7e8380cab68e7310d43c37f947602f5f.ppt

- Количество слайдов: 49

Financial and Managerial Accounting John J. Wild Third Edition Mc. Graw-Hill/Irwin Copyright © 2009 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

Financial and Managerial Accounting John J. Wild Third Edition Mc. Graw-Hill/Irwin Copyright © 2009 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

Chapter 3 Adjusting Accounts and Preparing Financial Statements

Chapter 3 Adjusting Accounts and Preparing Financial Statements

Conceptual Chapter Objectives C 1: Explain the importance of periodic reporting and the time period principle. C 2: Explain accrual accounting and how it improves financial statements. C 3: Identify steps in the accounting cycle. C 4: Explain and prepare a classified balance sheet. 3 -3

Conceptual Chapter Objectives C 1: Explain the importance of periodic reporting and the time period principle. C 2: Explain accrual accounting and how it improves financial statements. C 3: Identify steps in the accounting cycle. C 4: Explain and prepare a classified balance sheet. 3 -3

Analytical Chapter Objectives A 1: Explain how accounting adjustments link to financial statements. A 2: Compute profit margin and describe its use in analyzing company performance. A 3: Compute the current ratio and describe what it reveals about a company’s financial condition. 3 -4

Analytical Chapter Objectives A 1: Explain how accounting adjustments link to financial statements. A 2: Compute profit margin and describe its use in analyzing company performance. A 3: Compute the current ratio and describe what it reveals about a company’s financial condition. 3 -4

Procedural Chapter Objectives P 1: Prepare and explain adjusting entries. P 2: Explain and prepare an adjusted trial balance. P 3: Prepare financial statements from an adjusted trial balance. P 4: Describe and prepare closing entries. P 5: Explain and prepare a post-closing trial balance. 3 -5

Procedural Chapter Objectives P 1: Prepare and explain adjusting entries. P 2: Explain and prepare an adjusted trial balance. P 3: Prepare financial statements from an adjusted trial balance. P 4: Describe and prepare closing entries. P 5: Explain and prepare a post-closing trial balance. 3 -5

Procedural Chapter Objectives (Continued) P 6: Appendix 3 A: Explain the alternatives in accounting for prepaids. P 7: Appendix 3 B: Prepare a work sheet and explain its usefulness. 3 -6

Procedural Chapter Objectives (Continued) P 6: Appendix 3 A: Explain the alternatives in accounting for prepaids. P 7: Appendix 3 B: Prepare a work sheet and explain its usefulness. 3 -6

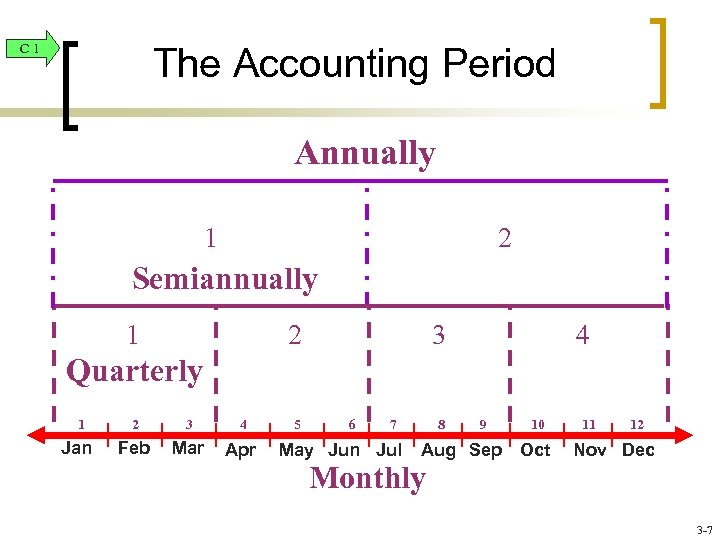

C 1 The Accounting Period Annually 1 2 Semiannually 1 2 3 4 Quarterly 1 Jan 2 3 4 Feb Mar Apr 5 6 7 May Jun Jul 8 9 10 Aug Sep Oct Monthly 11 12 Nov Dec 3 -7

C 1 The Accounting Period Annually 1 2 Semiannually 1 2 3 4 Quarterly 1 Jan 2 3 4 Feb Mar Apr 5 6 7 May Jun Jul 8 9 10 Aug Sep Oct Monthly 11 12 Nov Dec 3 -7

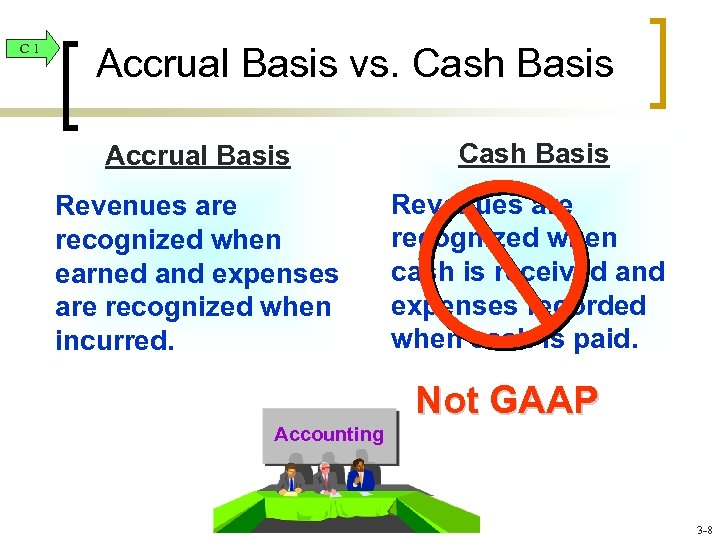

C 1 Accrual Basis vs. Cash Basis Accrual Basis Cash Basis Revenues are recognized when earned and expenses are recognized when incurred. Revenues are recognized when cash is received and expenses recorded when cash is paid. Not GAAP Accounting 3 -8

C 1 Accrual Basis vs. Cash Basis Accrual Basis Cash Basis Revenues are recognized when earned and expenses are recognized when incurred. Revenues are recognized when cash is received and expenses recorded when cash is paid. Not GAAP Accounting 3 -8

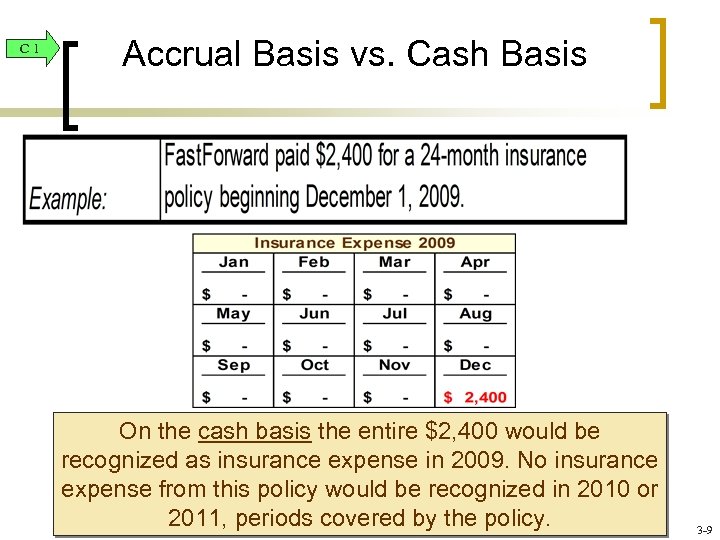

C 1 Accrual Basis vs. Cash Basis On the cash basis the entire $2, 400 would be recognized as insurance expense in 2009. No insurance expense from this policy would be recognized in 2010 or 2011, periods covered by the policy. 3 -9

C 1 Accrual Basis vs. Cash Basis On the cash basis the entire $2, 400 would be recognized as insurance expense in 2009. No insurance expense from this policy would be recognized in 2010 or 2011, periods covered by the policy. 3 -9

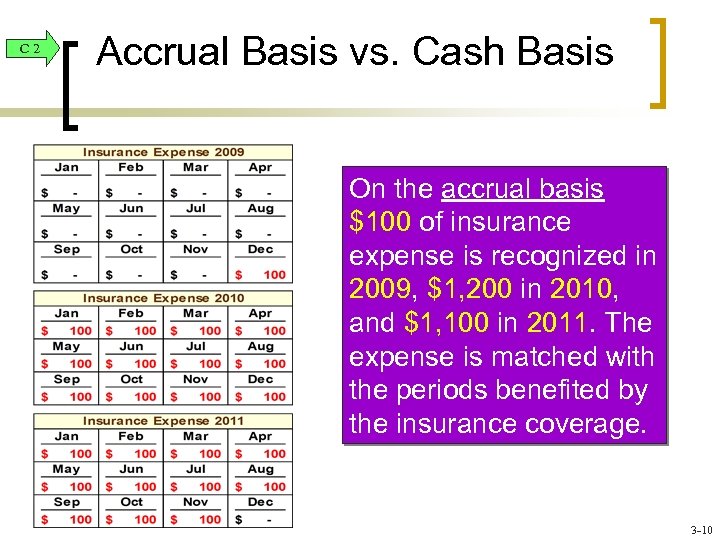

C 2 Accrual Basis vs. Cash Basis On the accrual basis $100 of insurance expense is recognized in 2009, $1, 200 in 2010, and $1, 100 in 2011. The expense is matched with the periods benefited by the insurance coverage. 3 -10

