ff5a336a19577c9cbbf6cb275b4c89a9.ppt

- Количество слайдов: 15

Financial Coaching: An Overview J. Michael Collins Prepared for presentation at the Centers for Working Families, July 22 -23, 2010

Financial Coaching: An Overview J. Michael Collins Prepared for presentation at the Centers for Working Families, July 22 -23, 2010

Typical Features of Coaching • As used across fields • One-one relationship over time • Focus on self-actualization – Practice skills and strategies with support • Generally goal-focused • Typical client has potential to improve performance – Non-clinical; strengths based; non-crisis

Typical Features of Coaching • As used across fields • One-one relationship over time • Focus on self-actualization – Practice skills and strategies with support • Generally goal-focused • Typical client has potential to improve performance – Non-clinical; strengths based; non-crisis

Financial Coaching • Relationship-based • Client Directed’ • Self-activated goals • Goal Focused – Performance improvement • Not an ‘expert’ – Goal setting • Monitoring & Accountability

Financial Coaching • Relationship-based • Client Directed’ • Self-activated goals • Goal Focused – Performance improvement • Not an ‘expert’ – Goal setting • Monitoring & Accountability

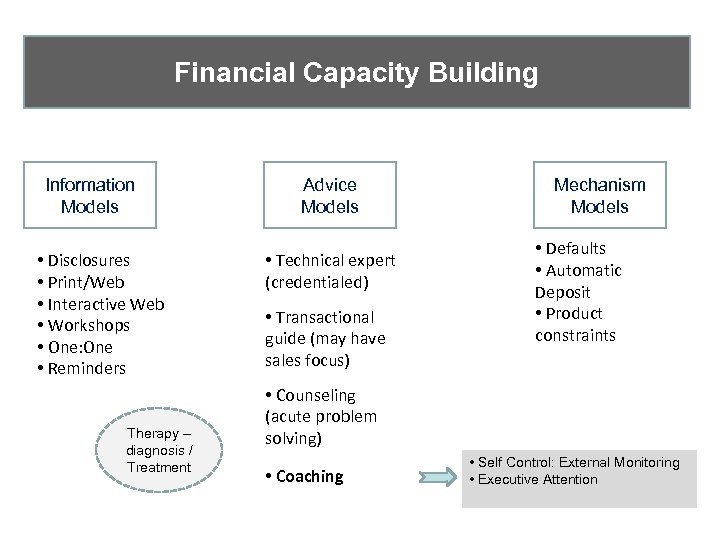

Financial Capacity Building Information Models • Disclosures • Print/Web • Interactive Web • Workshops • One: One • Reminders Therapy – diagnosis / Treatment Advice Models • Technical expert (credentialed) • Transactional guide (may have sales focus) Mechanism Models • Defaults • Automatic Deposit • Product constraints • Counseling (acute problem solving) • Coaching • Self Control: External Monitoring • Executive Attention

Financial Capacity Building Information Models • Disclosures • Print/Web • Interactive Web • Workshops • One: One • Reminders Therapy – diagnosis / Treatment Advice Models • Technical expert (credentialed) • Transactional guide (may have sales focus) Mechanism Models • Defaults • Automatic Deposit • Product constraints • Counseling (acute problem solving) • Coaching • Self Control: External Monitoring • Executive Attention

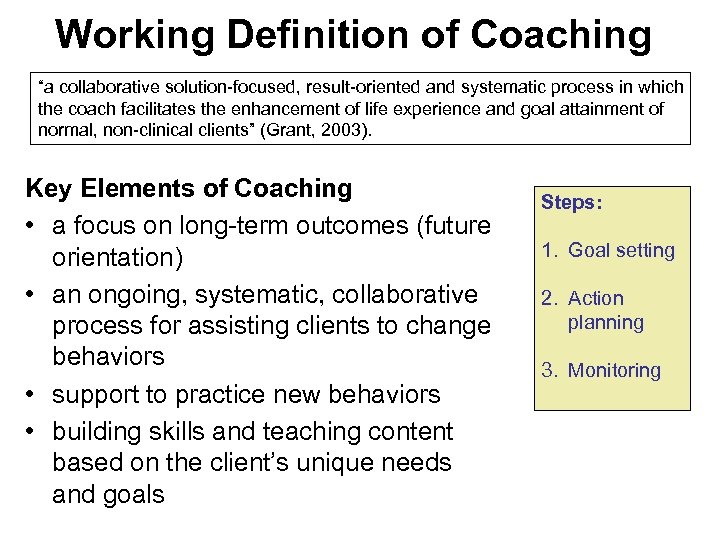

Working Definition of Coaching “a collaborative solution-focused, result-oriented and systematic process in which the coach facilitates the enhancement of life experience and goal attainment of normal, non-clinical clients” (Grant, 2003). Key Elements of Coaching • a focus on long-term outcomes (future orientation) • an ongoing, systematic, collaborative process for assisting clients to change behaviors • support to practice new behaviors • building skills and teaching content based on the client’s unique needs and goals Steps: 1. Goal setting 2. Action planning 3. Monitoring

