FA_v6.pptx

- Количество слайдов: 3

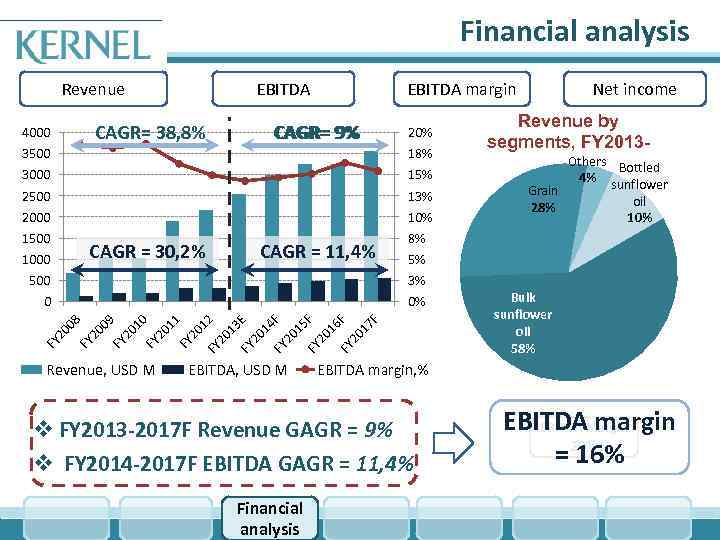

Financial analysis Revenue EBITDA CAGR= 38, 8% 4000 EBITDA margin CAGR= 9% 20% 3500 18% 3000 15% 2500 13% 2000 10% 1500 Net income Revenue by segments, FY 2013 - 8% CAGR = 30, 2% 1000 CAGR = 11, 4% Others Bottled 4% sunflower Grain oil 28% 10% 5% Revenue, USD M EBITDA, USD M F 17 20 FY FY 20 16 F F 15 20 F 14 FY 20 3 E FY 01 12 FY 2 20 FY 20 FY 11 0% 10 0 09 3% 08 500 EBITDA margin, % v FY 2013 -2017 F Revenue GAGR = 9% v FY 2014 -2017 F EBITDA GAGR = 11, 4% Financial analysis Bulk sunflower oil 58% EBITDAMargin EBITDA margin 20% 8% = 17% 16%

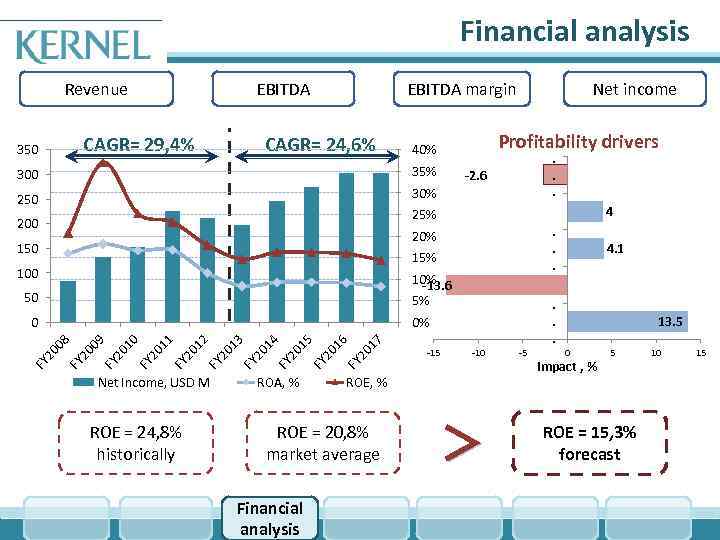

Financial analysis Revenue EBITDA CAGR= 29, 4% 350 EBITDA margin CAGR= 24, 6% Profitability drivers 40% 300 35% 250 Net income . . . 30% -2. 6 4 25% 200 . . . 20% 150 15% 100 10% -13. 6 5% 50 Net Income, USD M ROE = 24, 8% historically ROA, % 17 20 -10 ROE, % ROE = 20, 8% market average Financial analysis -15 FY 16 FY 20 15 20 14 FY FY 20 13 20 FY 12 20 11 FY FY 20 10 20 FY 09 0% 08 0 > -5 . . . 4. 1 13. 5 0 impact , % 5 ROE = 15, 3% forecast 10 15

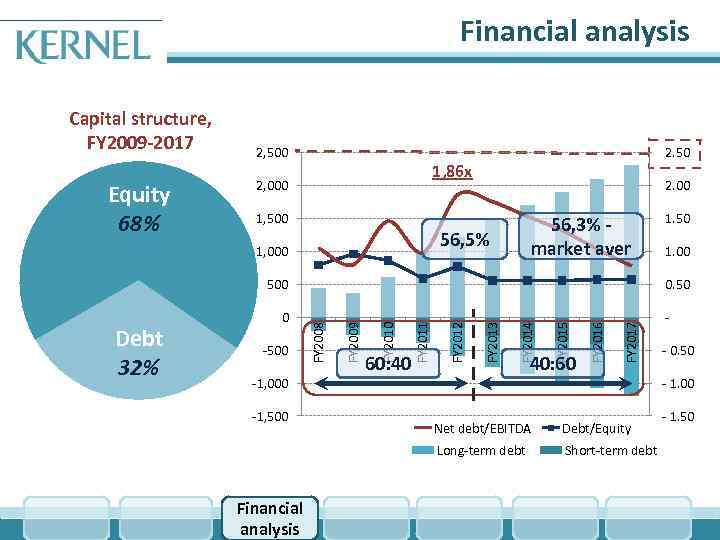

Financial analysis Capital structure, FY 2009 -2017 Equity 68% 2, 500 2. 50 1, 86 x 2, 000 1, 500 2. 00 56, 3% market aver 56, 5% 1, 000 -1, 500 FY 2017 40: 60 FY 2016 FY 2015 FY 2014 FY 2013 FY 2012 60: 40 FY 2011 FY 2010 32% -500 FY 2009 Debt 0 Net debt/EBITDA Debt/Equity Long-term debt Financial analysis 1. 00 0. 50 FY 2008 500 1. 50 Short-term debt - 0. 50 - 1. 00 - 1. 50

FA_v6.pptx