C 2 Accrual Basis vs. Cash Basis On the accrual basis $100 of insurance expense is recognized in 2009, $1, 200 in 2010, and $1, 100 in 2011. The expense is matched with the periods benefited by the insurance coverage. 3 -10

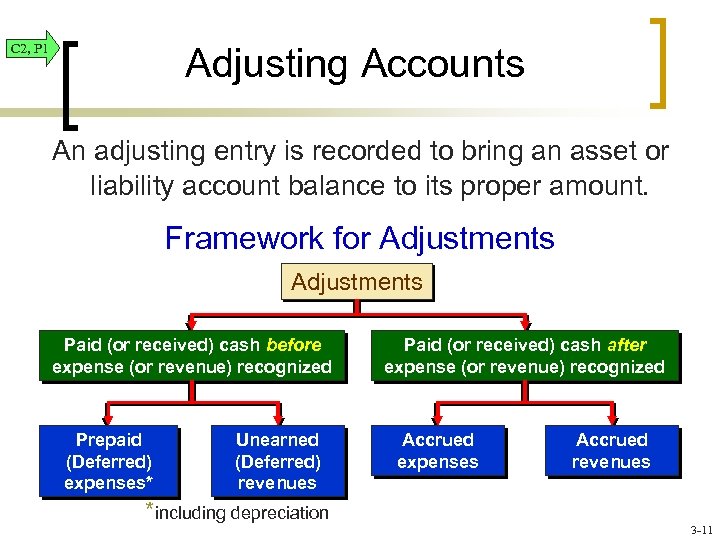

C 2, P 1 Adjusting Accounts An adjusting entry is recorded to bring an asset or liability account balance to its proper amount. Framework for Adjustments Paid (or received) cash before expense (or revenue) recognized Prepaid (Deferred) expenses* Unearned (Deferred) revenues *including depreciation Paid (or received) cash after expense (or revenue) recognized Accrued expenses Accrued revenues 3 -11

C 2, P 1 Adjusting Accounts An adjusting entry is recorded to bring an asset or liability account balance to its proper amount. Framework for Adjustments Paid (or received) cash before expense (or revenue) recognized Prepaid (Deferred) expenses* Unearned (Deferred) revenues *including depreciation Paid (or received) cash after expense (or revenue) recognized Accrued expenses Accrued revenues 3 -11

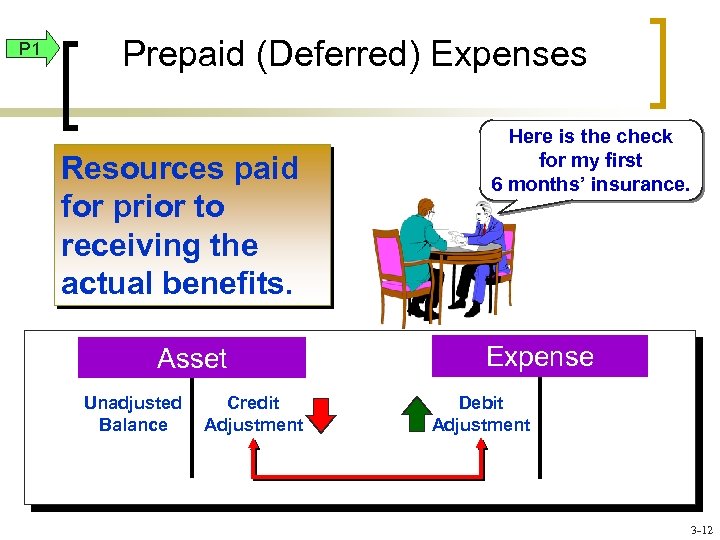

P 1 Prepaid (Deferred) Expenses Resources paid for prior to receiving the actual benefits. Asset Unadjusted Balance Credit Adjustment Here is the check for my first 6 months’ insurance. Expense Debit Adjustment 3 -12

P 1 Prepaid (Deferred) Expenses Resources paid for prior to receiving the actual benefits. Asset Unadjusted Balance Credit Adjustment Here is the check for my first 6 months’ insurance. Expense Debit Adjustment 3 -12

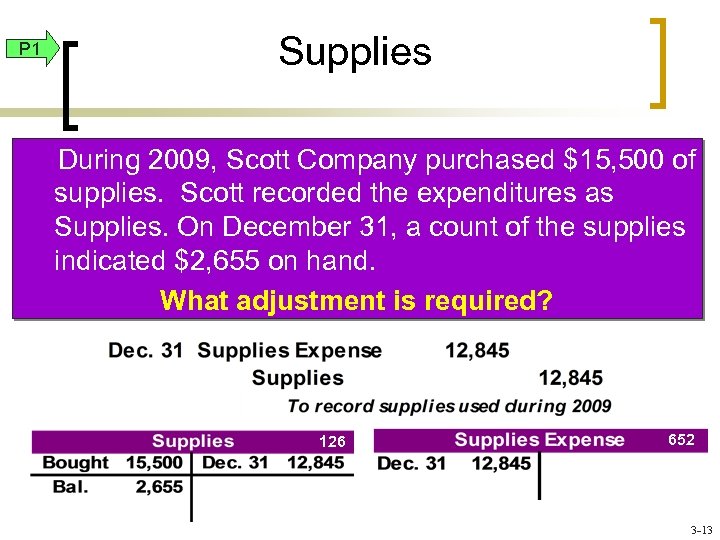

P 1 Supplies During 2009, Scott Company purchased $15, 500 of supplies. Scott recorded the expenditures as Supplies. On December 31, a count of the supplies indicated $2, 655 on hand. What adjustment is required? 126 652 3 -13

P 1 Supplies During 2009, Scott Company purchased $15, 500 of supplies. Scott recorded the expenditures as Supplies. On December 31, a count of the supplies indicated $2, 655 on hand. What adjustment is required? 126 652 3 -13

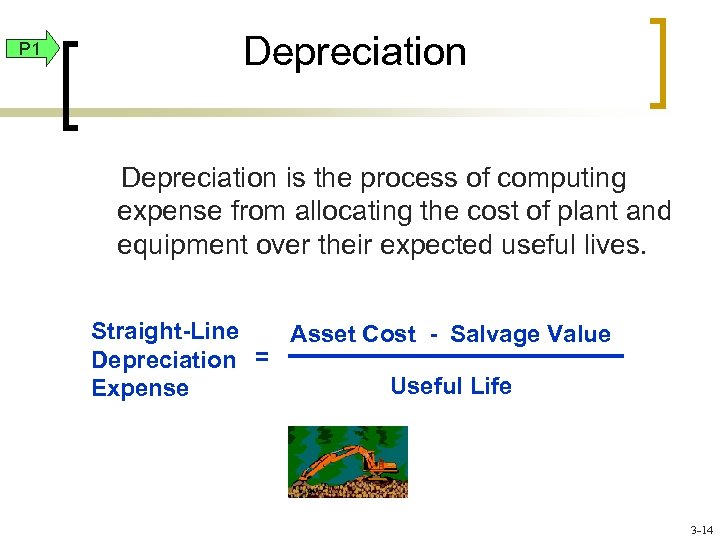

P 1 Depreciation is the process of computing expense from allocating the cost of plant and equipment over their expected useful lives. Straight-Line Asset Cost - Salvage Value Depreciation = Useful Life Expense 3 -14

P 1 Depreciation is the process of computing expense from allocating the cost of plant and equipment over their expected useful lives. Straight-Line Asset Cost - Salvage Value Depreciation = Useful Life Expense 3 -14

