d59c27db0c81f009c25a46618678e532.ppt

- Количество слайдов: 32

Financial Aid 101 College Costs 2016 -2017 Kilgore College Financial Aid Will Massey, Retention Counselor

Financial Aid 101 College Costs 2016 -2017 Kilgore College Financial Aid Will Massey, Retention Counselor

We will talk about: • • 2 Federal student aid State student aid Institutional Scholarships from other sources

We will talk about: • • 2 Federal student aid State student aid Institutional Scholarships from other sources

We will answer: • • • 3 What is financial aid? Who can get it? How much can I get? How do I apply? What happens next? Where can I get more info?

We will answer: • • • 3 What is financial aid? Who can get it? How much can I get? How do I apply? What happens next? Where can I get more info?

AID: Four Types from Four Sources Ø GRANTS Ø Department of Education (Federal) Ø State of Texas Ø LOANS ØDepartment of Education (Federal) Ø EMPLOYMENT ØCollege Work Study (Federal) ØInstitutional Positions/Fellowships Ø SCHOLARSHIPS ØState of Texas or Institution ØOutside Agencies or Donors

AID: Four Types from Four Sources Ø GRANTS Ø Department of Education (Federal) Ø State of Texas Ø LOANS ØDepartment of Education (Federal) Ø EMPLOYMENT ØCollege Work Study (Federal) ØInstitutional Positions/Fellowships Ø SCHOLARSHIPS ØState of Texas or Institution ØOutside Agencies or Donors

Who can get federal student aid? • • • 5 U. S. citizen or permanent resident High school graduate/GED holder Eligible degree/certificate program Valid Social Security number Males registered for Selective Service Satisfactory academic progress

Who can get federal student aid? • • • 5 U. S. citizen or permanent resident High school graduate/GED holder Eligible degree/certificate program Valid Social Security number Males registered for Selective Service Satisfactory academic progress

How much federal student aid can I get? In general, depends on your financial need. • Financial need determined by Expected Family Contribution (EFC) and cost of attendance (COA) • EFC comes from what you report on FAFSA • COA is tuition, fees, room and board, transportation, etc. COA – EFC = financial need 6

How much federal student aid can I get? In general, depends on your financial need. • Financial need determined by Expected Family Contribution (EFC) and cost of attendance (COA) • EFC comes from what you report on FAFSA • COA is tuition, fees, room and board, transportation, etc. COA – EFC = financial need 6

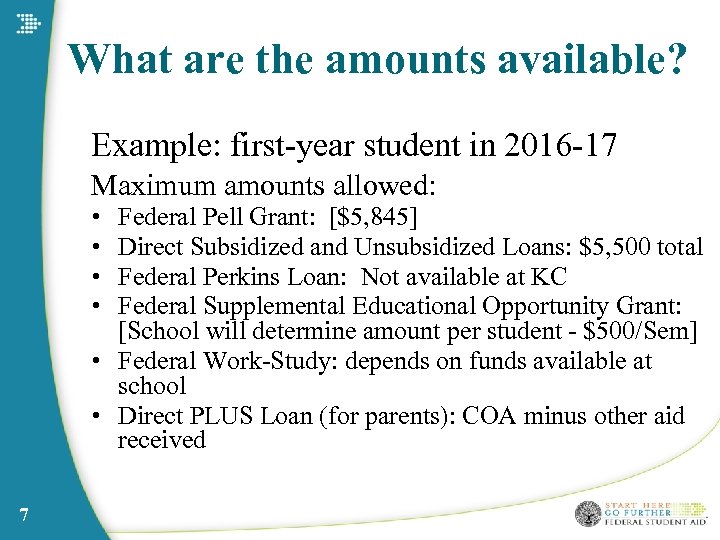

What are the amounts available? Example: first-year student in 2016 -17 Maximum amounts allowed: • • Federal Pell Grant: [$5, 845] Direct Subsidized and Unsubsidized Loans: $5, 500 total Federal Perkins Loan: Not available at KC Federal Supplemental Educational Opportunity Grant: [School will determine amount per student - $500/Sem] • Federal Work-Study: depends on funds available at school • Direct PLUS Loan (for parents): COA minus other aid received 7