Working Definition of Coaching “a collaborative solution-focused, result-oriented and systematic process in which the coach facilitates the enhancement of life experience and goal attainment of normal, non-clinical clients” (Grant, 2003). Key Elements of Coaching • a focus on long-term outcomes (future orientation) • an ongoing, systematic, collaborative process for assisting clients to change behaviors • support to practice new behaviors • building skills and teaching content based on the client’s unique needs and goals Steps: 1. Goal setting 2. Action planning 3. Monitoring

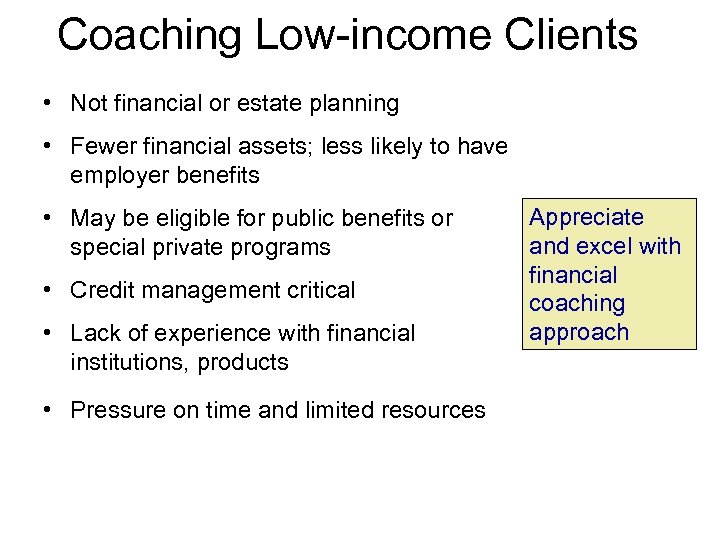

Coaching Low-income Clients • Not financial or estate planning • Fewer financial assets; less likely to have employer benefits • May be eligible for public benefits or special private programs • Credit management critical • Lack of experience with financial institutions, products • Pressure on time and limited resources Appreciate and excel with financial coaching approach

Coaching Low-income Clients • Not financial or estate planning • Fewer financial assets; less likely to have employer benefits • May be eligible for public benefits or special private programs • Credit management critical • Lack of experience with financial institutions, products • Pressure on time and limited resources Appreciate and excel with financial coaching approach

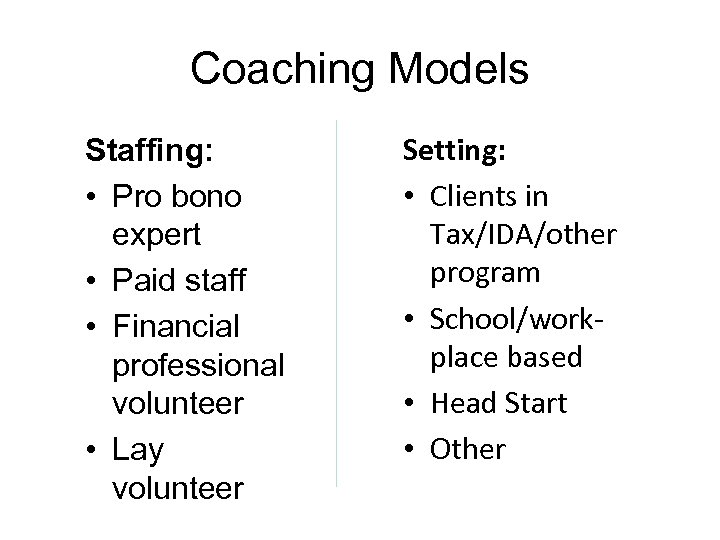

Coaching Models Staffing: • Pro bono expert • Paid staff • Financial professional volunteer • Lay volunteer Setting: • Clients in Tax/IDA/other program • School/workplace based • Head Start • Other

Coaching Models Staffing: • Pro bono expert • Paid staff • Financial professional volunteer • Lay volunteer Setting: • Clients in Tax/IDA/other program • School/workplace based • Head Start • Other

Facilitation Skills ICF Core Coaching Competencies 1. Setting the foundation • Ethical and professional standards • Establishing the coaching agreement 2. Co-creating the relationship • Establishing trust and intimacy with the client • Coaching presence 3. Communicating effectively • Active listening • Powerful questioning • Direct communication 4. Facilitating learning and results • Creating awareness • Designing actions • Planning and goal setting • Managing progress and accountability