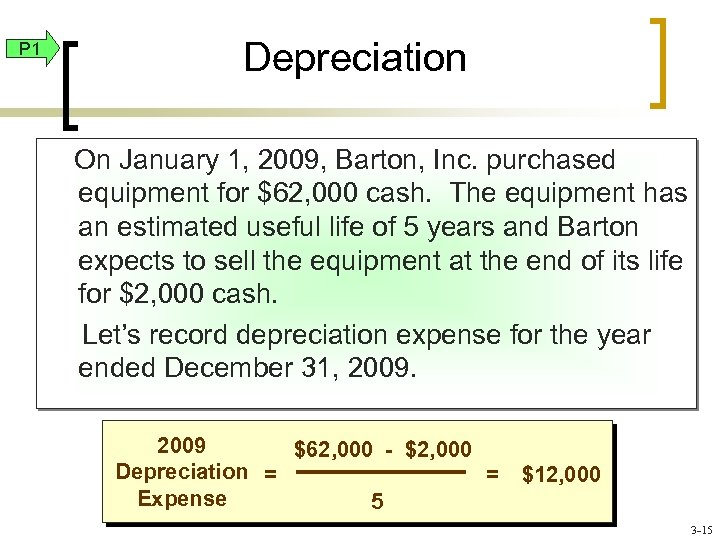

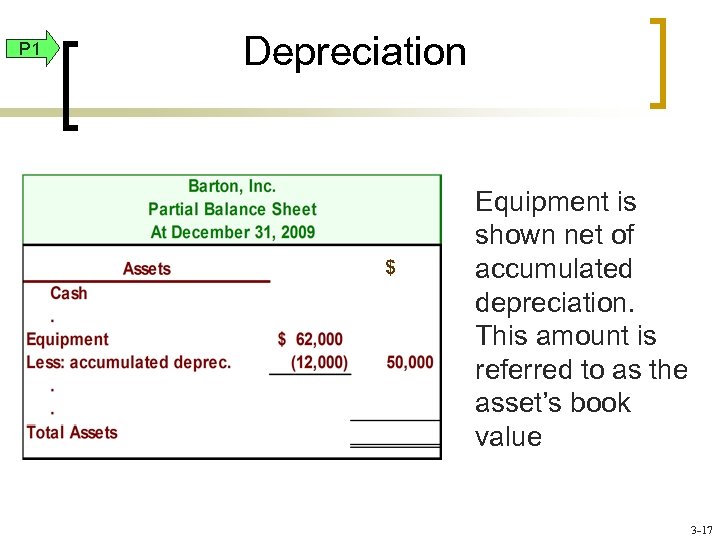

P 1 Depreciation On January 1, 2009, Barton, Inc. purchased equipment for $62, 000 cash. The equipment has an estimated useful life of 5 years and Barton expects to sell the equipment at the end of its life for $2, 000 cash. Let’s record depreciation expense for the year ended December 31, 2009 $62, 000 - $2, 000 Depreciation = = Expense 5 $12, 000 3 -15

P 1 Depreciation On January 1, 2009, Barton, Inc. purchased equipment for $62, 000 cash. The equipment has an estimated useful life of 5 years and Barton expects to sell the equipment at the end of its life for $2, 000 cash. Let’s record depreciation expense for the year ended December 31, 2009 $62, 000 - $2, 000 Depreciation = = Expense 5 $12, 000 3 -15

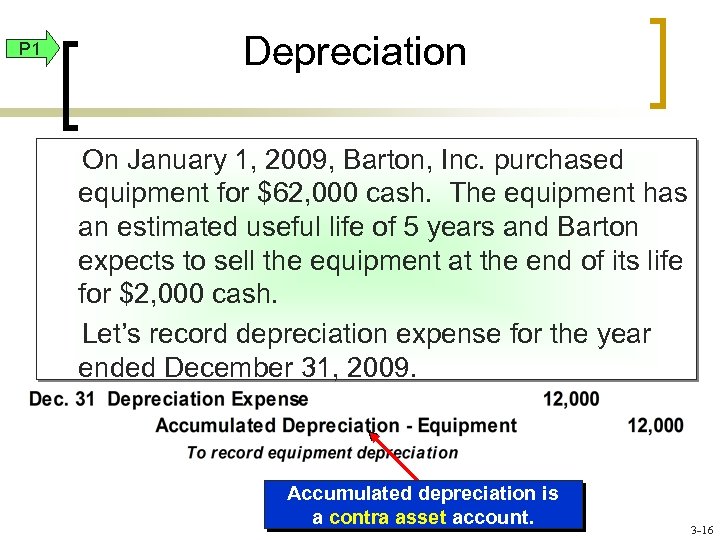

P 1 Depreciation On January 1, 2009, Barton, Inc. purchased equipment for $62, 000 cash. The equipment has an estimated useful life of 5 years and Barton expects to sell the equipment at the end of its life for $2, 000 cash. Let’s record depreciation expense for the year ended December 31, 2009. Accumulated depreciation is a contra asset account. 3 -16

P 1 Depreciation On January 1, 2009, Barton, Inc. purchased equipment for $62, 000 cash. The equipment has an estimated useful life of 5 years and Barton expects to sell the equipment at the end of its life for $2, 000 cash. Let’s record depreciation expense for the year ended December 31, 2009. Accumulated depreciation is a contra asset account. 3 -16

P 1 Depreciation $ Equipment is shown net of accumulated depreciation. This amount is referred to as the asset’s book value 3 -17

P 1 Depreciation $ Equipment is shown net of accumulated depreciation. This amount is referred to as the asset’s book value 3 -17

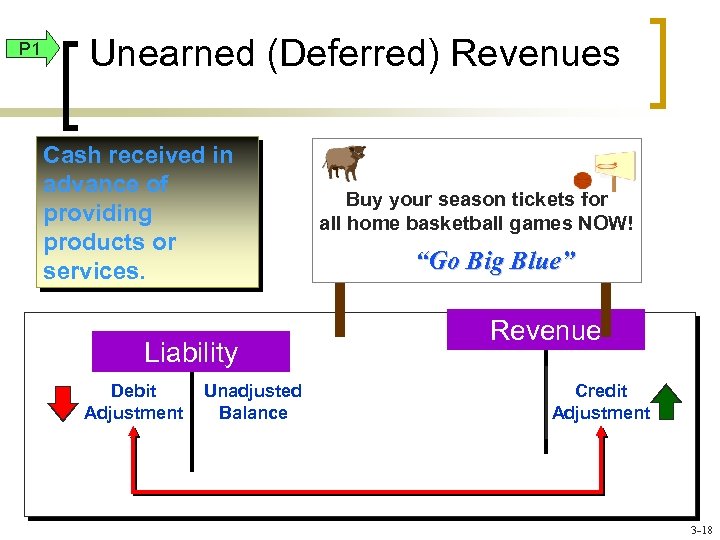

P 1 Unearned (Deferred) Revenues Cash received in advance of providing products or services. Liability Debit Adjustment Unadjusted Balance Buy your season tickets for all home basketball games NOW! “Go Big Blue” Revenue Credit Adjustment 3 -18

P 1 Unearned (Deferred) Revenues Cash received in advance of providing products or services. Liability Debit Adjustment Unadjusted Balance Buy your season tickets for all home basketball games NOW! “Go Big Blue” Revenue Credit Adjustment 3 -18

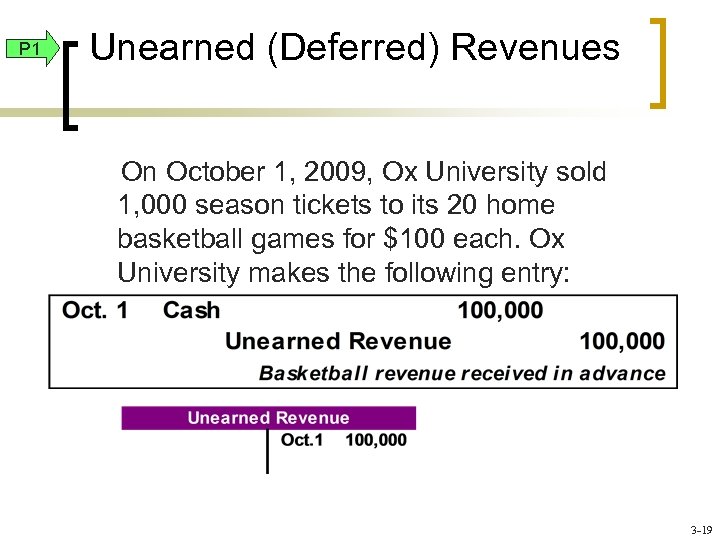

P 1 Unearned (Deferred) Revenues On October 1, 2009, Ox University sold 1, 000 season tickets to its 20 home basketball games for $100 each. Ox University makes the following entry: 3 -19

P 1 Unearned (Deferred) Revenues On October 1, 2009, Ox University sold 1, 000 season tickets to its 20 home basketball games for $100 each. Ox University makes the following entry: 3 -19

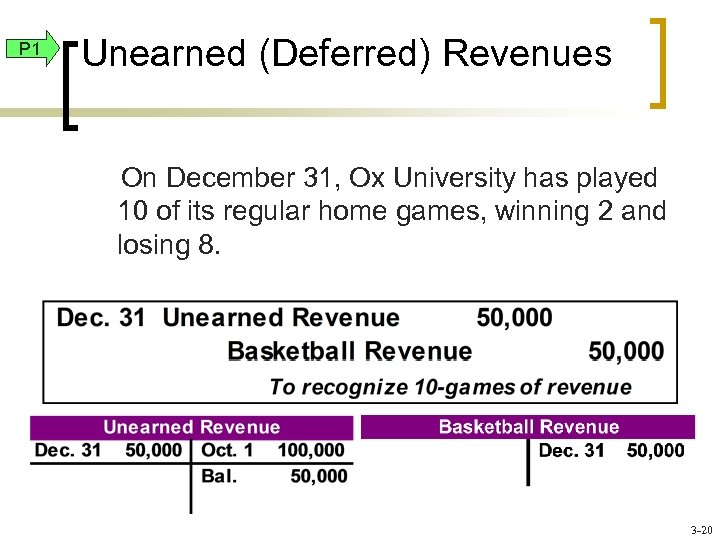

P 1 Unearned (Deferred) Revenues On December 31, Ox University has played 10 of its regular home games, winning 2 and losing 8. 3 -20