What are the amounts available? Example: first-year student in 2016 -17 Maximum amounts allowed: • • Federal Pell Grant: [$5, 845] Direct Subsidized and Unsubsidized Loans: $5, 500 total Federal Perkins Loan: Not available at KC Federal Supplemental Educational Opportunity Grant: [School will determine amount per student - $500/Sem] • Federal Work-Study: depends on funds available at school • Direct PLUS Loan (for parents): COA minus other aid received 7

What are some Fafsa guidelines? Apply Early – so complete tax info early also. • You can estimate your income, especially if you know will be late in filing your taxes. • However, the school will need your final 2015 AGI to correct the Fafsa information • The sooner you apply, the more aid you might be able to qualify for. 8

What are some Fafsa guidelines? Apply Early – so complete tax info early also. • You can estimate your income, especially if you know will be late in filing your taxes. • However, the school will need your final 2015 AGI to correct the Fafsa information • The sooner you apply, the more aid you might be able to qualify for. 8

Why should I do the Fafsa online? • Online apps are easier because it uses skip-logic to only ask relevant questions • Also, the Fafsa website is designed to catch common errors • Create an FSA ID for access to your FAFSA • You can save your data at any time and then return to it later, and also it allows for a timely submission of data and an electronic signature for students/parents 9

Why should I do the Fafsa online? • Online apps are easier because it uses skip-logic to only ask relevant questions • Also, the Fafsa website is designed to catch common errors • Create an FSA ID for access to your FAFSA • You can save your data at any time and then return to it later, and also it allows for a timely submission of data and an electronic signature for students/parents 9

IRS Data Retrieval • When you apply online, you can retrieve your IRS data to automatically populate the Fafsa. • This simplifies the application process, helps reduce errors and lowers your chances of being selected for verification of the income information. • You’ll need to complete taxes first. It will take around two weeks for taxes to be processed. After this, you should be able to get this information to automatically populate the Fafsa income portion. 10

IRS Data Retrieval • When you apply online, you can retrieve your IRS data to automatically populate the Fafsa. • This simplifies the application process, helps reduce errors and lowers your chances of being selected for verification of the income information. • You’ll need to complete taxes first. It will take around two weeks for taxes to be processed. After this, you should be able to get this information to automatically populate the Fafsa income portion. 10

Avoid Common Fafsa Errors • Don’t leave blank fields; this can cause rejections or miscalculations. • Always round to the nearest dollar; no decimals. • Carefully list your/ your parents’ SSNumbers/ dates of birth, and your driver’s license number. Do not make up a number. • List your name EXACTLY as it appears on your Soc. Sec. Card; no nicknames or other variations. • Enter your permanent address, not a campus dorm. 11

Avoid Common Fafsa Errors • Don’t leave blank fields; this can cause rejections or miscalculations. • Always round to the nearest dollar; no decimals. • Carefully list your/ your parents’ SSNumbers/ dates of birth, and your driver’s license number. Do not make up a number. • List your name EXACTLY as it appears on your Soc. Sec. Card; no nicknames or other variations. • Enter your permanent address, not a campus dorm. 11

And more Fafsa Income Errors……. • Entering the wrong federal income tax paid amount. This is not found on the W-2 form, but on the 1040, 1040 A, or 1040 EZ. • Incorrectly filing income taxes as head of household. If there is an error in head of household filing status, school will need an amended tax return to be filed with the IRS before awards can be paid. • Listing marital status incorrectly. The DOE wants to know your marital status on the day you sign the Fafsa. 12

And more Fafsa Income Errors……. • Entering the wrong federal income tax paid amount. This is not found on the W-2 form, but on the 1040, 1040 A, or 1040 EZ. • Incorrectly filing income taxes as head of household. If there is an error in head of household filing status, school will need an amended tax return to be filed with the IRS before awards can be paid. • Listing marital status incorrectly. The DOE wants to know your marital status on the day you sign the Fafsa. 12

Fafsa Errors about Marital Status • Listing parent marital status incorrectly. If your biological parent has remarried, you will need to include the step-parent’s information. • Failure to list both parents if they live together. If both legal parents (biological or adoptive) live in the same household, you need to list them. • Failure to report unborn children; if a child will be born during the award year who will receive half their support from you, count that child in the household. 13