Facilitation Skills ICF Core Coaching Competencies 1. Setting the foundation • Ethical and professional standards • Establishing the coaching agreement 2. Co-creating the relationship • Establishing trust and intimacy with the client • Coaching presence 3. Communicating effectively • Active listening • Powerful questioning • Direct communication 4. Facilitating learning and results • Creating awareness • Designing actions • Planning and goal setting • Managing progress and accountability

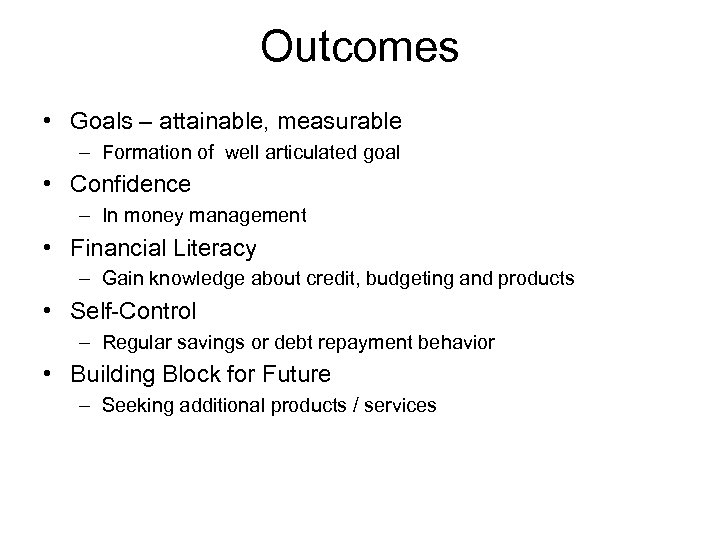

Outcomes • Goals – attainable, measurable – Formation of well articulated goal • Confidence – In money management • Financial Literacy – Gain knowledge about credit, budgeting and products • Self-Control – Regular savings or debt repayment behavior • Building Block for Future – Seeking additional products / services

Outcomes • Goals – attainable, measurable – Formation of well articulated goal • Confidence – In money management • Financial Literacy – Gain knowledge about credit, budgeting and products • Self-Control – Regular savings or debt repayment behavior • Building Block for Future – Seeking additional products / services

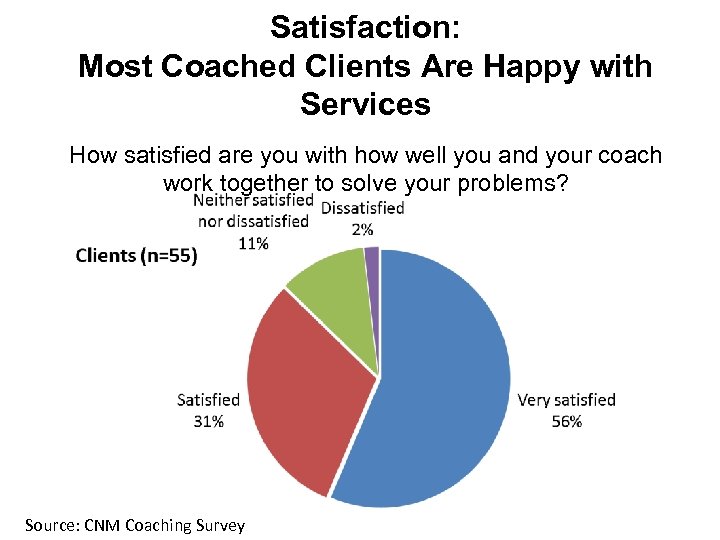

Satisfaction: Most Coached Clients Are Happy with Services How satisfied are you with how well you and your coach work together to solve your problems? Source: CNM Coaching Survey

Satisfaction: Most Coached Clients Are Happy with Services How satisfied are you with how well you and your coach work together to solve your problems? Source: CNM Coaching Survey

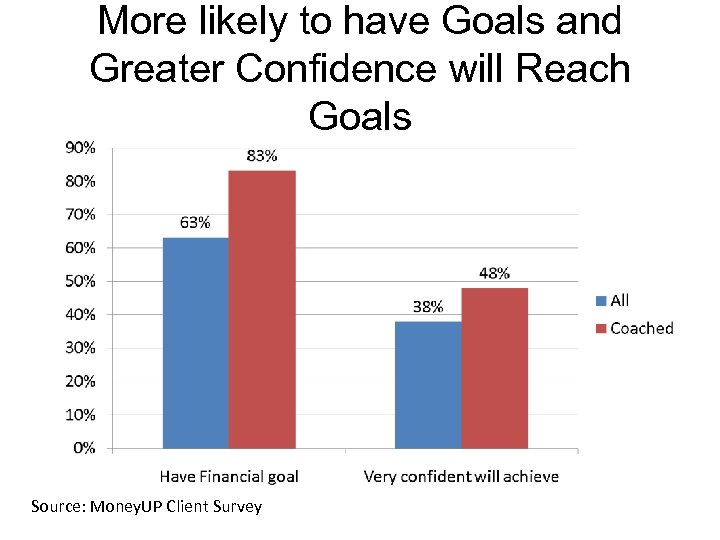

More likely to have Goals and Greater Confidence will Reach Goals Source: Money. UP Client Survey