P 1 Unearned (Deferred) Revenues On December 31, Ox University has played 10 of its regular home games, winning 2 and losing 8. 3 -20

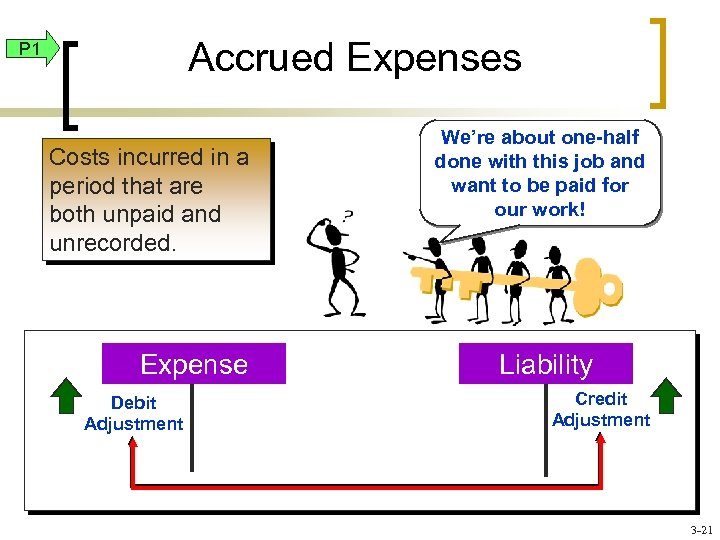

Accrued Expenses P 1 Costs incurred in a period that are both unpaid and unrecorded. Expense Debit Adjustment We’re about one-half done with this job and want to be paid for our work! Liability Credit Adjustment 3 -21

Accrued Expenses P 1 Costs incurred in a period that are both unpaid and unrecorded. Expense Debit Adjustment We’re about one-half done with this job and want to be paid for our work! Liability Credit Adjustment 3 -21

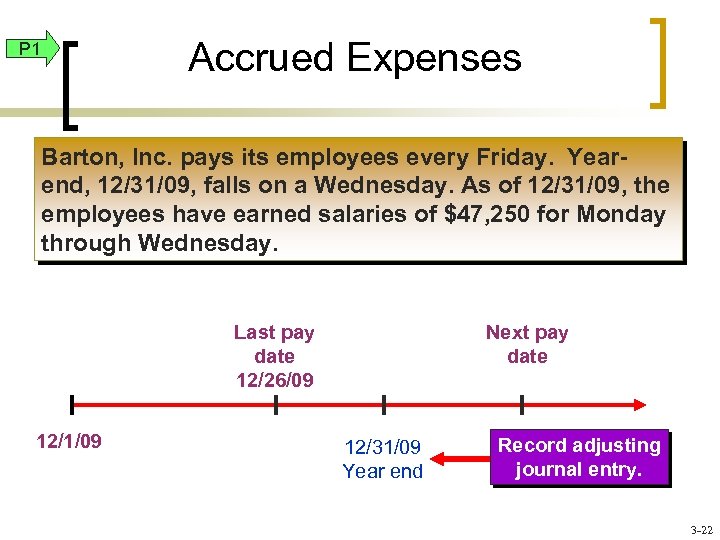

Accrued Expenses P 1 Barton, Inc. pays its employees every Friday. Yearend, 12/31/09, falls on a Wednesday. As of 12/31/09, the employees have earned salaries of $47, 250 for Monday through Wednesday. Last pay date 12/26/09 12/1/09 Next pay date 12/31/09 Year end Record adjusting journal entry. 3 -22

Accrued Expenses P 1 Barton, Inc. pays its employees every Friday. Yearend, 12/31/09, falls on a Wednesday. As of 12/31/09, the employees have earned salaries of $47, 250 for Monday through Wednesday. Last pay date 12/26/09 12/1/09 Next pay date 12/31/09 Year end Record adjusting journal entry. 3 -22

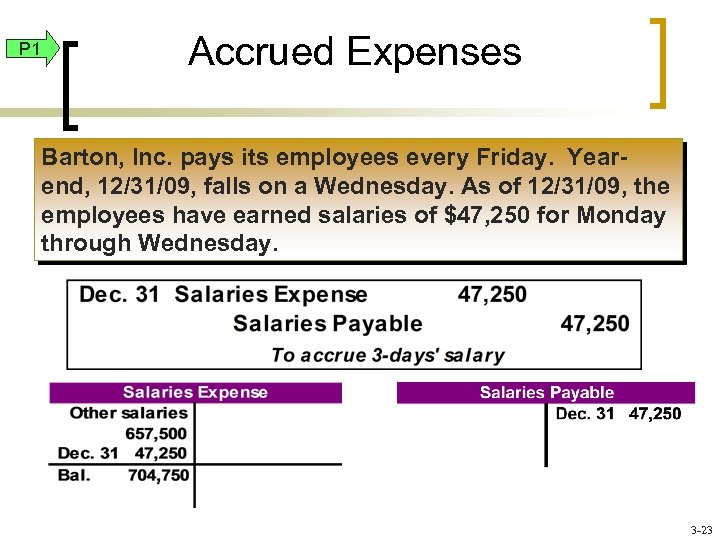

P 1 Accrued Expenses Barton, Inc. pays its employees every Friday. Yearend, 12/31/09, falls on a Wednesday. As of 12/31/09, the employees have earned salaries of $47, 250 for Monday through Wednesday. 3 -23

P 1 Accrued Expenses Barton, Inc. pays its employees every Friday. Yearend, 12/31/09, falls on a Wednesday. As of 12/31/09, the employees have earned salaries of $47, 250 for Monday through Wednesday. 3 -23

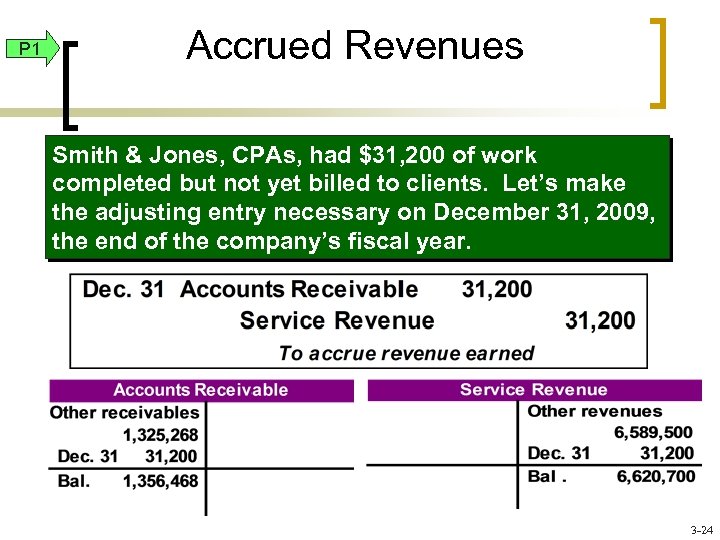

P 1 Accrued Revenues Smith & Jones, CPAs, had $31, 200 of work completed but not yet billed to clients. Let’s make the adjusting entry necessary on December 31, 2009, the end of the company’s fiscal year. 3 -24

P 1 Accrued Revenues Smith & Jones, CPAs, had $31, 200 of work completed but not yet billed to clients. Let’s make the adjusting entry necessary on December 31, 2009, the end of the company’s fiscal year. 3 -24