Fafsa Errors about Marital Status • Listing parent marital status incorrectly. If your biological parent has remarried, you will need to include the step-parent’s information. • Failure to list both parents if they live together. If both legal parents (biological or adoptive) live in the same household, you need to list them. • Failure to report unborn children; if a child will be born during the award year who will receive half their support from you, count that child in the household. 13

And Miscellaneous Errors………. • Failing to count yourself as a student. You are completing the Fafsa and count as a member of the household attending college during the award year. • Failing to register with Selective Service. If you are male and age 18 – 26, you must register. If you are younger, be sure to register by the new award year. • Forgetting to list the specific college you want to attend. • Do not send any other forms/documents to the DOE. 14

And Miscellaneous Errors………. • Failing to count yourself as a student. You are completing the Fafsa and count as a member of the household attending college during the award year. • Failing to register with Selective Service. If you are male and age 18 – 26, you must register. If you are younger, be sure to register by the new award year. • Forgetting to list the specific college you want to attend. • Do not send any other forms/documents to the DOE. 14

Documents needed to complete a Fafsa • • Social Security Number (on your official SS Card) Driver’s License W-2 forms of previous year and other money earned Most recent Federal income tax return (1040, 1040 A, 1040 EX, 1040 Telefile) • Child Support Paid or Child Support Received • Assets: business, investment information • Documentation of US permanent resident or eligible non-citizen 15

Documents needed to complete a Fafsa • • Social Security Number (on your official SS Card) Driver’s License W-2 forms of previous year and other money earned Most recent Federal income tax return (1040, 1040 A, 1040 EX, 1040 Telefile) • Child Support Paid or Child Support Received • Assets: business, investment information • Documentation of US permanent resident or eligible non-citizen 15

If I have lost my Job? • Your are considered a “dislocated worker” • Have a tax transcript of the previous year, with your W 2 forms, ready to submit • Also you will need a severance letter from your employer • And a document from the Texas Workforce Commission (showing Unemployment Benefits) 16

If I have lost my Job? • Your are considered a “dislocated worker” • Have a tax transcript of the previous year, with your W 2 forms, ready to submit • Also you will need a severance letter from your employer • And a document from the Texas Workforce Commission (showing Unemployment Benefits) 16

What about State of Texas aid? • • • 17 TEOG - $1368 per year (2015 -16) TPEG – up to $1000 per Year (15 -16) College for all Texans www. studentaid. ed. gov/scholarship Contact school’s financial aid office

What about State of Texas aid? • • • 17 TEOG - $1368 per year (2015 -16) TPEG – up to $1000 per Year (15 -16) College for all Texans www. studentaid. ed. gov/scholarship Contact school’s financial aid office

How do I apply for aid? • Federal student aid: fill out Free Application for Federal Student Aid (FAFSA) at www. fafsa. gov • State and School aid: contact financial aid office at schools you are considering • Outside Scholarships: contact donors / websites for specific information Examples: Civic Clubs, Churches, Businesses, Charitable Organizations 18

How do I apply for aid? • Federal student aid: fill out Free Application for Federal Student Aid (FAFSA) at www. fafsa. gov • State and School aid: contact financial aid office at schools you are considering • Outside Scholarships: contact donors / websites for specific information Examples: Civic Clubs, Churches, Businesses, Charitable Organizations 18

What happens next? • Each school will tell you how much aid you can get at that school. • Before you are awarded, the school may ask for additional documents in a process called Verification. • Provide the information asap, so it will not delay processing your aid. 19

What happens next? • Each school will tell you how much aid you can get at that school. • Before you are awarded, the school may ask for additional documents in a process called Verification. • Provide the information asap, so it will not delay processing your aid. 19

Institutional Verification Ø Confirms accuracy of FAFSA information Ø Application selected at random by CPS, but school is required to verify if selected Ø Often occurs if information is incomplete or questionable Ø School may request documents necessary to complete the verification process Ø Prepare copies for the school, Ø as originals will not be returned

Institutional Verification Ø Confirms accuracy of FAFSA information Ø Application selected at random by CPS, but school is required to verify if selected Ø Often occurs if information is incomplete or questionable Ø School may request documents necessary to complete the verification process Ø Prepare copies for the school, Ø as originals will not be returned