More likely to have Goals and Greater Confidence will Reach Goals Source: Money. UP Client Survey

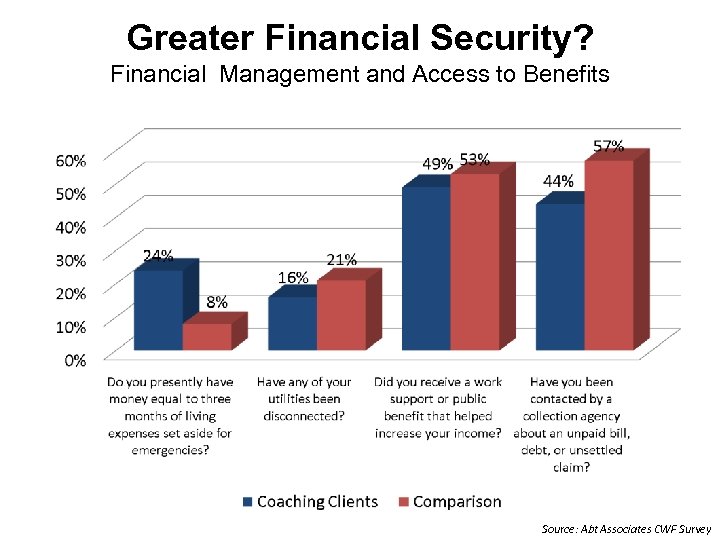

Greater Financial Security? Financial Management and Access to Benefits Source: Abt Associates CWF Survey

Greater Financial Security? Financial Management and Access to Benefits Source: Abt Associates CWF Survey

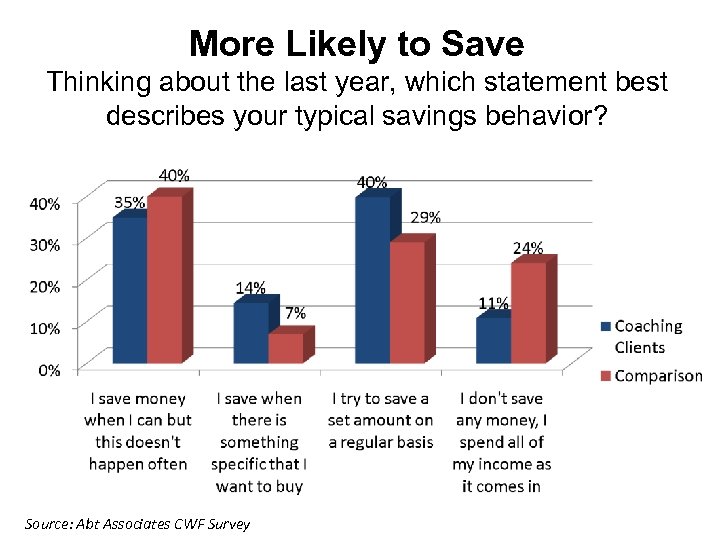

More Likely to Save Thinking about the last year, which statement best describes your typical savings behavior? Source: Abt Associates CWF Survey

More Likely to Save Thinking about the last year, which statement best describes your typical savings behavior? Source: Abt Associates CWF Survey

Measuring Impacts? • Self report + administrative data (FICO, account balances, etc) • Valid comparison group • Ideal: Randomize offer • But coaching has intrinsic bias of most motivated clients – hard to separate service from choice to participate • Focus more on mechanism: self control and executive attention

Measuring Impacts? • Self report + administrative data (FICO, account balances, etc) • Valid comparison group • Ideal: Randomize offer • But coaching has intrinsic bias of most motivated clients – hard to separate service from choice to participate • Focus more on mechanism: self control and executive attention

J. Michael Collins Faculty Director, Center for Financial Security University of Wisconsin-Madison 7401 Social Science, 1180 Observatory Drive Madison, WI 53706 608 -616 -0369 jmcollins@wisc. edu For More Information: http: //www. uwfamilyfinancialsecurity. org/

J. Michael Collins Faculty Director, Center for Financial Security University of Wisconsin-Madison 7401 Social Science, 1180 Observatory Drive Madison, WI 53706 608 -616 -0369 jmcollins@wisc. edu For More Information: http: //www. uwfamilyfinancialsecurity. org/