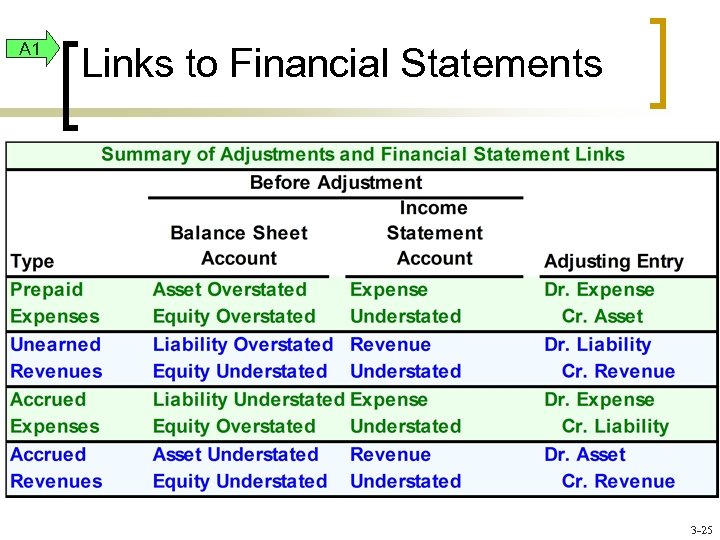

A 1 Links to Financial Statements 3 -25

A 1 Links to Financial Statements 3 -25

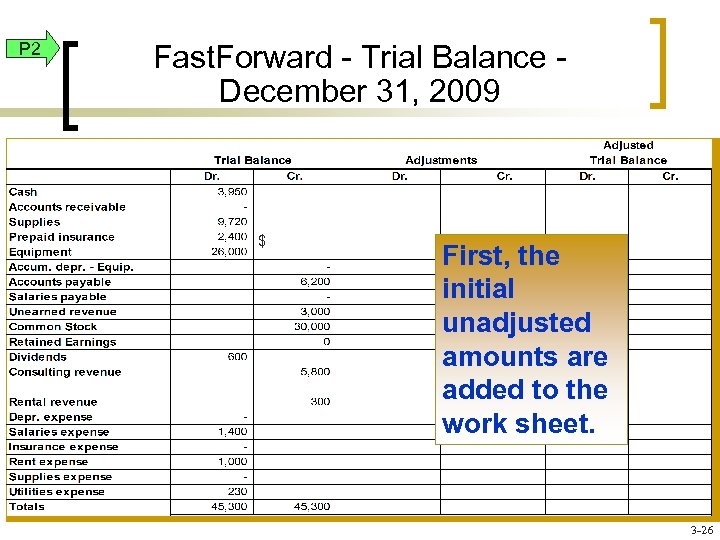

P 2 Fast. Forward - Trial Balance December 31, 2009 $ First, the initial unadjusted amounts are added to the work sheet. 3 -26

P 2 Fast. Forward - Trial Balance December 31, 2009 $ First, the initial unadjusted amounts are added to the work sheet. 3 -26

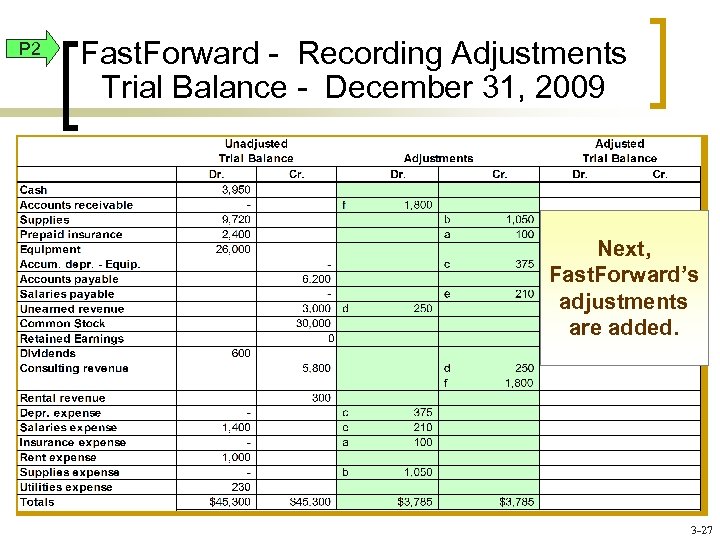

P 2 Fast. Forward - Recording Adjustments Trial Balance - December 31, 2009 Next, Fast. Forward’s adjustments are added. 3 -27

P 2 Fast. Forward - Recording Adjustments Trial Balance - December 31, 2009 Next, Fast. Forward’s adjustments are added. 3 -27

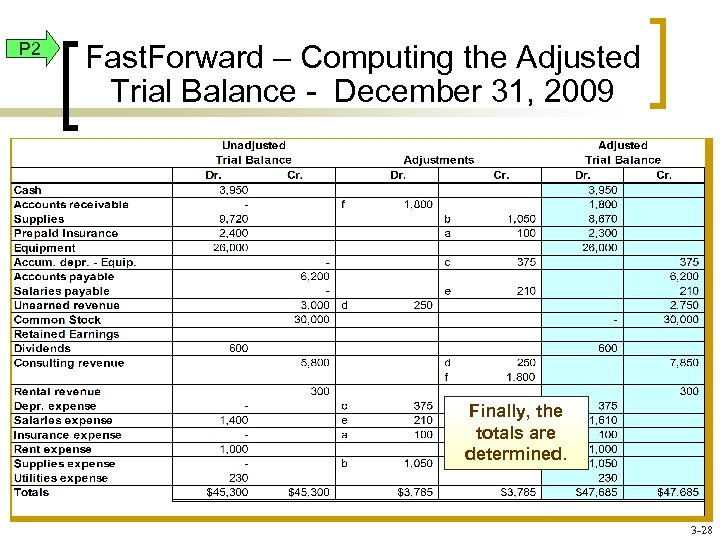

P 2 Fast. Forward – Computing the Adjusted Trial Balance - December 31, 2009 Finally, the totals are determined. 3 -28

P 2 Fast. Forward – Computing the Adjusted Trial Balance - December 31, 2009 Finally, the totals are determined. 3 -28

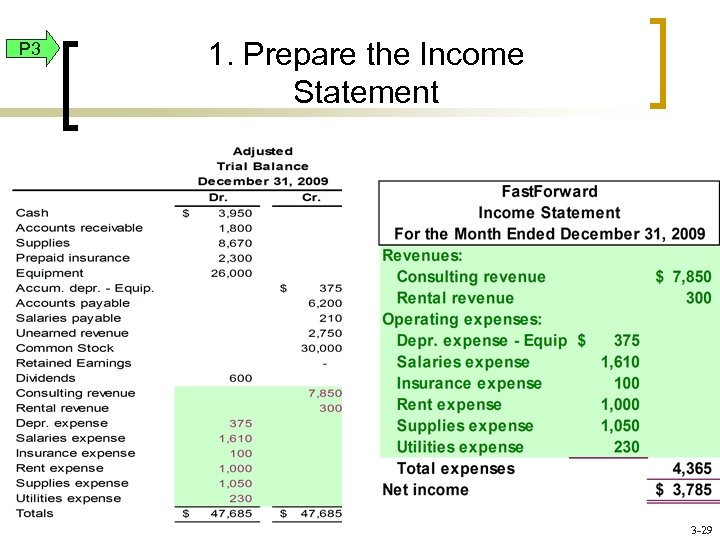

P 3 1. Prepare the Income Statement 3 -29

P 3 1. Prepare the Income Statement 3 -29

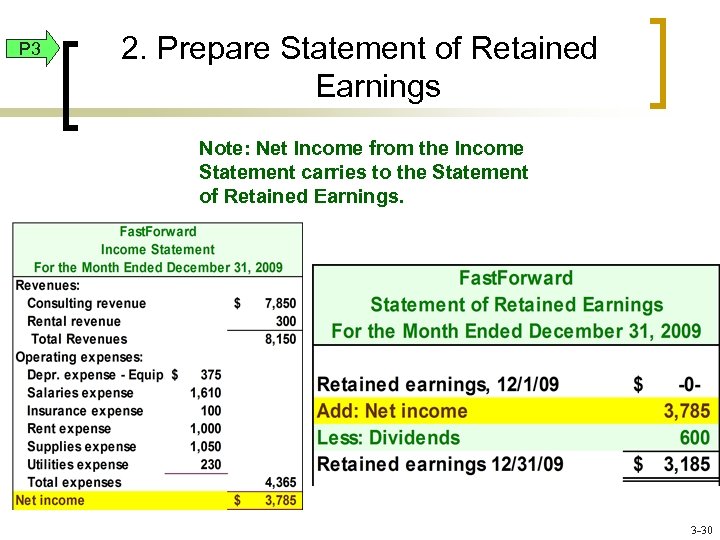

P 3 2. Prepare Statement of Retained Earnings Note: Net Income from the Income Statement carries to the Statement of Retained Earnings. 3 -30

P 3 2. Prepare Statement of Retained Earnings Note: Net Income from the Income Statement carries to the Statement of Retained Earnings. 3 -30

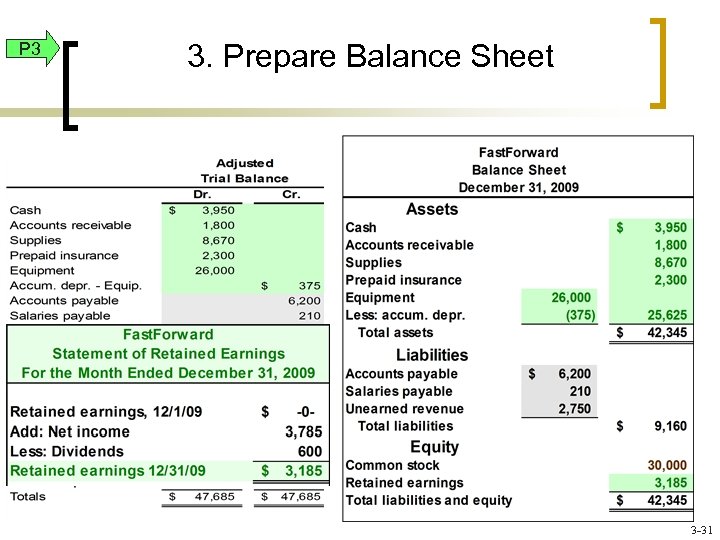

P 3 3. Prepare Balance Sheet 3 -31

P 3 3. Prepare Balance Sheet 3 -31

C 3 The Closing Process: Temporary and Permanent Accounts Temporary (nominal) accounts accumulate data related to one accounting period. They include all income statement accounts, the dividends account, and the Income Summary account. These accounts are “closed” at the end of the period to get ready for the next accounting period. Permanent (real) accounts report activities related to one or more future accounting periods. They carry ending balances to the next accounting period and are not “closed. ” 3 -32