Common Documents Ø BE PREPARED TO FURNISH: Ø Tax Return Transcripts and W-2(s) – Prior year Ø Untaxed income on tax return, such as Ø Tax Exempt Interest Income Ø Untaxed IRA distributions, annuity payments Ø Deductible IRA or Keogh payments Ø Homebuyer or Making Work Pay tax credits Ø Child Support Received or Paid Ø Unemployment Benefits Ø Welfare Benefits (Food Stamps) Ø Workers’ Compensation Ø Identity Information Ø Official High School Transcript

Common Documents Ø BE PREPARED TO FURNISH: Ø Tax Return Transcripts and W-2(s) – Prior year Ø Untaxed income on tax return, such as Ø Tax Exempt Interest Income Ø Untaxed IRA distributions, annuity payments Ø Deductible IRA or Keogh payments Ø Homebuyer or Making Work Pay tax credits Ø Child Support Received or Paid Ø Unemployment Benefits Ø Welfare Benefits (Food Stamps) Ø Workers’ Compensation Ø Identity Information Ø Official High School Transcript

What happens after verification? Ø After verification is complete, the counselor checks the Expected Family Contribution shown on the Fafsa Ø The EFC is a factor which uses the Fafsa data and a federal formula to rank students Ø It can change, based on results of Verification Ø Factors considered in EFC formula: Ø Parent and student prior year income Ø US Income Tax paid Ø Number of family members in household Ø Number of students attending college Ø Family assets

What happens after verification? Ø After verification is complete, the counselor checks the Expected Family Contribution shown on the Fafsa Ø The EFC is a factor which uses the Fafsa data and a federal formula to rank students Ø It can change, based on results of Verification Ø Factors considered in EFC formula: Ø Parent and student prior year income Ø US Income Tax paid Ø Number of family members in household Ø Number of students attending college Ø Family assets

So what is the next step in processing student aid? Ø After the EFC is determined, the aid counselor sets up a budget for the student, also known as a “cost of attendance”: Ø Definition of Cost of Attendance: Ø Tuition and Fees of particular institution Ø Books and Supplies Ø Room and Board, (dorm, apartment, or at home) Ø Transportation Ø Personal/Miscellaneous Expenses Ø Child Care Ø Disability expenses

So what is the next step in processing student aid? Ø After the EFC is determined, the aid counselor sets up a budget for the student, also known as a “cost of attendance”: Ø Definition of Cost of Attendance: Ø Tuition and Fees of particular institution Ø Books and Supplies Ø Room and Board, (dorm, apartment, or at home) Ø Transportation Ø Personal/Miscellaneous Expenses Ø Child Care Ø Disability expenses

Definition of Unmet Need Cost of Attendance (COA) – Expected Family Contribution (EFC) = Financial Need

Definition of Unmet Need Cost of Attendance (COA) – Expected Family Contribution (EFC) = Financial Need

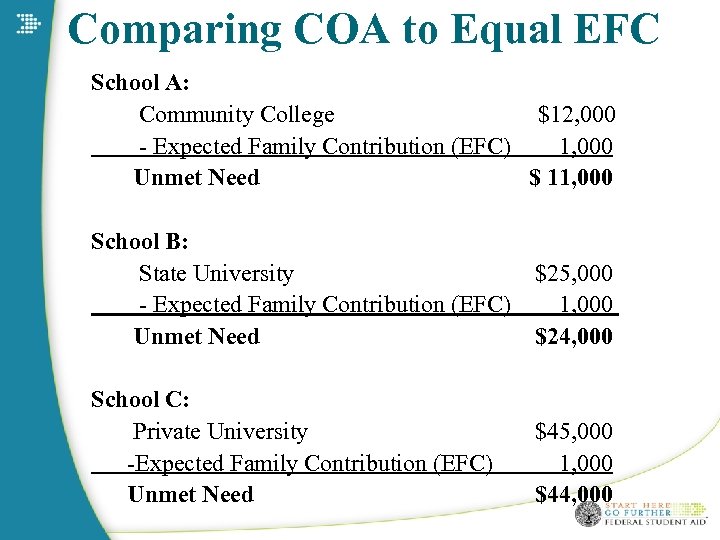

Comparing COA to Equal EFC School A: Community College $12, 000 - Expected Family Contribution (EFC) 1, 000 Unmet Need $ 11, 000 School B: State University - Expected Family Contribution (EFC) Unmet Need $25, 000 1, 000 $24, 000 School C: Private University -Expected Family Contribution (EFC) Unmet Need $45, 000 1, 000 $44, 000

