, but by a liquidity SS. n

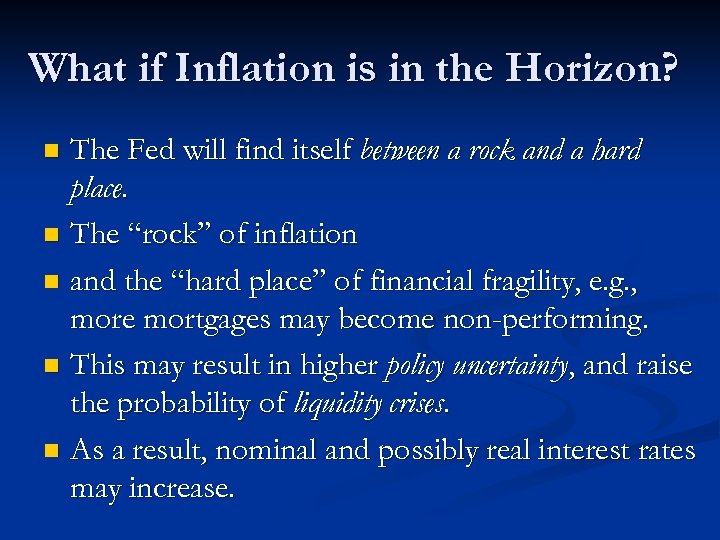

What if Inflation is in the Horizon? The Fed will find itself between a rock and a hard place. n The “rock” of inflation n and the “hard place” of financial fragility, e. g. , more mortgages may become non-performing. n This may result in higher policy uncertainty, and raise the probability of liquidity crises. n As a result, nominal and possibly real interest rates may increase. n

FINANCIAL CRISES Lessons and Prospects Guillermo Calvo Columbia University November 12, 2007

18eb6322bace6cb4bcafb419f7aee2c4.ppt