C 3 The Closing Process: Temporary and Permanent Accounts Temporary (nominal) accounts accumulate data related to one accounting period. They include all income statement accounts, the dividends account, and the Income Summary account. These accounts are “closed” at the end of the period to get ready for the next accounting period. Permanent (real) accounts report activities related to one or more future accounting periods. They carry ending balances to the next accounting period and are not “closed. ” 3 -32

P 4 Recording Closing Entries 1. Close revenue accounts. 2. Close expense accounts. 3. Close the income summary account. 4. Close dividends account. 3 -33

P 4 Recording Closing Entries 1. Close revenue accounts. 2. Close expense accounts. 3. Close the income summary account. 4. Close dividends account. 3 -33

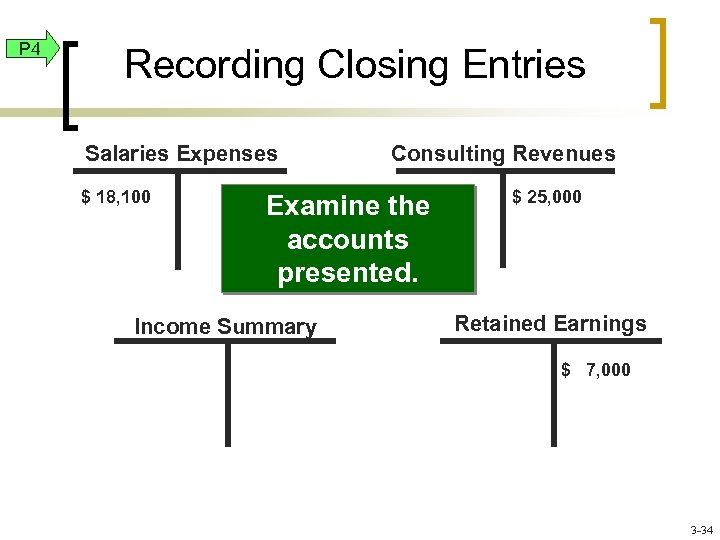

P 4 Recording Closing Entries Salaries Expenses $ 18, 100 Consulting Revenues Examine the accounts presented. Income Summary $ 25, 000 Retained Earnings $ 7, 000 3 -34

P 4 Recording Closing Entries Salaries Expenses $ 18, 100 Consulting Revenues Examine the accounts presented. Income Summary $ 25, 000 Retained Earnings $ 7, 000 3 -34

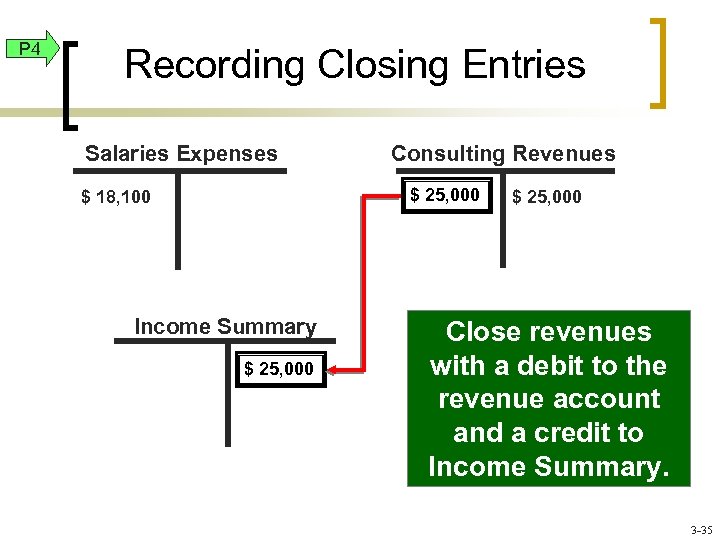

P 4 Recording Closing Entries Salaries Expenses Consulting Revenues $ 25, 000 $ 18, 100 Income Summary $ 25, 000 Close revenues with a debit to the revenue account and a credit to Income Summary. 3 -35

P 4 Recording Closing Entries Salaries Expenses Consulting Revenues $ 25, 000 $ 18, 100 Income Summary $ 25, 000 Close revenues with a debit to the revenue account and a credit to Income Summary. 3 -35

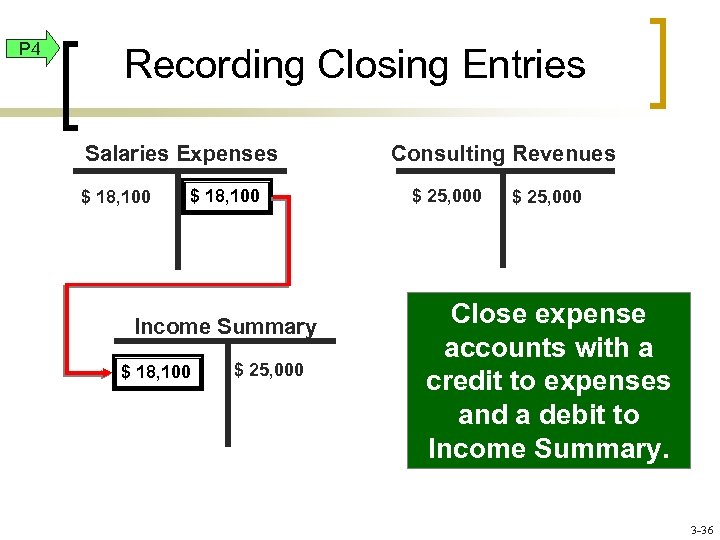

P 4 Recording Closing Entries Salaries Expenses $ 18, 100 Income Summary $ 18, 100 $ 25, 000 Consulting Revenues $ 25, 000 Close expense accounts with a credit to expenses and a debit to Income Summary. 3 -36

P 4 Recording Closing Entries Salaries Expenses $ 18, 100 Income Summary $ 18, 100 $ 25, 000 Consulting Revenues $ 25, 000 Close expense accounts with a credit to expenses and a debit to Income Summary. 3 -36

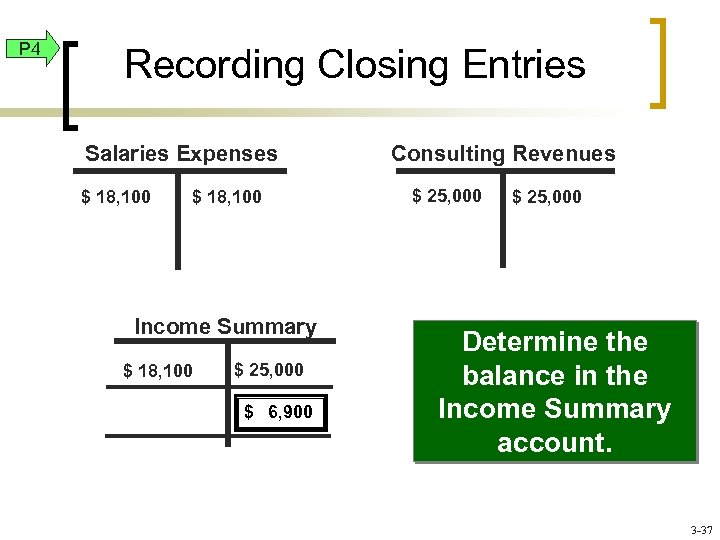

P 4 Recording Closing Entries Salaries Expenses $ 18, 100 Income Summary $ 18, 100 $ 25, 000 $ 6, 900 Consulting Revenues $ 25, 000 Determine the balance in the Income Summary account. 3 -37

P 4 Recording Closing Entries Salaries Expenses $ 18, 100 Income Summary $ 18, 100 $ 25, 000 $ 6, 900 Consulting Revenues $ 25, 000 Determine the balance in the Income Summary account. 3 -37