Comparing COA to Equal EFC School A: Community College $12, 000 - Expected Family Contribution (EFC) 1, 000 Unmet Need $ 11, 000 School B: State University - Expected Family Contribution (EFC) Unmet Need $25, 000 1, 000 $24, 000 School C: Private University -Expected Family Contribution (EFC) Unmet Need $45, 000 1, 000 $44, 000

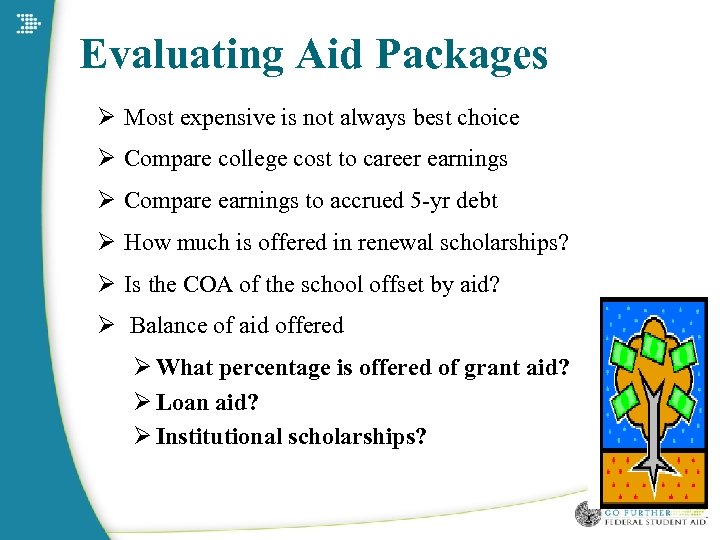

Evaluating Aid Packages Ø Most expensive is not always best choice Ø Compare college cost to career earnings Ø Compare earnings to accrued 5 -yr debt Ø How much is offered in renewal scholarships? Ø Is the COA of the school offset by aid? Ø Balance of aid offered Ø What percentage is offered of grant aid? Ø Loan aid? Ø Institutional scholarships?

Evaluating Aid Packages Ø Most expensive is not always best choice Ø Compare college cost to career earnings Ø Compare earnings to accrued 5 -yr debt Ø How much is offered in renewal scholarships? Ø Is the COA of the school offset by aid? Ø Balance of aid offered Ø What percentage is offered of grant aid? Ø Loan aid? Ø Institutional scholarships?

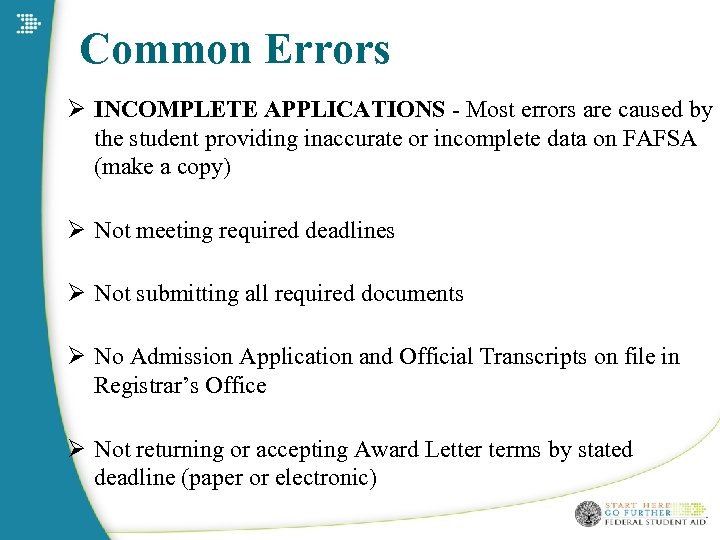

Common Errors Ø INCOMPLETE APPLICATIONS - Most errors are caused by the student providing inaccurate or incomplete data on FAFSA (make a copy) Ø Not meeting required deadlines Ø Not submitting all required documents Ø No Admission Application and Official Transcripts on file in Registrar’s Office Ø Not returning or accepting Award Letter terms by stated deadline (paper or electronic)