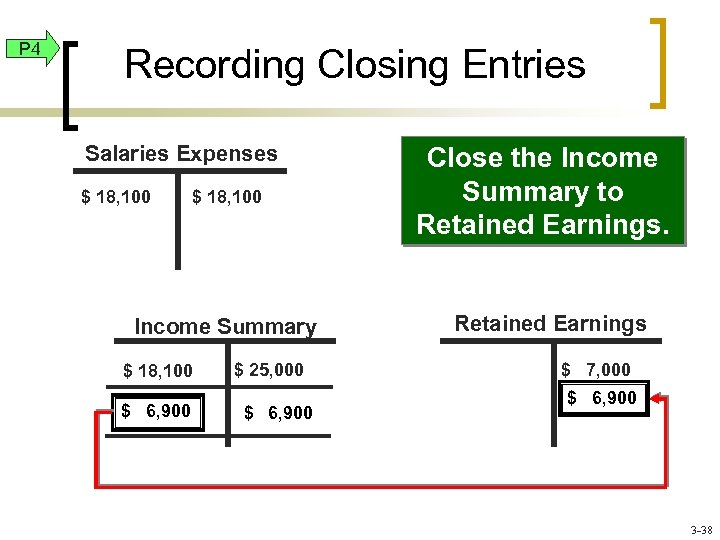

P 4 Recording Closing Entries Salaries Expenses $ 18, 100 Income Summary $ 18, 100 $ 6, 900 $ 25, 000 $ 6, 900 Close the Income Summary to Retained Earnings $ 7, 000 $ 6, 900 3 -38

P 4 Recording Closing Entries Salaries Expenses $ 18, 100 Income Summary $ 18, 100 $ 6, 900 $ 25, 000 $ 6, 900 Close the Income Summary to Retained Earnings $ 7, 000 $ 6, 900 3 -38

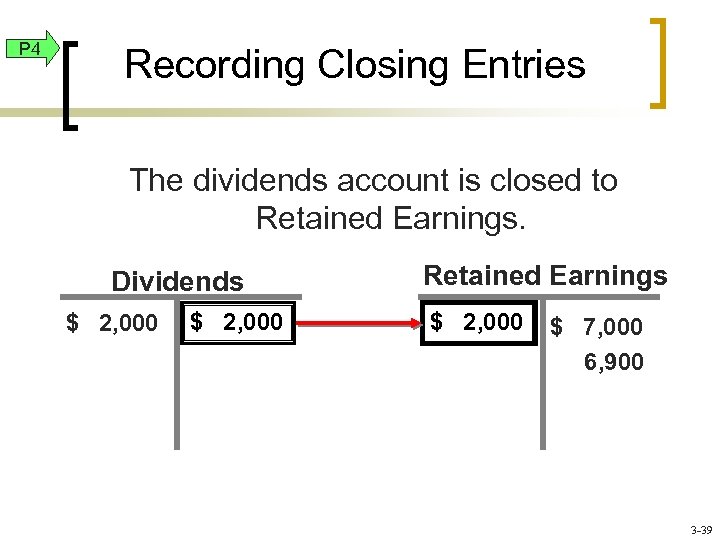

P 4 Recording Closing Entries The dividends account is closed to Retained Earnings. Dividends $ 2, 000 Retained Earnings $ 2, 000 $ 7, 000 6, 900 3 -39

P 4 Recording Closing Entries The dividends account is closed to Retained Earnings. Dividends $ 2, 000 Retained Earnings $ 2, 000 $ 7, 000 6, 900 3 -39

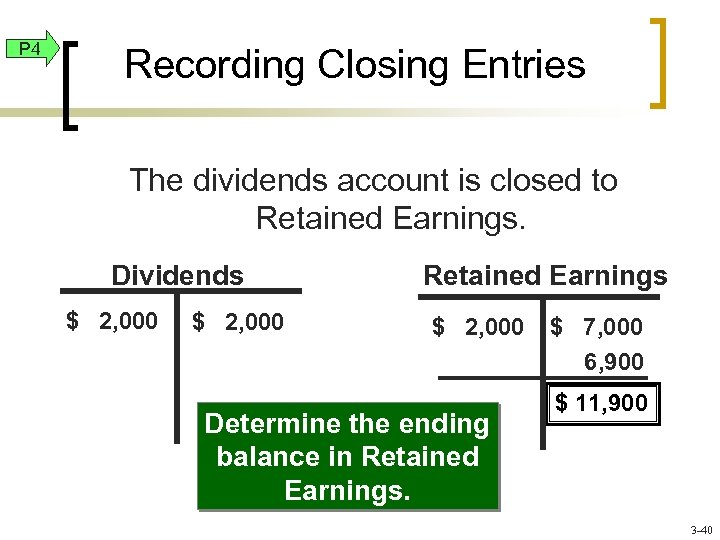

P 4 Recording Closing Entries The dividends account is closed to Retained Earnings. Dividends $ 2, 000 Retained Earnings $ 2, 000 Determine the ending balance in Retained Earnings. $ 7, 000 6, 900 $ 11, 900 3 -40

P 4 Recording Closing Entries The dividends account is closed to Retained Earnings. Dividends $ 2, 000 Retained Earnings $ 2, 000 Determine the ending balance in Retained Earnings. $ 7, 000 6, 900 $ 11, 900 3 -40

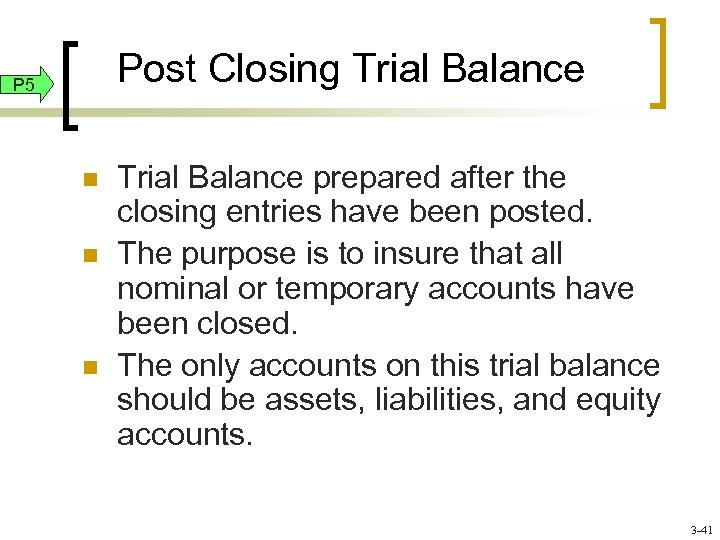

Post Closing Trial Balance P 5 n n n Trial Balance prepared after the closing entries have been posted. The purpose is to insure that all nominal or temporary accounts have been closed. The only accounts on this trial balance should be assets, liabilities, and equity accounts. 3 -41

Post Closing Trial Balance P 5 n n n Trial Balance prepared after the closing entries have been posted. The purpose is to insure that all nominal or temporary accounts have been closed. The only accounts on this trial balance should be assets, liabilities, and equity accounts. 3 -41

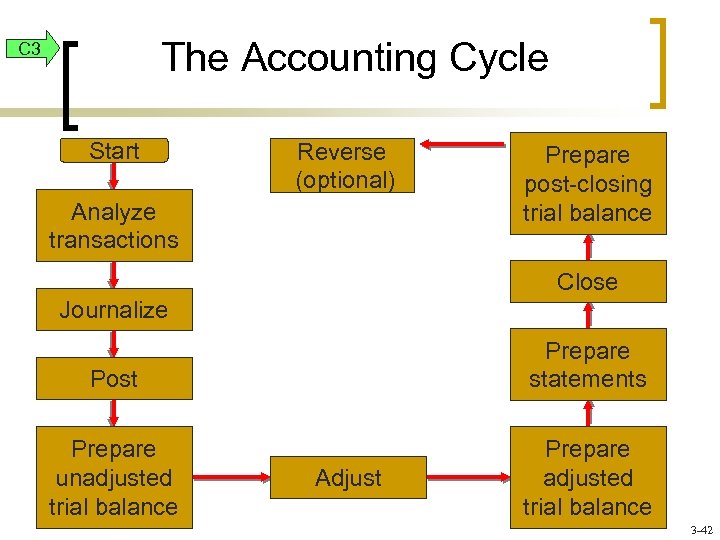

The Accounting Cycle C 3 Start Reverse (optional) Analyze transactions Prepare post-closing trial balance Close Journalize Post Prepare statements Prepare unadjusted trial balance Prepare adjusted trial balance Adjust 3 -42

The Accounting Cycle C 3 Start Reverse (optional) Analyze transactions Prepare post-closing trial balance Close Journalize Post Prepare statements Prepare unadjusted trial balance Prepare adjusted trial balance Adjust 3 -42

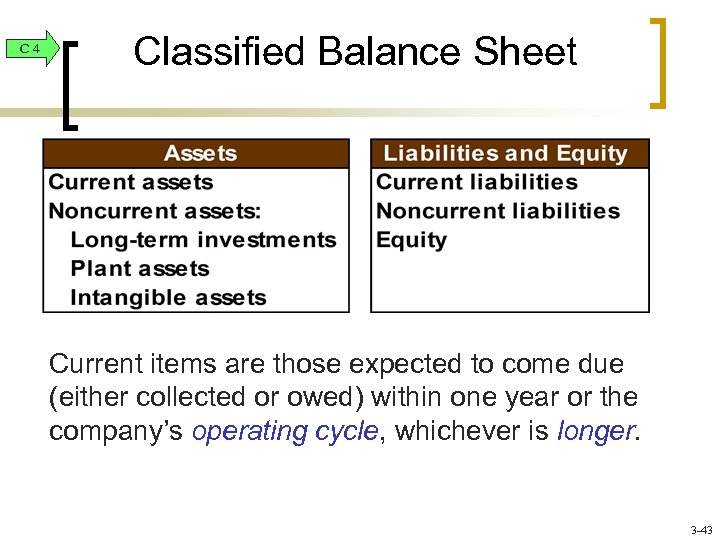

C 4 Classified Balance Sheet Current items are those expected to come due (either collected or owed) within one year or the company’s operating cycle, whichever is longer. 3 -43