Common Errors Ø INCOMPLETE APPLICATIONS - Most errors are caused by the student providing inaccurate or incomplete data on FAFSA (make a copy) Ø Not meeting required deadlines Ø Not submitting all required documents Ø No Admission Application and Official Transcripts on file in Registrar’s Office Ø Not returning or accepting Award Letter terms by stated deadline (paper or electronic)

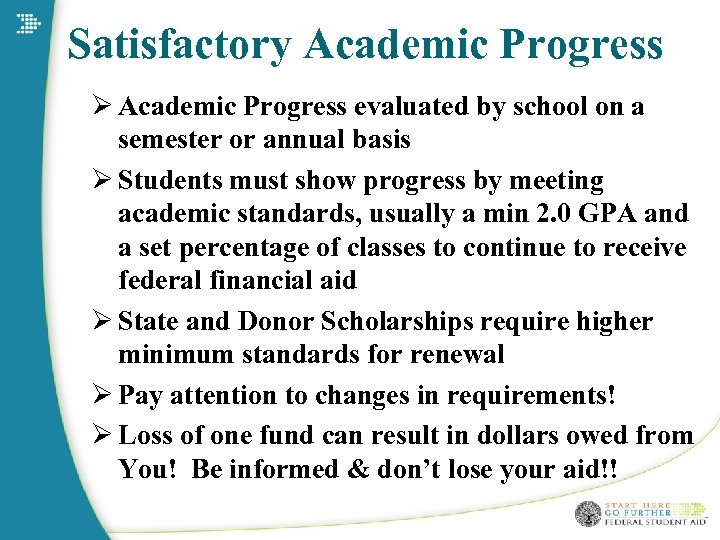

Satisfactory Academic Progress Ø Academic Progress evaluated by school on a semester or annual basis Ø Students must show progress by meeting academic standards, usually a min 2. 0 GPA and a set percentage of classes to continue to receive federal financial aid Ø State and Donor Scholarships require higher minimum standards for renewal Ø Pay attention to changes in requirements! Ø Loss of one fund can result in dollars owed from You! Be informed & don’t lose your aid!!

Satisfactory Academic Progress Ø Academic Progress evaluated by school on a semester or annual basis Ø Students must show progress by meeting academic standards, usually a min 2. 0 GPA and a set percentage of classes to continue to receive federal financial aid Ø State and Donor Scholarships require higher minimum standards for renewal Ø Pay attention to changes in requirements! Ø Loss of one fund can result in dollars owed from You! Be informed & don’t lose your aid!!

World Wide Web Øed. gov/studentaid Øfafsa. ed. gov Øcollegeforalltexans. com Ømappingyourfuture. org Østudentloans. gov Øfinaid. org

World Wide Web Øed. gov/studentaid Øfafsa. ed. gov Øcollegeforalltexans. com Ømappingyourfuture. org Østudentloans. gov Øfinaid. org

Where can I get more info? • www. studentaid. ed. gov – Information about aid programs – Free scholarship search – Free college search • 1 -800 -4 -FED-AID – Information about aid programs – Help with the FAFSA 30

Where can I get more info? • www. studentaid. ed. gov – Information about aid programs – Free scholarship search – Free college search • 1 -800 -4 -FED-AID – Information about aid programs – Help with the FAFSA 30

Pay Attention! Ø Review each school’s catalogs/website for information and application procedures. Ø Accurately complete and submit correct forms and respond promptly to requests. Ø Know each school’s deadlines be an early bird for best choice of funds! Ø Check SAP policies for renewal and make sure you meet them!

Pay Attention! Ø Review each school’s catalogs/website for information and application procedures. Ø Accurately complete and submit correct forms and respond promptly to requests. Ø Know each school’s deadlines be an early bird for best choice of funds! Ø Check SAP policies for renewal and make sure you meet them!

Thanks for coming Contact information: Name • Mr. Will Massey, Financial Aid Counselor, Kilgore College • Phone: (903) 983 - 8641 • Email: wmassey@Kilgore. edu 32

Thanks for coming Contact information: Name • Mr. Will Massey, Financial Aid Counselor, Kilgore College • Phone: (903) 983 - 8641 • Email: wmassey@Kilgore. edu 32