C 4 Classified Balance Sheet Current items are those expected to come due (either collected or owed) within one year or the company’s operating cycle, whichever is longer. 3 -43

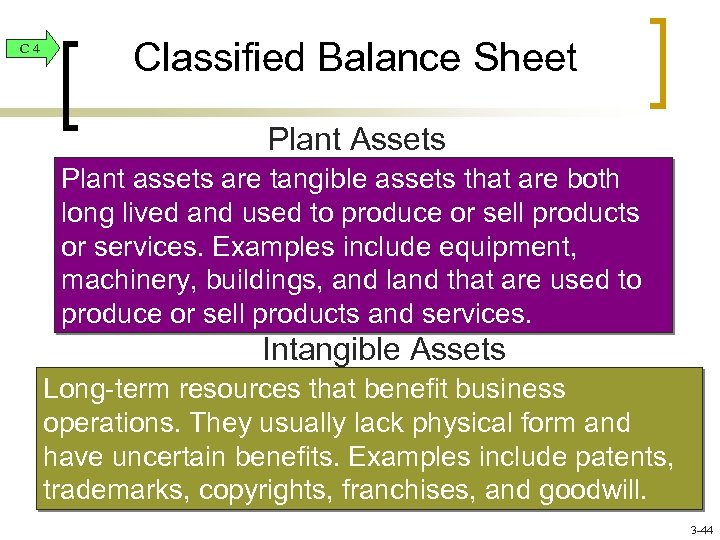

C 4 Classified Balance Sheet Plant Assets Plant assets are tangible assets that are both long lived and used to produce or sell products or services. Examples include equipment, machinery, buildings, and land that are used to produce or sell products and services. Intangible Assets Long-term resources that benefit business operations. They usually lack physical form and have uncertain benefits. Examples include patents, trademarks, copyrights, franchises, and goodwill. 3 -44

C 4 Classified Balance Sheet Plant Assets Plant assets are tangible assets that are both long lived and used to produce or sell products or services. Examples include equipment, machinery, buildings, and land that are used to produce or sell products and services. Intangible Assets Long-term resources that benefit business operations. They usually lack physical form and have uncertain benefits. Examples include patents, trademarks, copyrights, franchises, and goodwill. 3 -44

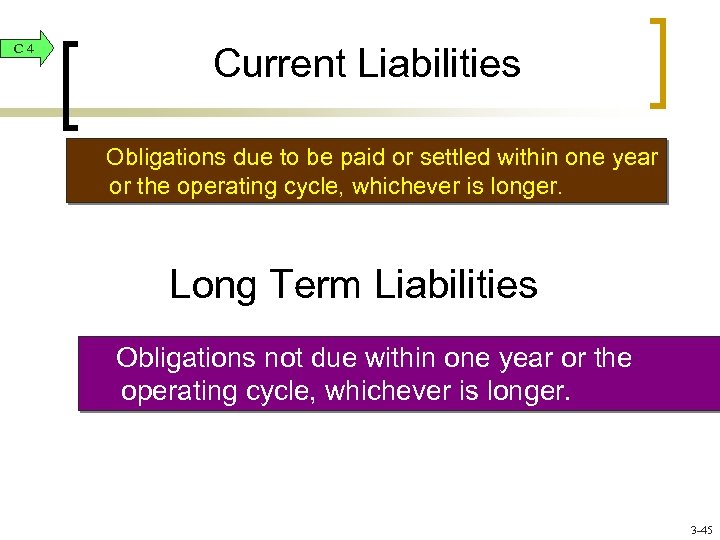

C 4 Current Liabilities Obligations due to be paid or settled within one year or the operating cycle, whichever is longer. Long Term Liabilities Obligations not due within one year or the operating cycle, whichever is longer. 3 -45

C 4 Current Liabilities Obligations due to be paid or settled within one year or the operating cycle, whichever is longer. Long Term Liabilities Obligations not due within one year or the operating cycle, whichever is longer. 3 -45

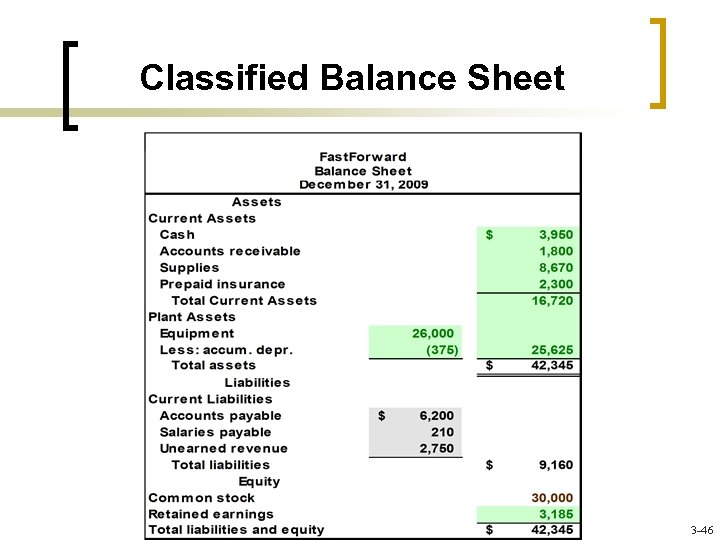

Classified Balance Sheet 3 -46

Classified Balance Sheet 3 -46

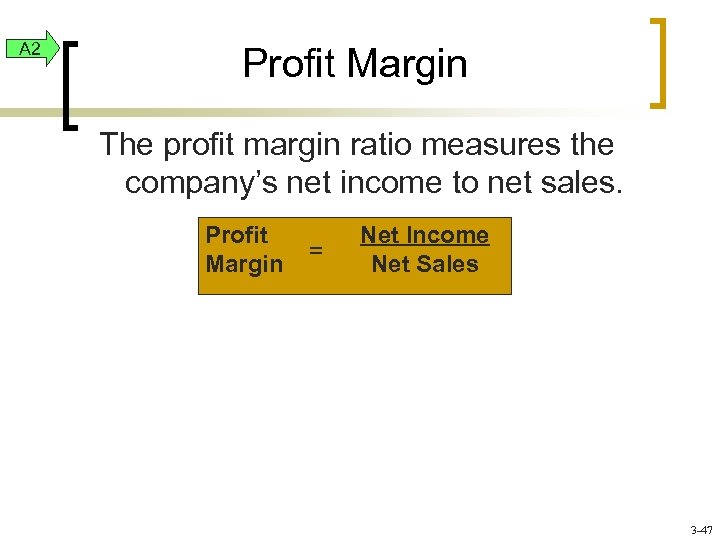

A 2 Profit Margin The profit margin ratio measures the company’s net income to net sales. Profit Margin = Net Income Net Sales 3 -47

A 2 Profit Margin The profit margin ratio measures the company’s net income to net sales. Profit Margin = Net Income Net Sales 3 -47

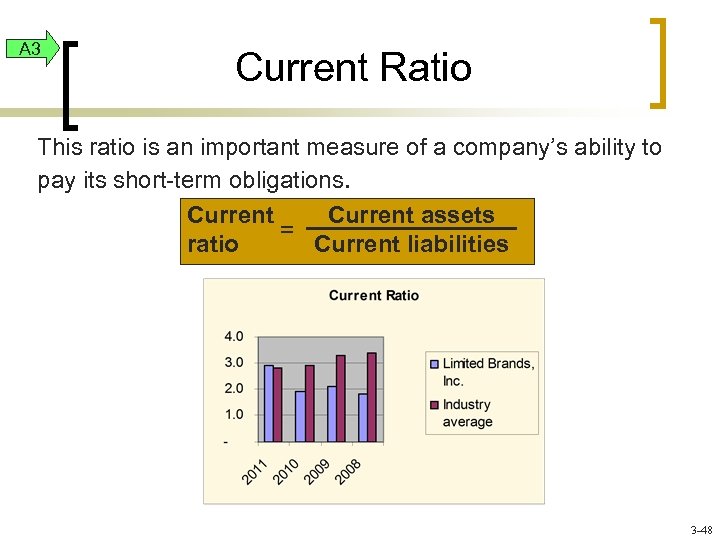

A 3 Current Ratio This ratio is an important measure of a company’s ability to pay its short-term obligations. Current assets = ratio Current liabilities 3 -48

A 3 Current Ratio This ratio is an important measure of a company’s ability to pay its short-term obligations. Current assets = ratio Current liabilities 3 -48

End of Chapter 3 3 -49

End of Chapter 3 3 -49